Introduction: Navigating the Global Market for uv led strip

Ultraviolet (UV) LED strips have emerged as a pivotal technology across a wide range of industries, from sterilization and curing processes to counterfeit detection and horticulture. For international B2B buyers—especially those in dynamic markets like Africa, South America, the Middle East, and Europe—mastering the complexities of UV LED strip sourcing is essential to securing competitive advantages and operational excellence. These strips combine energy efficiency, long lifespan, and precise wavelength control, enabling innovative applications that conventional lighting cannot match.

This guide offers a thorough exploration of the UV LED strip market and technology, tailored specifically for discerning buyers in regions such as Kenya and Poland. It delves into diverse product types, including variations in UV wavelength ranges (UVA, UVB, UVC), power outputs, and form factors to suit different industrial needs. Additionally, it covers critical material considerations, manufacturing techniques, and quality assurance protocols that influence product reliability and compliance with international standards.

Beyond technical insights, the guide provides actionable strategies for supplier evaluation, cost analysis, and navigating global market dynamics. It highlights emerging sourcing trends, sustainability factors, and regulatory challenges that impact procurement decisions. A dedicated FAQ section addresses common buyer concerns, helping to clarify complex specifications and mitigate risks.

By integrating this comprehensive knowledge, international B2B buyers can make informed, strategic purchasing decisions—balancing quality, cost-effectiveness, and innovation—to meet their unique operational requirements and thrive in a competitive global marketplace.

Understanding uv led strip Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| UVA LED Strip | Emits long-wave UV light (315-400 nm); common wavelengths 365nm, 385nm, 395nm | Curing adhesives, counterfeit detection, sterilization | Pros: Versatile for curing and inspection; energy-efficient; widely available. Cons: Limited penetration depth; safety precautions required. |

| UVB LED Strip | Emits medium-wave UV light (280-315 nm); less common, specialized | Medical therapy, plant growth stimulation, phototherapy | Pros: Effective for therapeutic and agricultural uses. Cons: Higher cost; more stringent safety and regulatory compliance. |

| UVC LED Strip | Emits short-wave UV light (100-280 nm), typically 260-280 nm; strong germicidal effect | Water purification, surface sterilization, air disinfection | Pros: Powerful sterilization; growing demand in hygiene-sensitive industries. Cons: Higher price; requires robust housing for safety; shorter LED lifespan. |

| Flexible UV LED Strip | Bendable strips with UV LEDs; available in UVA, UVB, or UVC variants | Custom installations, curved surfaces, portable sterilizers | Pros: High adaptability for complex designs; easy installation. Cons: Potential durability issues; may require protective coatings. |

| Waterproof UV LED Strip | UV LED strips with IP65-IP68 ratings for moisture and dust resistance | Outdoor UV curing, pool sterilization, industrial cleaning | Pros: Suitable for harsh environments; extends application scope. Cons: Slightly higher cost; reduced flexibility due to protective encapsulation. |

UVA LED Strip

UVA LED strips are the most commonly used UV strips, emitting wavelengths in the 365-395 nm range. Their versatility makes them ideal for applications such as curing adhesives and coatings, counterfeit detection, and sterilization processes. For B2B buyers, UVA strips offer a good balance of performance and cost-efficiency. However, buyers should ensure proper safety measures due to UV exposure risks and consider the penetration limitations when selecting for curing or sterilization.

UVB LED Strip

UVB LED strips operate in the 280-315 nm range and are less prevalent but essential in niche sectors like medical phototherapy and plant growth stimulation. These strips require buyers to navigate stricter regulatory standards and higher costs due to their specialized nature. B2B customers should prioritize suppliers with certifications for medical or agricultural use and assess the long-term reliability of these LEDs under continuous operation.

UVC LED Strip

UVC LED strips emit short-wave UV light (typically 260-280 nm) with potent germicidal properties, making them critical for water purification, surface sterilization, and air disinfection applications. For B2B procurement, the focus should be on durability, safety features such as protective housings, and LED lifespan, as UVC LEDs tend to degrade faster. Buyers targeting hygiene-sensitive industries should also verify compliance with international health and safety regulations.

Flexible UV LED Strip

Flexible UV LED strips combine the benefits of UV light with adaptable form factors, allowing installation on curved or irregular surfaces. Available across UVA, UVB, and UVC variants, these strips are suited for custom lighting designs and portable sterilization devices. B2B buyers should evaluate the strip’s durability, flexibility ratings, and protective coatings to ensure longevity and performance in their intended applications.

Waterproof UV LED Strip

Waterproof UV LED strips are engineered with IP65 to IP68 ratings to withstand moisture, dust, and harsh environments. This makes them ideal for outdoor UV curing, pool sterilization, and industrial cleaning operations where exposure to water or contaminants is inevitable. While these strips command a premium price, their extended operational life and reliability justify the investment for businesses operating in demanding conditions. Buyers should confirm the waterproof rating and compatibility with their power systems.

Related Video: How Large Language Models Work

Key Industrial Applications of uv led strip

| Industry/Sector | Specific Application of uv led strip | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Printing & Packaging | UV curing of inks and coatings on packaging materials | Rapid curing reduces production time and energy consumption; improves print durability and quality | Ensure wavelength compatibility with inks; durability under continuous use; supplier certifications for industrial-grade UV LEDs |

| Medical & Pharmaceutical | Sterilization and disinfection of equipment and surfaces | Enhances hygiene and safety by effectively eliminating pathogens without chemicals | UV output intensity and uniformity; compliance with health and safety standards; reliability in continuous operation |

| Automotive Manufacturing | UV curing of adhesives and coatings in assembly lines | Accelerates production cycles with fast curing; improves bond strength and finish quality | Robustness for industrial environments; compatibility with automotive-grade materials; supplier capacity for volume orders |

| Water & Air Purification | UV disinfection systems integrated into filtration units | Improves public health by eliminating bacteria and viruses; energy-efficient and chemical-free | UV LED lifespan and power efficiency; IP rating for wet environments; ease of integration with existing purification systems |

| Security & Forensics | Authentication and detection of security features on documents | Enhances anti-counterfeiting measures; quick and precise verification | UV wavelength specificity for fluorescence; durability and consistent output; availability of technical support for system integration |

UV LED strips are increasingly pivotal in printing and packaging industries, where they enable rapid UV curing of inks and coatings on diverse substrates. This technology dramatically shortens drying times compared to traditional methods, boosting throughput and reducing energy costs. For B2B buyers in regions like South America and Europe, it is critical to source UV LED strips that match the specific curing wavelengths of inks used locally, ensuring optimal adhesion and color stability. Industrial-grade durability and supplier certifications are essential to guarantee consistent performance in high-volume production lines.

In the medical and pharmaceutical sectors, UV LED strips serve as effective tools for sterilization and disinfection of instruments and surfaces. They provide a chemical-free method to reduce microbial contamination, which is vital for maintaining hygiene standards. Buyers from Africa and the Middle East should prioritize UV strips with high-intensity output and uniform irradiation to maximize sterilization efficacy. Compliance with international health and safety regulations and reliable supplier support for maintenance and replacement are crucial considerations in these sensitive environments.

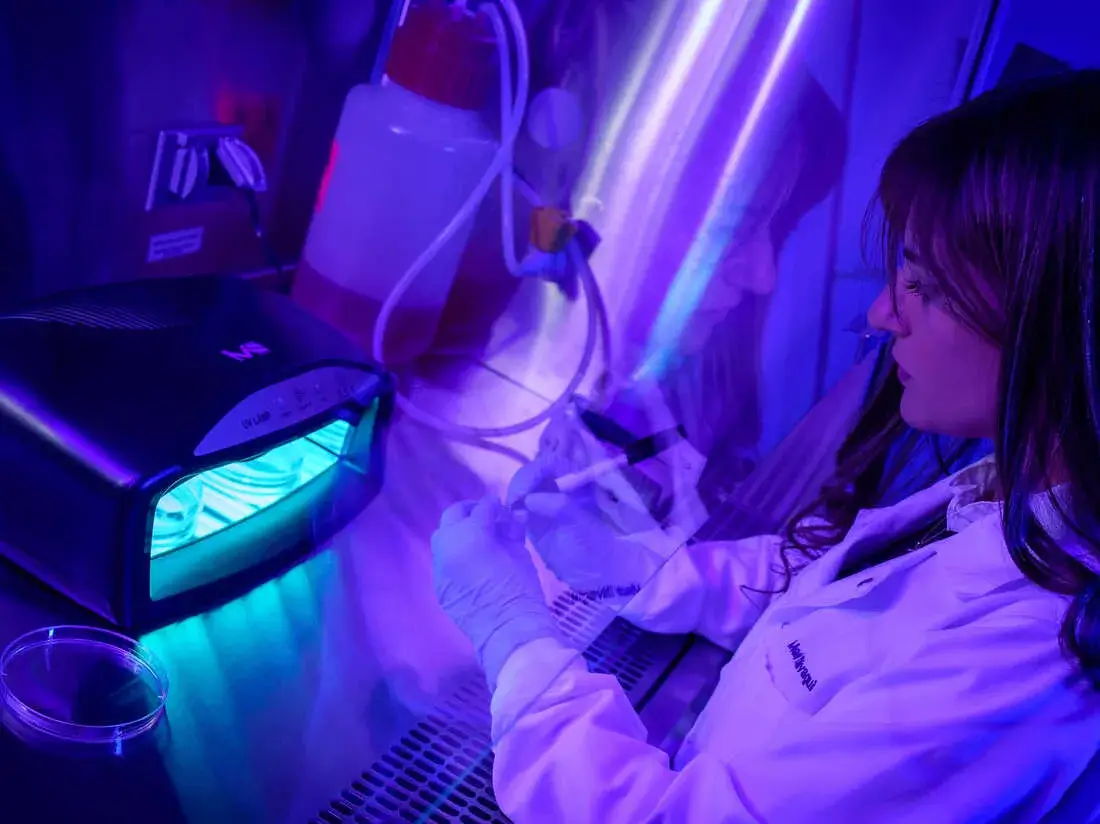

Illustrative Image (Source: Google Search)

The automotive manufacturing industry benefits from UV LED strips for curing adhesives and coatings during vehicle assembly. This application accelerates production cycles and enhances the durability and finish quality of automotive parts. For buyers in Poland and other European countries, sourcing UV LED strips requires attention to their robustness under industrial conditions and compatibility with automotive-grade materials. Suppliers capable of fulfilling large-scale orders with consistent quality are preferred to meet the demands of mass production.

In water and air purification systems, UV LED strips are integrated to provide effective disinfection by neutralizing harmful microorganisms without chemicals. This application is particularly relevant for emerging markets in Africa and the Middle East, where clean water and air are critical concerns. Buyers must evaluate the UV LED lifespan, power efficiency, and the product’s IP rating to ensure resistance to moisture. Additionally, ease of integration with existing filtration units and local regulatory compliance are important factors for successful deployment.

Lastly, in the security and forensic sectors, UV LED strips facilitate the authentication and detection of security features on documents and currency. This enhances anti-counterfeiting efforts by enabling quick and reliable verification. International buyers should focus on UV LEDs with specific wavelength outputs that trigger fluorescence in security inks and materials. Durability, consistent light output, and access to technical support for system integration are essential to maintain operational effectiveness in high-security environments.

Related Video: DIFFERENCE between 365nm and 400nm UV LED Black Lights Explained VISUALLY

Strategic Material Selection Guide for uv led strip

When selecting materials for UV LED strips, B2B buyers must consider performance characteristics such as thermal management, environmental resistance, and compliance with international standards. The choice of material directly influences the durability, efficiency, and suitability of the UV LED strip for specific industrial or commercial applications. Below is an analysis of four common materials used in UV LED strip manufacturing, with a focus on actionable insights for buyers from Africa, South America, the Middle East, and Europe.

Flexible Printed Circuit Board (FPCB) with Copper Layers

Key Properties:

FPCBs used in UV LED strips typically feature copper layers ranging from 1oz to 4oz thickness. Copper’s excellent electrical conductivity and thermal dissipation capabilities are critical for maintaining LED performance and longevity, especially under continuous UV operation which generates heat. The flexibility of the PCB allows installation on curved or irregular surfaces.

Pros & Cons:

– Pros: Superior heat dissipation reduces thermal degradation of UV LEDs, enhancing lifespan. Flexibility enables versatile application designs. Copper layers improve electrical efficiency.

– Cons: Higher copper weight increases cost and manufacturing complexity. Thicker copper layers may reduce flexibility slightly.

– Impact on Application: Ideal for applications requiring heat management such as UV curing systems in printing or medical sterilization.

– Considerations for Buyers: European buyers, especially in Poland, often require compliance with RoHS and REACH regulations, which mandate restrictions on hazardous substances in copper PCBs. African and Middle Eastern buyers should verify supplier adherence to ASTM or IEC standards for electrical safety and thermal performance, ensuring durability in high-temperature environments typical in these regions.

Silicone Encapsulation

Key Properties:

Silicone is commonly used as a protective encapsulant for UV LED strips due to its excellent UV resistance, flexibility, and temperature tolerance (typically -40°C to 200°C). It offers superior protection against moisture, dust, and chemical exposure.

Pros & Cons:

– Pros: High UV stability prevents yellowing or degradation, ensuring consistent light output. Flexible and waterproof, suitable for harsh outdoor or industrial environments.

– Cons: Silicone encapsulation is more expensive than epoxy alternatives and can complicate manufacturing due to curing times and handling.

– Impact on Application: Essential for outdoor UV LED applications such as water purification or agricultural pest control where exposure to elements is constant.

– Considerations for Buyers: Buyers in South America and the Middle East should prioritize silicone encapsulation for UV strips used in humid or corrosive environments. Compliance with IP ratings (IP65 to IP68) is critical. European buyers may require compliance with DIN standards for material safety and environmental impact.

Aluminum Substrate / Heat Sink

Key Properties:

Aluminum is widely used as a substrate or integrated heat sink for UV LED strips due to its high thermal conductivity (up to 205 W/mK) and lightweight nature. It effectively dissipates heat away from LEDs, preventing overheating.

Pros & Cons:

– Pros: Enhances thermal management, prolonging LED lifespan. Provides mechanical rigidity and corrosion resistance when anodized. Cost-effective and recyclable.

– Cons: Adds weight and reduces flexibility compared to FPCB-only designs. Requires precise manufacturing to ensure good thermal interface.

– Impact on Application: Ideal for fixed installations such as industrial curing lines or architectural UV lighting where rigidity and heat dissipation are priorities.

– Considerations for Buyers: In regions like Kenya and Poland, aluminum substrates must meet corrosion resistance standards (e.g., ASTM B117 salt spray test) due to varying environmental conditions. Buyers should verify anodizing quality and thickness for durability.

Epoxy Resin Coating

Key Properties:

Epoxy resin coatings are used to protect UV LED strips from mechanical damage and moisture ingress. While less UV resistant than silicone, epoxy offers good adhesion and hardness.

Pros & Cons:

– Pros: Lower cost and easier to apply than silicone. Provides robust mechanical protection.

– Cons: Susceptible to yellowing and degradation under prolonged UV exposure, which can reduce light transmission and efficiency. Limited flexibility.

– Impact on Application: Suitable for indoor UV LED applications where direct UV exposure is limited, such as in laboratory or manufacturing environments.

– Considerations for Buyers: For buyers in South America and Africa, where cost sensitivity is high, epoxy coatings may be attractive but require careful evaluation of UV exposure levels. Compliance with JIS or IEC standards for electrical insulation and flame retardancy is recommended.

| Material | Typical Use Case for uv led strip | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Flexible PCB with Copper | Curved or flexible UV LED installations requiring heat dissipation | Excellent thermal and electrical conductivity | Higher cost and reduced flexibility with thicker copper | Medium |

| Silicone Encapsulation | Outdoor or industrial UV applications exposed to moisture and chemicals | Superior UV resistance and waterproofing | Higher manufacturing complexity and cost | High |

| Aluminum Substrate/Heat Sink | Fixed installations needing mechanical rigidity and heat management | Excellent heat dissipation and corrosion resistance | Adds weight and reduces flexibility | Medium |

| Epoxy Resin Coating | Indoor UV LED applications with limited direct UV exposure | Cost-effective mechanical protection | Prone to yellowing and UV degradation | Low |

In-depth Look: Manufacturing Processes and Quality Assurance for uv led strip

Understanding the manufacturing processes and quality assurance protocols behind UV LED strips is essential for international B2B buyers aiming to source reliable, high-performance products. This knowledge enables buyers from regions such as Africa, South America, the Middle East, and Europe—including countries like Poland and Kenya—to make informed decisions that balance cost, durability, and compliance with local regulations.

Manufacturing Process Overview for UV LED Strips

UV LED strips are specialized lighting products that emit ultraviolet light, widely used in curing, sterilization, medical equipment, and industrial applications. Their manufacturing involves several critical stages:

-

Material Preparation

– Substrate Selection: Typically, a flexible printed circuit board (FPCB) is chosen for its flexibility and heat dissipation properties. Copper layers of 2oz to 4oz thickness are common to ensure efficient thermal management.

– LED Chips: UV LED chips are selected based on wavelength (commonly 365nm to 405nm), power output, and efficiency. Sourcing from reputable chip manufacturers ensures consistency.

– Components: Resistors, capacitors, connectors, and protective coatings are procured, often complying with RoHS and REACH standards to minimize hazardous substances. -

Forming and Circuit Fabrication

– FPCB Fabrication: The copper-clad flexible boards are etched to form circuit pathways tailored to the UV LEDs’ electrical requirements.

– Surface Mount Technology (SMT) Assembly: Automated pick-and-place machines mount UV LED chips and other components onto the PCB with high precision.

– Reflow Soldering: The assembled boards pass through reflow ovens, melting solder paste to secure components firmly, ensuring electrical conductivity and mechanical stability. -

Assembly and Integration

– Wiring and Connection: LED strips are wired with suitable connectors and cables, often incorporating waterproof seals if outdoor or humid environment use is intended.

– Encapsulation and Protective Coatings: UV-resistant silicone or epoxy coatings are applied to protect LEDs from environmental damage and enhance durability.

– Cutting and Sizing: Strips are cut to customer-specified lengths, with clear marking for cutting points to facilitate installation. -

Finishing and Packaging

– Labeling: Each strip is labeled with technical specifications, batch numbers, and compliance marks.

– Packaging: Anti-static and moisture-proof packaging is used to protect the product during transit, often including desiccants to prevent humidity damage.

Quality Assurance and Control (QA/QC) Framework

Quality assurance in UV LED strip manufacturing is multi-layered, integrating international standards, in-process inspections, and final product testing to guarantee performance and safety.

Relevant International and Industry Standards

- ISO 9001: This global quality management standard ensures that manufacturers maintain consistent production processes and continual improvement.

- CE Marking: Critical for European buyers, CE certification confirms conformity with EU safety, health, and environmental requirements.

- RoHS (Restriction of Hazardous Substances): Ensures the product is free from harmful materials like lead or mercury.

- UL/ETL Certifications: Particularly important for buyers in regions with stringent electrical safety laws.

- API or Industry-Specific Certifications: For UV LED strips used in medical or sterilization applications, compliance with relevant industry standards (e.g., FDA guidelines or IEC standards) is often required.

QC Checkpoints

-

Incoming Quality Control (IQC)

– Inspection and testing of raw materials and components upon arrival.

– Verification of LED chip specifications, substrate integrity, and solder paste quality.

– Ensures only conforming materials enter production. -

In-Process Quality Control (IPQC)

– Continuous monitoring during SMT placement, soldering, and assembly stages.

– Automated optical inspection (AOI) machines detect misaligned or missing components.

– Thermal imaging may be employed to assess solder joint quality and heat dissipation. -

Final Quality Control (FQC)

– Functional testing of completed UV LED strips, including voltage, current, and light output measurements.

– Wavelength verification using spectrometers to ensure UV emission matches specifications.

– Waterproof and insulation resistance tests for strips with IP ratings.

– Visual inspections for physical defects and packaging integrity.

Testing Methods Commonly Employed

- Electrical Testing: Ensures correct forward voltage and current characteristics.

- Photometric Testing: Measures UV intensity and uniformity to meet application-specific requirements.

- Environmental Testing: Includes temperature cycling and humidity exposure to verify reliability under operating conditions.

- Durability Testing: Simulates mechanical stress, bending, and vibration to assess strip robustness.

How B2B Buyers Can Verify Supplier QC Capabilities

- Factory Audits: Conduct on-site or virtual audits to evaluate manufacturing capabilities, QC processes, and compliance with international standards.

- Review of Quality Documentation: Request ISO certificates, test reports, and compliance certificates (e.g., CE, RoHS).

- Third-Party Inspection: Engage independent inspection agencies to perform pre-shipment inspections, random sampling, and laboratory testing.

- Sample Testing: Order samples for in-house testing or testing at accredited labs to confirm product claims.

QC and Certification Nuances for International Buyers

- Regional Compliance Requirements: Buyers from Europe must prioritize CE marking and RoHS compliance; Middle Eastern and South American markets may require additional certifications like SASO (Saudi Arabia) or INMETRO (Brazil).

- Customs and Import Regulations: Understanding local import restrictions and documentation requirements helps avoid delays and penalties.

- Supplier Transparency: Choose suppliers with open QC processes and willingness to share detailed test data, which is crucial for buyers in emerging markets where verifying product authenticity can be challenging.

- After-Sales Support: Ensure suppliers provide warranty terms, technical support, and replacement policies aligned with international trade norms.

Key Takeaways for B2B Buyers in Africa, South America, the Middle East, and Europe

- Prioritize Suppliers with Robust QA Systems: Look for ISO 9001 certification and adherence to international product safety standards to minimize risk.

- Demand Comprehensive QC Documentation: This is vital for audits and regulatory compliance in your respective markets.

- Leverage Third-Party Inspections: Especially important for buyers sourcing from overseas manufacturers to ensure quality before shipment.

- Understand Application-Specific Requirements: UV LED strips for sterilization require stricter wavelength and intensity controls compared to decorative UV lighting.

- Consider Environmental and Operational Conditions: Select UV LED strips with appropriate IP ratings and thermal management for your region’s climate.

By thoroughly understanding the manufacturing and quality assurance processes behind UV LED strips, international B2B buyers can confidently engage with suppliers, mitigate supply chain risks, and secure products that meet their technical and regulatory needs. This strategic approach supports sustainable partnerships and drives business success across diverse global markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for uv led strip Sourcing

When sourcing UV LED strips, understanding the detailed cost structure and pricing dynamics is crucial for international B2B buyers aiming to optimize procurement strategies. The pricing of UV LED strips is influenced by multiple cost components, which together shape the final purchase price and overall value proposition.

Key Cost Components

-

Materials: The core expense revolves around high-quality UV LEDs, flexible printed circuit boards (FPCBs), and protective coatings (often waterproofing materials). UV LEDs tend to be more expensive than standard visible-light LEDs due to specialized semiconductor materials and manufacturing complexity. Copper weight in PCBs (e.g., 2oz vs. 4oz) also impacts cost and performance.

-

Labor: Labor costs vary significantly by manufacturing location. Chinese factories, for instance, benefit from experienced labor pools and economies of scale, offering competitive pricing. However, labor rates in emerging markets may fluctuate due to local economic conditions and skill availability.

-

Manufacturing Overhead: This includes factory utilities, equipment depreciation, and indirect labor. Factories with advanced automation and quality control systems may charge slightly higher overhead but often deliver superior consistency and reliability.

-

Tooling and Setup: Custom UV LED strips, especially those requiring unique PCB designs or specialized encapsulation for UV resistance, involve upfront tooling expenses. These costs are amortized over production volume and directly affect unit pricing for smaller orders.

-

Quality Control (QC): Rigorous QC is essential for UV LED strips due to their application in sensitive industries such as medical sterilization or industrial curing. Costs related to testing equipment, certifications (e.g., CE, RoHS, UL), and defect mitigation contribute to pricing.

-

Logistics and Shipping: International freight, customs duties, and handling fees significantly impact landed cost. Buyers in Africa, South America, the Middle East, and Europe should consider port infrastructure, import tariffs, and shipping routes. Consolidated shipments and Incoterms (e.g., FOB, CIF) also influence total logistics expenses.

-

Supplier Margin: Manufacturers and distributors add margins reflecting brand reputation, service level, and market positioning. Premium suppliers with robust after-sales support and warranty policies may command higher prices.

Influential Pricing Factors

-

Order Volume and MOQ: Larger orders typically benefit from volume discounts and lower per-unit tooling costs. However, minimum order quantities (MOQs) can be a barrier for smaller buyers or pilot projects.

-

Technical Specifications and Customization: UV wavelength precision, LED density (LEDs per meter), strip length, waterproof rating (IP65, IP67, IP68), and additional features like dimmability or addressability increase complexity and cost.

-

Material Quality and Certifications: Compliance with international standards and certifications ensures reliability but increases production costs. Buyers targeting regulated markets (e.g., EU’s RoHS compliance) must prioritize certified products despite premium pricing.

-

Supplier Reliability and Location: Established suppliers with proven track records reduce risk but may charge a premium. Local or regional distributors might offer faster delivery but at higher prices due to intermediaries.

-

Incoterms and Payment Terms: Understanding trade terms is critical. For example, FOB pricing excludes shipping, placing logistics responsibility on the buyer, while CIF includes freight and insurance, simplifying procurement but possibly increasing cost.

Strategic Buyer Tips

-

Negotiate Beyond Price: Engage suppliers on payment terms, lead times, and after-sales service. Flexibility in these areas often yields greater overall value than marginal price reductions.

-

Evaluate Total Cost of Ownership (TCO): Consider product lifespan, energy efficiency, maintenance, and warranty support. Cheaper upfront prices can lead to higher operational costs or early replacements.

-

Leverage Local Market Insights: Buyers from regions like Kenya or Poland should account for import tariffs, currency fluctuations, and local demand cycles when negotiating. Partnering with suppliers familiar with these markets can streamline procurement.

-

Request Samples and Pilot Runs: Before committing to large volumes, validate product quality and supplier responsiveness through samples or small test orders.

-

Understand Pricing Nuances: UV LED strips are a niche within LED lighting; prices can vary widely based on wavelength specificity and application. Transparent communication of technical requirements minimizes costly misunderstandings.

Indicative Pricing Disclaimer

Prices for UV LED strips vary widely depending on specifications, volume, and supplier terms. This analysis serves as a general guide and should not substitute for direct quotations. Buyers are encouraged to request detailed proposals tailored to their specific needs to ensure accurate budgeting and procurement planning.

By thoroughly analyzing cost components and pricing influencers, international B2B buyers can optimize sourcing strategies for UV LED strips, balancing cost efficiency with quality and reliability to meet diverse market demands effectively.

Spotlight on Potential uv led strip Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘uv led strip’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for uv led strip

Key Technical Properties of UV LED Strip

Understanding the critical technical specifications of UV LED strips is essential for B2B buyers to ensure product performance, longevity, and suitability for specific applications such as curing, sterilization, or inspection. Here are the primary properties to evaluate:

-

Wavelength (nm)

UV LED strips emit light within specific ultraviolet ranges, commonly UVA (315–400 nm), UVB (280–315 nm), or UVC (100–280 nm). The exact wavelength determines the strip’s effectiveness for applications like disinfection (UVC) or fluorescence detection (UVA). Buyers must match the wavelength to their intended industrial use for optimal results. -

Power Consumption (Watts per meter)

This indicates the energy usage of the strip. Higher wattage typically correlates with greater UV intensity but also impacts operational costs and heat generation. For international buyers, especially in regions with variable energy costs, selecting an energy-efficient strip balances performance with cost savings. -

Radiant Flux / UV Intensity (mW/cm² or mW/m²)

This measures the UV energy emitted per unit area and is critical for processes requiring precise UV doses, such as curing adhesives or sterilizing surfaces. Understanding this metric helps buyers specify strips that meet strict industrial standards and ensures process consistency. -

Material Grade of Flexible PCB and Encapsulation

The quality of the flexible printed circuit board (FPCB) and the encapsulation material affects durability, heat dissipation, and resistance to environmental factors like moisture or chemicals. For buyers in humid or outdoor environments (e.g., coastal regions in South America or Middle East), IP-rated waterproof encapsulation (e.g., IP65, IP67) is vital to maintain reliability. -

Thermal Management / Operating Temperature Range

UV LEDs generate heat that can degrade performance and lifespan if not managed properly. Strips with superior heat sinks or copper layers in the PCB (commonly 2oz or higher copper weight) help maintain stable operation. Buyers should consider the ambient temperature of their installation site and opt for products with appropriate thermal ratings. -

Lifespan and Warranty

Typical UV LED strips offer lifespans ranging from 10,000 to 50,000 hours depending on quality and usage conditions. Longer warranty terms reflect supplier confidence and reduce risk for buyers investing in large-scale or critical applications.

Essential Trade Terminology for UV LED Strip Procurement

Navigating international B2B transactions requires familiarity with common industry and trade terms. Here are several key terms that buyers should understand:

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers who produce UV LED strips that can be branded or customized by the buyer. This is important for businesses seeking tailored solutions or private labeling to differentiate their offerings in local markets like Poland or Kenya. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. MOQs vary widely and impact pricing and inventory management. Buyers from emerging markets should negotiate MOQs to align with demand and cash flow constraints. -

RFQ (Request for Quotation)

A formal document sent by buyers to suppliers requesting price quotes and terms for specific UV LED strip specifications. A well-prepared RFQ accelerates supplier evaluation and ensures clear communication of technical requirements. -

Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, EXW) that define responsibilities for shipping, insurance, and customs clearance. Understanding Incoterms helps buyers manage logistics costs and risks, especially important for cross-continental shipments to Africa, the Middle East, or Europe. -

IP Rating (Ingress Protection)

Indicates the level of protection against solids and liquids (e.g., IP65 means dust-tight and water jets protected). Selecting the correct IP rating ensures the UV LED strip can withstand environmental conditions in the buyer’s region. -

Bin Code

A classification for LED color and brightness consistency. For UV LED strips, bin codes ensure uniform UV output across batches, which is crucial for quality control in industrial applications.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions that optimize procurement efficiency, product performance, and long-term supplier relationships in the competitive UV LED strip market.

Illustrative Image (Source: Google Search)

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the uv led strip Sector

Market Overview & Key Trends

The UV LED strip market is experiencing robust growth driven by expanding applications across industries such as healthcare, water purification, printing, and surface curing. For international B2B buyers, particularly from emerging and diverse markets like Africa, South America, the Middle East, and Europe (including Poland and Kenya), understanding the evolving market dynamics is crucial for strategic sourcing and competitive advantage.

Globally, the demand for UV LED strips is fueled by their energy efficiency, compact form factor, and ability to deliver precise UV wavelengths for specialized industrial processes. This contrasts with traditional UV lamps that are bulkier and consume more power. Buyers are increasingly prioritizing high-performance UV LED strips that offer consistent output, longer lifespans, and enhanced thermal management to support continuous industrial operations.

From a sourcing perspective, there is a noticeable trend toward customizable and application-specific UV LED solutions. Suppliers are offering modular strips with variable UV wavelengths (e.g., UVA, UVB, UVC) tailored for specific uses such as sterilization or adhesive curing. This trend aligns with buyers’ needs for flexible, scalable solutions in diverse sectors ranging from medical device manufacturing to agricultural sterilization.

Market dynamics also reflect regional supply chain considerations. African and South American buyers are focusing on suppliers capable of delivering reliable logistics and after-sales support, given challenges like import tariffs and infrastructure variability. European buyers, especially from countries like Poland, emphasize compliance with stringent regulatory standards (e.g., RoHS, CE marking) and demand transparent quality certifications. Meanwhile, Middle Eastern buyers seek robust, weather-resistant UV LED strips for harsh environmental conditions.

Technological innovation is another key driver. The integration of smart control systems and IoT-enabled UV LED strips enables remote monitoring, predictive maintenance, and enhanced process control. This development is critical for large-scale industrial buyers aiming to optimize operational efficiency and reduce downtime.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a decisive factor in the procurement of UV LED strips, reflecting a global shift toward environmentally responsible manufacturing and supply chains. UV LED technology inherently offers a more sustainable alternative to mercury-based UV lamps, as it eliminates hazardous materials and reduces energy consumption by up to 50-70%. This energy efficiency translates directly into lower operational carbon footprints, which is increasingly important to buyers seeking to meet corporate sustainability goals or regulatory mandates.

For B2B buyers, especially from regions with growing environmental regulations such as the European Union, sourcing from manufacturers that adhere to green certifications (e.g., ISO 14001, RoHS compliance, REACH) is essential. These certifications ensure that UV LED strip production minimizes environmental impact through responsible material sourcing, waste reduction, and safe chemical handling.

Ethical sourcing extends beyond environmental factors to include labor practices and supply chain transparency. Buyers from Africa, South America, and the Middle East should prioritize suppliers with verifiable social responsibility commitments to avoid reputational risks associated with unethical labor or conflict minerals. Engaging with manufacturers who provide full supply chain traceability and uphold fair labor standards reinforces long-term partnerships based on trust and compliance.

Material innovation is also driving sustainability. Some suppliers now offer UV LED strips utilizing recyclable PCB materials and lead-free soldering. Additionally, the adoption of low-toxicity encapsulants and adhesives improves end-of-life disposal and recycling prospects, aligning with circular economy principles.

Ultimately, integrating sustainability and ethical sourcing into procurement strategies not only reduces environmental and social risks but can also unlock cost efficiencies through improved product durability and energy savings, delivering tangible value for international B2B buyers.

Evolution and Historical Context

The UV LED strip sector has evolved significantly over the past two decades, transitioning from niche experimental technology to a mainstream industrial solution. Early UV LED devices were limited by low power output and short lifespans, restricting their commercial viability. However, advances in semiconductor materials, thermal management, and manufacturing precision have enabled the production of high-intensity, durable UV LED strips suitable for continuous industrial use.

This evolution has been accelerated by the global push to replace traditional mercury vapor UV lamps due to health, safety, and environmental concerns. The introduction of flexible UV LED strips has further broadened applications by allowing integration into complex shapes and confined spaces, previously unachievable with rigid UV sources.

For B2B buyers, understanding this trajectory underscores the importance of selecting suppliers with proven R&D capabilities and robust quality assurance processes. The historical shift also highlights growing industry standardization, which facilitates cross-border trade and supports buyers in Africa, South America, the Middle East, and Europe in adopting cutting-edge UV LED technologies with confidence.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of uv led strip

-

How can I effectively vet UV LED strip suppliers from different regions such as China, Europe, or the Middle East?

Start by verifying the supplier’s certifications related to product safety and quality, such as CE, RoHS, and UL. Request detailed technical datasheets and samples to evaluate product performance firsthand. Check their manufacturing capabilities, production capacity, and lead times to ensure they can meet your order volume. Additionally, review client testimonials and references, particularly from businesses in your region or industry. Utilize third-party factory audits or inspection services to validate their quality control systems and compliance with international standards before committing. -

What customization options are typically available for UV LED strips, and how can I ensure they meet my specific application needs?

Most manufacturers offer customization in terms of UV wavelength (e.g., 365nm, 385nm, 395nm), strip length, PCB thickness, waterproof rating (IP65, IP67, IP68), and adhesive backing types. You can also request specific LED chip brands or configurations to optimize brightness and energy efficiency. To ensure suitability, provide detailed technical requirements and intended use cases upfront. Collaborate closely with the supplier’s engineering team to validate design feasibility, and request prototypes or samples for functional testing under your operational conditions. -

What are typical minimum order quantities (MOQs) and lead times for UV LED strip orders, especially when importing to regions like Africa or South America?

MOQs vary widely depending on supplier scale and customization level, commonly ranging from 100 to 500 meters per order. Lead times can range from 3 to 8 weeks, influenced by production schedules, customization complexity, and shipping logistics. For buyers in Africa or South America, factor in additional transit time and customs clearance. Negotiate MOQs early to align with your inventory strategy, and clarify lead time commitments in contracts. Consider suppliers with local warehouses or partners to reduce delivery delays and buffer against supply chain disruptions. -

Which quality assurance certifications and testing should I prioritize when sourcing UV LED strips internationally?

Focus on certifications that demonstrate compliance with international safety and environmental standards, including CE (Europe), RoHS (restriction of hazardous substances), UL (safety in North America), and IEC standards. Additionally, verify that suppliers conduct rigorous photometric testing for UV intensity, wavelength accuracy, and consistency. Environmental testing for waterproofing (IP ratings), heat resistance, and lifespan (MTTF) is also critical. Request third-party lab test reports and ensure batch traceability to maintain quality consistency throughout your supply chain. -

How should I approach payment terms and mitigate financial risks when dealing with overseas UV LED strip suppliers?

Negotiate payment terms that balance risk and cash flow, such as an initial deposit (30%) with the balance paid upon inspection or before shipment. Use secure payment methods like Letters of Credit (LC) or escrow services to protect funds until contract conditions are met. Avoid full upfront payments unless you have a trusted relationship. Establish clear contractual terms covering delivery schedules, penalties for delays, and dispute resolution. Engage legal counsel familiar with international trade laws to review agreements, especially when working with suppliers from unfamiliar regions. -

What logistics considerations are important for importing UV LED strips to countries with complex customs procedures like Kenya or Brazil?

Ensure your supplier provides complete and accurate documentation, including commercial invoices, packing lists, certificates of origin, and compliance certificates. Collaborate with experienced freight forwarders who understand local customs requirements and can handle duties, taxes, and import permits efficiently. Opt for consolidated shipping if feasible to reduce costs and customs inspections. Plan for potential delays by building buffer times into your project schedules. Consider local regulations on electrical products and UV safety standards that might affect import clearance or market entry. -

How can I handle product disputes or quality issues effectively with international UV LED strip suppliers?

Establish clear quality benchmarks and acceptance criteria before production begins, documented in your purchase agreement. Conduct pre-shipment inspections either through your own team or third-party quality control firms. If defects arise, communicate promptly with detailed evidence (photos, test reports). Request corrective actions such as rework, replacement, or refunds. Maintain open and professional communication channels to facilitate resolution. If disputes escalate, leverage arbitration clauses or international trade dispute mechanisms included in your contract to protect your interests. -

Are there emerging market trends or technological developments in UV LED strips that B2B buyers should consider?

Yes, innovations include higher-efficiency UV-C LEDs for sterilization, enhanced flexible PCBs for curved surfaces, and integrated smart controls for IoT-enabled applications. Buyers in healthcare, water treatment, and industrial curing sectors should look for strips with precise wavelength control and longer lifespans. Sustainability is gaining focus, with suppliers adopting eco-friendly materials and energy-efficient designs. Staying informed about these trends can unlock new business opportunities and improve product performance, especially in fast-growing markets across Africa, the Middle East, and Europe.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for uv led strip

Strategic Sourcing Insights and Future Perspectives for UV LED Strip Buyers

As UV LED strip technology continues to evolve, international B2B buyers must prioritize a strategic sourcing approach that balances quality, innovation, and cost-efficiency. Key considerations include selecting suppliers with robust manufacturing capabilities, proven quality assurance processes, and compliance with international standards—factors that are especially critical for markets in Africa, South America, the Middle East, and Europe, where environmental conditions and application requirements vary widely. Understanding technical specifications such as wavelength precision, durability, and power consumption ensures optimal product performance tailored to diverse industrial, medical, and sterilization applications.

Strategic sourcing empowers buyers to:

- Mitigate supply chain risks by partnering with reliable manufacturers offering transparent production processes

- Leverage technological advancements such as enhanced UV-C efficacy and energy-efficient designs

- Optimize total cost of ownership through informed material selection and volume negotiations

- Align procurement with sustainability goals by prioritizing eco-friendly production and recyclable components

Looking ahead, the UV LED strip market promises dynamic growth fueled by expanding industrial use cases and heightened demand for disinfection solutions. Buyers in regions like Poland, Kenya, and beyond are encouraged to engage proactively with suppliers, invest in rigorous product testing, and explore innovative customization options. Embracing a forward-thinking sourcing strategy will not only secure competitive advantages but also drive long-term value in an increasingly UV-driven global landscape.