Introduction: Navigating the Global Market for ultraviolet led strips

Ultraviolet (UV) LED strips represent a transformative advancement in industrial and commercial lighting technology. Combining precision ultraviolet emission with the flexibility and energy efficiency of LED strips, these products unlock new possibilities across sectors such as manufacturing, healthcare, security, and environmental control. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—understanding the nuances of UV LED strips is crucial to capitalizing on their unique benefits and ensuring optimal application outcomes.

This comprehensive guide delves into the essential aspects of UV LED strips, offering an authoritative resource tailored to the needs of bulk purchasers and project developers. It covers the full spectrum of product types, including UV-A, UV-B, and UV-C variants, highlighting their specific applications and safety considerations. Buyers will gain insights into materials, manufacturing standards, and stringent quality control protocols that underpin product reliability and longevity. Detailed supplier evaluations and cost analysis empower buyers to navigate pricing structures and logistical challenges inherent in global sourcing.

Moreover, this guide addresses region-specific market dynamics and regulatory frameworks, enabling businesses from South Africa, Brazil, the UAE, Germany, and beyond to make informed procurement decisions aligned with local compliance and industry trends. A dedicated FAQ section tackles common concerns, streamlining the decision-making process.

By synthesizing technical knowledge with practical sourcing strategies, this guide equips B2B buyers to confidently select UV LED strip solutions that deliver superior performance, scalability, and value—driving innovation and efficiency across their operations.

Understanding ultraviolet led strips Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| UV-A LED Strips | Wavelength 315-400nm; longest UV wavelength; low energy | Industrial curing, currency verification, forensic analysis | Pros: Safe for human exposure, versatile, energy-efficient. Cons: Limited germicidal effect, not for disinfection. |

| UV-B LED Strips | Wavelength 280-315nm; medium UV wavelength; moderate energy | Medical therapy, lithography, antimicrobial applications | Pros: Effective for specialized medical uses, moderate penetration. Cons: Potential health risks, less common. |

| UV-C LED Strips | Wavelength 100-280nm; shortest UV wavelength; high energy | Air/water purification, sterilization, disinfection | Pros: Powerful germicidal effect, essential for sanitation. Cons: Harmful to humans, requires safety measures. |

| 365nm UV LED Strips | Narrow UV-A spectrum; peak wavelength at 365nm | UV printing, curing adhesives, fluorescence detection | Pros: High precision, ideal for industrial curing, stable output. Cons: Higher cost, application-specific. |

| 395nm UV LED Strips | Near-UV, edge of visible spectrum; peak wavelength at 395nm | Decorative lighting, counterfeit detection, general UV tasks | Pros: Lower cost, less intense UV exposure, versatile. Cons: Less effective for curing, weaker fluorescence effect. |

UV-A LED Strips

These strips emit UV light in the 315-400nm range, offering the longest wavelength and lowest energy among UV types. They are widely used in industrial curing, currency verification, and forensic applications due to their safety profile and energy efficiency. For B2B buyers, UV-A strips are ideal when human exposure is a concern or when applications require gentle UV irradiation. Buyers should consider wavelength precision and durability to ensure consistent performance in specialized industrial environments.

UV-B LED Strips

Operating in the 280-315nm spectrum, UV-B LED strips serve niche markets such as medical therapy and antimicrobial treatments. Their moderate energy level allows for deeper penetration than UV-A but requires careful handling due to potential health risks. For B2B purchasers, it’s essential to verify compliance with health and safety regulations and confirm supplier expertise in medical-grade UV products. These strips are less common and may involve higher procurement costs.

UV-C LED Strips

UV-C strips emit high-energy UV light between 100-280nm, making them highly effective for disinfection and sterilization in air and water purification systems. They are critical for industries prioritizing hygiene, such as healthcare and food processing. B2B buyers must prioritize products with robust safety features and certifications due to the harmful effects of UV-C on human skin and eyes. Longevity and stable output under continuous operation are key considerations.

365nm UV LED Strips

This specialized narrow-band UV-A strip peaks at 365nm, ideal for precise industrial applications like UV printing, adhesive curing, and fluorescence detection. These strips provide stable, high-intensity UV output, making them suitable for automated manufacturing environments. Buyers should focus on product customization options such as length, power, and waterproof ratings to fit complex installations and ensure integration with existing production lines.

395nm UV LED Strips

Positioned at the edge of the visible spectrum, 395nm UV LED strips offer lower-cost UV solutions with less intense irradiation. They are commonly used in decorative lighting, counterfeit detection, and general-purpose UV tasks. For B2B buyers, these strips provide versatility and cost efficiency but may not meet the requirements for high-precision or curing applications. Evaluating supplier quality and warranty terms is important to mitigate variability in performance.

Related Video: Denoising Diffusion Probabilistic Models | DDPM Explained

Key Industrial Applications of ultraviolet led strips

| Industry/Sector | Specific Application of Ultraviolet LED Strips | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Printing & Packaging | UV Curing for inks, coatings, and adhesives | Faster drying times, improved product durability, and reduced energy consumption | Select strips with specific UV-A wavelengths (365nm or 395nm), ensure consistent intensity and durability under industrial conditions |

| Medical & Dental | Sterilization, disinfection, and dental curing | Enhanced hygiene, precise treatment control, and reduced chemical use | Source mercury-free, low-heat UV-C strips with certified safety standards and reliable lifespan warranties |

| Forensic & Security | Fluorescent detection and counterfeit currency verification | Improved accuracy in detection, enhanced security protocols, and lower operational costs | Opt for UV-A strips with stable output, customizable lengths, and compatibility with portable devices for field use |

| Agriculture & Horticulture | Pest control and plant growth stimulation using UV light | Reduced pesticide use, increased crop yield, and eco-friendly pest management | Prioritize waterproof, robust strips with adjustable wavelength options suitable for diverse climates |

| Industrial Manufacturing | Surface treatment and adhesive curing on assembly lines | Higher throughput, consistent quality control, and energy savings | Choose strips with rapid start-up, high energy efficiency, and customizable form factors for integration |

Ultraviolet LED strips have become indispensable in printing and packaging industries, where UV curing technology is employed to rapidly dry inks, coatings, and adhesives. This application accelerates production cycles and enhances product durability while reducing energy consumption compared to traditional mercury lamps. For B2B buyers in regions like South America and Europe, sourcing UV LED strips with precise 365nm or 395nm wavelengths ensures compatibility with existing curing systems. Additionally, durability under continuous industrial use and consistent UV output are critical for maintaining quality and minimizing downtime.

In the medical and dental sectors, UV LED strips are widely used for sterilization and curing dental resins, providing a chemical-free method to ensure hygiene and treatment precision. The low heat emission of UV-C LED strips makes them ideal for sensitive environments, reducing thermal damage risks. Buyers from Africa and the Middle East should prioritize products that comply with international safety certifications and offer long operational lifespans to support stringent healthcare standards while managing maintenance costs effectively.

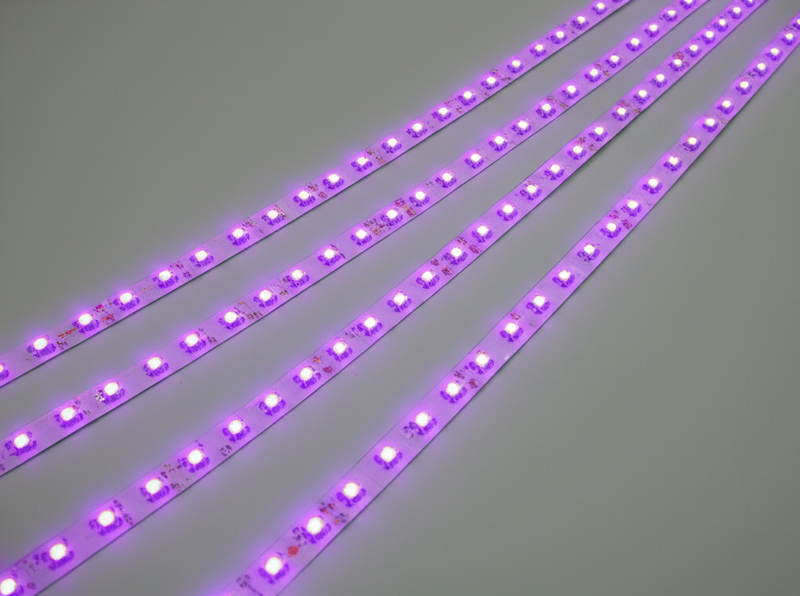

Illustrative Image (Source: Google Search)

For forensic and security applications, UV LED strips enable fluorescent detection of biological stains and verification of currency authenticity. This enhances investigative accuracy and strengthens security protocols without relying on bulky traditional UV lamps. International buyers, especially in regions with mobile or field operations, benefit from compact, customizable UV-A strips that deliver stable performance and are easily integrated into portable devices for on-site use.

In agriculture and horticulture, UV LED strips contribute to pest control by disrupting insect life cycles and stimulating plant growth through targeted UV exposure. This reduces reliance on chemical pesticides, promoting sustainable farming practices and increasing crop yields. Buyers in diverse climates, such as South Africa and Australia, must select waterproof, rugged strips with adjustable wavelengths to adapt to environmental variations and ensure reliable outdoor operation.

Finally, in industrial manufacturing, UV LED strips are essential for surface treatment and adhesive curing on fast-paced assembly lines. Their rapid start-up and energy efficiency enable higher throughput and consistent product quality. B2B buyers should look for highly customizable strips that can be tailored in length and power to fit specific machinery setups, while also ensuring supplier reliability for large-scale deployments across multiple sites in Europe and the Middle East.

Related Video: Understanding Ultraviolet UV Radiation and its Effects

Strategic Material Selection Guide for ultraviolet led strips

Material Considerations for Ultraviolet LED Strips in Industrial and Commercial Applications

Selecting the right materials for ultraviolet (UV) LED strips is critical for ensuring optimal performance, durability, and compliance with international standards. This is especially important for B2B buyers operating in diverse markets such as Africa, South America, the Middle East, and Europe, where environmental conditions and regulatory requirements vary significantly. Below is an in-depth analysis of four common materials used in UV LED strip construction, focusing on their properties, advantages, limitations, and regional considerations.

1. Flexible Polyimide (PI) Substrate

Key Properties:

Polyimide substrates are known for their exceptional thermal stability, withstanding temperatures up to 400°C. They offer excellent chemical resistance and mechanical flexibility, making them ideal for curved or irregular surfaces. PI substrates also exhibit good electrical insulation and UV resistance.

Pros & Cons:

– Pros: High temperature tolerance supports high-power UV LEDs; excellent flexibility enables complex installations; resistant to harsh chemicals and UV degradation.

– Cons: Higher material and manufacturing costs compared to standard PVC substrates; requires specialized handling during assembly due to brittleness under extreme bending.

Impact on Application:

PI substrates are well-suited for industrial UV curing and sterilization applications where elevated temperatures and chemical exposure are common. Their durability ensures consistent UV output over long operational periods.

International B2B Considerations:

Buyers in regions with high ambient temperatures, such as the Middle East and parts of Africa, benefit from PI’s thermal resilience. Compliance with European RoHS and REACH standards is generally straightforward with PI materials. South American buyers should verify local chemical resistance requirements, especially for outdoor or industrial environments.

2. Polyvinyl Chloride (PVC) Coating

Key Properties:

PVC coatings provide a cost-effective, flexible, and waterproof layer for UV LED strips. While PVC has moderate temperature resistance (up to ~80°C), it offers good electrical insulation and basic chemical resistance.

Pros & Cons:

– Pros: Low cost, easy to manufacture, widely available; good moisture and dust protection; suitable for general-purpose UV LED strip applications.

– Cons: Limited heat resistance restricts use in high-power or high-temperature environments; susceptible to UV degradation over time, potentially reducing lifespan.

Impact on Application:

PVC-coated UV strips are ideal for decorative or low-intensity UV applications, such as UV nail lamps or currency verification devices, where cost efficiency is prioritized over extreme durability.

International B2B Considerations:

PVC is widely accepted in South American and African markets due to its affordability. However, buyers in Europe and Australia should be cautious of PVC’s environmental impact and potential restrictions under stringent regulations like the EU’s RoHS directive. Middle Eastern buyers must consider ambient temperature limits to avoid premature material failure.

3. Silicone Encapsulation

Key Properties:

Silicone encapsulation offers excellent UV transparency, high flexibility, and outstanding thermal stability (up to 200°C). It provides superior resistance to moisture, chemicals, and mechanical stress, making it highly durable in harsh environments.

Pros & Cons:

– Pros: Exceptional durability under UV exposure; maintains performance in extreme temperatures; waterproof and chemically inert; flexible for complex installations.

– Cons: Higher cost and more complex manufacturing process; may require specialized adhesives for mounting.

Impact on Application:

Silicone-encapsulated UV LED strips are preferred in medical, biomedical, and outdoor disinfection applications where reliability and longevity under continuous UV exposure are critical.

International B2B Considerations:

European and Australian buyers often favor silicone for compliance with strict environmental and safety standards. In Africa and the Middle East, silicone’s resistance to heat and dust makes it suitable for outdoor and industrial use. South American buyers should assess cost-benefit trade-offs for large-scale projects.

4. Aluminum PCB Base

Key Properties:

Aluminum PCBs provide excellent heat dissipation, mechanical strength, and electrical conductivity. They can operate efficiently under high current loads and maintain stable UV output by minimizing thermal degradation.

Pros & Cons:

– Pros: Superior thermal management extends LED lifespan; robust mechanical support; compatible with high-power UV LEDs.

– Cons: Less flexible than polymer substrates; higher weight; increased cost and complexity in manufacturing.

Impact on Application:

Aluminum base UV LED strips are ideal for industrial curing, sterilization, and large-scale commercial installations requiring high power and consistent UV intensity.

International B2B Considerations:

Buyers in Europe and the Middle East with industrial-scale UV curing needs will find aluminum PCBs advantageous. African and South American buyers should consider logistics and shipping costs due to increased weight. Compliance with ASTM and DIN standards for thermal management is often required in these regions.

Summary Table of Materials for Ultraviolet LED Strips

| Material | Typical Use Case for ultraviolet led strips | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyimide (PI) | Industrial UV curing, sterilization, high-temp environments | High thermal stability and chemical resistance | Higher cost and brittle under extreme bends | High |

| Polyvinyl Chloride (PVC) | Decorative UV applications, low-power devices | Low cost and good moisture protection | Limited heat resistance and UV degradation | Low |

| Silicone Encapsulation | Medical, biomedical, outdoor disinfection | Excellent UV transparency and environmental durability | Higher cost and complex manufacturing | High |

| Aluminum PCB Base | Industrial curing, high-power UV LED installations | Superior heat dissipation and mechanical strength | Less flexible, heavier, costlier | Medium |

This material selection guide empowers international B2B buyers to make informed decisions tailored to their regional requirements and application demands. Understanding these material nuances ensures procurement of UV LED strips that deliver optimal performance, compliance, and cost-efficiency across diverse global markets.

In-depth Look: Manufacturing Processes and Quality Assurance for ultraviolet led strips

Manufacturing Processes for Ultraviolet LED Strips

The production of ultraviolet (UV) LED strips involves a sophisticated combination of advanced materials, precise assembly techniques, and stringent finishing processes to ensure high performance and durability. Understanding these manufacturing stages is crucial for B2B buyers, especially those importing into diverse markets such as Africa, South America, the Middle East, and Europe, where quality and compliance are paramount.

1. Material Preparation

The foundation of UV LED strip manufacturing starts with sourcing high-quality raw materials:

- Flexible Substrate: Typically a polyimide or flexible printed circuit board (FPCB) serves as the base, chosen for its heat resistance and flexibility.

- UV LED Chips: The core components are UV-specific LED chips, usually in the UV-A (365nm or 395nm) or UV-C range, selected based on the intended application.

- Conductive Traces and Solder Paste: Copper traces are etched or printed onto the substrate to provide electrical pathways. Solder paste must be compatible with UV LED chips and the strip’s power requirements.

- Encapsulation Materials: Silicone or epoxy resins are used to protect LEDs, ensuring durability and waterproofing if required.

Material quality is critical because impurities or inconsistencies can impact UV output, lifespan, and safety.

2. Forming and Circuit Fabrication

This stage transforms raw materials into functional LED strips:

- Substrate Etching: Precision etching or printing methods create the circuit pathways on the flexible substrate.

- Surface Mount Technology (SMT) Assembly: UV LED chips and other components (resistors, capacitors) are placed on the substrate using automated pick-and-place machines.

- Reflow Soldering: The assembly passes through a controlled heating oven, melting the solder paste to securely attach components while avoiding thermal damage to sensitive UV LEDs.

- Cutting and Shaping: The strips are cut into standardized or custom lengths using laser or mechanical cutters, maintaining clean edges for ease of installation.

3. Assembly and Integration

- Wiring and Connector Attachment: Electrical connectors, leads, or terminals are attached to allow easy integration into larger systems.

- Protective Coating and Encapsulation: Depending on the application, the strips may receive waterproof coatings (IP65 to IP68 ratings) or additional encapsulation to protect against moisture, dust, and UV degradation.

- Testing Points Integration: Manufacturers often embed test points for quality control and future maintenance.

4. Finishing and Packaging

- Visual Inspection: Strips undergo manual or automated optical inspections to detect soldering defects, misalignment, or physical damage.

- Functional Testing: The strips are powered on to verify UV output, color wavelength, brightness uniformity, and electrical safety.

- Labeling and Custom Packaging: For international B2B buyers, packaging can be customized with branding, compliance marks, and handling instructions, ensuring safe transport and regulatory adherence.

Quality Assurance and Control (QA/QC) for UV LED Strips

Robust quality control is essential to guarantee that UV LED strips meet international standards and perform reliably in diverse environments. B2B buyers should be well-versed in the QA/QC frameworks suppliers employ to ensure product consistency and safety.

Relevant International and Industry Standards

- ISO 9001: The globally recognized quality management standard ensures systematic production controls and continuous improvement.

- CE Marking: Mandatory for products sold in the European Economic Area, confirming compliance with EU safety, health, and environmental requirements.

- RoHS (Restriction of Hazardous Substances): Ensures the product is free from harmful materials such as lead, mercury, and cadmium, critical for environmental safety.

- UL Certification: Commonly required in markets like North America and increasingly recognized globally for electrical safety.

- Specific Industry Certifications: Depending on application, certifications like FDA (for medical use), API standards (for industrial curing), or IEC standards for electrical and UV safety may apply.

B2B buyers should verify the presence and validity of these certifications before procurement.

Key Quality Control Checkpoints

Quality control in UV LED strip manufacturing typically involves three main checkpoints:

-

Incoming Quality Control (IQC):

– Inspection of raw materials and components (LED chips, substrates, solder paste) for conformity with specifications.

– Testing for material integrity, purity, and consistency to prevent defects downstream. -

In-Process Quality Control (IPQC):

– Continuous monitoring during assembly, including solder joint inspections, component placement accuracy, and electrical continuity.

– Use of automated optical inspection (AOI) machines to detect defects early.

– Thermal profiling during reflow soldering to ensure proper temperature profiles without damaging UV LEDs.

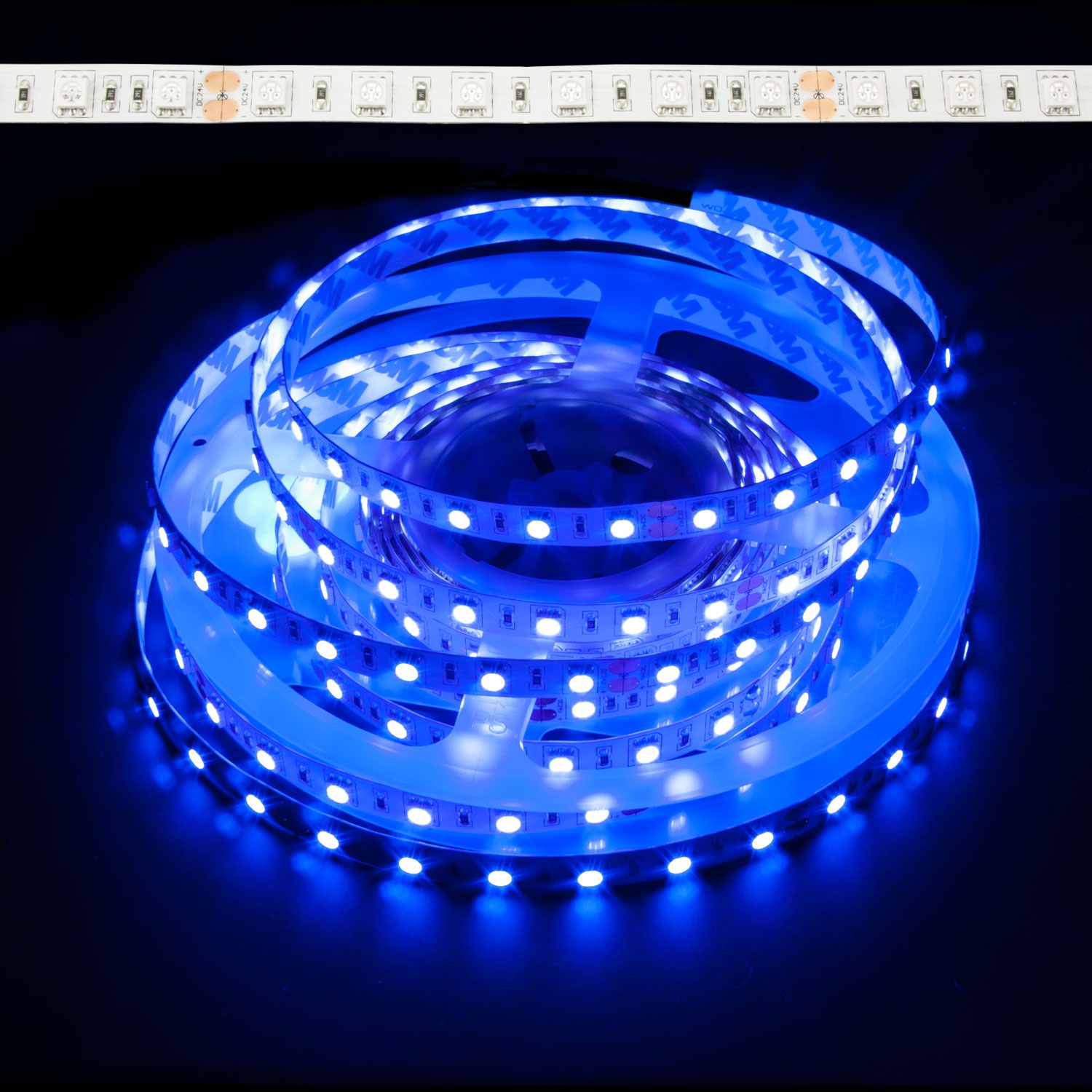

Illustrative Image (Source: Google Search)

- Final Quality Control (FQC):

– Comprehensive functional testing of finished strips, including UV wavelength verification (using spectrometers), irradiance measurements, and electrical safety tests (insulation resistance, dielectric strength).

– Environmental stress testing such as thermal cycling, humidity exposure, and waterproofing validation (IP rating tests).

– Visual inspection for cosmetic defects and packaging integrity.

Testing Methods Commonly Used in UV LED Strip QC

- Spectral Analysis: Confirms the emission wavelength matches product specifications (critical for UV applications where wavelength affects efficacy).

- Luminous Intensity Measurement: Ensures consistent brightness across batches.

- Electrical Testing: Verifies voltage, current, and resistance parameters for safety and performance.

- Thermal Imaging: Detects hotspots or uneven heat dissipation which may affect lifespan.

- Environmental Testing: Simulates operational conditions such as temperature extremes, moisture ingress, and UV exposure to assess durability.

How B2B Buyers Can Verify Supplier Quality Control

For international buyers, especially in regions like Africa, South America, the Middle East, and Europe, verifying supplier QC is essential to mitigate risks related to counterfeit or substandard products.

- Factory Audits: Request or arrange third-party on-site audits to review manufacturing processes, quality management systems, and worker training. Audits can be conducted by independent agencies or through buyer-appointed inspectors.

- Quality Documentation: Insist on receiving detailed QC reports, including IQC, IPQC, and FQC results, along with test certificates for each batch.

- Third-Party Testing: Engage accredited labs to independently verify critical parameters such as UV wavelength accuracy, electrical safety, and environmental resistance.

- Sample Testing: Always request pre-shipment samples for in-house or local laboratory evaluation to confirm product conformity.

- Certification Verification: Confirm authenticity of certifications (e.g., ISO, CE) through official registries or certification bodies.

QC and Certification Nuances for International Markets

-

Africa and South America:

These markets often have emerging regulatory frameworks. Buyers should prioritize suppliers with international certifications (ISO, CE) and ensure products comply with local import regulations to avoid customs delays or rejections. Emphasizing product robustness is important due to variable environmental conditions. -

Middle East:

Compliance with GCC standards and certifications like SASO (Saudi Arabia) or ESMA (UAE) may be required. UV LED strips for industrial or medical applications must meet stringent safety and performance criteria. Supplier transparency on QC processes is highly valued. -

Europe:

The European market demands rigorous adherence to CE marking, RoHS, and often REACH compliance. Energy efficiency and environmental impact are also scrutinized. Buyers should verify that manufacturers maintain ISO 9001 certification and provide comprehensive technical documentation. -

Australia:

While not explicitly mentioned in the initial audience, Australian standards often align with international ones such as IEC and ISO. Importers should verify compliance with electrical safety standards and environmental regulations.

Summary for B2B Buyers

When sourcing ultraviolet LED strips internationally, understanding the manufacturing and quality assurance landscape empowers buyers to make informed decisions. Key considerations include:

- Confirming the use of high-grade materials and precision manufacturing techniques that ensure consistent UV output and durability.

- Ensuring suppliers follow internationally recognized quality management systems (ISO 9001) and hold relevant certifications (CE, RoHS, UL).

- Insisting on thorough quality control checkpoints at all stages—IQC, IPQC, and FQC—with transparent testing data.

- Utilizing factory audits, third-party testing, and sample evaluations to validate supplier claims.

- Recognizing regional certification nuances and import regulations to streamline procurement and compliance.

By integrating these insights into their sourcing strategies, B2B buyers across Africa, South America, the Middle East, and Europe can secure high-quality UV LED strips that meet their technical requirements and regulatory obligations.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for ultraviolet led strips Sourcing

When evaluating the cost and pricing dynamics for sourcing ultraviolet (UV) LED strips, international B2B buyers must consider multiple cost components and market factors that collectively influence the final purchase price. Understanding these elements enables buyers from Africa, South America, the Middle East, and Europe to optimize procurement strategies, negotiate effectively, and achieve superior cost-efficiency.

Key Cost Components in UV LED Strip Manufacturing

-

Materials: The core cost driver includes UV LED chips (particularly those emitting UV-A, UV-B, or UV-C wavelengths), flexible PCB substrates, encapsulants, and protective coatings. High-quality UV chips, especially those with precise wavelength control (e.g., 365nm or 395nm), command premium prices. Additionally, materials that ensure waterproofing or enhanced durability add to costs.

-

Labor: Skilled labor is essential for assembling delicate UV LED components, soldering, and quality inspections. Labor costs vary significantly by manufacturing location, impacting the overall unit price.

-

Manufacturing Overhead: This encompasses factory utilities, equipment depreciation, and maintenance. Advanced production lines with automation for precision UV LED placement may increase overhead but improve yield and consistency.

-

Tooling and Customization: Custom tooling for specific strip lengths, unique form factors, or integrated connectors can involve upfront investment that is amortized over production runs. Custom packaging or branding also adds to this cost.

-

Quality Control (QC): Rigorous QC is critical due to the specialized nature of UV LED strips, especially for applications requiring strict wavelength accuracy and intensity uniformity. QC processes such as photometric testing, durability checks, and certification compliance contribute to costs.

-

Logistics: Shipping UV LED strips internationally requires careful handling to avoid damage. Costs include freight, customs duties, insurance, and potential warehousing. For buyers in regions like Africa or South America, logistics can be a significant portion of total cost due to longer transit routes and customs complexities.

-

Supplier Margin: Suppliers set margins based on market demand, competition, and value-added services such as technical support or after-sales warranties.

Influential Pricing Factors to Consider

-

Order Volume and Minimum Order Quantity (MOQ): Larger volume orders often yield substantial per-unit discounts. However, MOQs vary by supplier and product customization level, so buyers must balance inventory costs with pricing benefits.

-

Product Specifications and Customization: UV wavelength specificity, LED density per meter, waterproof rating (IP65, IP67, etc.), and additional features like dimmability or smart controls affect price. Custom lengths or packaging also increase costs.

-

Material Quality and Certifications: Strips using certified UV LEDs with stable output and environmental compliance (e.g., RoHS, CE) typically command higher prices but reduce risk and improve reliability.

-

Supplier Reputation and Location: Established suppliers with proven quality and reliable delivery may charge premiums but reduce risks related to defects or delays. Proximity to ports and logistics hubs influences shipping costs and lead times.

-

Incoterms and Payment Terms: Shipping terms (FOB, CIF, DDP) impact the total landed cost. Buyers should clarify which party bears freight, customs clearance, and insurance costs. Favorable payment terms (e.g., letters of credit, escrow) can also affect pricing negotiations.

Strategic Buyer Tips for International B2B Procurement

-

Negotiate Beyond Price: Leverage volume commitments or long-term contracts to negotiate better payment terms, warranty extensions, or free samples. Suppliers may offer tiered pricing or bundled services for repeat buyers.

-

Assess Total Cost of Ownership (TCO): Consider not only the unit price but also shipping, customs duties, potential import taxes, and inventory holding costs. For instance, sourcing from a supplier closer to your region (e.g., European buyers sourcing within EU) might reduce logistics expenses despite a higher unit price.

-

Request Samples for Quality Validation: Especially important for UV LED strips due to their technical nature. Confirm wavelength accuracy, light intensity, and durability before large-scale procurement.

-

Understand Pricing Nuances by Region: Buyers in Africa and South America should account for longer shipping times and potential customs delays that could increase costs. Middle Eastern and European buyers might have access to more competitive logistics networks and regional suppliers.

-

Use Transparent Incoterms: Clearly define responsibilities for shipping and customs to avoid hidden charges. For example, DDP (Delivered Duty Paid) can simplify procurement but usually comes at a higher price, while FOB (Free on Board) shifts logistics risk to the buyer.

-

Plan for Scalability: When sourcing for large projects, confirm that suppliers can maintain consistent quality and pricing as volumes increase. Scalability reduces per-unit cost and ensures project timelines are met.

Indicative Pricing Disclaimer

UV LED strip pricing varies widely based on specifications, volume, and supplier. Indicative prices may range from $5 to $20 per meter for standard UV-A strips (e.g., 365nm wavelength) in medium quantities. Custom or specialized UV-B/UVC strips, higher IP ratings, or integrated smart features can command prices well above this range. Buyers should conduct detailed supplier comparisons and request tailored quotations to obtain accurate pricing.

By thoroughly analyzing cost structures and applying strategic procurement practices, international B2B buyers can secure high-quality ultraviolet LED strips at competitive prices, optimizing both upfront investment and long-term operational efficiency.

Spotlight on Potential ultraviolet led strips Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘ultraviolet led strips’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for ultraviolet led strips

Key Technical Properties of Ultraviolet LED Strips

Understanding the core technical specifications of ultraviolet (UV) LED strips is crucial for international B2B buyers to ensure compatibility, performance, and long-term value in their applications. Below are the most critical properties to evaluate when sourcing UV LED strips:

-

Wavelength (nm)

UV LED strips emit light within specific wavelength bands—commonly UV-A (315–400 nm), UV-B (280–315 nm), and UV-C (100–280 nm). The wavelength determines the strip’s application, such as curing, disinfection, or fluorescence detection. Buyers must select the correct wavelength to meet their functional requirements, as mismatched wavelengths can lead to ineffective results or safety issues. -

Power Consumption and Efficiency (Watts per meter)

This defines the electrical power the strip consumes relative to its length. Lower power consumption with high UV output translates to energy savings and reduced operational costs, especially important for large-scale or continuous-use installations. Efficiency also impacts heat generation, which affects durability and safety. -

Light Intensity and Density (mW/cm² or mW/m)

The intensity or irradiance of UV light emitted per unit area is vital for applications like curing or sterilization. High-density LED strips deliver concentrated UV light for faster and more reliable processing. Buyers should verify that intensity levels align with their industrial or commercial standards to achieve optimal results. -

IP Rating (Ingress Protection)

The IP rating indicates resistance to dust and water. For outdoor or harsh industrial environments common in Africa, the Middle East, and South America, IP65 or higher is often required to ensure longevity and consistent performance. Understanding IP ratings helps buyers avoid premature product failures due to environmental exposure. -

Flexibility and Mounting Options

UV LED strips are usually built on flexible printed circuit boards, allowing installation on curved or uneven surfaces. For complex projects, buyers should confirm customization options for length, adhesive backing, or waterproof coatings, enabling seamless integration into diverse applications. -

Lifespan and Thermal Management

UV LED strips typically offer 10,000 to 20,000 hours of operation, significantly outlasting traditional UV lamps. However, efficient heat dissipation is critical to maintaining lifespan. Buyers should assess the presence of heat sinks or thermal interface materials to prevent overheating, which can degrade LED performance.

Common Trade Terminology for UV LED Strip Procurement

Navigating the international B2B trade landscape requires familiarity with key industry terms to streamline communication, negotiation, and logistics:

-

OEM (Original Equipment Manufacturer)

This refers to manufacturers who produce UV LED strips that can be rebranded or customized for a buyer’s specific requirements. OEM partnerships allow businesses to differentiate their products with unique specifications, packaging, or branding, essential for market positioning. -

MOQ (Minimum Order Quantity)

MOQ defines the smallest quantity a supplier is willing to sell in one order. Understanding MOQ helps buyers plan inventory, manage cash flow, and negotiate better pricing. For bulk buyers in Africa, Europe, or the Middle East, confirming MOQ upfront avoids unexpected procurement delays. -

RFQ (Request for Quotation)

An RFQ is a formal document sent by buyers to suppliers asking for detailed pricing and terms based on specified quantities and product features. Preparing a clear RFQ with technical specifications ensures accurate and comparable offers, facilitating informed decision-making. -

Incoterms (International Commercial Terms)

Incoterms are standardized trade terms defining responsibilities between buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free on Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Understanding Incoterms helps buyers from diverse regions manage risks and control logistics costs effectively. -

Lead Time

The lead time is the duration from order placement to product delivery. For project planning, especially in large-scale installations, knowing the lead time enables buyers to align procurement schedules with operational deadlines and avoid costly delays. -

Certification Standards

Certifications such as CE, RoHS, and UL indicate compliance with safety, environmental, and quality regulations. Buyers should verify certifications relevant to their local markets to ensure legal compliance and reduce import risks.

By mastering these technical properties and trade terms, international B2B buyers can confidently source ultraviolet LED strips that meet their exact operational needs while optimizing procurement efficiency and cost-effectiveness across diverse markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the ultraviolet led strips Sector

Market Overview & Key Trends

The global ultraviolet (UV) LED strip market is experiencing robust growth driven by increasing demand across diverse industrial and commercial sectors. Key drivers include the expanding use of UV LED technology in applications such as industrial curing, disinfection, medical treatments, and security. Particularly in regions like Africa, South America, the Middle East, and Europe, businesses are adopting UV LED strips for their superior energy efficiency, compact form factor, and long lifespan compared to traditional UV light sources such as mercury lamps and fluorescent tubes.

Emerging B2B trends highlight a shift toward customizable UV LED strip solutions tailored to specific wavelength requirements (commonly 365nm and 395nm in the UV-A range) and power densities. This enables buyers to optimize performance for applications including UV curing of inks and adhesives, forensic analysis, and biomedical devices. The flexibility of LED strip formats also facilitates integration into complex systems and tight installation spaces, a critical factor for buyers managing diverse industrial environments.

Supply chain dynamics reveal a growing preference for suppliers who offer direct manufacturing relationships, bulk order discounts, and logistics capabilities that ensure timely delivery to emerging markets. Buyers in Africa and South America, for instance, benefit from suppliers who provide consolidated shipping and local warehousing options, reducing lead times and costs. Additionally, the integration of smart UV LED strips with IoT and automation platforms is gaining traction in Europe and the Middle East, enabling remote control and real-time monitoring—features increasingly demanded by B2B customers focused on operational efficiency.

Sustainability & Ethical Sourcing in B2B

Sustainability considerations are becoming paramount in the procurement of ultraviolet LED strips. Unlike traditional UV lamps that often contain hazardous mercury, UV LED strips are mercury-free and consume significantly less energy, contributing to lower carbon footprints and reduced hazardous waste. For international buyers, particularly in regions with stringent environmental regulations such as the European Union, sourcing UV LED strips that comply with RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) standards is essential.

Ethical sourcing practices are gaining attention, with B2B buyers increasingly prioritizing suppliers that demonstrate transparent supply chains and responsible manufacturing processes. This includes adherence to labor standards, conflict-free materials, and environmental stewardship. Certifications such as ISO 14001 (Environmental Management Systems) and Energy Star ratings provide assurances of sustainability and energy efficiency, helping buyers mitigate risks and align procurement with corporate social responsibility (CSR) goals.

Additionally, buyers should consider suppliers offering UV LED strips made from eco-friendly materials and packaging, as well as those engaging in recycling programs or take-back schemes. These initiatives not only reduce environmental impact but also enhance brand reputation and meet growing demand from environmentally conscious end customers.

Evolution of Ultraviolet LED Strip Technology

Ultraviolet LED strip technology has evolved significantly over the past decade. Initially, UV light sources were dominated by bulky mercury vapor lamps and fluorescent tubes, which were energy-intensive, fragile, and environmentally hazardous due to mercury content. The advent of UV LED technology introduced compact, energy-efficient alternatives capable of immediate full brightness without warm-up times.

Advancements in semiconductor materials and chip packaging have enabled UV LEDs to operate reliably at specific wavelengths critical for curing, disinfection, and sensing applications. The development of flexible strip formats has further expanded use cases, allowing seamless integration into industrial automation lines, medical devices, and security systems. This evolution has transformed UV LED strips into versatile, cost-effective solutions favored by international B2B buyers seeking innovative, sustainable lighting technologies tailored to specialized industrial needs.

Related Video: The Inside Story of the Ship That Broke Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of ultraviolet led strips

-

How can I effectively vet UV LED strip suppliers for international B2B purchases?

Begin by verifying the supplier’s business credentials, including company registration and export licenses. Check for relevant industry certifications such as ISO 9001 for quality management and RoHS compliance for environmental safety. Request product datasheets and test reports to confirm technical specifications. Engage in direct communication to assess responsiveness and transparency. Additionally, seek references or customer reviews from buyers in your region to gauge reliability. For large orders, consider factory audits or third-party inspection services to ensure manufacturing capabilities and quality standards meet your requirements. -

What customization options are typically available when ordering UV LED strips in bulk?

Most manufacturers offer customization in length, wavelength (commonly 365nm or 395nm for UV-A), power ratings, and waterproofing levels (IP65, IP67, etc.). Packaging and labeling can often be tailored for branding purposes. Some suppliers also allow adjustments in LED density, flexible strip width, and adhesive backing types. Custom driver configurations and connectors may be available to fit specific industrial or commercial system requirements. Clearly communicate your technical and operational needs upfront to ensure the supplier can accommodate these customizations without significantly impacting lead times or costs. -

What are typical minimum order quantities (MOQs), lead times, and payment terms for UV LED strip orders?

MOQs vary widely depending on supplier capacity and customization level, often starting around 500 to 1,000 meters per order for standard products. Lead times usually range from 3 to 6 weeks, factoring in production and shipping durations, but can be longer for highly customized orders. Common payment terms include 30% deposit upfront with the balance paid before shipment or upon delivery via letter of credit, especially for new suppliers. Negotiate terms based on order size and your buyer-supplier relationship, and consider escrow or trade finance solutions to mitigate payment risks. -

Which quality assurance certifications should I require for UV LED strips to ensure compliance and reliability?

Request certifications such as CE (for European market compliance), RoHS (restriction of hazardous substances), and UL or ETL (safety standards). For medical or sanitation applications, verify compliance with FDA or ISO 13485 standards if applicable. Ask for photometric and electrical test reports that confirm wavelength accuracy, UV intensity, and lifespan claims. A supplier’s ability to provide detailed batch traceability and quality control process documentation is a strong indicator of reliability. Insist on warranty terms covering product defects and UV output degradation.

-

How should I approach logistics and shipping for large international orders of UV LED strips?

Choose suppliers with experience in international freight, ideally offering FOB or CIF terms to control shipping costs and risks. Confirm that packaging is robust and moisture-resistant to protect UV LED strips during transit, especially for long ocean shipments. Factor in customs clearance times, import duties, and compliance with local regulations in your country. Consolidate shipments when possible to reduce per-unit freight costs. Consider air freight for urgent orders despite higher costs. Work with freight forwarders familiar with electronics and hazardous material handling, if applicable. -

What are the common challenges in cross-border disputes related to UV LED strip orders and how can they be prevented?

Disputes often arise from product quality discrepancies, delayed deliveries, or miscommunication about specifications. Mitigate these risks by clearly documenting all technical requirements, inspection criteria, and delivery schedules in the purchase contract. Use third-party inspection services to verify product quality before shipment. Maintain regular communication channels and keep detailed records of all interactions. In case of disputes, leverage mediation clauses in contracts or engage trade bodies or chambers of commerce relevant to the supplier’s country for resolution assistance. -

How do regional regulations in Africa, South America, the Middle East, and Europe affect the import of UV LED strips?

Each region has specific import regulations, including safety certifications, electromagnetic compatibility (EMC) standards, and environmental restrictions. For example, Europe enforces stringent CE marking and RoHS compliance, while some Middle Eastern countries require additional conformity assessments. Importers must also be aware of customs tariffs and potential import quotas. Engage local customs brokers to navigate these regulations efficiently. Staying updated on evolving trade policies and bilateral agreements can provide cost advantages and smoother clearance processes. -

What key factors should I consider when selecting UV wavelength types (365nm vs. 395nm) for my industrial application?

The 365nm wavelength is preferred for applications requiring higher UV penetration and precise curing or fluorescence detection, such as forensic analysis and UV printing. The 395nm wavelength offers higher energy efficiency and is often used for general-purpose UV curing and decorative fluorescence. Consider the material compatibility, required curing speed, and safety implications of each wavelength. Some applications may benefit from a combination of both wavelengths. Verify that the supplier provides consistent wavelength output with minimal deviation to ensure process reliability.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for ultraviolet led strips

Ultraviolet LED strips represent a transformative technology for diverse industrial and commercial applications, combining energy efficiency, precise wavelength control, and long operational life. For international B2B buyers, especially in regions such as Africa, South America, the Middle East, and Europe, strategic sourcing is essential to leverage these advantages effectively. Prioritizing suppliers who offer customizable solutions, reliable warranties, and access to the latest UV LED innovations ensures product quality and operational consistency across projects.

Key takeaways for buyers include:

- Assessing UV wavelength requirements (UV-A, UV-B, UV-C) aligned to specific use cases such as curing, disinfection, or inspection.

- Emphasizing supplier credibility and sample testing to mitigate risks associated with product quality and shipment.

- Capitalizing on bulk purchasing benefits like cost savings, scalability, and streamlined logistics.

- Considering environmental impact and regulatory compliance, especially in markets with evolving standards.

Looking ahead, the UV LED strip market is poised for rapid growth driven by expanding industrial automation, healthcare, and environmental applications. Buyers who adopt a forward-thinking procurement strategy—integrating supplier partnerships with technological awareness—will unlock competitive advantages and drive innovation in their sectors. International buyers are encouraged to engage proactively with trusted manufacturers to customize solutions that meet evolving market demands and regulatory frameworks.