Guide to Thinnest Led Strip

- Introduction: Navigating the Global Market for thinnest led strip

- Understanding thinnest led strip Types and Variations

- Key Industrial Applications of thinnest led strip

- Strategic Material Selection Guide for thinnest led strip

- In-depth Look: Manufacturing Processes and Quality Assurance for thinnest led strip

- Comprehensive Cost and Pricing Analysis for thinnest led strip Sourcing

- Spotlight on Potential thinnest led strip Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for thinnest led strip

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the thinnest led strip Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of thinnest led strip

- Strategic Sourcing Conclusion and Outlook for thinnest led strip

Introduction: Navigating the Global Market for thinnest led strip

The demand for ultra-thin LED strips is rapidly increasing across diverse industries, driven by the need for sleek, energy-efficient, and flexible lighting solutions. For international B2B buyers—especially those operating in dynamic markets such as Africa, South America, the Middle East, and Europe—understanding the nuances of sourcing the thinnest LED strips is crucial to staying competitive and meeting evolving customer expectations. These products are not only essential for cutting-edge architectural lighting, automotive interiors, and consumer electronics but also pivotal in creating innovative commercial and industrial lighting designs where space and aesthetics are at a premium.

This comprehensive guide is designed to empower businesses with the knowledge needed to navigate the complexities of the global LED strip market effectively. It covers a wide spectrum of topics including the various types of thinnest LED strips, the materials and manufacturing processes that impact quality and durability, and the critical quality control measures that ensure product reliability. Additionally, the guide offers insights into identifying reputable suppliers, understanding cost structures, and analyzing market trends specific to regions such as the UAE, Nigeria, Brazil, and European hubs.

By leveraging this guide, B2B buyers can make informed decisions that optimize procurement strategies, reduce risks, and capitalize on technological advancements. Whether you are sourcing for large-scale commercial projects or specialized applications, this resource equips you with actionable insights to select the ideal thinnest LED strips that align with your operational needs and strategic goals.

Understanding thinnest led strip Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Ultra-Slim SMD LED Strip | Extremely thin PCB, surface-mounted LEDs, flexible design | Architectural lighting, retail displays, signage | Pros: High flexibility, easy installation; Cons: Lower brightness compared to thicker strips |

| COB (Chip-on-Board) LED Strip | LEDs densely packed on a single board, seamless light output | Hospitality, automotive interiors, premium decor | Pros: Uniform light, high color rendering; Cons: Higher cost, complex heat management |

| Waterproof Thin LED Strip | Slim profile with IP65-IP68 rating, silicone/rubber coating | Outdoor advertising, marine, industrial lighting | Pros: Weatherproof, durable; Cons: Slightly less flexible, higher price |

| Addressable Thin LED Strip | Ultra-thin with individually controllable LEDs | Event production, smart lighting, entertainment | Pros: Dynamic effects, customization; Cons: Requires controllers, higher technical complexity |

| High-Efficiency Thin LED Strip | Optimized for low power consumption with thin design | Office lighting, energy-conscious projects | Pros: Energy savings, long lifespan; Cons: May require specific drivers, higher upfront cost |

Ultra-Slim SMD LED Strip

These strips feature a very thin printed circuit board (PCB) with surface-mounted LEDs, offering exceptional flexibility and ease of installation in tight or curved spaces. Ideal for architectural and retail lighting, they enable elegant, discreet illumination. B2B buyers should consider the trade-off between their slim profile and slightly reduced brightness compared to thicker strips. Volume purchasing can yield cost benefits, but verifying supplier quality for consistency is critical.

COB (Chip-on-Board) LED Strip

COB LED strips integrate multiple LED chips closely packed on a single substrate, producing a continuous, uniform light without visible hotspots. Their high color rendering and smooth output make them suitable for premium environments like hospitality and automotive interiors. For B2B buyers, the higher upfront cost and need for effective heat dissipation are key considerations, especially when sourcing for large projects requiring consistent quality.

Waterproof Thin LED Strip

Designed with protective silicone or rubber coatings, these strips maintain a slim profile while offering IP65 to IP68 ratings for water and dust resistance. They are essential for outdoor advertising, marine applications, and industrial environments where durability against weather is mandatory. Buyers should evaluate flexibility needs and budget, as waterproofing adds to cost and may slightly reduce strip pliability.

Addressable Thin LED Strip

These ultra-thin LED strips feature individually controllable LEDs, enabling complex lighting effects and color changes. Commonly used in event production, entertainment, and smart lighting installations, they require compatible controllers and technical know-how for integration. B2B buyers must assess their technical capabilities and ensure supplier support for firmware and hardware to maximize these strips’ dynamic potential.

High-Efficiency Thin LED Strip

Optimized for energy savings, these thin LED strips deliver strong luminous output at lower power consumption. They are ideal for offices and projects prioritizing sustainability and long-term operational cost reduction. Buyers should verify compatibility with existing power supplies and consider the higher initial investment against the benefits of reduced energy bills and maintenance costs.

Related Video: Ultra Narrow 2mm LED Strip | Slim, Thin LED Strips in 2mm, 3mm, 4mm & 5mm Solutions

Key Industrial Applications of thinnest led strip

| Industry/Sector | Specific Application of thinnest led strip | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | Interior ambient lighting in compact vehicle cabins | Enhances passenger experience with space-efficient lighting | Flexibility, heat resistance, and compliance with automotive standards |

| Retail & Hospitality | Accent lighting for product displays and architectural details | Creates visually appealing environments to boost sales | Customizable color temperature, dimmability, and durability |

| Electronics & Wearables | Backlighting for ultra-thin devices and smart wearables | Enables sleek, lightweight product designs | Ultra-thin profile, low power consumption, and reliable lifespan |

| Aerospace & Defense | Instrument panel and cockpit lighting | Provides precise illumination without adding bulk or weight | High reliability, vibration resistance, and certifications (e.g., MIL-STD) |

| Medical Equipment | Lighting in diagnostic devices and surgical tools | Improves visibility with minimal heat emission and compact size | Sterilizable materials, consistent brightness, and safety standards compliance |

Automotive Industry: Interior Ambient Lighting

Thinnest LED strips are increasingly used in automotive interiors to provide ambient lighting within the confined spaces of modern vehicle cabins. Their ultra-slim profile allows integration into narrow panels, dashboards, and door trims without compromising design aesthetics or passenger comfort. This lighting solution enhances user experience by delivering customizable color and brightness while maintaining low energy consumption. For B2B buyers in regions like the UAE and Nigeria, sourcing LED strips that meet automotive quality and safety standards, such as temperature tolerance and vibration resistance, is critical to ensure durability and compliance with local regulations.

Retail & Hospitality: Accent Lighting

In retail stores and hospitality venues, thinnest LED strips serve as accent lighting to highlight products, architectural features, or signage. Their slim form factor enables installation in tight or unconventional spaces, creating dynamic visual effects that attract customers and improve brand perception. For international buyers, especially in South America and Europe, selecting LED strips with tunable white or RGB options and dimming capabilities allows for tailored lighting atmospheres aligned with cultural preferences and marketing strategies. Durability and ease of installation are key sourcing factors to support high foot traffic environments.

Electronics & Wearables: Backlighting

The electronics sector benefits from thinnest LED strips by integrating them into ultra-thin devices such as smartphones, tablets, and wearable technology. These LED strips provide consistent backlighting without adding bulk, supporting sleek and ergonomic product designs. Buyers from diverse markets must prioritize sourcing LED strips with ultra-low power consumption and long operational lifespans to enhance device battery efficiency and reliability. Additionally, compatibility with flexible circuit boards and adherence to RoHS and CE certifications ensure safe and environmentally responsible manufacturing.

Aerospace & Defense: Instrument Panel Lighting

Thinnest LED strips are essential in aerospace and defense applications where space and weight constraints are stringent. They illuminate instrument panels, control consoles, and cockpit displays with high precision and uniform brightness. For B2B buyers in the Middle East and Europe, sourcing LED strips certified for vibration resistance, thermal stability, and compliance with military standards such as MIL-STD is vital to guarantee performance under extreme conditions. The compact size of these LED strips also supports retrofitting and new aircraft designs requiring advanced lighting solutions.

Medical Equipment: Diagnostic and Surgical Lighting

Medical devices increasingly incorporate thinnest LED strips to provide bright, focused illumination in diagnostic tools and surgical instruments. Their minimal heat output and slim dimensions reduce interference with sensitive procedures and allow integration into compact medical equipment. International buyers, including those from Africa and Europe, must ensure that LED strips meet stringent sterilization and safety standards, such as FDA or CE medical certifications. Consistent brightness and color rendering index (CRI) are important to support accurate diagnostics and enhance operational efficiency in healthcare settings.

Related Video: Power Diode (Basics, Structure, Characteristics, Working, Applications, Biasing & Types) Explained

Strategic Material Selection Guide for thinnest led strip

When selecting materials for the thinnest LED strips, international B2B buyers must carefully evaluate the physical and chemical properties of the substrate and encapsulation materials to ensure optimal performance, durability, and compliance with regional standards. The choice of material directly impacts the LED strip’s flexibility, heat dissipation, longevity, and suitability for various environmental conditions prevalent across Africa, South America, the Middle East, and Europe.

Polyimide (PI) Substrate

Key Properties:

Polyimide is a high-performance polymer known for excellent thermal stability, withstanding temperatures up to 400°C. It offers outstanding chemical resistance, electrical insulation, and mechanical flexibility, making it ideal for ultra-thin LED strips that require bending and twisting.

Pros & Cons:

PI substrates are highly durable and provide excellent heat dissipation, which extends LED lifespan. However, they tend to be more expensive than polyester alternatives and require specialized manufacturing processes. Their superior thermal resistance makes them suitable for high-power LED strips but can increase production lead times.

Impact on Application:

Polyimide’s resilience to harsh chemicals and UV exposure suits outdoor and industrial lighting applications common in regions with extreme weather, such as the Middle East and parts of Africa. Its flexibility supports installation in tight or curved spaces, often required in automotive or architectural lighting projects.

Considerations for International Buyers:

Buyers from regions like the UAE and Nigeria should verify compliance with international standards such as ASTM D3350 for polymer materials and IEC 60384 for electronic components. Polyimide’s higher cost may be justified in premium projects where durability and heat resistance are critical.

Polyester (PET) Substrate

Key Properties:

Polyester substrates offer good mechanical strength, moderate thermal resistance (up to approximately 150°C), and excellent dimensional stability. PET is less flexible than polyimide but provides a smooth surface for LED mounting.

Pros & Cons:

PET is cost-effective and widely available, making it suitable for large-volume orders. It is easier to process but less resistant to high temperatures and chemical exposure, which can limit its use in high-power or outdoor applications.

Impact on Application:

Ideal for indoor LED strip lighting where ambient temperatures are controlled, such as retail displays and office lighting in Europe and South America. Its lower thermal tolerance means it is less suited for environments with high heat or direct sunlight exposure.

Considerations for International Buyers:

For buyers targeting budget-sensitive markets like Nigeria or parts of South America, PET substrates offer an economical solution. However, ensuring the supplier adheres to ISO 9001 quality management and RoHS compliance is essential for product safety and import regulations.

Flexible Printed Circuit Board (FPC) with Copper Traces

Key Properties:

FPCs use thin copper foil laminated on flexible substrates (typically polyimide or PET). Copper provides excellent electrical conductivity and thermal management, critical for maintaining LED performance in ultra-thin strips.

Pros & Cons:

Copper-based FPCs enable precise circuit layouts and high current capacity but increase material costs and manufacturing complexity. They are prone to corrosion if not properly coated, which can be a concern in humid or coastal environments.

Impact on Application:

Copper FPCs are preferred in applications requiring reliable electrical performance and heat dissipation, such as industrial lighting or automotive sectors prevalent in Europe and the Middle East. Protective coatings like ENIG (Electroless Nickel Immersion Gold) plating improve corrosion resistance.

Considerations for International Buyers:

Buyers should confirm that copper FPCs meet IPC standards (e.g., IPC-6013 for flexible circuits) and consider environmental factors like humidity in tropical African or South American markets. Supplier transparency on plating and protective finishes is crucial for long-term reliability.

Silicone Encapsulation

Key Properties:

Silicone is a flexible, transparent material used for encapsulating LED strips to provide waterproofing and mechanical protection. It withstands temperatures from -60°C to 200°C and resists UV degradation and many chemicals.

Pros & Cons:

Silicone encapsulation enhances durability and flexibility but adds thickness, which may conflict with the goal of achieving the absolute thinnest LED strip. It is more expensive than epoxy or polyurethane coatings but offers superior longevity and weather resistance.

Impact on Application:

Silicone-coated LED strips are ideal for outdoor, marine, or industrial applications requiring IP65 or higher ingress protection ratings. This is particularly relevant for buyers in humid or desert climates such as Nigeria or the UAE.

Considerations for International Buyers:

Compliance with IP rating standards (IEC 60529) and certifications like UL 94 for flammability is important. Buyers should assess the trade-off between thickness and protection based on end-use conditions and regional environmental challenges.

Summary Table

| Material | Typical Use Case for thinnest led strip | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyimide (PI) Substrate | High-power, flexible LED strips for industrial/outdoor use | Excellent thermal and chemical resistance | Higher cost, complex manufacturing | High |

| Polyester (PET) Substrate | Indoor lighting, budget-conscious applications | Cost-effective, good mechanical strength | Limited heat resistance, less flexible | Low |

| Flexible Printed Circuit Board (Copper-based FPC) | Precision circuit layout, high current capacity LED strips | Superior electrical conductivity and heat dissipation | Corrosion risk without proper coating, higher cost | Medium |

| Silicone Encapsulation | Waterproof, outdoor, and harsh environment LED strips | Excellent flexibility and environmental protection | Adds thickness, increases cost | Medium |

This guide equips international B2B buyers with critical insights to select the most appropriate materials for the thinnest LED strips, balancing performance, cost, and regional environmental demands.

In-depth Look: Manufacturing Processes and Quality Assurance for thinnest led strip

Manufacturing Processes for the Thinnest LED Strip

Producing ultra-thin LED strips demands precise, high-tech manufacturing processes to ensure flexibility, durability, and optimal lighting performance. The process can be broadly segmented into four key stages:

1. Material Preparation

- Substrate Selection: Ultra-thin LED strips typically use flexible substrates such as polyimide or ultra-thin flexible printed circuit boards (FPCBs) that provide both mechanical flexibility and thermal stability.

- LED Chip Procurement: High-quality SMD (Surface Mounted Device) LEDs or COB (Chip on Board) LEDs are sourced, focusing on miniaturized designs suitable for thin profiles.

- Conductive Layer Preparation: Thin copper or silver conductive traces are prepared with precise etching or plating to maintain electrical integrity while minimizing thickness.

2. Forming and Circuit Fabrication

- Photolithography & Etching: The flexible substrate undergoes photolithography to define circuit patterns, followed by chemical etching to remove excess metal, ensuring ultra-thin, accurate conductive paths.

- Lamination: Multiple ultra-thin layers, including insulation and protective films, are laminated carefully to preserve strip thinness without compromising mechanical strength.

- Precision Cutting: Laser or mechanical cutting shapes the strips to exact dimensions, allowing for intricate designs that maintain flexibility and thinness.

3. Assembly

- LED Mounting: Automated pick-and-place machines position tiny LED chips onto the substrate with micron-level accuracy. For thinnest strips, low-profile LEDs are selected to reduce overall height.

- Soldering: Advanced reflow soldering techniques using low-temperature solders ensure strong electrical connections without warping thin substrates.

- Encapsulation: Thin, transparent silicone or epoxy coatings protect LEDs from environmental damage while maintaining flexibility and minimal thickness.

4. Finishing and Packaging

- Adhesive Application: Ultra-thin double-sided adhesive tapes or peel-off liners are applied, designed to maintain strip thinness while enabling easy installation.

- Cut and Reel Packaging: Strips are cut into standard or customized lengths and carefully wound on reels to prevent damage during transport.

- Labeling and Documentation: Each batch is labeled with batch numbers, specifications, and compliance marks to facilitate traceability and quality control.

Quality Assurance Framework for Ultra-Thin LED Strips

For international B2B buyers, especially from Africa, South America, the Middle East, and Europe, understanding the rigorous quality assurance (QA) processes behind ultra-thin LED strips is critical to ensure product reliability and regulatory compliance.

International and Industry Standards

- ISO 9001: The foundational quality management system standard ensuring consistent manufacturing processes and continuous improvement.

- CE Marking: Mandatory for Europe and many Middle Eastern markets, indicating conformity with EU safety, health, and environmental requirements.

- RoHS Compliance: Restricts hazardous substances, vital for buyers focused on environmental regulations in Europe and increasingly enforced globally.

- UL Certification: Relevant for markets such as the UAE and some South American countries, demonstrating product safety for electrical devices.

- IP Ratings (e.g., IP20, IP65): Important for buyers specifying environmental resistance, especially for outdoor or industrial applications.

- Additional Certifications: Depending on the buyer’s region, certifications such as BIS (India), SABS (South Africa), or INMETRO (Brazil) may be required.

Key Quality Control (QC) Checkpoints

- Incoming Quality Control (IQC): Verification of raw materials and components, including LED chips, substrates, and adhesives, to ensure supplier compliance and material integrity.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly phases such as solder joint inspections, LED placement accuracy, and substrate integrity to catch defects early.

- Final Quality Control (FQC): Comprehensive testing of finished LED strips, including visual inspections, electrical testing, and packaging verification before shipment.

Common Testing Methods for Ultra-Thin LED Strips

- Electrical Testing: Measuring forward voltage, current leakage, and insulation resistance to confirm electrical performance and safety.

- Optical Testing: Evaluating luminous intensity, color temperature, and uniformity to ensure lighting quality meets specifications.

- Mechanical Flexibility Tests: Repeated bending and twisting cycles to verify durability and performance retention in flexible applications.

- Environmental Stress Testing: Exposure to humidity, temperature cycling, and UV light to assess long-term reliability, especially for outdoor use.

- Adhesion and Peel Tests: Ensuring the backing adhesive maintains strong, reliable adhesion without adding bulk.

Practical Steps for B2B Buyers to Verify Supplier Quality

B2B buyers from diverse international regions should adopt a proactive approach to verify supplier QC systems to minimize risk and ensure product consistency.

1. Conduct Factory Audits

- On-site Audits: Visit manufacturing facilities or hire third-party inspection agencies to assess production capabilities, QC processes, and compliance with international standards.

- Process Walkthroughs: Observe production lines, sampling methods, and storage conditions to gauge operational discipline and quality culture.

- Document Review: Request ISO 9001 certificates, test reports, and compliance certifications to verify authenticity and currency.

2. Request Product Samples and Testing Reports

- Sample Evaluation: Insist on receiving samples for in-house or third-party laboratory testing to validate performance claims.

- Third-Party Testing: Use independent labs to verify compliance with safety, environmental, and performance standards critical to your market.

- Batch Testing Reports: Require suppliers to provide batch-specific QC reports, including electrical and optical test data.

3. Leverage International Inspection Services

- Engage recognized inspection firms such as SGS, Bureau Veritas, or Intertek for pre-shipment inspections to confirm product conformity and packaging integrity.

- Use inspection results as a basis for negotiation or acceptance criteria, especially when dealing with large-volume orders.

Quality Control and Certification Nuances for Global Markets

Understanding regional nuances in QC and certification can help buyers from Africa, South America, the Middle East, and Europe make informed sourcing decisions.

- Africa (e.g., Nigeria, South Africa): Regulatory frameworks are evolving; buyers often prioritize CE and RoHS compliance for import clearance. Local standards may require additional testing; partnering with suppliers familiar with African market requirements is advantageous.

- South America (e.g., Brazil): INMETRO certification is often mandatory; buyers should verify supplier experience with INMETRO processes and ensure documentation aligns with local import regulations.

- Middle East (e.g., UAE): The market demands strict adherence to GCC standards and often UL or CE certifications. Suppliers with proven export experience to the region can better navigate customs and regulatory hurdles.

- Europe: Compliance with EU directives (CE, RoHS, REACH) is non-negotiable. Buyers should verify up-to-date certifications and ensure suppliers maintain traceability and batch control to meet stringent audit requirements.

Summary

For international B2B buyers sourcing the thinnest LED strips, a comprehensive understanding of the manufacturing and quality assurance processes is essential. The ultra-thin profile demands advanced material selection, precision fabrication, and meticulous assembly. Robust QC systems aligned with international standards such as ISO 9001, CE, and RoHS ensure product reliability and regulatory compliance.

Buyers should actively verify supplier quality through audits, sample testing, and third-party inspections, paying close attention to regional certification nuances. Such due diligence guarantees that the ultra-thin LED strips purchased will meet performance expectations and regulatory demands across Africa, South America, the Middle East, and Europe, facilitating successful project outcomes and long-term business partnerships.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for thinnest led strip Sourcing

Understanding the Cost Structure of Thinnest LED Strips

When sourcing the thinnest LED strips, buyers must appreciate the various cost components that influence the final pricing. These components include:

- Materials: The primary cost driver. High-quality LEDs, flexible PCBs, ultra-thin substrates, and protective coatings contribute significantly to material expenses. Premium materials that ensure durability and thinness typically raise costs.

- Labor: Skilled labor is required for precision assembly and quality control, especially given the delicate nature of ultra-thin strips. Labor costs vary by manufacturing location and can impact unit pricing.

- Manufacturing Overhead: This includes factory utilities, equipment depreciation, and indirect labor. High-tech manufacturing environments with advanced machinery for ultra-thin designs may have higher overheads.

- Tooling and Setup: Initial tooling costs for custom designs or very thin profiles can be substantial. These are usually amortized over large production volumes.

- Quality Control (QC): Rigorous testing is crucial to ensure LED strips meet thinness, brightness, and longevity standards. QC adds to cost but reduces returns and warranty claims.

- Logistics: Shipping ultra-thin LED strips safely requires careful packaging to prevent damage, influencing freight costs. For international buyers, customs duties, taxes, and import fees also add to total cost.

- Supplier Margin: Profit margins vary depending on supplier reputation, product exclusivity, and market demand.

Key Pricing Influencers to Consider

Several factors directly impact the quoted price for thinnest LED strips:

- Order Volume and MOQ: Larger orders generally unlock better per-unit pricing due to economies of scale. Minimum order quantities (MOQs) can also affect pricing tiers.

- Product Specifications & Customization: Custom lengths, colors, brightness levels, and additional features such as dimmability or waterproofing increase costs. Ultra-thin designs with advanced bending capabilities usually command premium prices.

- Material Quality and Certifications: LED strips with internationally recognized certifications (CE, RoHS, UL) or made with premium-grade LEDs cost more but provide better reliability and compliance for regulated markets.

- Supplier Location and Reputation: Established suppliers with robust quality systems may price higher but reduce risk. Proximity to manufacturing hubs can reduce shipping and lead times.

- Incoterms and Shipping Terms: Terms like FOB, CIF, or DDP affect who bears shipping and customs costs. Buyers from regions such as Africa, the Middle East, South America, and Europe should evaluate these carefully to optimize landed costs.

Strategic Buyer Tips for International B2B Sourcing

For buyers from regions including UAE, Nigeria, Brazil, or European countries, optimizing cost-efficiency while ensuring quality requires a strategic approach:

- Negotiate on Volume and Payment Terms: Engage suppliers to leverage bulk discounts and favorable payment terms (e.g., letters of credit, net 30/60 days). This can improve cash flow and reduce unit costs.

- Factor in Total Cost of Ownership (TCO): Beyond unit price, consider warranty support, expected lifespan, energy efficiency, and after-sales service. Sometimes a higher upfront price leads to lower long-term costs.

- Request Samples and Test Early: Validate product specifications and quality before committing to large orders. Samples help avoid costly returns and ensure compatibility with your applications.

- Understand Regional Import Duties and Compliance: Each region has different tariff structures and certification requirements. Working with customs brokers or freight forwarders familiar with your market can prevent unexpected expenses.

- Consolidate Shipments: Combining orders or sourcing from suppliers offering consolidated logistics can reduce freight costs and minimize delays.

- Monitor Currency Fluctuations: Exchange rate volatility can impact landed costs. Consider currency hedging or negotiating prices in stable currencies such as USD or EUR.

Indicative Pricing Insights

Prices for the thinnest LED strips vary widely depending on the above factors. As a broad indication:

- Basic ultra-thin LED strips may start around $1.50 to $3.00 per meter for standard specifications.

- Customized or premium-grade strips with advanced features can range from $4.00 to $8.00+ per meter.

- Large volume orders (thousands of meters) typically command significant discounts.

These figures are indicative and subject to change based on market conditions, supplier capabilities, and order specifics.

By carefully analyzing cost drivers and leveraging supplier relationships, international B2B buyers can secure competitively priced, high-quality thinnest LED strips optimized for their regional markets and applications.

Spotlight on Potential thinnest led strip Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘thinnest led strip’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for thinnest led strip

Key Technical Properties of the Thinnest LED Strip

Understanding the critical technical properties of the thinnest LED strips enables international buyers to make informed procurement decisions aligned with their project requirements. Here are the essential specifications:

-

Strip Thickness

The defining feature of these LED strips is their ultra-thin profile, often ranging from 0.8mm to 1.2mm. A thinner strip allows for installation in tight, narrow spaces such as behind signage, slim furniture, or architectural coves. For B2B buyers, confirming thickness compatibility with the installation environment is crucial to avoid costly redesigns or product returns. -

Material Grade and Flexibility

High-quality thinnest LED strips use flexible printed circuit boards (FPC) made from durable, heat-resistant materials like polyimide. This ensures longevity and resistance to bending fatigue. Buyers should prioritize suppliers who specify material grades and flexibility ratings, as these impact durability in dynamic or curved installations common in retail and hospitality sectors. -

LED Density (LEDs per Meter)

LED density affects brightness and uniformity of light output. Typical densities range from 60 to 240 LEDs per meter. Higher density strips deliver smoother illumination but may increase power consumption and cost. Buyers must balance LED density with energy efficiency needs and desired lighting effects, especially for large-scale projects in commercial or public spaces. -

Voltage and Power Consumption

Thinnest LED strips are commonly available in 5V, 12V, and 24V configurations. Lower voltage strips (e.g., 5V) are ideal for short runs and low-power applications, while 12V and 24V strips support longer lengths and higher power loads. Understanding voltage requirements helps buyers plan appropriate power supplies and avoid electrical compatibility issues across diverse markets. -

IP Rating (Ingress Protection)

Although many thinnest LED strips are designed for indoor use, some offer IP65 or higher ratings for dust and water resistance. Buyers targeting outdoor or humid environments in regions like the Middle East or coastal South America should specify the minimum IP rating to ensure durability and compliance with local standards. -

Color Temperature and CRI (Color Rendering Index)

Color temperature options range from warm white (2700K) to cool white (6500K), impacting ambiance and application suitability. A high CRI (above 80) indicates better color accuracy, important for retail displays and architectural lighting. Buyers should request datasheets specifying these values to match client expectations and regional aesthetic preferences.

Common Trade Terminology for B2B Buyers of LED Strips

Navigating international LED strip procurement requires familiarity with key trade terms that frequently appear in quotations, contracts, and communications with manufacturers and suppliers:

-

OEM (Original Equipment Manufacturer)

Refers to products made by one company to be rebranded and sold by another. B2B buyers may request OEM services to customize LED strips with their branding or packaging, enhancing market differentiation in local markets such as Nigeria or the UAE. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. MOQs can vary widely depending on the LED strip type and customization level. Buyers should negotiate MOQ terms that align with their inventory capacity and cash flow, especially when entering new markets or testing product demand. -

RFQ (Request for Quotation)

A formal inquiry sent by buyers to suppliers asking for pricing, lead times, and terms based on specified product requirements. Preparing detailed RFQs with technical specs and expected volumes improves supplier responsiveness and pricing accuracy. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities, risks, and costs between buyers and sellers during shipping. Common terms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and EXW (Ex Works). Understanding Incoterms helps buyers in Africa, Europe, and South America manage logistics and customs efficiently. -

Lead Time

The period from order confirmation to product shipment. Shorter lead times are advantageous for meeting tight project deadlines but may come at a premium. Buyers should clarify lead times upfront to align procurement schedules with installation plans. -

Certification Standards

Includes CE, RoHS, UL, and other regional certifications verifying product safety, environmental compliance, and quality. Buyers targeting regulated markets should ensure suppliers provide relevant certificates to avoid customs clearance issues and support warranty claims.

By mastering these technical properties and trade terms, international B2B buyers can confidently source the thinnest LED strips that meet their functional, aesthetic, and logistical needs, ensuring successful project execution and market competitiveness.

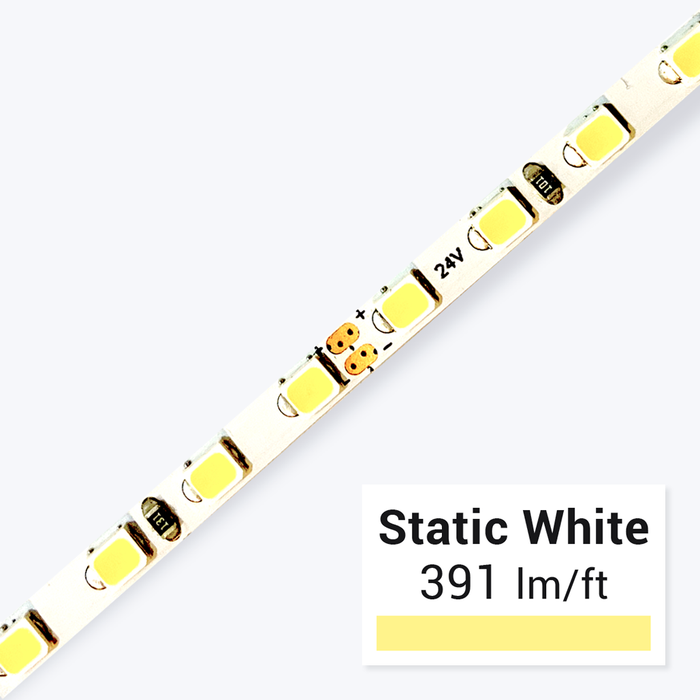

Illustrative Image (Source: Google Search)

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the thinnest led strip Sector

Market Overview & Key Trends

The global market for the thinnest LED strips is rapidly expanding, driven by increasing demand for sleek, energy-efficient lighting solutions across diverse sectors such as retail, hospitality, automotive, and smart home applications. International B2B buyers from regions including Africa, South America, the Middle East, and Europe are particularly focused on sourcing ultra-thin LED strips that enable innovative lighting designs without compromising on brightness or durability. This demand is propelled by urbanization, infrastructure development, and rising consumer preferences for minimalistic aesthetics combined with advanced technology.

Key market dynamics highlight a shift towards high-density, flexible LED strips with enhanced color rendering and tunable white features, meeting the growing needs for customizable lighting environments. The integration of smart controls—such as app-based dimming and color management—is becoming a standard expectation, especially in markets like the UAE and Europe where smart buildings and IoT adoption are accelerating. African and South American buyers are increasingly sourcing from suppliers that offer scalable solutions tailored for both indoor and outdoor use, with emphasis on waterproof and weather-resistant ultra-thin strips suitable for harsh climates.

Sourcing trends reveal a preference for suppliers who can provide not only competitive pricing but also technical support, product customization, and reliable logistics. Bulk purchasing remains a cost-effective strategy, with wholesalers offering flexible cut lengths and packaging options to meet project-specific requirements. The rise of direct-from-manufacturer sourcing platforms facilitates quicker lead times and reduces costs, a critical factor for buyers managing large-scale projects or retail inventories. Additionally, there is growing interest in LED strips with constant current drivers and high luminous efficacy, which enhance product lifespan and reduce energy consumption.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a pivotal consideration for B2B buyers in the thinnest LED strip sector, especially within regions like Europe and the UAE where regulatory frameworks and corporate social responsibility (CSR) commitments are stringent. The environmental impact of LED manufacturing—including raw material extraction, energy use, and waste generation—has prompted buyers to prioritize suppliers who adopt eco-friendly practices and transparent supply chains.

Ethical sourcing involves ensuring that components such as rare earth elements and electronic parts are obtained without exploiting labor or causing environmental degradation. Buyers increasingly seek certifications like RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and ISO 14001 for environmental management, which validate compliance with international sustainability standards. These certifications not only mitigate risk but also enhance brand reputation and customer trust in competitive markets.

From a materials perspective, the use of recyclable substrates, low-toxicity soldering materials, and lead-free components is gaining traction. Innovations in biodegradable packaging and reduced plastic use further align with global sustainability goals. For B2B buyers in Africa and South America, partnering with suppliers committed to sustainable practices can open access to green financing and government incentives, while Middle Eastern and European buyers benefit from alignment with their region’s green building certifications and energy efficiency mandates.

Brief Evolution and Industry Context

The evolution of the thinnest LED strip reflects broader advances in LED technology and miniaturization. Early LED strips were relatively thick and rigid, limiting their applications and design flexibility. Over the past decade, improvements in surface-mounted device (SMD) technology and flexible circuit boards have enabled manufacturers to produce ultra-thin, bendable strips with high light output and uniformity.

This technological progression has unlocked new applications, from intricate architectural lighting to automotive accent lighting, where space constraints demand slim profiles. For B2B buyers, understanding this evolution underscores the importance of partnering with suppliers who are at the forefront of innovation, capable of delivering cutting-edge products that meet evolving market demands for efficiency, durability, and aesthetic appeal. The continuous development of addressable and smart LED strips further enhances customization capabilities, offering significant value in competitive international markets.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of thinnest led strip

-

How can I verify the reliability of a supplier for thinnest LED strips in international markets?

To ensure supplier reliability, conduct thorough due diligence including verifying business licenses, certifications (such as ISO or CE), and customer reviews. Request detailed product specifications and quality assurance documents. For buyers in Africa, South America, the Middle East, and Europe, look for suppliers with experience in exporting to your region and those who provide transparent communication and after-sales support. Engaging third-party inspection services to audit manufacturing processes and product quality before shipment can further mitigate risks. -

What customization options are typically available when ordering thinnest LED strips wholesale?

Most reputable manufacturers offer customization in length, color temperature, LED density, and packaging to meet specific project needs. Some suppliers also provide options for waterproofing (IP ratings), connector types, and branding. For international B2B buyers, especially in diverse markets like the UAE or Nigeria, requesting samples of customized products before bulk ordering is essential. Custom orders may require minimum order quantities (MOQs) and longer lead times, so plan procurement accordingly.

-

What are common MOQ and lead time expectations when sourcing thinnest LED strips internationally?

MOQs vary widely but typically start around 500-1000 meters for standard models, with customized products potentially requiring higher MOQs. Lead times generally range from 2 to 6 weeks depending on order complexity and supplier capacity. International buyers should factor in additional shipping and customs clearance times. Establishing clear timelines in purchase agreements and maintaining communication with suppliers helps avoid delays, which is crucial for time-sensitive projects. -

Which payment terms are most secure and preferred for international B2B transactions of LED strips?

Common payment methods include Letters of Credit (LC), Telegraphic Transfers (T/T), and Escrow services. For first-time international transactions, using LCs provides security by ensuring payment is made only after meeting contract terms. Established buyers may negotiate partial upfront deposits with balance payments after delivery inspection. Always clarify payment terms upfront and use contracts to protect against fraud or non-performance, especially when dealing with suppliers across Africa, South America, the Middle East, and Europe. -

What quality certifications should I look for in thinnest LED strips to ensure compliance and durability?

Look for international certifications such as CE (European Conformity), RoHS (Restriction of Hazardous Substances), UL (Underwriters Laboratories), and FCC, which demonstrate compliance with safety and environmental standards. Certifications related to waterproof ratings (IP65, IP67) are important for outdoor or humid environments. Verified quality certifications not only ensure product reliability but also facilitate customs clearance and acceptance in regulated markets like the EU or UAE. -

How can international buyers optimize logistics and shipping for bulky orders of thinnest LED strips?

Consolidate orders to maximize container utilization and reduce per-unit freight costs. Choose suppliers with experience in exporting to your region who can provide DDP (Delivered Duty Paid) or FOB (Free on Board) shipping terms depending on your preference for customs handling. Engage freight forwarders familiar with African, South American, Middle Eastern, or European customs regulations to avoid delays. Additionally, consider transit times and seasonal factors affecting shipping routes to plan inventory efficiently. -

What steps should be taken to handle disputes or quality issues with international LED strip suppliers?

Establish clear contractual terms including product specifications, inspection procedures, warranty periods, and dispute resolution mechanisms (such as arbitration in a neutral location). Upon receipt, conduct thorough inspections and report discrepancies immediately with photo evidence. Maintain open communication channels and escalate issues professionally. If disputes arise, leveraging trade organizations or chambers of commerce in your country or supplier’s jurisdiction can facilitate resolution. Purchasing from suppliers offering warranties and after-sales support mitigates risk. -

Are there specific considerations for sourcing thinnest LED strips in regions like Nigeria, UAE, or South America?

Yes, regional factors such as import regulations, local electrical standards, and climate conditions must be considered. For example, in humid or tropical climates like Nigeria and parts of South America, waterproof or higher IP-rated LED strips may be necessary. The UAE and Europe often require compliance with stringent safety and energy efficiency standards. Additionally, currency fluctuations, customs duties, and reliable logistics partners are critical for cost-effective procurement. Partnering with suppliers familiar with these regional nuances can streamline sourcing and installation.

Strategic Sourcing Conclusion and Outlook for thinnest led strip

In today’s competitive global market, sourcing the thinnest LED strips requires a strategic approach that balances quality, innovation, and cost-effectiveness. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—leveraging trusted suppliers who offer cutting-edge, customizable LED strip solutions is essential to meet diverse application demands. Prioritizing suppliers with strong warranties, flexible order quantities, and the ability to deliver timely shipments will safeguard your investment and ensure project continuity.

Key considerations include understanding your project’s technical requirements, assessing supplier reliability, and exploring options for customization to align with branding and functional needs. Bulk purchasing from reputable manufacturers not only reduces unit costs but also provides access to the latest LED technologies that can differentiate your offerings in your local markets.

Looking ahead, the demand for ultra-thin, energy-efficient LED strips is poised to grow across commercial, industrial, and decorative sectors worldwide. Buyers who adopt a proactive sourcing strategy—emphasizing innovation, quality assurance, and supply chain agility—will be best positioned to capitalize on emerging opportunities. Engage with leading suppliers today to secure competitive advantage and drive sustainable growth in your lighting solutions portfolio.

Illustrative Image (Source: Google Search)