Introduction: Navigating the Global Market for philips hue led strip extension

The global smart lighting market is rapidly evolving, with Philips Hue LED strip extensions emerging as a pivotal component for dynamic, customizable lighting solutions. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—understanding the nuances of Philips Hue LED strip extensions is critical to capitalizing on growing demand for smart ambient lighting in commercial and residential projects.

Philips Hue LED strip extensions offer unparalleled flexibility, enabling tailored lighting designs that can be easily expanded or adapted to complex architectural layouts. Their compatibility with advanced smart home ecosystems and energy-efficient LED technology makes them an attractive proposition for businesses seeking to deliver innovative lighting experiences. However, sourcing these products requires a deep understanding of product variants, manufacturing standards, quality control protocols, and supplier reliability across diverse markets.

This comprehensive guide equips B2B buyers with actionable insights into:

- Types and configurations of Philips Hue LED strip extensions, including base kits, extension modules, and splitters for versatile installation.

- Material and component quality, ensuring durability and optimal light performance.

- Manufacturing and quality assurance standards that guarantee product consistency and compliance with international certifications.

- Global supplier landscape, highlighting key manufacturers and authorized distributors tailored to regional market needs.

- Cost structures and pricing strategies, enabling competitive procurement without compromising on quality.

- Market trends and demand forecasts within emerging and established markets.

- Frequently asked questions addressing installation, compatibility, and after-sales support.

By navigating this guide, B2B buyers from regions such as Nigeria and Mexico will be empowered to make informed sourcing decisions, optimize supply chains, and meet the evolving expectations of their clientele with confidence and precision.

Understanding philips hue led strip extension Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Philips Hue Extensions | Official 6-pin connectors, compatible with base kits | Retail lighting displays, office ambient lighting | + Reliable compatibility – Limited flexibility in layout |

| Splitter Extensions | Short cables (3 inches) for corner or multi-directional setups | Custom retail shelving, complex architectural lighting | + Enables corner bends – Limited length, basic branching |

| Litcessory Ribbon Cable Splitters | Flexible cables in varied lengths (2 inches to 10 feet) | Large-scale installations, modular shelving, hospitality | + Flexible layout options – Additional supplier sourcing |

| Power Supply Extensions | Extended power cables (up to 25 feet) for remote power needs | Warehouses, exhibition booths, outdoor commercial spaces | + Neat cable management – Added cost, compatibility check |

| Connector Converters | Adapters to mix v3 and v4 connector types | Mixed inventory setups, refurbishment projects | + Inventory optimization – Slight added complexity |

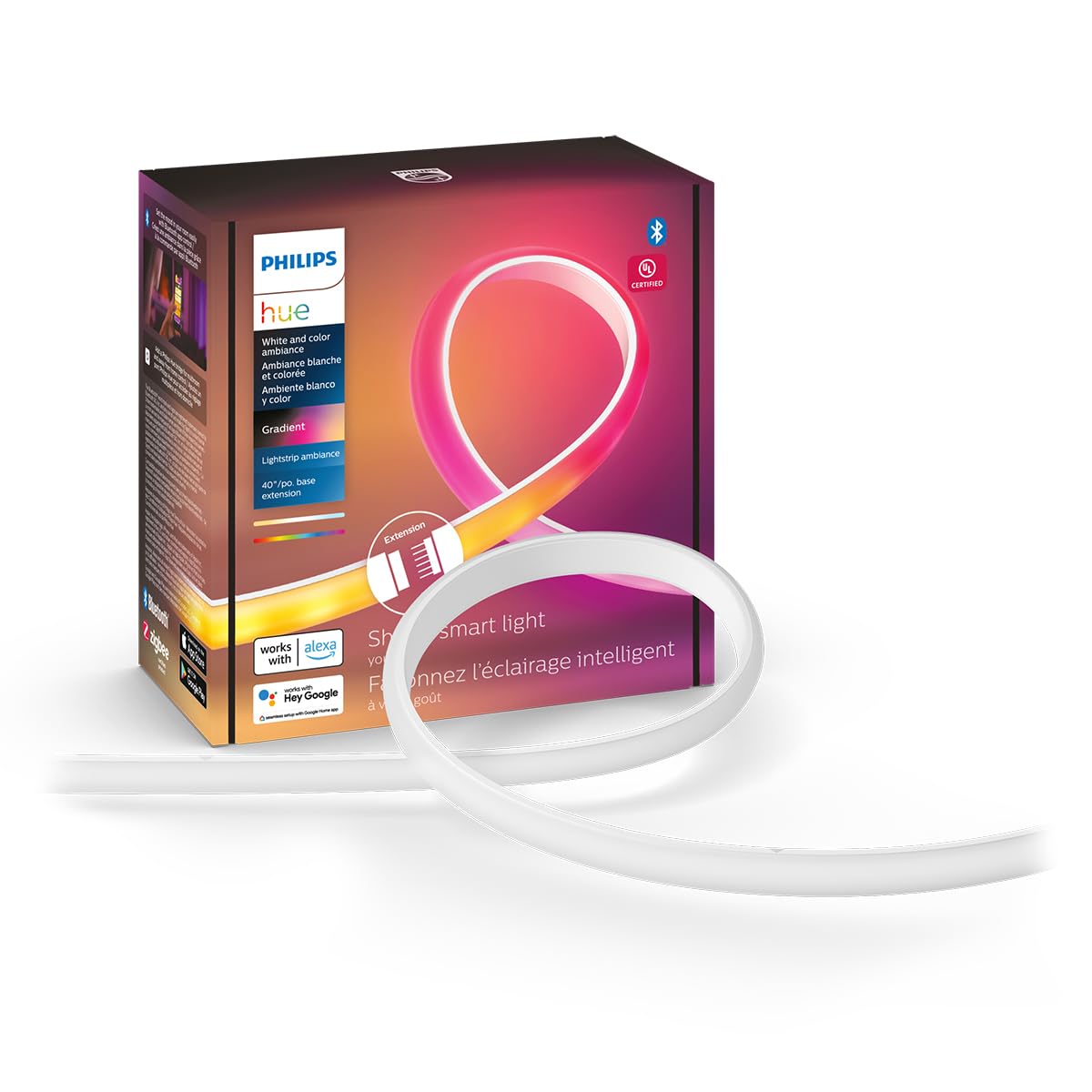

Standard Philips Hue Extensions

These are the official extension strips designed by Philips, featuring the native 6-pin connectors compatible with the base light strip kits. Ideal for straightforward lengthening of lighting setups, they provide guaranteed interoperability and are easy to install. For B2B buyers, especially retailers and office fit-outs in regions like Africa and South America, these extensions ensure a consistent product experience. However, their rigid design limits flexibility for complex installations, so buyers should assess project complexity before bulk purchasing.

Splitter Extensions

Philips Hue’s official splitter cables allow light strips to navigate corners or split into two directions using short, fixed-length cables. This type is highly useful in retail shelving or bespoke cabinetry where lighting must bend around corners without damage. B2B buyers in hospitality or commercial interiors will appreciate the ability to maintain a single controller for multiple strip sections, reducing system complexity. The downside is their limited length and branching options, which may necessitate additional accessories for larger projects.

Litcessory Ribbon Cable Splitters

Third-party accessories like Litcessory offer flexible ribbon cable splitters in multiple lengths, enhancing layout versatility for Philips Hue systems. These are particularly valuable in large commercial installations, exhibitions, or modular shelving units common in European and Middle Eastern markets, where lighting design requires longer gaps or flexible routing. While they expand design possibilities and reduce power outlet needs, sourcing from third-party suppliers means buyers must verify compatibility and warranty considerations.

Power Supply Extensions

Philips Hue’s standard power cables are about 8 feet long, which can be insufficient for expansive commercial or industrial spaces. Power supply extensions of up to 25 feet allow lighting units to be powered from distant sockets, improving installation neatness and safety. This is critical for buyers in warehouse or outdoor exhibition environments in regions like Nigeria or Mexico, where electrical infrastructure varies. The trade-off is the additional cost and the need for compatibility verification to avoid power issues.

Connector Converters

With Philips Hue evolving from v3 to v4 connectors, connector converters enable mixing of different generation strips within one system. This is a strategic option for B2B buyers managing mixed inventories or refurbishing existing installations, allowing cost savings by using leftover strips. Buyers should consider the slight complexity added to installation and ensure technical support for these adapters to maintain system integrity across diverse markets.

Related Video: Philips Hue LED Strip Light Plus Unboxing and Setup

Key Industrial Applications of philips hue led strip extension

| Industry/Sector | Specific Application of Philips Hue LED Strip Extension | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Hospitality & Leisure | Ambient lighting for hotel lobbies, restaurants, and bars | Enhances guest experience, flexible mood setting, energy-efficient lighting | Compatibility with existing systems, ease of installation, durability in humid environments |

| Retail & Commercial | Product display backlighting and shelf illumination | Improves product visibility, attracts customers, customizable color options | Scalability of strip length, color accuracy, power supply requirements, and local voltage compatibility |

| Office & Corporate | Dynamic workspace lighting for conference rooms and collaborative areas | Boosts employee productivity and well-being, supports circadian rhythms | Integration with smart office systems, control flexibility, and compliance with regional electrical standards |

| Entertainment & Events | Stage and event lighting with multi-zone color control | Creates immersive experiences, adaptable to various event themes | Robustness for transport, modular extension capability, and remote control features |

| Residential Real Estate | Smart home staging and ambient lighting in show homes | Increases property appeal, highlights architectural features | Easy scalability, user-friendly control, and compatibility with popular smart home ecosystems |

Hospitality & Leisure

Philips Hue LED strip extensions are widely used in hospitality environments to create customizable ambient lighting in hotel lobbies, restaurants, and bars. The ability to extend and shape the light strips allows for tailored lighting designs that enhance guest experiences by setting moods that align with the brand or time of day. For B2B buyers in regions like Africa or the Middle East, sourcing considerations include ensuring the lighting solutions can withstand local climate conditions such as humidity and heat, and that installation is straightforward to minimize downtime in busy venues.

Illustrative Image (Source: Google Search)

Retail & Commercial

In retail, Philips Hue LED strip extensions serve as effective tools for illuminating product displays and shelves, enhancing product visibility and attracting customer attention. The flexibility to extend strips to custom lengths and control colors enables retailers to highlight different products or promotions dynamically. Buyers in South America and Europe should prioritize sourcing options that offer precise color rendering and compatibility with existing electrical infrastructures, as well as ensuring power supply units support local voltage and frequency standards.

Office & Corporate

Modern office spaces benefit from Philips Hue LED strip extensions by integrating dynamic lighting that supports employee productivity and well-being. Adjustable color temperatures and brightness levels can mimic natural light cycles, improving focus and reducing fatigue. For corporate buyers, particularly in Europe and the Middle East, key considerations include seamless integration with existing smart office platforms, adherence to strict electrical safety standards, and flexibility in control options to accommodate different workspace layouts.

Entertainment & Events

Philips Hue LED strip extensions are essential in entertainment venues and event management for stage lighting and creating immersive atmospheres. Their modularity allows lighting designers to configure multi-zone setups that can be controlled independently to match event themes or performances. For international B2B buyers, especially in markets like Nigeria or Mexico, sourcing should focus on the durability of strips for frequent transport, ease of modular extension, and advanced remote control capabilities to facilitate complex event setups.

Residential Real Estate

In residential real estate, developers and home staging companies use Philips Hue LED strip extensions to enhance show homes with smart ambient lighting that highlights architectural features and creates inviting environments. This technology helps properties stand out in competitive markets by demonstrating modern smart home capabilities. Buyers should consider the ease of scalability to fit various room sizes, user-friendly controls for prospective buyers, and compatibility with popular smart home ecosystems common in target regions such as Europe and South America.

Related Video: Philips hue lightstrip – How to use extension cable

Strategic Material Selection Guide for philips hue led strip extension

When selecting materials for Philips Hue LED strip extensions, B2B buyers must consider factors such as durability, electrical safety, environmental resistance, and cost-effectiveness. The choice of material directly impacts the product’s performance, longevity, and compliance with regional standards, which is critical for buyers from diverse markets like Africa, South America, the Middle East, and Europe.

1. Flexible Polyvinyl Chloride (PVC)

Key Properties: PVC is widely used as the primary insulation and protective coating for LED strip extensions. It offers good flexibility, electrical insulation, and moderate resistance to heat (typically up to 60-80°C) and moisture. It is also resistant to many chemicals and UV radiation to some extent.

Pros & Cons: PVC is cost-effective and easy to manufacture, making it a popular choice for large-scale production. However, it has limited temperature tolerance and can become brittle in very cold climates, which may be a concern for regions with extreme weather variations. Additionally, PVC can emit harmful fumes if burned, raising environmental and safety concerns.

Impact on Application: PVC-coated strips are suitable for indoor ambient lighting applications where exposure to harsh environmental factors is minimal. Its moderate moisture resistance makes it acceptable for controlled indoor environments but less ideal for outdoor or high-humidity areas without additional sealing.

International Considerations: Buyers in Africa and South America should verify compliance with local fire safety and chemical regulations, as PVC’s flammability can be a concern. European buyers will find PVC materials often compliant with RoHS and REACH directives, but they should ensure suppliers provide certification. Middle Eastern markets may require adherence to ASTM or DIN standards for electrical insulation and flame retardancy.

2. Silicone Rubber

Key Properties: Silicone rubber is prized for its excellent flexibility, high-temperature resistance (up to 200°C), and superior weatherproofing. It is highly resistant to UV, ozone, and moisture, making it ideal for outdoor or semi-outdoor installations.

Pros & Cons: Silicone offers enhanced durability and longevity compared to PVC, especially in harsh environments. It is also non-toxic and more environmentally friendly. However, silicone materials are generally more expensive and can complicate manufacturing due to their curing processes.

Impact on Application: Silicone-coated LED strip extensions are optimal for outdoor lighting, commercial installations in humid or dusty environments, and applications requiring frequent bending or repositioning. Their robustness makes them suitable for regions with intense sun exposure, such as the Middle East and parts of Africa.

International Considerations: For buyers in Europe and the Middle East, silicone materials often meet stringent environmental and safety standards like EN 60598 for luminaires. In South America and Africa, the higher cost might be a limiting factor, but the material’s durability can offset replacement costs over time. Ensuring suppliers provide compliance documentation for regional electrical and environmental standards is essential.

3. Polycarbonate (PC) Housing or Cover

Key Properties: Polycarbonate is a rigid, transparent thermoplastic used primarily for protective covers or housings on LED strips. It boasts high impact resistance, excellent optical clarity, and good thermal stability (up to 115°C).

Pros & Cons: PC offers superior mechanical protection, which helps prevent damage during installation or operation. It is also UV resistant, reducing yellowing over time. However, polycarbonate is less flexible, which limits its use in curved or irregular installations. It is also more costly than PVC.

Impact on Application: Polycarbonate is ideal for premium LED strip extensions requiring robust protection, such as in retail displays or architectural lighting where aesthetics and durability are critical. It is less suited for flexible or tight corner installations.

International Considerations: European buyers will appreciate PC’s compliance with stringent safety and environmental standards like REACH and RoHS. In regions like the Middle East and South America, the material’s durability under intense sunlight is a significant advantage. However, buyers must consider the higher upfront cost and potential challenges in logistics due to fragility during transport.

4. Copper Conductors with Tin Plating

Key Properties: Copper is the standard conductor material used in LED strip extensions for its excellent electrical conductivity. Tin plating is applied to prevent corrosion and improve solderability.

Pros & Cons: Copper conductors ensure efficient power transmission and signal integrity. Tin plating enhances corrosion resistance, which is crucial in humid or coastal environments. However, copper is heavier and more expensive than alternatives like aluminum, and tin plating adds to manufacturing complexity.

Impact on Application: Copper with tin plating is essential for reliable, long-lasting electrical connections in LED strips, especially in regions with high humidity or salt exposure, such as coastal areas in Africa and South America. It supports stable performance in commercial and industrial lighting applications.

International Considerations: Buyers should ensure that copper conductors meet international standards like ASTM B170 or IEC 60228 for conductor quality. Tin plating thickness and quality should comply with IPC or JIS standards to prevent premature failure. In markets like Europe, compliance with RoHS and REACH is mandatory, while in Africa and the Middle East, buyers should verify corrosion resistance certifications for local environmental conditions.

Summary Table

| Material | Typical Use Case for philips hue led strip extension | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Flexible PVC | Indoor ambient lighting with moderate environmental exposure | Cost-effective, flexible, easy to manufacture | Limited temperature tolerance, flammable fumes | Low |

| Silicone Rubber | Outdoor or harsh environment installations requiring flexibility | High temperature & UV resistance, durable | Higher cost, complex manufacturing | High |

| Polycarbonate (PC) | Protective covers for premium or architectural lighting | Impact resistant, UV stable, excellent clarity | Rigid, less flexible, higher cost | Medium |

| Copper with Tin Plating | Electrical conductors in all strip extensions, especially humid/coastal areas | Excellent conductivity, corrosion resistant | Heavier and costlier than alternatives | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for philips hue led strip extension

The manufacturing and quality assurance of Philips Hue LED strip extensions involve meticulous processes and rigorous standards to ensure performance, safety, and reliability. For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, understanding these processes and how to verify quality is essential for successful procurement and long-term partnership.

Manufacturing Process Overview

The production of Philips Hue LED strip extensions can be broadly divided into four main stages: material preparation, forming, assembly, and finishing. Each phase incorporates specialized techniques to maintain the integrity and functionality of the product.

1. Material Preparation

- Raw Materials: High-grade flexible printed circuit boards (FPCBs), LED chips (typically SMD LEDs), resistors, connectors (6-pin male/female), adhesives, and protective coatings are sourced.

- Supplier Qualification: Materials are procured from certified vendors with compliance to environmental and safety standards such as RoHS (Restriction of Hazardous Substances).

- Incoming Quality Control (IQC): Each batch of materials undergoes inspection for dimensional accuracy, electrical properties, and material consistency before entering production.

2. Forming

- PCB Fabrication: The flexible circuit board is fabricated with copper traces arranged to support the required electrical pathways.

- LED Placement: Surface-mount technology (SMT) machines precisely place LEDs and electronic components onto the FPCB. Automated optical inspection (AOI) ensures proper positioning and soldering.

- Cutting Intervals: The strip is designed with marked cutting points to allow customization without damaging circuits, typically achieved via precision laser cutting or mechanical shearing.

3. Assembly

- Connector Attachment: The 6-pin connectors (male and female) are soldered or mechanically crimped onto the strip ends, enabling modular extension and compatibility with controllers.

- Wiring and Splitters: For complex installations, flexible cable splitters are integrated, allowing multi-directional or segmented lighting control.

- Encapsulation: The LED strips are coated with waterproof or protective silicone layers, enhancing durability against moisture and physical damage.

4. Finishing

- Functional Testing: Completed strips undergo electrical testing to verify LED functionality, voltage stability, and connector integrity.

- Packaging: Units are packaged with anti-static materials and clear installation instructions to preserve quality during transit and ease of use for buyers.

Quality Assurance and Control Measures

Philips Hue LED strip extensions adhere to stringent quality assurance protocols aligned with international standards and industry-specific certifications. This ensures that the products meet global safety, performance, and environmental benchmarks.

Key International Standards and Certifications

- ISO 9001: The manufacturing facilities typically operate under ISO 9001 quality management systems, emphasizing consistent process control and continuous improvement.

- CE Marking: Compliance with European Union directives for safety, electromagnetic compatibility, and environmental impact, crucial for buyers in Europe and regions recognizing CE.

- RoHS Compliance: Restriction of hazardous substances ensures the strips are free from harmful materials like lead, mercury, and cadmium.

- UL Certification: Though more common in North America, UL (Underwriters Laboratories) certification may also apply, indicating compliance with safety standards.

- Electromagnetic Compatibility (EMC) Testing: Ensures the strips do not interfere with other electronic devices, an important factor in professional installations.

Quality Control Checkpoints

- Incoming Quality Control (IQC): Verification of raw materials and components before assembly.

- In-Process Quality Control (IPQC): Continuous inspection during manufacturing stages, including solder joint integrity, LED placement accuracy, and connector assembly.

- Final Quality Control (FQC): Comprehensive testing of finished products, including:

- Visual inspection for defects or damage.

- Electrical testing for LED brightness, color accuracy, and power consumption.

- Functional testing with controllers to ensure seamless integration.

- Environmental stress tests (e.g., thermal cycling, moisture resistance).

Testing Methods Relevant to B2B Buyers

- Automated Optical Inspection (AOI): Detects defects in soldering and component placement with high precision.

- Electrical Load Testing: Confirms current flow and voltage stability across the strip and connectors.

- Color Consistency Testing: Measures LED color output to ensure uniformity, critical for ambient lighting applications.

- Durability Testing: Includes bending tests and exposure to humidity or dust, simulating real-world installation conditions.

Verifying Supplier Quality: Recommendations for B2B Buyers

For international buyers, especially in emerging markets such as Nigeria, Mexico, and other regions, verifying supplier quality is paramount to mitigate risks associated with counterfeit or substandard products.

Supplier Audits

- On-site Factory Audits: Engage third-party auditors to evaluate the supplier’s manufacturing processes, quality management systems (ISO 9001), and working conditions.

- Process Capability Assessments: Review process control charts, defect rates, and equipment calibration records to ensure consistency.

- Sample Inspections: Request product samples for independent laboratory testing to verify compliance with promised specifications.

Documentation and Certification Review

- Quality Certificates: Obtain copies of ISO 9001, CE declarations of conformity, RoHS compliance reports, and any other relevant certifications.

- Test Reports: Review batch-specific electrical and environmental testing results.

- Traceability Records: Ensure suppliers maintain detailed records linking materials to finished products, facilitating accountability.

Third-Party Inspection Services

- Utilize independent quality inspection firms for pre-shipment inspections, including:

- Visual and functional inspections.

- Random sample electrical and mechanical testing.

- Packaging and labeling verification.

Quality Assurance Considerations for Global Markets

International B2B buyers must be aware of regional variations and regulatory nuances:

- Africa & Middle East: While CE and RoHS are widely accepted, some countries may require additional local certifications or import approvals. Power supply compatibility (voltage/frequency) must be verified.

- South America: Buyers should check for compliance with local electrical standards (e.g., INMETRO in Brazil) and consider import tariffs and customs inspection processes.

- Europe: Strict adherence to EU regulations, including REACH (chemical safety) and WEEE (waste electrical equipment), is mandatory.

- Logistics and After-Sales: Consider suppliers’ capability to provide technical support, warranty services, and spare parts availability to minimize operational downtime.

By thoroughly understanding the manufacturing stages, quality control protocols, and certification frameworks of Philips Hue LED strip extensions, international B2B buyers can confidently evaluate suppliers, ensure product integrity, and optimize their procurement strategies for diverse markets. This knowledge empowers buyers to demand transparency, verify compliance, and ultimately secure lighting solutions that meet the highest standards of performance and safety.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for philips hue led strip extension Sourcing

When sourcing Philips Hue LED strip extensions for B2B purposes, understanding the full cost and pricing dynamics is crucial to making informed purchasing decisions and optimizing your supply chain. This analysis breaks down key cost components, pricing influencers, and strategic buyer considerations tailored for international buyers in Africa, South America, the Middle East, and Europe.

Key Cost Components in Philips Hue LED Strip Extension Manufacturing

-

Materials

The primary cost driver is the high-quality LED chips, flexible PCBs, connectors (6-pin types for v3 and v4), and power supply components. Philips Hue products utilize premium LEDs with smart control features, which inherently increase material costs compared to generic strips. -

Labor and Manufacturing Overhead

Assembly involves precision soldering, connector installation, and quality assurance testing. Manufacturing overhead includes factory utilities, equipment depreciation, and labor costs, which vary by region. For instance, labor costs in Europe tend to be higher than in Asia, affecting overall pricing. -

Tooling and Equipment

Specialized tooling for cutting, connecting, and encapsulating the LED strips ensures durability and compliance with Philips Hue standards. Initial tooling investments are amortized over production runs but can influence pricing for smaller volume orders. -

Quality Control (QC)

Rigorous QC processes, including electrical testing, waterproofing checks, and firmware verification, maintain product reliability and Philips brand reputation. These quality measures add to production time and costs but are vital for long-term customer satisfaction. -

Logistics and Distribution

Shipping costs, import duties, and customs clearance fees significantly impact landed cost, especially for buyers in Africa and South America where freight infrastructure may be less developed. Packaging designed to prevent damage during transit also adds incremental cost. -

Margin and Markup

Suppliers and distributors include their profit margins, which can vary based on exclusivity, service levels, and market demand. Premium smart lighting products like Philips Hue typically command higher markups due to brand value and technology integration.

Influential Pricing Factors for B2B Buyers

-

Order Volume and Minimum Order Quantity (MOQ)

Larger orders typically attract volume discounts, reducing unit cost. However, Philips Hue extensions often have standardized MOQs set by manufacturers or authorized distributors, which can impact initial investment size. -

Product Specifications and Customization

Custom lengths, connector types (v3 vs. v4), or added accessories (splitters, power extension cables) influence pricing. Custom firmware or packaging requests further increase costs and lead times. -

Material Quality and Certification

Philips Hue products comply with international standards (CE, RoHS, UL). Buyers should verify certifications to avoid counterfeit or substandard imports, which may be cheaper upfront but risk warranty claims and brand damage. -

Supplier Location and Reliability

Established Philips Hue distributors or authorized resellers ensure genuine products but may charge premiums. Direct sourcing from manufacturers in Asia can reduce costs but requires vetting for authenticity and quality. -

Incoterms and Shipping Terms

FOB, CIF, DDP, and other Incoterms affect who bears freight, insurance, and customs duties. Buyers in regions with complex import procedures (e.g., Nigeria, Brazil) should consider DDP to reduce logistical risks and unexpected costs.

Strategic Buyer Tips for International B2B Procurement

-

Negotiate Based on Volume and Long-term Partnership

Leverage forecasted purchase volumes and repeat business potential to negotiate better pricing and payment terms. Emphasize partnership to access exclusive deals or support. -

Evaluate Total Cost of Ownership (TCO)

Consider not only unit price but also shipping, customs, installation, warranty servicing, and energy consumption. Philips Hue’s energy-efficient design can reduce operational costs, adding value beyond upfront price. -

Mitigate Currency and Payment Risks

Use secure payment methods and consider currency hedging to manage exchange rate fluctuations common in emerging markets. -

Confirm Authenticity and Warranty Coverage

Prioritize authorized distributors to ensure genuine Philips Hue products with valid warranties, which minimize risk and potential replacement costs. -

Understand Regional Pricing Nuances

Import taxes, local regulations, and market demand can cause price variances across Africa, South America, the Middle East, and Europe. Engage local experts or agents to navigate these complexities effectively.

Indicative Pricing Disclaimer

Prices for Philips Hue LED strip extensions vary widely depending on order size, sourcing strategy, and regional factors. The insights provided serve as a guideline to help buyers conduct due diligence and cost analysis rather than fixed pricing references. Always request detailed quotes and verify terms before commitment.

By dissecting the cost structure and pricing influencers with an eye on international logistics and market-specific challenges, B2B buyers can optimize procurement strategies for Philips Hue LED strip extensions, ensuring cost-efficiency and supply reliability across diverse global markets.

Spotlight on Potential philips hue led strip extension Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘philips hue led strip extension’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for philips hue led strip extension

Critical Technical Properties of Philips Hue LED Strip Extensions

-

Connector Type and Compatibility

Philips Hue LED strip extensions utilize a proprietary 6-pin connector system, with two main variants: the older v3 and the newer v4 (Light Strip Plus) connectors. For B2B buyers, understanding this distinction is vital to ensure compatibility between base kits and extension strips. Mismatched connectors can lead to installation failures or require additional adapters, increasing costs and lead times. -

Maximum Extension Length and Power Supply Capacity

A single Philips Hue power supply supports up to approximately 10 meters (60 feet) of combined base strip and extensions—typically the base strip plus eight extension segments. Exceeding this length necessitates additional power supplies and controllers. This technical limit is critical in planning large-scale installations, especially for commercial projects in retail or hospitality sectors. -

Cutting Intervals and Modular Design

The LED strips are designed with marked cutting points, allowing them to be trimmed safely without damaging electronic components. This modularity enables customization to specific spatial requirements, minimizing waste and optimizing lighting design. For B2B buyers, this flexibility is essential when tailoring solutions for varied architectural layouts. -

Material Quality and Durability

Philips Hue LED strips are constructed with high-grade flexible PCB materials and encapsulated with durable, water-resistant coatings (especially for outdoor variants). This ensures longevity and resistance to environmental factors such as humidity and dust. For international buyers, particularly in humid or dusty climates common in Africa and the Middle East, this durability guarantees reliable performance and reduces maintenance costs. -

Color Range and Control Protocol

The strips offer full RGB color control with tunable white light options, managed through the Philips Hue ecosystem using Zigbee wireless protocol. This interoperability with smart home systems allows for advanced automation and scene setting. From a B2B perspective, this enhances the value proposition for clients seeking sophisticated, customizable lighting environments. -

Power Consumption and Efficiency

Philips Hue LED strips are energy-efficient, consuming low wattage relative to traditional lighting solutions. For large installations, understanding power consumption impacts operational costs and infrastructure planning. Buyers should assess the energy profile to ensure compliance with local energy regulations and sustainability goals.

Key Trade Terminology for Philips Hue LED Strip Extension Procurement

-

OEM (Original Equipment Manufacturer)

Refers to companies that produce the original Philips Hue LED strip components or authorized compatible products. Engaging OEMs can assure product authenticity, warranty support, and consistent quality, which is crucial for maintaining brand reputation in your market. -

MOQ (Minimum Order Quantity)

This term defines the smallest quantity of product units a supplier is willing to sell in a single order. For buyers in emerging markets like Nigeria or Mexico, negotiating MOQ is important to balance inventory costs with demand, especially when testing new product lines. -

RFQ (Request for Quotation)

An RFQ is a formal process where buyers solicit detailed pricing, terms, and delivery information from suppliers. Issuing an RFQ for Philips Hue LED strip extensions enables buyers to compare offers and secure competitive pricing and favorable contract terms. -

Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, DDP) that define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Understanding Incoterms is essential for international buyers to avoid unexpected costs and ensure smooth logistics. -

Lead Time

The period between placing an order and receiving the goods. For Philips Hue products, lead time affects project schedules and inventory planning. Buyers should confirm lead times upfront to align supply with installation deadlines. -

SKU (Stock Keeping Unit)

A unique identifier for each product variant (e.g., base kit, extension strip length, connector type). Proper SKU management simplifies ordering, inventory tracking, and after-sales support.

By grasping these technical properties and trade terms, international B2B buyers can make informed purchasing decisions, optimize supply chain efficiency, and customize Philips Hue LED strip extension solutions to meet diverse market needs across Africa, South America, the Middle East, and Europe.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the philips hue led strip extension Sector

Market Overview & Key Trends

The Philips Hue LED strip extension sector is experiencing robust growth driven by the global surge in smart lighting adoption across residential, commercial, and hospitality sectors. For international B2B buyers in emerging and mature markets such as Nigeria, Mexico, the Middle East, and Europe, this presents significant opportunities to capitalize on increasing demand for customizable, energy-efficient lighting solutions. The integration of IoT-enabled features and smart home ecosystems is a critical driver, enabling seamless control and automation that appeal to tech-savvy end-users.

Key market dynamics include the rising preference for modular and scalable lighting setups, where Philips Hue’s extension strips allow flexible length adjustments and multi-zone configurations. This versatility supports complex installations in retail displays, offices, hotels, and entertainment venues, where ambience and adaptive lighting are paramount. Additionally, the growing emphasis on aesthetic lighting design in emerging urban centers fuels demand for premium branded solutions like Philips Hue, recognized for reliability and extensive accessory ecosystems.

From a sourcing perspective, international buyers should note the increasing availability of third-party accessories (e.g., splitters, longer power cables) that complement Philips Hue products, allowing more tailored installations. However, maintaining compatibility and warranty integrity requires careful vendor selection. Furthermore, supply chain resilience remains a priority amid geopolitical uncertainties and fluctuating logistics costs, prompting buyers to seek diversified sourcing channels, including regional distributors and authorized Philips Hue partners.

In summary, B2B buyers should focus on:

- Leveraging Philips Hue’s modular system for scalable lighting projects.

- Prioritizing suppliers with proven product authenticity and after-sales support.

- Monitoring regional market trends and infrastructure developments to anticipate demand spikes.

- Exploring value-added accessories that enhance installation flexibility without compromising system integrity.

Sustainability & Ethical Sourcing in B2B

Sustainability is increasingly a decisive factor for B2B procurement in the Philips Hue LED strip extension sector. Philips has made substantial commitments to environmental stewardship, emphasizing energy-efficient LED technology that drastically reduces electricity consumption compared to traditional lighting. This is particularly relevant for buyers in regions with high energy costs or limited grid capacity, such as parts of Africa and South America, where energy savings translate directly into operational cost reductions.

Ethical sourcing is equally critical. Buyers should ensure their supply chains adhere to responsible labor practices, conflict-free sourcing of raw materials, and compliance with international environmental standards. Philips Hue products often come with certifications such as RoHS (Restriction of Hazardous Substances), CE marking, and Energy Star, which provide assurance regarding product safety, environmental impact, and energy efficiency.

Moreover, the use of recyclable materials and packaging reduction initiatives by Philips aligns with global circular economy principles, appealing to companies with robust ESG (Environmental, Social, Governance) mandates. In regions where regulatory frameworks on sustainability are tightening, partnering with manufacturers who prioritize transparency and traceability in their supply chain can mitigate risks related to compliance and reputational damage.

For B2B buyers, actionable steps include:

- Requesting supplier documentation on environmental certifications and labor standards.

- Prioritizing Philips Hue products or authorized extensions with clear sustainability credentials.

- Collaborating with logistics partners to optimize shipping routes and reduce carbon footprints.

- Educating clients on the long-term benefits of energy-efficient smart lighting investments.

Evolution and Industry Context

The Philips Hue LED strip extension market has evolved significantly since the introduction of the first Hue light strips in the early 2010s. Initially designed as standalone ambient lighting solutions, these strips have transformed into integral components of comprehensive smart lighting ecosystems. The launch of modular extension strips and accessories has allowed businesses to implement highly customized lighting designs without the need for multiple independent controllers, reducing complexity and installation costs.

Technological advancements such as Bluetooth and Zigbee connectivity, along with integration into popular smart home platforms (Amazon Alexa, Google Assistant, Apple HomeKit), have broadened the appeal of Philips Hue products globally. This evolution has been accompanied by an expanding ecosystem of third-party accessories that address installation challenges like corner navigation and power supply extension, enhancing flexibility for commercial applications.

For B2B buyers, understanding this evolution underscores the importance of investing in future-proof solutions that are compatible with emerging smart technologies and offer scalability. It also highlights the value of working with suppliers knowledgeable about the latest product generations and accessory options to maximize project outcomes.

This comprehensive understanding of market dynamics, sourcing trends, and sustainability considerations equips international B2B buyers to make informed decisions when procuring Philips Hue LED strip extensions, ensuring competitive advantage and alignment with evolving industry standards.

Frequently Asked Questions (FAQs) for B2B Buyers of philips hue led strip extension

-

How can I verify the credibility of Philips Hue LED strip extension suppliers internationally?

When sourcing Philips Hue LED strip extensions globally, especially from regions like Africa, South America, the Middle East, and Europe, prioritize suppliers with verified certifications such as ISO 9001 for quality management and CE for European compliance. Request references or case studies of previous B2B transactions. Use third-party inspection services to audit factories and verify production capabilities. Additionally, confirm that the supplier is an authorized Philips Hue distributor or an approved partner to ensure genuine products and avoid counterfeits. -

Are Philips Hue LED strip extensions customizable for large-scale B2B projects?

Yes, many suppliers and authorized distributors offer customization options such as length adjustments, connector types (v3 or v4), and packaging tailored for bulk orders. However, customization often requires minimum order quantities (MOQs) and additional lead time. For complex setups—like multi-branch light strips or extended power cables—partnering with accessory manufacturers (e.g., Litcessory) can provide specialized solutions. Always clarify customization capabilities and costs upfront during contract negotiations to align with your project needs. -

What are the typical minimum order quantities (MOQs), lead times, and payment terms for Philips Hue LED strip extensions in international trade?

MOQs vary by supplier but typically start around 100-500 units for standard extensions. Lead times range from 3 to 8 weeks depending on order size, customization, and shipping method. Payment terms often include a 30%-50% deposit upfront with the balance due before shipment or upon delivery. For buyers in emerging markets such as Nigeria or Mexico, negotiating flexible payment solutions like letters of credit or escrow accounts can mitigate risk. Early engagement with suppliers about these terms helps avoid delays and cash flow issues. -

What quality assurance (QA) measures and certifications should I expect from Philips Hue LED strip extension suppliers?

Suppliers should provide comprehensive QA documentation including product testing reports, compliance certificates (CE, RoHS, FCC), and warranty policies. Philips Hue products typically undergo rigorous electrical safety and electromagnetic compatibility testing. Insist on batch-wise inspection reports and, if possible, arrange for third-party lab testing. For large orders, a pre-shipment inspection (PSI) can verify packaging integrity and product functionality to ensure shipment quality aligns with contract standards. -

How can I efficiently manage logistics and shipping challenges for Philips Hue LED strip extensions across continents?

Plan logistics early by selecting freight forwarders experienced with electronics and Philips Hue products. Consider shipping modes—air freight for urgent orders or sea freight for cost efficiency. Ensure proper packaging to avoid damage during transit, especially for fragile connectors and power supplies. Customs clearance can be complex; verify HS codes and import regulations in your destination country to avoid delays. Utilizing consolidated shipments or regional distribution centers can optimize delivery times and reduce costs. -

What are best practices for handling disputes or quality issues with international Philips Hue LED strip extension suppliers?

Establish clear contract terms covering product specifications, delivery timelines, and quality standards. Include dispute resolution clauses specifying mediation or arbitration venues acceptable to both parties. Upon detecting defects, document issues with photos and inspection reports, then notify the supplier immediately. Reputable suppliers often offer replacement, repair, or refund options within warranty periods. Maintaining open communication and building long-term relationships helps resolve issues amicably and supports smoother future transactions. -

Are there specific regulatory considerations for importing Philips Hue LED strip extensions into Africa, South America, or the Middle East?

Yes, each region has unique electrical safety and environmental standards. For example, Nigeria requires SONCAP certification to ensure product compliance, while the Middle East may enforce G-Mark certification. South American countries often demand INMETRO or ANATEL approvals depending on use. Verify that suppliers provide these region-specific certifications and documentation before shipping. Engaging local customs brokers familiar with these regulations can facilitate smoother import clearance and reduce the risk of shipment rejection. -

How can B2B buyers optimize cost efficiency when purchasing Philips Hue LED strip extensions internationally?

To reduce costs, leverage bulk purchasing to benefit from volume discounts and negotiate better payment terms. Consolidate orders to minimize shipping expenses and avoid multiple freight charges. Consider sourcing from suppliers with local warehouses or distribution centers in your region to reduce lead times and customs duties. Additionally, evaluate total landed cost—including import taxes, duties, and logistics—to make informed purchasing decisions. Partnering with suppliers offering after-sales support and warranty services adds value and reduces long-term operational expenses.

Illustrative Image (Source: Google Search)

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for philips hue led strip extension

The Philips Hue LED strip extension market presents a compelling opportunity for international B2B buyers seeking to enhance smart lighting solutions with flexibility and scalability. Key sourcing considerations include understanding the product’s modular design—enabling seamless extension up to 10 meters per power supply—and leveraging third-party accessories like Litcessory splitters and power extensions to address complex installation needs. For buyers in regions such as Africa, South America, the Middle East, and Europe, prioritizing suppliers with proven logistics capabilities and local support can mitigate supply chain risks and ensure timely delivery.

Strategic sourcing of Philips Hue LED strip extensions should emphasize:

- Supplier reliability and certification to guarantee product authenticity and compliance with regional electrical standards.

- Customization options to meet diverse architectural and ambient lighting requirements.

- After-sales support and warranty terms tailored to international markets.

- Cost-efficiency through bundled purchasing and volume discounts to optimize procurement budgets.

Looking ahead, the growing adoption of smart home technologies across emerging markets signals sustained demand for versatile lighting products. B2B buyers are encouraged to establish strong partnerships with manufacturers and authorized distributors who offer innovation, scalability, and localized service. Proactive engagement in these markets will position businesses to capitalize on evolving lighting trends and deliver enhanced value to their end customers worldwide.