Guide to Led Strip Under Counter

- Introduction: Navigating the Global Market for led strip under counter

- Understanding led strip under counter Types and Variations

- Key Industrial Applications of led strip under counter

- Strategic Material Selection Guide for led strip under counter

- In-depth Look: Manufacturing Processes and Quality Assurance for led strip under counter

- Comprehensive Cost and Pricing Analysis for led strip under counter Sourcing

- Spotlight on Potential led strip under counter Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for led strip under counter

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led strip under counter Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of led strip under counter

- Strategic Sourcing Conclusion and Outlook for led strip under counter

Introduction: Navigating the Global Market for led strip under counter

In today’s fast-evolving commercial and residential lighting landscape, LED strip under counter lighting stands out as a transformative solution that blends functionality with aesthetic appeal. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—understanding the nuances of this versatile lighting technology is critical to making smart procurement decisions that optimize cost, quality, and performance.

These LED strips are not just decorative accents; they play a vital role in enhancing workspace visibility, improving energy efficiency, and elevating the customer experience in retail, hospitality, and industrial environments. Their flexibility, durability, and low power consumption make them indispensable for modern under-counter applications where space constraints and design precision are paramount.

This comprehensive guide delves deep into the various types and specifications of LED strip under counter lighting, material considerations including LED chip quality and PCB fabrication, and the manufacturing and quality control processes that ensure reliability and compliance with international standards. We also explore how to identify reputable suppliers, evaluate cost structures, and navigate the global market dynamics affecting pricing and availability.

By equipping you with actionable insights—tailored for diverse regional markets such as Spain, the UK, Middle Eastern hubs, and emerging economies in Africa and South America—this guide empowers procurement professionals to confidently source LED strip under counter lighting solutions that deliver exceptional value, meet project-specific requirements, and support scalable installations across multiple sectors. Whether upgrading existing setups or launching new projects, informed sourcing is your key to unlocking competitive advantage in the global lighting arena.

Understanding led strip under counter Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard White LED Strips | Fixed white color temperature, available in warm, neutral, or cool white | Retail counters, kitchen under-cabinet lighting, office workspaces | Pros: Cost-effective, energy-efficient; Cons: Limited color options |

| RGB LED Strips | Multi-color LEDs controllable via remote or system | Hospitality, retail displays, event venues | Pros: Versatile color options, dynamic lighting; Cons: Higher cost, requires controllers |

| Waterproof LED Strips | Encased in silicone or epoxy for moisture resistance | Outdoor kitchens, bars, industrial counters | Pros: Durable in humid/wet environments; Cons: Slightly bulkier, higher price |

| High Lumen LED Strips | High brightness output with superior LED chips | Task lighting in workshops, commercial kitchens | Pros: Excellent illumination, energy-saving; Cons: Can generate more heat, may need heat sinks |

| Flexible PCB LED Strips | Thin, bendable circuit boards for curved or irregular surfaces | Custom installations, architectural lighting | Pros: Easy installation in tight spaces; Cons: More delicate, requires careful handling |

Standard White LED Strips

Standard white LED strips are the most commonly used under-counter lighting solutions, offering fixed color temperatures ranging from warm to cool white. They are ideal for environments requiring consistent, non-distracting illumination such as retail counters, office workspaces, and residential kitchens. For B2B buyers, these strips provide a cost-effective, energy-efficient option with straightforward installation. When sourcing, it’s important to assess the color temperature that aligns with the intended ambiance and to verify the quality of LED chips for longevity.

RGB LED Strips

RGB LED strips provide dynamic, color-changing lighting controlled via remotes or smart systems, making them popular in hospitality, retail displays, and event venues where ambiance and visual impact are critical. B2B buyers should consider the compatibility of controllers and power supplies, as well as the total cost including installation complexity. These strips enable businesses to create customizable lighting experiences but may require technical support for integration and maintenance.

Waterproof LED Strips

Designed with silicone or epoxy coatings, waterproof LED strips are engineered to withstand moisture and humidity, making them suitable for outdoor kitchens, bars, and industrial counters exposed to wet conditions. For international buyers in humid or coastal regions, these strips ensure durability and safety compliance. While slightly more expensive and bulkier than standard strips, their longevity and resistance to environmental factors justify the investment for long-term projects.

High Lumen LED Strips

High lumen LED strips use premium LED chips to deliver bright, efficient illumination ideal for task-oriented environments such as commercial kitchens and workshops. They provide superior light output while maintaining energy efficiency, essential for businesses focused on productivity and safety. Buyers should evaluate heat dissipation features and may need to invest in additional heat sinks to maintain performance and extend lifespan, especially in continuous-use scenarios.

Flexible PCB LED Strips

Flexible PCB LED strips offer versatility in installation due to their bendable circuit boards, allowing them to fit curved or irregular surfaces commonly found in architectural or custom lighting projects. These strips are favored in design-centric commercial spaces where aesthetics and adaptability are priorities. B2B purchasers should handle these strips with care due to their delicate nature and ensure suppliers provide robust adhesive backing and clear installation guidelines to prevent damage during application.

Related Video: DIY Kitchen Under Cabinet Lighting

Key Industrial Applications of led strip under counter

| Industry/Sector | Specific Application of led strip under counter | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Hospitality | Ambient and task lighting in checkout counters and bars | Enhances customer experience, increases visibility, energy-efficient lighting reduces operating costs | Waterproof ratings, color temperature options, dimmability, ease of installation |

| Commercial Kitchens | Under-counter illumination for food prep and storage areas | Improves safety and hygiene, better visibility for staff, reduces energy consumption | High IP rating for moisture resistance, durable adhesive, compliance with food safety lighting standards |

| Office & Workspace | Under-desk lighting for ergonomic and focused illumination | Boosts employee productivity, reduces eye strain, customizable lighting environments | Adjustable brightness, low heat emission, compatibility with smart controls |

| Healthcare Facilities | Under-counter lighting in clinical and laboratory workstations | Enhances precision in medical tasks, promotes sterile environment, energy-saving | Sterilizable surfaces, flicker-free lighting, compliance with medical lighting regulations |

| Retail Display & Showrooms | Highlighting products under counters or display cases | Draws customer attention, improves product visibility, flexible design for varied display setups | Color rendering index (CRI), flexibility of strips, durability under continuous use |

Retail & Hospitality

In retail stores and hospitality venues such as bars and restaurants, LED strip under counter lighting serves both aesthetic and functional purposes. These strips provide subtle ambient lighting that enhances the customer experience while offering task lighting for staff at checkout counters or bars. For B2B buyers in Africa, South America, the Middle East, and Europe, sourcing LED strips with adjustable color temperatures and dimmable features is crucial to adapt to diverse cultural preferences and operational hours. Waterproof and easy-to-install designs ensure durability in busy environments, reducing maintenance costs.

Commercial Kitchens

Under-counter LED strips in commercial kitchens illuminate food preparation and storage areas where precision and hygiene are paramount. These lights improve visibility for kitchen staff, reducing accidents and ensuring compliance with food safety regulations. Buyers should prioritize LED strips with high IP ratings to withstand moisture, grease, and frequent cleaning. Durable adhesive backing and certifications aligned with local food industry standards are essential for buyers in regions with stringent hygiene requirements, such as the UK and Spain.

Office & Workspace

LED strips under desks or counters in office environments provide ergonomic lighting that minimizes eye strain and enhances focus. Adjustable brightness and low heat emission are key features that contribute to employee comfort and productivity. International buyers should consider strips compatible with smart lighting controls to integrate with modern office automation systems. This is particularly relevant in technologically advanced markets in Europe and the Middle East, where energy efficiency and user customization are highly valued.

Healthcare Facilities

In healthcare settings, under-counter LED lighting supports clinical precision and sterile conditions in labs and workstations. These LED strips must offer flicker-free illumination and be easy to sterilize or cover with hygienic materials. Compliance with medical lighting standards is a must for buyers in regulated markets like Europe. Additionally, energy-efficient lighting reduces operational costs in hospitals and clinics across Africa and South America, where budget constraints often require balancing quality with affordability.

Retail Display & Showrooms

LED strips placed under counters or within display cases highlight products effectively, attracting customer attention and enhancing visual merchandising. High color rendering index (CRI) LED strips ensure that product colors appear true and vibrant, a critical factor for fashion, jewelry, and electronics retailers. Buyers should look for flexible and durable strips that can be customized in length and brightness to fit diverse display configurations. This flexibility supports international buyers managing multi-location retail chains in Europe and South America, where consistent branding and presentation are key.

Related Video: How to Install LED Light Strips

Strategic Material Selection Guide for led strip under counter

When selecting materials for LED strip lights designed for under-counter applications, international B2B buyers must balance performance, durability, cost, and compliance with regional standards. The choice of materials directly impacts heat dissipation, adhesion, moisture resistance, and overall longevity—critical factors for environments such as kitchens, retail displays, and hospitality venues common across Africa, South America, the Middle East, and Europe.

Flexible PCB Substrate (Polyimide or PET)

Key Properties: Flexible printed circuit boards (PCBs) made from polyimide or polyethylene terephthalate (PET) substrates offer excellent flexibility, thermal stability (typically up to 200°C for polyimide), and electrical insulation. Polyimide is more heat resistant and durable than PET but comes at a higher cost.

Pros & Cons: Polyimide PCBs provide superior heat dissipation and can endure higher operating temperatures, making them ideal for continuous use under counters where heat buildup is a concern. PET substrates are more cost-effective but less heat resistant and may degrade faster in humid or high-temperature environments. Flexible PCBs enable easy installation in tight or curved under-counter spaces.

Impact on Application: For humid or kitchen environments, polyimide’s thermal and moisture resistance is advantageous, reducing risk of delamination or failure. PET-based PCBs may suffice for dry, low-heat applications but require careful environmental consideration.

International Buyer Considerations: European buyers, especially in the UK and Spain, often require compliance with RoHS and REACH regulations, favoring polyimide for its durability and compliance history. Buyers in Africa and the Middle East should verify supplier adherence to IEC or ASTM standards for electrical insulation and thermal performance. South American buyers may prioritize cost-effectiveness but should balance this with local climate conditions.

LED Chips (SMD 2835, 3528, 5050)

Key Properties: LED chips vary by size, power consumption, and luminous efficacy. Common types include SMD 2835 (high brightness, good efficiency), 3528 (lower brightness, cost-effective), and 5050 (multi-die, RGB capable). High-quality chips offer longer lifespan (up to 50,000 hours) and consistent color rendering.

Pros & Cons: High-performance chips like SMD 2835 deliver bright, uniform light with lower power consumption, ideal for under-counter task lighting. Lower-cost chips may reduce upfront expenses but risk uneven illumination and shorter lifespan. RGB-capable chips add versatility but increase complexity and cost.

Impact on Application: For commercial kitchens or retail counters requiring bright, reliable lighting, premium chips ensure consistent performance. Decorative or ambient lighting applications may tolerate lower-grade chips for cost savings.

International Buyer Considerations: Buyers in Europe prioritize energy efficiency and certifications such as CE and UL for safety and performance. Middle Eastern and African buyers should confirm chip suppliers meet IEC standards and consider ambient temperature effects on chip longevity. South American buyers might focus on availability and after-sales support.

Adhesive Backing (3M VHB, Acrylic, Silicone)

Key Properties: Adhesive backing secures LED strips under counters, requiring strong initial tack, resistance to heat, moisture, and chemicals. 3M VHB (Very High Bond) tapes offer excellent adhesion and durability. Acrylic adhesives provide good moisture resistance, while silicone adhesives excel in high-temperature environments.

Pros & Cons: 3M VHB adhesives are premium, providing long-lasting bonds even on textured or uneven surfaces but come at a higher cost. Acrylic adhesives balance cost and performance but may weaken over time in humid or oily conditions. Silicone adhesives are ideal for extreme heat but less common and more expensive.

Impact on Application: Kitchens with exposure to steam and grease benefit from silicone or high-grade acrylic adhesives. Retail or office under-counter installations may use standard 3M VHB adhesives for reliable mounting.

International Buyer Considerations: European buyers often require adhesives compliant with REACH and RoHS standards. African and Middle Eastern buyers should consider adhesive performance under high humidity and temperature fluctuations. South American buyers may prioritize cost but must ensure adhesive longevity to avoid costly reinstallation.

Protective Coating / Encapsulation (Silicone, Epoxy, PU)

Key Properties: Protective coatings shield LED strips from moisture, dust, and mechanical damage. Silicone encapsulation offers flexibility and excellent moisture resistance. Epoxy coatings provide robust mechanical protection but are rigid. Polyurethane (PU) coatings balance flexibility and durability.

Pros & Cons: Silicone coatings are preferred for wet or humid under-counter environments due to superior water resistance and flexibility. Epoxy provides strong protection but can crack under bending, limiting use in flexible strip designs. PU coatings offer a middle ground but may yellow over time under UV exposure.

Impact on Application: Food preparation areas or outdoor-facing under counters benefit from silicone encapsulation. Indoor retail or office applications may use epoxy or PU coatings where flexibility is less critical.

International Buyer Considerations: Compliance with food safety standards (e.g., EU food contact regulations) may be necessary for kitchen installations in Europe. Buyers in Africa and the Middle East should assess coating resistance to local environmental factors such as dust and heat. South American buyers should verify coatings against local durability standards.

| Material | Typical Use Case for led strip under counter | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Flexible PCB (Polyimide) | High-heat, humid environments requiring flexible installation | Excellent heat resistance and durability | Higher cost than PET; sourcing complexity | High |

| Flexible PCB (PET) | Dry, low-heat installations with budget constraints | Cost-effective and flexible | Lower heat and moisture resistance; shorter lifespan | Low |

| LED Chips (SMD 2835) | Bright, energy-efficient under-counter task lighting | High luminous efficacy and long lifespan | Higher upfront cost; requires quality sourcing | Medium |

| LED Chips (SMD 3528) | Ambient or decorative lighting with cost sensitivity | Lower cost and simpler manufacturing | Lower brightness and shorter lifespan | Low |

| Adhesive Backing (3M VHB) | General-purpose mounting on smooth or textured surfaces | Strong, durable adhesion across many surfaces | Higher cost; may be overkill for simple installs | Medium |

| Adhesive Backing (Acrylic) | Moderate humidity and temperature environments | Balanced cost and moisture resistance | Adhesion may degrade under harsh conditions | Low |

| Protective Coating (Silicone) | Moist, high-use areas requiring moisture protection | Superior moisture resistance and flexibility | Higher cost; potential sourcing limitations |

In-depth Look: Manufacturing Processes and Quality Assurance for led strip under counter

Understanding the manufacturing processes and quality assurance protocols for LED strip under counter lighting is critical for international B2B buyers aiming to procure reliable, high-performance products. This section outlines the typical production stages, key quality control measures, and certification requirements that suppliers must adhere to, with actionable insights tailored to buyers in Africa, South America, the Middle East, and Europe.

Manufacturing Process Overview for LED Strip Under Counter

The production of LED strip under counter lighting involves several precise stages designed to ensure optimal performance, durability, and ease of installation. Each stage employs advanced techniques and quality materials to meet the demands of commercial and residential applications.

1. Material Preparation

- Sourcing High-Quality Components: The foundation begins with procuring premium LED chips, typically from established manufacturers such as Cree, Samsung, or Nichia. These chips determine brightness, color accuracy, and energy efficiency.

- PCB Fabrication: Printed Circuit Boards (PCBs) serve as the base for mounting LEDs. For under-counter lighting, flexible PCBs are commonly used to allow easy installation in tight spaces. The PCB material must have excellent heat dissipation properties to maintain longevity.

- Adhesive Backing Preparation: High-grade adhesive tapes (often 3M or equivalent) are applied to the PCB’s underside. This ensures secure attachment to surfaces like kitchen cabinets or retail shelving.

2. Forming and Assembly

- LED Mounting and Soldering: LED chips are precisely placed and soldered onto the PCB using automated pick-and-place machines. This stage requires strict control to avoid damaging sensitive components.

- Resistor and Driver Integration: Resistors and constant current drivers are added to regulate voltage and prevent overheating, critical for consistent light output and safety.

- Encapsulation and Waterproofing: For under-counter applications that may be exposed to humidity or occasional splashes, manufacturers often apply a silicone or epoxy coating to protect the LEDs and circuitry.

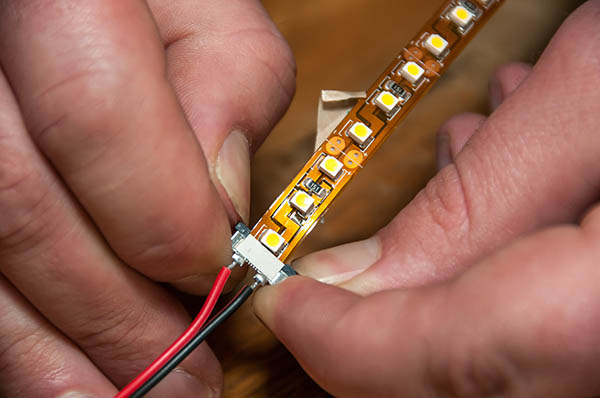

- Cutting and Connector Attachment: LED strips are cut into standard or custom lengths and fitted with connectors compatible with power supplies and controllers, facilitating modular installation.

3. Finishing

- Labeling and Packaging: Each LED strip is labeled with product codes, voltage ratings, and safety marks. Packaging is designed to protect the strips during transit and handling, often including anti-static materials and cushioning.

- Customization: Some manufacturers offer custom color temperatures, lengths, and even branding on the packaging to meet specific buyer requirements.

Quality Assurance and Control (QA/QC) Protocols

Robust quality assurance processes are indispensable to guarantee that LED strip under counter lighting meets international performance and safety standards. Buyers should be aware of the key quality checkpoints and testing methods suppliers employ.

Key Quality Control Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials and components such as LED chips, PCBs, and adhesives to verify compliance with specified standards before production begins.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly, including solder joint inspections, component placement accuracy, and electrical continuity checks.

- Final Quality Control (FQC): Comprehensive testing of finished LED strips, including functionality, brightness consistency, and physical inspection for defects or damage.

Common Testing Methods

- Electrical Testing: Verifies voltage, current, and power consumption to ensure LED strips operate within safe and efficient parameters.

- Luminous Efficacy and Color Accuracy: Measurement of light output (lumens) and color temperature (Kelvin) using photometric equipment.

- Durability and Environmental Testing: Includes thermal cycling, moisture resistance (IP rating verification), and adhesion tests to simulate real-world conditions.

- Safety Testing: Checks for electrical safety standards compliance, including insulation resistance and short-circuit protection.

International Standards and Certifications

For B2B buyers sourcing LED strip under counter lighting internationally, understanding certification and compliance is vital to avoid regulatory issues and ensure product quality.

- ISO 9001: This global quality management standard indicates that the manufacturer follows stringent processes for consistent product quality and continuous improvement.

- CE Marking (Europe): Mandatory for products sold within the European Economic Area, CE certification ensures conformity with health, safety, and environmental protection standards.

- RoHS Compliance: Restricts hazardous substances like lead and mercury, essential for environmental safety and often required in European and Middle Eastern markets.

- UL Certification (United States/Canada): Though not mandatory outside North America, UL marks provide assurance of electrical safety and performance that many international buyers consider a quality benchmark.

- IP Ratings: Indicate the level of protection against dust and water ingress. For under-counter lighting, IP65 or higher is often preferred, especially in humid environments.

- API and Regional Standards: Some regions in Africa, South America, and the Middle East may require compliance with local electrical and safety standards. Buyers should verify these with local authorities or consultants.

Verifying Supplier Quality Control: Best Practices for International Buyers

Ensuring that your supplier maintains rigorous quality control can prevent costly issues and protect your brand reputation.

- Factory Audits: Conduct on-site or third-party audits focusing on manufacturing capabilities, QC processes, equipment maintenance, and staff training.

- Request QC Documentation: Ask for detailed inspection reports, test certificates, and batch traceability records for each shipment.

- Third-Party Testing: Utilize independent laboratories to validate product performance and certification claims, especially for compliance with CE, RoHS, or UL standards.

- Sample Evaluation: Always request product samples to perform your own testing, including installation trials and environmental stress tests.

- Supplier Certifications: Confirm that suppliers hold ISO 9001 and relevant product certifications. Suppliers with multiple certifications typically demonstrate higher reliability.

QC and Certification Nuances for Buyers by Region

- Africa: Infrastructure variability means buyers should prioritize suppliers with proven durability and IP-rated products, given potential exposure to dust and humidity. Local certification acceptance varies; international standards like CE and RoHS are often preferred.

- South America: Customs and import regulations may require specific documentation; buyers should confirm compliance with local electrical safety standards alongside international certifications.

- Middle East: Climate conditions demand high heat and moisture resistance. CE and RoHS are critical, but also consider suppliers’ experience with GCC (Gulf Cooperation Council) standards.

- Europe (Spain, UK): Stringent environmental and safety regulations necessitate CE marking, RoHS compliance, and often energy efficiency certifications like ERP. Post-Brexit UK buyers should verify UKCA marking requirements alongside CE.

Summary for B2B Buyers

- Demand transparency on manufacturing stages and QC processes from your suppliers.

- Prioritize suppliers with ISO 9001 certification and recognized product certifications (CE, RoHS, UL).

- Verify quality through audits, samples, and third-party testing to mitigate risks.

- Consider regional environmental conditions and regulatory requirements when selecting product specifications and certifications.

- Engage suppliers offering customization and robust packaging to meet your project’s specific needs and logistical challenges.

By comprehensively understanding the manufacturing and quality assurance landscape of LED strip under counter lighting, international B2B buyers can make informed sourcing decisions that safeguard product quality, compliance, and customer satisfaction across diverse markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led strip under counter Sourcing

When sourcing LED strip lights designed for under-counter installation, understanding the detailed cost and pricing structure is essential for making informed purchasing decisions. This analysis breaks down the key cost components, price influencers, and strategic buyer tips tailored to international B2B buyers, including those in Africa, South America, the Middle East, and Europe.

Key Cost Components

-

Materials: The most significant portion of cost arises from raw materials such as high-quality LED chips, printed circuit boards (PCBs), adhesives, and protective coatings. Premium LED chips enhance brightness and lifespan but increase unit cost. Flexible PCBs suitable for under-counter use also carry variable pricing depending on quality and durability requirements.

-

Labor: Skilled labor is required for precision assembly, soldering, and quality control. Labor costs vary widely by manufacturing location, impacting final pricing, especially for buyers sourcing from Asia versus local European or Middle Eastern suppliers.

-

Manufacturing Overhead: This includes utilities, factory maintenance, and indirect labor costs. Efficient production lines and automation can reduce these overheads, contributing to competitive pricing.

-

Tooling and Setup Costs: Initial tooling for custom lengths, specific LED configurations, or packaging can add upfront expenses. These are usually amortized over large production volumes but can raise prices for smaller orders or custom runs.

-

Quality Control (QC): Rigorous testing, including stress tests and compliance verification (e.g., CE, RoHS certifications), ensures product reliability but adds to cost. Buyers should prioritize suppliers with documented QC processes to minimize returns and warranty claims.

-

Logistics and Shipping: Freight, customs duties, and import taxes significantly affect landed costs. Bulk shipments reduce per-unit logistics costs, but international buyers must consider varying port fees and transportation infrastructure efficiency across regions.

-

Supplier Margin: Margins reflect supplier business models, brand positioning, and service levels. Established suppliers with certifications and warranties may charge premium prices but offer better risk mitigation.

Price Influencers

-

Order Volume and Minimum Order Quantity (MOQ): Larger orders typically benefit from volume discounts. However, MOQs can be a barrier for smaller buyers, so negotiating flexible quantities or phased deliveries can optimize cash flow.

-

Product Specifications and Customization: Custom lengths, colors, waterproofing, or integrated smart controls increase costs. Buyers should evaluate if customization aligns with project needs to avoid unnecessary expenses.

-

Material Quality and Certifications: Products with higher-grade LED chips, flame-retardant PCBs, or international compliance certifications command higher prices but provide longer-term value through reduced maintenance and regulatory compliance.

-

Supplier Reliability and Location: Suppliers closer to the buyer’s region can offer faster lead times and lower logistics costs. Conversely, well-established Asian manufacturers may provide better pricing but require longer shipping schedules and more complex import procedures.

-

Incoterms and Payment Terms: Understanding Incoterms (e.g., FOB, CIF, DDP) is critical as they determine who bears shipping risk and cost at each stage. Favorable payment terms, such as letters of credit or escrow, can reduce financial risk for buyers.

Strategic Buyer Tips

-

Negotiate Beyond Unit Price: Explore discounts on shipping, packaging, or payment terms. Combining multiple product lines or committing to repeat orders can unlock better pricing.

-

Assess Total Cost of Ownership (TCO): Consider installation ease, energy consumption, warranty length, and expected lifespan. Sometimes a higher upfront price results in lower operational costs and fewer replacements.

-

Request Samples and Pilot Orders: Validate product quality and compatibility before large commitments, especially when dealing with new suppliers or unfamiliar specifications.

-

Leverage Regional Trade Agreements: Buyers in Africa, South America, the Middle East, and Europe should investigate applicable trade agreements or tariff exemptions to reduce import costs.

-

Factor in After-Sales Support: Reliable technical support and warranty services can save costs related to downtime or defective products.

-

Be Mindful of Currency Fluctuations: For international transactions, currency volatility can impact final costs. Hedging or agreeing on pricing in stable currencies may be advantageous.

Indicative Pricing Disclaimer

Pricing for LED strip under-counter lighting varies widely based on specifications, order volume, and supplier location. Indicative price ranges typically start from as low as $1.50 per meter for basic models to upwards of $5.00 or more per meter for premium, customized options with certifications. Buyers should conduct due diligence and obtain formal quotations to ensure accurate budgeting.

In summary, a comprehensive cost and pricing analysis for LED strip under-counter sourcing requires a holistic view of manufacturing inputs, supplier dynamics, and logistical considerations. By strategically managing these factors, international B2B buyers can optimize procurement costs while securing high-quality, reliable lighting solutions tailored to their regional market needs.

Spotlight on Potential led strip under counter Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘led strip under counter’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led strip under counter

When sourcing LED strip lights for under-counter applications, understanding the key technical properties and industry terminology is essential for making informed purchasing decisions. This knowledge helps ensure product quality, compatibility, and smooth procurement, especially for international B2B buyers.

Critical Technical Properties

1. LED Chip Quality and Luminous Efficacy

The LED chips are the core light sources. Higher-quality chips deliver brighter light (measured in lumens) while consuming less power. Luminous efficacy (lumens per watt) indicates energy efficiency—a vital factor for cost savings and sustainability in commercial projects. Buyers should prioritize chips from reputable manufacturers to ensure longevity and consistent brightness.

2. Color Temperature and CRI (Color Rendering Index)

Color temperature, measured in Kelvins (K), defines the light’s hue—ranging from warm white (~2700K) to cool white (~6500K). The CRI indicates how accurately the light reveals colors compared to natural light, with values above 80 preferred for under-counter lighting to enhance visual clarity and ambiance. Selecting the right combination impacts both aesthetics and user experience.

3. PCB Type and Heat Dissipation

The printed circuit board (PCB) supports the LEDs and affects durability. Flexible PCBs allow bending around corners or tight spaces, ideal for under-counter installations. High-quality PCBs with good thermal management prevent overheating, which can cause dimming or early failure. Efficient heat dissipation translates to longer product life and stable performance.

4. Waterproof Rating (IP Code)

Depending on the environment—such as kitchen counters prone to moisture—choosing an appropriate Ingress Protection (IP) rating is critical. For example, IP65 or higher means the strip is protected against water jets and dust, ensuring safety and reliability in humid or splash-prone areas.

5. Adhesive Backing Quality

Strong, durable adhesive backing ensures the LED strip stays firmly attached to surfaces over time. Poor adhesive can lead to peeling and installation failures. For B2B buyers, verifying adhesive type and suitability for intended surfaces (metal, wood, tile) reduces rework and maintenance costs.

6. Voltage and Power Specifications

Common under-counter LED strips operate on 12V or 24V DC. Understanding voltage requirements helps avoid electrical compatibility issues. Power consumption (watts per meter) affects energy costs and power supply sizing. Confirming these specs ensures safe, efficient installation and operation.

Common Trade and Industry Terms

OEM (Original Equipment Manufacturer)

OEM refers to manufacturers who produce LED strips that buyers can brand or customize. For B2B buyers, partnering with OEMs allows tailored product specifications, packaging, or private labeling, enhancing market differentiation.

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity a supplier will accept for an order. This term is crucial when balancing inventory costs against project scale. Knowing MOQ upfront helps international buyers plan budgets and logistics effectively.

RFQ (Request for Quotation)

An RFQ is a formal inquiry sent to suppliers requesting detailed pricing, lead times, and terms for specific LED strip products. It’s a key step in supplier evaluation and negotiation, ensuring transparency and competitive offers.

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Familiarity with terms like FOB (Free on Board) or DDP (Delivered Duty Paid) enables buyers to manage risks and costs in cross-border transactions.

IP Rating (Ingress Protection Rating)

This code classifies the degree of protection against solids and liquids. For under-counter LED strips, understanding IP ratings helps select products suitable for environments exposed to moisture or dust.

Luminous Flux and Wattage

Luminous flux (measured in lumens) indicates total light output, while wattage specifies power consumption. Buyers must evaluate both to balance brightness needs with energy efficiency and operational costs.

Mastering these technical properties and trade terms empowers international B2B buyers to source the right LED strip under-counter solutions confidently. It reduces procurement risks, supports compliance with local standards, and optimizes project outcomes across diverse markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led strip under counter Sector

Market Overview & Key Trends

The global market for LED strip under counter lighting is experiencing robust growth, driven by increasing demand for energy-efficient, versatile, and aesthetically pleasing lighting solutions across commercial and residential sectors. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—this sector offers significant opportunities fueled by urbanization, smart building adoption, and the expansion of retail, hospitality, and workspace environments.

Key drivers include:

- Energy Efficiency and Cost Savings: LED strips consume significantly less energy than traditional lighting, reducing operational costs—a critical factor for regions with fluctuating energy prices.

- Customization and Flexibility: The ability to cut, shape, and program LED strips allows tailored lighting designs, essential for diverse markets such as boutique retail stores in Spain or modern office spaces in the UK.

- Technological Advancements: Integration with IoT and smart controls enables remote dimming, color tuning, and scheduling, appealing to buyers seeking cutting-edge solutions to differentiate their offerings.

- Supply Chain Localization: African and Middle Eastern buyers increasingly prioritize suppliers with regional warehouses or manufacturing hubs to reduce lead times and logistics costs.

- Bulk Sourcing & Scalability: Large-scale projects in commercial real estate and infrastructure development in South America demand reliable suppliers offering volume discounts and consistent quality.

Emerging sourcing trends focus on partnering with manufacturers who provide comprehensive after-sales support, warranty guarantees, and compliance with international standards such as CE and RoHS. Buyers are also leveraging digital platforms for supplier vetting, sample testing, and order tracking to streamline procurement.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a central concern for B2B buyers in the LED strip under counter sector, reflecting broader environmental commitments and regulatory pressures worldwide. The environmental footprint of LED lighting is relatively low compared to conventional options; however, the sourcing of raw materials and manufacturing processes still require scrutiny.

Illustrative Image (Source: Google Search)

Key sustainability considerations include:

- Material Selection: Opting for LED chips and PCBs manufactured with low-toxicity materials and recyclable components reduces environmental impact. Suppliers offering halogen-free and lead-free products align better with global eco-regulations.

- Energy Efficiency Certifications: Products certified under Energy Star, DLC, or similar schemes guarantee reduced power consumption and longer lifespan, translating into lower carbon emissions over the product lifecycle.

- Ethical Supply Chains: Transparency in sourcing—ensuring conflict-free minerals and fair labor practices—is increasingly demanded by buyers from Europe and the UK, who face stringent import regulations and corporate social responsibility mandates.

- Green Packaging: Sustainable packaging reduces waste and supports brand reputation, a growing priority for buyers targeting eco-conscious end users.

- End-of-Life Management: Collaborating with suppliers who provide recycling programs or design products for easy disassembly helps buyers meet circular economy goals.

Investing in suppliers committed to sustainability not only mitigates regulatory risks but also enhances brand value and opens access to markets where green procurement policies are enforced.

Brief Evolution and Industry Context

The LED strip lighting industry has evolved from simple, low-brightness decorative strips into sophisticated, high-performance lighting solutions integral to modern architectural and commercial design. Initially used primarily for accent lighting, under counter LED strips now incorporate advanced features such as tunable white light, RGB color control, and smart integration.

This evolution reflects broader technological advancements in LED chip efficiency, PCB design, and control electronics, enabling manufacturers to offer products that are more reliable, versatile, and cost-effective. For B2B buyers, understanding this trajectory highlights the importance of sourcing from suppliers who invest in continuous innovation and quality assurance to meet diverse and evolving project requirements.

Related Video: International Trade 101 | Economics Explained

Frequently Asked Questions (FAQs) for B2B Buyers of led strip under counter

-

How can I effectively vet LED strip under counter suppliers for international B2B purchases?

To vet suppliers, prioritize those with verifiable business licenses, positive customer reviews, and established international trade experience. Request detailed product specifications, certifications (e.g., CE, RoHS), and sample products before committing. Engage in direct communication to assess responsiveness and transparency. Checking their production capacity and quality control processes ensures they can meet your volume and quality demands. For buyers in Africa, South America, the Middle East, and Europe, working with suppliers who understand local import regulations and provide clear documentation will help avoid customs delays and compliance issues. -

What customization options are typically available for LED strip under counter lighting in bulk orders?

Most reputable suppliers offer customization on length, color temperature, LED density, adhesive backing type, and packaging. Some also provide branding options such as custom labels or packaging designs. For projects requiring specific functionalities like dimmability or waterproofing, ensure the supplier can tailor the product accordingly. Customization is crucial for meeting local market preferences or project specifications, especially when lighting standards differ across regions like Europe or the Middle East. Early discussion on customization with suppliers helps avoid delays and additional costs. -

What are common minimum order quantities (MOQs) and lead times for bulk LED strip under counter orders?

MOQs vary widely depending on the supplier, ranging from a few hundred meters to several thousand. Lead times generally span 2 to 6 weeks, influenced by order size, customization, and supplier location. For international buyers, factor in additional time for shipping and customs clearance. To optimize supply chain efficiency, negotiate MOQs that balance cost savings with inventory management. Some suppliers may offer flexible MOQs for new buyers or sample orders, which is valuable for market testing in regions like South America or Africa. -

Which payment terms and methods are safest for international B2B transactions involving LED strips?

Common payment methods include wire transfers (T/T), letters of credit (L/C), and escrow services. Letters of credit provide strong protection for buyers by tying payment to shipment and quality conditions, ideal for first-time international transactions. Wire transfers are faster but riskier without established trust. Negotiate payment terms such as partial upfront deposits with balance upon delivery to mitigate risks. Always confirm supplier banking details independently and avoid payments outside verified channels to prevent fraud. -

How can I ensure the LED strip under counter products meet quality and safety standards?

Request product certifications like CE (Europe), RoHS (hazardous substances), UL (safety), and IP ratings for water/dust resistance. Verify that the supplier performs rigorous quality control tests, including luminous efficacy, heat dissipation, and adhesive durability. Insist on samples and conduct your own testing, especially for critical parameters like brightness and color consistency. Working with suppliers who adhere to international standards reduces the risk of returns and regulatory issues, particularly important for compliance-driven markets like the UK and EU. -

What logistical considerations should I be aware of when importing LED strip under counter lighting internationally?

Understand import duties, taxes, and customs clearance procedures specific to your country. Choose suppliers who provide detailed shipping documentation (commercial invoice, packing list, certificate of origin) to facilitate smooth customs processing. Consider shipping methods balancing cost and speed, such as sea freight for large volumes or air freight for urgent orders. Also, assess packaging quality to prevent damage during transit. Partnering with freight forwarders experienced in your target regions (Africa, Middle East, Europe) can streamline logistics and reduce delays. -

How should disputes or quality issues be managed with international LED strip suppliers?

Establish clear contractual terms outlining product specifications, delivery schedules, and warranty conditions before ordering. If quality issues arise, promptly document and communicate them with photos or videos. Most reputable suppliers offer repair, replacement, or refund policies for defective goods. Utilize third-party inspection services to verify product quality pre-shipment. In case of unresolved disputes, leverage trade protection mechanisms like arbitration clauses or engage trade associations. Maintaining professional and transparent communication is key to preserving long-term partnerships. -

Are there particular challenges or advantages for buyers from Africa, South America, or the Middle East when sourcing LED strip under counter lighting?

Buyers from these regions may face challenges such as longer shipping times, fluctuating import tariffs, and variable infrastructure for quality testing. However, these markets often benefit from growing demand for energy-efficient lighting and government incentives promoting LED adoption. Establishing relationships with suppliers who understand regional market conditions and can provide flexible payment and shipping options is advantageous. Additionally, sourcing from manufacturers offering multilingual support and tailored solutions can improve project success and customer satisfaction.

Strategic Sourcing Conclusion and Outlook for led strip under counter

Strategic sourcing of LED strip under counter lighting is pivotal for businesses aiming to optimize cost-efficiency, quality, and innovation in their projects. International buyers from Africa, South America, the Middle East, and Europe must prioritize partnerships with reputable suppliers who offer comprehensive product selections, customization options, and robust warranties. Emphasizing quality components—such as premium LED chips, high-grade PCBs, and durable adhesives—ensures longevity and performance, reducing maintenance costs and enhancing end-user satisfaction.

Illustrative Image (Source: Google Search)

Key takeaways for B2B buyers include:

- Leveraging bulk purchasing to unlock competitive pricing and scalable inventory management

- Conducting thorough supplier due diligence to verify certifications, production capabilities, and after-sales support

- Testing samples before large orders to guarantee product compatibility and quality standards

- Staying abreast of emerging LED technologies, including smart and energy-efficient solutions, to maintain market relevance

Looking ahead, the LED strip under counter market is poised for continued growth driven by advancements in energy efficiency and design flexibility. Buyers who adopt a strategic sourcing approach will not only secure superior products but also foster innovation and sustainability within their supply chains. To capitalize on these opportunities, international businesses should engage proactively with trusted manufacturers and distributors, ensuring their lighting solutions meet evolving market demands with excellence and reliability.