Introduction: Navigating the Global Market for led light strips for cars

The automotive industry is witnessing a transformative shift with the integration of LED light strips, redefining vehicle aesthetics and functionality. For international B2B buyers across Africa, South America, the Middle East, and Europe—including emerging markets like Indonesia and Egypt—understanding this dynamic product segment is essential for capitalizing on growth opportunities. LED light strips for cars combine energy efficiency, durability, and customizable design, making them indispensable for aftermarket upgrades, commercial fleets, and vehicle manufacturers alike.

This comprehensive guide delves into the critical aspects that influence successful sourcing and deployment of automotive LED light strips. It covers a broad spectrum of topics including the variety of LED strip types (waterproof, RGB, high-lumen), essential material components such as premium LED chips and heat-dissipating PCBs, and the intricacies of manufacturing and quality control processes that ensure product reliability. Additionally, the guide provides strategic insights into evaluating suppliers, understanding cost structures, and navigating international trade considerations.

By equipping buyers with in-depth knowledge about product specifications, supplier evaluation, and market trends, this resource empowers businesses to make informed procurement decisions. Whether you are a distributor aiming to expand your product portfolio or an automotive manufacturer seeking scalable lighting solutions, the insights offered here will help you optimize cost-efficiency, ensure compliance with quality standards, and meet diverse customer demands across multiple regions. Embrace this opportunity to leverage cutting-edge LED lighting technology and gain a competitive edge in the evolving global automotive market.

Understanding led light strips for cars Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Single-Color LED Strips | Fixed color output, typically white or amber; simple circuitry | Basic car interior/exterior accent lighting | + Cost-effective, easy installation – Limited customization |

| RGB LED Strips | Multi-color capability with remote/app control; dynamic effects | Customizable ambient lighting, show cars | + High flexibility, attractive for premium markets – Higher cost, requires controllers |

| Waterproof LED Strips | Sealed with silicone or epoxy coating; resistant to moisture | Exterior vehicle lighting, undercarriage, off-road vehicles | + Durable in harsh conditions – Slightly bulkier, higher price |

| Flexible LED Strips | Highly bendable PCB for curved surfaces | Complex interior designs, dashboards, trim | + Easy to install on irregular surfaces – May have lower heat dissipation |

| High-Lumen LED Strips | Enhanced brightness with premium LED chips | Task lighting, headlights, auxiliary lights | + Superior illumination, energy-efficient – Higher initial investment |

Single-Color LED Strips

Single-color LED strips offer a straightforward lighting solution with a fixed color, most commonly white or amber. They are ideal for basic car accent lighting such as footwells, door panels, or simple exterior highlights. For B2B buyers targeting budget-conscious markets in Africa or South America, these strips provide an affordable and reliable option. When sourcing, focus on suppliers that ensure consistent color output and long lifespan to minimize returns and maintain client satisfaction.

RGB LED Strips

RGB LED strips enable multi-color lighting controlled via remotes or smartphone apps, making them popular for customizable ambient lighting and show cars. These strips cater to premium aftermarket segments in regions like the Middle East and Europe, where consumers seek personalization. B2B buyers should prioritize suppliers offering advanced control systems and durable components to meet higher expectations. While more expensive, RGB strips can command better margins due to their versatility and appeal.

Waterproof LED Strips

Waterproof LED strips are sealed with protective coatings to withstand exposure to moisture, dust, and dirt, making them suitable for exterior applications such as undercarriage lighting or off-road vehicles. This type is critical for markets with harsh climates or demanding road conditions, such as parts of Africa and Indonesia. Buyers should verify the IP rating and durability certifications from manufacturers to ensure product reliability and compliance with local regulations.

Flexible LED Strips

Flexible LED strips feature bendable PCBs that conform to curved or irregular surfaces, perfect for intricate interior designs like dashboards or trim lines. Their adaptability makes them attractive for automotive customization shops and OEMs seeking innovative lighting solutions. When purchasing, B2B buyers should assess the thermal management capabilities and adhesive quality to avoid installation issues and premature failures, especially in hot environments.

High-Lumen LED Strips

High-lumen LED strips use premium chips to deliver superior brightness and energy efficiency, suitable for task lighting, headlights, or auxiliary lighting in vehicles. These strips are favored by commercial fleets and automotive parts suppliers focusing on safety and performance enhancements. Buyers should emphasize supplier quality control and certifications to guarantee product consistency and compliance with international standards, ensuring long-term customer trust and reduced warranty claims.

Related Video: CAR RGB LED LIGHTING INSTALL! (TIPS and TRICKS for Easy Installation)

Key Industrial Applications of led light strips for cars

| Industry/Sector | Specific Application of led light strips for cars | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | Interior ambient lighting for passenger vehicles | Enhances vehicle appeal and customer satisfaction, differentiates brand | High durability, customizable colors, compliance with automotive standards |

| Automotive Aftermarket | Custom exterior lighting (underglow, accent lights) | Enables personalization and upgrades, increases aftermarket sales | Weatherproofing (IP rating), ease of installation, compatibility with various vehicle models |

| Commercial Fleet Services | Safety and visibility lighting on commercial vehicles (trucks, vans) | Improves road safety, reduces accidents, complies with regulatory requirements | High brightness, energy efficiency, long lifespan, certifications for road use |

| Automotive Repair & Customization Shops | Replacement and upgrade lighting solutions for retrofitting older vehicles | Provides value-added services, extends vehicle lifecycle, boosts customer retention | Flexibility in strip length, adhesive strength, compatibility with vehicle electrical systems |

| Taxi and Ride-Sharing Services | Interior and exterior lighting for enhanced passenger experience and brand visibility | Improves passenger comfort and brand recognition, supports driver safety | Low power consumption, adjustable brightness, ease of maintenance |

Automotive Manufacturing

In vehicle production, LED light strips are increasingly integrated as interior ambient lighting to elevate the driving experience and distinguish models in a competitive market. Manufacturers in regions like Europe and the Middle East prioritize customizable color options and stringent compliance with automotive safety standards. For B2B buyers, sourcing durable LED strips with consistent quality and certifications such as ECE or ISO is essential to meet regulatory demands and consumer expectations.

Automotive Aftermarket

Aftermarket companies leverage LED light strips for custom exterior applications such as underglow or accent lighting to appeal to vehicle enthusiasts across Africa, South America, and Southeast Asia. These strips must be weatherproof and flexible to fit diverse vehicle shapes. International buyers should focus on suppliers offering IP65 or higher rated products and easy installation kits to reduce labor costs and enhance product appeal in varied climates.

Commercial Fleet Services

Fleet operators in logistics and public transport sectors require LED light strips to improve vehicle visibility and safety, especially in regions with high night-time driving such as Egypt and Brazil. High brightness and energy-efficient strips ensure compliance with road safety regulations while minimizing operational costs. Buyers should prioritize LED strips with long lifespans, robust heat dissipation, and certifications like CE or UL to ensure reliability and legal acceptance.

Automotive Repair & Customization Shops

Repair and customization shops benefit from LED strips as retrofit lighting solutions that refresh older vehicle models or provide bespoke upgrades. Flexibility in strip length and strong adhesive backing are crucial for fitting various vehicle interiors and exteriors. B2B buyers in emerging markets must ensure compatibility with local vehicle electrical systems and seek suppliers that offer technical support and customizable options to meet diverse client needs.

Taxi and Ride-Sharing Services

Taxi fleets and ride-sharing companies use LED light strips to enhance passenger comfort with adjustable interior lighting and improve brand visibility through exterior accents. In markets like Indonesia and South Africa, low power consumption and ease of maintenance are critical to reduce operational downtime and costs. Buyers should look for dimmable LED strips with remote control features and robust adhesives to withstand frequent vehicle use and cleaning.

Related Video: How to Cut and Connect LED Light Strips.

Strategic Material Selection Guide for led light strips for cars

Flexible Printed Circuit Board (FPCB)

Key Properties:

FPCBs used in LED light strips for cars are typically made from polyimide or polyester films, offering excellent flexibility, high temperature resistance (up to 130°C or higher), and good electrical insulation. They provide moderate mechanical strength and are designed to endure bending and vibration without cracking.

Pros & Cons:

FPCBs enable easy installation on curved or irregular surfaces common in automotive interiors and exteriors. They allow for compact, lightweight designs and good heat dissipation when paired with appropriate copper thickness. However, they are generally more expensive than rigid PCBs and require precise manufacturing processes to avoid defects.

Impact on Application:

Flexible PCBs are ideal for automotive lighting applications where space constraints and complex shapes are involved, such as dashboard accent lighting or undercarriage illumination. Their flexibility also supports dynamic lighting designs that follow car contours.

Considerations for International B2B Buyers:

Buyers from regions like Africa, South America, and the Middle East should ensure FPCBs comply with international standards such as IPC-2223 for flexible circuits and automotive-specific certifications. Given the climate variability (e.g., high temperatures in Egypt or humidity in Indonesia), selecting FPCBs with enhanced thermal and moisture resistance is crucial. European buyers often require RoHS and REACH compliance, which should be confirmed with suppliers.

Rigid Printed Circuit Board (PCB)

Key Properties:

Rigid PCBs are made from FR4 fiberglass epoxy resin, offering high mechanical strength, excellent heat resistance (up to 150°C), and superior durability. They provide stable electrical performance and are less prone to damage from mechanical stress compared to flexible boards.

Pros & Cons:

Rigid PCBs are cost-effective and simpler to manufacture, making them suitable for standard LED strip designs that do not require bending. However, their lack of flexibility limits their use in tight or curved automotive spaces. They tend to be heavier and bulkier.

Impact on Application:

Rigid PCBs are best suited for fixed, flat mounting locations in cars, such as trunk lighting or under-hood illumination, where durability and heat resistance are prioritized over flexibility.

Considerations for International B2B Buyers:

Buyers should verify that rigid PCBs meet automotive-grade standards like ISO/TS 16949 and withstand environmental factors such as vibrations and temperature fluctuations common in vehicles across diverse climates. Compliance with ASTM and DIN standards for material quality is often requested by European and Middle Eastern clients.

Silicone-Based Adhesive Backing

Key Properties:

Silicone adhesives provide excellent temperature tolerance (from -50°C to +200°C), superior UV and moisture resistance, and strong adhesion to various automotive surfaces including plastics and metals.

Pros & Cons:

Silicone adhesive backing ensures long-term durability of LED strips in harsh automotive environments, preventing peeling and degradation. It is more expensive than acrylic adhesives and may require specialized application equipment.

Impact on Application:

This adhesive is preferred for exterior automotive LED strips exposed to weather, such as underbody or grille lighting, where resistance to water, dust, and temperature extremes is critical.

Considerations for International B2B Buyers:

In regions with extreme climates like the Middle East and parts of Africa, silicone adhesives are highly recommended. Buyers should confirm adhesive certifications related to automotive standards (e.g., SAE J200) and ensure compatibility with local environmental regulations. European buyers often demand compliance with REACH and RoHS for adhesives.

High-Quality LED Chips (e.g., Samsung, Cree)

Key Properties:

Premium LED chips offer high luminous efficacy (lumens per watt), long lifespan (up to 50,000 hours), and stable color rendering. They typically operate efficiently at automotive voltage ranges and withstand thermal cycling.

Pros & Cons:

Using high-quality LED chips enhances overall strip performance, energy efficiency, and reliability, reducing warranty claims and maintenance costs. However, they increase the unit cost and may require more sophisticated driving circuitry.

Impact on Application:

High-grade LED chips are essential for automotive lighting applications where brightness, color consistency, and longevity are critical, such as daytime running lights or interior ambient lighting.

Considerations for International B2B Buyers:

Buyers should source LED chips from reputable manufacturers with proven automotive-grade certifications (e.g., AEC-Q101). Regions like Europe and the Middle East often require compliance with stringent energy efficiency and safety standards. For markets in Africa and South America, balancing cost and quality is key, but investing in reliable chips ensures better after-sales performance.

Summary Table

| Material | Typical Use Case for led light strips for cars | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Flexible Printed Circuit Board (FPCB) | Curved or irregular surfaces, interior/exterior accent lighting | High flexibility and heat resistance | Higher cost and complex manufacturing | High |

| Rigid Printed Circuit Board (PCB) | Flat, fixed mounting locations like trunk or under-hood lighting | Durable, cost-effective, heat resistant | Lack of flexibility limits applications | Low |

| Silicone-Based Adhesive Backing | Exterior automotive strips exposed to weather and heat | Excellent temperature and moisture resistance | More expensive than acrylic adhesives | Medium |

| High-Quality LED Chips (Samsung, Cree) | High-brightness, long-life automotive lighting applications | Superior luminous efficacy and lifespan | Higher cost, requires precise driving | High |

In-depth Look: Manufacturing Processes and Quality Assurance for led light strips for cars

Manufacturing LED light strips for automotive applications involves a precise, multi-stage process designed to ensure durability, performance, and compliance with stringent automotive standards. For international B2B buyers, especially those sourcing from or distributing to regions such as Africa, South America, the Middle East, and Europe, understanding these processes and quality assurance protocols is critical to making informed procurement decisions.

Core Manufacturing Stages of LED Light Strips for Cars

1. Material Preparation

The manufacturing journey begins with sourcing and preparing high-grade materials essential for automotive-grade LED strips. This includes:

– LED Chips: High-efficiency, automotive-grade LEDs that offer longevity and brightness while maintaining low power consumption. The chip quality directly impacts luminous efficacy and lifespan.

– Printed Circuit Boards (PCBs): Flexible or rigid PCBs designed to withstand automotive environmental stresses, such as vibrations, temperature fluctuations, and moisture. Copper thickness and substrate quality are crucial for heat dissipation and electrical stability.

– Adhesive Backing: Automotive-grade adhesives that can endure heat, humidity, and exposure to chemicals, ensuring stable installation on vehicle surfaces.

– Protective Coatings: Often silicone or epoxy encapsulation is applied to enhance water resistance and mechanical protection, vital for external automotive applications.

2. Forming and Circuit Fabrication

PCBs are fabricated and cut to specified lengths and shapes. This stage often involves:

– Etching and Laminating: To create precise circuit pathways that connect LEDs and other electronic components.

– Surface Treatment: Ensures solderability and corrosion resistance, which are critical given automotive exposure to harsh elements.

3. Assembly and Soldering

LED chips and electronic components are mounted onto the PCBs using automated pick-and-place machines. Key techniques include:

– Soldering: High-precision soldering (often reflow soldering) ensures strong electrical connections without damaging sensitive components.

– Wire Bonding: In some designs, wire bonding connects LED chips to the PCB circuit.

– Encapsulation: After assembly, LED strips are coated or encased with protective materials to enhance durability.

4. Finishing and Packaging

Final steps involve quality finishing touches to prepare the strips for shipment:

– Cutting and Testing: Strips are cut to standardized or custom lengths and subjected to preliminary electrical testing.

– Labeling and Packaging: Customized packaging protects the product during transit and may include branding or compliance information. Packaging also considers humidity and static protection.

Quality Assurance and Control (QA/QC) in LED Strip Manufacturing

Quality assurance in automotive LED strip manufacturing is rigorous, given the safety and reliability demands of the automotive industry. The process integrates multiple quality control checkpoints aligned with international and industry-specific standards.

Relevant International and Industry Standards

- ISO 9001: The foundational quality management system standard ensuring consistent production quality and continuous improvement.

- Automotive-Specific Standards:

- IATF 16949: The automotive sector’s quality management standard, emphasizing defect prevention and reduction of variation and waste.

- CE Marking: Confirms compliance with European safety, health, and environmental requirements, critical for European markets.

- RoHS Compliance: Restricts hazardous substances, important for environmental regulations worldwide.

- IP Ratings (Ingress Protection): Defines the LED strip’s resistance to dust and water, essential for automotive exterior lighting.

- Other Certifications: Depending on the market, certifications like E-Mark (Europe), API (specific industry protocols), or regional electrical safety certifications may be required.

QC Checkpoints Throughout Production

- Incoming Quality Control (IQC): Inspection of raw materials and components such as LED chips, PCBs, and adhesives before production starts. This includes verifying certificates of conformity and performing sample testing for defects or deviations.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly phases, including solder joint inspection, circuit continuity tests, and visual inspections to catch assembly defects early.

- Final Quality Control (FQC): Comprehensive testing of finished LED strips, including electrical performance, brightness uniformity, waterproofing tests, and mechanical stress tests.

Common Testing Methods in Automotive LED Strip Production

- Electrical Testing: Measures voltage, current, and luminous intensity to ensure operational parameters meet design specs.

- Thermal Testing: Simulates operating temperatures to verify heat dissipation and thermal stability, preventing premature failure.

- Environmental Stress Testing: Includes vibration, humidity, salt spray, and UV exposure tests to emulate harsh automotive environments.

- Durability and Adhesion Testing: Ensures adhesive backing maintains strong bond under temperature cycles and mechanical stress.

- Optical Performance Tests: Check color temperature, uniformity, and viewing angles to ensure consistent lighting quality.

- Ingress Protection (IP) Testing: Validates resistance to water and dust penetration, critical for external automotive applications.

How B2B Buyers Can Verify Supplier Quality Control

For international B2B buyers, especially in regions like Africa, South America, the Middle East, and Europe, ensuring supplier quality goes beyond trusting certifications. Practical verification includes:

- Factory Audits: Conducting or commissioning third-party audits of the supplier’s manufacturing facilities to evaluate adherence to quality standards, production capabilities, and working conditions. Audits aligned with ISO 9001 and IATF 16949 are particularly valuable.

- Reviewing Quality Documentation: Requesting detailed quality control reports, test results, and certificates of conformity for batches supplied. Transparency in documentation signals a mature quality management system.

- Sample Testing: Procuring product samples for independent lab testing to verify performance claims and compliance with regional regulations. This is especially important when entering new markets with unique standards.

- Third-Party Inspections: Employing inspection services during production or pre-shipment to ensure product quality matches contractual specifications.

- Compliance Verification: Checking that products meet region-specific compliance requirements, such as CE for Europe, or local electrical safety standards in Middle Eastern or African markets.

Quality Control Considerations for International Buyers by Region

- Africa and South America: Buyers should emphasize suppliers’ compliance with environmental and safety standards relevant to their local regulations, which may evolve rapidly. Given import restrictions and customs scrutiny, verified certifications and thorough documentation ease clearance and build trust.

- Middle East: High temperatures and dust exposure necessitate LED strips with strong IP ratings and robust adhesive backing. Buyers should prioritize suppliers with proven environmental stress testing and regional certifications.

- Europe: Stringent environmental and safety regulations demand full compliance with CE, RoHS, and often REACH standards. Buyers must verify that suppliers have up-to-date certifications and that products have undergone rigorous testing for emissions and safety.

- Southeast Asia (e.g., Indonesia): Rapidly growing automotive markets require cost-effective yet quality-compliant products. Buyers should focus on suppliers who balance cost with adherence to international standards and who offer clear quality assurance documentation.

Final Recommendations for B2B Buyers

- Clarify Product Specifications Early: Define required certifications, IP ratings, and performance parameters upfront to guide supplier selection.

- Prioritize Suppliers with Transparent QC Processes: Those offering access to audit reports, third-party test results, and sample testing build greater confidence.

- Consider Local Regulatory Requirements: Factor in import regulations, electrical safety, and environmental standards relevant to your target markets.

- Plan for After-Sales Support: Quality assurance extends beyond manufacturing; reliable suppliers offer warranties and responsive technical support.

- Leverage Technology: Use digital platforms for traceability of quality documentation and production status to streamline procurement and quality management.

By thoroughly understanding the manufacturing and quality assurance processes behind automotive LED light strips, international B2B buyers can make informed sourcing decisions that optimize product reliability, regulatory compliance, and cost-efficiency across diverse global markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led light strips for cars Sourcing

When sourcing LED light strips for cars, understanding the detailed cost structure and pricing dynamics is essential for international B2B buyers to optimize procurement strategies and achieve cost efficiency.

Key Cost Components in LED Light Strip Pricing

-

Materials: The most significant cost driver includes high-quality LED chips, flexible or rigid PCBs, adhesives, and protective coatings. Premium LED chips enhance brightness and longevity but come at a higher price. Material quality directly impacts performance, durability, and compliance with certifications such as CE and RoHS.

-

Labor and Manufacturing Overhead: Skilled labor for precision assembly, soldering, and quality control testing adds to the cost. Overhead includes factory utilities, equipment maintenance, and indirect labor, which vary depending on the manufacturing location and scale.

-

Tooling and Customization: Custom lengths, colors, packaging, and special features like waterproofing or smart controls increase tooling and setup costs. These upfront investments are amortized over order volumes but can raise unit prices for smaller quantities.

-

Quality Control (QC): Rigorous QC processes, including stress testing and compliance verification, ensure product reliability and reduce returns. Higher QC standards may increase costs but protect buyers from downstream failures and warranty claims.

-

Logistics and Shipping: Freight charges, customs duties, and insurance vary by destination and shipping method. Bulk shipments generally reduce per-unit logistics costs, but buyers should anticipate additional expenses for expedited or specialized handling.

-

Profit Margin: Suppliers incorporate margins to cover business risks and generate profit. Margins fluctuate based on supplier reputation, product uniqueness, and competitive dynamics.

Influential Pricing Factors

-

Order Volume and Minimum Order Quantity (MOQ): Larger orders significantly reduce per-unit costs due to economies of scale. Buyers from regions like Africa, South America, the Middle East, and Europe should negotiate MOQs aligned with demand forecasts to avoid overstocking or higher unit prices.

-

Specifications and Customization: Tailored features such as RGB capabilities, waterproof ratings, or integration with vehicle systems command premium pricing. Clear specification alignment helps avoid paying for unnecessary features.

-

Material Grade and Certifications: LED strips with certifications (e.g., CE, RoHS, UL) assure compliance with international standards but may cost more. Buyers targeting regulated markets must prioritize certified products despite the price premium.

-

Supplier Reputation and Location: Established suppliers with proven quality often price higher but reduce risks. Proximity to manufacturing hubs (e.g., China, Southeast Asia) can influence lead times and shipping costs.

-

Incoterms: Terms like FOB, CIF, or DDP affect total landed cost. Buyers should understand responsibilities for freight, insurance, and customs to avoid unexpected charges.

Strategic Tips for International B2B Buyers

-

Negotiate Volume Discounts: Consolidate orders or partner with other buyers to increase volumes, enabling better pricing and favorable payment terms.

-

Evaluate Total Cost of Ownership (TCO): Beyond unit price, consider warranty, expected lifespan, energy consumption, and after-sales support. Higher upfront costs may yield savings over the product lifecycle.

-

Request Samples and Test Quality: Before committing to bulk purchases, verify product quality and compatibility, especially given the varying environmental conditions in regions like Egypt or Indonesia.

-

Leverage Supplier Relationships: Build long-term partnerships to gain priority access to new technologies and flexible customization options.

-

Understand Regional Logistics Nuances: Factor in local import regulations, taxes, and potential delays. Working with freight forwarders familiar with your region can optimize shipping costs.

-

Clarify Payment Terms and Currency Risks: Negotiate terms that protect against currency fluctuations and provide financial flexibility.

Indicative Pricing Disclaimer

Pricing for LED light strips for cars varies widely based on specifications, volumes, and supplier terms. Typical wholesale unit prices may range from approximately $1 to $5 per meter, excluding shipping and taxes. Buyers should conduct due diligence and obtain multiple quotes to ensure competitive pricing tailored to their specific needs.

By comprehensively analyzing cost components and pricing influencers, international B2B buyers can make informed sourcing decisions that balance quality, cost-efficiency, and supply reliability across diverse markets.

Spotlight on Potential led light strips for cars Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led light strips for cars’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led light strips for cars

Critical Technical Properties of LED Light Strips for Cars

When sourcing LED light strips for automotive applications, understanding the key technical specifications is essential to ensure product performance, durability, and regulatory compliance. Here are the most important properties international B2B buyers should focus on:

-

Material Grade and PCB Type

The Printed Circuit Board (PCB) material—typically flexible (FPC) or rigid—affects heat dissipation and installation adaptability. High-grade PCBs with excellent thermal conductivity prevent overheating, which is crucial for automotive environments subject to vibration and temperature fluctuations. For buyers in regions with harsh climates, choosing strips with automotive-grade materials ensures longevity and reliability. -

Ingress Protection (IP) Rating

IP ratings indicate the strip’s resistance to dust and water. For car lighting, strips with at least an IP65 rating are recommended to withstand exposure to rain, car washes, and road debris. Higher ratings like IP67 or IP68 offer waterproofing suitable for external mounting or off-road vehicles, a critical factor for buyers targeting markets in humid or rainy regions. -

Color Temperature and Luminosity (Brightness)

Color temperature (measured in Kelvin) defines the light’s hue, from warm white (2700K) to cool daylight (6500K). Automotive LED strips often require specific color temps for aesthetics or signaling purposes. Luminosity, measured in lumens, impacts visibility and safety. Buyers should specify brightness levels that balance visibility with power consumption for efficient vehicle lighting. -

Voltage and Power Consumption

Most automotive LED strips operate at 12V DC, compatible with standard vehicle electrical systems. Power consumption (watts per meter) influences energy efficiency and battery load. Lower consumption strips reduce strain on the vehicle’s electrical system, a key consideration for fleet operators or aftermarket installers. -

Cuttable Length and Flexibility

The ability to cut LED strips at designated points allows customization for different vehicle sizes and shapes. Flexible strips facilitate installation on curved surfaces like bumpers or dashboards. Buyers should verify the minimum cuttable unit length and flexibility specifications to ensure compatibility with their application. -

Adhesive Quality and Mounting Options

Strong, automotive-grade adhesive backing ensures strips remain securely attached despite vibrations and temperature changes. Some products offer additional mounting options such as clips or channels for enhanced durability. This property is especially important for buyers supplying to markets with rough road conditions.

Key Industry and Trade Terminology for LED Light Strips

Familiarity with common trade terms and industry jargon helps B2B buyers negotiate effectively and streamline procurement processes:

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers that produce LED strips to be branded and sold by another company. Buyers seeking private label products or custom branding should clarify if the supplier offers OEM services, which can include customized packaging, specifications, and logos. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in one order. Understanding MOQ is vital for managing inventory costs and cash flow, especially for small to medium-sized businesses or those testing new markets. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers requesting detailed pricing, lead times, and terms for specific LED strip products. An RFQ helps buyers compare suppliers objectively and negotiate better deals. -

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common Incoterms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Knowing Incoterms helps buyers from Africa, South America, the Middle East, and Europe manage logistics and cost expectations. -

Luminous Efficacy

A technical term expressing the efficiency of the LED strip in converting electrical power into visible light (lumens per watt). Higher luminous efficacy means brighter light with lower energy consumption—important for environmentally conscious buyers and those seeking cost savings. -

Color Rendering Index (CRI)

Measures how accurately the LED light reveals colors compared to natural light, on a scale from 0 to 100. Automotive applications requiring precise color distinction (e.g., interior lighting) benefit from strips with a high CRI (above 80).

Understanding these technical properties and trade terms enables B2B buyers to make informed decisions, ensuring the LED light strips they purchase meet performance requirements and align with regional market needs. This knowledge also facilitates smoother communication with suppliers, helping secure the best value and product quality for automotive lighting projects.

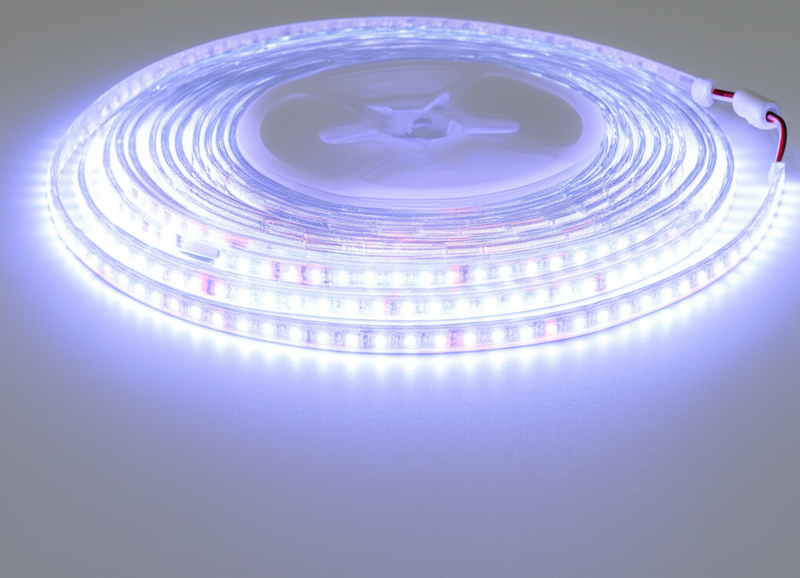

Illustrative Image (Source: Google Search)

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led light strips for cars Sector

Market Overview & Key Trends

The global market for LED light strips tailored for automotive applications is experiencing robust growth, driven by increasing demand for enhanced vehicle aesthetics, improved safety features, and energy-efficient lighting solutions. For B2B buyers across Africa, South America, the Middle East, and Europe—including emerging markets like Indonesia and Egypt—the sector offers significant opportunities fueled by rising automotive production and aftermarket customization trends.

Key market drivers include the growing preference for customizable and dynamic lighting in cars, such as RGB and color-changing LED strips, which appeal to both original equipment manufacturers (OEMs) and aftermarket suppliers. Additionally, the shift towards electric vehicles (EVs) and the integration of smart lighting technologies that can sync with vehicle systems are shaping sourcing priorities. Buyers are increasingly seeking LED strips with advanced features like app-controlled dimming, improved durability against harsh environments, and compatibility with vehicle electronics.

From a sourcing perspective, international buyers are focusing on suppliers who provide flexibility in product customization—such as tailored lengths, waterproofing, and specific color temperatures—to meet diverse regional regulations and consumer preferences. The ability to source from manufacturers offering compliance with international standards (e.g., CE, RoHS) is critical to ensure smooth import processes and market acceptance.

Moreover, supply chain agility is paramount amid ongoing global disruptions. B2B buyers are prioritizing suppliers with transparent lead times, reliable logistics, and localized support in target regions to mitigate risks. The demand for scalable solutions that can support both small batches for niche markets and bulk orders for large commercial projects is also shaping procurement strategies.

Sustainability & Ethical Sourcing in B2B

Sustainability considerations are becoming central in the procurement of LED light strips for cars. The environmental impact of manufacturing, materials sourcing, and end-of-life disposal is under increasing scrutiny by buyers, regulators, and end consumers alike. International B2B buyers are thus placing greater emphasis on partnering with manufacturers committed to reducing carbon footprints and utilizing eco-friendly components.

Ethical sourcing plays a pivotal role in ensuring supply chain transparency and compliance with labor and environmental standards. Buyers are encouraged to verify that their suppliers adhere to certifications such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), which limit hazardous materials in LED components. These certifications not only reduce environmental harm but also facilitate easier market entry, particularly in Europe and the Middle East, where regulatory frameworks are stringent.

Material selection is critical for sustainability. Opting for LED chips and PCBs made from recyclable materials, alongside adhesives that avoid harmful solvents, contributes to a greener product lifecycle. Additionally, manufacturers employing energy-efficient production techniques and waste minimization practices offer added value to conscientious buyers.

Illustrative Image (Source: Google Search)

Finally, longevity and durability of LED strips contribute to sustainability by reducing replacement frequency and electronic waste generation. B2B buyers should seek suppliers with rigorous quality control and warranties that guarantee long-term performance. Engaging with manufacturers that support recycling or take-back programs further enhances a company’s sustainability credentials and aligns with growing global circular economy initiatives.

Brief Evolution of LED Light Strips in Automotive Applications

LED light strips for cars have evolved significantly over the past two decades. Initially used primarily for basic interior accent lighting, advances in LED technology and materials have expanded their applications to exterior lighting, including daytime running lights, turn indicators, and undercarriage illumination.

Early versions were often rigid and limited in color options. However, improvements in flexible PCB manufacturing and LED chip efficiency have enabled the production of highly adaptable strips that can curve around vehicle contours and offer vibrant, customizable colors. This evolution has aligned with broader automotive trends emphasizing personalization and smart vehicle integration.

Today, LED light strips serve both functional and aesthetic roles in automotive design. Their integration with vehicle electronics and connectivity features has transformed them into critical components for modern car lighting systems, blending safety, style, and sustainability. This trajectory underscores the importance of sourcing cutting-edge LED strip technology for businesses aiming to stay competitive in the automotive lighting market.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of led light strips for cars

-

How can I effectively vet LED strip light suppliers for automotive use in international markets?

To ensure reliability, focus on suppliers with proven experience in automotive-grade LED strips. Verify certifications such as ISO, CE, RoHS, and automotive-specific standards like ECE or SAE compliance. Request samples to test product durability, brightness, and heat resistance under automotive conditions. Check supplier references and reviews, especially from buyers in your region (Africa, Middle East, South America, Europe). Prioritize suppliers offering transparent quality control processes and who provide clear documentation on materials sourcing and manufacturing practices. -

What customization options are typically available for LED light strips designed for cars?

Most reputable suppliers offer custom lengths, colors (including RGB and dynamic color-changing options), waterproof ratings (IP65, IP67), and voltage specifications (12V or 24V) tailored to automotive needs. Packaging customization and branding can also be arranged to align with your company identity. For international buyers, specifying environmental tolerances such as UV resistance or vibration durability is crucial. Early communication about your exact requirements ensures the supplier can meet compliance and functional needs relevant to your target markets. -

What are typical minimum order quantities (MOQs) and lead times for bulk LED strip light orders?

MOQs vary widely but generally range from 500 to 2,000 meters per model or color variant. Lead times depend on order size and customization complexity, typically between 3 to 8 weeks. For buyers in Africa, South America, or the Middle East, consider additional time for shipping and customs clearance. To optimize logistics, consolidate orders where possible and confirm production schedules upfront. Negotiate payment terms like deposits with balance on delivery to manage cash flow while securing production slots.

-

Which quality assurance practices and certifications should I require for LED strip lights intended for cars?

Require products to have undergone rigorous testing for heat tolerance, vibration resistance, and waterproofing suitable for automotive environments. Insist on certifications like CE, RoHS, and UL, which indicate compliance with international safety and environmental standards. Automotive-specific approvals such as ECE R10 or SAE certification add credibility. A supplier’s willingness to share test reports, batch traceability, and warranty terms reflects strong quality assurance commitment vital for long-term B2B partnerships. -

How should international B2B buyers approach logistics and shipping for LED strip lights?

Choose suppliers who offer flexible shipping options—air freight for faster delivery or sea freight for cost efficiency. Understand incoterms clearly (FOB, CIF, DDP) to manage costs and responsibilities during transit. Factor in regional customs regulations and potential import duties in your country. Working with freight forwarders familiar with your local market can streamline customs clearance. Ensure packaging is robust to prevent damage during long transit, particularly for fragile LED components. -

What payment methods and terms are recommended for international bulk purchases of LED light strips?

Common payment methods include Letters of Credit (L/C), Telegraphic Transfers (T/T), and Escrow services, each offering varying levels of security for buyers and suppliers. Negotiate terms such as 30% deposit upfront with 70% upon delivery to balance risk. For first-time orders, requesting samples with payment before bulk purchase mitigates risk. Establishing long-term relationships can open doors to more favorable credit terms. Always verify supplier banking details carefully to avoid fraud. -

How can disputes or product issues be effectively managed with overseas LED strip suppliers?

Start by clearly defining product specifications and quality expectations in contracts. Maintain regular communication and document all agreements and quality checks. In case of defects or shipment issues, request photographic evidence and involve third-party inspection agencies if necessary. Use dispute resolution clauses specifying mediation or arbitration venues agreeable to both parties. Building trust through transparent, timely communication minimizes conflicts and expedites resolutions. -

What are the key considerations for selecting LED strip lights suitable for diverse climate conditions in Africa, South America, and the Middle East?

Prioritize LED strips with high IP ratings (IP65 or above) for protection against dust, moisture, and occasional water exposure. Ensure adhesive backing and materials are UV-resistant to withstand intense sunlight common in these regions. Heat dissipation is critical; select products with quality PCBs and LED chips designed to operate efficiently in high temperatures. Confirm supplier testing includes environmental stress testing to guarantee performance and longevity in varied and harsh climates.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led light strips for cars

Key Takeaways for Strategic Sourcing of LED Light Strips for Cars

Sourcing LED light strips for automotive applications demands a balance of quality, cost-efficiency, and supplier reliability. Prioritize suppliers who demonstrate strong quality control, offer customization options, and provide competitive bulk pricing. Focus on key product attributes such as durable adhesive backing, high-quality LED chips, and robust PCBs to ensure longevity and consistent performance in diverse environments. Leveraging wholesale opportunities not only reduces costs but also enables scalability for large projects and fleet outfitting.

The Value of a Strategic Sourcing Approach

A strategic sourcing framework empowers international B2B buyers—especially from emerging and diverse markets like Africa, South America, the Middle East, and Europe—to optimize procurement processes while mitigating risks. By conducting thorough supplier due diligence, requesting samples for quality validation, and understanding specific lighting requirements (e.g., waterproofing, color customization), businesses can secure products that align with both technical and commercial objectives. Additionally, integrating suppliers who comply with international standards (CE, RoHS) ensures regulatory alignment and market acceptance.

Looking Ahead: Seizing Growth Opportunities

As automotive customization and smart vehicle technologies evolve, LED light strips will play an increasingly vital role in enhancing aesthetics and safety. Buyers from regions such as Indonesia and Egypt are well-positioned to capitalize on this trend by forging partnerships with innovative manufacturers and embracing cutting-edge LED technologies. Now is the time to adopt a proactive sourcing strategy that embraces quality, innovation, and supply chain resilience—unlocking long-term value and competitive advantage in the automotive lighting market.