Introduction: Navigating the Global Market for led light strip for tailgate

The global demand for LED light strips for tailgates is surging as automotive businesses and fleet operators seek innovative lighting solutions that enhance vehicle safety, aesthetics, and energy efficiency. For international B2B buyers—particularly from dynamic markets in Africa, South America, the Middle East, and Europe—understanding the nuances of this specialized product is critical to making informed procurement decisions that align with local regulations and customer expectations.

LED tailgate light strips offer a versatile, durable, and visually striking alternative to traditional lighting, combining multi-functionality with low power consumption and high reliability. However, sourcing the right product requires insight into various technical specifications, including LED density, waterproof ratings, voltage compatibility, and integration capabilities with vehicle wiring systems. Moreover, factors such as manufacturing quality control, supplier credibility, and cost-effectiveness play a pivotal role in ensuring product longevity and customer satisfaction.

This comprehensive guide equips buyers with in-depth knowledge on the types of LED tailgate light strips, key materials and manufacturing standards, critical quality assurance processes, and strategies for evaluating global suppliers. It also addresses pricing considerations, market trends, and frequently asked questions tailored to the unique challenges and opportunities faced by buyers in emerging and established automotive markets.

By leveraging this resource, B2B buyers from regions like Kenya, Brazil, the UAE, and Germany will gain a strategic advantage in selecting premium LED tailgate lighting solutions that meet both operational demands and consumer preferences—ultimately driving successful partnerships and sustained business growth in the competitive automotive aftermarket landscape.

Understanding led light strip for tailgate Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Basic Single-Function | Single-color illumination, standard 12V operation, IP65+ waterproofing | Aftermarket tailgate upgrades, budget fleet enhancements | Pros: Cost-effective, simple installation Cons: Limited functionality, less visual impact |

| Sequential Turn Signal | High LED density (120+ LEDs/m), dynamic sequential lighting effect, IP67 waterproof rating | Custom trucks, premium commercial vehicles | Pros: Enhanced safety and aesthetics, eye-catching Cons: Higher cost, more complex wiring |

| Multi-Function RGB | RGB color-changing LEDs, integrated controller, multi-voltage compatibility, IP67 waterproof | Show vehicles, custom builds, marketing fleets | Pros: Versatile lighting effects, branding opportunities Cons: Requires controller, higher price point |

| Scanning/Chase Effect | Ultra-high LED density, programmable lighting sequences, premium IP67+ waterproofing | High-end custom installations, luxury fleet vehicles | Pros: Superior visual appeal, advanced customization Cons: Complex installation, premium cost |

| Commercial Vehicle Grade | Dual voltage (12/24V), robust IP68 waterproofing, durable build for heavy-duty use | Fleet trucks, trailers, buses, industrial vehicles | Pros: Reliable in harsh environments, versatile voltage Cons: Bulkier design, less aesthetic flexibility |

Basic Single-Function LED Tail Light Strips

These strips provide straightforward, single-color illumination, typically red for tail lights, running on standard 12V vehicle power systems. Their IP65 or higher waterproof rating ensures basic weather resistance, suitable for everyday aftermarket upgrades or budget-conscious fleet enhancements. For B2B buyers, these strips offer a cost-effective solution with ease of installation and maintenance. However, their limited functionality means they do not support advanced signaling or color effects, making them less suitable for premium or branding-focused applications.

Sequential Turn Signal LED Strips

Featuring a higher LED density and dynamic sequential lighting patterns, these strips significantly enhance vehicle visibility and aesthetic appeal. With IP67 waterproofing, they withstand harsher conditions, making them ideal for custom trucks and premium commercial vehicles. B2B buyers benefit from the added safety and market differentiation these strips provide, though they require more sophisticated wiring and control systems. The increased complexity and cost are justified in markets where visual impact and compliance with advanced signaling standards are priorities.

Multi-Function RGB LED Strips

These versatile strips integrate RGB LEDs with embedded controllers, enabling color changes and multiple functions such as running lights, brake lights, and turn signals within a single unit. Their IP67 rating supports outdoor use, and multi-voltage compatibility caters to diverse vehicle fleets. For B2B buyers, these strips open opportunities for customization and branding through dynamic lighting effects. However, they demand higher upfront investment and technical know-how for installation and programming, suitable for companies targeting show vehicles or marketing fleets.

Scanning/Chase Effect LED Strips

Designed for premium custom installations, these strips boast ultra-high LED density and programmable lighting sequences, offering sophisticated scanning or chase effects. Their rugged IP67+ waterproofing ensures durability under extreme conditions. This type appeals to luxury fleet operators and custom vehicle builders who prioritize standout aesthetics and advanced lighting technology. While offering superior visual appeal, these strips require expert installation and programming, representing a significant investment but delivering high differentiation in competitive markets.

Commercial Vehicle Grade LED Strips

Built for durability and versatility, these LED strips support both 12V and 24V systems and feature IP68 waterproofing to endure heavy-duty environments. They are tailored for fleets including trucks, trailers, and buses where reliability and longevity are critical. B2B buyers in industrial sectors benefit from these strips’ robust construction and compatibility with diverse vehicle types. The tradeoff includes a bulkier design and fewer aesthetic options, but these are outweighed by the operational reliability and reduced maintenance costs essential for commercial fleet management.

Related Video: The Best Light Bar for Your Truck? Putco LED Blade Tailgate Light Bar Install & Review!

Key Industrial Applications of led light strip for tailgate

| Industry/Sector | Specific Application of led light strip for tailgate | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Logistics & Transportation | Enhanced visibility for delivery and fleet vehicles | Improves road safety, reduces accident risk, and ensures regulatory compliance | Waterproof rating (IP67/IP68), durability under vibration, compatibility with 12/24V vehicle systems |

| Agriculture | Tailgate illumination for farm trucks and equipment | Enables safe nighttime operations, reduces downtime, and improves operational efficiency | High brightness, dust and water resistance, rugged mounting hardware |

| Construction & Mining | Heavy-duty tailgate lighting for trucks and utility vehicles | Enhances worker safety on site, supports compliance with site lighting regulations | Robust build quality, shock resistance, multi-function lighting capabilities |

| Automotive Customization & Aftermarket | Custom tailgate lighting for pickup trucks and SUVs | Adds aesthetic appeal, differentiates products, and increases resale value | Flexible design options, color customization, ease of installation |

| Public Safety & Emergency Services | Tailgate lighting for emergency response vehicles | Provides clear signaling and visibility, supports quick response times | Rapid installation, multi-function lighting (brake, turn, hazard), high reliability |

Logistics & Transportation

In the logistics sector, LED light strips for tailgates are widely used to enhance the visibility of delivery vans, trucks, and fleet vehicles during night operations or adverse weather conditions. This application addresses the common challenge of poor rear visibility, which can lead to accidents or delays. For B2B buyers in regions like Kenya or Brazil, sourcing strips with high waterproof ratings (IP67 or above) and compatibility with both 12V and 24V systems is critical to ensure long-term reliability across diverse vehicle fleets.

Agriculture

Farm vehicles and equipment often operate in low-light or dusty environments where traditional lighting fails. LED tailgate strips provide bright, uniform illumination that helps operators safely load and unload materials after sunset, reducing downtime and enhancing productivity. For buyers in Africa and South America, durability against dust, moisture, and rough handling is essential, making rugged mounting options and high lumen output key procurement criteria.

Construction & Mining

Heavy-duty trucks and utility vehicles in construction and mining sites require robust tailgate lighting solutions that withstand shocks, vibrations, and harsh environmental conditions. LED strips in this sector improve site safety by clearly signaling vehicle movements and braking to workers. Buyers from the Middle East and Europe should prioritize multi-function strips that integrate brake, turn, and hazard lights with superior impact resistance to meet stringent industrial standards.

Automotive Customization & Aftermarket

In the aftermarket segment, LED tail light strips serve both functional and aesthetic purposes for pickup trucks and SUVs. Customizable colors and sequential lighting effects enable businesses to offer unique product lines that appeal to vehicle owners looking for personalization. European and South American buyers should focus on flexible strip designs with easy installation features and options for RGB or multi-function lighting to capitalize on market trends.

Public Safety & Emergency Services

Emergency response vehicles rely heavily on clear, reliable lighting to signal their presence and intentions on the road. LED tailgate strips that combine brake, turn signal, and hazard functions enhance visibility and response times. For B2B buyers in diverse regions, sourcing products with rapid installation capabilities and high operational reliability is vital to ensure these critical vehicles maintain optimal performance in urgent situations.

Related Video: LED Tailgate Brake Light Strip Install (Wired To 7-Pin Trailer Plug)

Strategic Material Selection Guide for led light strip for tailgate

When selecting materials for LED light strips designed specifically for tailgate applications, understanding the performance requirements and environmental challenges is essential. Tailgate LED strips must endure exposure to outdoor elements, mechanical stress, and electrical demands while maintaining consistent illumination and longevity. Below is an analysis of four common materials used in LED tailgate strips, focusing on their technical properties, practical advantages and disadvantages, and considerations for international B2B buyers across Africa, South America, the Middle East, and Europe.

1. Polyvinyl Chloride (PVC) Coating

Key Properties:

PVC is a widely used polymer for LED strip encapsulation and insulation. It offers good flexibility, moderate temperature resistance (typically up to 60-80°C), and basic protection against moisture and UV exposure. PVC coatings provide electrical insulation and some chemical resistance but can degrade under prolonged UV exposure.

Pros & Cons:

– Pros: Cost-effective and easy to manufacture, PVC coatings provide a flexible protective layer that resists abrasion and minor impacts. It is widely available and compatible with standard LED strip manufacturing processes.

– Cons: Lower temperature tolerance and susceptibility to UV degradation limit its durability in harsh outdoor environments. PVC can become brittle over time, especially in regions with intense sunlight or extreme temperatures.

Impact on Application:

PVC-coated LED strips are suitable for tailgates in moderate climates or for vehicles primarily used in urban settings with limited exposure to extreme weather. However, in regions like the Middle East or parts of Africa where high heat and sun exposure are common, PVC may require additional UV stabilizers or protective housings.

International B2B Considerations:

Buyers in countries such as Kenya or Brazil should verify compliance with international standards like ASTM D1784 for PVC materials and ensure suppliers provide UV-resistant formulations. PVC’s widespread use means it generally meets global electrical safety standards, but its environmental impact and recyclability may be scrutinized under European regulations (e.g., RoHS, REACH).

2. Silicone Rubber Encapsulation

Key Properties:

Silicone rubber offers excellent thermal stability (-60°C to +200°C), outstanding UV and weather resistance, and superior flexibility. It is highly resistant to moisture ingress and chemical corrosion, making it ideal for harsh outdoor automotive applications.

Pros & Cons:

– Pros: Exceptional durability under extreme temperatures and weather conditions, silicone encapsulation protects LED strips from water, dust, and mechanical stress. It maintains flexibility over time and does not yellow or crack easily.

– Cons: Higher material and manufacturing costs compared to PVC. Silicone’s softness can complicate mounting and may require specialized adhesives or mechanical fasteners.

Impact on Application:

Silicone-encapsulated LED strips are preferred for tailgates exposed to heavy rain, dust, or frequent washing, such as in fleet vehicles or trucks operating in rugged environments. Its resistance to chemical agents also makes it suitable for industrial or agricultural vehicles common in South America and parts of Africa.

International B2B Considerations:

For buyers in Europe and the Middle East, silicone encapsulation aligns well with stringent automotive standards (e.g., DIN 75200 for weather resistance). Its higher upfront cost is often justified by reduced warranty claims and longer service life, important for large fleet buyers in Brazil or Kenya who prioritize reliability.

3. Polycarbonate (PC) Lens Covers

Key Properties:

Polycarbonate is a rigid, transparent thermoplastic known for its high impact resistance and excellent optical clarity. It withstands temperatures up to 135°C and offers good UV protection when treated with coatings.

Pros & Cons:

– Pros: Provides robust mechanical protection for LED strips against impacts and scratches, ideal for tailgates prone to physical damage. Its clarity ensures maximum light transmission and brightness uniformity.

– Cons: Less flexible than silicone or PVC, making installation on curved surfaces more challenging. Polycarbonate can yellow over time if UV coatings degrade, and it is more expensive than PVC.

Impact on Application:

Polycarbonate covers are well-suited for tailgate LED strips on commercial vehicles or premium aftermarket upgrades where durability and aesthetics are priorities. They protect LEDs from stones, debris, and vandalism, common concerns in many African and South American markets.

International B2B Considerations:

Buyers should ensure polycarbonate components comply with international standards such as ASTM D3923 for UV resistance and ISO 4892 for weathering. In Europe, adherence to REACH and RoHS directives is critical. The material’s rigidity may necessitate customized mounting solutions for different vehicle models.

4. Thermoplastic Polyurethane (TPU) Protective Coating

Key Properties:

TPU is a versatile elastomer combining flexibility, abrasion resistance, and good chemical resistance. It performs well across a temperature range of approximately -40°C to +90°C and offers superior resistance to oils, greases, and solvents.

Pros & Cons:

– Pros: TPU coatings provide a tough, flexible protective layer that resists scratches, impacts, and environmental contaminants. It maintains elasticity and adhesion over time, making it suitable for dynamic automotive parts.

– Cons: Slightly higher cost than PVC and requires precise manufacturing controls to ensure consistent coating thickness. TPU’s thermal limits are lower than silicone, which may restrict use in extremely hot climates.

Impact on Application:

TPU-coated LED strips are ideal for tailgates subjected to frequent mechanical abrasion or chemical exposure, such as agricultural vehicles in South America or utility trucks in the Middle East. Its flexibility supports installation on complex tailgate geometries.

International B2B Considerations:

For buyers in diverse climates like Kenya or Brazil, TPU offers a balanced solution between cost and durability. Compliance with ASTM D412 for tensile properties and ISO 1817 for chemical resistance should be verified. TPU’s recyclability and environmental profile are increasingly important in European markets.

Summary Table of Materials for LED Light Strips in Tailgate Applications

| Material | Typical Use Case for led light strip for tailgate | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyvinyl Chloride (PVC) | Basic tailgate lighting in moderate climates | Cost-effective, flexible, widely available | Lower UV and temperature resistance, less durable | Low |

| Silicone Rubber | Heavy-duty, weather-exposed tailgates and fleet vehicles | Excellent temperature and UV resistance, durable | Higher cost, softer material complicates mounting | High |

| Polycarbonate (PC) | Premium tailgate protection requiring impact resistance | High impact resistance, excellent optical clarity | Rigid, less flexible |

In-depth Look: Manufacturing Processes and Quality Assurance for led light strip for tailgate

Manufacturing Processes for LED Light Strips for Tailgate

The production of LED light strips designed specifically for automotive tailgate applications involves a series of precise manufacturing stages to ensure durability, performance, and compliance with automotive standards. Understanding these stages helps B2B buyers evaluate supplier capabilities and product quality.

1. Material Preparation

This initial phase focuses on sourcing and preparing high-grade raw materials: flexible printed circuit boards (FPCBs), LEDs, resistors, and waterproof coatings. The FPCB substrate must be compatible with automotive voltage levels (typically 12V DC) and resistant to heat and vibration. LEDs are selected based on brightness, color temperature, and energy efficiency, often from reputable chip manufacturers. Suppliers may also prepare waterproof encapsulation materials such as silicone or epoxy resins to meet IP ratings (IP65 to IP68).

2. Forming and Mounting

In this stage, the LEDs and electronic components are precisely mounted onto the FPCB using automated pick-and-place machines, ensuring accurate placement and reducing human error. Surface Mount Technology (SMT) is the standard technique for attaching components. After placement, soldering is performed, typically through reflow ovens, to secure electrical connections. The forming process includes cutting the LED strip to specific lengths and shaping it to match tailgate contours, sometimes involving custom molds or channels.

3. Assembly and Integration

The assembled LED strips are integrated with additional components such as controllers, connectors, and wiring harnesses. For multifunctional strips (e.g., combining brake, turn signal, and running lights), control modules are incorporated to enable sequential or programmable lighting effects. Assembly also involves adding protective layers, such as UV-resistant coatings or adhesive backings designed for automotive-grade adhesion and vibration resistance.

4. Finishing and Waterproofing

A critical final step is applying waterproofing treatments to ensure strips withstand harsh environmental conditions. Techniques include coating with silicone gels, potting compounds, or encapsulation with thermoplastic elastomers. The finishing process may also involve quality labeling, packaging, and preparation for shipment, including anti-static and moisture-proof packaging to preserve product integrity during transit.

Quality Assurance Frameworks and Standards

For international B2B buyers, especially in regions like Africa, South America, the Middle East, and Europe, understanding the applicable quality standards and certifications is essential to mitigate risks and ensure compliance.

Relevant International and Industry Standards

– ISO 9001: The foundational quality management system standard that ensures consistent manufacturing processes and continuous improvement practices. Suppliers certified to ISO 9001 demonstrate commitment to quality control and customer satisfaction.

– CE Marking (Europe): Indicates conformity with European health, safety, and environmental protection standards. For LED tail light strips, CE certification confirms compliance with directives such as EMC (Electromagnetic Compatibility) and low voltage safety.

– RoHS Compliance: Restricts hazardous substances in electronic products, crucial for buyers in Europe and increasingly relevant worldwide.

– IP Ratings (Ingress Protection): Essential for automotive exterior lighting, with IP65 minimum recommended; IP67 or IP68 preferred for higher durability against water and dust.

– Automotive-Specific Standards: Some suppliers adhere to ISO/TS 16949 (automotive quality management) or SAE standards related to lighting performance and electrical safety. While not mandatory for all LED strip suppliers, these certifications signal higher reliability.

Quality Control Checkpoints and Testing Methods

Manufacturers implement multi-stage quality control (QC) to detect defects early and ensure product reliability in automotive environments.

1. Incoming Quality Control (IQC)

Material inspection occurs on all incoming components — LEDs, PCBs, adhesives, and connectors. IQC checks for material conformity, dimensional accuracy, and supplier certifications. This stage prevents defective raw materials from entering production.

2. In-Process Quality Control (IPQC)

During manufacturing, IPQC involves monitoring soldering quality, LED placement accuracy, and electrical continuity. Automated optical inspection (AOI) systems are often employed to detect misaligned or missing components. Real-time monitoring reduces rework and scrap rates.

3. Final Quality Control (FQC)

Completed LED strips undergo comprehensive testing before packaging:

– Electrical Testing: Verifies voltage, current draw, and correct function of all lighting modes (brake, turn signal, running lights).

– Optical Testing: Measures brightness uniformity, color consistency, and LED density adherence.

– Environmental Testing: Includes waterproof tests (immersion or water jet), vibration, temperature cycling, and UV exposure to simulate real-world automotive conditions.

– Mechanical Testing: Checks adhesion strength of mounting adhesives and resistance to physical stress.

How B2B Buyers Can Verify Supplier Quality Control

For international buyers, especially those sourcing from regions with variable manufacturing practices, rigorous supplier assessment is crucial.

- Factory Audits: Arrange on-site or third-party audits focusing on manufacturing processes, equipment, QC procedures, and staff qualifications. Audits verify compliance with ISO 9001 and automotive standards.

- Review QC Documentation: Request detailed inspection reports, including IQC, IPQC, and FQC results, batch traceability, and test certifications. Documentation transparency is a key indicator of supplier professionalism.

- Third-Party Testing and Certification: Employ independent labs to verify product claims such as IP ratings, electrical safety, and environmental resistance. This is especially important for buyers in regulated markets like Europe.

- Sample Testing: Before large orders, obtain product samples to conduct in-house or local lab testing for performance verification. This practice reduces risks related to product incompatibility or inferior quality.

- Continuous Quality Monitoring: Establish agreements with suppliers for periodic quality reviews and defect rate reporting during ongoing supply contracts. This ensures sustained product quality over time.

QC and Certification Nuances for Different Regions

International buyers must consider region-specific regulatory and operational nuances to ensure smooth market entry and compliance.

- Africa (e.g., Kenya): Regulatory frameworks are evolving, with many countries recognizing international certifications like CE and ISO 9001. However, buyers should ensure products meet local electrical safety requirements and consider climate resilience due to high temperatures and dust exposure.

- South America (e.g., Brazil): Brazil’s INMETRO certification may be required for automotive lighting products. Buyers should verify supplier compliance with local standards and confirm that product documentation includes Portuguese translations where necessary.

- Middle East: Countries emphasize conformity to GCC standards and may require additional certifications depending on import regulations. Given the region’s extreme heat and dust conditions, waterproofing and UV resistance are critical QC focus areas.

- Europe: The most stringent market, requiring CE marking, RoHS compliance, and adherence to automotive lighting regulations (e.g., ECE R48). Buyers should prioritize suppliers with ISO/TS 16949 certification and robust traceability systems.

Conclusion

For international B2B buyers sourcing LED light strips for tailgate applications, a deep understanding of manufacturing processes and quality assurance protocols is vital. Evaluating suppliers based on their material selection, production technologies, and adherence to internationally recognized standards (ISO 9001, CE, RoHS) helps ensure product reliability and regulatory compliance. Implementing stringent QC checkpoints—from IQC to FQC—and leveraging audits and third-party testing empowers buyers to mitigate risks and secure high-quality automotive lighting solutions tailored to their regional market requirements.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led light strip for tailgate Sourcing

Understanding Cost Components in LED Tailgate Light Strip Sourcing

When sourcing LED light strips for tailgates, international B2B buyers must analyze the comprehensive cost structure to make informed purchasing decisions. The total cost typically comprises several key components:

- Materials: The core raw materials include LED chips, flexible PCB substrates, resistors, waterproof coatings (IP65 to IP68), and protective silicone or epoxy layers. Higher-quality LEDs and superior waterproofing ratings elevate material costs.

- Labor: Skilled labor is essential for assembly, soldering, and quality inspections. Labor costs vary significantly by country, influencing overall pricing.

- Manufacturing Overhead: This includes factory utilities, equipment depreciation, and indirect labor costs. Efficient factories with automation can reduce overhead expenses.

- Tooling: Custom molds, cutting dies, and specialized wiring harness tools represent upfront investments, often amortized over large production runs.

- Quality Control (QC): Rigorous testing for brightness consistency, waterproof integrity, and electrical safety adds to cost but ensures product reliability.

- Logistics: Freight, customs duties, and insurance costs vary by shipping method (air vs. sea), origin country, and destination port.

- Margin: Suppliers include profit margins that reflect market demand, product uniqueness, and brand positioning.

Key Price Influencers for International Buyers

Several factors directly impact the price of LED tailgate light strips and should be carefully considered during sourcing negotiations:

- Order Volume and Minimum Order Quantity (MOQ): Larger orders typically unlock volume discounts. Buyers from Africa, South America, the Middle East, and Europe should leverage consolidated purchasing to reduce per-unit costs.

- Product Specifications and Customization: Features such as LED density (60 vs. 120+ LEDs/m), multi-function capabilities (running lights, brake, turn signals), and waterproof rating influence pricing. Customized colors, lengths, or packaging also increase costs.

- Material Quality and Certifications: Strips with automotive-grade components, CE, RoHS, or ISO certifications command higher prices but offer greater reliability and compliance for regulated markets.

- Supplier Location and Capabilities: Established suppliers with advanced manufacturing facilities often price higher but provide consistent quality and better support.

- Incoterms and Shipping Terms: Understanding terms like FOB, CIF, or DDP is crucial as they define responsibility for shipping, insurance, and import duties, impacting the landed cost.

Practical Buyer Tips to Optimize Cost-Efficiency

For international B2B buyers—especially those from Kenya, Brazil, UAE, or Germany—the following strategies can enhance cost-effectiveness and reduce procurement risks:

- Negotiate Beyond Unit Price: Discuss payment terms, warranty conditions, after-sales support, and spare parts availability. These elements affect total cost of ownership (TCO).

- Consider Total Cost of Ownership: Factor in installation complexity, potential warranty claims, and energy savings from efficient LEDs when evaluating price offers.

- Request Samples and Test Locally: Validate product quality before bulk purchasing to avoid costly returns or reputation damage.

- Consolidate Shipments: Pool orders with other buyers or combine multiple SKUs to reduce freight charges and customs processing time.

- Verify Supplier Credentials: Choose suppliers with proven track records and certifications to mitigate risks related to counterfeit or substandard products.

- Understand Import Regulations: Each region may have specific standards or tariffs for automotive lighting. Early compliance checks prevent unexpected costs.

Indicative Pricing Overview (Subject to Market Fluctuations)

- Basic single-function LED tailgate strips typically range from $8 to $15 per meter in bulk.

- High-density, multi-function, or RGB strips command prices between $20 and $40 per meter, depending on customization and certifications.

-

Additional costs for tooling or custom packaging may range from $500 to $2,000 per production run, amortized over order volume.

-

Note: Prices vary based on supplier, order size, market conditions, and currency fluctuations. Buyers should obtain multiple quotes and conduct due diligence to secure competitive terms.*

By thoroughly understanding the cost structure, price influencers, and applying practical sourcing strategies, international B2B buyers can optimize their procurement of LED light strips for tailgates, ensuring a balance of quality, reliability, and cost-efficiency tailored to their regional market needs.

Spotlight on Potential led light strip for tailgate Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led light strip for tailgate’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led light strip for tailgate

Critical Technical Properties for LED Light Strips for Tailgate

When sourcing LED light strips for tailgate applications, understanding key technical specifications is essential to ensure product reliability, compliance, and customer satisfaction in diverse markets such as Africa, South America, the Middle East, and Europe.

-

Voltage Compatibility (Typically 12V DC):

Most automotive LED strips operate on 12V DC to match standard vehicle electrical systems. Ensuring correct voltage compatibility prevents electrical failures and reduces warranty claims. For commercial or heavy vehicles, 24V options may be necessary. Verify voltage requirements early to avoid costly mismatches. -

LED Density (LEDs per Meter):

LED density affects brightness uniformity and visual appeal. Common densities range from 60 LEDs/meter (standard) to 120+ LEDs/meter (high density). High-density strips provide smoother illumination without visible dots, critical for tailgate brake lights and turn signals where clarity impacts safety and regulatory compliance. -

Ingress Protection Rating (IP65 to IP68):

Waterproofing is mandatory for exterior automotive lighting. An IP rating of at least IP65 ensures protection against water jets, while IP67/IP68 ratings offer resistance to temporary or continuous submersion. Select strips with appropriate IP ratings based on the intended environment to guarantee durability and reduce maintenance costs. -

Material Quality and Thermal Management:

Premium LED strips use flexible PCBs with high-grade copper and silicone coatings for heat dissipation and flexibility. Good thermal management prevents overheating, extends LED lifespan, and maintains brightness consistency, which is particularly important in hot climates like the Middle East and parts of Africa. -

Multi-Function Capability:

Advanced tailgate LED strips may integrate multiple functions such as running lights, brake lights, and turn signals within a single unit. This reduces wiring complexity and installation time but requires compatibility with vehicle controllers. Understanding these features supports more sophisticated product offerings and higher value projects. -

Tolerance and Durability Standards:

Automotive-grade LED strips should meet strict tolerance levels for voltage, current, and color temperature to ensure consistent performance across production batches. Durability against vibration, UV exposure, and temperature swings is critical for reliability in diverse geographic markets.

Key Trade Terminology for International B2B Buyers

Familiarity with common trade terms streamlines communication with suppliers and optimizes procurement processes in the international LED lighting market.

-

OEM (Original Equipment Manufacturer):

Refers to companies that produce LED strips to be branded and sold by another company. OEM partnerships allow buyers to customize products and packaging to their brand specifications, crucial for differentiation in competitive markets. -

MOQ (Minimum Order Quantity):

The smallest quantity a supplier is willing to sell in a single order. Understanding MOQ helps buyers balance inventory costs against supplier requirements, especially important for emerging businesses or projects with limited budgets. -

RFQ (Request for Quotation):

A formal inquiry sent to suppliers to obtain pricing, delivery timelines, and terms for specific LED strip products. RFQs enable buyers to compare multiple offers efficiently and negotiate better terms based on volume or customization needs. -

Incoterms (International Commercial Terms):

Standardized trade terms published by the International Chamber of Commerce that define responsibilities for shipping, insurance, and tariffs between buyer and seller. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Clear understanding prevents disputes and controls logistics costs. -

Lead Time:

The period between order placement and delivery. Accurate knowledge of lead times helps buyers plan inventory and project schedules, reducing downtime and ensuring timely product availability. -

IP Rating (Ingress Protection Rating):

A standardized measure of protection against solids and liquids. For tailgate LED strips, the IP rating is often a critical purchasing factor. Buyers should specify minimum acceptable IP ratings based on application environment.

By mastering these technical properties and trade terms, international B2B buyers can confidently evaluate suppliers, ensure product quality, and negotiate favorable contracts for LED light strips tailored to tailgate applications. This knowledge facilitates smoother procurement processes and supports long-term business growth across diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led light strip for tailgate Sector

Market Overview & Key Trends

The global market for LED light strips designed for tailgate applications is experiencing robust growth driven by increasing demand for automotive customization, enhanced vehicle safety, and energy-efficient lighting solutions. International B2B buyers from regions such as Africa, South America, the Middle East, and Europe are capitalizing on these trends, fueled by expanding automotive sectors and rising consumer preferences for stylish, durable, and multifunctional lighting components.

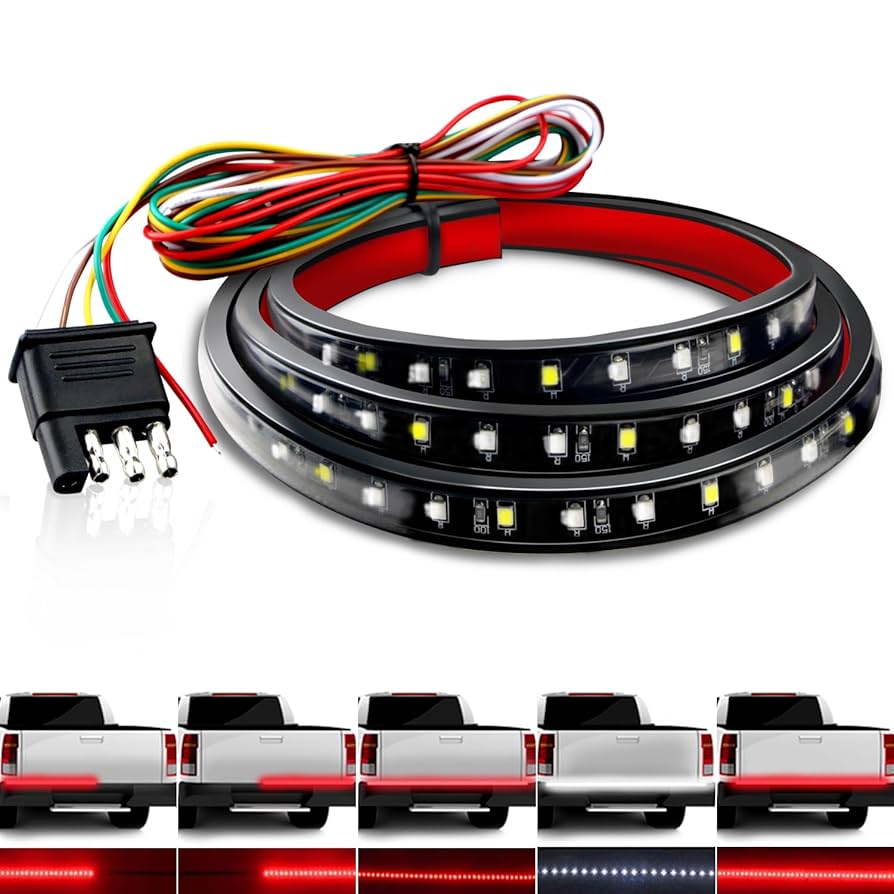

Illustrative Image (Source: Google Search)

Key drivers include the automotive aftermarket boom, where fleets and individual vehicle owners seek cost-effective upgrades that improve visibility and aesthetic appeal. LED tail light strips offer advantages such as low power consumption, long lifespan, and superior brightness uniformity, making them highly attractive for commercial trucks, buses, and passenger vehicles. In emerging markets like Kenya and Brazil, where road safety regulations are tightening, demand for compliant, high-quality lighting solutions is increasing rapidly.

From a sourcing perspective, buyers prioritize suppliers offering a wide range of waterproof, high-density LED strips with integrated multi-function capabilities (e.g., brake, turn signal, running lights). The trend towards modular, plug-and-play designs simplifies installation for fleet operators and automotive workshops, reducing labor costs and downtime. Additionally, advancements in intelligent LED controllers and app-enabled lighting customization are creating new B2B opportunities, allowing businesses to differentiate their offerings with smart lighting solutions.

Global supply chains are becoming more streamlined, with many suppliers in Asia providing direct-to-buyer shipping and customizable packaging options, which is crucial for buyers managing large-scale projects or resale. However, buyers must navigate challenges such as fluctuating raw material costs and compliance with diverse regional automotive standards. Strategic partnerships with reliable manufacturers who provide technical support, warranty assurance, and flexible MOQ (minimum order quantity) terms are essential for sustained success.

Sustainability & Ethical Sourcing in B2B

Sustainability has emerged as a critical factor shaping procurement decisions for LED tail light strips, particularly among B2B buyers committed to reducing their environmental footprint and ensuring ethical supply chains. The production of LED components traditionally involves raw materials such as rare earth elements and plastics, which pose environmental challenges if not responsibly sourced.

Leading suppliers now emphasize the use of eco-friendly materials, including recyclable aluminum channels for strip mounting and halogen-free wiring, which minimize toxic emissions during manufacturing and disposal. Compliance with international environmental certifications like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) is increasingly demanded by buyers to ensure product safety and sustainability.

Illustrative Image (Source: Google Search)

Ethical sourcing extends beyond materials to encompass labor practices and transparency across the supply chain. Buyers targeting markets in Europe and the Middle East, where corporate social responsibility is rigorously enforced, benefit from partnering with manufacturers who uphold fair labor standards and provide traceability documentation. Green certifications such as Energy Star for LED efficiency and ISO 14001 for environmental management systems add credibility and market appeal.

Incorporating sustainability into sourcing strategies also aligns with growing regulatory pressures in many countries to reduce vehicle emissions and energy consumption. LED tail light strips, due to their lower power requirements and longer operational life compared to incandescent lighting, contribute directly to these goals. B2B buyers can leverage these benefits in marketing and compliance, enhancing their competitive positioning while supporting global sustainability initiatives.

Brief Evolution and Industry Context

LED lighting technology for automotive applications has evolved significantly over the past two decades. Initially, LED tail lights were simple, single-function units primarily used in luxury vehicles. Advances in LED chip efficiency, miniaturization, and flexible circuit design expanded their use to multifunctional strips capable of integrating brake lights, turn signals, and running lights into a single seamless unit.

This evolution coincided with growing consumer demand for vehicle personalization and stricter safety regulations worldwide. The development of waterproofing standards (IP65 and above) and higher LED densities allowed manufacturers to produce durable, high-visibility tailgate strips suitable for diverse climates and road conditions, including those prevalent in Africa and South America.

Today’s LED tail light strips embody the convergence of technology, design, and sustainability, offering B2B buyers a versatile product category that supports both functional safety and aesthetic customization. Understanding this progression helps buyers appreciate the technical sophistication and sourcing complexities involved, enabling smarter procurement decisions aligned with market needs.

Related Video: Incoterms for beginners | Global Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of led light strip for tailgate

-

How can I effectively vet suppliers of LED light strips for tailgates to ensure quality and reliability?

To vet suppliers, start by reviewing their business credentials, certifications (such as ISO 9001 or automotive-grade standards), and years of industry experience. Request product samples to verify build quality, LED density, and waterproof ratings. Check customer references and online reviews, focusing on international clients similar to your region (e.g., Africa or South America). Verify their compliance with relevant automotive safety and environmental standards, which is crucial for tailgate lighting. Finally, assess their after-sales support and warranty policies to ensure long-term reliability. -

What customization options are typically available for LED light strips in tailgate applications, and how can these benefit my business?

Suppliers often offer customization in LED density, strip length, color temperature, and multifunction integration (e.g., brake, turn signal, running light). Custom packaging and branding can also be negotiated, which helps in market differentiation. For international buyers, requesting waterproof ratings tailored to local climate conditions (IP67/IP68 for humid or rainy regions) is vital. Custom wiring harnesses compatible with specific vehicle models can reduce installation complexity and returns. These options enhance product appeal and ensure compliance with local vehicle regulations, boosting your competitive edge. -

What are typical minimum order quantities (MOQs) and lead times when purchasing LED tailgate strips in bulk internationally?

MOQs vary by supplier but generally range from 100 to 500 units per SKU, with flexibility depending on customization complexity. Lead times typically span 3 to 6 weeks from order confirmation, including production and quality checks. For buyers in regions like the Middle East or Europe, factor in additional shipping and customs clearance time, which can add 1-2 weeks. Establish clear communication about MOQs early in negotiations to align your inventory planning and avoid stockouts or overstocking. -

What payment terms and methods are standard for international B2B transactions of LED tailgate light strips?

Common payment terms include 30% upfront deposit with balance paid before shipment or upon delivery, depending on supplier trustworthiness. International wire transfers (T/T) are widely accepted, alongside letters of credit for larger orders to mitigate risk. Some suppliers accept escrow or payment via trade assurance platforms. For buyers in emerging markets like Kenya or Brazil, confirm currency conversion fees and banking regulations. Always negotiate payment milestones tied to production progress or quality inspections to protect your investment. -

Which quality assurance certifications should I look for when sourcing LED light strips for automotive tailgates?

Prioritize suppliers with ISO 9001 certification to ensure consistent manufacturing quality. Automotive-specific certifications such as IATF 16949 or compliance with ECE R7 (for lighting devices) are strong indicators of product suitability. Check for RoHS and CE markings to confirm environmental and safety compliance, especially for European markets. Waterproof ratings (IP65 to IP68) should be certified through standardized testing. Request test reports or third-party lab certifications to validate claims, reducing the risk of product failures and warranty claims. -

How can I manage logistics and shipping challenges when importing LED tailgate light strips from overseas suppliers?

Plan shipments using a reliable freight forwarder experienced in your region to handle customs clearance efficiently. Choose between air freight (faster but costlier) and sea freight (cost-effective for bulk orders but slower). Ensure packaging is robust and meets international shipping standards to prevent damage. Understand import duties, taxes, and local regulations in your country to avoid delays. Negotiate with suppliers for FOB or CIF terms, clarifying responsibility for shipping costs and risk transfer. Use trackable shipping methods and maintain open communication with logistics partners. -

What strategies can help resolve disputes related to product quality or delivery delays with international LED strip suppliers?

Establish clear contractual terms covering product specifications, delivery schedules, and penalties for non-compliance. Document all communications and inspections during production and upon receipt. If disputes arise, use mediation or arbitration clauses stipulated in contracts to avoid costly litigation. Request replacement shipments or partial refunds for defective products, supported by photographic evidence and inspection reports. Building long-term relationships with suppliers who prioritize transparency and responsiveness reduces dispute risks and facilitates quicker resolutions.

- Are there specific considerations for sourcing LED tailgate light strips in regions like Africa or South America compared to Europe or the Middle East?

Yes, regional climate, vehicle standards, and import regulations differ significantly. In Africa and South America, prioritize waterproof and dustproof ratings due to harsher environments. Verify supplier familiarity with local voltage variations and vehicle wiring standards. Logistics can be more complex due to less frequent shipping routes or customs bureaucracy; plan accordingly. In Europe and the Middle East, compliance with stricter automotive and environmental regulations is mandatory. Additionally, suppliers offering multilingual support and local certifications can ease market entry in these diverse regions.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led light strip for tailgate

Key Takeaways for Strategic Sourcing of LED Tailgate Light Strips

For international B2B buyers, especially from emerging and dynamic markets like Africa, South America, the Middle East, and Europe, strategic sourcing of LED light strips for tailgates hinges on understanding product specifications, supplier reliability, and installation requirements. Prioritize suppliers offering high-density, waterproof strips (IP65 and above) with multi-function capabilities to meet diverse vehicle lighting needs. Emphasize sourcing automotive-grade materials and components to ensure durability and compliance with safety standards, reducing warranty risks and enhancing end-user satisfaction.

The Value of a Strategic Sourcing Approach

Adopting a strategic sourcing framework enables businesses to optimize costs without compromising quality. Bulk purchasing from reputable manufacturers can unlock competitive pricing, access to advanced LED technologies, and customized solutions tailored to local market preferences. Additionally, leveraging suppliers with strong after-sales support, warranty coverage, and efficient logistics can streamline procurement and installation processes, mitigating downtime and operational disruptions.

Looking Ahead: Opportunities for Global Buyers

As automotive lighting technology advances, LED tailgate light strips will continue to evolve with smarter functions and enhanced energy efficiency. International buyers are encouraged to engage early with innovative suppliers who offer scalable solutions and local regulatory compliance. By investing in informed sourcing strategies today, businesses in Kenya, Brazil, the UAE, and across Europe can secure a competitive edge in their automotive aftermarket or fleet services, positioning themselves for sustainable growth in a rapidly electrifying industry.

Take action now: evaluate your sourcing partners critically, prioritize quality and innovation, and prepare to capitalize on the expanding global demand for reliable, high-performance LED tailgate lighting solutions.