Introduction: Navigating the Global Market for led behind tv

The global demand for advanced display technologies continues to surge, with LED behind TV solutions playing a pivotal role in enhancing visual experiences across residential, commercial, and hospitality sectors. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—understanding the complexities of sourcing high-quality LED behind TV components is essential to staying competitive and meeting evolving market expectations.

This guide offers a thorough exploration of the LED behind TV landscape, covering key aspects such as various LED types, selection of premium materials, manufacturing best practices, and stringent quality control measures. Buyers will gain insight into identifying reputable suppliers who can deliver consistent performance and reliability, while also navigating cost factors that impact project budgets without compromising on quality.

Furthermore, the guide delves into regional market dynamics, enabling procurement professionals from diverse geographies—including emerging markets like Vietnam and Australia—to tailor their sourcing strategies effectively. Detailed FAQs address common challenges and technical considerations, empowering buyers to make confident, data-driven decisions.

By synthesizing technical knowledge with market intelligence, this resource equips international buyers with the tools to optimize their procurement process, minimize risks, and secure LED behind TV products that align perfectly with their operational and commercial goals. Whether upgrading existing installations or embarking on new projects, this guide is an indispensable asset for unlocking value in the competitive global marketplace.

Understanding led behind tv Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Edge-Lit LED | LEDs positioned along TV edges; light guided by light guides | Retail displays, budget-conscious commercial use | Pros: Slim design, cost-effective, energy-efficient. Cons: Uneven brightness, limited local dimming. |

| Direct-Lit LED | LEDs placed directly behind the entire screen | Professional signage, mid-range commercial TVs | Pros: Uniform brightness, better contrast than edge-lit. Cons: Thicker panels, higher power usage. |

| Full-Array LED | Full array of LEDs with local dimming zones | High-end commercial displays, broadcast studios | Pros: Superior contrast, precise dimming, excellent picture quality. Cons: Higher cost, complex tech. |

| Mini-LED | Thousands of tiny LEDs for finer local dimming control | Premium digital signage, medical imaging displays | Pros: Exceptional brightness control, thin profile, enhanced HDR. Cons: Premium pricing, complex installation. |

| Micro-LED | Self-emissive microscopic LEDs, no backlight needed | Cutting-edge commercial displays, luxury markets | Pros: Outstanding color accuracy, infinite contrast, ultra-thin. Cons: Very high cost, limited availability. |

Edge-Lit LED

Edge-lit LED TVs feature LEDs placed along the edges of the screen, using light guides to distribute illumination evenly. This design enables slim and lightweight panels, making them attractive for retail environments where aesthetics and space-saving are priorities. However, B2B buyers should consider that edge-lit models may exhibit uneven brightness and lack advanced local dimming, which can impact image quality in professional settings. These TVs are best suited for budget-conscious projects where cost and form factor outweigh the need for top-tier picture performance.

Direct-Lit LED

Direct-lit LED TVs position LEDs directly behind the entire display surface, providing more uniform backlighting than edge-lit variants. This type is commonly used in mid-range commercial applications such as conference rooms or digital signage where consistent brightness is essential. Buyers benefit from improved contrast and color uniformity but must account for thicker panels and increased power consumption. Direct-lit models strike a balance between cost and image quality, making them a practical choice for many B2B environments.

Full-Array LED

Full-array LED TVs utilize a dense grid of LEDs across the entire back panel, often combined with local dimming zones that independently adjust brightness. This technology delivers superior contrast ratios, deeper blacks, and enhanced HDR performance, which are critical for high-end commercial use cases like broadcast studios and professional displays. While offering excellent visual fidelity, full-array models come at a higher price point and require more sophisticated installation and maintenance. B2B buyers should prioritize these TVs when image quality and precision are non-negotiable.

Mini-LED

Mini-LED technology incorporates thousands of smaller LEDs behind the screen, allowing for more precise local dimming and greater control over brightness zones. This results in improved HDR effects and thinner TV designs, suitable for premium digital signage and specialized applications such as medical imaging. However, mini-LED TVs typically command premium pricing and may involve complex integration processes. B2B buyers focused on delivering outstanding visual impact and energy efficiency should consider mini-LED as a future-proof investment.

Micro-LED

Micro-LED represents the latest advancement with self-emissive microscopic LEDs that eliminate the need for a separate backlight. These displays offer unparalleled color accuracy, infinite contrast ratios, and ultra-thin form factors. Micro-LEDs are ideal for cutting-edge commercial displays in luxury markets or high-end corporate environments where image quality is paramount. Despite their exceptional performance, these TVs are currently limited by very high costs and availability constraints. B2B buyers targeting exclusive projects should evaluate Micro-LED for long-term strategic value.

Related Video: OLED, QLED, or Mini-LED? Which to TV Buy in 2025

Key Industrial Applications of led behind tv

| Industry/Sector | Specific Application of led behind tv | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Advertising | Digital Signage and Interactive Displays | Enhances visual appeal, attracts customers, and increases engagement | Durability for continuous operation, energy efficiency, customizable brightness and color settings |

| Hospitality & Tourism | Ambient Lighting for Hotel Rooms and Lobbies | Creates immersive guest experiences and supports brand ambiance | Compatibility with existing control systems, ease of installation, and compliance with regional standards |

| Broadcast & Media | Studio Backlighting and Visual Effects | Improves on-screen image quality and reduces eye strain for talent | High color accuracy, flicker-free operation, and seamless integration with studio equipment |

| Education & Corporate | Conference Room Displays and Digital Whiteboards | Facilitates clear presentations and interactive learning | Robustness for frequent use, wide viewing angles, and reliable supplier technical support |

| Healthcare | Patient Room Displays and Diagnostic Imaging Monitors | Enhances patient comfort and supports precise diagnostics | Low heat emission, medical-grade certifications, and long lifespan under continuous use |

Retail & Advertising: Digital Signage and Interactive Displays

In retail environments, LEDs positioned behind TVs are crucial for digital signage that captivates shoppers with vivid visuals and dynamic content. This application addresses the need for high brightness and color contrast to ensure visibility even in brightly lit stores. For international buyers, especially in emerging markets like Africa and South America, sourcing LED modules that balance cost-efficiency with durability is vital due to varying power conditions and retail environments. Customizable brightness and energy-efficient models help retailers reduce operational costs while maximizing customer engagement.

Hospitality & Tourism: Ambient Lighting for Hotel Rooms and Lobbies

Hotels and resorts use LED-backlit TVs to create ambient lighting that enhances the guest experience by complementing room décor and mood settings. This application demands LEDs capable of smooth dimming and color temperature adjustments to match different times of day or thematic settings. Buyers from regions such as the Middle East and Europe should prioritize LEDs with compatibility for smart control systems and certifications for safety and energy efficiency, ensuring seamless integration with existing infrastructure and compliance with local regulations.

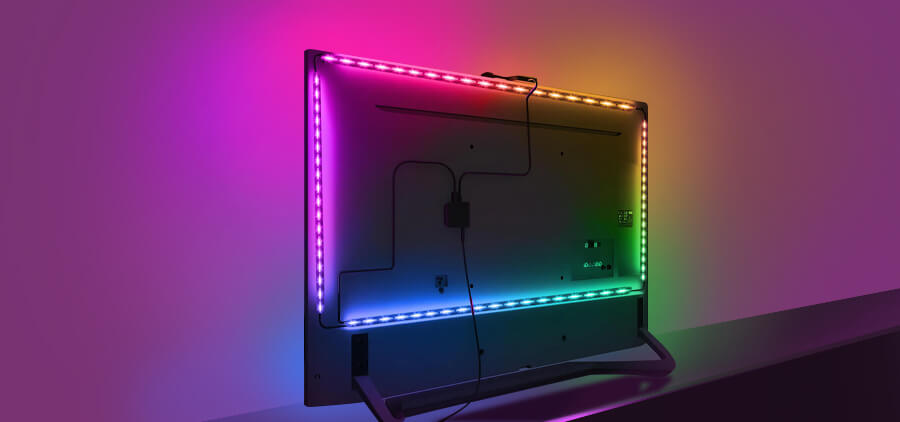

Illustrative Image (Source: Google Search)

Broadcast & Media: Studio Backlighting and Visual Effects

In broadcast studios, LEDs behind TVs provide essential backlighting that improves on-screen visuals and reduces eye strain for presenters. This use case requires LEDs with high color fidelity and flicker-free performance to maintain broadcast quality standards. International B2B buyers must consider suppliers offering precise technical specifications and custom solutions tailored to studio environments. High reliability and technical support are critical to avoid disruptions during live broadcasts, especially in competitive media markets across Europe and Australia.

Education & Corporate: Conference Room Displays and Digital Whiteboards

LEDs behind TVs in conference rooms and classrooms enhance visibility and interactivity of presentations and digital whiteboards. This application demands wide viewing angles and robust LED panels that withstand frequent use. For buyers in South America and Vietnam, sourcing from manufacturers who provide strong after-sales service and technical documentation is essential. Additionally, energy efficiency and ease of installation reduce total cost of ownership in institutional settings with budget constraints.

Healthcare: Patient Room Displays and Diagnostic Imaging Monitors

Healthcare facilities utilize LED-backlit TVs for patient entertainment and diagnostic displays, where accurate color rendering and low heat emission are paramount. LEDs must meet stringent medical-grade certifications and offer long operational lifespans under continuous use. Buyers from all targeted regions should prioritize suppliers with proven compliance to healthcare standards and the ability to provide customized solutions that ensure patient safety and diagnostic accuracy, supporting the demanding conditions of medical environments.

Related Video: Uses and Gratifications Theory

Strategic Material Selection Guide for led behind tv

Aluminum

Key Properties: Aluminum is lightweight, has excellent thermal conductivity, and good corrosion resistance. It typically withstands temperatures up to 200°C and performs well under normal atmospheric pressure. Its natural oxide layer provides protection against corrosion, making it suitable for various environments.

Pros & Cons: Aluminum offers superior heat dissipation, which is critical for LED systems behind TVs to prevent overheating and maintain longevity. It is also relatively easy to machine and extrude into complex shapes, supporting customized LED housing designs. However, aluminum can be more expensive than some plastics and may require anodizing or coating for enhanced surface durability.

Impact on Application: Due to its thermal properties, aluminum is ideal for LED backlighting frames or heat sinks. It supports efficient heat management, ensuring stable LED performance and longer lifespan. Its corrosion resistance suits humid or coastal regions, common in parts of Africa and the Middle East.

International B2B Considerations: Buyers from Europe and Australia often require compliance with ASTM B221 or EN 573 standards for aluminum alloys, ensuring quality and traceability. In South America and Vietnam, sourcing aluminum that meets international certification can be challenging but necessary for warranty and performance assurances. Aluminum’s recyclability also aligns with sustainability trends prevalent in European markets.

Polycarbonate (PC)

Key Properties: Polycarbonate is a transparent thermoplastic with high impact resistance and good heat resistance, typically up to 135°C. It offers excellent optical clarity and moderate UV resistance but can degrade under prolonged UV exposure without additives.

Pros & Cons: Polycarbonate is lightweight and cost-effective compared to metals, making it attractive for LED diffusers or protective covers behind TVs. Its impact resistance reduces damage risk during shipping and installation. However, it is less effective at heat dissipation than metals and may yellow over time if not UV-stabilized.

Impact on Application: PC is commonly used for diffusers or lens covers that evenly distribute LED light while protecting components. Its clarity enhances visual quality, important for premium TV installations. However, in hot climates like parts of Africa or the Middle East, UV stabilization is critical to avoid material degradation.

International B2B Considerations: Compliance with ISO 9001 and ASTM D3935 for polycarbonate materials is often requested by buyers in Europe and South America to ensure durability and safety. Importers in Vietnam and Australia should verify UV resistance certifications to prevent premature yellowing. Polycarbonate’s recyclability is increasingly important for environmentally conscious buyers.

Acrylic (PMMA)

Key Properties: Acrylic offers excellent optical clarity, higher scratch resistance than polycarbonate, and can tolerate temperatures up to around 80-90°C. It is less impact-resistant but provides superior light transmission (up to 92%).

Pros & Cons: Acrylic is highly effective for LED light guides or decorative panels behind TVs due to its clarity and light diffusion properties. It is generally less expensive than polycarbonate but more brittle, making it susceptible to cracking under mechanical stress. Acrylic also has lower heat resistance, which may limit its use in high-temperature LED applications.

Impact on Application: Acrylic is preferred when maximum light transmission and aesthetic appeal are priorities, such as in premium LED backlighting designs. However, its brittleness requires careful handling and packaging, especially for international shipments to regions with rough logistics, such as some African or South American markets.

International B2B Considerations: Buyers in Europe and Australia often require compliance with DIN 1249 or ASTM D4802 to ensure material quality. In the Middle East and Vietnam, acrylic’s lower heat resistance demands careful specification to avoid failures in high-temperature environments. Its cost-effectiveness makes it attractive for volume production but may require additional quality assurance.

Silicone Rubber

Key Properties: Silicone rubber is flexible, highly resistant to heat (up to 250°C), and has excellent weather and UV resistance. It is also chemically inert and provides good electrical insulation.

Pros & Cons: Silicone is ideal for LED sealing, cushioning, or light diffusion layers behind TVs, especially where flexibility and durability under thermal cycling are needed. Its high-temperature tolerance protects LEDs from heat damage. However, silicone is more expensive than typical plastics and requires specialized manufacturing processes.

Impact on Application: Silicone’s flexibility allows for custom-fit LED strips or cushioning layers that absorb vibrations and thermal expansion stresses. This is particularly valuable in markets with variable climates, such as the Middle East and parts of South America, where temperature fluctuations are common.

International B2B Considerations: Compliance with ASTM D2000 and ISO 10993 standards is critical for buyers in Europe and Australia to ensure material safety and performance. For African and Vietnamese buyers, sourcing silicone with consistent quality and certification can be challenging but essential for long-term reliability. Its higher cost is often justified by enhanced durability and performance.

| Material | Typical Use Case for led behind tv | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum | Heat sinks, LED housing frames | Excellent thermal conductivity and corrosion resistance | Higher cost, requires surface treatment for durability | High |

| Polycarbonate | LED diffusers, protective covers | High impact resistance and optical clarity | Lower heat resistance, potential UV degradation | Medium |

| Acrylic (PMMA) | Light guides, decorative panels | Superior light transmission and scratch resistance | Brittle, lower heat tolerance | Low |

| Silicone Rubber | Sealing, cushioning, flexible diffusion layers | High heat resistance and flexibility | Higher cost and complex manufacturing | High |

In-depth Look: Manufacturing Processes and Quality Assurance for led behind tv

Manufacturing Processes for LED Behind TV Solutions

The manufacturing of LED behind TV systems involves a sequence of specialized stages designed to ensure optimal performance, durability, and energy efficiency. International B2B buyers should familiarize themselves with these key production phases to assess supplier capabilities effectively.

1. Material Preparation

This foundational stage sets the quality baseline. High-grade raw materials such as LED chips, printed circuit boards (PCBs), diffusers, and aluminum or plastic housings are sourced. Suppliers often prioritize components with verified certifications like RoHS compliance to ensure environmental safety and regulatory adherence.

- Key Techniques:

- Procurement of semiconductor-grade LED wafers

- PCB fabrication using advanced photolithography for precise circuitry

- Surface treatment of metal parts for corrosion resistance

2. Forming and Component Fabrication

In this phase, raw materials are shaped and processed into functional components. For LED behind TV applications, this involves creating LED arrays or strips, light guide plates (LGP), and structural frames.

- Techniques include:

- SMT (Surface-Mount Technology) for mounting LEDs onto PCBs with high precision

- Injection molding or extrusion for plastic frames and diffusers

- CNC machining or stamping for metal frames and heat sinks

3. Assembly

Assembly integrates the components into a cohesive LED backlighting module compatible with TV designs. This step demands strict control over alignment, soldering quality, and electrical connections.

- Key assembly processes:

- Automated pick-and-place machines for LED placement to ensure uniformity

- Reflow soldering for secure and reliable LED-PCB connections

- Encapsulation and sealing to protect against moisture and dust ingress

4. Finishing and Packaging

The final stage involves cosmetic and functional finishing touches, including surface coating, labeling, and packaging designed for safe transit and easy installation.

- Finishing techniques:

- Anti-reflective and anti-static coatings on light guide plates

- Custom branding and labeling per buyer requirements

- Protective packaging with shock-absorbent materials

Quality Assurance and Control Frameworks

Robust quality assurance (QA) and quality control (QC) are critical to guarantee the performance and longevity of LED behind TV products, especially for international buyers who face diverse regulatory environments.

International Standards and Certifications

-

ISO 9001: The globally recognized standard for quality management systems, ensuring consistent product quality and continuous improvement. Suppliers certified with ISO 9001 demonstrate mature production controls and systematic quality checks.

-

CE Marking: Mandatory for products sold within the European Economic Area (EEA), the CE mark confirms compliance with safety, health, and environmental protection standards.

-

RoHS Compliance: Restricts hazardous substances in electrical equipment, a key standard for environmental and health safety.

-

UL / ETL Certifications: Particularly relevant for North American and some Middle Eastern markets, these certifications verify electrical safety.

-

Additional Industry-Specific Certifications: Depending on the region, certifications such as BIS (India), SAA (Australia), or SASO (Saudi Arabia) might be required.

Quality Control Checkpoints

A comprehensive QC system typically incorporates multiple inspection stages:

-

Incoming Quality Control (IQC): Verifies raw materials and components before entering production. This includes dimensional checks, material composition analysis, and functionality tests of LED chips and PCBs.

-

In-Process Quality Control (IPQC): Conducted during assembly, IPQC ensures adherence to process parameters such as solder joint integrity, component placement accuracy, and electrical continuity.

-

Final Quality Control (FQC): Post-assembly testing to confirm that the finished LED modules meet all technical specifications and operational standards.

Common Testing Methods

-

Electrical Testing: Measures voltage, current, and power consumption to confirm LED efficiency and safety.

-

Optical Testing: Assesses luminance, color temperature, uniformity, and beam angle to ensure visual performance matches specifications.

-

Environmental and Durability Tests: Includes thermal cycling, humidity resistance, and vibration testing to simulate real-world operating conditions.

-

Safety and EMC Testing: Evaluates electrical safety and electromagnetic compatibility to prevent interference with other devices.

Verifying Supplier Quality Assurance: Actionable Steps for B2B Buyers

For buyers across Africa, South America, the Middle East, and Europe, due diligence in verifying supplier QC practices is essential to mitigate risks and ensure compliance with local regulations.

1. Conduct On-site Audits and Factory Visits

- Evaluate manufacturing workflows and QC procedures firsthand.

- Verify the presence of calibrated testing equipment and trained quality personnel.

- Confirm adherence to international standards and certifications displayed.

2. Request Comprehensive QC Documentation

- Review inspection reports from IQC, IPQC, and FQC stages.

- Analyze batch testing data and product traceability records.

- Obtain copies of certification documents such as ISO 9001, CE, RoHS, and others relevant to your region.

3. Engage Third-Party Inspection Agencies

- Employ independent inspection companies to perform random sampling and testing.

- Use these reports to validate supplier claims and ensure unbiased quality verification.

- Third-party audits are particularly valuable when suppliers are overseas or when regulatory compliance is critical.

4. Understand Regional QC and Certification Nuances

-

Africa & South America: Regulatory frameworks can vary widely; buyers should ensure products meet both international standards and any local import regulations. Certifications like CE and RoHS are often accepted, but local certifications may be required.

-

Middle East: Countries like UAE and Saudi Arabia often require SASO certification alongside international marks. Electrical safety and EMC compliance are closely scrutinized.

-

Europe: The CE mark is mandatory, with strict enforcement on energy efficiency and environmental standards. Buyers should verify that suppliers keep up with evolving EU directives.

-

Australia & Vietnam: Compliance with SAA (Australia) and Vietnam’s MOIT requirements is necessary; buyers should confirm the supplier’s ability to meet these alongside global standards.

Key Takeaways for International B2B Buyers

-

Prioritize suppliers with comprehensive ISO 9001 certification and recognized regional certifications. These indicate mature quality systems and regulatory compliance.

-

Insist on transparent QC processes with documented IQC, IPQC, and FQC checkpoints. Visibility into these stages reduces supply chain risks.

-

Leverage third-party inspections for objective quality verification, especially when sourcing from distant or unfamiliar regions.

-

Understand local import and certification requirements in your region to avoid compliance issues and ensure smooth market entry.

-

Request product samples and conduct your own testing if possible, focusing on electrical, optical, and environmental performance benchmarks.

By thoroughly evaluating manufacturing processes and quality assurance practices, international buyers can confidently select LED behind TV suppliers that deliver reliable, high-performance products tailored to their regional market needs.

Related Video: The Most Sophisticated Manufacturing Process In The World Inside The Fab | Intel

Comprehensive Cost and Pricing Analysis for led behind tv Sourcing

When sourcing LED behind TV solutions, understanding the detailed cost structure and pricing dynamics is essential for making informed purchasing decisions. This analysis breaks down the primary cost components, key pricing influencers, and practical buyer strategies to optimize procurement, especially for international B2B buyers from regions such as Africa, South America, the Middle East, and Europe.

Key Cost Components in LED Behind TV Manufacturing

- Materials: The most significant cost driver, including LED chips, PCB substrates, diffusers, housing materials (plastics or metals), and electronic components. Material quality and source origin heavily influence price and product longevity.

- Labor: Skilled labor costs cover assembly, soldering, testing, and packaging. Labor expenses vary widely by country, impacting overall production costs.

- Manufacturing Overhead: Includes factory utilities, equipment depreciation, and indirect labor. Efficient manufacturing processes and automation can reduce these costs.

- Tooling: Initial setup costs for molds, dies, and assembly jigs. These are fixed costs amortized over production volume and can be significant for custom designs.

- Quality Control (QC): Testing LED brightness, color consistency, electrical safety, and durability. High QC standards add cost but reduce returns and enhance reputation.

- Logistics: Freight, customs duties, and handling fees for shipping from manufacturing sites (often Asia) to end markets. Costs fluctuate with shipment size, mode (air, sea), and regional trade agreements.

- Margin: Supplier markup to cover profit and business sustainability. Margins depend on market competition, brand positioning, and order volume.

Primary Price Influencers for LED Behind TV Products

- Order Volume and Minimum Order Quantity (MOQ): Larger volumes reduce per-unit costs due to economies of scale and better bargaining power. MOQ requirements vary; buyers should align order sizes with demand forecasts to optimize pricing.

- Product Specifications and Customization: Higher specifications (e.g., advanced color tuning, longer lifespan LEDs) or custom form factors increase costs. Standardized models are generally more cost-effective.

- Material Quality and Certifications: Premium-grade LEDs and components certified for energy efficiency, safety (CE, RoHS), and environmental compliance command higher prices but reduce risk and total cost of ownership.

- Supplier Factors: Established suppliers with proven track records, robust QC, and after-sales support may price higher but offer reliability and reduced operational risk.

- Incoterms and Delivery Terms: Terms such as FOB, CIF, or DDP affect who bears shipping and customs costs. Buyers should understand these to calculate landed costs accurately.

Strategic Tips for International B2B Buyers

- Negotiate Beyond Unit Price: Engage suppliers on tooling amortization, payment terms, and logistics support to lower overall costs. Volume commitments and long-term partnerships can unlock better deals.

- Assess Total Cost of Ownership (TCO): Factor in installation, energy consumption, maintenance, warranty servicing, and potential downtime. Sometimes, a slightly higher upfront cost yields savings over product lifecycle.

- Leverage Regional Trade Agreements: For buyers in Africa, South America, the Middle East, and Europe, explore preferential tariffs or free trade zones that can reduce import duties and expedite customs clearance.

- Consider Local Compliance and After-Sales Support: Sourcing from suppliers that understand local market regulations and provide accessible technical support minimizes hidden costs and risks.

- Be Mindful of Pricing Fluctuations: Raw material shortages, currency exchange rates, and global shipping disruptions can impact prices. Building flexibility into procurement plans helps manage these risks.

Indicative Pricing Disclaimer

Due to variability in product specifications, order volumes, supplier capabilities, and global market conditions, pricing for LED behind TV solutions can range widely. Buyers should use this analysis as a framework for negotiation and cost evaluation rather than fixed price expectations. Obtaining multiple quotes and conducting thorough supplier due diligence remain critical steps.

By carefully dissecting cost elements and leveraging pricing influencers, international B2B buyers can strategically source LED behind TV products that balance quality, cost-efficiency, and long-term value—ultimately supporting successful project outcomes across diverse global markets.

Spotlight on Potential led behind tv Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led behind tv’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led behind tv

Understanding the critical technical properties and common trade terminology related to LED behind TV products is essential for international B2B buyers. This knowledge enables informed procurement decisions, smooth supplier communication, and effective negotiation, especially when dealing across diverse markets such as Africa, South America, the Middle East, and Europe.

Key Technical Properties of LED Behind TV

-

Material Grade and Durability

The LED strips and components should use high-grade materials such as copper-clad substrates and quality LEDs (e.g., SMD 5050 or 2835). These materials ensure longevity and consistent light output. For B2B buyers, prioritizing durable materials reduces replacement frequency and maintenance costs, critical for commercial or large-scale installations. -

Color Temperature (Kelvin Scale)

Color temperature defines the light’s warmth or coolness, typically ranging from 2700K (warm white) to 6500K (daylight). Buyers must select LEDs with color temperatures that complement TV displays and ambient room lighting to enhance viewer experience. Offering adjustable or tunable color temperature LEDs can be a strong selling point. -

Luminous Intensity and Efficiency (Lumens per Watt)

This measures brightness relative to energy consumption. High luminous efficiency means brighter output with lower power usage, important for energy-conscious projects and compliance with international energy standards. B2B buyers should request detailed lumen output and power consumption data to evaluate product efficiency. -

Voltage and Power Specifications

Common LED strips behind TVs operate on 12V or 24V DC. Understanding these specifications ensures compatibility with power supplies and avoids installation issues. For buyers, verifying voltage requirements upfront helps in planning the electrical setup and controlling operational costs. -

IP Rating (Ingress Protection)

Though LEDs behind TVs are generally used indoors, some applications may require moisture or dust resistance, indicated by IP ratings (e.g., IP20 for indoor use, IP65 for water resistance). Buyers targeting diverse environments should clarify IP ratings to guarantee product suitability and durability. -

Tolerance and Uniformity

Tolerance refers to the acceptable variation in product dimensions, brightness, or color consistency. Low tolerance is crucial for uniform light diffusion behind TV panels, preventing uneven illumination or color shifts. B2B buyers should demand tolerance specifications to ensure consistent quality, especially in bulk orders.

Common Trade Terms for International B2B Buyers

-

OEM (Original Equipment Manufacturer)

OEM refers to companies that manufacture products or components to be rebranded and sold by another company. For buyers, partnering with OEMs can enable customization and branding flexibility, often at competitive costs. Understanding OEM terms is key when negotiating private label LED behind TV solutions. -

MOQ (Minimum Order Quantity)

MOQ specifies the smallest number of units a supplier is willing to sell per order. MOQs vary widely and impact inventory planning and pricing. Buyers should negotiate MOQs that align with their project scale and budget, especially when entering new markets or testing product lines. -

RFQ (Request for Quotation)

An RFQ is a formal document sent to suppliers asking for pricing, lead times, and terms for specific products. Mastering RFQ preparation helps buyers receive accurate, comparable offers, facilitating informed supplier selection and cost control. -

Incoterms (International Commercial Terms)

Incoterms define shipping responsibilities, costs, and risk transfer points between buyers and sellers. Common terms include FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Understanding Incoterms enables buyers to clarify logistics, reduce hidden costs, and streamline import processes. -

Lead Time

Lead time is the duration between order placement and product delivery. For LED behind TV products, long lead times can delay project schedules. Buyers should confirm lead times upfront and factor them into procurement planning to avoid costly downtime.

- Certification and Compliance

Certifications such as CE, RoHS, UL, or Energy Star indicate compliance with regional safety, environmental, and energy standards. For international buyers, verifying certifications ensures regulatory adherence and smooth customs clearance, minimizing risks of shipment rejection.

Actionable Insight:

When sourcing LED behind TV products, international B2B buyers should request detailed technical datasheets covering these properties and clarify trade terms early in negotiations. This approach reduces misunderstandings, aligns expectations, and fosters successful supplier partnerships across diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led behind tv Sector

Market Overview & Key Trends

The LED behind TV sector has witnessed rapid transformation driven by technological innovation and shifting global demand patterns. For international B2B buyers, especially from Africa, South America, the Middle East, and Europe (including emerging markets like Australia and Vietnam), understanding these dynamics is crucial for strategic sourcing and competitive advantage.

Global Drivers: The surge in demand for ultra-high-definition displays, energy-efficient lighting solutions, and seamless integration of smart technologies fuels the growth of LED backlighting in TVs. Buyers are increasingly prioritizing displays that offer superior brightness, contrast ratios, and color accuracy—attributes heavily influenced by advancements in LED technology such as mini-LED and micro-LED.

Emerging Sourcing Trends:

– Customization and Modular Design: Manufacturers now offer configurable LED panels allowing buyers to tailor specifications like brightness levels, color temperature, and form factor to regional market preferences and regulatory standards.

– Digital Procurement Platforms: With 67% of B2B buyers conducting research online before supplier engagement, platforms that provide detailed product specs, virtual demos, and real-time inventory visibility are becoming essential. This trend is particularly relevant for buyers in regions with complex logistics or fluctuating currency conditions.

– Strategic Partnerships: To mitigate supply chain risks heightened by geopolitical shifts and global disruptions, buyers are favoring suppliers with transparent operations, localized support, and multi-region manufacturing footprints.

Market Dynamics:

– Price Sensitivity & Quality Balance: African and South American markets often seek cost-effective solutions without compromising durability, while European and Middle Eastern buyers emphasize certifications and long-term energy savings.

– Regulatory Compliance: Increasing regional regulations on energy efficiency and electronic waste management require buyers to ensure compliance through supplier audits and product certifications.

– Innovation Adoption: Regions like Europe and Australia are early adopters of next-gen LED tech (e.g., mini-LED backlighting), whereas emerging markets prioritize robust, scalable solutions that balance performance with affordability.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a pivotal factor in sourcing LED behind TV components, with environmental impact and ethical practices influencing purchasing decisions globally. B2B buyers must navigate these considerations to align with corporate social responsibility goals and regional regulatory frameworks.

Environmental Impact: LED backlighting significantly reduces power consumption compared to traditional CCFL (Cold Cathode Fluorescent Lamp) technologies, contributing to lower carbon footprints for TV manufacturers and end-users. However, the production of LEDs involves rare earth elements and semiconductor materials, which require responsible extraction and recycling to minimize ecological harm.

Ethical Supply Chains: Ensuring ethical sourcing involves verifying supplier adherence to labor standards, conflict-free mineral sourcing, and transparent supply chain traceability. Buyers from Africa, South America, and the Middle East should particularly scrutinize upstream suppliers to avoid complicity in exploitative practices, while European buyers often demand third-party audits and certifications as part of procurement contracts.

Green Certifications & Materials:

– Energy Star & EU Ecodesign: Widely recognized certifications that validate energy efficiency and environmental performance.

– RoHS Compliance: Restricts hazardous substances in electronic components, essential for market access in Europe and increasingly enforced globally.

– ISO 14001 Environmental Management: Indicates a supplier’s commitment to sustainable manufacturing processes.

– Use of Recycled Materials: Preference for LEDs incorporating recycled semiconductor materials or packaging reduces environmental impact and can enhance brand positioning.

Incorporating sustainability into sourcing strategies not only mitigates risks but also unlocks new market opportunities, particularly in regions where environmental regulations are tightening and consumer awareness is rising.

Evolution of LED Behind TV Technology

The evolution of LED backlighting for TVs has been marked by continuous innovation aimed at enhancing picture quality and energy efficiency. Initially, CCFL technology dominated backlighting, but its bulkiness and higher power consumption paved the way for LED solutions in the early 2000s.

Early LED implementations used edge-lit designs, where LEDs were placed along the screen edges to provide illumination. This method offered slimmer profiles but limited local dimming capabilities, affecting contrast. The shift to direct-lit and full-array LED backlighting around the 2010s enabled better brightness uniformity and introduced local dimming zones, significantly improving image contrast and black levels.

More recently, mini-LED and micro-LED technologies have revolutionized the sector by incorporating thousands of tiny LEDs behind the display, delivering superior brightness, dynamic range, and color fidelity. These advancements have not only elevated consumer viewing experiences but also expanded B2B opportunities for suppliers who can provide cutting-edge, customizable LED modules that meet diverse regional demands.

Understanding this technological trajectory allows B2B buyers to anticipate future trends, align procurement with innovation cycles, and select suppliers positioned at the forefront of LED backlighting advancements.

Related Video: Exim Trade Conclave 2025 LIVE | Finance Minister Nirmala Sitharaman Delivers Keynote Address | N18L

Frequently Asked Questions (FAQs) for B2B Buyers of led behind tv

-

How can I effectively vet LED behind TV suppliers internationally?

To vet suppliers, start by verifying their certifications such as ISO, CE, or RoHS, which confirm compliance with international quality and safety standards. Request detailed product specifications, case studies, and client references, especially from buyers in your region. Use digital channels to assess their online presence and responsiveness, and consider third-party audits or factory visits if possible. Ensuring transparent communication and asking for samples before large orders helps mitigate risks associated with new suppliers. -

Are LED behind TV products customizable to specific regional requirements?

Yes, many manufacturers offer customization options including size, brightness, color temperature, and installation methods to meet diverse market needs. For B2B buyers in regions like Africa or South America, specify any voltage, environmental, or regulatory requirements upfront. Discuss customization timelines and costs early in negotiations to align expectations. Customized solutions can provide competitive advantages but may influence minimum order quantities (MOQs) and lead times. -

What are typical minimum order quantities (MOQs) and lead times for international orders?

MOQs vary widely depending on the supplier and customization level but generally range from 50 to 500 units for LED behind TV products. Lead times can span from 4 to 12 weeks, influenced by order size, customization, and current supply chain conditions. Buyers should confirm these details upfront, especially when importing to regions with longer shipping durations. Planning orders well in advance and maintaining clear communication can help avoid delays. -

What payment terms are commonly accepted for international B2B transactions in this sector?

Standard payment terms include a 30-50% deposit upfront with the balance paid before shipment or upon delivery. Letters of credit (LC), telegraphic transfers (T/T), and escrow services are popular methods to secure transactions. For buyers in emerging markets, negotiating flexible terms or phased payments may be possible with trusted suppliers. Always ensure payment terms are clearly documented in contracts to protect both parties. -

What quality assurance measures should I expect from LED behind TV manufacturers?

Reliable manufacturers implement rigorous quality control protocols including pre-production samples, in-process inspections, and final product testing for brightness, color consistency, and durability. Certifications such as CE, UL, or Energy Star add credibility. Request quality assurance documentation and warranties before purchase. For large orders, consider third-party inspection services to verify product compliance and reduce the risk of defects. -

Which certifications and standards are most important for LED behind TV products in global markets?

Key certifications include CE (Europe), FCC (North America), RoHS (hazardous substances), and ISO 9001 (quality management). Energy efficiency certifications may also be critical in regions with strict environmental regulations. For buyers in Africa or the Middle East, check for local standards or import requirements. Ensuring products meet these certifications facilitates smoother customs clearance and enhances buyer confidence. -

What logistics considerations should I be aware of when importing LED behind TV products?

Due to the fragility and size of LED units, packaging must be robust to prevent damage during transit. Confirm whether suppliers handle FOB, CIF, or DDP shipping terms and clarify responsibilities for customs clearance and duties. Lead times can be affected by port congestion or regional holidays, so factor these into your planning. Partnering with experienced freight forwarders familiar with your destination market is advisable for smoother delivery. -

How should I handle disputes or quality issues with overseas suppliers?

To mitigate disputes, establish clear contracts detailing product specs, delivery schedules, payment terms, and quality standards. Maintain thorough documentation of communications and inspections. If issues arise, engage suppliers promptly to negotiate solutions such as replacements, refunds, or discounts. Utilizing escrow payment services or third-party dispute resolution platforms can protect buyers. Building strong relationships and choosing reputable suppliers reduces the likelihood of serious conflicts.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led behind tv

Strategic sourcing of LED behind TV technology is a critical lever for international B2B buyers aiming to optimize cost, quality, and innovation. By prioritizing suppliers with robust digital presence, verified certifications, and comprehensive technical support, buyers can significantly reduce procurement risks and accelerate project timelines. Embracing digital tools such as interactive configurators and energy efficiency calculators empowers procurement teams to make informed decisions tailored to diverse market demands across Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Key takeaways include the importance of evaluating supplier credibility through transparent case studies and certifications, leveraging data-driven insights to align product specifications with end-user requirements, and fostering close collaboration with manufacturers who understand regional market nuances. Strategic sourcing goes beyond price negotiations—it’s about securing long-term value through reliability, innovation, and sustainability credentials.

Looking ahead, the LED behind TV market is poised for rapid evolution driven by technological advancements and increasing digital procurement sophistication. Buyers who adopt a proactive, informed sourcing approach will unlock competitive advantages and future-proof their supply chains. We encourage procurement leaders across emerging and developed markets to deepen supplier engagement, invest in digital sourcing platforms, and continuously monitor industry trends to stay ahead in this dynamic sector.