Guide to Covers For Led Strip Lights

- Introduction: Navigating the Global Market for covers for led strip lights

- Understanding covers for led strip lights Types and Variations

- Key Industrial Applications of covers for led strip lights

- Strategic Material Selection Guide for covers for led strip lights

- In-depth Look: Manufacturing Processes and Quality Assurance for covers for led strip lights

- Comprehensive Cost and Pricing Analysis for covers for led strip lights Sourcing

- Spotlight on Potential covers for led strip lights Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for covers for led strip lights

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the covers for led strip lights Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of covers for led strip lights

- Strategic Sourcing Conclusion and Outlook for covers for led strip lights

Introduction: Navigating the Global Market for covers for led strip lights

In the dynamic world of LED lighting, covers for LED strip lights are indispensable components that enhance durability, safety, and aesthetic appeal. For international B2B buyers—particularly those operating in diverse markets across Africa, South America, the Middle East, and Europe—understanding the nuances of these covers is crucial for optimizing product performance and meeting regional compliance standards.

LED strip light covers serve multiple critical functions: they protect delicate LEDs from dust, moisture, and physical impact; diffuse light to reduce glare and create uniform illumination; and contribute to the overall design integrity of lighting installations. Selecting the right cover not only extends the lifespan of LED strips but also adds value by improving customer satisfaction and reducing maintenance costs.

This comprehensive guide delves into the full spectrum of considerations for sourcing LED strip light covers effectively. You will find detailed insights into:

- Types and profiles of covers suited for different applications, from rigid to flexible options

- Material choices, including polycarbonate, acrylic, and silicone, with their respective durability and light transmission properties

- Manufacturing quality and quality control processes that ensure consistent performance and regulatory compliance

- Reliable supplier evaluation criteria tailored for international procurement, emphasizing flexibility for various order volumes and customization needs

- Cost factors and market trends to aid in budgeting and competitive pricing strategies

- Frequently asked questions addressing common technical and logistical concerns faced by global buyers

By equipping you with this knowledge, the guide empowers B2B buyers to make informed, strategic sourcing decisions that align with their operational goals and regional market demands. Whether you are expanding your product portfolio or optimizing existing supply chains, this resource is designed to facilitate confident partnerships and successful outcomes in the global LED lighting industry.

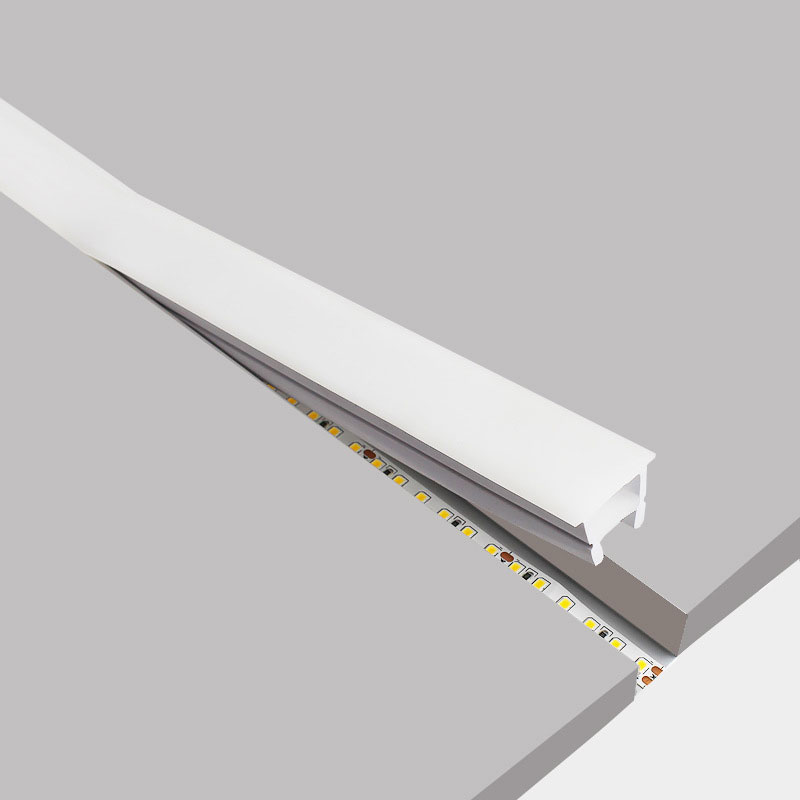

Understanding covers for led strip lights Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Clear Acrylic Cover | Transparent, rigid plastic that offers high light output | Retail displays, architectural lighting | Pros: Excellent brightness, durable; Cons: Less impact-resistant |

| Frosted Polycarbonate Cover | Diffuses light to reduce glare and hotspots | Hospitality, office environments | Pros: Soft light diffusion, UV resistant; Cons: Slightly lower brightness |

| Silicone Rubber Cover | Flexible, waterproof, and heat resistant | Outdoor, industrial, marine applications | Pros: Weatherproof, flexible; Cons: Lower light transmission |

| Aluminum Profile Cover | Metal housing with integrated cover for heat dissipation | Commercial installations, high-performance setups | Pros: Enhances heat management, robust; Cons: Higher cost, heavier |

| Diffuser Lens Cover | Textured or ribbed surface to evenly spread LED light | Museums, galleries, luxury retail | Pros: Uniform light distribution, aesthetic appeal; Cons: Reduced intensity |

Clear Acrylic Cover

Clear acrylic covers are prized for their high transparency and rigidity, making them ideal for applications where maximum brightness and crisp light output are required. They are commonly used in retail displays and architectural lighting where visual clarity is paramount. B2B buyers should consider the trade-off between durability and impact resistance; while acrylic is sturdy, it is more prone to cracking under heavy impact compared to polycarbonate options.

Frosted Polycarbonate Cover

Frosted polycarbonate covers provide a diffused light effect, reducing glare and softening hotspots, which is especially valuable in hospitality and office settings. Their UV resistance extends product lifespan in environments exposed to sunlight. Buyers targeting indoor commercial projects will appreciate the balance of light quality and durability, although the slight reduction in brightness compared to clear covers should be factored into lighting design.

Silicone Rubber Cover

Silicone rubber covers excel in flexibility, waterproofing, and heat resistance, making them suitable for harsh outdoor, industrial, and marine environments. Their pliability allows for easy installation on curved or irregular surfaces. B2B buyers focusing on outdoor or rugged applications must weigh the advantage of weatherproof protection against the reduced light transmission inherent to silicone materials.

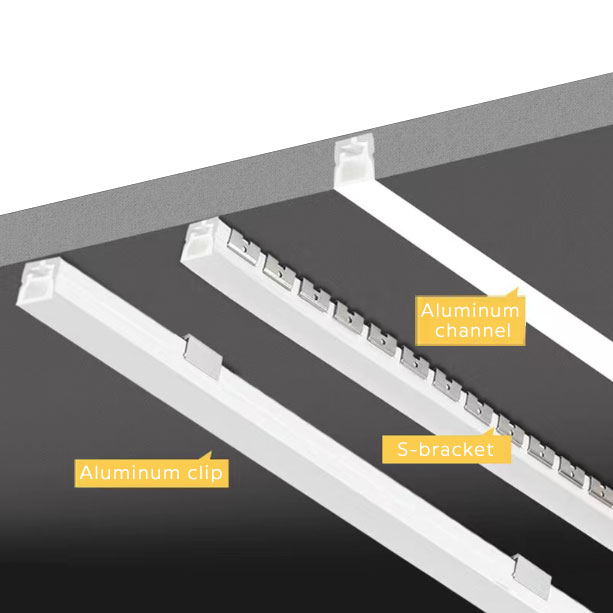

Aluminum Profile Cover

Aluminum profile covers combine a metal housing with an integrated cover, offering enhanced heat dissipation and structural strength. These are favored in commercial installations and high-performance LED setups where thermal management is critical to maintaining LED lifespan and efficiency. The higher cost and weight of aluminum profiles may impact logistics and installation costs, important considerations for bulk procurement.

Diffuser Lens Cover

Diffuser lens covers feature textured or ribbed surfaces designed to evenly distribute LED light, reducing sharp shadows and creating a uniform illumination effect. This type is commonly used in museums, galleries, and luxury retail environments where aesthetic lighting quality is essential. Buyers should consider that while these covers improve visual comfort and appeal, they also reduce overall light intensity, necessitating adjustments in LED brightness or quantity.

Related Video: LED Strip Lighting Installs: Beginner, Intermediate and Expert Level

Key Industrial Applications of covers for led strip lights

| Industry/Sector | Specific Application of covers for led strip lights | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial | Display and accent lighting protection | Enhances aesthetic appeal while protecting LEDs from dust and damage | UV resistance, transparency level, ease of installation |

| Automotive Manufacturing | Interior and exterior ambient lighting covers | Protects LED strips from moisture, vibration, and chemical exposure | Heat resistance, durability under vibration, material flexibility |

| Hospitality & Tourism | Decorative lighting in hotels and resorts | Ensures long-lasting, safe lighting with customizable diffusion | Compliance with safety standards, customizable light diffusion |

| Industrial & Warehousing | Task lighting and safety indicator covers | Guards LEDs against dust, impact, and harsh environmental conditions | High-impact resistance, IP rating, chemical resistance |

| Architecture & Urban Planning | Outdoor LED strip covers for façade and pathway lighting | Protects lighting installations against weather and vandalism | Weatherproofing, anti-glare properties, corrosion resistance |

Retail & Commercial Applications

In retail and commercial environments, covers for LED strip lights are primarily used to protect accent and display lighting from dust, physical damage, and UV degradation. These covers maintain the visual clarity and brightness of LED strips, which is crucial for attractive product displays and customer engagement. International B2B buyers, particularly in regions with intense sunlight such as parts of South America and the Middle East, must prioritize UV-resistant materials. Additionally, transparency and diffusion properties are important to achieve the desired lighting effect without compromising protection.

Automotive Manufacturing

The automotive sector uses covers for LED strip lights extensively in both interior ambient lighting and exterior decorative applications. These covers shield the LEDs from moisture, vibration, and exposure to automotive chemicals such as oils and cleaners. For manufacturers in Europe and Africa, sourcing covers with high heat resistance and flexibility is critical due to varying climate conditions and strict automotive standards. Durable materials that withstand constant motion and temperature fluctuations help reduce maintenance costs and improve product reliability.

Hospitality & Tourism

Hotels, resorts, and other hospitality venues rely on LED strip light covers to enhance ambiance while protecting lighting installations from wear and tear. Covers enable the customization of light diffusion to create warm, inviting atmospheres without harsh glare. For B2B buyers in international markets like France or Indonesia, compliance with local fire safety and electrical standards is essential. Selecting covers that facilitate easy cleaning and maintenance also supports operational efficiency in high-traffic areas.

Illustrative Image (Source: Google Search)

Industrial & Warehousing

In industrial and warehousing settings, LED strip light covers serve a protective function against dust, impacts, and chemical exposure, ensuring consistent task lighting and safety indicator visibility. Buyers from regions with heavy industrial activity, such as parts of South America and the Middle East, should prioritize covers with high ingress protection (IP) ratings and chemical resistance. Impact-resistant materials help prolong the lifespan of lighting systems in harsh environments, reducing downtime and replacement costs.

Architecture & Urban Planning

Outdoor architectural lighting and urban pathway illumination benefit from specialized covers that protect LED strips from weather conditions, vandalism, and corrosion. For B2B buyers in Europe and Africa, sourcing covers with excellent weatherproofing and anti-glare properties is vital to maintain lighting performance and safety. Corrosion-resistant materials ensure longevity in coastal or polluted urban areas, supporting sustainable infrastructure investments and enhancing public safety.

Related Video: How to Install LED Strip Lights

Strategic Material Selection Guide for covers for led strip lights

When selecting materials for covers for LED strip lights, international B2B buyers must weigh performance characteristics, manufacturing feasibility, and regional compliance requirements. The choice of material directly affects product durability, light diffusion quality, environmental resistance, and cost-efficiency. Below is a detailed analysis of four common materials used for LED strip light covers: Polycarbonate (PC), Acrylic (PMMA), Silicone, and PVC.

Polycarbonate (PC)

Key Properties:

Polycarbonate is a high-impact thermoplastic known for excellent mechanical strength and heat resistance, typically withstanding temperatures up to 120°C. It offers superior UV resistance and good chemical stability, making it suitable for outdoor and industrial environments.

Pros & Cons:

PC covers provide excellent durability and impact resistance, reducing the risk of cracking or breaking during installation or transportation. They offer good light transmission with moderate diffusion, preserving brightness while minimizing glare. However, polycarbonate is more expensive than other plastics and can be prone to scratching unless coated. Manufacturing complexity is moderate, requiring injection molding or extrusion processes.

Application Impact:

PC covers are ideal for harsh or outdoor environments, such as industrial facilities or architectural lighting in regions with intense sunlight (e.g., Middle East, parts of Africa). Their UV resistance ensures longevity in these climates. They also perform well in humid or dusty environments common in South America and Southeast Asia.

International Considerations:

Buyers should verify compliance with ASTM D3935 (UV resistance) and ISO 4892 standards. In Europe, compliance with REACH and RoHS regulations is critical. PC covers often meet UL 94 V-0 flammability ratings, important for safety certifications in France and other European markets.

Acrylic (PMMA)

Key Properties:

Acrylic is a transparent thermoplastic with excellent optical clarity and light transmittance (up to 92%). It has moderate impact resistance and can withstand temperatures up to 80-90°C. Acrylic is chemically stable but less UV resistant than PC unless specially treated.

Pros & Cons:

Acrylic covers deliver superior light diffusion and clarity, enhancing the aesthetic appeal of LED strips. They are easier and less costly to manufacture than PC, often via extrusion or casting. However, acrylic is more brittle and prone to cracking under stress or impact. It also yellows over time if exposed to prolonged UV without additives.

Application Impact:

Acrylic is preferred for indoor applications or decorative lighting where visual clarity and color fidelity are priorities, such as retail or hospitality sectors in Europe and South America. It is less suitable for outdoor or industrial use unless UV-stabilized.

International Considerations:

Compliance with DIN 53455 (impact strength) and JIS K 6745 (weather resistance) may be relevant for buyers in Japan-influenced markets like Indonesia. European buyers must ensure conformity with EN 71-3 (safety of toys) if used in consumer-facing products. Acrylic’s lower thermal tolerance requires consideration in hot climates like the Middle East.

Silicone

Key Properties:

Silicone covers are flexible, highly resistant to extreme temperatures (-60°C to 230°C), and possess excellent weathering and chemical resistance. They offer moderate light diffusion and are inherently UV stable.

Pros & Cons:

Silicone’s flexibility makes it ideal for curved or irregular LED strip installations. It resists yellowing and maintains clarity over long periods, even under harsh environmental conditions. The main drawbacks are higher material cost and more complex manufacturing processes (molding or extrusion). Silicone covers may also have lower mechanical strength compared to rigid plastics.

Application Impact:

Silicone is well-suited for outdoor, marine, or food-grade applications where flexibility and chemical inertness are required. It is preferred in regions with extreme temperature variations such as parts of Europe and the Middle East. Its resistance to moisture and chemicals is advantageous for industrial buyers in Africa and South America.

International Considerations:

Buyers should verify compliance with FDA standards for food contact if applicable, as well as ASTM D2000 for elastomers. Silicone covers typically meet IP65 or higher ingress protection ratings, important for outdoor installations. European buyers should confirm REACH compliance and RoHS directives.

Polyvinyl Chloride (PVC)

Key Properties:

PVC is a versatile thermoplastic with moderate impact resistance and good chemical and corrosion resistance. It typically withstands temperatures up to 60-70°C and offers decent weather resistance when stabilized.

Pros & Cons:

PVC covers are cost-effective and easy to manufacture via extrusion, making them attractive for large volume orders. They provide good protection against dust and moisture but have lower optical clarity and tend to yellow over time. PVC is less environmentally friendly and can emit harmful substances if burned.

Application Impact:

PVC is commonly used for indoor LED strip covers in budget-sensitive markets or where mechanical protection is required without premium optical performance. It is suitable for regions with moderate climates but less ideal for high UV exposure or extreme temperatures.

International Considerations:

Buyers should ensure compliance with local environmental regulations, especially in Europe where PVC use is increasingly restricted. ASTM D1784 and EN 71-3 standards may apply. For markets in Africa and South America, availability and cost advantages often outweigh environmental concerns, but buyers should consider future regulatory trends.

| Material | Typical Use Case for covers for led strip lights | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polycarbonate (PC) | Outdoor/industrial LED strip lighting requiring durability | High impact resistance and UV stability | Higher cost and prone to scratching | High |

| Acrylic (PMMA) | Indoor decorative and retail lighting | Superior optical clarity and light diffusion | Brittle, less UV resistant, yellows over time | Medium |

| Silicone | Flexible, outdoor, marine, or food-grade applications | Extreme temperature resistance and flexibility | Higher cost, lower mechanical strength | High |

| Polyvinyl Chloride (PVC) | Budget indoor applications with moderate protection | Cost-effective and easy to manufacture | Lower clarity, yellows, environmental concerns | Low |

This material selection guide helps international B2B buyers tailor their LED strip light cover choices to specific market demands, environmental conditions, and regulatory frameworks. Understanding these material nuances ensures optimal product performance, compliance, and cost management across diverse global regions.

In-depth Look: Manufacturing Processes and Quality Assurance for covers for led strip lights

Manufacturing Processes for Covers of LED Strip Lights

The production of covers for LED strip lights involves a series of precise manufacturing stages designed to ensure durability, optical clarity, and compatibility with LED strips. These covers protect the LEDs from dust, moisture, and mechanical damage while diffusing or directing light effectively. Understanding the manufacturing workflow helps B2B buyers assess supplier capabilities and product quality.

1. Material Preparation

The process begins with selecting raw materials, typically high-grade polycarbonate (PC), acrylic (PMMA), or flexible silicone, chosen for their transparency, UV resistance, and impact strength. Material preparation includes:

- Compounding and drying: Resins are dried to remove moisture that can cause defects during molding.

- Color and additive mixing: UV stabilizers, anti-yellowing agents, or diffusers may be blended into the resin to enhance performance and longevity.

- Sheet extrusion or pelletizing: Depending on the forming technique, materials are either extruded into sheets or prepared as pellets for molding.

2. Forming and Shaping

The core shaping process involves transforming prepared materials into the cover’s desired profile and dimensions. Common techniques include:

- Extrusion: Continuous profiles are formed by pushing molten plastic through shaped dies, ideal for linear LED covers with consistent cross-sections.

- Injection Molding: For complex shapes or end caps, molten resin is injected into molds, allowing high precision and repeatability.

- Thermoforming: Heated sheets are molded over forms to produce curved or custom shapes.

- Silicone molding: For flexible or soft covers, silicone is cast or injection molded.

Each technique demands strict control over temperature, pressure, and cycle times to avoid warping, bubbles, or surface defects.

3. Assembly and Integration

After forming, covers may undergo assembly steps such as:

- Cutting and sizing: Profiles or molded parts are cut to length, often with CNC machinery for accuracy.

- Attachment features: Clips, grooves, or adhesive backing may be integrated or added to facilitate installation on LED strips.

- Sealing or coating: Some covers receive additional coatings (e.g., anti-scratch, anti-glare) or sealing elements to improve environmental resistance.

4. Finishing and Quality Enhancement

Final finishing ensures aesthetic appeal and functional performance:

- Polishing: Surfaces are polished to enhance transparency or diffuse light evenly.

- Surface treatment: UV protection layers or anti-yellowing treatments are applied.

- Inspection and packaging: Covers are cleaned, inspected for defects, and packed in protective materials to prevent damage during transport.

Quality Assurance Framework for LED Strip Light Covers

High-quality LED strip light covers must comply with stringent quality standards to meet diverse international market requirements. B2B buyers should be familiar with the quality assurance (QA) systems and certifications that reputable manufacturers implement.

Key International and Industry Standards

- ISO 9001:2015: The foundational quality management system standard ensuring consistent processes, continuous improvement, and customer satisfaction.

- CE Marking: Mandatory for products sold in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

- RoHS Compliance: Restriction of hazardous substances, critical for electronics-related components.

- UL/CSA Certification: Relevant for North American markets, focusing on safety aspects.

- IP Ratings (Ingress Protection): Defines resistance to dust and water, important for covers used in outdoor or damp environments.

- REACH Compliance: European regulation on chemical substances, ensuring materials used are safe.

Critical Quality Control Checkpoints

Quality control (QC) in manufacturing covers is typically segmented into three main stages:

-

Incoming Quality Control (IQC)

Raw materials and components are inspected for conformity with specifications. This includes verifying resin properties, color consistency, and absence of contaminants. -

In-Process Quality Control (IPQC)

During forming and assembly, dimensional checks, surface inspections, and defect detection (e.g., bubbles, warping) are conducted. Process parameters are monitored to maintain consistency. -

Final Quality Control (FQC)

Finished covers undergo comprehensive testing to ensure optical clarity, mechanical strength, and dimensional accuracy. Packaging integrity and labeling are also verified.

Common Testing Methods

- Visual and Microscopic Inspection: Detects surface defects, inclusions, or discolorations.

- Dimensional Measurement: Uses calipers, gauges, or optical scanners to confirm tolerances.

- Light Transmission and Diffusion Testing: Measures the percentage of light passing through and evaluates diffusion quality using photometric equipment.

- Mechanical Testing: Includes impact resistance, flexibility, and hardness tests to simulate real-world usage.

- Environmental Testing: UV aging, temperature cycling, and humidity exposure tests assess durability.

- Chemical Resistance Tests: Ensures covers withstand cleaning agents and environmental chemicals.

Verifying Supplier Quality Assurance for International B2B Buyers

For buyers in Africa, South America, the Middle East, and Europe, verifying a supplier’s quality assurance processes is crucial to mitigate risks associated with international procurement.

Recommended Verification Practices

-

Factory Audits

Conduct on-site or virtual audits focusing on manufacturing capabilities, quality control systems, and compliance with certifications like ISO 9001. Audits provide insights into process discipline and worker training. -

Review of Quality Documentation

Request and analyze QC reports, inspection records, and material certificates. Verify the authenticity of certifications such as CE, RoHS, or UL. -

Third-Party Inspections

Employ independent inspection agencies to perform pre-shipment inspections (PSI), sample testing, and factory evaluations. This is especially important when direct visits are challenging due to geographic distance. -

Sample Testing and Validation

Obtain and test product samples in accredited labs within the buyer’s region or globally recognized facilities. This confirms conformity with local regulations and performance expectations. -

Supplier Quality Agreements (SQA)

Establish clear contractual terms defining quality standards, inspection protocols, and remedies for non-conformance.

Navigating QC and Certification Nuances by Region

-

Africa & South America:

Many countries are developing local standards; however, international certifications like ISO and CE remain the benchmark. Logistics challenges may require more rigorous pre-shipment inspections and robust packaging standards to prevent damage. -

Middle East:

Import regulations often emphasize safety and environmental compliance (e.g., Gulf Conformity Mark). Buyers should verify suppliers meet both international and regional standards, especially for outdoor applications in harsh climates. -

Europe (e.g., France):

The European market is highly regulated with strict CE marking enforcement and chemical compliance (REACH). Buyers must ensure that suppliers provide full documentation and that products undergo rigorous testing for safety and environmental impact. -

Southeast Asia (e.g., Indonesia):

While standards are evolving, buyers often require compliance with international norms. Local market preferences may influence material choices and product design, so understanding supplier adaptability is essential.

Actionable Insights for B2B Buyers

- Prioritize suppliers with certified ISO 9001 quality management systems and valid international certifications (CE, RoHS).

- Request detailed QC documentation and independent third-party inspection reports before finalizing contracts.

- Factor in regional regulatory requirements and adapt quality criteria accordingly to ensure market acceptance.

- Consider arranging sample testing at accredited labs to validate optical and mechanical properties specific to your application needs.

- Engage in supplier audits focusing not only on product quality but also on manufacturing process controls and workforce competency.

By thoroughly understanding manufacturing processes and quality assurance frameworks, international B2B buyers can make informed decisions, minimize supply chain risks, and secure reliable, high-performance LED strip light covers tailored to their markets.

Related Video: Inside LEDYi LED Strip Factory | Full Manufacturing Process by Leading LED Strip Manufacturer

Comprehensive Cost and Pricing Analysis for covers for led strip lights Sourcing

Understanding the cost structure and pricing dynamics of covers for LED strip lights is crucial for international B2B buyers seeking optimal value and competitive advantage. This analysis dissects the key cost components, price influencers, and strategic buyer considerations to empower procurement decisions, especially for buyers from Africa, South America, the Middle East, and Europe.

Key Cost Components in Covers for LED Strip Lights

-

Materials

The choice of materials—commonly polycarbonate, acrylic, or aluminum—significantly impacts costs. Polycarbonate offers durability and UV resistance but at a higher price point than acrylic. Aluminum covers provide superior heat dissipation but involve more complex manufacturing. Material sourcing location and availability also influence raw material costs. -

Labor and Manufacturing Overhead

Labor costs vary widely depending on the manufacturing country. Regions with lower labor costs can offer competitive pricing but buyers must balance this against quality standards. Manufacturing overhead includes facility costs, utilities, and indirect labor, which scale with production volume.

Illustrative Image (Source: Google Search)

-

Tooling and Setup Fees

Initial tooling for extrusion molds or injection molds can be a significant upfront investment, especially for custom profiles or unique designs. These costs are amortized over order volumes, making higher volumes more cost-effective per unit. -

Quality Control (QC)

QC processes—ranging from dimensional inspections to material certification and durability testing—add to cost but are essential for ensuring product reliability and compliance with international standards. -

Logistics and Shipping

Freight costs, customs duties, and import taxes vary by destination and shipping mode. For international buyers, especially in Africa, South America, and remote regions of Europe, logistics can be a substantial portion of total cost. -

Supplier Margin

Manufacturers and distributors include margins to cover risk, profit, and service. Margins may fluctuate based on market demand, competition, and supplier specialization.

Pricing Influencers to Consider

-

Order Volume and Minimum Order Quantities (MOQ)

Higher volumes typically unlock better pricing through economies of scale. However, MOQ requirements can be a barrier for smaller buyers or those testing new suppliers. Negotiating flexible MOQs can reduce initial investment. -

Specifications and Customization

Customized covers with special dimensions, colors, finishes, or integrated features (e.g., diffusers or clips) increase costs due to tooling complexity and production adjustments. -

Material Grade and Certifications

Premium materials with certifications (e.g., RoHS, REACH, UL) command higher prices but reduce compliance risks in regulated markets such as the EU. -

Supplier Reputation and Location

Established suppliers with proven quality and export experience may charge premiums but offer reliability and faster turnaround. Proximity to buyer markets affects shipping time and cost. -

Incoterms and Payment Terms

Shipping terms like FOB, CIF, or DDP affect total landed cost and risk allocation. Buyers should assess these carefully to avoid unexpected charges. Favorable payment terms (e.g., net 30) can improve cash flow.

Strategic Buyer Tips for International Procurement

-

Negotiate Beyond Price

Leverage volume commitments, repeat business potential, and long-term partnerships to negotiate tooling fee reductions, sample costs, or extended warranties. -

Evaluate Total Cost of Ownership (TCO)

Consider quality-related costs such as returns, replacements, and warranty claims alongside unit price. Cheaper covers may incur higher lifecycle costs. -

Factor in Logistics Efficiency

Consolidate shipments and choose suppliers with regional warehouses or distribution centers to reduce freight costs and lead times. -

Understand Regional Pricing Nuances

Buyers in Africa and South America should anticipate higher logistics and customs costs, making supplier proximity or local distributors advantageous. European buyers, especially in France, benefit from suppliers complying with strict environmental and safety regulations, which influence cost but assure market access. -

Use Incoterms Wisely

For first-time international orders, CIF or DDP terms reduce risk but may carry higher prices. Experienced buyers may prefer FOB to control shipping and logistics. -

Request Transparent Cost Breakdowns

Engage suppliers to provide detailed quotations that separate material, labor, tooling, and logistics costs. This transparency aids in benchmarking and negotiation.

Disclaimer on Pricing

Prices for covers for LED strip lights vary widely based on material choice, customization, order volume, and supplier location. The figures discussed here are indicative and should be validated with direct supplier quotes and market research tailored to your specific sourcing context.

By closely analyzing these cost and pricing factors, international B2B buyers can optimize procurement strategies, secure competitive pricing, and ensure quality and compliance in their LED strip light cover sourcing.

Spotlight on Potential covers for led strip lights Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘covers for led strip lights’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for covers for led strip lights

When sourcing covers for LED strip lights, understanding the critical technical properties and commonly used trade terminology can significantly enhance decision-making and supplier communication. Below are the essential specifications and terms that international B2B buyers, especially from Africa, South America, the Middle East, and Europe, should be familiar with.

Key Technical Properties of LED Strip Light Covers

1. Material Grade

Most LED strip light covers are made from polycarbonate (PC) or acrylic (PMMA). Polycarbonate is favored for its superior impact resistance and heat tolerance, making it ideal for industrial or outdoor applications. Acrylic offers excellent clarity and UV resistance but is less impact-resistant. Selecting the right material grade affects durability, light diffusion, and environmental suitability.

2. Light Transmission & Diffusion

This property defines how much light passes through the cover and how evenly it spreads. Covers can be clear, frosted, or opal. Clear covers maximize brightness but may cause hotspots, whereas frosted or opal diffusers soften the light and reduce glare, enhancing aesthetic appeal. Understanding these differences helps tailor lighting effects to specific projects.

3. Dimensional Tolerance

Tolerance refers to the allowable deviation in cover dimensions (length, width, thickness). Tight tolerance ensures a secure fit with LED strips and mounting channels, preventing dust ingress and mechanical stress. For B2B buyers, specifying tolerance levels guarantees product compatibility and reduces installation issues.

4. IP (Ingress Protection) Rating Compatibility

While covers themselves may not carry an IP rating, their design must complement the LED strip’s IP rating, especially for outdoor or humid environments. Covers that seal well help maintain water and dust resistance, critical for longevity and safety in harsh climates typical in many African and Middle Eastern markets.

5. Heat Resistance and Thermal Conductivity

LED strips generate heat, and covers must withstand elevated temperatures without deforming or yellowing. Materials with good thermal stability prevent premature aging. Buyers should consider the maximum operating temperature of the cover to ensure reliable performance in warm climates or enclosed fixtures.

6. Length and Customization Options

Covers come in standard lengths (e.g., 1m, 2m) but custom lengths are often required for large-scale or specialized projects. Flexible manufacturing partners offering customizable sizes, profiles, and even color tints can provide a competitive advantage for international buyers.

Common Trade Terminology for LED Strip Light Covers

OEM (Original Equipment Manufacturer)

Refers to manufacturers that produce covers based on a buyer’s specifications and branding. OEM services allow buyers to request custom designs, materials, and packaging under their own brand, crucial for companies seeking differentiation in competitive markets.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce or sell per order. MOQs can vary widely depending on the manufacturer and customization level. Understanding MOQ helps buyers plan inventory and budget effectively, especially when importing to regions with fluctuating demand.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for pricing, lead times, and terms based on specific product requirements. Well-prepared RFQs with detailed technical specs for LED strip covers help secure accurate quotes and streamline the procurement process.

Incoterms (International Commercial Terms)

Standardized trade terms defined by the International Chamber of Commerce that clarify the responsibilities of buyers and sellers regarding shipping, insurance, and customs. Common Incoterms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Selecting appropriate Incoterms reduces misunderstandings in international transactions.

Lead Time

The period from order confirmation to delivery. Lead times can be impacted by production complexity, material availability, and shipping logistics. Buyers should negotiate realistic lead times, especially for custom covers, to align with project timelines and avoid costly delays.

Profile Type

Describes the shape and mounting style of the cover, such as “U-shaped,” “diffuser,” or “flat.” Choosing the correct profile ensures compatibility with the LED strip and installation environment, affecting both performance and aesthetics.

Actionable Insights for B2B Buyers

- Specify material and optical properties upfront to ensure the covers meet the environmental and performance demands of your target market.

- Clarify MOQ and lead times early with suppliers to optimize supply chain planning and reduce inventory risks.

- Use precise technical language in RFQs to avoid miscommunication, leveraging terms like tolerance, IP compatibility, and profile type.

- Understand Incoterms thoroughly to negotiate favorable shipping and delivery terms, especially when dealing with suppliers in Asia or Europe.

- Partner with manufacturers offering customization and certification support to meet regional regulatory requirements and differentiate your product offering.

By mastering these technical and trade fundamentals, B2B buyers can make informed purchasing decisions, minimize risks, and build stronger supplier relationships in the global LED lighting market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the covers for led strip lights Sector

Market Overview & Key Trends

The global market for covers for LED strip lights is experiencing robust growth, driven by expanding applications in commercial, architectural, automotive, and residential lighting sectors. Key demand drivers include the rising adoption of LED lighting due to its energy efficiency and longer lifespan, coupled with increasing consumer and industrial emphasis on aesthetic integration and protection of LED strips. For B2B buyers in regions such as Africa, South America, the Middle East, and Europe, understanding regional market dynamics is critical. In Europe, especially in countries like France, stringent regulations on product safety and energy efficiency are shaping procurement strategies, favoring suppliers who can provide certified, high-quality covers. Similarly, emerging markets in Africa and South America are witnessing rapid urbanization and infrastructure development, amplifying demand for durable and weather-resistant covers that can withstand diverse environmental conditions.

From a sourcing perspective, manufacturers are innovating with customizable covers that offer varied diffusion levels, colors, and shapes, enhancing flexibility for different lighting designs. The integration of smart technology compatibility—such as covers designed to work seamlessly with IoT-enabled LED strips—is an emerging trend, particularly relevant for advanced markets in Europe and the Middle East. Supply chain agility is increasingly prioritized; buyers seek manufacturers offering flexible minimum order quantities (MOQs) and fast prototyping to cater to localized needs and reduce inventory risks. Furthermore, digital platforms and virtual sampling tools are gaining traction, enabling international buyers to evaluate product options remotely and streamline decision-making.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a decisive factor in sourcing covers for LED strip lights, with B2B buyers prioritizing environmentally responsible materials and ethical supply chains. The production of covers traditionally relies on plastics such as polycarbonate and acrylic, which pose environmental challenges due to their non-biodegradable nature. Consequently, there is a marked shift toward bio-based polymers and recyclable materials that reduce carbon footprints without compromising durability or optical performance. Suppliers offering covers made from recycled plastics or with reduced VOC (volatile organic compounds) emissions are gaining preference in markets with strict environmental regulations, including the European Union.

Ethical sourcing extends beyond materials to encompass labor practices and transparent supply chains. Buyers from Africa, South America, and the Middle East are increasingly requiring certifications such as ISO 14001 (Environmental Management), RoHS (Restriction of Hazardous Substances), and REACH compliance to ensure product safety and sustainability. Collaborating with manufacturers who provide full traceability and adhere to fair labor standards mitigates reputational risks and aligns with corporate social responsibility (CSR) goals. Additionally, green certifications related to energy-efficient manufacturing processes and packaging innovation—such as minimal or biodegradable packaging—are becoming decisive factors in supplier selection, enabling buyers to meet the growing demand for sustainable LED lighting solutions.

Evolution and Historical Context

Covers for LED strip lights have evolved significantly alongside advancements in LED technology itself. Initially, covers were simple, rigid plastic profiles designed primarily to protect LED strips from dust and mechanical damage. Over time, the function of covers expanded to include light diffusion and aesthetic enhancement, prompting the development of frosted and opal finishes that soften LED brightness and create uniform illumination. This evolution reflects the increasing integration of LED strip lights into interior design and architectural projects, where visual appeal is paramount.

Moreover, as LED strips became more versatile and found applications in outdoor and industrial environments, covers adapted to provide enhanced waterproofing and UV resistance. This shift necessitated innovations in materials and extrusion techniques, positioning covers as critical components for ensuring longevity and performance. Understanding this historical progression helps B2B buyers appreciate the technical nuances and quality benchmarks essential when sourcing covers tailored to specific environmental and design requirements.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of covers for led strip lights

-

How can I effectively vet suppliers of covers for LED strip lights for international orders?

When sourcing covers for LED strip lights internationally, thorough supplier vetting is crucial. Begin by verifying the supplier’s business license and factory certifications, such as ISO or CE, to ensure legitimacy. Request product samples to assess quality and compatibility with your LED strips. Check references and client testimonials, especially from buyers in your region (Africa, South America, Middle East, Europe). Use third-party inspection services for quality audits. Confirm their ability to comply with your technical specifications, lead times, and after-sales support before finalizing any contract. -

What customization options are typically available for LED strip light covers, and how do they affect pricing?

Customization can include material choice (PC, acrylic, silicone), color, diffuser opacity (clear, frosted, milky), length, width, and mounting style (surface mount, recessed). Some suppliers offer branding options such as logo printing or tailored packaging. Customization often requires tooling or design adjustments, which may increase the unit cost and minimum order quantities (MOQs). Discuss your exact requirements upfront to get accurate pricing and lead time estimates. Bulk customization can reduce per-unit costs, making it more economical for larger orders. -

What are the typical minimum order quantities (MOQs) and lead times for international B2B orders of LED strip light covers?

MOQs vary significantly by manufacturer and customization level but generally range from 500 to 5,000 units for standard covers. Custom designs typically require higher MOQs due to tooling costs. Lead times for standard products are usually 2–4 weeks, while customized covers can take 4–8 weeks or longer, especially if new molds are required. It is essential to clarify MOQs and lead times before placing an order to align with your project timelines and inventory planning, particularly when coordinating shipments to regions with longer logistics cycles. -

Which quality assurance standards and certifications should I expect from LED strip light cover suppliers?

Reliable suppliers should provide covers that comply with international standards such as RoHS (Restriction of Hazardous Substances), CE marking for European markets, and UL or ETL certifications if applicable. These certifications ensure safety, environmental compliance, and product reliability. Additionally, inquire about in-house quality control processes like dimensional checks, material testing, and UV resistance assessments. Request test reports or certificates of conformity before purchase, especially for markets with strict regulatory requirements like the EU or Middle East. -

What payment terms are common when purchasing LED strip light covers from overseas suppliers?

Common international payment terms include 30% deposit upfront and 70% balance before shipment or upon delivery. Letters of credit (LC) are popular for larger orders as they provide security for both buyer and supplier. Some suppliers accept PayPal or escrow services for smaller transactions. Negotiate payment terms based on your relationship and order volume; trusted suppliers may offer more flexible terms. Always ensure payment methods comply with your local banking regulations and factor in currency exchange risks when budgeting. -

How should I plan logistics and shipping for importing LED strip light covers to regions like Africa or South America?

Shipping LED strip light covers requires selecting between air freight for faster delivery or sea freight for cost efficiency. Sea freight is preferred for large volumes but requires longer lead times and good port infrastructure at the destination. Use experienced freight forwarders familiar with your target region’s customs regulations to avoid delays. Ensure proper packaging to prevent damage during transit. Consider Incoterms carefully to define responsibilities for shipping costs, insurance, and customs clearance. Early coordination with logistics partners can streamline delivery and reduce unexpected costs. -

What strategies can help resolve disputes or quality issues with international suppliers of LED strip light covers?

Establish clear contractual terms including product specifications, inspection protocols, and dispute resolution mechanisms before ordering. In case of quality issues, document the defects with photos and third-party inspection reports. Communicate promptly and professionally with the supplier to negotiate remedies such as replacements, refunds, or discounts. Using escrow payments or letters of credit can protect your funds during disputes. If negotiations fail, consider mediation or arbitration through trade organizations or chambers of commerce relevant to your sourcing region. -

How do regional market requirements (e.g., Europe vs. Middle East) influence the choice of LED strip light covers?

Different regions have specific regulatory and consumer preferences impacting cover selection. For example, Europe often requires stringent CE and RoHS compliance and favors eco-friendly, recyclable materials. The Middle East market may demand high UV resistance and heat tolerance due to climate. Africa and South America buyers might prioritize durability and cost-effectiveness with flexible MOQ options. Understanding these regional nuances helps in selecting covers that meet local standards and customer expectations, reducing compliance risks and improving market acceptance.

Strategic Sourcing Conclusion and Outlook for covers for led strip lights

In navigating the complex landscape of covers for LED strip lights, strategic sourcing remains paramount for international B2B buyers aiming to optimize quality, cost-efficiency, and supply reliability. Prioritizing suppliers with proven expertise in customization, material innovation, and certifications ensures that product specifications align with regional standards and environmental conditions—critical for markets in Africa, South America, the Middle East, and Europe.

Key takeaways highlight the importance of:

- Evaluating supplier capabilities including in-house design and flexible minimum order quantities to tailor solutions that meet diverse application needs.

- Assessing material durability and environmental resistance, which directly impact product longevity in varying climates.

- Leveraging supply chain transparency to mitigate risks associated with lead times and compliance.

Looking ahead, B2B buyers should actively engage with manufacturers who invest in R&D for smart integration and sustainability, fostering partnerships that drive innovation and competitive advantage. Embracing these strategic principles will empower buyers to secure high-quality covers for LED strip lights that enhance product performance and market differentiation.

For businesses in regions such as France, Indonesia, and beyond, the call to action is clear: adopt a proactive sourcing strategy that balances cost, quality, and agility to thrive in the evolving global LED lighting ecosystem.