Introduction: Navigating the Global Market for battery for led remote

The demand for reliable and efficient batteries tailored for LED remotes is escalating globally, driven by the proliferation of LED lighting solutions across commercial, industrial, and residential sectors. For international B2B buyers—particularly those operating in dynamic markets such as Africa, South America, the Middle East, and Europe (notably Germany and Spain)—securing high-quality batteries is fundamental to ensuring uninterrupted device performance, customer satisfaction, and long-term operational efficiency. These batteries are not merely power sources; they are critical components that influence the durability, responsiveness, and overall user experience of LED remote controls.

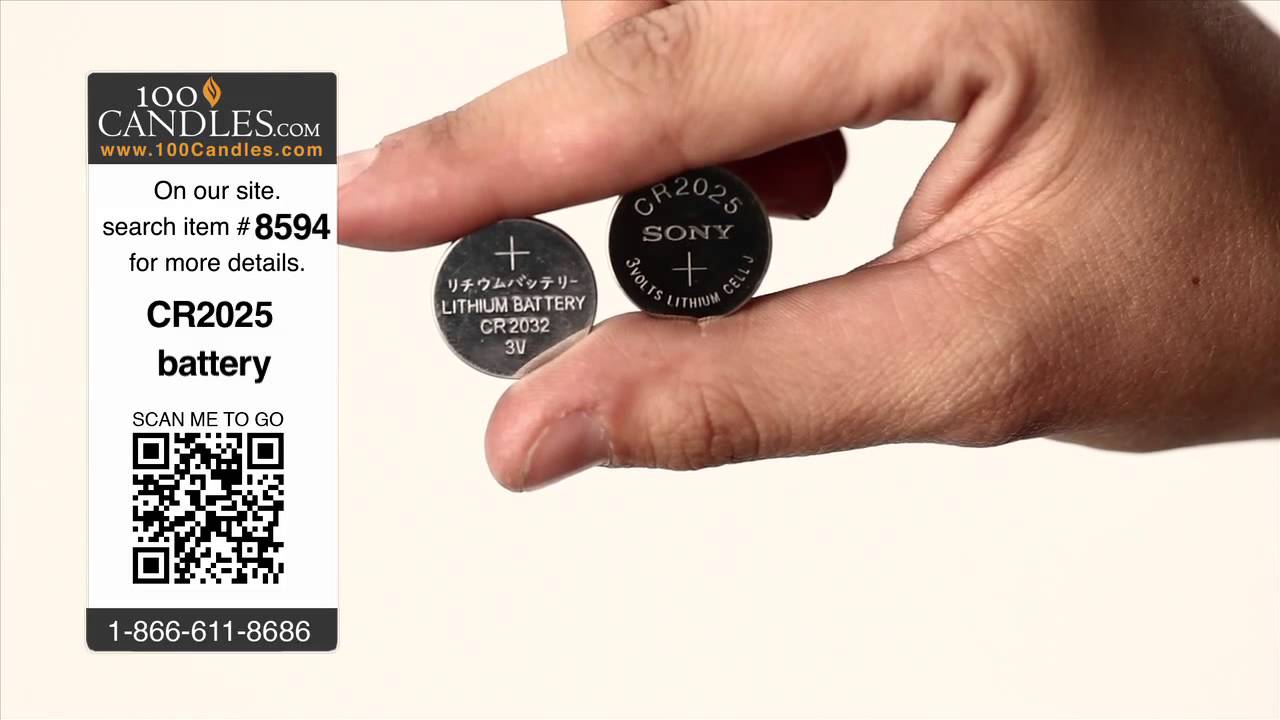

Illustrative Image (Source: Google Search)

Navigating this complex market requires a nuanced understanding of diverse battery types, chemistry, and manufacturing standards that align with regional regulatory requirements and environmental conditions. Buyers must also evaluate supplier reliability, cost structures including total cost of ownership, and after-sales support to mitigate risks associated with counterfeit or substandard products. Furthermore, considerations around sustainability and compliance with international certifications are increasingly shaping procurement strategies.

This comprehensive guide equips B2B buyers with actionable insights into the entire procurement lifecycle for batteries used in LED remotes. It covers key topics such as battery technologies and materials, quality assurance processes, supplier vetting criteria, pricing dynamics, and region-specific market trends. Additionally, practical advice on logistics, warranty management, and frequently asked questions is provided to empower buyers to make informed, strategic sourcing decisions. By leveraging this knowledge, businesses can optimize their supply chain resilience, reduce operational disruptions, and enhance competitive advantage in a rapidly evolving global marketplace.

Understanding battery for led remote Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Alkaline Button Cell | Non-rechargeable, zinc-manganese dioxide chemistry | Standard LED remote controls, low-drain devices | Low cost, widely available; shorter lifespan, non-rechargeable |

| Lithium Coin Cell | High energy density, long shelf life, lightweight | Premium LED remotes, high-performance devices | Long-lasting, stable voltage; higher upfront cost, careful storage needed |

| Rechargeable NiMH Cell | Rechargeable, moderate capacity, environmentally friendly | Specialized LED remotes with recharge feature | Cost-effective over time, eco-friendly; requires charging infrastructure |

| Silver Oxide Button Cell | Stable voltage output, high energy density | High-end LED remotes, precision devices | Reliable performance, longer life; higher cost, limited rechargeability |

| Zinc-Air Battery | Very high energy density, activated by air exposure | Rare or specialized LED remotes, medical devices | Excellent capacity, lightweight; short shelf life once activated, niche availability |

Alkaline Button Cell

Alkaline button cells are the most common batteries used in standard LED remote controls due to their low cost and widespread availability. They are suitable for low-drain devices where replacement frequency is less critical. For B2B buyers, their affordability makes them ideal for bulk procurement targeting cost-sensitive markets such as retail or entry-level electronics across Africa and South America. However, buyers should note their limited lifespan and non-rechargeable nature, which may increase long-term replacement costs.

Lithium Coin Cell

Lithium coin cells offer superior energy density and longer shelf life compared to alkaline types, making them well-suited for premium LED remotes requiring stable voltage over extended periods. They are favored in markets with high expectations for device reliability, such as in Europe and the Middle East. B2B buyers should consider the higher purchase price balanced against reduced replacement frequency and improved customer satisfaction. Proper logistics and storage conditions must be ensured to maintain battery integrity during transit.

Rechargeable NiMH Cell

Nickel-Metal Hydride (NiMH) rechargeable batteries provide an eco-friendly alternative for LED remotes designed with rechargeable capabilities. These cells reduce total cost of ownership by enabling multiple charge cycles, which is attractive for corporate clients or service providers emphasizing sustainability. Buyers should evaluate the compatibility of devices and the availability of charging infrastructure. This option is particularly relevant in regions with growing environmental regulations, such as the EU, where sustainability credentials can be a market differentiator.

Silver Oxide Button Cell

Silver oxide batteries deliver stable voltage and higher energy density than alkaline cells, making them ideal for high-end or precision LED remote controls. Their consistent performance ensures reliable device operation in professional or industrial settings, including specialized lighting controls. For B2B procurement, the trade-off is a higher unit cost and limited recharge options. Buyers should verify supplier quality certifications and ensure the batteries meet regional safety standards to avoid compliance issues.

Zinc-Air Battery

Zinc-air batteries are less common but offer exceptionally high energy density by utilizing oxygen from the air. They are typically used in niche or specialized LED remotes, including medical or assistive technology devices requiring lightweight and long-lasting power sources. Their activation upon exposure to air limits shelf life post-opening, necessitating careful inventory management. B2B buyers should assess demand carefully and work with suppliers experienced in handling these batteries to optimize supply chain efficiency.

Related Video: Battery replacement for rgb led remote

Key Industrial Applications of battery for led remote

| Industry/Sector | Specific Application of battery for led remote | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Commercial Real Estate | Remote control of LED lighting systems in office buildings | Enables energy-efficient lighting management, reducing operational costs and improving occupant comfort | Long battery life, consistent voltage output, compatibility with varied remote designs, and compliance with regional safety standards (CE in Europe, GCC in Middle East) |

| Hospitality & Tourism | Battery-powered LED remote controls for hotel room lighting | Enhances guest experience through convenient lighting control while minimizing maintenance downtime | Reliable battery performance under frequent use, availability of bulk supply, and adherence to environmental regulations for disposal in diverse markets |

| Industrial Manufacturing | Control of LED indicator and task lighting in production lines | Improves operational efficiency by allowing remote adjustments, reducing downtime and manual intervention | Durability under varying temperatures, resistance to vibration, and supplier ability to provide certifications for industrial use |

| Retail & Warehousing | Remote operation of LED lighting in warehouses and stores | Facilitates flexible lighting control to optimize energy use and improve visibility for safety and inventory management | Long-lasting batteries with stable discharge rates, cost-effective bulk purchase options, and logistics support for timely delivery |

| Healthcare Facilities | Remote control of LED lighting in patient rooms and labs | Supports hygienic, touchless lighting control to enhance patient comfort and comply with strict healthcare standards | High reliability, low leakage batteries, compliance with health and safety certifications, and supplier support for urgent replenishment |

In Commercial Real Estate, batteries for LED remotes are critical for managing lighting systems remotely across large office complexes. This application helps facility managers reduce energy consumption by enabling scheduled or sensor-triggered lighting adjustments, which is essential in regions like Europe where sustainability regulations are stringent. Buyers from Africa and South America must ensure batteries can operate reliably in varying climates, while Middle Eastern buyers look for compliance with regional electrical safety standards.

Within the Hospitality & Tourism sector, LED remote batteries power lighting controls in hotel rooms, offering guests seamless convenience. High turnover and frequent use demand batteries with long life and consistent performance to minimize maintenance costs. International buyers should prioritize suppliers offering bulk purchasing options and environmentally friendly disposal solutions, aligning with global sustainability trends and local regulations across diverse markets.

In Industrial Manufacturing, LED remote batteries enable workers to control task lighting and indicator LEDs without interrupting workflows. This reduces downtime and enhances safety on the factory floor. Buyers, especially in Europe and South America, must focus on batteries that withstand industrial conditions such as temperature extremes and vibration, ensuring product certifications that meet local industrial standards.

For Retail & Warehousing, LED remote batteries support flexible lighting control to improve energy efficiency and worker safety. Reliable, long-lasting batteries with stable discharge rates are essential to prevent frequent replacements that disrupt operations. B2B buyers from Africa and the Middle East should also assess suppliers’ logistics capabilities to secure timely deliveries, avoiding inventory shortages that could impact business continuity.

In Healthcare Facilities, LED remote batteries facilitate touchless lighting control, crucial for maintaining hygiene and patient comfort. These batteries must exhibit low self-discharge and meet strict health and safety standards. Buyers in Europe and the Middle East, where regulatory compliance is rigorous, should select suppliers with proven quality assurance and rapid after-sales support to ensure uninterrupted operation in sensitive environments.

Related Video: How To Make A Super Bright LED Light Panel (Battery Powered)

Strategic Material Selection Guide for battery for led remote

When selecting materials for batteries used in LED remotes, international B2B buyers must carefully balance performance, cost, and compliance with regional standards. The choice of battery material directly influences device reliability, lifespan, and environmental compatibility, all critical factors for markets in Africa, South America, the Middle East, and Europe. Below is an analysis of the most common battery materials in this context.

Alkaline Batteries

Key Properties:

Alkaline batteries typically use a zinc anode and manganese dioxide cathode with an alkaline electrolyte. They offer stable voltage output, moderate energy density, and good shelf life. Their performance is reliable across a wide temperature range (-20°C to 54°C), with decent resistance to leakage and corrosion under normal use.

Pros and Cons:

Alkaline batteries are cost-effective and widely available, making them a popular choice for low-drain devices like LED remotes. They require minimal manufacturing complexity and have well-established supply chains globally. However, their energy density and lifespan are lower than lithium alternatives, and they are non-rechargeable, which may increase long-term costs and waste.

Impact on Application:

For LED remotes, alkaline batteries provide sufficient power for moderate usage patterns. Their stable voltage ensures consistent LED performance. However, in high-temperature climates common in parts of Africa and the Middle East, alkaline batteries may degrade faster, necessitating more frequent replacements.

B2B Considerations:

Buyers in Europe (Germany, Spain) should verify compliance with EN and IEC standards for alkaline batteries, such as IEC 60086. In Africa and South America, ASTM and local certifications may apply. Bulk procurement benefits from standardized packaging and compatibility with common remote designs. Environmental disposal regulations are increasingly strict in Europe, so suppliers offering recycling programs add value.

Lithium Coin Cell Batteries (Lithium Manganese Dioxide – Li-MnO2)

Key Properties:

Lithium coin cells offer high energy density, long shelf life (up to 10 years), and excellent performance in extreme temperatures (-30°C to 60°C). They have a stable voltage output and low self-discharge rate, making them ideal for compact, low-drain devices.

Pros and Cons:

These batteries are lightweight and compact, enhancing remote ergonomics. Their longevity reduces replacement frequency, lowering total cost of ownership. However, lithium coin cells are more expensive upfront and require careful handling due to safety concerns. Manufacturing complexity is higher, and supply chains can be sensitive to geopolitical factors affecting lithium availability.

Impact on Application:

For LED remotes used in harsh environments (e.g., industrial settings or regions with wide temperature fluctuations like parts of South America and the Middle East), lithium coin cells ensure consistent performance and reliability. Their small form factor also supports sleek remote designs favored in European markets.

B2B Considerations:

Compliance with UN 38.3 transport regulations and IEC 60086-4 is essential for lithium batteries. European buyers prioritize RoHS and REACH compliance due to environmental regulations. African and South American buyers should confirm import/export restrictions and supplier certifications to avoid counterfeit products. Long-term contracts with reputable suppliers help mitigate supply risks.

Nickel-Metal Hydride (NiMH) Rechargeable Batteries

Key Properties:

NiMH batteries provide moderate energy density with the advantage of rechargeability, supporting hundreds of charge cycles. They operate well in moderate temperature ranges (0°C to 45°C) and have lower self-discharge rates than older NiCd batteries.

Pros and Cons:

Rechargeability significantly reduces waste and lifetime costs, aligning with sustainability goals prominent in European markets. However, NiMH batteries have a higher initial cost and require compatible charging infrastructure. They are bulkier than lithium coin cells, which may limit use in ultra-compact remotes.

Impact on Application:

NiMH batteries suit LED remotes in environments where frequent use and recharging are feasible, such as office settings or homes with charging stations. They are less ideal for remote or outdoor use in regions with limited access to power or in hot climates like parts of Africa and the Middle East due to temperature sensitivity.

B2B Considerations:

Buyers should ensure chargers meet IEC standards (IEC 61951) and that batteries comply with ISO 9001 quality management. European buyers will value suppliers with strong environmental credentials and recycling programs. In emerging markets, availability of compatible chargers and after-sales support is critical for adoption.

Zinc-Air Batteries

Key Properties:

Zinc-air batteries utilize oxygen from the air as a cathode reactant, enabling high energy density and lightweight design. They have a nominal voltage around 1.4V and operate best at moderate temperatures (10°C to 40°C). Their shelf life is limited once activated due to air exposure.

Pros and Cons:

These batteries are cost-effective and environmentally friendly, with minimal heavy metal content. However, they are typically single-use and sensitive to humidity and temperature extremes, which can limit their reliability in hot or humid climates. Manufacturing complexity is moderate, with some supply constraints.

Impact on Application:

Zinc-air batteries are less common in LED remotes but may be chosen for specialized low-drain or eco-friendly products. Their sensitivity to environmental conditions makes them less suitable for markets with extreme climates unless proper packaging is ensured.

B2B Considerations:

Buyers in Europe should confirm compliance with EU battery directives and proper labeling. In Africa and South America, logistical considerations around storage and transport to avoid premature activation are crucial. Supplier transparency on shelf life and handling instructions is a key procurement factor.

| Material | Typical Use Case for battery for led remote | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Alkaline | Standard LED remotes for general consumer markets | Widely available, low upfront cost | Shorter lifespan, non-rechargeable | Low |

| Lithium Coin Cell (Li-MnO2) | High-performance, compact LED remotes for harsh environments | High energy density, long shelf life | Higher cost, strict handling and transport | High |

| Nickel-Metal Hydride (NiMH) | Rechargeable LED remotes in office/home settings | Rechargeable, environmentally friendly | Bulkier size, requires charging infrastructure | Medium |

| Zinc-Air | Eco-friendly or specialized low-drain LED remotes | High energy density, lightweight, eco-friendly | Sensitive to humidity/temperature, limited shelf life | Low to Medium |

This guide assists international B2B buyers in selecting the most appropriate battery material for LED remotes by considering performance, cost, and compliance factors

In-depth Look: Manufacturing Processes and Quality Assurance for battery for led remote

The manufacturing and quality assurance of batteries for LED remotes involve a series of precise, controlled processes designed to ensure product reliability, safety, and performance—critical factors for international B2B buyers. Understanding these processes and quality standards empowers buyers from Africa, South America, the Middle East, and Europe to make informed sourcing decisions that align with their operational and regulatory requirements.

Manufacturing Processes for Batteries in LED Remotes

The production of batteries for LED remotes generally follows a structured sequence of stages, each employing specialized techniques to guarantee consistency and longevity.

1. Material Preparation

Raw materials—primarily active chemicals, electrode foils, separators, and casing materials—are carefully selected based on purity and compliance with safety standards. For alkaline batteries, for example, the cathode mixture (manganese dioxide and carbon powder) and anode material (zinc powder) undergo rigorous testing before processing. In lithium-based batteries, the preparation of lithium compounds and electrolytes demands precision to ensure stable electrochemical performance. Suppliers typically source materials from certified vendors to maintain supply chain integrity.

2. Electrode Formation

Electrodes are created by coating metal foils with active materials. This step requires advanced coating machines to achieve uniform thickness and surface quality. After coating, electrodes undergo drying in controlled environments to eliminate moisture, which can degrade battery life. The electrodes are then rolled or stacked depending on battery design, influencing energy density and size.

3. Cell Assembly

This stage involves assembling the electrodes, separators, electrolyte filling, and casing. Automated machinery ensures precise alignment and sealing, critical for avoiding leaks and short circuits. For cylindrical alkaline batteries common in LED remotes, the assembly includes inserting anode and cathode components into metal cans, followed by sealing with safety vents. Lithium batteries require inert atmosphere assembly to prevent oxidation. This phase is highly sensitive to contamination and requires cleanroom conditions in many cases.

4. Formation and Aging

Once assembled, cells undergo a formation process where they are charged and discharged under controlled conditions to activate chemical reactions and stabilize performance. Aging allows internal components to settle, reducing the risk of early failures. This phase can last from hours to days depending on battery chemistry and manufacturer protocols.

5. Finishing and Packaging

Final steps include applying external labels, protective coatings, and packaging according to buyer specifications. Packaging is designed to protect batteries during transportation and storage, complying with international shipping regulations.

Quality Assurance and Control (QA/QC) in Battery Manufacturing

For B2B buyers, the integrity of the battery supply hinges on rigorous quality management systems and adherence to international and industry-specific standards.

Relevant International and Industry Standards

– ISO 9001: The cornerstone quality management system standard that ensures consistent production processes and continuous improvement. Buyers should verify supplier certification to ISO 9001 as a baseline for quality assurance.

– IEC 60086 Series: International standards specifically governing primary batteries, addressing safety, dimensions, and performance.

– CE Marking: Essential for products sold in Europe, indicating compliance with EU safety, health, and environmental protection requirements.

– UN38.3: A critical standard for lithium battery transport safety, ensuring batteries can withstand conditions during shipping without hazards.

– RoHS Compliance: Restricts hazardous substances in batteries, crucial for buyers in Europe and increasingly relevant worldwide.

– Additional Regional Certifications: For example, the Gulf Cooperation Council (GCC) standards in the Middle East or INMETRO in South America may apply depending on end markets.

QC Checkpoints Throughout Production

– Incoming Quality Control (IQC): Inspection and testing of raw materials and components before production. Ensures suppliers meet material specifications and regulatory compliance.

– In-Process Quality Control (IPQC): Continuous monitoring during manufacturing stages such as electrode coating thickness, electrolyte purity, and assembly precision. This reduces defects early and ensures process consistency.

– Final Quality Control (FQC): Comprehensive testing on finished batteries, including capacity, voltage, leakage, and safety tests (e.g., short-circuit, overcharge, and drop tests). Only batteries passing these stringent checks are approved for shipment.

Common Testing Methods

– Capacity and Discharge Testing: Measures how long the battery can power a device under specific loads, simulating real-world usage conditions for LED remotes.

– Leakage and Corrosion Tests: Batteries are subjected to humidity and temperature stress to ensure casing integrity and electrolyte containment.

– Safety and Abuse Tests: Includes nail penetration, crush, thermal stability, and overcharge tests to verify resistance to misuse and environmental extremes.

– Visual and Dimensional Inspections: Automated and manual checks to detect physical defects or deviations from design tolerances.

Verifying Supplier Quality Assurance for International B2B Buyers

Due diligence in supplier quality management is essential to mitigate risks such as product failure, regulatory non-compliance, and reputational damage.

1. Supplier Audits

Conducting on-site audits or engaging third-party audit firms provides direct insight into a supplier’s manufacturing environment, process controls, and quality culture. Audits should assess compliance with ISO 9001 and industry standards, cleanliness of production areas, traceability systems, and employee training programs.

2. Quality Documentation and Reporting

Request comprehensive quality documentation, including Certificates of Analysis (CoA), material test reports, and batch traceability records. Suppliers should also provide detailed QC test results for each production lot and evidence of compliance with regulatory standards relevant to the buyer’s region.

3. Third-Party Inspections and Testing

Independent labs can verify battery performance, safety, and certification claims before shipment. This is particularly valuable for buyers in Africa, South America, and the Middle East, where local regulatory frameworks may require additional validation or where logistics complexity demands risk mitigation.

4. Sample Testing and Pilot Orders

Prior to large-scale procurement, buyers should request samples for in-house or third-party testing to validate supplier claims on capacity, compatibility with LED remote devices, and environmental robustness.

Navigating QC and Regulatory Nuances Across Regions

Africa and South America:

Buyers should prioritize suppliers who provide clear documentation on battery safety and environmental compliance, considering emerging local regulations on hazardous materials and waste management. Ensuring batteries meet global standards like IEC and UN38.3 helps facilitate import approvals and reduces customs delays.

Middle East:

Given the region’s hot climate, batteries must demonstrate stable performance under high temperature conditions. Buyers should verify suppliers conduct thermal cycling tests and provide certifications accepted by Gulf Cooperation Council (GCC) authorities. Timely delivery and supplier flexibility to meet urgent demand fluctuations are also critical.

Europe (e.g., Germany, Spain):

European buyers face stringent regulatory requirements, including CE marking, RoHS, and REACH compliance. Suppliers must provide full transparency on material sourcing and lifecycle environmental impact. ISO 9001 certification is often a minimum expectation, and suppliers capable of supporting extensive audits and traceability are preferred. Additionally, compliance with the Battery Directive and Extended Producer Responsibility (EPR) regulations is essential.

Key Takeaways for B2B Buyers

- Demand transparency and certification: Always verify supplier certifications such as ISO 9001, CE, and UN38.3 to ensure product quality and regulatory compliance.

- Insist on rigorous QC processes: Confirm that suppliers implement IQC, IPQC, and FQC with documented results and allow third-party testing or audits.

- Adapt sourcing strategy to regional requirements: Understand specific regulatory and environmental conditions in your market to select batteries optimized for performance and compliance.

- Leverage pilot testing: Use sample orders and independent lab testing to validate supplier claims and mitigate risk before scaling purchases.

- Focus on supplier reliability: Evaluate suppliers’ capacity for consistent quality, timely delivery, and after-sales support to build resilient supply chains.

By thoroughly understanding the manufacturing processes and quality assurance frameworks behind batteries for LED remotes, international B2B buyers can secure dependable products that meet their performance, safety, and compliance needs—ultimately driving business success across diverse global markets.

Related Video: Battery Manufacturing Process | Vehicle Battery Mass Production in Factory | Unbox Engineering

Comprehensive Cost and Pricing Analysis for battery for led remote Sourcing

Understanding the cost and pricing dynamics of batteries for LED remotes is essential for international B2B buyers aiming to optimize procurement strategies across diverse markets such as Africa, South America, the Middle East, and Europe. This analysis breaks down the key cost components, price influencers, and practical buyer considerations to support informed decision-making and cost efficiency.

Key Cost Components in Battery Sourcing

-

Materials

The core raw materials—primarily alkaline or lithium chemistries—constitute a significant portion of the cost. Prices fluctuate with global commodity markets, impacting the cost of zinc, manganese dioxide, lithium compounds, and casing materials. Quality and purity of materials directly affect battery performance and longevity. -

Labor and Manufacturing Overhead

Labor costs vary widely depending on the manufacturing country. Regions with advanced automation may have lower labor input but higher capital expenses. Overhead includes factory utilities, maintenance, and administrative costs, which scale with production volume. -

Tooling and Equipment

Initial tooling investments for battery casing molds, assembly lines, and testing equipment can be substantial. These fixed costs are amortized over production runs, so higher volumes reduce per-unit tooling cost. -

Quality Control (QC)

Rigorous QC processes—including capacity testing, leakage checks, and certification compliance—add to costs but are critical for reliability. Batteries destined for regulated markets (e.g., CE marking in Europe) require additional testing and documentation. -

Logistics and Freight

Shipping costs depend on origin-destination pairs, transport mode, and current global freight rates. Batteries are classified as hazardous goods in many jurisdictions, necessitating specialized packaging and compliance with international transport regulations, which increases cost. -

Supplier Margin

Suppliers incorporate margins to cover risks, service, and profit. Margins vary by supplier reputation, contract terms, and market competition.

Price Influencers in Battery Procurement

-

Order Volume and MOQ (Minimum Order Quantity)

Larger orders typically secure better unit pricing due to economies of scale and lower relative tooling and shipping costs. However, buyers should balance volume discounts against inventory holding costs and product shelf life. -

Specifications and Customization

Custom sizes, branded packaging, or enhanced performance features (e.g., longer shelf life, high-drain capability) elevate costs. Standard AA or AAA alkaline batteries are generally the most cost-effective. -

Material Quality and Certifications

Batteries with certifications such as CE, RoHS, UN38.3 (transport safety), and IEC standards command higher prices but reduce risks of regulatory issues and returns. -

Supplier Reliability and Service

Established suppliers with proven quality, technical support, and flexible payment terms may charge premiums but reduce operational risk. -

Incoterms and Payment Terms

Delivery terms (e.g., FOB, CIF, DDP) influence the landed cost. Buyers in regions with complex customs procedures (like parts of Africa and South America) should consider DDP (Delivered Duty Paid) for smoother logistics, albeit at higher upfront cost.

Strategic Buyer Tips for International B2B Procurement

-

Negotiate Beyond Unit Price

Focus on total value including warranty, after-sales support, and logistics reliability. Request detailed cost breakdowns to identify negotiable components like tooling amortization or freight consolidation. -

Evaluate Total Cost of Ownership (TCO)

Consider battery lifespan, replacement frequency, and disposal costs. For example, lithium batteries may have higher upfront costs but reduce long-term maintenance and replacement expenses. -

Understand Regional Market Nuances

Buyers from Africa and South America should prioritize suppliers with strong logistics networks and compliance expertise to mitigate customs delays and import taxes. European buyers, particularly in Germany and Spain, often require strict adherence to environmental and safety standards, influencing price and supplier selection. -

Leverage Volume Commitments and Long-Term Contracts

Where feasible, negotiate framework agreements for steady supply and price stability, especially in volatile commodity markets. -

Assess Currency Fluctuation Risks

For buyers in emerging markets, consider contracts in stable currencies or include clauses to manage exchange rate volatility, protecting procurement budgets.

Indicative Pricing Disclaimer

Battery prices vary significantly based on order size, specification, certification, and market conditions. For standard alkaline batteries suitable for LED remotes, unit costs typically range from $0.10 to $0.50 per piece, excluding shipping and taxes. Custom or certified batteries command premium pricing. Buyers should request formal quotations tailored to their specific requirements.

By dissecting these cost and pricing factors, international B2B buyers can strategically navigate the complexities of sourcing batteries for LED remotes. This approach fosters cost efficiency, risk mitigation, and supplier collaboration aligned with regional market demands.

Spotlight on Potential battery for led remote Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘battery for led remote’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for battery for led remote

Critical Technical Properties of Batteries for LED Remotes

When sourcing batteries for LED remotes, understanding key technical properties is essential for ensuring device compatibility, reliability, and cost-effectiveness. Below are the most critical specifications that B2B buyers should evaluate:

-

Battery Chemistry (Material Grade):

Common chemistries include alkaline and lithium variants. Alkaline batteries are cost-effective for low-drain devices like LED remotes, while lithium batteries offer longer shelf life and better performance in extreme temperatures. Selecting the right chemistry impacts device longevity and customer satisfaction, especially in diverse climates across Africa, South America, the Middle East, and Europe. -

Voltage Rating:

Standard LED remote batteries typically operate at 1.5V (alkaline) or 3V (lithium coin cells). Matching the correct voltage is vital to ensure proper remote function and avoid damage. Buyers must verify that suppliers provide batteries conforming to the exact voltage specifications required by their LED remote models. -

Capacity (mAh – milliampere-hour):

Capacity determines how long the battery powers the remote before replacement. Higher mAh ratings mean longer service life, reducing frequency of replacements and operational downtime. For B2B buyers, especially those managing large inventories or servicing contracts, optimizing capacity translates into lower total cost of ownership. -

Tolerance and Consistency:

Battery tolerance refers to the acceptable variance in voltage and capacity from the nominal value. Tight tolerances ensure predictable device performance and reduce failure rates. Reliable suppliers provide batteries with consistent quality and documented tolerance ranges, which is critical for maintaining brand reputation and minimizing after-sales issues. -

Shelf Life and Storage Conditions:

Batteries degrade over time, even when unused. Shelf life is typically 5 to 10 years for alkaline and lithium batteries but varies by manufacturer. Buyers should request data sheets detailing shelf life and recommended storage conditions to avoid stock losses, especially when importing large volumes or serving geographically distant markets. -

Dimensions and Form Factor:

The physical size and shape of the battery must precisely match the LED remote’s battery compartment. Standard sizes include AA, AAA, and coin cells like CR2032. Ensuring dimensional compliance prevents compatibility issues and costly returns.

Key Trade Terminology for B2B Battery Procurement

Understanding common trade terms helps international buyers navigate negotiations, contracts, and logistics with confidence. Below are essential terms frequently encountered in battery procurement:

-

OEM (Original Equipment Manufacturer):

Refers to the company that originally manufactures the battery or the LED remote device. Purchasing OEM batteries often guarantees compatibility and quality but may come at a premium. Some buyers opt for OEM-approved aftermarket batteries to balance cost and reliability. -

MOQ (Minimum Order Quantity):

The smallest quantity a supplier is willing to sell in one order. MOQs vary widely depending on supplier capabilities and battery type. B2B buyers should consider MOQs in relation to their inventory needs and storage capacity to avoid excess stock or supply shortages. -

RFQ (Request for Quotation):

A formal inquiry sent by buyers to suppliers asking for pricing, lead times, and terms for specific battery models and quantities. A well-prepared RFQ includes technical specs, certifications required, and delivery expectations, enabling suppliers to provide accurate and comparable quotes. -

Incoterms (International Commercial Terms):

Standardized trade terms that define responsibilities between buyer and seller for shipping, insurance, and customs. Common Incoterms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Selecting the appropriate Incoterm impacts total landed cost and risk allocation, crucial for buyers importing batteries internationally. -

Certification and Compliance:

Batteries must meet regional safety and environmental standards such as CE (Europe), RoHS (Restriction of Hazardous Substances), or UN38.3 (transport safety for lithium batteries). Verifying certifications protects buyers from regulatory penalties and ensures market access. -

Lead Time:

The period from order placement to delivery. Lead times affect inventory planning and customer service. Buyers should clarify lead times upfront and consider supplier reliability and logistics capabilities, especially when serving multiple international regions with varying customs processes.

By carefully assessing these technical properties and mastering key trade terms, international B2B buyers can make informed decisions, mitigate risks, and establish strong supply chains for batteries powering LED remotes. This strategic approach is particularly valuable when operating across diverse markets with distinct operational and regulatory challenges.

Illustrative Image (Source: Google Search)

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the battery for led remote Sector

Market Overview & Key Trends

The global market for batteries used in LED remote controls is shaped by increasing demand for energy-efficient and reliable power sources in consumer electronics and commercial lighting systems. As LED lighting adoption accelerates worldwide, particularly in emerging and established markets such as Africa, South America, the Middle East, and Europe, B2B buyers face a dynamic sourcing landscape driven by evolving technology, regional regulatory requirements, and supply chain complexities.

Key market drivers include the widespread transition to LED technology for cost savings and environmental benefits, which boosts demand for compact, long-lasting batteries tailored for remote controls. In Africa and South America, expanding urbanization and rising middle-class consumption fuel growth, with buyers prioritizing affordable yet durable battery options that withstand varied climatic conditions. Meanwhile, in the Middle East and Europe—especially countries like Germany and Spain—buyers focus heavily on compliance with stringent safety and environmental standards, such as CE and RoHS certifications, as well as the integration of rechargeable and eco-friendly battery technologies.

Sourcing trends highlight a shift towards lithium-ion and advanced alkaline batteries offering longer life cycles and better performance under temperature extremes common in many regions. B2B buyers increasingly seek suppliers capable of delivering consistent quality at scale, with flexible customization to meet device-specific voltage and size requirements. Strategic partnerships with manufacturers providing end-to-end support, from technical consultation to after-sales service, are becoming critical for minimizing downtime and ensuring supply continuity.

Additionally, market dynamics are influenced by geopolitical factors and raw material availability, impacting battery costs and lead times. Buyers are advised to diversify their supplier base across multiple regions to mitigate risks and leverage competitive pricing. Digital procurement platforms and data-driven supplier evaluation tools are gaining traction, enabling more transparent and efficient sourcing decisions.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a cornerstone in battery procurement for LED remotes, reflecting broader corporate responsibility goals and regulatory pressures globally. Batteries contain metals like lithium, cobalt, and nickel, which pose environmental and social challenges if mined or disposed of irresponsibly. For B2B buyers, embedding sustainability into the sourcing process not only mitigates reputational risks but can also unlock long-term cost efficiencies through circular economy practices.

Ethical sourcing involves partnering with suppliers who adhere to responsible mining standards and maintain transparent supply chains free from conflict minerals. Certifications such as the Responsible Minerals Initiative (RMI) and adherence to International Labour Organization (ILO) standards are increasingly demanded in Europe and the Middle East, where regulatory frameworks penalize non-compliance. Buyers from Africa and South America, often closer to raw material sources, have unique opportunities to foster sustainable local supply ecosystems that benefit communities and ensure traceability.

Green certifications like UL Environment’s Zero Waste to Landfill or ISO 14001 environmental management systems signal supplier commitment to reducing carbon footprint and waste. Additionally, many B2B buyers are prioritizing batteries with recyclable components or those designed for easy disassembly to facilitate end-of-life recycling. Rechargeable lithium-ion batteries are favored over disposable alkaline variants, aligning with energy efficiency and waste reduction targets.

Integrating sustainability criteria in supplier evaluation — including lifecycle assessments, carbon emissions reporting, and social impact audits — empowers buyers to build resilient supply chains that support circular economy principles. This proactive approach also aligns with growing buyer expectations and regulatory mandates in Europe and the Middle East, helping businesses stay ahead of compliance and market demands.

Evolution of Batteries for LED Remotes

The battery technology powering LED remote controls has evolved significantly over the past decades, transitioning from simple disposable alkaline cells to more sophisticated, energy-dense chemistries. Initially, zinc-carbon and alkaline batteries dominated the market due to low cost and adequate performance for low-drain remote devices.

With the rise of LED lighting and increasingly feature-rich remote controls, battery requirements have shifted toward longer lifespan, stable voltage output, and better temperature tolerance. This led to the adoption of lithium-ion and advanced alkaline batteries, which offer higher energy densities and rechargeability options. The miniaturization of battery cells and improvements in battery management systems have further enhanced reliability and user convenience.

Today’s B2B buyers benefit from a diverse range of battery options tailored specifically for LED remote controls, balancing cost, performance, and environmental impact. This evolution reflects broader trends in electronics and energy storage, emphasizing sustainability, safety, and supply chain transparency as essential components of modern procurement strategies.

Related Video: Trade and tariffs | APⓇ Microeconomics | Khan Academy

Frequently Asked Questions (FAQs) for B2B Buyers of battery for led remote

1. How can I effectively vet suppliers of batteries for LED remotes in diverse international markets?

Supplier vetting should focus on verifying certifications relevant to your region, such as CE and RoHS for Europe or other local standards for Africa, the Middle East, and South America. Request detailed product datasheets, samples for quality testing, and proof of factory audits. Check the supplier’s track record with international clients, shipping reliability, and after-sales support. Leveraging third-party inspection services and references from existing customers can mitigate risks. Strong communication and transparency about production processes and quality controls are essential for building a trustworthy partnership.

2. Is customization of battery specifications (size, chemistry, capacity) feasible for LED remote applications?

Yes, many B2B suppliers offer customization options tailored to LED remote requirements, including battery size, voltage, chemistry (alkaline, lithium-ion), and capacity. Customization can improve device performance and battery life, particularly for specialized or branded LED remotes. When negotiating, clarify minimum order quantities (MOQs), lead times, and any additional costs. Ensure the supplier can comply with your target market’s safety and environmental regulations. Collaborating early with suppliers on design and testing helps avoid costly modifications later in the supply chain.

3. What are typical minimum order quantities (MOQs) and lead times for batteries used in LED remotes?

MOQs vary widely depending on supplier capabilities and battery type but generally start from 1,000 units for standard alkaline or lithium coin cells. Lead times typically range from 4 to 8 weeks, factoring in production schedules and international shipping. For buyers in regions like Africa and South America, longer transit and customs clearance times should be anticipated. Negotiating flexible MOQs or phased deliveries can reduce inventory risk. Establishing long-term contracts with suppliers may also secure better pricing and priority manufacturing slots.

4. Which quality assurance measures and certifications should I insist on for batteries powering LED remotes?

Demand batteries that comply with international safety and environmental standards such as CE, RoHS, UN38.3 (for lithium batteries), and IEC certifications. Quality assurance should include production batch testing, capacity verification, and lifecycle assessments. Request certificates of analysis and test reports from accredited labs. For European buyers, compliance with REACH and WEEE directives is crucial. Insist on traceability documentation to ensure consistent quality and facilitate recall management if necessary. Regular supplier audits and third-party inspections reinforce quality assurance.

5. How can I optimize logistics and shipping for bulk battery imports to regions like the Middle East or Africa?

Batteries are classified as hazardous goods, requiring compliance with IATA and IMDG regulations for air and sea freight. Work with logistics partners experienced in handling hazardous shipments to avoid delays. Consolidate shipments where possible to reduce costs, and plan for customs clearance by ensuring all documentation (MSDS, certificates, invoices) is accurate and complete. Consider local warehousing solutions to buffer against transit disruptions. For high-demand markets, establishing regional distribution centers can enhance supply chain responsiveness.

6. What payment terms are standard in international B2B battery procurement, and how can I mitigate financial risks?

Common payment terms include 30-60 days net after shipment, letters of credit, or partial upfront deposits with balance on delivery. Negotiating escrow arrangements or using trade finance instruments can protect both buyer and supplier. For new or smaller buyers, starting with smaller orders and progressive payments builds trust. Always verify supplier credentials before releasing funds and use secure payment platforms. Insurance options for goods in transit and credit insurance for receivables add layers of financial security.

7. How should I handle disputes related to battery quality or shipment delays in international transactions?

First, maintain clear, documented communication channels and detailed contracts specifying quality standards, inspection procedures, and delivery timelines. In case of disputes, promptly engage the supplier with evidence such as test reports or photos. Utilize arbitration clauses or international trade dispute resolution bodies like the ICC if negotiations stall. Establishing a local legal advisor familiar with international trade law is beneficial. Proactive risk management, including penalty clauses for delays and quality failures, helps minimize disputes.

8. Are there environmental or sustainability considerations I should prioritize when sourcing batteries for LED remotes?

Absolutely. Prioritize suppliers who use environmentally responsible materials and comply with directives like RoHS and WEEE, which restrict hazardous substances and mandate recycling. Lithium-ion batteries, while efficient, require proper end-of-life management to avoid environmental damage. Investigate supplier initiatives on battery recycling programs and take-back schemes. Sustainability credentials can also enhance your company’s corporate social responsibility profile, increasingly important in Europe and the Middle East. Request lifecycle impact data to inform greener procurement decisions.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for battery for led remote

Strategic sourcing of batteries for LED remotes is a critical lever for international B2B buyers aiming to optimize product performance, cost efficiency, and supply chain resilience. Prioritizing battery compatibility, certification compliance, and supplier reliability ensures that your LED remotes deliver consistent functionality and longevity—key factors in customer satisfaction and brand reputation. Buyers should also weigh total cost of ownership by considering battery lifespan, disposal requirements, and potential logistics challenges, especially when sourcing across regions like Africa, South America, the Middle East, and Europe.

For markets with diverse climatic and regulatory conditions, selecting suppliers who demonstrate robust quality control, environmental responsibility, and flexible delivery capabilities can mitigate risk and enhance operational continuity. Additionally, adopting a forward-looking approach by monitoring innovations in battery technology—such as improvements in lithium-ion or eco-friendly chemistries—can unlock competitive advantages and support sustainability goals.

As global demand for efficient LED solutions grows, international buyers are encouraged to forge strategic partnerships with trusted manufacturers and distributors who align with regional market needs and compliance standards. Embrace data-driven sourcing decisions and proactive supplier engagement to future-proof your procurement strategy and capitalize on emerging opportunities in the dynamic LED remote battery landscape.