Introduction: Navigating the Global Market for auto led strip lights

In today’s rapidly evolving automotive and lighting industries, auto LED strip lights have emerged as essential components for enhancing vehicle aesthetics, safety, and functionality. Their energy efficiency, durability, and adaptability make them indispensable for automotive manufacturers, aftermarket suppliers, and fleet operators alike. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—understanding the complexities of sourcing high-quality auto LED strip lights is critical to staying competitive and meeting diverse customer demands.

This comprehensive guide offers an authoritative roadmap to navigating the global market for auto LED strip lights. It covers a wide spectrum of topics including the latest product types, advanced materials, manufacturing standards, and stringent quality control processes that ensure reliability and performance. Additionally, the guide delves into supplier evaluation, cost analysis, and market trends, empowering buyers to make data-driven sourcing decisions.

By addressing region-specific challenges—such as supply chain logistics, regulatory compliance, and local market preferences—this resource equips international buyers from countries like South Africa and Saudi Arabia with actionable insights. Whether you are looking to optimize procurement strategies, reduce costs, or secure cutting-edge technology, this guide is designed to support your business in achieving operational excellence and sustainable growth in the competitive auto lighting sector.

Understanding auto led strip lights Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Single-Color LED Strips | Emit a uniform, fixed color (commonly white, red, blue) | Basic automotive lighting, accent lighting | Pros: Cost-effective, simple installation; Cons: Limited customization |

| RGB LED Strips | Capable of producing multiple colors via integrated RGB LEDs | Mood lighting, customizable interior/exterior lighting | Pros: Highly customizable colors; Cons: Higher cost, requires controllers |

| Waterproof LED Strips | Encased in silicone or epoxy for water and dust resistance | Exterior vehicle lighting, off-road vehicles | Pros: Durable and weather-resistant; Cons: Slightly higher price, less flexible |

| High-Brightness LED Strips | Higher lumen output for enhanced visibility and safety | Headlights, brake lights, indicator lights | Pros: Improved safety and visibility; Cons: Higher power consumption |

| Smart LED Strips | Integrated with smart controls, app compatibility, and sensors | Advanced vehicle lighting systems, fleet management | Pros: Remote control, programmable effects; Cons: Complexity, higher upfront cost |

Single-Color LED Strips

Single-color LED strips are the most basic and widely used type in automotive applications. Typically available in white or standard colors like red and blue, these strips provide consistent illumination suited for accent lighting or basic functional lighting such as interior cabin lights or simple exterior highlights. For B2B buyers, these strips offer an economical option with straightforward installation and minimal compatibility concerns. However, they lack the flexibility of color change, making them less suitable for projects requiring dynamic lighting effects.

RGB LED Strips

RGB LED strips incorporate red, green, and blue LEDs to create millions of color combinations through a controller. This versatility makes them ideal for businesses targeting automotive customization markets or luxury vehicle interiors where mood and ambiance lighting are valued. Buyers should consider the additional cost of controllers and the need for compatible power supplies. Customization options and branding opportunities are strong selling points, especially for distributors and automotive accessory retailers in regions with growing personalization trends.

Waterproof LED Strips

Designed with protective silicone or epoxy coatings, waterproof LED strips are essential for external automotive applications exposed to weather, dust, and moisture. These are commonly used for undercarriage lighting, off-road vehicles, and exterior accents. For international B2B buyers in climates with heavy rainfall or dusty conditions (such as parts of the Middle East and Africa), waterproof LED strips provide durability and reliability. The trade-off is a slight reduction in flexibility and a moderate increase in price, which should be factored into procurement decisions.

High-Brightness LED Strips

High-brightness strips feature LEDs with increased lumen output, enhancing visibility for safety-critical functions like headlights, brake lights, and turn indicators. These are crucial for commercial vehicle fleets, taxis, and public transport vehicles where compliance with safety standards is mandatory. Buyers should evaluate power requirements and heat dissipation needs, as these strips consume more energy and may require specialized drivers. Their superior brightness can justify higher costs through improved safety and regulatory compliance.

Smart LED Strips

Smart LED strips integrate advanced features such as wireless control, programmable lighting patterns, and sensor responsiveness. These are suited for innovative automotive lighting solutions, including fleet management systems where lighting can signal vehicle status or enhance brand visibility dynamically. While offering cutting-edge capabilities, smart strips involve higher initial investment and technical complexity. B2B buyers should assess the compatibility with existing vehicle electronics and the potential for after-sales support and software updates to maximize value.

Related Video: 2019/2020 Toyota RAV4 headlight LED strip install DRL/SIGNAL

Key Industrial Applications of auto led strip lights

| Industry/Sector | Specific Application of auto led strip lights | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | Interior ambient lighting and dashboard illumination | Enhances vehicle aesthetics and driver experience; reduces energy consumption | Durable, flexible strips with consistent color and brightness; compliance with automotive standards; heat resistance |

| Transportation & Logistics | Cargo area and vehicle exterior lighting | Improves visibility and safety during loading/unloading; reduces maintenance costs | Waterproof, shock-resistant, and energy-efficient strips; easy installation and replacement |

| Industrial Equipment | Machine status indicators and workspace illumination | Increases operational safety and efficiency; reduces downtime | High-lumen, long-life strips with robust protection against dust and vibrations |

| Commercial Vehicle Fleets | Customizable lighting for branding and safety | Strengthens brand visibility; improves night-time road safety | Custom color options, durable and weatherproof strips; scalable supply for fleet size |

| Public Infrastructure | Roadside and tunnel lighting for vehicles | Enhances driver safety and infrastructure visibility; energy savings | High brightness, weatherproof, and long-lasting LED strips; compliance with regional safety standards |

Automotive Manufacturing

In automotive manufacturing, auto LED strip lights are primarily used for interior ambient lighting and dashboard illumination. These strips provide customizable lighting that improves the overall aesthetic appeal and comfort inside vehicles, which is a key selling point in premium and mid-range markets. For international B2B buyers in regions like South Africa or Saudi Arabia, sourcing LED strips that comply with automotive industry standards and offer heat resistance is critical due to varying climate conditions. The flexibility and durability of strips ensure seamless integration in confined and curved interior spaces.

Transportation & Logistics

Auto LED strip lights play a vital role in cargo area and exterior vehicle lighting within transportation and logistics industries. They enhance visibility during loading and unloading operations, significantly reducing accidents and operational delays. Buyers from South America or Europe should prioritize waterproof and shock-resistant LED strips to withstand harsh environmental conditions and frequent vehicle movement. Energy-efficient lighting also lowers operational costs, which is essential for fleet operators managing large vehicle numbers.

Industrial Equipment

In industrial settings, auto LED strip lights are extensively used as machine status indicators and for workspace illumination. These applications improve safety by providing clear visual signals of machine operation states and ensuring well-lit working environments. For B2B buyers in the Middle East or Africa, selecting LED strips with high lumen output and robust protection against dust and vibrations is paramount to maintain long-term reliability in demanding industrial environments. Long lifespan LEDs reduce maintenance frequency and costs.

Commercial Vehicle Fleets

Commercial vehicle fleets benefit from auto LED strip lights by using customizable lighting solutions for branding and safety purposes. These lights increase brand visibility during night-time operations and improve road safety with enhanced vehicle outline illumination. Buyers in Europe and the Middle East should look for suppliers offering custom color options and weatherproof designs to suit specific branding requirements and regional climate challenges. Scalability in supply is crucial to accommodate fleet expansion plans.

Public Infrastructure

Auto LED strip lights are increasingly used in public infrastructure projects such as roadside and tunnel lighting for vehicles. These installations contribute to improved driver safety by enhancing visibility in critical areas while reducing energy consumption compared to traditional lighting. For international buyers, particularly in regions with stringent safety regulations like Europe, sourcing high-brightness, weatherproof LED strips compliant with local standards is essential. Durable strips ensure minimal maintenance and long service life in outdoor environments.

Related Video: DIFFERENCE between 365nm and 400nm UV LED Black Lights Explained VISUALLY

Strategic Material Selection Guide for auto led strip lights

When selecting materials for auto LED strip lights, B2B buyers must consider factors such as environmental exposure, mechanical stresses, and regulatory compliance relevant to automotive applications. Below is an analysis of four common materials used in auto LED strip lights, focusing on their performance characteristics, advantages, limitations, and regional considerations for buyers from Africa, South America, the Middle East, and Europe.

Polycarbonate (PC)

Key Properties:

Polycarbonate is a thermoplastic known for its high impact resistance, excellent clarity, and good thermal stability, typically withstanding temperatures up to 115°C. It offers good resistance to UV radiation and moderate chemical exposure, which is crucial for automotive environments exposed to sunlight and occasional cleaning agents.

Pros & Cons:

PC provides excellent durability and transparency, making it ideal for LED covers that require light diffusion without significant loss. It is relatively lightweight and cost-effective compared to glass. However, it can be prone to scratching and may yellow over time if not treated with UV stabilizers. Manufacturing complexity is moderate, with injection molding being the common process.

Impact on Application:

Polycarbonate is suitable for external LED strip housings where impact resistance and clarity are priorities. Its UV resistance makes it favorable for regions with high sun exposure, such as South Africa and Saudi Arabia. However, in extremely harsh chemical environments, it may degrade faster.

Regional Considerations:

Buyers should verify compliance with ASTM D3935 (UV resistance) and ISO 527 (mechanical properties) standards, which are widely accepted in Europe and increasingly recognized in Middle Eastern markets. In South America and Africa, suppliers often align with DIN standards for plastics. PC’s balance of cost and performance suits large-scale automotive lighting projects in these regions.

Silicone Rubber

Key Properties:

Silicone rubber is prized for its exceptional flexibility, high thermal stability (operating temperatures from -60°C to 230°C), and outstanding resistance to weathering, ozone, and chemicals. It maintains elasticity over a wide temperature range, which is critical for automotive applications subject to vibration and temperature fluctuations.

Pros & Cons:

Silicone offers superior sealing and waterproofing capabilities, essential for LED strips exposed to moisture and dust. It is highly durable but generally more expensive than typical plastics. Manufacturing involves molding or extrusion, which can increase lead times and costs. Its softness may limit structural support roles.

Impact on Application:

Ideal for encapsulating LED strips to ensure IP67 or higher ingress protection ratings, silicone rubber is preferred in regions with heavy rains or dust storms, such as parts of the Middle East and tropical areas in South America and Africa. Its thermal resilience also supports under-hood or near-engine applications.

Regional Considerations:

Compliance with ASTM D2000 (rubber classification) and ISO 10993 (biocompatibility, if relevant) is important. European buyers often require RoHS and REACH compliance for silicone compounds. In Middle Eastern markets, certifications related to weather resistance and flame retardancy may be necessary.

Aluminum Alloy (Housing/Base)

Key Properties:

Aluminum alloys used in LED strip housings offer excellent thermal conductivity, corrosion resistance (especially with anodized finishes), and mechanical strength. They can operate effectively in temperatures ranging from -40°C to 150°C and withstand vibration and mechanical shocks common in automotive environments.

Pros & Cons:

Aluminum provides superior heat dissipation, enhancing LED lifespan and performance. It is lightweight yet sturdy, reducing overall vehicle weight. However, it is costlier than plastic alternatives and requires more complex manufacturing processes such as extrusion and CNC machining. Corrosion resistance depends on surface treatment.

Impact on Application:

Aluminum is the material of choice for premium automotive LED strips where heat management and durability are critical, such as in headlamps or brake lights. It is especially suitable for buyers in Europe and the Middle East, where stringent automotive standards demand robust materials.

Regional Considerations:

Buyers should ensure compliance with EN 573 (aluminum alloy standards) and ASTM B221 (extruded aluminum). In regions with high humidity or coastal exposure like South Africa and parts of South America, anodized or powder-coated aluminum is recommended to prevent corrosion.

Polyvinyl Chloride (PVC)

Key Properties:

PVC is a versatile thermoplastic with good chemical resistance, moderate temperature tolerance (up to 60-70°C), and inherent flame retardancy. It is commonly used for insulation and protective coatings on LED strip wiring and flexible substrates.

Pros & Cons:

PVC is cost-effective and easy to process, making it attractive for budget-sensitive projects. However, it has lower thermal resistance and mechanical strength compared to PC or silicone, limiting its use in high-temperature or high-stress automotive environments. Environmental concerns over plasticizers and additives also exist.

Impact on Application:

PVC is suitable for internal LED strip applications where exposure to heat and mechanical stress is limited. It is often used in wiring insulation or as a protective jacket. Its flame retardant properties meet basic automotive safety requirements but may not suffice for premium or exterior lighting.

Regional Considerations:

B2B buyers should verify compliance with international standards such as UL 94 (flammability) and ISO 14001 (environmental management). European markets may impose stricter regulations on PVC use due to environmental directives, while markets in Africa and South America might prioritize cost and availability.

| Material | Typical Use Case for auto led strip lights | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polycarbonate | External LED covers and diffusers | High impact resistance and UV stability | Susceptible to scratching and yellowing | Medium |

| Silicone Rubber | Waterproof encapsulation and flexible sealing | Excellent thermal and weather resistance | Higher cost and softer, less structural | High |

| Aluminum Alloy | Housing/base for heat dissipation and mechanical support | Superior heat dissipation and durability | Higher manufacturing complexity and cost | High |

| Polyvinyl Chloride (PVC) | Wiring insulation and internal protective coatings | Cost-effective and flame retardant | Limited thermal resistance and mechanical strength | Low |

This guide equips international B2B buyers with a clear understanding of material selection tailored to diverse automotive lighting needs and regional market demands. Strategic material choice ensures product longevity, regulatory compliance, and cost efficiency across Africa, South America, the Middle East, and Europe.

In-depth Look: Manufacturing Processes and Quality Assurance for auto led strip lights

Manufacturing Processes for Auto LED Strip Lights

The production of auto LED strip lights involves a series of meticulously controlled stages designed to ensure durability, performance, and safety—critical factors for automotive applications where environmental exposure and reliability are paramount.

1. Material Preparation

Raw materials include LED chips, flexible printed circuit boards (FPCBs), resistors, drivers, connectors, adhesives, and protective coatings. The quality of these inputs significantly affects the final product’s longevity and performance. Suppliers often source high-grade semiconductor LEDs and automotive-grade flexible substrates resistant to heat, vibration, and moisture. Material preparation includes cutting raw FPCBs to size and pre-treating surfaces for optimal component adhesion.

2. Forming and Circuit Fabrication

This stage involves printing or etching copper circuits onto the flexible substrate, followed by solder masking and surface finishing. Precision in circuit design is essential to ensure uniform electrical conductivity and heat dissipation. Automated machinery typically handles copper plating, laser cutting, and contouring to meet exact automotive standards for size and shape.

3. Assembly

Automated pick-and-place machines mount LEDs and other electronic components onto the circuit boards. Soldering methods such as reflow soldering or wave soldering ensure secure electrical connections. For automotive applications, special attention is given to the mounting of waterproof connectors and heat-resistant drivers. The assembly phase may also include embedding resistors and integrating dimming or color-changing control modules tailored to vehicle lighting systems.

4. Finishing and Protection

After assembly, LED strips receive protective coatings such as silicone or epoxy encapsulation to guard against moisture, dust, and mechanical stress. Encapsulation is critical for meeting automotive ingress protection (IP) ratings, often IP67 or higher, ensuring strips function reliably in harsh environments like engine bays or undercarriages. Final cutting and packaging are customized to client specifications, including length, connectors, and branding.

Quality Assurance and Control Measures

Maintaining stringent quality standards is essential for auto LED strip lights, given their safety-critical role in vehicles. Buyers should expect suppliers to adhere to internationally recognized quality management systems and automotive-specific standards.

Relevant International and Industry Standards

– ISO 9001: This universal quality management system standard ensures consistent manufacturing processes and continuous improvement. Suppliers certified under ISO 9001 demonstrate robust internal controls and quality documentation.

– IATF 16949: An automotive industry-specific quality management standard that integrates ISO 9001 requirements with additional automotive quality control protocols. This certification is a strong indicator of a supplier’s capability to meet automotive OEM standards.

– CE Marking: Required for products sold within the European Economic Area, confirming compliance with health, safety, and environmental protection legislation.

– RoHS Compliance: Restricts hazardous substances in electronic products, critical for environmental regulations in Europe and increasingly adopted worldwide.

– Ingress Protection (IP) Ratings: IP67 or IP68 ratings are common for auto LED strips, signifying resistance to dust and water ingress.

Key Quality Control Checkpoints

– Incoming Quality Control (IQC): Inspection and testing of raw materials and components upon arrival. IQC verifies LED chip brightness, color temperature, FPCB integrity, and connector quality before entering production.

– In-Process Quality Control (IPQC): Continuous monitoring during assembly, including solder joint inspections, circuit continuity tests, and visual checks for component placement accuracy. Automated optical inspection (AOI) systems are often employed to detect defects early.

– Final Quality Control (FQC): Comprehensive testing of completed LED strips, including electrical performance, waterproof testing, thermal resistance, and lifespan simulation. FQC ensures that every batch meets contractual and regulatory specifications before shipment.

Common Testing Methods for Auto LED Strip Lights

To guarantee performance and reliability, manufacturers employ several rigorous tests aligned with automotive standards:

- Electrical Testing: Verifies voltage, current, and luminous intensity under standard operating conditions. This includes surge and transient testing to simulate automotive electrical environments.

- Thermal Cycling and Heat Resistance: LED strips are subjected to repeated heating and cooling cycles to assess durability under temperature fluctuations typical in vehicles.

- Waterproof and Dustproof Testing: Using IP testing chambers, products are exposed to water jets, immersion, and dust to confirm ingress protection claims.

- Vibration and Shock Testing: Simulates the mechanical stresses experienced during vehicle operation to ensure solder joints and components remain intact.

- Photometric Testing: Measures color consistency, brightness uniformity, and beam angle to meet aesthetic and functional requirements.

How B2B Buyers Can Verify Supplier Quality Assurance

For international buyers, especially in regions such as Africa, South America, the Middle East, and Europe, confirming a supplier’s quality assurance processes is vital to mitigate risks and ensure compliance with local regulations.

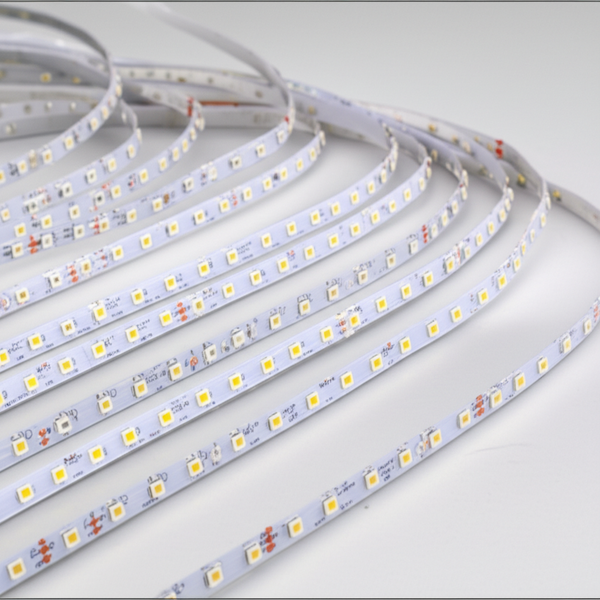

Illustrative Image (Source: Google Search)

1. Supplier Audits

Conducting on-site or remote audits allows buyers to evaluate manufacturing facilities, observe production processes, and verify adherence to quality standards. Audits should include reviews of quality management documentation, calibration records, and employee training programs.

2. Reviewing Quality Reports and Certifications

Demand up-to-date copies of ISO 9001, IATF 16949, CE certificates, and RoHS compliance documents. Additionally, request batch-specific quality inspection reports and test data to confirm product consistency.

3. Third-Party Inspections and Testing

Engaging independent inspection agencies provides unbiased verification of product quality. Third-party labs can perform destructive and non-destructive testing, including electrical, environmental, and mechanical assessments, ensuring products meet international automotive standards.

4. Sample Evaluation

Request product samples for in-house testing under your specific application conditions. This hands-on approach helps verify supplier claims regarding durability, brightness, and waterproofing.

QC and Certification Nuances for International Buyers

Africa and South America:

Buyers in these regions should prioritize suppliers compliant with international automotive standards (IATF 16949) and those offering clear documentation on RoHS and CE compliance, as many countries harmonize regulations with Europe. Import duties and certification recognition vary, so understanding local customs requirements for electronic automotive parts is crucial.

Middle East (e.g., Saudi Arabia):

The Gulf Cooperation Council (GCC) often requires conformity to regional standards alongside international certifications. Buyers should verify that suppliers provide Gulf Conformity Mark (G-mark) documentation if applicable and ensure packaging meets import regulations.

Europe:

The European market demands strict compliance with CE marking and RoHS directives, alongside compliance with REACH regulations concerning chemical substances. European buyers should also verify compliance with automotive lighting regulations such as ECE R10 and R112, which govern electromagnetic compatibility and lighting performance.

Actionable Takeaways for B2B Buyers

- Prioritize suppliers with automotive-specific quality certifications (IATF 16949) over generic ISO 9001 to ensure higher manufacturing standards.

- Implement a multi-tiered QC verification strategy combining supplier audits, third-party testing, and sample evaluations to minimize quality risks.

- Understand regional certification requirements to avoid customs delays and ensure legal compliance—this is especially critical for buyers in Africa, South America, and the Middle East.

- Demand transparency on manufacturing processes and QC checkpoints to foster trust and long-term supplier partnerships.

- Consider suppliers offering customization and scalability in production to accommodate evolving automotive lighting technologies and project demands.

By focusing on these manufacturing and quality assurance dimensions, international B2B buyers can confidently source auto LED strip lights that meet stringent automotive standards and regional compliance requirements, ensuring product reliability and customer satisfaction across diverse markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for auto led strip lights Sourcing

When sourcing auto LED strip lights for international B2B purposes, understanding the detailed cost structure and pricing dynamics is essential for making informed procurement decisions. This analysis unpacks the key cost components, price influencers, and strategic tips tailored for buyers from regions such as Africa, South America, the Middle East, and Europe.

Key Cost Components in Auto LED Strip Lights

-

Materials

The primary cost driver is the raw materials used, including LED chips, flexible PCB substrates, adhesives, connectors, and protective coatings. High-quality LEDs and durable materials (e.g., waterproof coatings for automotive environments) typically command higher costs but ensure longer lifespan and reliability. -

Labor and Manufacturing Overhead

Labor costs vary significantly by manufacturing location. Countries with lower labor expenses can offer competitive pricing, but buyers should weigh this against quality control and lead times. Overhead includes factory utilities, equipment depreciation, and indirect labor. -

Tooling and Setup Costs

Initial tooling for custom designs or proprietary configurations can add upfront expenses. For buyers requiring bespoke lengths, color temperatures, or smart features, tooling costs may be amortized over larger production runs. -

Quality Control (QC)

Rigorous QC processes—such as photometric testing, waterproofing checks, and electrical safety inspections—add to production costs but reduce failure rates and returns, critical for automotive applications where reliability is paramount. -

Logistics and Shipping

Transportation costs depend on order volume, shipping mode (air vs. sea freight), packaging requirements, and destination port. Buyers from Africa, South America, and the Middle East should factor in customs duties, import taxes, and potential delays in port clearance. -

Supplier Margin

Suppliers typically build margins into pricing to cover profit and risk. Margins can fluctuate based on market demand, supplier reputation, and exclusivity of product offerings.

Influential Pricing Factors

-

Order Volume and Minimum Order Quantity (MOQ)

Larger volume orders generally unlock significant price breaks. MOQ thresholds vary by supplier, with discounts increasing substantially for bulk purchases—critical for large-scale automotive projects or distributors. -

Product Specifications and Customization

Customized features such as specific color temperatures, smart controls, or enhanced durability increase unit costs. Standardized products are cheaper but may not meet all automotive requirements. -

Material Quality and Certifications

Compliance with automotive standards (e.g., ISO/TS 16949, RoHS, CE, UL) and certifications for heat resistance or waterproofing influence pricing. Certified products often cost more but mitigate risk and liability. -

Supplier Factors and Reliability

Established suppliers with proven track records and robust supply chains may price higher but offer better reliability, warranty terms, and post-sale support. -

Incoterms and Delivery Terms

Pricing varies depending on agreed Incoterms (e.g., FOB, CIF, DDP). For international buyers, DDP (Delivered Duty Paid) pricing offers convenience but at a premium, whereas FOB pricing requires buyers to manage shipping and customs clearance themselves.

Strategic Buyer Tips for International B2B Sourcing

-

Negotiate Beyond Unit Price

Engage suppliers on payment terms, lead times, packaging, and after-sales support. Volume commitments or long-term contracts can unlock better overall terms. -

Focus on Total Cost of Ownership (TCO)

Consider not only upfront costs but also warranty coverage, expected lifespan, energy efficiency, and maintenance. Higher-quality strips may have a higher purchase price but reduce replacement and operational costs. -

Optimize Order Consolidation and Logistics

Combining orders or partnering with freight forwarders can reduce shipping expenses, especially for buyers in remote or high-tariff regions like parts of Africa and South America. -

Understand Pricing Nuances per Region

Market conditions, import regulations, and currency fluctuations affect final landed costs. For example, South African buyers should account for import VAT and customs duties, while Middle Eastern buyers might benefit from free trade zones. -

Request Samples and Verify Certifications

Before committing to large orders, validate product quality and compliance with automotive standards to avoid costly returns or regulatory issues.

Indicative Pricing Disclaimer

Pricing for auto LED strip lights varies widely depending on specifications, volume, and supplier. Typical wholesale unit prices can range from $1 to $5 per meter, excluding shipping and customs fees. Buyers should conduct detailed quotations and cost modeling tailored to their unique project requirements.

Illustrative Image (Source: Google Search)

By dissecting cost components and pricing influencers while applying strategic sourcing tactics, international B2B buyers can optimize procurement of auto LED strip lights, balancing cost-efficiency with quality and reliability for successful automotive lighting solutions.

Spotlight on Potential auto led strip lights Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘auto led strip lights’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for auto led strip lights

When sourcing auto LED strip lights for international markets such as Africa, South America, the Middle East, and Europe, understanding key technical properties and trade terminology is essential for making informed purchasing decisions. This knowledge helps buyers evaluate product quality, negotiate effectively, and manage supply chain expectations.

Critical Technical Properties of Auto LED Strip Lights

-

Material Grade and PCB Quality

Auto LED strips rely on printed circuit boards (PCBs) that must withstand automotive environments, including temperature fluctuations and vibrations. High-quality PCBs use materials like flexible polyimide or FR4 with proper copper thickness (usually 1 oz or more) for durability and efficient heat dissipation. For B2B buyers, verifying PCB material grade ensures longer lifespan and reduces warranty claims. -

Ingress Protection (IP) Rating

The IP rating indicates the strip’s resistance to dust and water. For automotive use, waterproof ratings such as IP65, IP67, or IP68 are common, protecting against rain, splashes, and car washes. Buyers targeting outdoor or engine bay applications should prioritize higher IP ratings to guarantee reliability in harsh conditions. -

Color Temperature and CRI (Color Rendering Index)

Color temperature (measured in Kelvin) affects the visual tone of the light—cool white (~6000K) is common for modern automotive aesthetics, while warm white (~3000K) offers softer lighting. CRI measures how accurately the light renders colors; values above 80 are preferred for natural, vibrant illumination. These specs are crucial when lighting quality impacts vehicle appearance or safety. -

Power Consumption and Efficiency

LED strips vary in power draw, typically measured in watts per meter. Efficient strips consume less power while providing sufficient brightness (lumens per watt). For fleet buyers or manufacturers, selecting energy-efficient strips reduces overall vehicle power load and supports sustainability goals. -

Voltage Compatibility

Most auto LED strips operate at 12V DC, matching standard vehicle electrical systems. However, some may support 24V for larger vehicles or commercial fleets. Confirming voltage compatibility avoids installation issues and potential damage. -

Tolerance and Flexibility

Tolerance refers to allowable deviations in electrical or physical parameters, affecting performance consistency. Flexible strips with good bending radius (often 5 cm or less) enable installation in curved or confined automotive spaces, increasing versatility for diverse vehicle models.

Common Trade Terminology in Auto LED Strip Lights Procurement

-

OEM (Original Equipment Manufacturer)

Refers to companies that produce LED strips intended for direct installation by vehicle manufacturers. OEM products meet strict automotive standards and are typically more expensive but offer higher reliability. Buyers seeking branded or large-scale automotive supply contracts often require OEM certification. -

MOQ (Minimum Order Quantity)

The smallest amount of product a supplier will sell per order. MOQs vary widely and impact pricing and inventory management. Understanding MOQ helps buyers plan budgets and storage while negotiating flexible terms for smaller pilot projects or regional distribution. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers requesting detailed pricing, specifications, and delivery terms. RFQs are standard practice for B2B procurement, enabling buyers to compare offers and select the best value option while ensuring compliance with technical needs. -

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance (e.g., FOB, CIF, DDP). Familiarity with Incoterms is critical to avoid unexpected costs and delays in cross-border transactions. -

Bin Code

A classification used for LEDs indicating brightness and color binning. Consistent bin codes ensure uniform lighting across batches, important for automotive applications where visual consistency is key. -

Lumens (lm)

A unit measuring the total visible light output. Higher lumens mean brighter light. Buyers should match lumens to application needs, balancing brightness with power consumption.

Understanding these technical properties and trade terms empowers international B2B buyers to make strategic purchasing decisions, ensuring that auto LED strip lights meet quality, performance, and logistical requirements. This foundation supports smoother negotiations, optimized supply chains, and successful product integration in diverse automotive markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the auto led strip lights Sector

Market Overview & Key Trends

The global market for auto LED strip lights is experiencing robust growth driven by increasing demand for energy-efficient, durable, and customizable automotive lighting solutions. Key growth drivers include advancements in LED technology, rising vehicle production rates, and stringent regulatory standards on vehicle lighting safety and energy consumption. For international B2B buyers, especially those from Africa, South America, the Middle East, and Europe, understanding these dynamics is crucial to making informed sourcing decisions.

In regions like South Africa and Saudi Arabia, the automotive aftermarket is expanding rapidly, creating substantial opportunities for suppliers of LED strip lights tailored to both OEM and aftermarket applications. Buyers are increasingly seeking products that offer enhanced brightness, flexible installation options, and smart connectivity features, such as app-controlled color and intensity adjustments. This trend aligns with the broader move toward vehicle customization and smart automotive components.

From a sourcing perspective, international buyers benefit from engaging with suppliers who offer scalable production capabilities and a wide product range, including waterproof and heat-resistant LED strips suitable for diverse climatic conditions. Additionally, the rise of smart LED strips with IoT integration is reshaping procurement priorities, as buyers look for cutting-edge solutions that add value to their automotive lighting portfolios.

Market dynamics also reflect a shift toward regional diversification of suppliers. While China remains a dominant manufacturing hub, buyers in Europe and the Middle East increasingly explore partnerships with suppliers in Turkey, Eastern Europe, and the UAE to reduce lead times and mitigate geopolitical risks. For African and South American buyers, leveraging local distribution networks and consolidators can enhance supply chain reliability and cost efficiency.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a pivotal consideration in the auto LED strip lights sector, driven by global environmental regulations and growing corporate responsibility mandates. For B2B buyers, particularly in Europe and the Middle East, sourcing products that minimize environmental impact throughout their lifecycle is essential.

The production of LED strip lights involves materials such as rare earth elements and electronic components, which can have significant ecological footprints if not responsibly sourced. Ethical supply chains that prioritize conflict-free minerals, reduce hazardous waste, and ensure fair labor practices are increasingly demanded by buyers aiming to uphold their own sustainability commitments.

Many suppliers now offer LED strips certified with recognized environmental standards, such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals). These certifications assure buyers that products meet strict limits on toxic substances, reducing environmental and health risks.

Additionally, energy efficiency remains a core sustainability metric. Auto LED strip lights consume considerably less power than traditional lighting, contributing to lower vehicle emissions over time. Buyers should prioritize products with high luminous efficacy and long operational lifespans to maximize sustainability benefits.

Incorporating recyclable materials and designing for ease of disassembly also aligns with circular economy principles, which are gaining traction globally. B2B buyers are advised to engage with suppliers who demonstrate transparency in their environmental practices and provide detailed sustainability reports to validate their green credentials.

Evolution and Historical Context

The evolution of auto LED strip lights mirrors broader trends in automotive lighting technology. Initially introduced as decorative accent lighting, LED strips quickly gained traction due to their compact size, flexibility, and energy efficiency. Over the past decade, technological advances have enabled integration of these strips into primary vehicle lighting systems, including daytime running lights (DRLs), turn signals, and brake lights.

Historically, the shift from incandescent and halogen bulbs to LEDs was driven by regulatory changes demanding improved vehicle safety and reduced energy consumption. This transition has opened new avenues for customization and enhanced vehicle aesthetics, propelling the auto LED strip lights market forward.

For B2B buyers, understanding this historical trajectory highlights the importance of selecting suppliers who invest in ongoing innovation and comply with evolving automotive standards. It also underscores the value of LED strip lights not only as functional components but as integral elements of modern automotive design and branding strategies.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of auto led strip lights

-

How can I effectively vet suppliers of auto LED strip lights for international B2B purchases?

To vet suppliers, start by verifying their business licenses and certifications relevant to LED manufacturing and export. Request product samples to assess quality and durability, especially under automotive conditions. Check references or customer reviews, focusing on buyers from similar regions (Africa, Middle East, South America, Europe) to understand their reliability. Evaluate their communication responsiveness and transparency regarding lead times, MOQ, and customization capabilities. Additionally, confirm compliance with international standards such as CE, RoHS, or E-Mark certifications to ensure product safety and regulatory adherence. -

What customization options are typically available for auto LED strip lights in bulk orders?

Wholesale suppliers often provide customization in terms of strip length, LED color temperature, brightness levels, waterproof ratings (IP65, IP67), and connector types compatible with various vehicle models. Branding options like packaging design or private labeling may also be offered. For markets in Africa or the Middle East, suppliers might tailor voltage specifications or add features like flexible adhesive backing for easier installation. Early discussions about customization ensure alignment with your project requirements and can impact lead times and minimum order quantities (MOQs). -

What are typical minimum order quantities (MOQs) and lead times for international bulk orders of auto LED strip lights?

MOQs vary widely depending on supplier and customization level but generally range from 500 to 2,000 units per SKU. Lead times can fluctuate from 3 to 8 weeks, accounting for production, quality checks, and international shipping. For buyers in South America or Africa, factor in additional time for customs clearance. To optimize timelines, consolidate orders when possible and clarify production schedules upfront. Some suppliers offer tiered MOQs with price breaks, enabling smaller initial orders for testing before scaling up. -

Which payment terms and methods are most secure and practical for international B2B transactions in this sector?

Common payment terms include 30% upfront deposit with the balance paid upon shipment or after passing inspection. Letters of credit (LCs) and escrow services provide added security for large orders. Wire transfers via SWIFT are standard, but platforms like Payoneer or Alibaba Trade Assurance can offer protection for new partnerships. Always confirm payment conditions in the contract, and consider working with suppliers who accept partial payments or milestone-based releases to mitigate risk. -

What quality assurance (QA) processes and certifications should I expect from reputable auto LED strip light suppliers?

Reputable suppliers implement rigorous QA including in-line testing for LED brightness, color consistency, waterproof sealing, and electrical safety. Certifications to look for include CE (Europe), RoHS (restricted hazardous substances), E-Mark (automotive compliance), and ISO 9001 for quality management systems. Request test reports or certificates of conformity to verify compliance. For automotive applications, durability under vibration, temperature fluctuations, and moisture exposure is critical, so inquire about environmental stress testing procedures. -

How can I best manage logistics and shipping challenges when importing auto LED strip lights to Africa, South America, or the Middle East?

Choose suppliers with experience shipping to your region, as they understand local customs regulations and preferred freight routes. Opt for consolidated shipments to reduce costs and improve tracking. Air freight offers speed but at higher cost; sea freight is economical for large volumes but slower. Ensure packaging is robust to prevent damage during transit and verify that suppliers provide clear documentation (commercial invoices, packing lists, certificates) to avoid customs delays. Partnering with freight forwarders familiar with your destination can streamline clearance.

-

What dispute resolution mechanisms are advisable when dealing with international suppliers of auto LED strip lights?

Include clear terms in contracts regarding product specifications, delivery timelines, payment schedules, and penalties for non-compliance. Use internationally recognized dispute resolution methods such as arbitration under ICC rules or mediation clauses. Retain evidence of communications and quality inspections. For cross-border transactions, leveraging platforms with trade assurance or third-party inspection services can help preempt disputes. Establishing a trusted local agent or representative can facilitate quicker resolution and maintain supplier relationships. -

How do I ensure product consistency and compatibility across large-scale automotive projects in diverse international markets?

Standardize product specifications with your supplier and request batch testing for uniformity in color, brightness, and electrical parameters. Insist on samples from each production batch and perform in-house or third-party testing before installation. Clarify vehicle compatibility, especially for regions with varying voltage standards or connector types. Maintaining ongoing communication with your supplier about any design changes or component substitutions is crucial. For multi-country projects, verify compliance with each market’s automotive lighting regulations to ensure legal use and safety.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for auto led strip lights

In today’s dynamic automotive lighting market, strategic sourcing of auto LED strip lights is pivotal for international B2B buyers aiming to balance cost, quality, and innovation. Prioritizing partnerships with reputable suppliers who offer customizable, energy-efficient, and durable LED strips can significantly enhance product offerings while optimizing procurement budgets. For regions like Africa, South America, the Middle East, and Europe, understanding local market demands alongside global supply chain intricacies ensures smoother operations and reduced lead times.

Key takeaways for buyers include leveraging bulk purchasing to achieve cost advantages, insisting on sample evaluations to verify quality, and cultivating strong supplier relationships to mitigate supply risks. Additionally, embracing suppliers with access to the latest LED technologies—such as smart, dimmable, or waterproof strips—can future-proof product lines and meet evolving client expectations.

Looking ahead, businesses that invest in robust supply chain management and diversify their sourcing strategies will be better positioned to capitalize on emerging trends in automotive lighting. Buyers are encouraged to proactively engage with trusted manufacturers and distributors who understand regional market nuances and can offer flexible, scalable solutions. By doing so, companies across South Africa, Saudi Arabia, Brazil, and Europe can confidently drive innovation while maintaining competitive advantage in the auto LED strip lights segment.