Introduction: Navigating the Global Market for addressable led tape

Addressable LED tape has rapidly become a transformative technology in modern lighting solutions, offering unparalleled flexibility and precision control over individual LEDs. For international B2B buyers, especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe, understanding this technology is crucial to unlocking innovative applications—from architectural highlights and retail displays to entertainment and smart city projects. The ability to program each LED independently allows businesses to create vibrant, customizable lighting effects that can differentiate their offerings and enhance user experiences.

This guide serves as an authoritative resource designed to empower procurement professionals and technical decision-makers with comprehensive insights into addressable LED tape. It covers essential topics such as the various types and IC technologies available, material considerations, manufacturing standards, and quality control benchmarks. Additionally, it provides a detailed overview of leading global suppliers, cost factors, and emerging market trends that influence sourcing strategies.

By navigating this guide, buyers will gain the knowledge to make informed decisions tailored to their specific project requirements and regional market conditions. Whether sourcing for large-scale commercial installations or specialized niche applications, the guide helps mitigate risks related to compatibility, quality, and cost-efficiency. Ultimately, this resource is crafted to support B2B buyers in selecting the optimal addressable LED tape solutions that drive innovation, ensure reliability, and maximize value across diverse international markets.

Understanding addressable led tape Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| WS2812B (NeoPixel) | Integrated driver IC per LED, single data line, RGB color control | Architectural lighting, signage, entertainment | + Easy to program and widely supported – Limited refresh rate for large installations |

| SK6812 (RGBW) | Similar to WS2812B but with additional white LED for enhanced color rendering | Retail displays, hospitality, high-end decor | + Improved white light quality – Slightly higher cost than RGB-only strips |

| DMX512 Addressable Tape | Uses DMX512 protocol, supports long cable runs and complex control | Large-scale events, stage lighting, urban installations | + Industry standard for professional control – Requires specialized controllers and setup expertise |

| APA102 (DotStar) | Separate clock and data lines, higher refresh rate and color accuracy | High-speed animations, interactive exhibits | + Superior color fidelity and speed – More complex wiring and higher cost |

| Analog Addressable Tape | LED groups controlled individually but with analog signals, simpler ICs | Basic decorative lighting, cost-sensitive projects | + Lower cost and simpler control – Limited effects and flexibility |

WS2812B (NeoPixel)

WS2812B strips are among the most popular addressable LED tapes, featuring an integrated driver IC on each LED that allows individual RGB control via a single data line. This simplicity makes them ideal for architectural accent lighting, signage, and entertainment environments where dynamic color effects are essential. For B2B buyers, WS2812B offers a balance of affordability and ease of programming, supported by a large ecosystem of controllers and software. However, for very large-scale projects, the refresh rate may limit performance, requiring careful planning.

SK6812 (RGBW)

The SK6812 variant enhances the standard RGB LED tape by adding a dedicated white LED, enabling more natural and vibrant white lighting alongside full RGB control. This makes it highly suitable for retail displays, hospitality venues, and premium decorative applications where color accuracy and white light quality are critical. Buyers should consider the slightly higher upfront cost but benefit from improved lighting versatility and customer appeal, especially in markets valuing sophisticated ambiance.

DMX512 Addressable Tape

DMX512 addressable LED strips utilize the professional DMX512 communication protocol, enabling robust control over long distances and integration with existing stage or architectural lighting systems. This type is preferred in large-scale events, theaters, and urban installations where synchronized complex lighting effects are required. For B2B buyers, DMX512 strips demand investment in compatible controllers and technical expertise but deliver unmatched scalability and reliability in demanding environments.

Illustrative Image (Source: Google Search)

APA102 (DotStar)

APA102 LED tapes separate the clock and data signals, allowing higher refresh rates and superior color accuracy compared to single-line protocols. This makes them ideal for high-speed animations, interactive exhibits, and applications where precise timing is critical. While APA102 strips involve more complex wiring and higher costs, they provide excellent performance for businesses targeting cutting-edge visual effects and interactive installations.

Analog Addressable Tape

Analog addressable LED tapes control small groups of LEDs rather than each LED individually, using simpler integrated circuits and analog signals. These strips serve well in basic decorative lighting or projects with tight budgets where full programmability is not essential. Although they offer limited effects and less flexibility, analog addressable tapes are attractive to buyers seeking cost-effective solutions without compromising the appearance of dynamic lighting.

Key Purchasing Considerations for B2B Buyers:

- Application Needs: Choose based on required control complexity, color fidelity, and installation scale.

- Compatibility: Ensure controller and software support aligns with the LED strip IC type.

- Budget vs. Performance: Balance cost constraints with desired lighting effects and longevity.

- Technical Expertise: Factor in installation and programming capabilities available locally or within your team.

- Supply Chain & Support: Prioritize suppliers offering reliable product availability and technical support in your region (Africa, South America, Middle East, Europe).

Related Video: Getting Started With Arduino To Control An Addressable LED Strip In This Beginner Project Tutorial

Key Industrial Applications of addressable led tape

| Industry/Sector | Specific Application of addressable led tape | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Hospitality | Dynamic in-store displays and ambient lighting | Enhances customer engagement and brand differentiation through vibrant, customizable lighting effects | Durability for high-traffic areas, ease of installation, compatibility with control systems, and energy efficiency |

| Entertainment & Events | Stage lighting and immersive event environments | Enables complex lighting animations and mood settings to captivate audiences and enhance event experiences | High refresh rate, color accuracy, seamless control integration, and scalability for large installations |

| Architectural & Urban Design | Façade lighting and public space illumination | Improves aesthetic appeal and safety while allowing programmable light shows for cultural or promotional events | Weather resistance (IP rating), long lifespan, energy consumption, and local regulatory compliance |

| Automotive & Transportation | Interior ambient lighting and exterior accent lighting | Adds luxury and customization options for vehicles, improving customer satisfaction and brand prestige | Flexibility for curved surfaces, vibration resistance, thermal management, and compliance with automotive standards |

| Advertising & Signage | Digital signage and interactive advertising panels | Attracts attention with dynamic visuals and interactive lighting, increasing advertising effectiveness | Brightness levels, pixel density, ease of programming, and integration with digital control platforms |

Retail & Hospitality

Addressable LED tape is widely used in retail stores and hospitality venues to create dynamic in-store displays and ambient lighting that can be customized to match branding or promotional campaigns. This technology enables businesses to shift colors and patterns easily, creating an inviting atmosphere that draws customers and encourages longer visits. For international B2B buyers in regions like the UAE or Egypt, sourcing addressable LED tape with robust control compatibility and energy-efficient features is critical to manage operational costs and ensure seamless integration with existing lighting systems.

Entertainment & Events

In the entertainment sector, addressable LED tape plays a pivotal role in stage lighting and immersive event setups. Its ability to individually control LEDs allows for intricate animations, synchronized effects with music, and mood lighting that transforms spaces dynamically. Event organizers and production companies in South America and Europe benefit from selecting LED tapes with high refresh rates and superior color accuracy to avoid flickering on camera and deliver professional-grade performances.

Architectural & Urban Design

Architectural firms and urban planners use addressable LED tape for illuminating building façades and public spaces, enabling programmable light shows that can celebrate cultural events or promote tourism. Buyers from African and Middle Eastern markets must prioritize weatherproof LED tapes with high IP ratings to withstand harsh environmental conditions, alongside energy-efficient designs to reduce long-term operational expenses. Compliance with local safety and lighting regulations is also a key consideration.

Illustrative Image (Source: Google Search)

Automotive & Transportation

Automotive manufacturers and aftermarket suppliers integrate addressable LED tape into vehicle interiors and exteriors to provide customizable ambient lighting and accent features. This application enhances the luxury appeal and personalization options for consumers. For B2B buyers in Europe and the Middle East, sourcing LED tapes that conform to automotive vibration and thermal standards is essential to ensure durability and safety over the vehicle’s lifespan.

Advertising & Signage

Digital signage and interactive advertising panels leverage addressable LED tape to display vivid, animated content that captures attention in busy commercial environments. This technology allows advertisers to quickly update visuals and create engaging displays that can adapt to different campaigns. Buyers in international markets must focus on LED tapes with high brightness, pixel density, and easy programmability to maximize advertising impact while maintaining cost-effectiveness.

Related Video: Six Steps to Make an Addressable Neon Lights – How to Pass Flexible LED Strip Through The Neon Tube

Strategic Material Selection Guide for addressable led tape

Flexible Printed Circuit Board (FPCB)

Key Properties:

FPCB is the foundational substrate material for most addressable LED tapes, characterized by its flexibility, thinness, and ability to withstand moderate temperatures (typically up to 105°C). It offers excellent electrical insulation, good thermal conductivity, and resistance to mechanical stress, making it ideal for bending and shaping in diverse installations.

Pros & Cons:

– Pros: Highly flexible, lightweight, and enables compact designs. It supports high LED density and complex circuitry integration. Manufacturing processes are mature, allowing for consistent quality and scalability.

– Cons: Moderate temperature tolerance limits use in extreme heat environments. Susceptible to damage from sharp bends or excessive mechanical stress. Costs are moderate but can increase with complex multilayer designs.

Impact on Application:

FPCB-based LED tapes are suitable for intricate architectural lighting, retail displays, and entertainment venues where flexibility and high customization are essential. However, they require careful handling during installation to prevent damage.

International B2B Considerations:

Buyers in regions like the Middle East (e.g., UAE) and Africa (e.g., Egypt) must ensure compliance with international standards such as IPC-2223 for flexible circuits and ASTM D257 for electrical properties. The material’s moderate thermal rating aligns well with indoor commercial environments common in Europe and South America but may require additional protection for outdoor or high-temperature applications. Sourcing from suppliers with ISO 9001 certification ensures quality consistency.

Silicone Rubber Coating

Key Properties:

Silicone rubber coatings provide excellent environmental protection, offering superior resistance to moisture, UV radiation, and temperature extremes (operational range from -40°C to 200°C). The coating is flexible and durable, enhancing the LED tape’s mechanical strength and longevity.

Pros & Cons:

– Pros: Exceptional waterproofing and weather resistance, ideal for outdoor and harsh environments. High temperature tolerance supports use in hot climates prevalent in the Middle East and parts of Africa.

– Cons: Adds to manufacturing complexity and cost. Silicone coatings can increase the tape’s thickness, potentially limiting use in tight spaces. Repair and rework are more challenging compared to uncoated tapes.

Impact on Application:

Silicone-coated LED tapes are preferred for outdoor signage, architectural facades, and marine applications where exposure to elements is significant. They are well-suited for regions with high UV exposure and humidity, such as coastal areas in South America and the Middle East.

International B2B Considerations:

Compliance with IP67 or higher ingress protection ratings is critical for buyers targeting outdoor use. Certifications like IEC 60529 and RoHS compliance are often required in European markets. Buyers should verify the silicone’s chemical resistance to local environmental factors, such as sand and salt in desert regions like UAE.

Polyvinyl Chloride (PVC) Sheathing

Key Properties:

PVC sheathing is commonly used as a protective outer layer for LED tapes, offering good electrical insulation, moderate flexibility, and resistance to abrasion and chemicals. It typically withstands temperatures up to 70°C.

Pros & Cons:

– Pros: Cost-effective and widely available, making it attractive for large-scale projects with tight budgets. Easy to manufacture and handle.

– Cons: Lower temperature tolerance limits use in high-heat environments. PVC can degrade under prolonged UV exposure, reducing lifespan outdoors. Environmental concerns over PVC disposal and plasticizers may affect procurement.

Impact on Application:

PVC-sheathed LED tapes are ideal for indoor commercial lighting, retail displays, and temporary installations where cost control is paramount. They are less suited for outdoor or industrial environments with extreme conditions.

International B2B Considerations:

Buyers in Europe and South America often require compliance with REACH and RoHS regulations restricting hazardous substances in PVC. In Africa and the Middle East, where environmental regulations may be evolving, buyers should assess local disposal and recycling capabilities. ASTM D1784 standards for PVC materials can guide quality assurance.

Polyurethane (PU) Encapsulation

Key Properties:

PU encapsulation provides a robust protective layer with excellent mechanical strength, flexibility, and chemical resistance. It withstands temperatures up to approximately 120°C and offers good resistance to abrasion and impact.

Pros & Cons:

– Pros: Superior durability and flexibility compared to PVC, with better resistance to oils, solvents, and chemicals. Suitable for harsh industrial environments.

– Cons: Higher cost and more complex manufacturing process. PU can yellow over time under UV exposure unless UV stabilizers are added.

Impact on Application:

PU-encapsulated LED tapes are favored in industrial, automotive, and outdoor applications requiring enhanced protection against mechanical and chemical stress. They are suitable for markets with demanding environmental conditions, such as mining operations in Africa or industrial zones in Europe.

International B2B Considerations:

Compliance with DIN standards for polyurethane materials and UV resistance is important for European buyers. Buyers in the Middle East and South America should verify chemical resistance profiles relevant to local industrial pollutants. PU encapsulation aligns well with sustainability trends if sourced from suppliers offering eco-friendly formulations.

| Material | Typical Use Case for addressable led tape | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Flexible Printed Circuit Board (FPCB) | Indoor architectural lighting, retail displays, entertainment | High flexibility and integration capability | Moderate temperature tolerance, delicate handling | Medium |

| Silicone Rubber Coating | Outdoor signage, architectural facades, marine applications | Excellent waterproofing and UV resistance | Increased thickness and higher cost | High |

| Polyvinyl Chloride (PVC) Sheathing | Indoor commercial lighting, temporary installations | Cost-effective and widely available | Low heat and UV resistance, environmental concerns | Low |

| Polyurethane (PU) Encapsulation | Industrial, automotive, and outdoor harsh environments | Superior durability and chemical resistance | Higher cost and potential UV yellowing | High |

In-depth Look: Manufacturing Processes and Quality Assurance for addressable led tape

Manufacturing Processes of Addressable LED Tape

The production of addressable LED tape involves a series of highly specialized and precise manufacturing stages, each critical to ensuring product performance, durability, and reliability. Understanding these stages helps B2B buyers evaluate suppliers and select high-quality products suitable for demanding commercial applications across Africa, South America, the Middle East, and Europe.

1. Material Preparation

Manufacturing begins with sourcing and preparing raw materials. This includes:

- Flexible Printed Circuit Board (FPCB): The base substrate, often made from polyimide or PET, is cut to size. This flexible board supports the LEDs and circuitry.

- LED Chips and Integrated Circuits (ICs): High-quality addressable LEDs with built-in or attached ICs are procured, typically from reputable manufacturers adhering to international standards.

- Conductive Materials: Copper foils for circuit traces and solder pastes are prepared for assembly.

- Protective Coatings and Adhesives: Materials for waterproofing (e.g., silicone or epoxy encapsulation) and adhesive backing for installation are selected based on intended use environments.

Strict supplier qualification ensures material consistency and compliance with environmental standards such as RoHS (Restriction of Hazardous Substances), critical for international trade.

2. Circuit Forming and Assembly

This stage integrates the electronic components onto the flexible PCB:

- Surface Mount Technology (SMT): Automated pick-and-place machines position LEDs and IC chips precisely on the FPCB. SMT ensures high-density placement critical for addressable functionality.

- Soldering: Reflow soldering secures components electrically and mechanically. Controlled temperature profiles prevent damage to sensitive ICs.

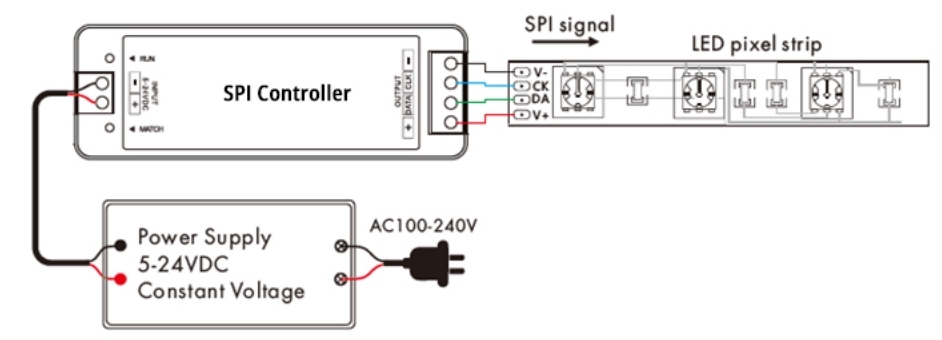

- Integrated Circuit Programming: Some manufacturers program the ICs during or post-assembly to enable specific control protocols (e.g., SPI, DMX512).

- Inspection: Automated Optical Inspection (AOI) systems detect misalignment, soldering defects, and component integrity early in the process.

This phase demands cleanroom conditions and stringent process controls to minimize contamination and defects.

3. Finishing Processes

After assembly, finishing enhances durability and usability:

- Encapsulation and Waterproofing: Addressable LED tapes destined for outdoor or humid environments undergo coating with waterproof silicone or epoxy layers.

- Cutting and Packaging: The tape is cut into standardized lengths, with copper pads exposed for easy electrical connections. Packaging often includes anti-static bags and reels to protect during shipping.

- Labeling and Documentation: Each batch is labeled with production codes, batch numbers, and compliance marks to ensure traceability.

Quality at this stage directly influences product lifespan and installation ease.

Quality Assurance and Control (QA/QC) in Addressable LED Tape Production

Robust QA/QC frameworks are essential to guarantee consistent product quality and compliance with international trade requirements. B2B buyers must understand these processes to verify supplier credibility and mitigate risks such as product failures, delayed shipments, and non-compliance penalties.

International and Industry Standards

Leading manufacturers align their processes with internationally recognized standards, including:

- ISO 9001: A foundational quality management system standard emphasizing consistent process control, continuous improvement, and customer satisfaction.

- CE Marking: Mandatory for products sold in the European Economic Area, indicating compliance with EU safety, health, and environmental protection requirements.

- RoHS Compliance: Restricts hazardous substances in electronic products, essential for global market acceptance.

- UL Certification: Particularly relevant for North American markets but often sought globally, it certifies electrical safety.

- Other Regional Certifications: Depending on the market, certifications like SASO (Saudi Arabia), INMETRO (Brazil), or G-mark (Gulf Cooperation Council) may apply.

For buyers in Africa, South America, the Middle East, and Europe, verifying these certifications is critical to ensure legal importation and market acceptance.

QC Checkpoints Throughout Production

Quality control is implemented at multiple stages to detect and rectify defects early:

- Incoming Quality Control (IQC): Raw materials and components are inspected upon receipt. Parameters such as LED brightness, IC functionality, and substrate integrity are verified.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly includes solder joint inspection, electrical continuity tests, and programming verification.

- Final Quality Control (FQC): Finished products undergo comprehensive testing including visual inspection, functional testing of addressability and color accuracy, waterproof testing, and mechanical flexibility assessments.

These checkpoints minimize defective outputs and ensure compliance with specifications.

Common Testing Methods

To validate product quality and performance, manufacturers employ:

- Electrical Testing: Verification of voltage, current consumption, and signal integrity for each LED segment.

- Color Consistency and Brightness Testing: Using spectrometers and luminance meters to ensure uniform output across the tape.

- Environmental Stress Testing: Simulating temperature extremes, humidity, and mechanical bending to assess durability.

- Waterproof Testing: Immersion or spray tests for tapes labeled as waterproof (e.g., IP65, IP67 ratings).

- Longevity and Burn-In Testing: Extended operation under load to detect early failures.

For B2B buyers, insisting on documented test results and certifications from accredited labs is a best practice.

How B2B Buyers Can Verify Supplier Quality Assurance

Ensuring supplier reliability requires proactive verification beyond certifications:

- Factory Audits: On-site or virtual audits assess manufacturing capabilities, process controls, and staff qualifications. Buyers should request audit reports or arrange third-party inspections.

- Review of Quality Documentation: Suppliers should provide detailed QC reports, test data, and traceability records for each batch.

- Third-Party Inspections: Independent inspection agencies (e.g., SGS, Intertek) can perform pre-shipment inspections to validate compliance and quality.

- Sample Testing: Buyers may request product samples for in-house testing or third-party lab validation before large orders.

- Supplier Communication: Transparent dialogue regarding production processes, lead times, and quality challenges builds trust and reduces risks.

QC and Certification Nuances for International Buyers from Africa, South America, Middle East, and Europe

International B2B buyers face unique challenges when sourcing addressable LED tape:

- Regional Certification Requirements: Buyers should verify if additional local certifications are necessary. For example, UAE and Saudi Arabia require SASO certification, while Brazil mandates INMETRO compliance.

- Customs and Import Compliance: Non-compliance with certifications can lead to shipment delays, fines, or product seizure at borders.

- Environmental and Safety Standards: Regions like the EU have strict environmental directives (e.g., WEEE, RoHS) that must be respected.

- Supplier Location and Logistics: Proximity to manufacturing hubs and reliable shipping routes impact lead times and cost. Buyers in Africa and South America should consider suppliers with proven export experience.

- After-Sales Support and Warranty: Due to long supply chains, robust warranty terms and accessible technical support are critical for addressing potential defects or failures.

By incorporating these factors into supplier evaluation and procurement strategies, buyers can secure high-quality addressable LED tape that meets both technical and regulatory demands.

Summary

For B2B buyers targeting addressable LED tape, understanding the detailed manufacturing processes and rigorous quality assurance protocols is vital. Key manufacturing stages—from material preparation through assembly and finishing—require precision and advanced technology. Quality assurance anchored in international standards like ISO 9001 and CE, supported by systematic QC checkpoints and testing, assures product reliability and compliance.

International buyers, especially from Africa, South America, the Middle East, and Europe, should emphasize supplier transparency, certification verification, and third-party validation to mitigate risks and ensure smooth market entry. Strategic supplier audits and comprehensive documentation review form the backbone of a robust procurement process, enabling buyers to confidently invest in addressable LED tape solutions that deliver performance, longevity, and regulatory compliance.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for addressable led tape Sourcing

Understanding the Cost Structure of Addressable LED Tape

When sourcing addressable LED tape, international B2B buyers must grasp the fundamental cost components that manufacturers consider. These components collectively influence the final price and the product’s value proposition.

- Materials: The primary cost driver includes LEDs, integrated circuits (ICs), flexible printed circuit boards (FPCBs), resistors, and other electronic components. High-quality LEDs and advanced ICs for finer control increase material costs.

- Labor: Skilled labor is required for assembly, programming, and quality checks. Labor costs vary significantly by region and manufacturing practices.

- Manufacturing Overhead: This covers utilities, facility expenses, equipment depreciation, and indirect labor supporting production lines.

- Tooling and Setup: Initial costs for creating molds, assembly jigs, and programming setups can be substantial, especially for custom designs or low volumes.

- Quality Control (QC): Rigorous testing ensures product reliability, especially for demanding applications. QC investments include testing equipment and personnel.

- Logistics and Shipping: Freight, customs, and handling fees add to landed costs. International shipments to regions like Africa, South America, the Middle East, and Europe may incur varying tariffs and lead times.

- Margin: Manufacturers and suppliers include profit margins, which depend on market demand, competition, and negotiation leverage.

Key Pricing Influencers in Addressable LED Tape Procurement

Pricing is dynamic and influenced by several factors beyond raw costs:

- Order Volume and Minimum Order Quantity (MOQ): Larger orders typically attract volume discounts. However, MOQ requirements can be a barrier for smaller businesses or pilots.

- Specifications and Customization: Higher LED densities, advanced IC types (e.g., WS2812B vs. SK6812), extended strip lengths, and additional features like waterproofing or certifications (IP65/IP67) increase costs.

- Material Quality and Certifications: Compliance with international standards (CE, RoHS, UL) ensures safety and reliability but adds to cost.

- Supplier Reputation and Location: Established suppliers with proven quality may price at a premium but reduce risks. Proximity to manufacturing hubs (e.g., China) affects shipping and lead times.

- Incoterms: Delivery terms such as FOB, CIF, or DDP impact who bears shipping, insurance, and customs duties, influencing total landed cost.

Strategic Tips for International B2B Buyers

To optimize procurement and cost-efficiency, buyers—especially those from emerging markets and diverse regions—should adopt the following strategies:

- Negotiate Volume-Based Pricing: Engage suppliers early to understand discount thresholds. Consolidate orders where possible to meet MOQ and unlock better rates.

- Prioritize Total Cost of Ownership (TCO): Look beyond unit price. Factor in installation costs, energy consumption, lifespan, maintenance, and potential downtime costs. High-quality addressable LED tape may offer lower TCO despite a higher upfront price.

- Leverage Regional Logistics Expertise: Work with freight forwarders experienced in your region (e.g., Egypt, UAE, Brazil, South Africa) to navigate customs efficiently and reduce delays.

- Assess Supplier Certifications and Warranty Terms: Certified products reduce compliance risks in regulated markets and support smoother import clearance.

- Understand Pricing Nuances: Addressable LED tape pricing often includes hidden costs such as controller compatibility, programming software licenses, or additional accessories. Clarify all inclusions upfront.

- Request Samples Before Large Commitments: Validating product quality and compatibility can prevent costly errors and reorders.

- Consider Local Assembly or Value-Added Services: For markets with high import duties, partially assembling or programming LED strips locally can optimize costs.

Indicative Pricing Disclaimer

Due to variable factors such as technology advancements, supplier pricing strategies, and fluctuating raw material costs, addressable LED tape prices can vary widely. Indicative unit prices for standard addressable LED strips typically range from $5 to $20 per meter, excluding controllers and accessories. Custom specifications, certifications, and logistics add to this base price. Buyers are advised to request detailed quotations tailored to their project needs and negotiate terms to secure competitive pricing.

By understanding the full cost structure, recognizing key price influencers, and employing strategic sourcing tactics, international B2B buyers can secure high-quality addressable LED tape solutions that deliver both performance and value across diverse global markets.

Spotlight on Potential addressable led tape Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘addressable led tape’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for addressable led tape

Critical Technical Properties of Addressable LED Tape

When sourcing addressable LED tape for international B2B projects, understanding key technical specifications ensures you select products that meet performance, durability, and compatibility requirements. Below are essential properties to evaluate:

-

LED Density (LEDs per Meter)

This indicates how many LEDs are mounted per meter of tape, commonly ranging from 30 to 144 LEDs/m. Higher density delivers smoother, more uniform lighting and finer detail in animations, which is crucial for architectural lighting or signage applications requiring visual precision. -

Integrated Circuit (IC) Type

The IC embedded in each LED segment controls color and brightness individually. Popular ICs include WS2812B, SK6812, and APA102, differing in data transmission speed, color depth, and refresh rate. Selecting the right IC affects animation smoothness, compatibility with controllers, and overall lighting effect quality. -

Color Configuration

Addressable LED tapes come in RGB, RGBW (with white LEDs), or RGBIC variants. RGBW and RGBIC offer enhanced color mixing and the ability to produce pure white light, expanding design flexibility for commercial spaces needing both vibrant color and quality white illumination. -

Material Grade and IP Rating

The tape substrate and coating material define durability and environmental resistance. For outdoor or humid environments common in regions like the Middle East or coastal Africa, selecting IP65 or higher-rated waterproof tapes ensures longevity and reduces maintenance costs. -

Voltage and Power Consumption

Most addressable LED tapes operate at 5V or 12V DC, with power consumption measured in watts per meter. Understanding these specs is vital for power supply sizing, energy budgeting, and ensuring safety compliance, especially for large-scale installations. -

Cutting and Soldering Tolerance

Addressable LED tapes can be cut at designated points to fit custom lengths. Tolerance refers to how precisely the tape can be cut and reconnected without signal loss or damage. Reliable cutting tolerance minimizes waste and installation complexity, an important consideration for large projects.

Key Trade Terminology for International B2B Buyers

Navigating the global LED tape market requires familiarity with common trade terms to streamline procurement and contract negotiations:

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers producing LED tape products that other brands re-label and sell. Partnering with OEMs can reduce costs and allow customization, but buyers must verify quality control and certification standards to avoid substandard imports. -

MOQ (Minimum Order Quantity)

The smallest number of units a supplier is willing to sell per order. MOQs vary widely; understanding them helps buyers plan inventory, negotiate better pricing, and avoid overstocking, particularly important for SMEs in emerging markets. -

RFQ (Request for Quotation)

A formal document buyers send to suppliers to obtain pricing, lead times, and terms for specific LED tape products. Crafting clear RFQs accelerates supplier responses and ensures comparable quotes for effective supplier selection. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyers and sellers. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, Freight). Knowing Incoterms helps buyers manage logistics risks and costs, especially when importing to countries like Egypt or UAE. -

Lead Time

The time from order placement to product delivery. Understanding supplier lead times is critical for project scheduling and avoiding costly delays in construction or retail setups. -

Color Rendering Index (CRI)

A measure of how accurately a light source reveals the colors of objects compared to natural light. High CRI (above 80) is essential for retail and display applications where true color representation affects customer perception.

By grasping these technical properties and trade terms, international B2B buyers can make informed purchasing decisions, optimize supply chain management, and ensure their addressable LED tape investments deliver reliable, high-quality lighting solutions tailored to their specific project needs.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the addressable led tape Sector

Market Overview & Key Trends

The global addressable LED tape market is witnessing robust growth driven by increasing demand for highly customizable, energy-efficient lighting solutions across commercial, architectural, entertainment, and smart city applications. For international B2B buyers, especially in emerging and developing markets such as Africa, South America, the Middle East (notably Egypt and UAE), and Europe, the sector presents significant opportunities fueled by urbanization, infrastructure development, and digital transformation initiatives.

Key market drivers include:

- Technological advancements: Innovations in integrated circuit (IC) technologies and flexible printed circuit boards (FPCBs) enable finer pixel control, higher LED density, and enhanced color accuracy. This facilitates complex dynamic lighting effects that appeal to sectors like hospitality, retail, and entertainment.

- Customization and programmability: Addressable LED tape’s ability to control individual LEDs or segments independently allows B2B buyers to tailor lighting schemes to specific brand experiences or architectural requirements, a critical differentiator in competitive markets.

- Integration with IoT and smart controls: Growing adoption of DMX512, SPI, and wireless control protocols enables seamless integration with building management systems and interactive installations, aligning with smart city and smart building trends worldwide.

- Supply chain diversification: Buyers in Africa, South America, and the Middle East increasingly seek reliable suppliers beyond traditional hubs in East Asia, focusing on regional distributors and manufacturers offering tailored logistics and after-sales support.

- Cost efficiency and scalability: Advances in manufacturing and component miniaturization have reduced costs, making addressable LED tapes more accessible for large-scale projects without compromising quality.

Emerging sourcing trends:

- Preference for modular and standardized LED tape formats that simplify installation and maintenance.

- Demand for multi-protocol compatibility to future-proof investments.

- Increased interest in turnkey solutions including controllers, power supplies, and software from single vendors to streamline procurement and integration.

- Growing emphasis on supplier transparency, certifications, and compliance with international standards to mitigate risks associated with quality and regulatory adherence.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a critical factor for B2B buyers in the addressable LED tape sector, driven by tightening environmental regulations and growing corporate social responsibility (CSR) mandates across Africa, South America, the Middle East, and Europe. Addressable LED tapes inherently offer energy-saving benefits compared to traditional lighting, but the environmental impact extends beyond operational efficiency.

Key sustainability considerations include:

- Material selection: Buyers should prioritize LED tapes made with non-toxic, recyclable materials, including halogen-free substrates and lead-free soldering processes. These choices reduce hazardous waste and support circular economy initiatives.

- Energy efficiency: Opting for LEDs with high luminous efficacy and low power consumption contributes directly to reducing carbon footprints and operational costs.

- Supply chain ethics: Ensuring suppliers adhere to ethical labor practices, conflict-free sourcing of raw materials (such as rare earth elements and semiconductors), and compliance with international labor standards is vital. This is especially relevant in regions where supply chains can be complex and opaque.

- Certifications and standards: Look for products and suppliers certified under recognized frameworks such as RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and ISO 14001 (Environmental Management Systems). These certifications signal commitment to environmental stewardship and regulatory compliance.

- End-of-life management: Engage suppliers that offer take-back programs, recycling partnerships, or design products for easy disassembly to minimize electronic waste.

Incorporating sustainability and ethical sourcing into procurement strategies not only mitigates risks but also enhances brand reputation and aligns with the increasing expectations of global partners and consumers.

Brief Evolution and Historical Context

Addressable LED tape technology emerged as a natural evolution of traditional LED strip lighting, combining advances in microcontroller ICs and flexible circuit design to enable individual LED control. Initially popularized in hobbyist and entertainment sectors, the technology rapidly matured through the 2010s with the introduction of protocols like SPI and DMX512, enhancing scalability and integration capabilities.

For B2B buyers, understanding this evolution is crucial as it reflects the shift from simple, uniform lighting solutions to highly programmable and interactive installations. This transition has opened new markets in architectural lighting, retail displays, and experiential environments, particularly in regions investing in modern infrastructure and digital innovation.

Today, the addressable LED tape sector is characterized by a diverse ecosystem of manufacturers, component suppliers, and software developers, offering comprehensive solutions tailored to complex, large-scale commercial projects worldwide. Recognizing this historical trajectory enables buyers to better assess product maturity, vendor reliability, and future-proofing potential for their lighting projects.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of addressable led tape

-

How can I effectively vet suppliers of addressable LED tape to ensure reliability and quality?

Begin by requesting detailed product datasheets and certifications such as CE, RoHS, and UL to verify compliance with international standards. Check the supplier’s track record through reviews, client references, and case studies, especially from regions similar to yours (Africa, Middle East, South America, Europe). Verify their production capacity and quality control processes, including in-house testing and third-party inspections. Request samples to assess product performance firsthand. Additionally, confirm their responsiveness and willingness to customize products to your specifications, which reflects professionalism and flexibility. -

What customization options are typically available for addressable LED tape, and how can I ensure they meet my project requirements?

Addressable LED tape can be customized in terms of LED density (LEDs per meter), color types (RGB, RGBW, RGBIC), strip length, voltage, IC type, and waterproofing level (IP rating). To align with your project, clearly communicate your required lighting effects, control protocols (SPI, DMX512), and environmental conditions. Engage suppliers early to discuss these parameters and request prototype samples or technical drawings. Custom firmware or software compatibility may also be arranged. Detailed specification sheets and samples help avoid misunderstandings and ensure the final product fits your operational needs. -

What are typical minimum order quantities (MOQs) and lead times for addressable LED tape, especially when sourcing from international suppliers?

MOQs vary widely depending on the supplier and customization level but typically range from 500 to 5,000 meters per order. Standard lead times span 3 to 6 weeks, factoring in production and shipping. Custom orders may require longer. For buyers in Africa, South America, and the Middle East, consider additional time for customs clearance and local logistics. Negotiate MOQs and lead times upfront, especially if you plan multiple orders. Some suppliers offer sample orders or smaller pilot runs to validate quality before committing to large volumes. -

What payment terms and methods are common in international B2B transactions for addressable LED tape, and how can I mitigate financial risks?

Common payment terms include 30% upfront deposit with the balance paid before shipment or upon delivery, often via wire transfer (T/T), Letter of Credit (L/C), or escrow services. For new supplier relationships, secure payment methods like L/C or escrow reduce risk. Negotiate clear contract terms covering delivery schedules, quality standards, and penalties for delays or defects. Using reputable payment platforms and involving trade finance instruments can protect your investment. Always confirm supplier bank details independently to avoid fraud.

-

What quality assurance measures should I expect from addressable LED tape suppliers, and how can I verify product quality before bulk purchasing?

Top suppliers implement rigorous QA protocols including in-line optical inspections, electrical testing for voltage and current, and environmental stress tests (humidity, temperature). Request supplier quality certificates and compliance documents. Insist on product samples and conduct your own tests, such as color consistency, signal integrity, and durability under your expected operating conditions. Consider third-party inspection services or factory audits, especially for large orders. Clear contractual agreements on quality standards and return policies are essential for dispute resolution. -

How can I navigate logistics challenges when importing addressable LED tape to regions like Egypt, UAE, or South America?

Plan shipments considering lead times, preferred transport modes (sea freight for cost-efficiency, air freight for speed), and customs regulations specific to your country. Work with freight forwarders experienced in electronics imports and ensure all documentation (commercial invoice, packing list, certificates) is accurate to avoid clearance delays. Understand import duties, taxes, and local standards compliance. Establish clear communication channels with suppliers for real-time shipment tracking. Consolidating shipments can reduce costs but balance this against inventory and cash flow constraints. -

What certifications and standards should addressable LED tape comply with for international markets, particularly in Africa, the Middle East, and Europe?

Look for CE marking for European compliance, RoHS for hazardous substances restriction, and UL or ETL certifications for safety standards. In the Middle East and Africa, compliance with IEC standards and local electrical codes is important. Suppliers should provide test reports from accredited labs verifying electrical safety, electromagnetic compatibility (EMC), and environmental compliance. Certifications not only ensure safety and quality but also ease customs clearance. Request these documents early in the sourcing process to avoid compliance issues post-shipment. -

How should disputes or quality issues be handled when dealing with overseas suppliers of addressable LED tape?

Establish clear contractual terms defining product specifications, inspection procedures, dispute resolution mechanisms, and warranties before placing orders. Use Incoterms to clarify responsibilities for shipping and risk transfer. In case of defects or non-compliance, document issues thoroughly with photos and test reports. Engage the supplier promptly to negotiate replacements, refunds, or discounts. Utilizing third-party arbitration or mediation can be effective for unresolved disputes. Maintaining professional, transparent communication and building strong supplier relationships are key to minimizing conflicts in international trade.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for addressable led tape

Addressable LED tape represents a transformative opportunity for businesses seeking advanced lighting solutions that combine flexibility, customization, and energy efficiency. For international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe, understanding the nuances of LED strip technologies—from IC types and control protocols to power and compatibility considerations—is essential to sourcing products that align with project requirements and regional market demands.

Strategic sourcing in this sector demands careful evaluation of supplier capabilities, product quality certifications, and after-sales support to mitigate risks such as technical incompatibility and supply chain disruptions. Prioritizing suppliers who offer comprehensive technical documentation, customization options, and scalable solutions will empower businesses to deliver innovative lighting designs that stand out in competitive markets.

Looking ahead, the addressable LED tape market is poised for growth driven by increasing adoption in commercial, architectural, and entertainment applications worldwide. Buyers are encouraged to leverage emerging technologies, such as integrated smart controls and enhanced color rendering, to future-proof their investments. Engaging with trusted manufacturers and staying informed about evolving standards will position businesses to capitalize on this dynamic lighting trend and unlock new value across diverse international markets.