Guide to Addressable Led Strips

- Introduction: Navigating the Global Market for addressable led strips

- Understanding addressable led strips Types and Variations

- Key Industrial Applications of addressable led strips

- Strategic Material Selection Guide for addressable led strips

- In-depth Look: Manufacturing Processes and Quality Assurance for addressable led strips

- Comprehensive Cost and Pricing Analysis for addressable led strips Sourcing

- Spotlight on Potential addressable led strips Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for addressable led strips

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the addressable led strips Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of addressable led strips

- Strategic Sourcing Conclusion and Outlook for addressable led strips

Introduction: Navigating the Global Market for addressable led strips

Addressable LED strips have revolutionized lighting solutions across industries, delivering unmatched flexibility and vibrant customization that traditional lighting simply cannot match. For international B2B buyers—particularly those operating in dynamic markets such as Africa, South America, the Middle East, and Europe—understanding the nuances of addressable LED technology is critical to sourcing products that meet both technical demands and cost-efficiency goals. Whether for architectural projects in Italy, entertainment venues in Argentina, or commercial installations across emerging markets, these intelligent lighting systems offer transformative potential.

This guide provides a comprehensive roadmap to mastering the global addressable LED strip market. It covers the full spectrum of essential topics, including the various types of addressable LED strips, key materials and components, manufacturing best practices, and quality control standards. In addition, it offers actionable insights into identifying reliable suppliers, evaluating cost structures, and navigating regional market trends and challenges.

Designed to empower procurement professionals and technical buyers, the guide demystifies complex specifications and highlights critical decision factors—such as voltage levels, integrated circuit types, and controller compatibility—that directly impact project success. By equipping you with a thorough understanding of the technology and marketplace, this resource enables confident, informed sourcing decisions that optimize performance, durability, and budget.

For businesses seeking to harness the full power of addressable LED strips, this guide is an indispensable tool to unlock innovation and competitive advantage in today’s interconnected global market.

Understanding addressable led strips Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| WS2811 Addressable LED Strip | Uses external IC, available in 12V and 5V versions; controls 3 LEDs per IC | Architectural lighting, long-run installations | + Longer runs with less voltage drop (12V version) – Less granular control, higher power consumption |

| WS2812/WS2812B Strip | Integrated IC per LED, single data line, 5V operation | Interactive displays, retail signage | + Fine individual LED control, widely supported – Single data line risks full strip failure if one LED breaks |

| WS2813 Addressable LED Strip | Dual data lines with LED bypass capability; 5V operation | High-reliability installations, entertainment | + Improved fault tolerance, maintains function despite LED failure – Slightly higher cost and complexity |

| Voltage Variants (5V, 12V, 24V) | Different operating voltages affecting power consumption and voltage drop | Various industrial and commercial lighting projects | + Higher voltage reduces voltage drop over long runs – Higher voltage may require compatible controllers and power supplies |

| RGB vs RGBW vs RGBIC Variants | Color capabilities: RGB (3 colors), RGBW (with white LED), RGBIC (integrated IC for color mixing) | Decorative lighting, mood lighting, specialized color rendering | + Greater color range and quality with RGBW/RGBIC – Increased cost and complexity in control systems |

WS2811 Addressable LED Strips

WS2811 strips use an external integrated circuit controlling groups of three LEDs at a time, typically operating at 12V or 5V. The 12V variant is preferred for commercial projects requiring longer strip runs with reduced voltage drop, which is important for installations in large venues or architectural facades common in Europe and the Middle East. However, WS2811 strips offer less precise individual LED control, which may limit their use in highly detailed lighting designs. B2B buyers should consider power supply compatibility and the trade-off between control granularity and installation scale.

WS2812 / WS2812B Addressable LED Strips

These strips feature an integrated IC for each LED, enabling individual pixel control with a single 5V data line. They are widely used in retail displays, interactive signage, and dynamic lighting projects requiring fine control and vivid color effects. However, their single data line design makes them vulnerable to complete strip failure if one LED malfunctions, a risk factor for critical installations. Buyers in South America and Africa should ensure reliable quality sourcing and consider redundancy planning for mission-critical applications.

WS2813 Addressable LED Strips

WS2813 strips build on WS2812 technology by introducing dual data lines and a bypass feature, which allows the strip to continue functioning even if one LED fails. This makes WS2813 ideal for high-reliability applications such as entertainment venues, museums, and large-scale architectural lighting projects where downtime is costly. Although slightly more expensive, the improved fault tolerance can reduce maintenance costs and operational disruptions, a key consideration for B2B buyers managing long-term installations.

Voltage Variants: 5V, 12V, and 24V

Addressable LED strips come in various voltage ratings, each with implications for power efficiency and installation complexity. Higher voltage strips (12V and 24V) experience less voltage drop over long distances, making them suitable for extensive commercial and industrial lighting projects across regions like Europe and the Middle East. However, they require compatible controllers and more robust power supplies, increasing initial investment. Buyers should evaluate project scale, power infrastructure, and total cost of ownership when selecting voltage levels.

RGB, RGBW, and RGBIC Color Variants

Variations in color capabilities offer different creative and functional benefits. RGB strips provide basic red, green, and blue mixing, while RGBW adds dedicated white LEDs for better color rendering and lighting versatility. RGBIC incorporates integrated chips enabling complex color mixing and effects at the pixel level, ideal for high-end decorative and mood lighting applications in luxury retail or hospitality sectors. Although these offer superior visual quality, they demand more advanced control systems and higher budgets, factors B2B buyers must weigh against desired lighting outcomes.

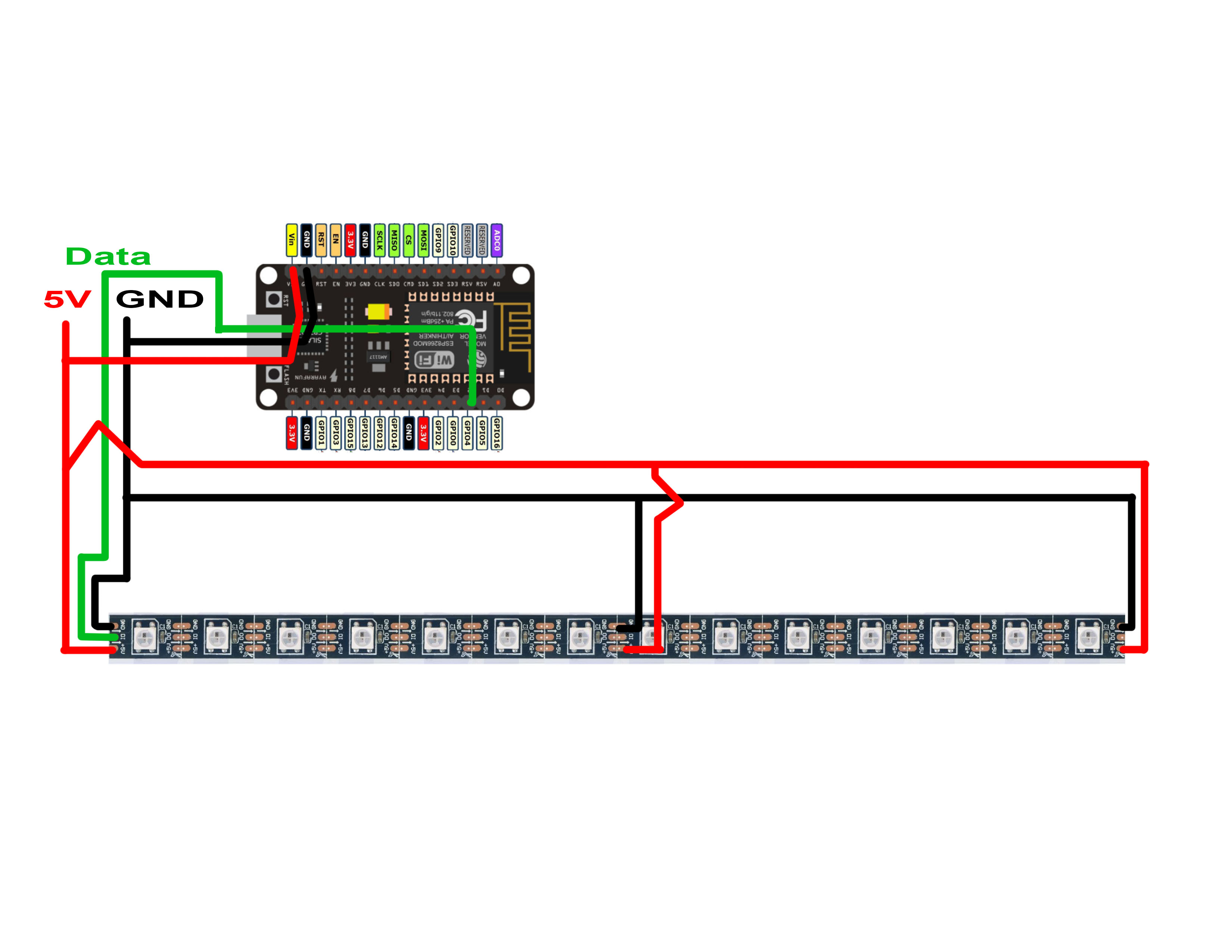

Related Video: How To Use Addressable RGB WS2812B LED Strips With a Raspberry Pi Single Board Computer

Key Industrial Applications of addressable led strips

| Industry/Sector | Specific Application of addressable led strips | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Advertising | Dynamic in-store displays and signage | Enhances customer engagement, drives sales with eye-catching visuals | Durability, color accuracy, ease of programming, compatibility with controllers |

| Entertainment & Events | Stage lighting and immersive visual effects | Creates customizable, dynamic lighting that elevates audience experience | High refresh rate, reliability under continuous use, DMX compatibility |

| Architecture & Interior Design | Ambient and accent lighting in commercial buildings | Adds aesthetic appeal, energy-efficient mood lighting with flexible design | Voltage options, IP rating for indoor/outdoor use, uniform brightness |

| Automotive & Transportation | Customizable lighting for vehicle interiors and exteriors | Improves brand image and passenger experience with tailored lighting effects | Heat resistance, flexible form factor, automotive-grade certifications |

| Hospitality & Tourism | Themed lighting for hotels, resorts, and attractions | Enhances guest experience, supports branding with programmable effects | Weatherproofing, ease of installation, integration with existing control systems |

Retail & Advertising

In retail environments across Europe and South America, addressable LED strips are extensively used for dynamic in-store displays and signage. These strips enable businesses to program vibrant, multicolor lighting effects that attract customers and highlight products effectively. The ability to customize each LED individually allows retailers to create animations or color transitions that can be synchronized with marketing campaigns. For international buyers, especially in emerging markets like Africa and the Middle East, sourcing LED strips with reliable controllers and high color fidelity is crucial to maintain brand consistency and ensure long-term operational stability.

Entertainment & Events

The entertainment industry in regions such as Italy and Argentina benefits significantly from addressable LED strips for stage lighting and immersive visual effects. These strips provide lighting designers with the flexibility to craft complex animations and color schemes that respond to music or live action, enhancing audience engagement. Buyers must focus on strips with fast refresh rates, robust build quality, and DMX512 compatibility to ensure seamless integration with professional lighting control systems, which is vital for large-scale events and touring productions.

Architecture & Interior Design

In architectural projects, especially in commercial buildings and luxury interiors across Europe and the Middle East, addressable LED strips serve as ambient and accent lighting solutions. Their flexibility allows designers to create subtle mood lighting or dramatic effects that emphasize structural features. For B2B buyers, important considerations include selecting strips with appropriate voltage options (commonly 12V or 24V for longer runs), high IP ratings for indoor or outdoor use, and consistent brightness to avoid uneven lighting. These factors ensure energy efficiency and aesthetic quality in high-end installations.

Automotive & Transportation

Automotive manufacturers and customizers in Africa and South America are increasingly adopting addressable LED strips for vehicle interior and exterior lighting customization. These strips enhance the driving experience and reinforce brand identity through bespoke lighting effects. Buyers should prioritize LED strips with high heat resistance and flexible form factors to fit complex vehicle contours. Additionally, automotive-grade certifications and compliance with local regulations are essential to ensure safety and durability under varying environmental conditions.

Hospitality & Tourism

Hotels, resorts, and tourism attractions in the Middle East and Europe leverage addressable LED strips to create themed environments and memorable guest experiences. Programmable lighting can simulate natural cycles, support event-based themes, or reinforce brand colors dynamically. For international B2B buyers, sourcing weatherproof and easy-to-install LED strips compatible with existing building automation systems reduces installation complexity and operational costs. Ensuring the lighting solution can withstand harsh climates is particularly important in regions with extreme temperatures or humidity.

Related Video: TM1814 RGBW Pixel Addressable Digital LED Strips Engineering Project

Strategic Material Selection Guide for addressable led strips

When selecting materials for addressable LED strips, B2B buyers must consider factors such as durability, environmental resistance, manufacturing complexity, and compliance with regional standards. The choice of material directly impacts the longevity, performance, and suitability of LED strips for specific applications, especially across diverse markets like Africa, South America, the Middle East, and Europe.

1. Flexible Printed Circuit Board (FPCB) – Polyimide (PI)

Key Properties:

Polyimide-based FPCBs offer excellent thermal stability (up to 260°C), high flexibility, and chemical resistance. They withstand mechanical bending and have good dielectric properties, making them ideal for compact LED strip designs.

Pros & Cons:

– Pros: High temperature tolerance, excellent flexibility for curved installations, and good resistance to solvents and oils.

– Cons: Higher cost compared to standard polyester films; manufacturing requires precise handling due to material sensitivity.

Impact on Application:

Ideal for dynamic installations where strips must bend or flex, such as architectural lighting in curved facades or automotive interiors. Polyimide FPCBs maintain performance in high-temperature environments, suitable for regions with hot climates like the Middle East and parts of Africa.

International Considerations:

Polyimide FPCBs generally comply with international standards like IPC-2223 for flexible circuits. Buyers in Europe (Italy) and South America (Argentina) should verify RoHS and REACH compliance to meet environmental regulations. The material’s high-temperature tolerance aligns well with ASTM and DIN standards for thermal resistance.

2. Flexible Printed Circuit Board (FPCB) – Polyester (PET)

Key Properties:

PET-based FPCBs are cost-effective with moderate thermal resistance (up to 130°C) and good dimensional stability. They are less flexible than polyimide but still suitable for many flat or gently curved applications.

Pros & Cons:

– Pros: Lower cost, easier to manufacture, and good electrical insulation.

– Cons: Limited temperature resistance, less durable in harsh environments, and prone to deformation under prolonged heat exposure.

Impact on Application:

Best suited for indoor lighting projects with stable ambient temperatures, such as retail displays or office lighting. Not recommended for outdoor or high-temperature environments common in parts of Africa or the Middle East without additional protective coatings.

International Considerations:

PET FPCBs are widely accepted and meet common standards like JIS and IEC. However, buyers should ensure that the product meets local fire safety and flammability requirements, particularly in Europe and South America. The lower thermal rating may limit usage in regions with extreme heat unless paired with protective measures.

3. Silicone Encapsulation (for LED Strip Coating)

Key Properties:

Silicone encapsulants provide excellent UV resistance, waterproofing (IP65 to IP68 ratings), and flexibility. They tolerate extreme temperature ranges (-60°C to 200°C) and resist chemical corrosion.

Pros & Cons:

– Pros: Superior environmental protection, ideal for outdoor and harsh conditions, maintains LED brightness and color stability.

– Cons: Higher material and processing costs; potential challenges in mass production scalability.

Impact on Application:

Perfect for outdoor installations, signage, and marine environments where moisture and UV exposure are concerns. This makes silicone-coated strips highly relevant for buyers in coastal regions of South America and the Middle East, where humidity and sun exposure are significant.

International Considerations:

Silicone coatings typically comply with ASTM D2000 and ISO 10993 standards for durability and safety. Buyers should verify certifications for UV resistance and waterproof ratings to ensure suitability for their target market. In Europe, compliance with CE marking and RoHS directives is essential.

4. Epoxy Resin Encapsulation

Key Properties:

Epoxy resin offers robust mechanical protection and excellent adhesion to substrates. It provides good electrical insulation and moderate chemical resistance but has limited flexibility and can yellow over time under UV exposure.

Pros & Cons:

– Pros: Cost-effective, strong protective layer, suitable for rigid installations.

– Cons: Brittle compared to silicone, less UV stable, prone to cracking under mechanical stress.

Impact on Application:

Best used in controlled indoor environments or fixed installations where mechanical protection is needed but flexibility is not critical. Less suitable for outdoor or flexible applications common in dynamic architectural or entertainment lighting projects.

International Considerations:

Epoxy encapsulants must meet ASTM and DIN standards for electrical insulation and mechanical strength. Buyers in regions with strict environmental standards, such as Europe, should confirm low VOC emissions and RoHS compliance. The material’s brittleness may limit its adoption in markets requiring flexible or curved LED strips.

| Material | Typical Use Case for addressable led strips | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyimide (PI) FPCB | Flexible, high-temperature installations, curved surfaces | High thermal stability and excellent flexibility | Higher cost and sensitive manufacturing process | High |

| Polyester (PET) FPCB | Indoor, flat or gently curved lighting applications | Cost-effective and easy to manufacture | Limited temperature resistance and durability | Low |

| Silicone Encapsulation | Outdoor, waterproof, UV-exposed environments | Superior environmental protection and flexibility | Higher cost and complex processing | High |

| Epoxy Resin Encapsulation | Indoor, rigid installations requiring mechanical protection | Strong adhesion and mechanical protection | Brittle, less UV stable, limited flexibility | Medium |

This guide equips international B2B buyers with a clear understanding of material options for addressable LED strips, helping them align product choices with application needs and regional standards for optimal performance and compliance.

In-depth Look: Manufacturing Processes and Quality Assurance for addressable led strips

Manufacturing Processes for Addressable LED Strips

The production of addressable LED strips involves a complex, multi-stage process that demands precision and advanced technology to ensure performance, durability, and safety. Understanding these stages is crucial for international B2B buyers to evaluate suppliers effectively and ensure that the products meet their specific application needs.

Illustrative Image (Source: Google Search)

1. Material Preparation

The foundation of quality addressable LED strips starts with high-grade raw materials:

- Flexible Printed Circuit Board (FPCB): Typically made from polyimide or polyester films, the FPCB provides the flexible base on which LEDs and integrated circuits are mounted. Material thickness and copper weight are critical parameters affecting durability and conductivity.

- LED Chips and ICs: Addressable strips incorporate LEDs paired with integrated circuit (IC) chips such as WS2811, WS2812, or WS2813b. These components must be sourced from reliable manufacturers to ensure consistent color rendering and signal integrity.

- Solder and Conductive Materials: High-purity solder and conductive adhesives are used for robust electrical connections, minimizing the risk of failures during operation.

2. Forming and Circuit Printing

- Circuit Patterning: Copper traces are etched or printed on the FPCB to create the circuit paths. Precision in etching ensures minimal resistance and consistent voltage distribution across the strip.

- Component Placement: Automated pick-and-place machines position LEDs and ICs accurately on the FPCB. This stage requires micron-level precision to avoid misalignment, which can cause malfunction or uneven lighting.

- Soldering: Reflow soldering is the standard method for securing components. Controlled temperature profiles prevent damage to sensitive ICs and maintain solder joint reliability.

3. Assembly and Encapsulation

- Testing During Assembly: Inline testing equipment checks for shorts, opens, and correct LED functionality during the assembly line to catch defects early.

- Encapsulation and Coating: To protect the strips from moisture, dust, and mechanical damage, manufacturers apply silicone or epoxy coatings. The choice of coating impacts flexibility, heat dissipation, and IP (Ingress Protection) rating.

- Cutting and Connector Attachment: Strips are cut to standard lengths or customer specifications. Connectors and terminals are then attached, enabling easy integration into larger lighting systems.

4. Finishing and Packaging

- Final Inspection: Visual and automated inspections confirm uniform LED brightness, color accuracy, and physical integrity.

- Packaging: Anti-static bags, moisture barrier films, and cushioning materials are used to prevent electrostatic discharge and physical damage during transit.

- Labeling: Compliance marks, batch numbers, and handling instructions are clearly printed for traceability and regulatory adherence.

Quality Assurance and Control (QA/QC)

Robust quality assurance is essential to guarantee that addressable LED strips perform reliably, especially for demanding commercial and industrial applications across diverse international markets.

Key International and Industry Standards

- ISO 9001: The global benchmark for quality management systems, ensuring consistent production processes and continuous improvement.

- CE Marking: Mandatory for products sold in the European Economic Area (EEA), indicating conformity with health, safety, and environmental protection standards.

- RoHS Compliance: Restricts hazardous substances in electrical and electronic equipment, critical for European and many Middle Eastern markets.

- UL Certification: Widely recognized in the Americas and parts of Europe, certifying electrical safety and fire resistance.

- IP Ratings (Ingress Protection): Defines the strip’s resistance to dust and water, crucial for outdoor or industrial applications.

- Other Regional Certifications: Some countries in Africa and South America may require local certifications or customs-specific documentation; buyers should verify these requirements early.

QC Checkpoints Throughout Production

- Incoming Quality Control (IQC): Raw materials, including LED chips, ICs, FPCB, and solder, undergo rigorous testing for specifications, defects, and compliance before entering production.

- In-Process Quality Control (IPQC): Continuous inspections during assembly check solder joints, LED placement accuracy, electrical connectivity, and early functional tests to detect defects promptly.

- Final Quality Control (FQC): Comprehensive end-of-line tests verify full strip functionality, brightness uniformity, color accuracy, signal integrity, and mechanical durability.

Common Testing Methods

- Electrical Testing: Verification of voltage, current consumption, and signal transmission integrity to ensure proper LED addressing and color control.

- Visual and Optical Testing: Automated cameras and sensors measure LED brightness, color consistency, and detect physical defects or misalignments.

- Environmental Stress Testing: Includes thermal cycling, humidity exposure, and vibration tests to simulate real-world operating conditions, ensuring long-term reliability.

- Mechanical Flexibility Testing: For flexible strips, bending and torsion tests confirm durability without performance degradation.

- Signal and Communication Testing: Ensures that the integrated IC chips respond correctly to controller inputs, critical for dynamic lighting effects.

How B2B Buyers Can Verify Supplier Quality Control

For international buyers, especially those operating in Africa, South America, the Middle East, and Europe, verifying supplier QC capabilities is essential to mitigate risks and ensure product consistency.

Supplier Audits and Factory Inspections

- On-site Audits: Conduct comprehensive factory audits focusing on manufacturing processes, QC procedures, equipment calibration, and staff training.

- Third-Party Inspections: Engage independent inspection agencies (e.g., SGS, Intertek) to perform random batch testing and factory compliance verification.

- Sample Testing: Request product samples for independent lab testing in buyer’s country or trusted third-party labs to confirm certifications and performance claims.

Documentation and Reporting

- Quality Certificates: Verify ISO 9001, CE, RoHS, UL, and any other relevant certificates. Ensure they are current and issued by accredited bodies.

- Test Reports: Obtain detailed IQC, IPQC, and FQC reports for production batches, including electrical, optical, and environmental test results.

- Traceability Records: Confirm that the supplier maintains batch numbers and production logs, enabling root cause analysis in case of defects.

QC and Certification Nuances for International Buyers

- Voltage and Signal Standards: Different regions may have varying voltage preferences (5V, 12V, 24V) and controller compatibilities; ensure the supplier’s products align with your regional standards.

- Environmental Considerations: Buyers from humid or hot climates (e.g., parts of Africa and the Middle East) should prioritize IP65 or higher rated strips with robust encapsulation.

- Regulatory Compliance: European buyers, such as those in Italy, must prioritize CE and RoHS compliance. South American buyers, like those in Argentina, should verify import regulations and local certification requirements to avoid customs delays.

- After-Sales Support and Warranty: Evaluate the supplier’s capacity for technical support, replacement policies, and warranty terms, which are critical for maintaining long-term partnerships.

Summary for B2B Buyers

Selecting addressable LED strips requires a deep understanding of the manufacturing and quality assurance processes to mitigate risks and ensure product excellence. By focusing on supplier transparency in material sourcing, manufacturing precision, adherence to international standards, and rigorous QC protocols, buyers from Africa, South America, the Middle East, and Europe can confidently procure LED strips tailored to their operational environments and regulatory frameworks.

Engaging in thorough supplier audits, demanding comprehensive quality documentation, and leveraging third-party inspections are effective strategies to secure reliable, high-performance addressable LED strips that enhance your lighting projects and business reputation.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for addressable led strips Sourcing

Understanding the cost structure and pricing dynamics of addressable LED strips is essential for international B2B buyers aiming to optimize procurement and manage budgets effectively. This analysis breaks down key cost components, pricing influencers, and strategic buyer tips tailored to markets in Africa, South America, the Middle East, and Europe.

Key Cost Components in Addressable LED Strip Manufacturing

-

Materials

The primary cost driver is the selection of LEDs (e.g., WS2812B, WS2813), integrated circuits (ICs), flexible printed circuit boards (FPCBs), and power supplies. High-quality chips and durable FPCBs raise material costs but improve longevity and performance. Voltage options (5V, 12V, 24V) also impact material expenses due to differing power requirements. -

Labor

Skilled labor is needed for assembly, soldering, and quality inspections. Labor costs vary significantly by region—manufacturing hubs in Asia typically offer lower labor costs compared to Europe or the Middle East, influencing the final price. -

Manufacturing Overhead

This includes factory utilities, equipment depreciation, and process management. Efficient production lines and automation reduce overhead, enabling competitive pricing at scale. -

Tooling and Setup

Initial investments in molds, fixtures, and programming tools for custom LED configurations or new IC types add upfront costs. These are amortized over production volumes. -

Quality Control (QC)

Rigorous testing for color uniformity, signal integrity, and durability is critical. Higher QC standards, certifications (CE, RoHS, UL), and reliability testing increase costs but reduce defects and returns. -

Logistics and Shipping

Costs for packaging, freight, customs duties, and insurance vary with shipment size, destination, and mode (air vs. sea). Buyers in Africa and South America may face higher logistics costs and longer lead times due to port and infrastructure challenges. -

Supplier Margin

Margins depend on supplier positioning, competition, and order volume. Established suppliers with strong reputations may command higher prices but offer better reliability and support.

Pricing Influencers for Addressable LED Strips

-

Order Volume and Minimum Order Quantity (MOQ):

Larger orders benefit from economies of scale and lower per-unit prices. MOQ requirements vary, with some suppliers offering flexibility for sample or pilot projects. -

Specifications and Customization:

Customized LED densities, IC types, color capabilities (RGB vs. RGBW), and strip lengths influence pricing. Complex programming or proprietary controller compatibility can increase costs. -

Material Quality and Certifications:

Certified components and compliance with international safety and environmental standards justify premium pricing but facilitate access to regulated markets. -

Supplier Location and Reputation:

Proximity to manufacturing hubs reduces logistics costs. Suppliers with proven track records reduce risks related to delays and quality issues. -

Incoterms and Payment Terms:

Understanding Incoterms (FOB, CIF, DDP) is crucial for cost transparency. Buyers should negotiate terms that align with their import capabilities to avoid unexpected expenses.

Strategic Buyer Tips for International B2B Procurement

-

Negotiate Beyond Price:

Engage suppliers on MOQ flexibility, payment terms, warranty, and after-sales support. Volume discounts can be enhanced by committing to longer-term partnerships. -

Consider Total Cost of Ownership (TCO):

Factor in installation complexity, energy consumption, maintenance, and potential downtime costs alongside purchase price. Higher upfront investment in quality often leads to lower TCO. -

Validate Samples and Certifications:

Request product samples and verify compliance certificates early to avoid quality surprises. This is especially important for buyers in regions with strict import regulations like the EU. -

Leverage Regional Trade Agreements:

Utilize trade agreements and preferential tariffs where applicable to reduce import duties and taxes, particularly relevant for buyers in South America and Africa. -

Plan for Logistics Variability:

Build buffer time into project schedules to accommodate longer shipping times and customs clearance delays common in some regions. -

Be Wary of Unrealistically Low Prices:

Extremely low quotes may indicate compromised quality, lack of certifications, or hidden costs. Prioritize supplier transparency and reliability.

Indicative Pricing Disclaimer

Pricing for addressable LED strips varies widely based on specifications, order size, and supplier terms. As a general benchmark, unit prices can range from approximately $5 to $20 per meter for standard addressable LED strips, excluding shipping and taxes. Buyers should conduct direct supplier inquiries and request detailed quotations tailored to their project requirements.

By thoroughly understanding the cost drivers and pricing factors, international B2B buyers can make well-informed sourcing decisions, balancing cost-efficiency with quality and reliability to achieve optimal outcomes in their addressable LED strip projects.

Spotlight on Potential addressable led strips Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘addressable led strips’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for addressable led strips

Critical Technical Properties of Addressable LED Strips

Understanding the essential technical properties of addressable LED strips is crucial for international B2B buyers aiming to select the right product that fits their project requirements and ensures operational efficiency.

-

Voltage Rating (5V, 12V, 24V)

The voltage rating determines the power supply requirements and impacts voltage drop along the strip. Higher voltages like 12V or 24V reduce voltage drop, enabling longer runs without brightness loss—critical for large-scale installations common in commercial or architectural projects. Selecting the correct voltage ensures stable performance and reduces maintenance costs. -

LED Density (LEDs per Meter)

LED density affects brightness uniformity and resolution of lighting effects. Higher densities (e.g., 60 to 144 LEDs/meter) provide smoother gradients and more detailed animations, which is essential for dynamic visual displays in retail, entertainment, or hospitality sectors. Buyers should balance density with cost and power consumption to optimize ROI. -

Integrated Circuit (IC) Type

The IC embedded in each LED defines addressability and signal reliability. Popular ICs include WS2811, WS2812B, and WS2813, each with distinct features such as signal redundancy and power consumption. For instance, WS2813 offers dual-signal lines for enhanced fault tolerance, a vital consideration for critical installations where uptime is non-negotiable. -

Color Configuration (RGB, RGBW, RGBIC, etc.)

Color capabilities influence the range and quality of lighting effects. RGB strips provide basic color mixing, while RGBW adds a dedicated white LED for better white light rendering. Advanced types like RGBIC allow individual LED control with multiple colors simultaneously. This property directly affects the complexity and visual appeal of lighting designs. -

Material Quality and Flexibility

The substrate material, usually a Flexible Printed Circuit Board (FPCB), impacts durability and ease of installation. High-grade FPCBs resist heat and environmental factors, essential for outdoor or industrial applications. Flexibility is also important for installations on curved or irregular surfaces, common in architectural projects across diverse regions. -

Ingress Protection (IP) Rating

The IP rating indicates resistance to dust and water. For outdoor or harsh environment applications, IP65 or higher is necessary to prevent damage and ensure longevity. This specification affects warranty terms and lifecycle costs, making it a key factor in procurement decisions.

Common Trade Terminology for Addressable LED Strip Procurement

Familiarity with industry jargon streamlines communication and negotiation between buyers and suppliers, reducing errors and expediting procurement.

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers who produce LED strips that can be branded and customized by other companies. For B2B buyers, OEM partnerships allow tailored products to meet specific project needs, often with flexible minimum order quantities and proprietary features. -

MOQ (Minimum Order Quantity)

The smallest amount of product a supplier is willing to sell in one order. Understanding MOQ helps buyers plan inventory and budget, especially important for businesses in emerging markets where upfront capital may be limited. -

RFQ (Request for Quotation)

A formal process where buyers solicit price and delivery information from suppliers. RFQs are critical for comparing offers, negotiating terms, and ensuring compliance with local import regulations and standards in regions like Africa, South America, and the Middle East. -

Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, EXW) defining responsibilities for shipping, insurance, and customs between buyer and seller. Knowledge of Incoterms enables buyers to manage logistics efficiently and avoid unexpected costs during cross-border transactions. -

Lead Time

The period between placing an order and receiving the goods. Lead time impacts project scheduling and cash flow management. Buyers should confirm lead times upfront, particularly when sourcing from overseas suppliers to mitigate delays. -

Batch Consistency

Refers to the uniformity of product quality and color between production runs. Maintaining batch consistency is vital for projects requiring seamless lighting effects, especially in large installations or phased rollouts.

By mastering these technical properties and trade terms, B2B buyers across Africa, South America, the Middle East, and Europe can make informed purchasing decisions, optimize supply chain efficiency, and secure high-quality addressable LED strips tailored to their unique market needs.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the addressable led strips Sector

Market Overview & Key Trends

The global market for addressable LED strips is expanding rapidly, driven by increasing demand for customizable, energy-efficient lighting solutions across commercial, architectural, and entertainment sectors. For international B2B buyers, especially from Africa, South America, the Middle East, and Europe, this sector offers significant opportunities owing to rising urbanization, infrastructure development, and a growing emphasis on smart lighting technologies.

Key market drivers include:

- Customization and Control: Addressable LED strips enable individual LED control, allowing complex lighting effects and animations, which are highly sought after in retail, hospitality, and event management industries.

- Technological Advancements: Integration with IoT and smart controllers (e.g., DMX512, SPI protocols) is enabling remote and synchronized lighting solutions, appealing to businesses aiming for advanced lighting management.

- Diverse Voltage Options: Availability in 5V, 12V, and 24V variants caters to different project scales and power requirements, enhancing adaptability for diverse regional infrastructures.

- Durability and Reliability: Innovations such as dual-signal chips (e.g., WS2813) improve reliability by ensuring signal continuity even if individual LEDs fail, reducing maintenance costs for large installations.

Emerging sourcing trends relevant to B2B buyers:

- Regional Manufacturing Hubs: Asia remains a dominant manufacturing base, but buyers in Europe and South America are increasingly sourcing from local or regional suppliers to reduce lead times and import tariffs.

- Customization Services: Suppliers now offer tailored LED densities, color mixes (RGB, RGBW, RGBIC), and flexible PCB designs to meet specific project needs, allowing buyers to differentiate their offerings.

- Integrated Supply Chains: Buyers are prioritizing suppliers who provide comprehensive solutions—LED strips, controllers, power supplies, and software—streamlining procurement and technical support.

For buyers in regions like Africa and the Middle East, where infrastructure modernization is accelerating, investing in scalable, high-quality addressable LED strips aligns with growing smart city initiatives. European buyers, particularly in design-centric markets like Italy, seek high-performance and aesthetically versatile lighting that supports architectural innovation. Meanwhile, South American markets such as Argentina benefit from flexible sourcing strategies that balance cost-efficiency with product quality.

Illustrative Image (Source: Google Search)

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a critical factor in the procurement of addressable LED strips, driven by regulatory pressures and corporate responsibility commitments globally. For B2B buyers, understanding the environmental impact and ethical considerations in the supply chain is essential to align with both market expectations and compliance requirements.

Environmental Impact Considerations:

- Energy Efficiency: Addressable LED strips consume significantly less power than traditional lighting, contributing to reduced operational costs and lower carbon footprints for businesses.

- Material Use: The production involves electronic components and flexible PCBs, which require careful sourcing to minimize hazardous substances such as lead, mercury, and certain flame retardants.

- Waste Management: Buyers should inquire about manufacturers’ practices regarding electronic waste recycling and take-back programs to mitigate landfill contributions.

Ethical Supply Chain Importance:

- Responsible Sourcing: Ensuring suppliers comply with international labor standards, including fair wages and safe working conditions, is vital for sustainable procurement and brand reputation.

- Certifications to Look For: Buyers should seek products with recognized certifications such as RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and ISO 14001 (Environmental Management) to guarantee compliance with environmental and safety standards.

- Green Materials: Increasingly, suppliers are adopting lead-free solder, recyclable packaging, and low-impact manufacturing processes, which buyers should prioritize to support sustainability goals.

For regions like Europe, strict EU environmental regulations make sustainability compliance non-negotiable. Buyers in Africa and South America can leverage sustainable sourcing as a competitive advantage, appealing to global partners and investors focused on ESG (Environmental, Social, Governance) criteria. In the Middle East, where rapid industrial growth is ongoing, integrating sustainability into procurement can future-proof businesses against tightening regulations.

Evolution and Historical Context

Addressable LED strips have evolved significantly over the past decade, transitioning from simple, uniform lighting solutions to sophisticated digital displays capable of dynamic, pixel-level control. Early iterations relied on basic RGB LEDs controlled as a single unit, limiting creative possibilities.

The introduction of integrated circuit chips like the WS2811 and WS2812 series revolutionized the sector by embedding control logic directly within the strip, enabling each LED to be individually addressed and programmed. This advancement opened new avenues in architectural lighting, entertainment, and advertising industries, where vibrant, customizable lighting is essential.

More recently, innovations such as dual-signal chips (WS2813) and higher voltage options (12V, 24V) have improved reliability and scalability, addressing challenges like voltage drop and single-point failures. This maturation of technology allows B2B buyers to confidently adopt addressable LED strips for large-scale, mission-critical projects worldwide.

The evolution reflects a broader industry trend toward smart, energy-efficient, and highly customizable lighting solutions, positioning addressable LED strips as a strategic investment for businesses seeking to innovate and differentiate in competitive markets.

Related Video: What is the Strait of Hormuz – and why does it matter to global trade?

Frequently Asked Questions (FAQs) for B2B Buyers of addressable led strips

-

How can I effectively vet suppliers of addressable LED strips to ensure product quality and reliability?

To vet suppliers, request detailed product specifications, certifications (such as CE, RoHS, UL), and quality assurance documentation upfront. Ask for samples to verify LED performance and durability under your expected conditions. Check references or reviews from other international buyers, especially those in your region. Evaluate the supplier’s manufacturing capabilities, including technology used (e.g., IC chip types), and compliance with international standards. Prioritize suppliers with transparent communication, clear warranty policies, and responsive customer service to minimize risks in your supply chain. -

What customization options are typically available for addressable LED strips, and how can I specify them to suppliers?

Customization options often include LED density (LEDs per meter), voltage (5V, 12V, 24V), IC chip type (WS2811, WS2812B, WS2813), color modes (RGB, RGBW, RGBIC), waterproofing levels, and strip length. You can also request specific connectors, flexible PCB thickness, and packaging tailored to your branding. When specifying, provide detailed technical requirements and intended application scenarios. This clarity helps suppliers propose suitable solutions and accurate quotes. For international buyers, clarify any regional electrical standards or certifications needed to ensure compliance in your market. -

What are the typical minimum order quantities (MOQs), lead times, and payment terms I should expect when sourcing addressable LED strips internationally?

MOQs vary widely but generally start around 100 to 500 meters depending on customization and supplier scale. Lead times commonly range from 3 to 6 weeks, including production and quality checks, with expedited options available at a premium. Payment terms often require 30% upfront deposit and 70% balance before shipment or upon delivery, though terms can be negotiated based on buyer-supplier relationship and order size. For buyers in Africa, South America, or the Middle East, consider currency fluctuations and international banking fees when agreeing on payment methods. -

What quality assurance measures should I insist on to minimize defects and ensure long-term reliability?

Insist on suppliers performing comprehensive testing such as aging tests, color consistency checks, waterproofing tests (if applicable), and voltage drop assessments. Request a quality control (QC) report for each batch shipped. Certifications like ISO 9001 for manufacturing processes add credibility. Additionally, confirm the supplier’s capability for batch traceability and after-sales support. Partnering with suppliers who provide warranties and clear defect handling procedures protects your investment and supports smoother dispute resolution if issues arise. -

Which certifications and compliance standards are crucial when importing addressable LED strips into Europe, South America, Africa, or the Middle East?

For Europe, CE marking and RoHS compliance are mandatory to ensure safety and environmental standards. In South America, certification requirements vary by country but often include electrical safety marks and import permits. African markets may require compliance with regional bodies such as SABS (South Africa) or KEBS (Kenya). The Middle East often demands GSO certification or equivalent. Confirm these requirements early with suppliers and request documentation to avoid customs delays or product rejections. -

What logistics considerations should I keep in mind when importing addressable LED strips to regions like Africa, South America, or the Middle East?

Consider shipping methods balancing cost, speed, and product sensitivity—air freight offers speed but at higher cost, while sea freight suits larger volumes but takes longer. Addressable LED strips are sensitive to moisture and electrostatic discharge, so ensure suppliers use appropriate anti-static and waterproof packaging. Factor in customs clearance times and import duties specific to your country. Partner with freight forwarders experienced in handling electronics imports to navigate local regulations smoothly and reduce delivery delays. -

How can I manage disputes or quality issues efficiently with international suppliers of addressable LED strips?

Establish clear contractual terms including product specifications, inspection criteria, delivery schedules, and penalties for non-compliance. Use third-party inspection services before shipment to verify quality. Maintain detailed communication records and photographic evidence of any defects. If disputes arise, attempt resolution through negotiation or mediation first. For larger contracts, consider using trade assurance platforms or letters of credit to protect payments. Building long-term relationships with suppliers who value transparency and accountability reduces the likelihood of conflicts. -

What are the key technical factors to clarify with suppliers to ensure compatibility with my existing LED controllers and systems?

Confirm the IC chip type and communication protocol (SPI, DMX512, etc.) used by the addressable LED strips to ensure compatibility with your controllers. Verify voltage requirements and power consumption to match your power supplies. Ask about signal wiring standards and connector types to avoid integration challenges. If using software like Madrix or Resolume, ensure the LED strips support these platforms. Clear technical alignment prevents costly returns and operational disruptions, especially important for large-scale or complex installations.

Strategic Sourcing Conclusion and Outlook for addressable led strips

Selecting the right addressable LED strips requires a nuanced understanding of product specifications, integration capabilities, and supplier reliability. For international B2B buyers—especially those in emerging and diverse markets like Africa, South America, the Middle East, and Europe—strategic sourcing means balancing innovation, cost-efficiency, and supply chain resilience. Addressable LED strips offer unparalleled flexibility through individual LED control, enabling sophisticated lighting designs that can differentiate your offerings in competitive markets.

Key takeaways for buyers include:

- Prioritize suppliers who demonstrate deep technical expertise and provide comprehensive support on product customization and integration.

- Evaluate LED strip voltage options (5V, 12V, 24V) carefully to mitigate voltage drop issues and ensure consistent lighting performance.

- Consider the robustness of integrated circuits (e.g., WS2813 vs WS2812) to enhance reliability in demanding applications.

- Factor in logistics, local regulations, and after-sales service when selecting international partners to avoid costly delays or compatibility issues.

Looking ahead, the demand for intelligent, dynamic lighting solutions is set to grow as smart infrastructure and experiential environments expand globally. For B2B buyers in Italy, Argentina, and beyond, embracing strategic partnerships and investing in cutting-edge addressable LED technology will unlock new business opportunities and long-term value. Take proactive steps today to engage with trusted suppliers who align with your innovation goals and regional market needs—your next competitive advantage lies in the smart illumination of tomorrow.