Introduction: Navigating the Global Market for addressable led lights

In today’s rapidly evolving lighting industry, addressable LED lights stand out as a transformative technology that enables unprecedented control and customization. Unlike traditional LED solutions, addressable LEDs allow each individual diode to be programmed with unique colors and effects, opening up vast possibilities for dynamic lighting designs across multiple sectors. For international B2B buyers—especially those operating in diverse markets such as Africa, South America, the Middle East, and Europe—understanding this innovation is essential to meeting growing customer demands for flexibility, efficiency, and visual impact.

This comprehensive guide serves as a strategic resource to empower buyers with critical insights into the global market for addressable LED lights. You will find detailed information on the various types of addressable LEDs, the materials and technologies involved in their manufacturing, and quality control processes that ensure reliability and longevity. Additionally, the guide explores sourcing strategies, supplier evaluation criteria, and cost considerations tailored to different regional markets, including emerging economies and established industrial hubs like Thailand and the UK.

By addressing frequently asked questions and highlighting best practices for selecting trusted manufacturers, this guide equips you to make informed procurement decisions that align with your business goals. Whether you aim to enhance product offerings, optimize supply chains, or gain a competitive edge, understanding the nuances of addressable LED technology and its global marketplace is key to success in today’s lighting industry.

Understanding addressable led lights Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| WS2812 (NeoPixel) | Integrated IC per LED allowing individual control; widely used; 5V operation | Decorative lighting, signage, event installations | Pros: Easy programming, cost-effective, widely supported. Cons: Limited to 5V, moderate brightness. |

| APA102 (DotStar) | Separate clock and data lines for faster refresh rates; 5V or 12V variants | High-speed displays, video walls, interactive installations | Pros: High refresh rate, precise color control. Cons: Slightly higher cost, more complex wiring. |

| SK6812 | Similar to WS2812 but supports RGBW (white LED) for enhanced color | Architectural lighting, commercial displays, mood lighting | Pros: Added white channel for better whites, versatile. Cons: Higher cost, requires compatible controllers. |

| DMX Addressable LEDs | Uses DMX512 protocol; supports large-scale, complex lighting setups | Stage lighting, large events, architectural facades | Pros: Industry standard for professional use, scalable. Cons: Requires specialized controllers and knowledge. |

| APA104 | Improved version of WS2812 with higher refresh rate and better color accuracy | Retail displays, automotive lighting, smart home systems | Pros: Better performance than WS2812, compatible with existing setups. Cons: Less common, may have higher price. |

WS2812 (NeoPixel)

WS2812 LEDs are among the most popular addressable LEDs in B2B markets due to their integrated driver ICs and ease of use. Each LED can be individually controlled for color and brightness, making them ideal for decorative and signage applications. Their 5V operation simplifies power requirements but limits maximum brightness. Buyers should consider their widespread compatibility with controllers and software, making them a cost-effective choice for projects requiring moderate brightness and flexible control.

APA102 (DotStar)

APA102 addressable LEDs stand out with separate clock and data lines, enabling faster refresh rates and smoother animations. This feature makes them highly suitable for high-speed displays, video walls, and interactive installations where precise timing is critical. They operate at 5V or 12V, offering flexibility in power design. For B2B buyers, the slightly higher cost and more complex wiring are balanced by superior performance and durability in demanding environments.

SK6812

The SK6812 series extends WS2812 functionality by adding a dedicated white LED channel (RGBW), enhancing color rendering and producing cleaner whites. This makes them particularly attractive for architectural lighting and commercial displays where color accuracy and ambiance are paramount. Buyers should ensure compatibility with their control systems and be prepared for a higher price point. The enhanced color range justifies investment for premium lighting projects.

DMX Addressable LEDs

DMX addressable LEDs leverage the DMX512 communication protocol, an industry standard for professional lighting. They support large-scale and complex setups, making them ideal for stage lighting, large events, and architectural facades. B2B buyers benefit from the scalability and robust control offered by DMX systems but must invest in specialized controllers and technical expertise. This type suits enterprises requiring high reliability and precision in dynamic lighting environments.

APA104

APA104 LEDs offer an improved alternative to the WS2812 series, with higher refresh rates and better color accuracy, making them well-suited for retail displays, automotive lighting, and smart home applications. They maintain compatibility with many existing WS2812 controllers, facilitating upgrades without major redesigns. Buyers should note that APA104 LEDs are less common and may come at a premium, but their enhanced performance can justify the investment for quality-sensitive projects.

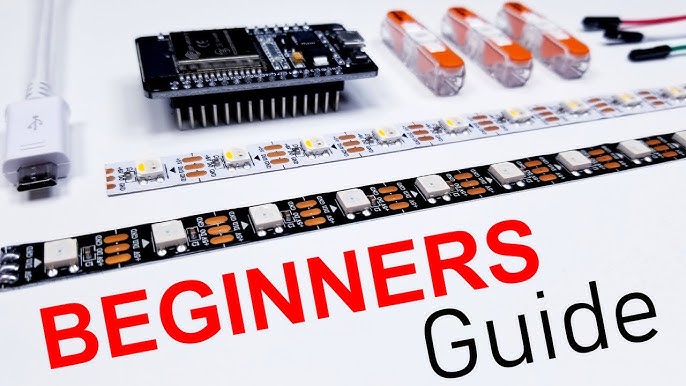

Related Video: Addressable LED Strip + Arduino (Tutorial)

Key Industrial Applications of addressable led lights

| Industry/Sector | Specific Application of Addressable LED Lights | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Entertainment & Events | Dynamic stage lighting and immersive visual effects | Enhances audience engagement with customizable, programmable lighting; supports brand differentiation | Ensure supplier offers high color fidelity, durable flexible strips, and easy integration with control systems |

| Architecture & Retail | Facade illumination and interior accent lighting | Creates visually striking environments to attract customers and increase dwell time | Look for weatherproof, UV-resistant LEDs with precise color control and scalability for large installations |

| Marine & Outdoor | Decorative and safety lighting on boats, docks, and outdoor venues | Combines aesthetic appeal with functional lighting resistant to harsh environments | Prioritize IP-rated, salt spray compliant products with robust controllers for remote operation |

| Automotive & Transport | Customizable interior and exterior vehicle lighting | Improves vehicle aesthetics and safety, offering unique branding opportunities | Select LEDs with vibration resistance, long lifespan, and compatibility with automotive electrical systems |

| Advertising & Signage | Programmable LED signs and digital billboards | Enables dynamic messaging and eye-catching displays that boost brand visibility and customer interaction | Verify supplier’s ability to deliver high-brightness, energy-efficient LEDs with synchronized control features |

Entertainment & Events

Addressable LED lights are extensively used in the entertainment sector for stage lighting, concerts, and event venues. Their ability to individually control each LED allows for complex lighting patterns, dynamic color changes, and synchronized effects that enhance audience experience. For B2B buyers in regions such as Africa and South America, sourcing durable and flexible LED strips that can withstand frequent installation and removal is critical. Additionally, compatibility with common lighting control protocols ensures seamless integration with existing event technology.

Architecture & Retail

In architectural and retail environments, addressable LEDs enable designers to create captivating facades and interior accent lighting that can be programmed to highlight architectural features or seasonal themes. Buyers from the Middle East and Europe should focus on LEDs with high UV resistance and weatherproofing to maintain performance in outdoor installations. Scalability and precise color control are essential to adapt lighting schemes for various building sizes and retail layouts, helping businesses increase foot traffic and customer engagement.

Marine & Outdoor

The marine industry benefits from addressable LEDs for decorative and safety lighting on vessels, docks, and outdoor entertainment venues. These LEDs must comply with salt spray and UV resistance standards to withstand harsh marine environments. International buyers, especially from coastal regions in Africa and South America, should prioritize suppliers offering IP-rated products and robust controllers that enable remote operation and customization, ensuring both safety and aesthetic appeal.

Automotive & Transport

Addressable LEDs are increasingly integrated into automotive interiors and exteriors to provide customizable lighting effects that enhance vehicle aesthetics and brand identity. For B2B buyers in Europe and the Middle East, LEDs must be vibration-resistant and compatible with automotive power systems to ensure durability and safety. The ability to deliver long-lasting, energy-efficient lighting solutions supports manufacturers and custom shops in differentiating their products in competitive markets.

Advertising & Signage

Programmable addressable LEDs are ideal for digital signage and billboards, offering dynamic messaging and vibrant displays that capture consumer attention. Buyers from diverse international markets should seek suppliers capable of providing high-brightness, energy-efficient LEDs with synchronized control capabilities. This ensures that advertising installations remain visually impactful while minimizing operational costs, enabling businesses to maximize return on investment in competitive advertising spaces.

Related Video: 100 Addressable LED Lights Arduino Build (Quick)

Strategic Material Selection Guide for addressable led lights

Common Materials for Addressable LED Lights: In-Depth Analysis

1. Polycarbonate (PC)

Key Properties:

Polycarbonate is a highly durable thermoplastic known for its excellent impact resistance and clarity. It has a high temperature tolerance, typically up to 115°C, and good dimensional stability. PC also offers moderate resistance to UV radiation and chemicals, making it suitable for both indoor and outdoor LED applications.

Pros & Cons:

Polycarbonate’s robustness makes it ideal for protective covers and housings in addressable LED strips, especially where mechanical stress or accidental impacts are concerns. Its transparency allows for efficient light transmission without significant diffusion. However, PC is more expensive than common plastics and can yellow over time if not UV stabilized. Manufacturing complexity is moderate, requiring injection molding or extrusion processes.

Impact on Application:

PC is well-suited for outdoor or semi-exposed environments, including architectural lighting and marine applications, where durability and clarity are essential. Its UV resistance is crucial for buyers in regions with intense sunlight such as the Middle East and parts of Africa.

International B2B Considerations:

Buyers from Europe and the UK will appreciate PC’s compliance with stringent standards like REACH and RoHS, ensuring chemical safety and environmental compliance. In South America and Africa, the material’s durability against harsh climates is a significant advantage. However, importers should verify local certifications (e.g., ASTM or DIN) for plastics to ensure smooth customs clearance and market acceptance.

2. Silicone Rubber

Key Properties:

Silicone rubber is a flexible, heat-resistant elastomer with excellent weathering and UV resistance. It can withstand temperatures from -60°C up to 230°C, making it highly versatile. Silicone also exhibits outstanding resistance to moisture and many chemicals, including salt spray, which is critical for marine and outdoor lighting.

Pros & Cons:

Its flexibility allows for easy installation on curved or irregular surfaces, enhancing design versatility. Silicone encapsulation provides excellent protection for LEDs against dust and water ingress (IP67 or higher ratings). The downside is a higher cost compared to conventional plastics and more complex manufacturing processes such as molding and curing. Additionally, silicone can attract dust and dirt due to its slightly tacky surface.

Impact on Application:

Silicone is ideal for outdoor and marine addressable LED lights, especially in coastal regions of Africa and South America where salt corrosion is a concern. Its thermal stability also benefits high-power LED applications requiring effective heat dissipation.

International B2B Considerations:

For buyers in the Middle East and Europe, silicone’s compliance with food-grade and medical-grade standards can be a plus if LEDs are used in sensitive environments. Certifications like UL94 for flammability and ASTM D2000 for rubber quality are important to verify. The material’s premium cost should be balanced against longevity and reduced maintenance in harsh climates.

3. Aluminum (for LED Housing and Heat Sinks)

Key Properties:

Aluminum is widely used for LED housings and heat sinks due to its excellent thermal conductivity (around 205 W/m·K) and lightweight nature. It also offers good corrosion resistance, especially when anodized, and can withstand temperatures up to 200°C without deformation.

Pros & Cons:

Aluminum efficiently dissipates heat, prolonging LED lifespan and maintaining performance. It is relatively low cost compared to other metals like copper and easy to manufacture via extrusion or CNC machining. However, aluminum housings can be prone to scratching and denting, and non-anodized surfaces may corrode in highly saline environments.

Impact on Application:

Ideal for industrial, architectural, and outdoor addressable LED installations where heat management is critical. In regions with high ambient temperatures such as the Middle East and parts of Africa, aluminum heat sinks prevent thermal degradation of LEDs.

International B2B Considerations:

European and UK buyers often require compliance with EN standards for metal finishes and corrosion resistance. In South America and Africa, anodized aluminum is preferred for durability. Buyers should confirm supplier adherence to ISO 9001 for quality management and ensure proper surface treatments to meet local environmental conditions.

4. Flexible Printed Circuit Boards (FPC)

Key Properties:

FPCs are thin, flexible substrates made from polyimide or polyester films, supporting the LED chips and integrated circuits. They offer excellent electrical insulation, thermal stability (up to 260°C for polyimide), and flexibility for complex LED strip designs.

Pros & Cons:

FPCs enable compact, lightweight, and customizable addressable LED strips with precise LED placement. They simplify installation on curved surfaces and allow for intricate lighting effects. However, FPCs are sensitive to mechanical damage if improperly handled and require careful moisture protection. Manufacturing involves sophisticated processes, increasing costs compared to rigid PCBs.

Impact on Application:

FPCs are essential for wearable, architectural, and automotive addressable LED applications where flexibility and compactness are critical. Their heat resistance supports high-density LED configurations suitable for demanding environments.

International B2B Considerations:

Buyers from Europe and the UK should verify compliance with IPC standards for PCB quality and RoHS directives for hazardous substances. In Africa and South America, the focus should be on supplier capabilities to provide moisture-proof coatings and robust connectors to ensure product longevity in humid or tropical climates.

Summary Table of Materials for Addressable LED Lights

| Material | Typical Use Case for addressable led lights | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polycarbonate (PC) | Protective covers, housings for indoor/outdoor use | High impact resistance and clarity | Higher cost, potential yellowing over time | Medium |

| Silicone Rubber | Outdoor/marine encapsulation and flexible mounts | Excellent heat and UV resistance, flexible | Higher cost, tacky surface attracts dust | High |

| Aluminum | Heat sinks and housings for thermal management | Superior thermal conductivity and lightweight | Prone to scratching, corrosion if untreated | Medium |

| Flexible PCB (FPC) | Flexible LED strips for curved or compact designs | High flexibility and thermal stability | Sensitive to mechanical damage, higher manufacturing complexity | High |

In-depth Look: Manufacturing Processes and Quality Assurance for addressable led lights

Addressable LED lights combine advanced electronics with precise manufacturing to deliver individually controllable lighting solutions. For international B2B buyers, understanding the manufacturing stages and quality assurance protocols is critical to selecting suppliers that consistently meet performance, durability, and regulatory requirements. This knowledge is especially important when sourcing from or distributing to diverse markets such as Africa, South America, the Middle East, and Europe, where certification and quality expectations may vary.

Manufacturing Processes for Addressable LED Lights

The production of addressable LED lights typically involves several key stages, each requiring specialized techniques and controls to ensure the final product’s functionality and reliability.

1. Material Preparation

The manufacturing process begins with sourcing high-quality raw materials, including:

- LED chips and integrated circuit (IC) controllers: Core components that enable individual LED addressability.

- Flexible or rigid circuit boards: Usually made of copper-clad substrates, prepared through etching and layering processes.

- Solder paste and conductive adhesives: For component attachment.

- Encapsulation materials: Silicone or epoxy resins for environmental protection.

Material preparation includes thorough inspection and testing of components for electrical and physical conformity before assembly.

2. Forming and Circuit Board Fabrication

Circuit boards are fabricated using photolithography and etching techniques to create precise copper traces that connect LEDs and control ICs. For flexible LED strips, polyimide or similar substrates are shaped and layered to maintain flexibility without compromising electrical integrity.

3. Assembly

Assembly is a critical phase involving:

- Surface Mount Technology (SMT): Automated placement of LEDs, ICs, resistors, and capacitors on the PCB with high precision.

- Soldering: Typically reflow soldering is used to ensure reliable electrical connections without damaging sensitive components.

- Integrated Circuit Programming: The IC chips are programmed with firmware that controls LED behavior, enabling individual LED control on the strip.

- Wiring and Connector Attachment: Power and control connectors are affixed to facilitate integration into larger systems.

Automated optical inspection (AOI) is often employed during assembly to detect placement errors or soldering defects early.

4. Finishing and Encapsulation

To protect the delicate electronics, addressable LED strips are coated or encapsulated with materials resistant to moisture, UV exposure, and mechanical stress. This finishing stage may include:

- Silicone or epoxy coating: Enhances durability and weather resistance.

- Cutting and packaging: Strips are cut to standard or custom lengths and packaged with anti-static materials to prevent damage during shipping.

Quality Assurance and Control (QA/QC) Frameworks

Ensuring consistent quality in addressable LED lights requires rigorous quality control at multiple stages, supported by international standards and testing protocols.

International and Industry Standards

- ISO 9001: This global quality management standard ensures that manufacturers have robust processes for consistent product quality, traceability, and continuous improvement.

- CE Marking (Europe): Indicates compliance with EU safety, health, and environmental protection requirements, crucial for European buyers.

- RoHS (Restriction of Hazardous Substances): Limits use of hazardous materials, important for environmental compliance globally.

- UL/ETL (North America): Certifications focused on electrical safety; while not mandatory outside North America, they are often sought for global market acceptance.

- IP Ratings: Define the level of ingress protection against dust and water, essential for outdoor or marine applications.

- Specific Regional Certifications: Buyers from Africa, the Middle East, and South America should verify compliance with local standards or import regulations, such as SABS in South Africa or SASO in Saudi Arabia.

Key QC Checkpoints

- Incoming Quality Control (IQC): Inspection and testing of all raw materials and components upon arrival to ensure they meet specifications.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing, including solder joint inspection, component placement accuracy, and functional testing of programmed ICs.

- Final Quality Control (FQC): Comprehensive testing of finished products, including visual inspection, electrical performance, and environmental resistance tests.

Common Testing Methods

- Electrical Testing: Verification of LED functionality, color accuracy, and addressability by sending control signals and measuring responses.

- Thermal Testing: Ensures heat dissipation meets design criteria to prevent premature failure.

- Environmental Stress Testing: Includes humidity, salt spray, and UV exposure tests to confirm suitability for outdoor and marine environments.

- Mechanical Testing: Flexibility and durability tests for flexible LED strips.

- Safety Testing: Checks for electrical insulation, short circuits, and compliance with safety standards.

How B2B Buyers Can Verify Supplier Quality Control

International buyers must proactively verify supplier QC capabilities to mitigate risks related to quality inconsistencies, shipment delays, and certification issues.

- Factory Audits: Conduct or commission third-party audits to assess manufacturing processes, quality systems (e.g., ISO 9001 certification validity), and production capacity.

- Review QC Documentation: Request detailed inspection reports, test results, and certification copies for compliance verification.

- Third-Party Inspections: Engage independent inspection agencies to perform pre-shipment inspections and random sampling to ensure product conformity.

- Sample Testing: Obtain product samples for in-house or third-party laboratory testing before placing large orders.

- Supplier Communication: Establish clear communication channels to discuss QC standards, corrective actions, and continuous improvement plans.

QC and Certification Nuances for International Markets

For buyers in Africa, South America, the Middle East, and Europe, understanding regional certification requirements and quality expectations is essential.

- Europe (e.g., UK): CE marking is mandatory for lighting products, with additional emphasis on energy efficiency and environmental compliance (e.g., WEEE directive).

- Middle East: Regulatory bodies may require SASO certification (Saudi Arabia) or Emirates Conformity Assessment Scheme (ECAS) compliance; buyers should verify local import regulations.

- Africa: Some countries accept international certifications like CE or UL but may have additional local standards or customs clearance requirements; working with suppliers familiar with these is advantageous.

- South America: Certifications such as INMETRO (Brazil) or IRAM (Argentina) might be necessary; ensuring supplier experience with these markets can prevent import delays.

Buyers should also be aware of the potential for counterfeit certifications and insist on validation through official channels or trusted third-party verification services.

By thoroughly understanding the manufacturing workflow and quality assurance practices for addressable LED lights, B2B buyers can confidently select suppliers that deliver innovative, reliable, and compliant products. Prioritizing suppliers with robust QC systems and internationally recognized certifications will reduce risks and enhance market competitiveness across diverse global regions.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for addressable led lights Sourcing

Understanding Cost Components in Addressable LED Lights Sourcing

When sourcing addressable LED lights for B2B purposes, it is crucial to dissect the cost structure to make informed purchasing decisions and negotiate effectively. The primary cost components include:

- Materials: High-quality addressable LEDs incorporate integrated circuit chips, RGB LED clusters, controllers, and durable substrates. Material costs vary significantly based on LED chip quality, protective coatings (e.g., UV or salt spray resistance), and type of controller used.

- Labor: Skilled labor is essential for precise assembly and programming of addressable LED strips. Labor costs fluctuate depending on the manufacturing location, with notable differences between Asia, Europe, and other regions.

- Manufacturing Overhead: This encompasses factory utilities, equipment depreciation, and indirect labor. Efficient, automated production lines typically reduce overhead, improving cost competitiveness.

- Tooling: Initial tooling and mold creation for custom LED strip designs or housings can be a significant upfront expense, especially for small-to-medium order quantities.

- Quality Control (QC): Rigorous QC processes, including electrical testing and certification compliance (e.g., CE, RoHS, UL), add to costs but are essential for reliability and market acceptance.

- Logistics: Freight, customs duties, and insurance costs vary widely based on shipment origin, destination, and chosen Incoterms (e.g., FOB, CIF). These can significantly impact landed costs for international buyers.

- Supplier Margin: Suppliers factor in profit margins influenced by their scale, brand positioning, and service level agreements (SLAs).

Key Pricing Influencers for Addressable LED Lights

Several factors directly impact the final price per unit or batch:

- Order Volume and Minimum Order Quantity (MOQ): Larger volumes typically unlock economies of scale, reducing per-unit costs. However, MOQ requirements can be a barrier for smaller buyers or markets with limited demand.

- Specifications and Customization: Custom lengths, color profiles, waterproofing, and embedded control features increase complexity and price. Buyers seeking unique programmable effects or special certifications should anticipate premium pricing.

- Material Quality: Premium LEDs and controllers sourced from leading chipset manufacturers command higher prices but yield better longevity and performance.

- Quality Certifications: Compliance with international standards (e.g., CE for Europe, UL for the US, or regional certifications) adds credibility but also cost, especially important for buyers targeting regulated markets.

- Supplier Reputation and Location: Established suppliers with proven track records may charge more but offer reliability and support. Proximity to major shipping hubs can reduce logistics costs.

- Incoterms Selection: The choice between FOB (Free On Board), CIF (Cost, Insurance, and Freight), or DDP (Delivered Duty Paid) affects who bears the logistics risk and cost, influencing the buyer’s total expenses.

Strategic Buyer Tips for International B2B Procurement

For buyers from Africa, South America, the Middle East, and Europe, sourcing addressable LED lights efficiently involves several strategic considerations:

- Negotiate Beyond Price: Discuss payment terms, lead times, warranty, and after-sales support. Long-term partnerships can unlock better pricing and priority manufacturing slots.

- Evaluate Total Cost of Ownership (TCO): Consider energy efficiency, lifespan, and maintenance costs alongside purchase price. Higher upfront costs can be justified by lower operational expenses.

- Understand Pricing Nuances by Region: Logistics and customs duties can add 10–30% or more to the base cost. For example, African import tariffs and South American logistics complexities often inflate landed costs.

- Leverage Volume Aggregation: Collaborate with local distributors or other buyers to meet MOQ thresholds and negotiate volume discounts.

- Request Samples and Certifications: Always verify product quality through samples and documentation before bulk orders, especially when importing from new suppliers.

- Clarify Incoterms: Ensure clarity on responsibilities for shipping, insurance, and customs clearance to avoid unexpected charges.

- Plan for Currency Fluctuations: International buyers should account for exchange rate volatility which can impact final costs, particularly in emerging markets.

Disclaimer on Pricing

The pricing landscape for addressable LED lights is dynamic and influenced by raw material availability, global supply chain conditions, and technological advancements. All cost estimates and analyses provided here are indicative and should be validated through direct supplier engagement and up-to-date market research.

By comprehensively understanding these cost and pricing factors, international B2B buyers can optimize their procurement strategies, ensuring cost-effective sourcing of high-quality addressable LED lighting solutions tailored to their market needs.

Spotlight on Potential addressable led lights Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘addressable led lights’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for addressable led lights

Critical Technical Properties of Addressable LED Lights

Understanding these key specifications will help B2B buyers, especially in diverse markets like Africa, South America, the Middle East, and Europe, select the right addressable LED products to meet their operational and client demands.

-

Pixel Density (LEDs per meter)

This indicates how many individual addressable LEDs are embedded per meter of the strip or module. Higher pixel density enables finer resolution in lighting effects and smoother color transitions, which is crucial for applications requiring detailed lighting displays such as architectural facades or high-end retail. Buyers should balance pixel density with power consumption and cost based on their project needs. -

Control Protocol (e.g., WS2812, APA102)

The communication standard used to send data to each LED’s integrated circuit chip. Different protocols affect refresh rate, color accuracy, and compatibility with controllers. For B2B buyers, confirming protocol compatibility with existing systems or controllers is essential to avoid integration issues and ensure smooth programmability. -

Voltage and Power Consumption

Addressable LED strips commonly operate at 5V or 12V DC. Voltage affects installation complexity and power supply requirements, while power consumption impacts energy costs and thermal management. International buyers should verify voltage compatibility with local power standards and consider efficiency ratings to optimize operational costs. -

Ingress Protection (IP) Rating

Defines the LED product’s resistance to dust and water ingress, typically ranging from IP20 (indoor use only) to IP67 or higher (waterproof and dustproof). For buyers in regions with harsh climates or outdoor applications, selecting appropriate IP-rated products ensures longevity and reduces maintenance costs. -

Material Quality and Flexibility

The base material (such as flexible PCB or rigid substrates) influences durability, ease of installation, and bending radius. High-grade materials withstand environmental stressors better, which is vital for outdoor or industrial applications common in global markets. -

Color Rendering Index (CRI) and Color Gamut

CRI measures how accurately colors are represented under the LED light, while color gamut refers to the range of colors the LEDs can produce. High CRI and wide color gamut are desirable for environments where color fidelity matters, such as retail or hospitality sectors.

Common Industry and Trade Terminology for Addressable LED Lights

Familiarity with these terms empowers B2B buyers to communicate effectively with suppliers, negotiate better deals, and streamline procurement processes.

-

OEM (Original Equipment Manufacturer)

Refers to a manufacturer that produces LED products which can be rebranded or customized by the buyer. OEM partnerships allow buyers to offer tailored solutions under their own brand, which is advantageous for building brand identity and meeting specific client requirements. -

MOQ (Minimum Order Quantity)

The smallest number of units a supplier is willing to sell in one order. Understanding MOQ helps buyers plan inventory and cash flow, especially important for startups or regional distributors in emerging markets where upfront investment needs to be controlled. -

RFQ (Request for Quotation)

A formal document sent to suppliers requesting detailed pricing, lead times, and terms based on specific product requirements. Mastering RFQ preparation ensures clear communication, reduces misunderstandings, and helps in comparing multiple suppliers objectively. -

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Choosing the right Incoterm minimizes risks and clarifies cost responsibilities during international shipping. -

Binning

The process of sorting LEDs based on color and brightness consistency. High-quality binning ensures uniform lighting appearance, which is critical for large-scale or visually demanding projects. -

Daisy-Chaining

A wiring method where multiple LED strips are connected end-to-end, controlled by a single controller. Understanding daisy-chaining limitations helps buyers plan system design to avoid signal loss or power drop-offs, ensuring reliable performance.

For B2B buyers, especially those operating across continents with diverse market conditions, mastering these technical properties and trade terms is vital. It enables informed decision-making, optimizes supply chain efficiency, and ultimately delivers superior lighting solutions that meet both functional and aesthetic demands.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the addressable led lights Sector

Market Overview & Key Trends

The global addressable LED lights market is experiencing robust growth, driven by increasing demand for customizable, energy-efficient lighting solutions across diverse industries. International B2B buyers, particularly from Africa, South America, the Middle East, and Europe (including markets like Thailand and the UK), are capitalizing on this trend to enhance commercial, architectural, and entertainment lighting projects. Key drivers include urbanization, smart city initiatives, and the rising adoption of Internet of Things (IoT)-enabled lighting systems that enable granular control of individual LEDs for dynamic effects and energy savings.

Emerging sourcing trends emphasize modular, programmable LED strips that provide unique color control per LED unit, allowing for tailored lighting experiences. This shift from traditional RGB to addressable RGB LEDs introduces significant competitive advantages through enhanced flexibility and user engagement. Buyers should watch for suppliers offering customizable control modules, UV and salt spray resistant products, and integration with existing smart infrastructure.

Market dynamics in these regions reflect a growing preference for suppliers who combine innovation with supply chain reliability. For instance, African and South American markets prioritize cost-effective, durable solutions adaptable to varied climate conditions, while Middle Eastern and European buyers often seek compliance with stringent quality and safety certifications (e.g., CE, RoHS). Thailand and the UK exemplify markets where demand for premium, certified addressable LEDs aligns with smart building and entertainment sectors.

Supply chain agility, including on-time delivery and transparent communication, is increasingly critical due to geopolitical shifts and shipping challenges. Additionally, buyers benefit from partnering with manufacturers who offer technical support, scalable production, and customization services, enabling them to meet diverse project requirements efficiently.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a cornerstone for B2B buyers in the addressable LED lights sector, reflecting global commitments to reduce environmental impact and foster ethical business practices. Addressable LEDs inherently contribute to energy efficiency by enabling precise control and dimming capabilities, reducing unnecessary electricity consumption significantly compared to traditional lighting.

Beyond energy savings, buyers should prioritize suppliers that demonstrate responsible sourcing of raw materials, such as conflict-free rare earth elements and lead-free soldering processes. Ethical supply chains ensure compliance with labor standards and environmental regulations, mitigating risks associated with human rights violations or ecological damage.

Green certifications like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) are increasingly demanded by European and Middle Eastern buyers, serving as indicators of environmentally sound manufacturing. Additionally, certifications such as Energy Star and UL Environment provide assurance of product energy efficiency and sustainability credentials, which are particularly influential in developed markets like the UK and parts of Europe.

B2B buyers from emerging markets in Africa and South America should consider suppliers who engage in circular economy practices, including recyclable packaging and product lifecycle management, to align with growing regional environmental policies. Investing in sustainable addressable LED solutions not only reduces operational carbon footprints but also enhances brand reputation and meets the expectations of eco-conscious end-users.

Evolution and Historical Context

The evolution of addressable LED technology marks a significant leap from traditional RGB lighting systems. Initially, LED strips could only display a single color across all diodes simultaneously, limiting their application scope. The advent of addressable LEDs introduced integrated circuit chips within each LED segment, enabling independent control of color and brightness at the pixel level.

This technological progression has unlocked diverse applications—from architectural accent lighting to dynamic signage and entertainment displays—transforming how businesses design lighting environments. For B2B buyers, understanding this history underscores the value proposition of addressable LEDs: unmatched customization, scalability, and energy efficiency that meet the sophisticated demands of modern commercial projects worldwide.

As the sector continues to innovate, buyers should anticipate further integration with IoT platforms and AI-driven lighting management systems, solidifying addressable LEDs as a pivotal component in future-ready lighting solutions.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of addressable led lights

-

How can I effectively vet suppliers of addressable LED lights for international B2B purchases?

To vet suppliers, start by verifying their business licenses, certifications (such as CE, RoHS, or UL), and customer references. Request detailed product datasheets and inquire about manufacturing processes and quality control measures. Check for their experience in exporting to your region (Africa, South America, Middle East, Europe) and confirm compliance with local regulations. Utilize platforms like LinkedIn or trade associations for background checks. Finally, request samples to assess quality firsthand before committing to large orders. -

What customization options are typically available for addressable LED lights, and how can I ensure they meet my market’s needs?

Most manufacturers offer customization in LED color, pixel density, strip length, waterproof ratings, and control protocols (e.g., DMX, SPI). You can also request custom firmware or software for specific lighting effects. Clearly communicate your technical requirements and intended applications to the supplier. Collaborate on prototypes and test them under real-world conditions to ensure compatibility with your customers’ expectations and regional power standards. -

What are common minimum order quantities (MOQs) and lead times for addressable LED light orders from international suppliers?

MOQs vary widely but typically range from 500 to 2,000 units depending on product complexity and customization. Lead times can range from 3 to 8 weeks, influenced by production schedules, customization level, and shipping method. Negotiate MOQs upfront and confirm lead times in your contract. For urgent projects, ask if suppliers offer expedited manufacturing or partial shipments. Planning ahead is crucial to accommodate longer international shipping durations. -

Which payment terms are standard for international B2B transactions involving addressable LED lights, and how can I minimize financial risk?

Common payment terms include 30% deposit upfront with balance upon shipment or letter of credit (L/C) arrangements for higher-value orders. Using escrow services or trade assurance platforms can also reduce risk. Verify supplier credibility before payment and avoid full prepayment without guarantees. Insist on clear contractual terms regarding product specifications, delivery schedules, and penalties for non-compliance to protect your investment. -

What quality assurance (QA) practices and certifications should I expect from reputable addressable LED light manufacturers?

Look for ISO 9001 certification indicating robust quality management systems. Product-specific certifications like CE (Europe), RoHS (hazardous substances compliance), UL or ETL (safety in the US), and IP ratings (water and dust resistance) are essential. Reputable suppliers conduct in-line testing, functional tests, and final inspections to ensure product consistency. Request QA reports and test results before shipment, especially for large-scale or customized orders. -

How can I navigate logistics challenges when importing addressable LED lights to regions like Africa, South America, the Middle East, or Europe?

Work with suppliers experienced in international shipping and customs procedures for your target region. Choose reliable freight forwarders familiar with local import regulations and documentation requirements to avoid delays or extra costs. Clarify Incoterms (e.g., FOB, CIF) to define responsibilities. Plan for potential customs duties, VAT, and import taxes. Establish clear communication channels with all parties to track shipments and swiftly address any logistical issues. -

What steps should I take if there is a dispute or product quality issue with my addressable LED light supplier?

Immediately document the issue with photos, test reports, and communication records. Notify the supplier formally and request a resolution, such as replacement, refund, or repair. Review your contract’s dispute resolution clause and consider mediation or arbitration if needed. Maintaining open, professional dialogue helps preserve business relationships. For cross-border disputes, engage local trade chambers or export promotion agencies that can assist with negotiation or legal advice. -

How can I ensure ongoing innovation and competitiveness when sourcing addressable LED lights for diverse international markets?

Regularly engage suppliers on new product developments and emerging technologies like improved chipsets, enhanced control protocols, or energy-efficient designs. Attend industry trade shows and webinars to monitor trends. Request supplier support for custom R&D projects tailored to your markets’ preferences. Establish long-term partnerships with flexible manufacturers who can adapt production quickly and offer competitive pricing without compromising quality. This approach helps maintain a strong market position globally.

Illustrative Image (Source: Google Search)

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for addressable led lights

Addressable LED lights represent a transformative opportunity for B2B buyers seeking to differentiate their product offerings with cutting-edge, customizable lighting solutions. Their unique ability to control individual LEDs enables dynamic, multi-color effects that traditional RGB lighting cannot match. For buyers in Africa, South America, the Middle East, and Europe, this translates into enhanced value propositions for end customers across sectors such as architecture, marine, retail, and entertainment.

Illustrative Image (Source: Google Search)

Strategic sourcing is essential to capitalize on these advantages. Prioritizing suppliers who demonstrate consistent product quality, compliance with international certifications, and robust after-sales support will mitigate risks related to shipment delays and quality inconsistencies. Moreover, engaging manufacturers with flexible customization capabilities allows you to tailor solutions that meet specific regional market needs and technical requirements, maximizing customer satisfaction and competitive edge.

Looking ahead, the demand for intelligent, addressable lighting is set to grow as smart infrastructure and experiential design become global priorities. International buyers are encouraged to leverage strategic partnerships with innovative suppliers who invest in research, development, and sustainable manufacturing practices. By doing so, businesses can future-proof their lighting portfolios while driving growth in increasingly competitive markets. Now is the time to act decisively—embrace addressable LED technology to illuminate new possibilities for your business and customers worldwide.