Introduction: Navigating the Global Market for 12 volt led strip lights automotive

In today’s fast-evolving automotive industry, 12 volt LED strip lights have become indispensable components, offering enhanced vehicle aesthetics, improved safety, and energy-efficient lighting solutions. For B2B buyers operating across Africa, South America, the Middle East, and Europe, understanding the nuances of sourcing these automotive lighting products is critical to maintaining a competitive edge. The global demand for high-quality, durable, and customizable 12V LED strip lights is rising, driven by advancements in LED technology, stricter vehicle safety regulations, and the growing preference for aftermarket vehicle enhancements.

This comprehensive guide delivers an authoritative roadmap to the global market of 12 volt LED strip lights tailored specifically for automotive applications. It covers a wide spectrum of vital topics, including:

- Types and specifications of LED strips suited for diverse automotive needs—from interior ambient lighting to exterior accent and functional lighting.

- Material innovations that ensure durability against harsh automotive environments such as moisture, vibration, and temperature fluctuations.

- Manufacturing standards and quality control protocols that reputable suppliers implement to guarantee product consistency and compliance with international certifications.

- Supplier evaluation criteria focusing on reliability, scalability, and logistical capabilities to support international trade.

- Cost considerations including bulk pricing, import duties, and total landed costs relevant to various regional markets.

- Current global market trends and emerging technologies shaping the future of automotive LED lighting.

- Frequently asked questions addressing common challenges in product selection, installation, and warranty management.

By synthesizing these critical insights, this guide empowers international B2B buyers to make informed, strategic sourcing decisions—optimizing product quality, cost-efficiency, and supply chain resilience across diverse international markets. Whether sourcing for fleets, automotive manufacturers, or aftermarket distributors, this resource is designed to support your business’s success in a competitive global landscape.

Understanding 12 volt led strip lights automotive Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Single Color LED Strips | Emit one fixed color, often white or amber; simple design | Interior automotive lighting, dashboard, cargo areas | Pros: Cost-effective, easy installation; Cons: Limited customization |

| RGB LED Strips | Multi-color LEDs with color-changing capability via controller | Ambient lighting, mood lighting, customizable vehicle interiors | Pros: Versatile color options, enhanced aesthetics; Cons: Higher cost, requires controllers |

| Waterproof LED Strips | Encased in silicone or epoxy for moisture resistance | Exterior automotive lighting, undercarriage, off-road vehicles | Pros: Durable in harsh environments; Cons: Slightly bulkier, higher price point |

| High-Density LED Strips | Increased LED count per meter for brighter, uniform light | Headliner lighting, accent lighting, commercial vehicle interiors | Pros: Superior brightness, uniform illumination; Cons: Higher power consumption, costlier |

| Flexible Neon-Style LED Strips | Flexible, tube-like design mimicking neon lights | Custom exterior accents, branding, signage on vehicles | Pros: Highly flexible, unique look; Cons: More complex installation, premium pricing |

Single Color LED Strips are the most straightforward variant, offering fixed color illumination that suits basic automotive lighting needs such as dashboard backlighting or cargo area illumination. For B2B buyers, these strips provide an economical solution with straightforward installation. They are ideal for fleet vehicles or commercial trucks where cost control is paramount. However, their lack of color flexibility limits their use in premium or customizable applications.

RGB LED Strips introduce multi-color capabilities controlled via remote or app, enabling dynamic lighting effects. This type is popular for aftermarket customization and luxury automotive interiors, where ambiance and personalization are key selling points. B2B buyers targeting automotive accessory markets or premium vehicle segments should consider RGB strips despite their higher upfront costs, as they add significant value to the end product.

Waterproof LED Strips are designed with protective coatings to withstand moisture, dust, and harsh weather, making them essential for exterior automotive lighting applications. Buyers sourcing for off-road vehicles, trucks, or marine vehicles will find these strips highly reliable. The trade-off is a slightly bulkier profile and elevated pricing, but these are justified by enhanced durability and longer service life in challenging environments.

High-Density LED Strips pack more LEDs per meter, producing brighter and more uniform illumination. These are suitable for applications demanding high visibility and quality light diffusion, such as commercial vehicle interiors or headliner lighting. While they consume more power and cost more, their superior performance supports premium automotive lighting solutions, appealing to buyers focused on quality and brand differentiation.

Flexible Neon-Style LED Strips offer a unique, neon-like appearance with excellent flexibility for creative automotive lighting designs. They are favored for custom exterior accents and branding on commercial vehicles. For B2B buyers, these strips represent an opportunity to offer standout, visually striking lighting solutions, though installation complexity and higher price points require careful consideration during procurement.

Related Video: How To Rig LED Strip Lights To 12V Battery

Key Industrial Applications of 12 volt led strip lights automotive

| Industry/Sector | Specific Application of 12 volt led strip lights automotive | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | Interior ambient lighting for passenger vehicles | Enhances vehicle aesthetics and customer experience, differentiates product | Compliance with automotive safety standards, durability, color consistency |

| Commercial Transport | Cargo and utility vehicle interior illumination | Improves visibility and safety during loading/unloading | Waterproof and dustproof ratings, ease of installation, long lifespan |

| Recreational Vehicles | Customizable lighting for camper vans and motorhomes | Provides energy-efficient, flexible lighting solutions for comfort and style | Energy efficiency, flexibility, compatibility with 12V systems |

| Aftermarket Automotive | Accent lighting for car modification and customization | Adds value to vehicles, attracts enthusiasts and aftermarket retailers | Variety of colors, brightness levels, and control options |

| Marine & Off-road Vehicles | Exterior and interior lighting for boats and off-road vehicles | Enhances safety and visibility in harsh environments | Waterproofing, vibration resistance, corrosion resistance |

Automotive Manufacturing

In automotive manufacturing, 12 volt LED strip lights are extensively used for interior ambient lighting to elevate the cabin experience. These lights allow manufacturers to create customizable color zones that appeal to consumer preferences in diverse markets such as Europe and the Middle East. For B2B buyers, sourcing LED strips that meet stringent automotive safety and durability standards is crucial. Consistency in color temperature and brightness ensures a premium feel, which is essential for OEM partnerships and brand reputation.

Commercial Transport

For commercial transport vehicles, including trucks and delivery vans, LED strip lights provide essential illumination inside cargo areas. This application addresses the challenge of poor visibility during night operations, reducing loading errors and enhancing safety. International buyers from regions like South America and Africa prioritize robust, waterproof designs with high IP ratings to withstand dust and moisture. Easy installation and long operational life reduce maintenance costs, making these strips a cost-effective lighting upgrade for fleets.

Recreational Vehicles (RVs)

RVs and camper vans benefit from 12V LED strip lights for both functional and decorative lighting. These strips offer flexibility to create cozy, energy-efficient interiors that appeal to travelers worldwide. Buyers in the Middle East and Europe often seek LED strips compatible with solar-powered 12V systems, emphasizing energy conservation. The ability to customize color and brightness supports diverse consumer preferences, while durability against vibrations and temperature fluctuations ensures reliable performance on the road.

Aftermarket Automotive

In the aftermarket sector, LED strip lights are popular for vehicle customization, including undercarriage accents, dashboard highlights, and door panel illumination. This segment thrives on variety and innovation, making the availability of multiple colors, dimming options, and remote controls critical for buyers in global markets such as the UK and Mexico. Suppliers must ensure product compliance with local regulations regarding vehicle lighting and provide flexible solutions to meet enthusiast demands.

Marine & Off-road Vehicles

Marine and off-road vehicles operate in extreme conditions where lighting reliability is paramount. 12V LED strips are used for both interior and exterior lighting, improving visibility and safety during nighttime navigation or rugged terrain driving. International B2B buyers from coastal regions in Africa and the Middle East require LED strips with high waterproof ratings, corrosion resistance, and the ability to withstand vibrations. Selecting products with robust housings and proven longevity is essential to minimize downtime and maintain operational efficiency.

Related Video: 12-volt vs. 24-volt LED strip lights – what is the difference?

Strategic Material Selection Guide for 12 volt led strip lights automotive

When selecting materials for 12 volt LED strip lights used in automotive applications, it is critical for international B2B buyers to consider factors such as thermal management, environmental resistance, manufacturing feasibility, and compliance with regional standards. The choice of materials directly influences product longevity, safety, and performance under varying operational conditions common in automotive environments across Africa, South America, the Middle East, and Europe.

Polyimide (PI) Flexible Substrate

Key Properties: Polyimide substrates offer excellent thermal stability, typically withstanding continuous temperatures up to 260°C. They exhibit strong chemical resistance and flexibility, making them ideal for curved or irregular surfaces in automotive interiors or under-hood applications.

Pros & Cons: The high-temperature tolerance ensures durability in engine compartments where heat is significant. Its flexibility allows for versatile installation. However, polyimide is more expensive than standard PET substrates and requires specialized manufacturing processes, potentially increasing lead times and costs.

Impact on Application: Polyimide substrates are well-suited for LED strips exposed to high temperatures or chemical vapors, such as near engines or exhaust systems. Their resistance to thermal degradation ensures consistent light output and prevents substrate warping.

Regional Considerations: Buyers in regions with hot climates like the Middle East or parts of Africa should prioritize polyimide for durability. Compliance with international standards such as ASTM D3350 or DIN EN ISO 10289 ensures material quality and performance consistency. European buyers often require RoHS and REACH compliance, which polyimide materials can meet when sourced from reputable manufacturers.

Aluminum PCB (Printed Circuit Board)

Key Properties: Aluminum PCBs provide excellent heat dissipation due to their metal core, with thermal conductivity typically around 2.0 W/mK or higher. They offer mechanical strength and resistance to vibration and shock, crucial for automotive environments.

Pros & Cons: The superior thermal management extends LED lifespan and performance, especially in high-power LED strips. Aluminum PCBs are more costly than traditional FR4 boards but provide better durability and reliability. Manufacturing complexity is moderate, with many suppliers experienced in automotive-grade aluminum PCBs.

Impact on Application: Ideal for external automotive lighting or high-intensity interior lighting where heat buildup is a concern. Aluminum PCBs improve energy efficiency and reduce failure rates in harsh conditions.

Regional Considerations: Buyers in Europe and Mexico should verify compliance with automotive industry standards such as ISO 16750 for electrical and environmental testing. Aluminum PCBs are widely accepted in these markets. In South America and Africa, sourcing from suppliers with certifications like IATF 16949 ensures quality and compatibility with automotive OEM requirements.

Silicone Encapsulation

Key Properties: Silicone encapsulants provide excellent waterproofing (IP67 or higher), UV resistance, and flexibility. They can endure extreme temperatures (-60°C to 200°C), making them suitable for both interior and exterior automotive lighting.

Pros & Cons: Silicone encapsulation significantly enhances durability against moisture, dust, and mechanical stress. It also offers chemical resistance against automotive fluids. The downside is a higher material and processing cost compared to epoxy or polyurethane encapsulants.

Impact on Application: Silicone encapsulated LED strips are preferred for exterior automotive lighting, such as undercarriage or accent lighting, where exposure to water, dirt, and UV radiation is frequent.

Regional Considerations: In regions with heavy rainfall or high humidity like parts of South America and Africa, silicone encapsulation ensures longer product life. Buyers should confirm compliance with IP rating standards (IEC 60529) and regional environmental regulations. European buyers often require REACH compliance for silicone materials.

Polyethylene Terephthalate (PET) Substrate

Key Properties: PET substrates are commonly used for flexible LED strips due to their low cost, good dimensional stability, and moderate temperature resistance (up to ~120°C). They offer decent electrical insulation but lower thermal conductivity compared to polyimide or aluminum.

Pros & Cons: PET is cost-effective and easy to manufacture, making it attractive for large-volume production. However, its lower heat resistance limits use in high-temperature automotive zones. It is less chemically resistant and more prone to deformation under stress.

Impact on Application: Suitable for interior ambient lighting or decorative applications where thermal and chemical exposure is minimal. Not recommended for engine bays or exterior lighting.

Regional Considerations: Buyers targeting budget-sensitive markets in Africa or South America may prefer PET-based strips for non-critical lighting applications. Compliance with ASTM D882 for tensile properties and local electrical safety standards is essential. European and Middle Eastern buyers should ensure PET materials meet fire retardancy requirements (UL 94 V-0 or equivalent).

| Material | Typical Use Case for 12 volt led strip lights automotive | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyimide (PI) | High-temperature zones like engine compartments and under-hood lighting | Excellent thermal stability and chemical resistance | Higher cost and complex manufacturing | High |

| Aluminum PCB | High-power LED strips requiring superior heat dissipation and durability | Superior thermal management and mechanical strength | Moderate cost, heavier than flexible substrates | Medium |

| Silicone Encapsulation | Exterior automotive lighting exposed to water, dust, and UV | Outstanding waterproofing and UV resistance | Higher material and processing cost | High |

| PET Substrate | Interior ambient or decorative lighting with low thermal stress | Cost-effective and easy to manufacture | Limited heat resistance and chemical durability | Low |

In-depth Look: Manufacturing Processes and Quality Assurance for 12 volt led strip lights automotive

The manufacturing and quality assurance of 12 volt LED strip lights for automotive applications involve a series of carefully controlled stages to ensure product reliability, durability, and compliance with international standards. For B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe, understanding these processes is crucial for selecting suppliers capable of delivering consistent, high-quality products tailored to automotive requirements.

Manufacturing Processes for 12V Automotive LED Strip Lights

1. Material Preparation

Manufacturing begins with sourcing and preparing raw materials, including flexible printed circuit boards (FPCBs), LED chips (commonly SMD types like 5050 or 3528), resistors, capacitors, and protective coatings. The FPCB substrate must be selected for automotive-grade flexibility and thermal resistance. Suppliers often procure LEDs from certified manufacturers to guarantee brightness, color consistency, and lifespan.

Key considerations during material prep include:

– Ensuring high-purity copper traces on PCBs for optimal conductivity.

– Using automotive-grade adhesives and solder paste with low outgassing and high temperature tolerance.

– Verifying raw materials through Incoming Quality Control (IQC) to prevent defective components entering the production line.

2. Forming and PCB Fabrication

The flexible PCBs are fabricated through photolithography and etching processes, creating the circuits that power the LEDs. Precision in trace width and spacing is vital to prevent shorts or voltage drops. The strips are then cut into reels or specified lengths.

Automotive LED strips often require additional layers, such as polyimide films, to enhance heat dissipation and mechanical strength. Forming may also involve bending or shaping the strips for specific automotive design needs.

3. Assembly

Assembly includes soldering LEDs and electronic components onto the FPCB using automated pick-and-place machines and reflow soldering ovens. This stage demands precision to avoid misalignment or poor solder joints, which can cause early failures.

In automotive applications, assembly often integrates:

– Waterproofing techniques, such as coating with silicone or epoxy resins, to meet IP65/IP67 standards.

– Embedding connectors or terminals compatible with vehicle electrical systems.

– Adding heat sinks or aluminum profiles to manage thermal output.

4. Finishing

Finishing involves protective encapsulation, cutting to length, and packaging. The strips may be coated with UV-resistant layers to prevent degradation from sunlight exposure. Labels with batch numbers, specifications, and certification marks are applied for traceability.

Packaging for export markets is designed to prevent damage during transit and often includes moisture barrier bags and shock-resistant materials.

Quality Assurance and Control (QA/QC)

Ensuring consistent quality in automotive 12V LED strip lights requires adherence to stringent international and industry-specific standards, alongside robust quality control practices.

Relevant International and Industry Standards

- ISO 9001: A fundamental quality management system standard that demonstrates a supplier’s capability to consistently meet customer and regulatory requirements.

- CE Marking: Required for products sold in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

- RoHS Compliance: Restricts hazardous substances, critical for European and some Middle Eastern markets.

- IP Ratings (e.g., IP65, IP67): Define protection levels against dust and water ingress, essential for automotive exterior or engine bay applications.

- Automotive Industry Standards: Depending on the region, compliance with standards such as IATF 16949 (automotive quality management) and specific regulations like ECE R10 for electromagnetic compatibility may be necessary.

QC Checkpoints in Manufacturing

- Incoming Quality Control (IQC): Verification of raw materials and components before production starts to catch defects early.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly, including solder joint inspections, LED placement accuracy, and coating uniformity.

- Final Quality Control (FQC): Comprehensive testing of finished products, including visual inspections, functionality tests, and packaging verification.

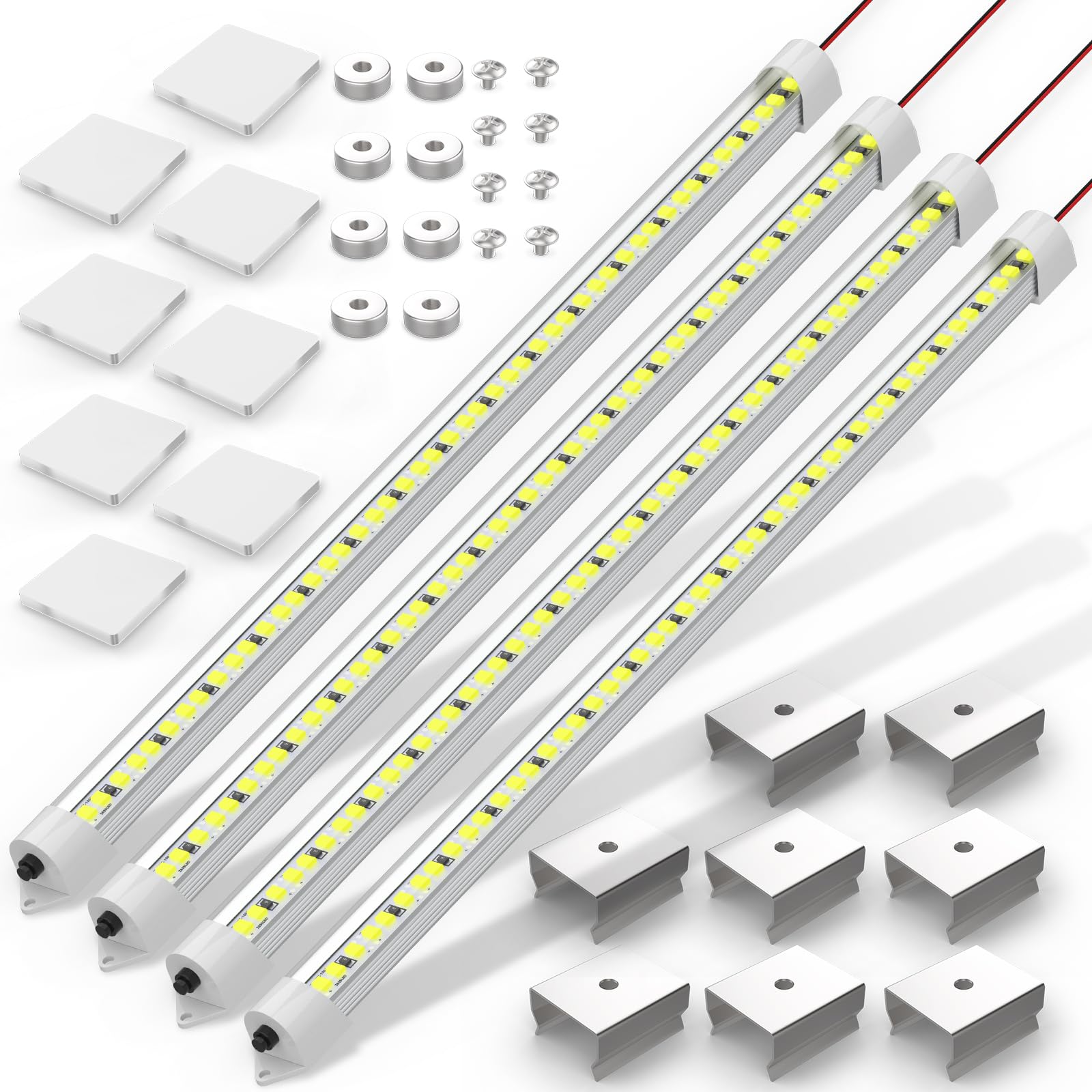

Illustrative Image (Source: Google Search)

Common Testing Methods

- Electrical Testing: Verifying voltage, current, and resistance parameters to ensure consistent operation at 12V.

- Light Output and Color Consistency: Measuring luminous flux (lumens) and color temperature using spectrometers to guarantee uniformity across batches.

- Environmental Testing: Subjecting strips to thermal cycling, humidity exposure, and vibration tests simulating automotive conditions.

- Waterproofing Tests: Immersion or spray tests to confirm IP ratings.

- Durability and Lifespan Testing: Accelerated aging tests to estimate product longevity under continuous use.

How B2B Buyers Can Verify Supplier Quality

Supplier Audits

Conducting on-site audits allows buyers to evaluate manufacturing capabilities, process controls, and worker training. Audits should verify:

– Adherence to documented procedures.

– Cleanliness and organization of production lines.

– Calibration and maintenance of testing equipment.

– Certification authenticity (ISO 9001, IATF 16949, CE).

Reviewing Quality Documentation

Requesting detailed QC reports, including:

– Incoming material inspection records.

– In-process inspection data.

– Final product test results.

– Certificates of conformity and compliance.

Third-party testing reports from accredited laboratories add credibility, especially for buyers unfamiliar with supplier claims.

Third-Party Inspections

Engaging independent inspection agencies to perform pre-shipment inspections helps mitigate risks. These inspections typically cover:

– Visual and dimensional checks.

– Functional and safety testing.

– Packaging and labeling compliance.

QC and Certification Nuances for International B2B Buyers

- Africa and South America: Buyers should verify that products meet local import regulations, which may differ widely. For example, some countries require specific electromagnetic compatibility (EMC) certifications or customs-specific documentation.

- Middle East: Compliance with Gulf Cooperation Council (GCC) standards and certifications like SASO (Saudi Standards) may be required alongside CE marking.

- Europe (including UK): Post-Brexit, UK buyers must ensure products comply with UKCA marking in addition to or instead of CE. RoHS and REACH regulations are strictly enforced.

- Mexico: Adherence to NOM (Norma Oficial Mexicana) standards is often necessary for automotive components.

Buyers should also be aware of potential variations in certification acceptance and testing rigor across regions. Engaging suppliers experienced in exporting to these markets can streamline compliance.

Summary: For international B2B buyers sourcing 12V automotive LED strip lights, a clear understanding of manufacturing stages—from raw material preparation to final packaging—and rigorous quality assurance protocols is essential. Verifying supplier adherence to internationally recognized standards, conducting thorough audits, and demanding comprehensive testing documentation are best practices that safeguard investments and ensure product reliability in diverse markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for 12 volt led strip lights automotive Sourcing

Understanding Cost Components in 12V LED Strip Lights Automotive Sourcing

When sourcing 12 volt LED strip lights for automotive applications, a detailed grasp of the underlying cost components is crucial for effective budgeting and negotiation. The primary cost factors include:

-

Materials: High-quality LEDs (such as SMD 5050, 2835, or 3528 chips), flexible PCBs, waterproof coatings (like silicone or epoxy), connectors, and aluminum profiles for heat dissipation. Material quality directly impacts durability and performance, especially in automotive environments exposed to vibration and temperature fluctuations.

-

Labor: Manufacturing labor costs vary significantly depending on the country of production. Precision assembly, soldering, and quality control checks are labor-intensive steps affecting cost.

-

Manufacturing Overhead: Includes factory utilities, equipment depreciation, and indirect labor. Efficient production lines and automation can reduce these costs.

-

Tooling: Initial setup costs for molds, stencil printing, and custom fixtures can be substantial, especially for customized or proprietary designs.

-

Quality Control (QC): Rigorous QC processes, including LED binning, waterproof testing, and electrical safety checks, add to the cost but are essential for automotive-grade reliability.

-

Logistics: Freight charges, customs duties, and insurance costs vary by region. For international buyers in Africa, South America, the Middle East, and Europe, logistics can represent a significant portion of the landed cost.

-

Margin: Supplier margins typically range from 10% to 30%, depending on brand reputation, order size, and market positioning.

Key Price Influencers for International B2B Buyers

Several factors influence the final pricing of 12V automotive LED strips:

-

Order Volume & Minimum Order Quantity (MOQ): Larger volumes usually secure better unit pricing. MOQ can range from a few hundred meters to thousands depending on the supplier’s scale.

-

Specifications & Customization: Custom color temperatures, waterproof ratings (IP65, IP67, IP68), cut lengths, and integrated controllers increase costs. Automotive-specific certifications (e.g., ISO/TS 16949) also add value and price.

-

Material Quality: Premium LEDs and robust waterproofing materials cost more but offer longer lifespan and reliability, critical for automotive use.

-

Certifications & Compliance: Products meeting CE, RoHS, UL, or automotive-specific standards carry higher costs but reduce risks related to safety and regulatory compliance in target markets.

-

Supplier Factors: Established manufacturers with proven track records may charge premiums but offer reliability and better after-sales support.

-

Incoterms: Terms like FOB, CIF, DDP affect who bears shipping, customs, and insurance costs. DDP (Delivered Duty Paid) is costlier upfront but simplifies import logistics for buyers unfamiliar with customs processes.

Strategic Buyer Tips for Cost-Efficient Sourcing

International B2B buyers, particularly from Africa, South America, the Middle East, and Europe, can adopt several strategies to optimize sourcing costs and ensure quality:

-

Negotiate Based on Volume and Long-Term Partnerships: Suppliers often offer significant discounts for repeat business or larger orders. Emphasize long-term collaboration to unlock better pricing and priority production slots.

-

Focus on Total Cost of Ownership (TCO): Evaluate not just the unit price but also durability, energy efficiency, warranty, and after-sales service. Cheaper lights with poor longevity can increase replacement and maintenance costs.

-

Leverage Group Purchasing or Import Consortia: Buyers in emerging markets can collaborate to consolidate orders, reducing shipping and customs costs.

-

Clarify Incoterms Early: Choose terms that align with your logistical capabilities. For example, buyers new to international trade might prefer DDP to avoid hidden costs and delays.

-

Request Samples and Certifications: Prioritize suppliers who provide comprehensive testing reports and product samples to verify quality before bulk purchases.

-

Account for Currency Fluctuations and Import Duties: Currency volatility can impact landed costs; consider hedging or fixed-price contracts. Understand local import tariffs to avoid unexpected expenses.

Indicative Pricing Disclaimer

Pricing for 12 volt automotive LED strip lights varies widely depending on specifications, order volume, and supplier location. For reference, basic single-color strips typically start around $1–$3 per meter at MOQ levels, while premium RGB or customized automotive-grade strips may range from $4 to $10 per meter or more. These figures are indicative and subject to change based on market conditions and negotiation outcomes.

By understanding these cost drivers and price influencers, international B2B buyers can make informed sourcing decisions, negotiate effectively, and optimize their investment in 12 volt LED strip lights tailored for automotive applications.

Illustrative Image (Source: Google Search)

Spotlight on Potential 12 volt led strip lights automotive Manufacturers and Suppliers

This section looks at several manufacturers active in the ’12 volt led strip lights automotive’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for 12 volt led strip lights automotive

When sourcing 12 volt LED strip lights for automotive applications, understanding the key technical specifications and industry terminology is crucial for making informed purchasing decisions. This knowledge ensures product compatibility, quality assurance, and smooth international trade transactions, especially for B2B buyers in Africa, South America, the Middle East, and Europe.

Critical Technical Properties

1. Voltage and Current Rating

Automotive LED strips typically operate at a nominal 12 volts DC, matching vehicle electrical systems. Confirming the exact voltage and current requirements is essential to avoid overloading circuits or causing premature LED failure. For B2B buyers, requesting datasheets with detailed electrical parameters helps ensure compatibility with automotive power sources.

2. LED Chip Type and Density

Common LED chip types include SMD 3528, 5050, and 2835, each differing in size, brightness, and power consumption. Chip density (LEDs per meter) impacts overall luminosity and uniformity. Buyers should specify the chip type and density to meet brightness and energy efficiency goals while aligning with vehicle design constraints.

3. Waterproof Rating (IP Code)

Automotive environments demand resistance to moisture, dust, and vibration. LED strips with an IP65, IP67, or IP68 rating provide varying levels of protection. IP67 and IP68 offer full waterproofing suitable for exterior or undercarriage applications. Selecting the correct IP rating is vital for durability and compliance with automotive standards.

4. Material and Build Quality

The substrate material (usually flexible PCB) and encapsulation materials affect heat dissipation and flexibility. High-grade copper substrates with silicone or epoxy coatings enhance longevity and resistance to automotive temperature fluctuations. Buyers should verify material certifications and testing reports to ensure reliability in harsh automotive conditions.

5. Color Temperature and CRI (Color Rendering Index)

For interior automotive lighting, selecting the appropriate color temperature (measured in Kelvin) affects ambiance and driver comfort. Typical options range from warm white (2700K) to daylight white (6500K). CRI indicates how accurately colors appear under the light; a CRI above 80 is desirable for true color representation.

6. Cuttable and Connectable Design

Automotive LED strips often feature designated cutting points and compatible connectors to allow customized length and easy installation. Understanding these design aspects helps buyers specify flexible solutions tailored to diverse vehicle models and retrofit projects.

Key Trade Terminology

OEM (Original Equipment Manufacturer)

Refers to manufacturers that produce LED strips to be rebranded or integrated into another company’s product line. For B2B buyers, working with OEMs can offer customization options and cost advantages but requires careful vetting of quality standards.

MOQ (Minimum Order Quantity)

The smallest number of units a supplier is willing to sell in a single order. Understanding MOQ helps buyers plan inventory, budget, and negotiate terms, especially when entering new markets or testing products.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for pricing, lead times, and specifications. A clear and detailed RFQ enables suppliers to provide accurate quotes, facilitating faster procurement decisions and price comparisons.

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free on Board), CIF (Cost, Insurance, Freight), and EXW (Ex Works). Knowing Incoterms aids buyers in managing logistics costs and risks effectively.

Lead Time

The period between placing an order and receiving the goods. Lead time impacts project schedules and inventory management. Buyers should clarify lead times upfront to align supply chain operations with production needs.

Certification and Compliance

Terms such as CE, RoHS, and ECE certification indicate compliance with safety, environmental, and automotive regulations. Ensuring LED strips meet relevant certifications is critical for legal importation and market acceptance in regions like Europe and the Middle East.

By mastering these technical specifications and trade terms, international B2B buyers can confidently evaluate 12 volt LED strip light suppliers, negotiate favorable contracts, and ensure product performance tailored to automotive applications. This strategic approach minimizes risks and supports long-term business success across diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the 12 volt led strip lights automotive Sector

Market Overview & Key Trends

The global market for 12 volt LED strip lights in the automotive sector is experiencing robust growth driven by increasing demand for energy-efficient, durable, and customizable lighting solutions. This trend is particularly pronounced in regions such as Africa, South America, the Middle East, and Europe, where automotive manufacturers and aftermarket suppliers seek innovative lighting to enhance vehicle aesthetics, safety, and functionality. In Africa and South America, expanding automotive industries and rising consumer awareness about vehicle customization fuel demand. Meanwhile, Europe and the Middle East focus heavily on compliance with stringent safety and environmental regulations, pushing suppliers to offer high-quality, certified products.

Key market dynamics include a strong shift towards smart, connected lighting systems that integrate with vehicle electronics for enhanced control and diagnostics. Automotive LED strip lights now often feature adjustable colors, brightness, and patterns controlled via mobile apps or onboard vehicle systems. For B2B buyers, this evolution translates into sourcing opportunities for suppliers who can provide modular, customizable, and technologically advanced products.

Sourcing trends reveal a growing preference for suppliers offering comprehensive solutions—LED strips combined with compatible controllers, sensors, and power supplies—to streamline procurement and installation. International buyers are increasingly valuing suppliers with flexible production capabilities that allow for tailored designs, batch sizes, and certifications. Given the prominence of China as a manufacturing hub, buyers in regions like the UK and Mexico are leveraging direct partnerships with Chinese manufacturers to optimize costs while ensuring quality compliance.

Furthermore, supply chain resilience has become a priority post-pandemic, encouraging buyers to diversify sourcing strategies across multiple regions. This mitigates risks related to logistics disruptions and tariff fluctuations. Digital platforms and virtual trade shows are also facilitating more transparent, efficient supplier evaluation and negotiation, especially for buyers in emerging markets.

Sustainability & Ethical Sourcing in B2B

Sustainability has emerged as a critical factor shaping procurement decisions in the automotive LED strip lights sector. International B2B buyers are increasingly scrutinizing the environmental footprint of LED production, including energy consumption, material sourcing, and end-of-life recyclability. The transition to 12V LED strips itself supports sustainability goals by significantly reducing power usage compared to traditional lighting technologies.

Ethical sourcing is equally important, with buyers demanding transparency throughout the supply chain. This includes verifying that raw materials such as rare earth elements and electronic components are sourced responsibly, avoiding conflict minerals and ensuring fair labor practices. Suppliers adhering to internationally recognized standards—such as ISO 14001 for environmental management and SA8000 for social accountability—stand out as preferred partners.

Green certifications like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) are essential for market access, particularly in Europe and the Middle East. Buyers should prioritize suppliers offering LED strips made with low-toxic, recyclable materials and energy-efficient manufacturing processes. Additionally, innovations in biodegradable or reduced-plastic packaging are gaining traction among environmentally conscious automotive manufacturers.

By integrating sustainability criteria into sourcing strategies, B2B buyers not only comply with evolving regulations but also enhance brand reputation and meet end-customer expectations for eco-friendly vehicles. Collaborative supplier relationships focused on continuous improvement in environmental and social performance create long-term value and reduce operational risks.

Evolution and Historical Context

The automotive use of 12V LED strip lights has evolved significantly over the past two decades. Initially, LED strips were niche products mainly used for accent lighting inside vehicles. However, advancements in LED technology and driver electronics have expanded their applications to exterior lighting, including daytime running lights, turn signals, and brake lights.

Early LED strips offered limited color options and lower brightness levels, but recent generations provide high luminous efficacy, color temperature variety, and smart control capabilities. This evolution aligns with the broader automotive industry’s shift towards electrification and digitalization, where LED lighting plays a crucial role in energy efficiency and vehicle design flexibility.

For B2B buyers, understanding this progression highlights the importance of partnering with suppliers that invest in R&D and can offer next-generation LED strip solutions compliant with the latest automotive standards and consumer preferences. This knowledge enables buyers to anticipate market shifts and secure competitive advantages through innovative lighting products.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of 12 volt led strip lights automotive

-

How can I effectively vet suppliers of 12 volt LED strip lights automotive for international B2B purchases?

To vet suppliers, start by verifying their business licenses, manufacturing capabilities, and certifications such as ISO and CE. Request product samples to assess quality and check references or reviews from other international buyers. Use platforms that offer trade assurance or escrow services to minimize risks. For regions like Africa or South America, confirm the supplier’s export experience and compliance with local import regulations. Visiting the factory or hiring third-party inspection agencies can provide added confidence in supplier reliability. -

What customization options are typically available for automotive 12V LED strip lights, and how should I approach them?

Most manufacturers offer customization in length, LED type (e.g., SMD 5050 or 2835), color temperature, waterproof rating (IP65, IP67), and connector types. Some also provide custom branding, packaging, and control systems integration. Discuss your specific automotive application needs upfront, including voltage compatibility and environmental exposure. Clarify technical specifications and request prototypes before bulk production. Tailoring product features to regional market preferences, such as color or brightness levels, can improve end-customer satisfaction. -

What are typical minimum order quantities (MOQs), lead times, and payment terms for international B2B orders?

MOQs vary widely but generally start from 500 to 1,000 meters per model for 12V LED strips. Lead times typically range from 2 to 6 weeks depending on customization and order size. Payment terms often include 30% deposit upfront with balance before shipment or upon delivery via letter of credit or PayPal. For buyers in Africa and the Middle East, negotiating flexible payment options like escrow or milestone payments can mitigate risk. Early communication about production timelines helps manage supply chain expectations. -

What quality assurance measures and certifications should I expect when sourcing automotive 12V LED strip lights?

Ensure suppliers provide LED-specific certifications such as RoHS for hazardous substances, CE for European markets, and UL or ETL for safety standards. Quality assurance should include in-line production testing, aging tests, and final inspection reports. Request third-party test reports for brightness, color consistency, waterproofing, and durability under automotive conditions. Insist on warranties or quality guarantees to protect your investment. Certification compliance is crucial for smooth customs clearance in Europe, the UK, and other regulated regions. -

What are the best logistics practices for shipping 12V LED strip lights internationally to regions like South America and Africa?

Choose suppliers experienced with international shipping and customs clearance in your target markets. Air freight is faster but costlier; sea freight is economical for large volumes but slower. Confirm packaging standards to prevent damage during transit, including waterproof and anti-static materials. Work with freight forwarders familiar with automotive lighting products and local import duties. Track shipments actively and plan buffer times for customs delays, especially in regions with complex import regulations like some African countries. -

How should I handle disputes or quality issues with suppliers after placing an international order?

Establish clear contractual terms including dispute resolution clauses before ordering. If quality issues arise, document them with photos and test reports, then promptly communicate with the supplier. Use trade platforms’ dispute mechanisms or third-party mediation if necessary. Retain samples and inspection reports to support your claims. For recurring issues, consider switching suppliers or negotiating compensation. Maintaining a collaborative yet firm approach helps preserve long-term partnerships while protecting your business interests. -

Are there regional differences in regulations or standards I should be aware of when importing 12V LED strip lights for automotive use?

Yes, regulatory requirements differ by region. Europe and the UK enforce strict CE marking, RoHS, and EMC standards for automotive lighting. The Middle East may require SASO certification or local approvals. South American countries often have specific import tariffs and safety standards. Africa’s regulations vary widely; some countries require pre-shipment inspections or certification from recognized bodies. Engaging local customs brokers and understanding each market’s legal framework is essential to ensure compliance and avoid shipment delays. -

What payment methods are safest and most efficient for international B2B transactions involving automotive LED strip lights?

Letters of credit (LC) remain a secure choice for large orders, protecting both buyer and supplier. Escrow services and trade assurance platforms offer additional security for smaller transactions. Bank wire transfers are common but carry more risk without formal contracts. For buyers in emerging markets, combining partial upfront payments with balance after inspection can be effective. Always verify supplier bank details independently to prevent fraud. Align payment terms with order size and trust level to balance cash flow and risk management.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for 12 volt led strip lights automotive

In the dynamic automotive lighting market, strategic sourcing of 12 volt LED strip lights is pivotal for international B2B buyers seeking competitive advantage. Key considerations include prioritizing suppliers with proven quality certifications, innovation in energy-efficient and durable LED technology, and the flexibility to customize products to meet diverse automotive standards and aesthetic preferences. Buyers in Africa, South America, the Middle East, and Europe should leverage global manufacturing hubs, particularly those with strong production capabilities in China and emerging regions, to optimize cost-efficiency and supply chain reliability.

Effective strategic sourcing also demands thorough vetting of supplier logistics, after-sales support, and compliance with environmental regulations, ensuring sustainable and uninterrupted supply. Building strong partnerships with manufacturers who invest in smart and customizable LED solutions will facilitate access to cutting-edge products that align with evolving automotive trends.

Looking ahead, the 12V LED strip light market is poised for continued growth driven by technological advancements and rising demand for automotive personalization. International buyers are encouraged to adopt a proactive sourcing strategy—engaging in direct supplier dialogue, exploring innovative product lines, and monitoring regulatory shifts—to secure long-term value and resilience. By doing so, businesses can confidently navigate market complexities and capitalize on emerging opportunities in automotive lighting.