Introduction: Navigating the Global Market for neon led strip

In today’s dynamic global marketplace, neon LED strips have emerged as a pivotal lighting solution, transforming commercial signage, architectural designs, and ambient lighting projects worldwide. For B2B buyers in regions such as Africa, South America, the Middle East, and Europe—including markets like Brazil and Spain—the ability to source high-quality neon LED strips efficiently and cost-effectively is vital to maintaining competitive advantage and meeting diverse client demands.

This guide offers a comprehensive overview tailored to international buyers, addressing every critical aspect of the neon LED strip supply chain. From understanding the various types of neon LED strips and the significance of premium materials to evaluating manufacturing processes and quality control standards, the guide equips buyers with the knowledge to discern superior products from subpar alternatives. It also explores how to identify reliable suppliers, navigate pricing structures, and leverage customization options to fulfill unique project specifications.

Moreover, the guide demystifies market trends and regulatory certifications crucial for global trade compliance, empowering buyers to mitigate risks and optimize procurement strategies. Practical insights on minimum order quantities (MOQs), shipping logistics, and after-sales support further enable buyers to streamline operations and enhance profitability.

By consolidating these key factors, this resource serves as an essential roadmap for businesses aiming to make informed, strategic decisions when purchasing neon LED strips in bulk. Whether you are a distributor, contractor, or project manager, leveraging this knowledge will help you secure competitive pricing, ensure product reliability, and foster long-term partnerships with reputable manufacturers across continents.

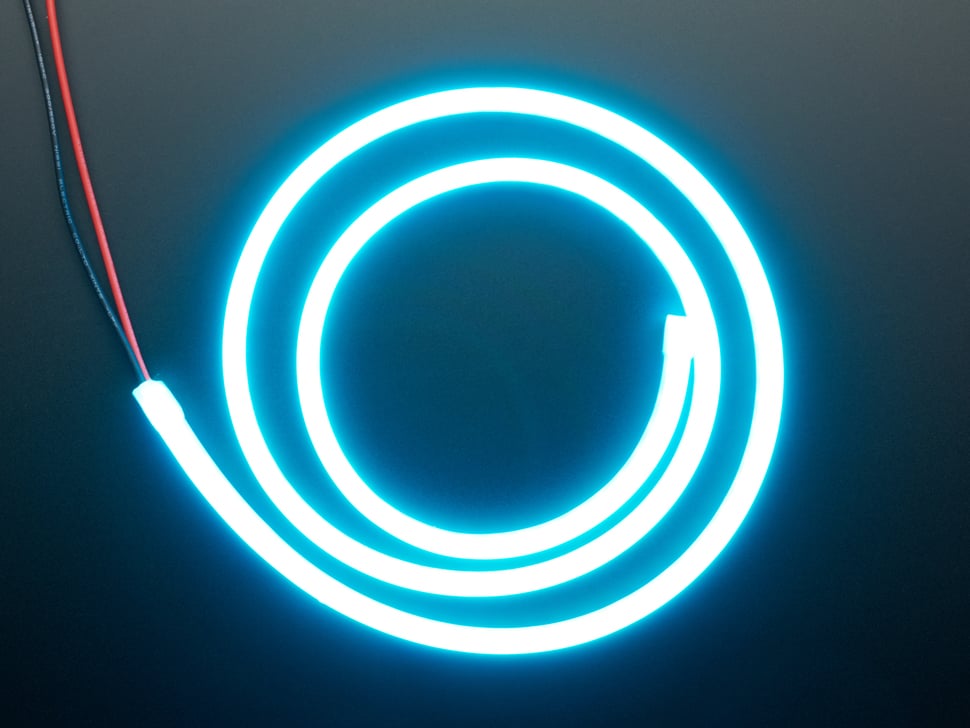

Illustrative Image (Source: Google Search)

Understanding neon led strip Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Silicone Neon Flex | Flexible silicone casing, side/top bending options, high waterproof rating (IP65-IP68) | Outdoor signage, architectural lighting, retail displays | Pros: Durable, waterproof, versatile bending; Cons: Higher MOQ for customization, premium price |

| PVC Neon Strip | PVC outer layer, typically less flexible, lower waterproof rating (IP44-IP65) | Indoor decorative lighting, event setups, temporary installations | Pros: Cost-effective, easier to source; Cons: Less durable, limited outdoor use |

| RGB & Addressable LED Neon | Multi-color control, programmable color changes, app or controller operated | Dynamic advertising, entertainment venues, smart lighting projects | Pros: High customization, eye-catching effects; Cons: Higher complexity, increased cost |

| High-Brightness Mono Color | Single color, high lumen output, often with premium LED chips | Task lighting, industrial applications, commercial interiors | Pros: Superior brightness, energy-efficient; Cons: Limited color options, may require heat management |

| Free-Bending Neon Strip | 360° bending capability, ultra-flexible silicone or PVC | Complex signage, custom shapes, artistic lighting | Pros: Maximum flexibility, creative freedom; Cons: Higher cost, specialized handling required |

Silicone Neon Flex

Silicone neon flex strips are renowned for their durability and flexibility, featuring side or top bending capabilities and high waterproof ratings (IP65 to IP68). These strips are ideal for outdoor commercial signage, architectural accents, and retail displays where weather resistance and longevity are critical. For B2B buyers, investing in silicone neon flex means balancing a higher upfront cost and MOQ with long-term reliability and premium aesthetics. Customization options are extensive but often come with increased MOQs and lead times.

PVC Neon Strip

PVC neon strips offer a more budget-friendly option, typically used indoors due to their lower waterproof rating and limited flexibility. These strips suit event organizers, indoor decorators, and temporary installations where cost efficiency and ease of procurement are priorities. While PVC neon strips may not match silicone flex in durability or outdoor suitability, they offer an accessible entry point for businesses with tight budgets or short-term projects.

RGB & Addressable LED Neon

RGB and addressable LED neon strips provide dynamic lighting solutions with programmable color changes controlled via apps or dedicated controllers. These are highly sought after in entertainment venues, dynamic advertising, and smart lighting projects. For B2B buyers, these strips enable differentiation through customizable effects but require more technical knowledge and higher investment. Considerations include compatibility with control systems and potential after-sales support for programming.

High-Brightness Mono Color

High-brightness mono color LED neon strips utilize premium LED chips to deliver intense, energy-efficient illumination. These are optimal for task lighting in industrial settings, commercial interiors, and environments demanding consistent, bright light. Buyers should evaluate heat dissipation needs and ensure product certifications (e.g., CE, RoHS) when sourcing these strips. While color options are limited, their superior brightness and efficiency often justify the investment.

Free-Bending Neon Strip

Free-bending neon strips allow 360° bending, offering unparalleled flexibility for complex signage and artistic lighting designs. These products are usually made from ultra-flexible silicone or PVC materials tailored for custom shapes. B2B buyers should be prepared for higher costs and specialized handling requirements but can leverage these strips to deliver unique, high-impact lighting solutions. They are particularly valuable in markets where bespoke installations drive premium pricing and customer loyalty.

Related Video: Spotless NEON Effect LED Strips, which is Best? Govee, BTF-Lighting, Alitove and more.

Key Industrial Applications of neon led strip

| Industry/Sector | Specific Application of neon led strip | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial | Illuminated signage and storefront decoration | Enhances brand visibility and attracts customers with vibrant, energy-efficient lighting | Ensure durability (IP65/IP68), color consistency, and compliance with local certifications (CE, RoHS) |

| Hospitality & Leisure | Ambient and accent lighting in hotels, bars, and restaurants | Creates inviting atmospheres, improves guest experience, and reduces energy costs | Custom length and color options; heat resistance and safety certifications for indoor use |

| Architecture & Urban Design | Architectural outlines and façade lighting | Highlights structural features, increases nighttime visibility, and adds aesthetic value | Weatherproofing (UV and waterproof), flexible bending types, and compliance with regional electrical standards |

| Automotive & Transportation | Interior and exterior vehicle lighting | Provides stylish, flexible lighting solutions for branding and safety | Low voltage options (12V/24V), vibration resistance, and adherence to automotive lighting regulations |

| Entertainment & Events | Stage, exhibition, and event lighting | Offers dynamic, customizable lighting effects that enhance visual impact and audience engagement | Rapid delivery, customizable RGB options, and supplier support for large-scale projects |

Retail & Commercial Applications

In retail environments, neon LED strips are widely used for illuminated signage and storefront decoration. These strips offer bright, uniform lighting that enhances brand visibility and draws customer attention, essential for competitive markets in regions like Europe and South America. For B2B buyers, ensuring product durability against environmental factors such as dust and moisture (IP65/IP68 ratings) is critical, especially for outdoor signage. Consistent color quality and compliance with safety certifications like CE and RoHS are also vital to meet regulatory demands and maintain brand reputation.

Hospitality & Leisure

Hotels, bars, and restaurants use neon LED strips to create ambient and accent lighting that elevates guest experience while reducing energy consumption. The flexibility to customize lengths and colors allows businesses in the Middle East and Africa to tailor lighting schemes to cultural preferences and design themes. Buyers should prioritize heat resistance and safety certifications since these installations often operate for extended hours indoors, requiring reliable and safe lighting solutions that comply with local standards.

Architecture & Urban Design

Architectural lighting with neon LED strips highlights building contours and urban features, adding aesthetic appeal and improving nighttime visibility. In Europe and South America, where architectural preservation and modern design coexist, these strips provide a non-invasive, energy-efficient way to accentuate structures. Buyers must focus on weatherproofing features such as UV resistance and waterproofing, as well as flexible bending types to adapt to complex building shapes. Compliance with regional electrical safety standards ensures long-term project success.

Automotive & Transportation

Neon LED strips are increasingly used in vehicles for interior mood lighting and exterior accent lighting, contributing to brand identity and safety. In markets like the Middle East and Africa, where vehicle customization is popular, low voltage options (12V or 24V) and vibration resistance are critical to withstand harsh driving conditions. Buyers should ensure that suppliers provide products compliant with automotive lighting regulations to avoid legal issues and ensure durability.

Entertainment & Events

For stages, exhibitions, and large events, neon LED strips offer dynamic, customizable lighting effects that captivate audiences. In fast-growing event markets across Europe and South America, these lighting solutions support quick installation and flexible design changes. B2B buyers must seek suppliers that offer rapid delivery, customizable RGB options, and strong after-sales support to handle large-scale orders and tight project timelines efficiently.

Related Video: How to Cut and Connect Led Neon strip Flexible Strip Light | Neon Home Decor | RGB | Rope Light |

Strategic Material Selection Guide for neon led strip

When selecting materials for neon LED strips, B2B buyers must consider performance characteristics, manufacturing complexity, and regional compliance standards to ensure the product meets application demands and regulatory requirements. Below is an in-depth analysis of four common materials used in neon LED strip manufacturing, tailored to the needs of international buyers from Africa, South America, the Middle East, and Europe.

Silicone Rubber

Key Properties: Silicone rubber is prized for its excellent thermal stability (operating temperatures from -60°C to 200°C), high flexibility, and outstanding UV and weather resistance. It also offers strong chemical inertness and is waterproof, often rated at IP65 to IP68.

Pros & Cons: Silicone’s durability against harsh environmental conditions makes it ideal for outdoor and industrial applications. It resists cracking and yellowing over time, ensuring long-lasting color fidelity. However, silicone is more expensive than other materials and requires specialized extrusion processes, which can increase lead times and MOQ (Minimum Order Quantity).

Impact on Application: Silicone’s waterproof and UV-resistant qualities make it suitable for outdoor signage, architectural lighting, and marine environments common in coastal regions of Brazil, South Africa, and the Mediterranean. Its flexibility allows for complex bending and shaping.

International B2B Considerations: European buyers often require compliance with RoHS and REACH standards, both of which silicone easily meets. In the Middle East and South America, buyers should verify certifications like CE and UL for safety and performance. Additionally, silicone’s higher cost might be a factor in price-sensitive African markets, but its longevity can justify the investment.

Polyvinyl Chloride (PVC)

Key Properties: PVC is a widely used thermoplastic with good chemical resistance and moderate temperature tolerance (-20°C to 60°C). It is inherently rigid but can be made flexible with plasticizers.

Pros & Cons: PVC is cost-effective and easy to manufacture, enabling lower MOQ and faster production cycles. However, it is less UV stable and prone to yellowing and brittleness over time, especially under prolonged sunlight exposure. PVC is also less environmentally friendly compared to silicone.

Impact on Application: PVC neon strips are better suited for indoor applications or short-term outdoor use in shaded areas. They are common in retail lighting and temporary displays where cost constraints are paramount.

International B2B Considerations: PVC products must comply with regional regulations regarding plasticizers and phthalates, particularly in Europe (REACH) and parts of South America. African and Middle Eastern buyers should inquire about flame retardancy certifications (e.g., ASTM E84 or DIN 4102) due to safety codes in commercial buildings.

Thermoplastic Polyurethane (TPU)

Key Properties: TPU offers excellent abrasion resistance, elasticity, and moderate temperature resistance (-40°C to 90°C). It also has good resistance to oils and chemicals, with better flexibility than PVC.

Pros & Cons: TPU provides a balance between durability and cost, with superior mechanical properties compared to PVC but at a moderate price point. It is less UV stable than silicone but more resistant to environmental stress cracking.

Impact on Application: TPU neon strips are ideal for applications requiring frequent handling or mechanical stress, such as interactive signage or flexible architectural elements. Its chemical resistance suits industrial environments with exposure to oils or solvents.

International B2B Considerations: Buyers in Europe and South America should verify compliance with environmental standards and ensure TPU compounds meet local fire safety codes. In Africa and the Middle East, TPU’s moderate cost and durability make it attractive for infrastructure projects with budget constraints.

Aerosil-Reinforced Silicone (ARS)

Key Properties: ARS is a high-performance silicone variant reinforced with Aerosil (silica) particles, enhancing mechanical strength, UV resistance, and thermal stability beyond standard silicone. It withstands temperatures from -60°C to 230°C and maintains flexibility.

Pros & Cons: ARS offers superior longevity and robustness, making it suitable for demanding outdoor and industrial environments. The trade-off is a 20-30% higher cost compared to standard silicone and more complex manufacturing processes.

Impact on Application: ARS neon strips are preferred for premium architectural lighting, outdoor signage in harsh climates (e.g., deserts in the Middle East, tropical zones in South America), and applications requiring extended warranties.

International B2B Considerations: European buyers highly value ARS for compliance with stringent environmental and safety standards. In Africa and the Middle East, ARS’s durability justifies the premium for infrastructure projects exposed to extreme weather. Buyers should negotiate MOQs carefully due to the higher cost and production complexity.

Summary Table

| Material | Typical Use Case for neon led strip | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicone Rubber | Outdoor signage, architectural lighting, marine use | Excellent UV/weather resistance and flexibility | Higher cost and specialized manufacturing | High |

| Polyvinyl Chloride (PVC) | Indoor lighting, temporary displays | Cost-effective and easy to produce | Poor UV stability, yellows and brittle over time | Low |

| Thermoplastic Polyurethane (TPU) | Interactive signage, industrial environments | Good abrasion and chemical resistance | Moderate UV stability, moderate cost | Medium |

| Aerosil-Reinforced Silicone (ARS) | Premium outdoor/industrial applications, harsh climates | Superior durability and thermal stability | 20-30% more expensive than standard silicone | High |

This material selection guide empowers international B2B buyers to align neon LED strip materials with project requirements, regional standards, and budget considerations, facilitating informed procurement decisions that optimize product performance and lifecycle value.

In-depth Look: Manufacturing Processes and Quality Assurance for neon led strip

Manufacturing Processes for Neon LED Strips

The production of neon LED strips involves a series of precise, well-controlled stages designed to ensure durability, flexibility, and optimal lighting performance. For international B2B buyers, understanding these manufacturing stages can help in evaluating supplier capabilities and product quality.

1. Material Preparation

High-quality raw materials are the foundation of superior neon LED strips. This stage includes sourcing premium LED chips (commonly from reputable brands like San’an or Epistar), flexible printed circuit boards (PCBs), and silicone or PVC casings. The silicone used is often Aerosil-Reinforced Silicone (ARS) for enhanced UV resistance and longevity, which is particularly valuable in outdoor or harsh environmental conditions common in regions like the Middle East or South America. Material preparation also involves cutting the flexible PCB to size and preparing the silicone casing molds.

2. Forming and Extrusion

Silicone or PVC casings are formed through extrusion, a process where the material is heated and pushed through shaped dies to create the neon strip’s profile. This profile dictates the strip’s flexibility and bending type (side bending, top bending, or free bending), essential for complex architectural installations. For example, side bending profiles are popular in Europe for signage, while free bending types offer greater versatility for custom projects in Africa.

3. Assembly

During assembly, LED chips are mounted on the flexible PCB, and electrical connections are soldered with precision. Automated pick-and-place machines are often employed for efficiency and accuracy, minimizing human error. The LED-PCB assembly is then encased in the silicone or PVC housing, with care taken to ensure full encapsulation for waterproofing—IP65 to IP68 ratings are common and critical for outdoor applications. Electrical testing is performed here to verify continuity and functionality before moving forward.

4. Finishing and Packaging

The final stage involves cutting the neon LED strips into standard or customized lengths, attaching connectors, and adding any additional protective coatings. Packaging is designed to prevent damage during shipping, with options for bulk rolls or individually boxed units. Custom packaging can be requested by buyers, especially in European and South American markets where branding and product presentation affect resale value.

Quality Assurance and Control in Neon LED Strip Production

Robust quality assurance (QA) and quality control (QC) processes are vital for producing neon LED strips that meet international standards and buyer expectations. B2B buyers should prioritize suppliers with transparent and certified QA/QC systems.

Key International and Industry Standards

– ISO 9001: This globally recognized quality management system standard ensures consistent manufacturing processes and continuous improvement. Suppliers certified under ISO 9001 demonstrate a commitment to quality and reliability.

– CE Marking: Essential for products sold in the European Union, indicating compliance with health, safety, and environmental protection standards.

– RoHS Compliance: Restricts hazardous substances in electrical products, crucial for buyers in Europe and increasingly important worldwide.

– UL Certification: Widely recognized in the Americas and Middle East, UL certification confirms electrical safety and performance.

– IP Ratings (IP65, IP68): Define the waterproof and dustproof level, critical for outdoor or industrial applications in harsh climates such as in Africa and the Middle East.

Quality Control Checkpoints

– Incoming Quality Control (IQC): Raw materials like LED chips, silicone compounds, and PCBs are inspected for defects or deviations from specifications. For buyers in Brazil or Spain, requesting detailed IQC reports ensures the supplier uses consistent, high-quality inputs.

– In-Process Quality Control (IPQC): During assembly and extrusion, continuous monitoring verifies dimensions, electrical integrity, and encapsulation quality. IPQC often includes visual inspections and functional testing to catch defects early.

– Final Quality Control (FQC): Finished products undergo comprehensive testing before shipment. This includes optical performance tests (brightness, color consistency), waterproof tests (immersion or spray), and mechanical stress tests (bend radius, tensile strength).

Common Testing Methods

– Electrical Testing: Verifies voltage, current, and power consumption align with product specs.

– Light Uniformity and Color Temperature Testing: Ensures even illumination and accurate color reproduction, essential for branding and aesthetic consistency.

– Durability and Environmental Tests: Includes UV resistance, thermal cycling, and humidity exposure to simulate real-world conditions, particularly important for buyers targeting outdoor projects in hot or humid regions.

– Safety and EMC Testing: Checks for electromagnetic compatibility and electrical safety to comply with regional regulations.

How B2B Buyers Can Verify Supplier Quality Control

For international buyers, especially those operating across Africa, South America, the Middle East, and Europe, verifying supplier quality is critical for mitigating risks associated with bulk LED neon strip purchases.

1. Factory Audits

Request or conduct on-site factory audits to review manufacturing processes, QC systems, and certifications. Audits can be done directly or through third-party inspection agencies specializing in electronics manufacturing. For buyers in Brazil or Spain, partnering with local inspection firms can facilitate language and regulatory compliance.

2. Quality Documentation and Reports

Require suppliers to provide detailed QC documentation, including IQC, IPQC, and FQC reports, along with certificates of conformity (COCs) for international standards like CE or UL. These documents provide transparency and traceability for each production batch.

3. Third-Party Inspections and Testing

Engage independent laboratories or inspection companies to conduct random product sampling and testing before shipment. This independent verification is especially recommended for first-time orders or when sourcing from new regions. Third-party inspections can verify IP ratings, electrical safety, and performance claims.

4. Sample Evaluation

Before committing to large orders, request samples for in-house testing under your specific environmental and usage conditions. This is crucial for buyers in climates with extreme heat or moisture, such as the Middle East or tropical South America.

Quality Control Considerations for International Markets

Regional Regulatory Nuances

– Europe (e.g., Spain): Strict adherence to CE, RoHS, and WEEE directives is mandatory. Buyers should ensure suppliers provide all necessary documentation to avoid customs clearance issues.

– South America (e.g., Brazil): INMETRO certification may be required for electrical products. Understanding local import regulations and testing requirements prevents shipment delays.

– Middle East: UL certification and adherence to GCC Standardization Organization (GSO) standards may be necessary for certain countries. Buyers should confirm supplier compliance accordingly.

– Africa: Regulatory frameworks vary widely; however, focus on IP ratings and durability is critical due to often harsh environmental conditions. Confirming supplier capability to produce rugged, weather-resistant neon LED strips is essential.

MOQ and Customization Impact on QC

Higher MOQs often allow suppliers to invest more in QC and custom testing, but buyers should balance order size with quality assurance needs. Custom colors, profiles, or voltages require additional QC steps, so clear communication with the supplier about customization and associated QC protocols is vital.

Summary for B2B Buyers

- Understand the full manufacturing cycle to better evaluate suppliers’ technical capabilities and production consistency.

- Prioritize suppliers with internationally recognized certifications (ISO 9001, CE, UL) and robust QC checkpoints (IQC, IPQC, FQC).

- Implement verification strategies, including factory audits, third-party inspections, and sample testing, tailored to your regional compliance needs.

- Recognize regional regulatory nuances to ensure smooth import and market entry for neon LED strips.

- Communicate clearly about customization requirements and confirm how these impact manufacturing and QC processes.

By integrating these insights, international B2B buyers can confidently source neon LED strips that meet stringent quality standards, ensuring long-term project success and customer satisfaction across diverse global markets.

Related Video: Inside LEDYi LED Strip Factory | Full Manufacturing Process by Leading LED Strip Manufacturer

Comprehensive Cost and Pricing Analysis for neon led strip Sourcing

Understanding the detailed cost and pricing dynamics of neon LED strip sourcing is essential for international B2B buyers aiming to optimize procurement strategies and maximize ROI. The pricing landscape is shaped by multiple cost components and market factors, all of which influence the final purchase price and total cost of ownership.

Key Cost Components in Neon LED Strip Production

-

Raw Materials: The primary cost driver includes high-quality LED chips (brands like San’an or Epistar), premium silicone casings (notably Aerosil-Reinforced Silicone for enhanced durability and UV resistance), and flexible printed circuit boards (PCBs). Material quality directly impacts product longevity and performance, with premium inputs costing 20–30% more but offering superior value.

-

Labor and Manufacturing Overhead: Skilled labor for assembly, quality control, and packaging adds to costs, especially in regions with higher wage standards. Overhead includes factory utilities, equipment depreciation, and indirect manufacturing expenses, which vary depending on the supplier’s location and production scale.

-

Tooling and Setup Costs: Customization requests—such as unique colors, bending types, or silicone profiles—often require tooling changes and production setup, increasing upfront costs. These expenses are typically amortized over the order volume but can raise the minimum order quantities (MOQ) and price per meter.

-

Quality Control (QC) and Certifications: Rigorous QC processes and compliance with international certifications (CE, RoHS, UL) add to production costs but are critical for ensuring product reliability and meeting regulatory requirements in markets like Europe and the Middle East.

-

Logistics and Shipping: Freight costs depend on shipment size, mode (air or sea), and destination, with additional customs duties and import taxes in regions such as Africa and South America. Efficient logistics management can reduce delays and minimize unexpected expenses.

-

Supplier Margin: The profit margin set by manufacturers or distributors reflects market positioning, brand reputation, and after-sales service quality. Established suppliers with proven track records may price higher but offer greater reliability.

Influential Factors Affecting Neon LED Strip Pricing

-

Order Volume and MOQ: Bulk orders benefit from economies of scale, lowering the unit price. MOQ varies by model and customization level, commonly ranging from 50 meters for standard models to 500 meters for highly customized strips. Negotiating MOQ flexibility can improve affordability for smaller projects.

-

Product Specifications and Customization: Higher wattage, specific voltage requirements (12V vs. 24V), unique color temperatures, or advanced features like RGB control increase production complexity and cost. Buyers should carefully assess which specifications are essential to avoid overpaying.

-

Material Grade and Quality Certifications: Opting for certified products with premium materials ensures longevity but comes at a premium. Non-certified or lower-grade options may reduce upfront costs but risk higher failure rates and potential compliance issues.

-

Supplier Location and Incoterms: Suppliers based in China or Southeast Asia often offer competitive prices due to lower labor costs. Understanding Incoterms (e.g., FOB, CIF, DDP) is crucial, as they determine who bears shipping, insurance, and customs responsibilities, affecting landed costs significantly.

-

Market Demand and Seasonality: Prices may fluctuate with raw material shortages or peak demand periods. Planning procurement cycles around these factors can secure better pricing.

Strategic Tips for International B2B Buyers

-

Negotiate MOQ and Pricing: Engage suppliers early to discuss MOQ adjustments, especially for initial orders. Building long-term relationships can unlock volume discounts and priority production slots.

-

Evaluate Total Cost of Ownership (TCO): Consider not just the unit price but also durability, energy efficiency, warranty, and after-sales support. Higher-quality strips may reduce replacement and maintenance costs, offering better TCO.

-

Leverage Sample Orders: Request product samples before committing to large orders to verify quality and compatibility with your project requirements.

-

Compare Multiple Suppliers: Solicit quotations from several manufacturers to benchmark prices, factoring in shipping, customs, and potential tariffs. Pay attention to lead times and supplier responsiveness.

-

Understand Regional Import Regulations: For buyers in Africa, South America, the Middle East, and Europe, local regulations, certifications, and customs processes can impact cost and delivery timelines. Engage local customs brokers or consultants to navigate these complexities.

-

Optimize Shipping and Payment Terms: Consolidate shipments where possible to reduce freight costs. Favor payment terms that balance supplier trust with your cash flow needs, such as letters of credit or escrow services.

Disclaimer: Pricing for neon LED strips varies widely based on product specifications, order size, supplier, and market conditions. The figures discussed are indicative and should be verified with suppliers for accurate quotations tailored to specific project needs.

Spotlight on Potential neon led strip Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘neon led strip’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for neon led strip

Key Technical Properties of Neon LED Strips

Understanding the critical technical specifications of neon LED strips helps B2B buyers make informed decisions, ensuring product suitability for their projects and compliance with regional standards.

-

Material Grade (Silicone Quality)

The silicone casing protects LED components and affects durability, flexibility, and weather resistance. High-grade silicone, such as Aerosil-Reinforced Silicone (ARS), offers superior UV protection and waterproofing, essential for outdoor and harsh environment installations. Although it commands a higher price, investing in premium silicone increases product lifespan and reduces maintenance costs. -

Voltage and Wattage

Neon LED strips commonly operate at 12V or 24V DC. Voltage impacts power consumption, brightness, and safety requirements. Lower voltage strips are safer for indoor use, while higher voltage strips can support longer runs with consistent brightness. Wattage determines energy efficiency and heat generation, influencing both operational costs and installation constraints. -

Ingress Protection (IP) Rating

The IP rating indicates the strip’s resistance to dust and water. Common ratings include IP65 (water-resistant) and IP68 (fully waterproof). For buyers targeting outdoor, industrial, or humid environments, selecting the appropriate IP rating ensures compliance with local regulations and reduces failure risks due to environmental exposure. -

Bending Type and Flexibility

LED neon strips come with different bending capabilities: side bending, top bending, and free bending. This property affects installation versatility, especially on curved surfaces or complex architectural designs. Understanding bending types helps buyers specify the right product for aesthetic and functional requirements without compromising durability. -

Color Temperature and Brightness (Lumen Output)

Color temperature, measured in Kelvins (K), ranges from warm white (~2700K) to cool white (~6500K) and impacts ambiance and visual appeal. Lumen output reflects brightness and is critical for applications requiring high visibility, such as signage or commercial lighting. Buyers should match these specs to their project’s lighting goals. -

Tolerance and Consistency

Manufacturing tolerance relates to dimensional accuracy and color consistency across production batches. Tight tolerances ensure uniform appearance and seamless installation in large-scale projects. For repeat orders, verifying supplier adherence to tolerance standards reduces risks of mismatched products and costly reworks.

Common Trade Terminology for Neon LED Strip Procurement

Familiarity with industry jargon empowers buyers to communicate effectively with suppliers, negotiate better deals, and navigate international trade complexities.

-

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity a supplier will accept per order. It varies based on product type, customization, and supplier policy. Understanding MOQ helps buyers plan inventory, manage upfront costs, and negotiate flexible terms for trial orders or smaller projects. -

OEM (Original Equipment Manufacturer)

OEM refers to products manufactured by one company but branded and sold by another. Buyers seeking custom designs or private-label solutions often engage OEM suppliers to tailor neon LED strips’ colors, packaging, or technical features, enhancing brand differentiation. -

RFQ (Request for Quotation)

RFQ is a formal process where buyers solicit price and terms from suppliers for specific products and quantities. Clear, detailed RFQs accelerate supplier responses and enable buyers to compare offers accurately, fostering transparency and competitive pricing. -

Incoterms (International Commercial Terms)

Incoterms define responsibilities for shipping, insurance, and customs between buyers and sellers in international trade. Common terms include FOB (Free on Board) and CIF (Cost, Insurance, Freight). Knowing Incoterms helps buyers understand cost allocation and risks during transit, crucial for budgeting and logistics planning. -

Lead Time

Lead time is the period from order confirmation to product delivery. For neon LED strips, lead times vary with order size and customization level. Accurate lead time expectations are vital for project scheduling and meeting client deadlines. -

Certification Compliance (CE, RoHS, UL)

Certifications ensure products meet safety, environmental, and quality standards required in different markets. For example, CE is mandatory in Europe, RoHS restricts hazardous substances, and UL certifies electrical safety in the US. Buyers should verify certifications to avoid import issues and guarantee product reliability.

By mastering these technical properties and trade terms, international B2B buyers can optimize procurement strategies, minimize risks, and secure neon LED strips that align perfectly with their operational and market needs.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the neon led strip Sector

Market Overview & Key Trends

The global neon LED strip market is experiencing robust growth fueled by increasing demand for energy-efficient, flexible, and visually striking lighting solutions across commercial, architectural, and entertainment sectors. For international B2B buyers from regions like Africa, South America, the Middle East, and Europe, this sector presents significant opportunities driven by urbanization, infrastructure development, and a rising preference for sustainable technologies.

Key Market Drivers:

- Energy Efficiency & Cost Savings: LED neon strips consume substantially less power than traditional neon lighting, which appeals to businesses aiming to reduce operational costs and comply with stricter energy regulations prevalent in Europe and the Middle East.

- Design Flexibility: The malleable nature of LED neon strips allows for creative signage, branding, and ambient lighting applications that are increasingly favored in retail, hospitality, and public spaces in emerging markets such as Brazil and South Africa.

- Technological Advancements: Innovations like smart LED strips with app-controlled color changing and dimming features are gaining traction, particularly among European buyers seeking cutting-edge solutions to differentiate their offerings.

Sourcing Trends:

- Customization & MOQ Flexibility: Buyers prioritize suppliers who offer tailored solutions—custom colors, silicone profiles, and packaging—while providing manageable minimum order quantities (MOQs). This is critical for companies in Africa and South America, where budget constraints often require smaller initial orders.

- Direct Manufacturer Relationships: To optimize costs and ensure consistent quality, many B2B buyers are shifting towards direct partnerships with manufacturers, bypassing intermediaries. This trend is especially strong in the Middle East and Europe, where procurement teams emphasize transparency and supply chain reliability.

- Quality Certifications: Compliance with international standards such as CE, RoHS, and UL is a non-negotiable requirement for European buyers and increasingly important in other regions to guarantee product safety and performance.

Market Dynamics:

- Price Sensitivity vs Quality: While cost remains a critical factor, buyers are increasingly aware that ultra-low prices often compromise longevity and brightness. The focus is shifting toward value-based purchasing, balancing upfront cost with lifecycle performance.

- Supply Chain Resilience: Recent global disruptions have underscored the importance of diversified sourcing strategies, encouraging buyers to evaluate suppliers with robust logistics capabilities and local warehousing options in target markets.

- After-Sales Support: Comprehensive warranties and responsive technical support are differentiators that influence supplier selection, particularly for large-scale projects in Europe and the Middle East.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a cornerstone in the procurement strategies of many international businesses, especially within regions with stringent environmental policies like the European Union. For B2B buyers of neon LED strips, understanding and integrating sustainability and ethical sourcing principles is essential to meet regulatory requirements and corporate social responsibility (CSR) goals.

Illustrative Image (Source: Google Search)

Environmental Impact:

LED neon strips offer significant environmental advantages over traditional neon lighting, including lower energy consumption, reduced heat emission, and longer operational life, which minimizes waste. However, the production process involves materials such as silicone and electronic components that require responsible sourcing and disposal practices to minimize ecological footprints.

Ethical Supply Chains:

Ensuring that suppliers adhere to ethical labor practices and maintain transparent supply chains is increasingly important. Buyers from Africa, South America, and the Middle East are progressively demanding certifications and audits that confirm fair working conditions and prohibit conflict minerals in LED chip manufacturing.

Green Certifications & Materials:

- Certifications: CE and RoHS certifications are baseline requirements, while emerging standards like Energy Star and TUV Rheinland’s environmental marks provide additional assurance of eco-friendly product design.

- Material Innovations: Premium silicone compounds reinforced with Aerosil (ARS) not only enhance durability but are often more environmentally stable and recyclable than lower-grade alternatives. Selecting suppliers who use such advanced materials supports sustainability goals.

- Circular Economy Practices: Some manufacturers are adopting take-back programs and modular designs that facilitate repair and recycling, aligning with global moves towards circular economy models.

For B2B buyers, prioritizing suppliers with verified sustainability credentials reduces risk, enhances brand reputation, and aligns with the growing demand from end customers for green products.

Evolution of Neon LED Strips: A Brief Context

The neon LED strip is a modern reinterpretation of the classic neon lighting technology that emerged in the early 20th century. Traditional neon lights, which used gas-filled tubes to produce luminous signs, were bulky, fragile, and energy-intensive. The advent of LED technology revolutionized this space by introducing flexible, energy-efficient, and safer alternatives that mimic the vibrant glow of neon.

Since the early 2000s, advances in LED chip technology and silicone encapsulation have enabled the creation of LED neon strips that offer comparable brightness and color saturation with enhanced durability and customization capabilities. This evolution has expanded their applicability far beyond signage to include architectural lighting, interior décor, and artistic installations.

For international B2B buyers, understanding this technological progression underscores the value proposition of LED neon strips — combining aesthetic appeal with operational efficiency and sustainability, meeting the demands of contemporary projects across diverse markets.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of neon led strip

-

How can I verify the reliability of a neon LED strip supplier when sourcing internationally?

To ensure reliability, start by assessing the supplier’s certifications such as CE, RoHS, and UL, which indicate compliance with international safety and quality standards. Request references and verify their track record with other international clients, especially in your region (Africa, South America, Middle East, Europe). Evaluate their after-sales support, warranty policies, and responsiveness. Visiting the supplier’s factory or requesting virtual tours can provide deeper insights. Using third-party inspection services before shipment further safeguards against quality and compliance risks. -

What customization options are typically available for neon LED strips, and how can they benefit my business?

Customization options often include color temperature, LED chip brand, silicone casing profile, length, voltage, and packaging. For international buyers, customized branding and packaging can enhance market differentiation and customer recognition. Tailoring voltage and IP ratings to local standards ensures product safety and functionality. Custom colors or dynamic RGB options can meet niche market demands. Engaging suppliers early about customization capabilities and MOQ for custom orders is vital to align production timelines and costs with your project requirements. -

What are typical Minimum Order Quantities (MOQs) for neon LED strips, and how do they affect lead times and pricing?

MOQs vary based on product type and customization level; standard strips often start around 50-200 meters, while custom designs may require 300-500 meters. Higher MOQs typically reduce unit costs but increase upfront investment. Lead times can range from 2 to 6 weeks depending on order size and complexity. Negotiating MOQ flexibility, especially for first-time orders, can help manage inventory risks. Understanding MOQ implications enables better budgeting and project scheduling, particularly when coordinating international shipping and customs clearance. -

Which payment terms and methods are advisable when dealing with international neon LED strip suppliers?

Common payment methods include wire transfers (T/T), Letters of Credit (L/C), and escrow services. For new suppliers, securing a partial upfront payment (30-50%) with balance upon shipment or after inspection mitigates risk. Established buyers might negotiate net terms (e.g., 30 days). Using internationally recognized banks or payment platforms with buyer protection adds security. Clarify currency used and potential exchange rate impacts. Transparent, mutually agreed payment terms foster trust and smooth transactions across borders. -

What quality assurance practices should I expect from a reputable neon LED strip manufacturer?

A reliable manufacturer conducts in-process quality checks, including LED chip testing, silicone sealing integrity, and waterproofing tests (IP ratings). Finished products should undergo electrical safety, brightness uniformity, and lifespan assessments. Request documentation such as product test reports and certifications. Insist on factory audit reports or third-party inspection certificates. For large or ongoing orders, establish quality control checkpoints and sample approvals before mass production. This approach minimizes defects and ensures compliance with your market’s regulatory requirements.

-

How should I plan for logistics and shipping when importing neon LED strips internationally?

Consider shipping modes (air, sea, express courier) based on order urgency and cost. Bulk orders usually favor sea freight for cost efficiency, but factor in longer transit times and customs clearance delays. Confirm supplier’s export documentation, including commercial invoice, packing list, and certificates of origin. Understand import duties, VAT, and regulations in your country to avoid unexpected fees. Partnering with freight forwarders experienced in handling electronics ensures smoother customs processing. Early coordination with logistics providers prevents bottlenecks and maintains project timelines. -

What steps can I take to resolve disputes or product issues with neon LED strip suppliers?

First, maintain clear communication and document all agreements and specifications. If issues arise, promptly notify the supplier with evidence such as photos and test reports. Request replacement, repair, or refund based on warranty terms. Escalate unresolved disputes through mediation or arbitration clauses included in contracts. For international transactions, familiarity with Incoterms and legal frameworks (e.g., CISG) aids in dispute resolution. Building strong relationships and selecting suppliers with transparent policies reduces conflict likelihood. -

How do product certifications impact the acceptance of neon LED strips in markets like Europe, Brazil, or the Middle East?

Certifications such as CE (Europe), INMETRO (Brazil), and SASO (Saudi Arabia) are often mandatory for market entry, ensuring compliance with safety, electromagnetic compatibility, and environmental regulations. Products lacking proper certification risk customs rejection, fines, or market bans. Working with suppliers who provide these certificates streamlines import processes and builds buyer confidence. Additionally, certifications enhance product credibility with end customers and can be a key differentiator in competitive markets. Always verify that certificates are authentic and up-to-date.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for neon led strip

When sourcing neon LED strips for international B2B projects, strategic procurement is paramount to balancing quality, cost, and customization. Buyers from Africa, South America, the Middle East, and Europe must prioritize suppliers who offer transparent MOQs, competitive pricing aligned with material and technology quality, and robust certifications such as CE and RoHS. Leveraging suppliers with flexible MOQ policies and comprehensive customization capabilities enables businesses to tailor products precisely to project specifications while optimizing inventory investment.

Additionally, evaluating supplier reliability through warranty terms, after-sales support, and sample testing can mitigate risks associated with bulk purchasing and ensure consistent product performance. Given the rapidly evolving LED technology landscape, partnering with forward-looking manufacturers grants access to innovations like smart controls and enhanced durability that differentiate offerings in competitive markets.

Looking ahead, the growing demand for energy-efficient, visually striking lighting solutions positions neon LED strips as a strategic asset across diverse industries and geographies. For B2B buyers in emerging and mature markets alike, cultivating long-term supplier relationships grounded in trust, transparency, and technological alignment will unlock sustainable growth and superior project outcomes. Now is the time to engage proactively with reputable suppliers to secure advantageous terms and stay ahead in the dynamic lighting industry.