Introduction: Navigating the Global Market for mini strip led

In today’s rapidly evolving lighting industry, mini strip LED technology stands out as a pivotal innovation reshaping commercial and industrial applications worldwide. For international B2B buyers from regions such as Africa, South America, the Middle East, and Europe, including key markets like the UAE and Brazil, understanding the nuances of mini strip LEDs is essential to unlocking competitive advantages. These compact, energy-efficient lighting solutions offer unparalleled flexibility for architectural, retail, automotive, and smart city projects, driving demand across diverse sectors.

This comprehensive guide is designed to empower procurement professionals and business decision-makers with a strategic roadmap for sourcing mini strip LEDs effectively on the global stage. It delves into critical aspects including:

- Types and specifications tailored to varied operational environments

- Material selections that influence durability and performance

- Manufacturing processes and quality control standards ensuring product reliability

- Identifying credible suppliers and navigating minimum order quantities

- Cost structures and pricing insights for budget optimization

- Global market trends shaping supply and demand dynamics

- An in-depth FAQ section addressing common challenges faced by international buyers

By synthesizing these elements, the guide facilitates informed decision-making that mitigates risks and enhances supply chain resilience. Buyers will gain clarity on how to align product choices with local regulatory requirements, environmental conditions, and technological integration needs. Ultimately, this resource supports strategic partnerships and sourcing strategies that drive growth and innovation in competitive international markets.

Understanding mini strip led Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Mini Strip LED | Compact size with 3528 or 2835 SMD LEDs; single color or RGB options | Retail displays, signage, architectural accents | Pros: Cost-effective, versatile; Cons: Limited brightness in very large spaces |

| Waterproof Mini Strip LED | Encased in silicone or epoxy resin for IP65-IP68 ratings | Outdoor lighting, marine, industrial settings | Pros: Durable, weather-resistant; Cons: Slightly higher cost, limited heat dissipation |

| High-Density Mini Strip LED | Higher LED count per meter, typically 120-240 LEDs/meter | High-detail lighting, video walls, luxury interiors | Pros: Brighter, smoother light output; Cons: Increased power consumption, cost |

| Addressable Mini Strip LED | Individually controllable LEDs for dynamic effects | Entertainment, advertising, smart lighting solutions | Pros: Customizable lighting effects; Cons: Complex installation, higher price point |

| Flexible Mini Strip LED | Extremely bendable substrate for curved or irregular surfaces | Automotive, wearable tech, creative installations | Pros: Design flexibility; Cons: Potential durability issues under stress |

Standard Mini Strip LED

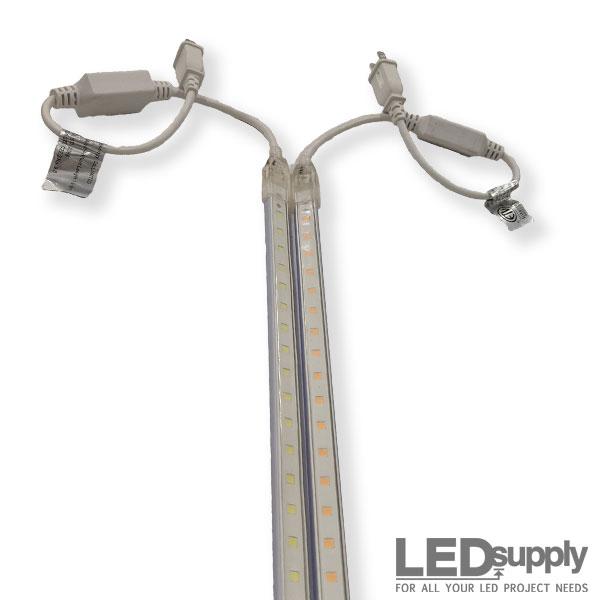

Standard mini strip LEDs are widely used due to their compact size and cost efficiency. They typically feature 3528 or 2835 SMD LEDs and come in single colors or RGB variants. This type suits retail environments, indoor signage, and architectural accents where moderate brightness is sufficient. For B2B buyers, standard strips offer a balance between performance and price, making them ideal for bulk purchases with straightforward installation needs. However, buyers should consider their lighting scale, as these strips may not suffice for very large or highly illuminated spaces.

Waterproof Mini Strip LED

Waterproof mini strip LEDs are coated with silicone or epoxy to achieve IP65 to IP68 ratings, making them resistant to water, dust, and harsh environmental conditions. These strips are essential for outdoor, marine, and industrial applications where exposure to moisture or dust is frequent. International buyers, especially from regions with humid or rainy climates (e.g., Brazil, UAE), benefit from their durability and longevity. While they command a higher upfront cost, the reduced maintenance and replacement frequency provide long-term value.

High-Density Mini Strip LED

High-density mini strip LEDs pack more LEDs per meter, often between 120 and 240, delivering a brighter and more uniform light output. This type is suitable for applications requiring detailed illumination such as luxury interiors, high-end retail, and video wall installations. B2B buyers focusing on premium projects should weigh the increased power consumption and cost against the superior lighting quality. Procurement from manufacturers offering customization and certification support can ensure performance consistency.

Addressable Mini Strip LED

Addressable mini strip LEDs allow individual control of each LED, enabling dynamic lighting effects and color changes. They are popular in entertainment venues, advertising displays, and smart lighting systems. For B2B buyers targeting innovative or interactive installations, these strips offer unmatched flexibility. However, they require more complex controllers and installation expertise. Buyers should partner with manufacturers offering technical support and scalable minimum order quantities to optimize project outcomes.

Flexible Mini Strip LED

Flexible mini strip LEDs use a highly bendable substrate, enabling installation on curved or irregular surfaces such as automotive interiors, wearable technology, and creative architectural designs. This variation is prized for design adaptability but may face durability challenges if repeatedly flexed or stressed. Buyers in markets with growing automotive customization or fashion tech industries should consider flexible strips for their unique applications, ensuring they source from suppliers with quality assurance and robust warranty terms.

Related Video: OLED, QLED, or Mini-LED? Which to TV Buy in 2025

Key Industrial Applications of mini strip led

| Industry/Sector | Specific Application of mini strip led | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial | Shelf and display case lighting | Enhances product visibility, drives customer engagement, and boosts sales | High color rendering index (CRI), customizable lengths, energy efficiency |

| Automotive & Transportation | Interior ambient lighting in vehicles | Improves passenger comfort and brand differentiation | Durability under vibration, heat resistance, compliance with automotive standards |

| Hospitality & Tourism | Accent and mood lighting in hotels and resorts | Creates inviting atmospheres, elevates guest experience | Waterproof ratings, dimmability, compatibility with smart control systems |

| Manufacturing & Warehousing | Task and safety lighting in assembly lines and storage areas | Increases worker safety and productivity | Robustness, long lifespan, easy installation and maintenance |

| Architecture & Urban Development | Facade and pathway lighting for commercial buildings and public spaces | Enhances aesthetics and security, reduces energy costs | Weatherproofing, energy consumption, local regulatory compliance |

Mini strip LEDs are revolutionizing retail and commercial lighting by providing focused illumination on shelves and display cases. This application improves product visibility and attractiveness, crucial for markets in regions like Brazil and the UAE where competitive retail environments demand standout presentation. Buyers should prioritize strips with a high CRI to ensure colors appear natural and appealing, alongside customizable lengths to fit diverse display sizes and energy-efficient options to reduce operational costs.

In the automotive and transportation sector, mini strip LEDs are increasingly used for interior ambient lighting, enhancing passenger comfort and reinforcing brand identity. For B2B buyers in Africa and Europe, sourcing products that withstand vibrations and high temperatures typical of vehicle environments is essential. Compliance with international automotive standards ensures safety and durability, which are critical for fleet operators and vehicle manufacturers.

The hospitality and tourism industry leverages mini strip LEDs for accent and mood lighting in hotel lobbies, rooms, and outdoor resort areas. These lighting solutions create memorable guest experiences by adjusting ambiance dynamically. International buyers should focus on waterproof and dimmable mini strip LEDs compatible with smart control systems to meet the diverse climatic conditions of the Middle East and South America, while facilitating energy savings and operational flexibility.

In manufacturing and warehousing, mini strip LEDs serve as task and safety lighting, improving visibility in assembly lines and storage zones. This application directly contributes to worker safety and operational efficiency. Buyers must look for robust, long-lasting strips that can endure harsh industrial environments and allow for straightforward installation and maintenance to minimize downtime, a key consideration for industrial buyers across all regions.

Finally, in architecture and urban development, mini strip LEDs are used for facade and pathway lighting to enhance building aesthetics and public safety. This application is particularly relevant for commercial projects in Europe and the Middle East where energy efficiency and compliance with local regulations are mandatory. Buyers should ensure weatherproofing and low energy consumption while balancing design flexibility to meet specific architectural requirements.

Related Video: DIFFERENCE between 365nm and 400nm UV LED Black Lights Explained VISUALLY

Strategic Material Selection Guide for mini strip led

When selecting materials for mini strip LED products, international B2B buyers must balance performance requirements, manufacturing complexity, and regional compliance standards. The choice of substrate and encapsulation materials directly influences durability, thermal management, and environmental resistance, which are critical for markets with diverse climates such as Africa, South America, the Middle East, and Europe.

1. Flexible Polyimide (PI) Substrate

Key Properties: Polyimide substrates offer excellent thermal stability, withstanding temperatures up to 260°C, and possess good mechanical flexibility. They provide moderate chemical resistance and are lightweight.

Pros & Cons: PI substrates enable compact and flexible LED strips suitable for curved or irregular surfaces. They are relatively cost-effective compared to other high-performance polymers. However, their moisture resistance is limited, requiring additional protective coatings for humid environments.

Impact on Application: Ideal for indoor and semi-outdoor installations where flexibility and heat dissipation are important. In regions with high humidity or heavy rainfall, such as parts of South America and Africa, additional waterproofing measures are necessary.

Regional Considerations: Buyers in the UAE and Europe should verify compliance with UL and IEC standards for electrical safety and fire retardancy. Polyimide’s thermal endurance aligns well with ASTM D2863 flammability ratings, commonly referenced in these markets.

2. Rigid FR4 (Fiberglass Epoxy) Substrate

Key Properties: FR4 is a rigid, flame-retardant fiberglass epoxy laminate with high mechanical strength and excellent electrical insulation. It supports operating temperatures up to 130°C and offers good moisture resistance.

Pros & Cons: FR4 is durable and cost-effective for applications requiring structural rigidity. Its rigidity limits use in flexible LED strips but enhances heat dissipation and longevity. Manufacturing complexity is moderate due to widespread industry familiarity.

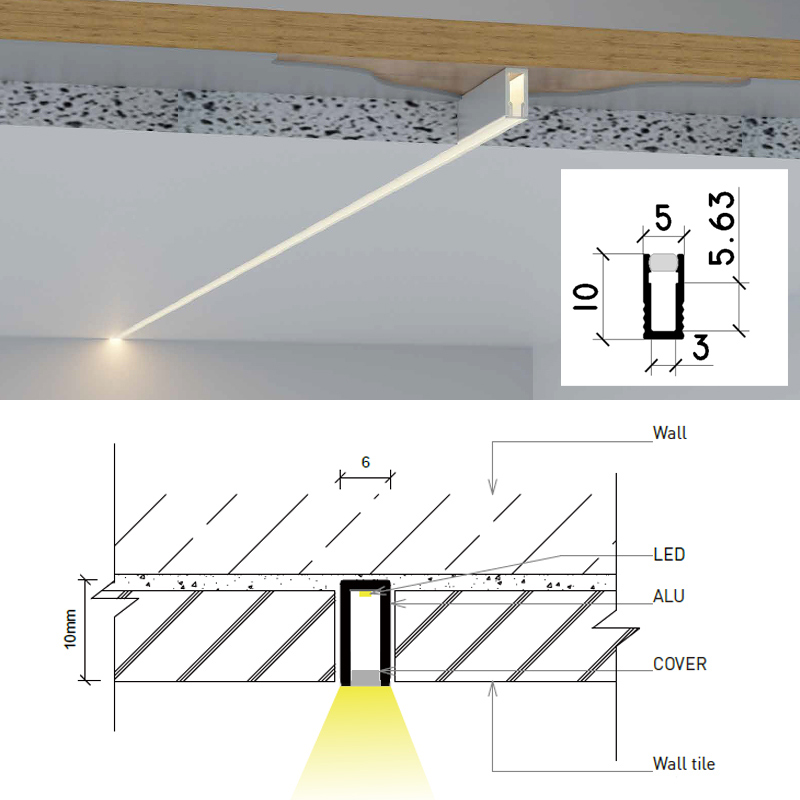

Impact on Application: Best suited for fixed installations such as signage and architectural lighting in controlled environments. Its robustness is advantageous in industrial or commercial settings common in Europe and the Middle East.

Regional Considerations: FR4 meets DIN and JIS standards for electrical and mechanical properties, which supports acceptance in European and Asian markets. Its flame-retardant properties are crucial for compliance with strict fire safety regulations in the UAE and Brazil.

3. Silicone Encapsulation

Key Properties: Silicone encapsulants provide excellent UV resistance, high flexibility, and outstanding thermal stability, typically up to 200°C. They exhibit superior moisture and chemical resistance compared to standard epoxy resins.

Pros & Cons: Silicone encapsulation extends LED strip lifespan in harsh outdoor environments and extreme temperatures. The trade-off is a higher material cost and more complex manufacturing processes requiring specialized curing equipment.

Impact on Application: Highly recommended for outdoor, marine, and desert applications prevalent in the Middle East and coastal African regions. Silicone’s weatherproofing protects against corrosion and degradation from UV exposure.

Regional Considerations: Buyers should ensure silicone materials comply with ASTM D4329 for UV exposure and IEC 60529 for ingress protection ratings. This is particularly important in regions like Brazil and South Africa where outdoor durability is critical.

4. Copper Clad Laminates (CCL)

Key Properties: Copper layers provide excellent electrical conductivity and thermal management. Copper thickness and quality impact current-carrying capacity and heat dissipation efficiency.

Pros & Cons: CCL substrates improve LED performance by reducing thermal resistance, thus enhancing brightness and lifespan. However, copper increases material cost and weight, and requires careful handling to prevent corrosion.

Impact on Application: Preferred in high-performance mini strip LEDs where thermal management is critical, such as industrial lighting in Europe and technologically advanced markets in the UAE.

Regional Considerations: Corrosion resistance treatments must meet ISO 9227 salt spray testing standards to ensure longevity in humid or coastal environments like those in South America and the Middle East.

| Material | Typical Use Case for mini strip led | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Flexible Polyimide | Flexible indoor and semi-outdoor lighting | High thermal stability and flexibility | Limited moisture resistance without coating | Medium |

| Rigid FR4 | Fixed architectural and industrial lighting | Durable, flame-retardant, good insulation | Not flexible, lower max temperature | Low |

| Silicone Encapsulation | Harsh outdoor, marine, and desert environments | Superior UV and moisture resistance | Higher cost and complex manufacturing | High |

| Copper Clad Laminates | High-performance, thermally demanding applications | Excellent electrical and thermal conductivity | Increased cost and corrosion risk | High |

This guide equips international B2B buyers with critical insights to select materials that align with their operational environments, regulatory requirements, and performance expectations for mini strip LED products. Tailoring material choices to regional conditions ensures product reliability, compliance, and competitive advantage.

In-depth Look: Manufacturing Processes and Quality Assurance for mini strip led

Overview of Manufacturing Processes for Mini Strip LED

The production of mini strip LED lighting involves several critical stages, each essential for ensuring product performance, reliability, and durability. Understanding these stages helps B2B buyers from regions such as Africa, South America, the Middle East, and Europe to select manufacturers who meet their quality and customization needs.

1. Material Preparation

This initial phase involves sourcing and preparing high-quality raw materials. Key components include:

- LED Chips: Sourced from reputable semiconductor manufacturers, selected based on brightness, color rendering, and efficiency.

- Flexible PCB (Printed Circuit Board): Typically made from copper-clad polyimide or polyester films, designed for flexibility and heat dissipation.

- Resistors and Drivers: To regulate current and voltage for optimal LED function.

- Encapsulation Materials: Such as silicone or epoxy for protection against moisture and mechanical damage.

Suppliers must ensure traceability and consistency in material quality, as poor inputs lead to substandard final products.

2. Forming and Circuit Fabrication

The flexible PCB undergoes photolithography and etching to form precise copper circuits. This process involves:

- Patterning: Defining LED placement and circuit pathways.

- Copper Etching: Removing unwanted copper to create circuit traces.

- Solder Mask Application: Protecting circuits and preventing short circuits.

Advanced laser cutting and punching techniques are used to achieve precise strip dimensions and designated cutting points.

3. Assembly and Soldering

Assembly is a highly automated process combining efficiency and precision:

- Pick and Place Machines: Precisely position LED chips and electronic components onto the PCB.

- Reflow Soldering: Components are soldered using controlled heating to ensure reliable electrical connections without damaging sensitive parts.

- Coating and Encapsulation: Applying protective coatings or silicone encapsulation to enhance water resistance and durability.

Manufacturers often integrate smart control chips during assembly for dimming, color changing, or remote operation capabilities.

4. Finishing and Packaging

The final stage includes:

- Cutting to Length: According to customer specifications, enabling modular use.

- Testing Points Marking: Clear markings for ease of installation and maintenance.

- Packaging: Usually moisture-proof and anti-static to protect during transit and storage.

Customization options such as branding, labels, and accessories (connectors, controllers) are added here.

Quality Assurance Frameworks and Standards

For international B2B buyers, especially those from diverse regulatory environments like the UAE, Brazil, or South Africa, understanding quality assurance (QA) and certification standards is crucial to minimize risks and ensure compliance.

Key International Standards

- ISO 9001: A fundamental quality management system (QMS) certification ensuring consistent manufacturing quality, process control, and continuous improvement.

- CE Marking: Mandatory for products sold in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

- RoHS Compliance: Restricts hazardous substances, critical for environmental and health safety, especially in Europe and increasingly in other regions.

- UL Certification: Common in North America but often recognized globally, focusing on safety and performance.

- API and IEC Standards: For electrical and lighting product safety and performance, applicable in various international markets.

Buyers should request evidence of these certifications to verify manufacturer credibility.

Quality Control (QC) Checkpoints and Testing Methods

Quality control in mini strip LED manufacturing is multi-layered, ensuring defects are identified early and products meet specifications.

QC Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials and components for compliance with specifications before production starts.

- In-Process Quality Control (IPQC): Ongoing inspections during manufacturing, including solder joint integrity, LED placement accuracy, and circuit continuity.

- Final Quality Control (FQC): Comprehensive testing of completed products for functionality, appearance, and packaging integrity before shipment.

Common Testing Methods

- Electrical Testing: Verifies voltage, current, and power consumption to ensure operational efficiency.

- Optical Testing: Measures brightness (lumens), color temperature, and color rendering index (CRI).

- Environmental Testing: Includes moisture resistance (IP rating tests), thermal cycling, and UV exposure to simulate real-world conditions.

- Mechanical Testing: Flexibility and durability tests to assess strip resilience during installation and use.

- Burn-in Testing: Extended operation under load to detect early failures or defects.

How B2B Buyers Can Verify Supplier Quality Assurance

For buyers in emerging and established markets, verifying a supplier’s QC processes is essential to avoid costly quality issues or regulatory non-compliance.

Recommended Verification Practices

- Supplier Audits: Conduct on-site audits or hire third-party inspection firms to review manufacturing processes, facility hygiene, equipment calibration, and staff training.

- Review of QC Documentation: Request detailed QC reports, including batch inspection results, testing certificates, and non-conformance records.

- Third-Party Testing: Engage independent labs to perform product certification and compliance testing, particularly for CE, RoHS, and IP ratings.

- Sample Evaluation: Obtain product samples for in-house testing under local environmental and operational conditions.

- Factory Capability Assessment: Evaluate manufacturer’s capacity for customization, scalability, and responsiveness to quality issues.

Navigating QC and Certification Nuances for International Markets

International B2B buyers face unique challenges due to varying regulatory requirements and market expectations.

- Africa & Middle East: Regulatory frameworks are evolving; buyers should prioritize suppliers with ISO 9001 and CE certifications and consider local testing requirements or customs clearance documentation.

- South America (e.g., Brazil): Compliance with ANATEL and INMETRO certifications may be necessary; understanding import restrictions and local standards is key.

- Europe: Strict adherence to CE, RoHS, and WEEE directives is mandatory; buyers must ensure traceability and supplier transparency.

- Middle East (e.g., UAE): Emphasis on safety certifications and environmental standards is growing; suppliers offering documentation aligned with Gulf Cooperation Council (GCC) regulations have an advantage.

Buyers should engage with suppliers who demonstrate familiarity with these regional nuances and provide tailored documentation to facilitate smooth importation and market entry.

Summary

For international B2B buyers sourcing mini strip LED products, a deep understanding of manufacturing processes and quality assurance protocols is critical. From material selection through assembly and final testing, each stage influences product reliability and compliance. Leveraging robust QC checkpoints, international certifications, and verification strategies enables buyers across Africa, South America, the Middle East, and Europe to mitigate risks and secure high-quality lighting solutions tailored to their market demands.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for mini strip led Sourcing

Breakdown of Cost Components in Mini Strip LED Sourcing

When sourcing mini strip LEDs for international B2B procurement, understanding the underlying cost components is crucial for effective budgeting and negotiation. The primary cost drivers include:

- Materials: High-quality LEDs, flexible PCB substrates, resistors, adhesives, and protective coatings constitute the raw materials. Premium materials, such as high-grade chips or waterproof coatings, increase costs but enhance durability and performance.

- Labor: Assembly and manual handling, especially for customized or precision mini strip LEDs, impact labor costs. Labor rates vary significantly by manufacturing country, influencing overall pricing.

- Manufacturing Overhead: This covers factory utilities, equipment depreciation, quality control processes, and production line management, contributing to the fixed and variable costs embedded in the final price.

- Tooling and Setup: Custom designs often require specific tooling or molds, leading to upfront one-time costs that may be amortized over order volumes.

- Quality Control (QC): Rigorous testing for brightness uniformity, electrical safety, and compliance with international standards adds to costs but reduces the risk of returns or failures.

- Logistics: Freight, customs clearance, insurance, and warehousing fees vary by destination region. Shipping from Asia to Africa, South America, the Middle East, or Europe introduces different cost and time considerations.

- Supplier Margin: This reflects the manufacturer’s profit margin, influenced by market competition, order size, and relationship depth.

Key Pricing Influencers for International Buyers

Several factors directly impact the quoted price per unit or batch for mini strip LEDs:

- Order Volume and MOQ: Larger orders typically reduce unit cost due to economies of scale, while minimum order quantities (MOQs) can set a baseline purchase size impacting cash flow.

- Specifications and Customization: Tailored lengths, color temperature, IP ratings, or smart control integrations increase complexity and price.

- Material Quality and Certifications: Certified components (e.g., RoHS, CE, UL) ensure compliance with regional regulations but add to procurement costs.

- Supplier Capabilities and Reputation: Established suppliers with in-house R&D, testing labs, and fast prototyping may charge premiums but offer reliability and innovation.

- Incoterms and Payment Terms: Shipping terms like FOB, CIF, or DDP determine which party bears transportation risk and costs, affecting the total landed price.

- Currency Fluctuations and Tariffs: Exchange rates and import duties in markets such as UAE, Brazil, or South Africa can significantly alter the final cost.

Actionable Buyer Insights for Cost-Efficient Sourcing

International B2B buyers, especially from regions like Africa, South America, the Middle East, and Europe, should consider these strategies to optimize cost and value:

- Negotiate Beyond Price: Discuss tooling fees, payment terms, and volume discounts. Long-term partnerships can unlock better pricing and priority production slots.

- Assess Total Cost of Ownership (TCO): Factor in not just unit price but warranty, expected lifespan, energy efficiency, and after-sales support to avoid hidden costs.

- Leverage Flexible MOQ Options: Some manufacturers offer tiered pricing or smaller MOQs for prototyping or market testing, reducing upfront investment risk.

- Prioritize Quality Certifications: Compliance with local regulations avoids costly delays and penalties; insist on suppliers providing verifiable certification documents.

- Optimize Logistics: Consolidate shipments or select appropriate Incoterms to balance cost versus control. Consider regional warehouses or distributors to reduce lead times and customs complexity.

- Request Samples and Prototypes: Validate product quality and specifications early to prevent costly errors in bulk orders.

- Monitor Market Trends: Stay informed on raw material price shifts or geopolitical changes affecting supply chains to time purchases advantageously.

Pricing Disclaimer

Prices for mini strip LEDs vary widely depending on customization, order volume, and supplier location. The figures discussed herein are indicative and meant to guide strategic decision-making rather than serve as fixed quotes. Always obtain multiple formal quotations and conduct due diligence before finalizing procurement contracts.

By dissecting the cost structure and recognizing key pricing influencers, international B2B buyers can negotiate smarter deals, reduce risks, and secure mini strip LEDs that align with their operational and financial goals.

Spotlight on Potential mini strip led Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘mini strip led’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for mini strip led

Critical Technical Properties of Mini Strip LED

For international B2B buyers sourcing mini strip LEDs, understanding key technical specifications ensures product suitability and quality consistency across diverse markets such as Africa, South America, the Middle East, and Europe.

-

Material Grade (Copper and PCB Quality):

The base material, typically copper, affects conductivity and durability. High-grade copper with low resistivity enhances energy efficiency and heat dissipation. PCB substrate quality (flexible or rigid) influences flexibility and lifespan. Buyers should request material certifications to confirm compliance with international standards, which is critical for long-term reliability in harsh environments. -

LED Chip Density (LEDs per Meter):

This specifies how many individual LEDs are embedded per meter of the strip. Higher density yields brighter, more uniform lighting but increases power consumption. Selecting the right density aligns with application needs—decorative lighting may require fewer LEDs, whereas commercial or architectural uses demand higher density. -

Power Consumption and Voltage Rating:

Mini strip LEDs commonly operate at 12V or 24V DC. Understanding wattage per meter is essential for power supply planning and energy cost estimation. Overloading or incorrect voltage can reduce lifespan or cause failure, so buyers must ensure compatibility with local electrical infrastructure. -

IP Rating (Ingress Protection):

The IP rating defines resistance to dust and water. For outdoor or industrial environments, a minimum of IP65 (dust-tight and water jets protection) is recommended. In indoor or dry settings, IP20 may suffice. This impacts installation flexibility and durability, particularly in regions with high humidity or dust. -

Color Temperature and CRI (Color Rendering Index):

Color temperature (measured in Kelvins) affects ambiance and visual comfort; options range from warm white (~2700K) to daylight (~6500K). CRI indicates how accurately colors appear under the light source, with values above 80 considered good for retail or display applications. Specifying these helps buyers tailor lighting to cultural preferences and use cases. -

Tolerance and Dimensional Accuracy:

Tolerance refers to permissible deviations in dimensions and electrical characteristics. Tight tolerances ensure consistent performance and ease of integration into fixtures or systems. For B2B buyers, verifying tolerance reduces the risk of installation issues and costly returns.

Common Industry and Trade Terminology for Mini Strip LED

Navigating the LED supply chain requires familiarity with key terms that streamline communication and procurement processes.

-

OEM (Original Equipment Manufacturer):

Refers to manufacturers that produce LED strips to be branded and sold by other companies. Choosing an OEM partner can enable customization and exclusive product lines, critical for businesses aiming to differentiate in competitive markets. -

MOQ (Minimum Order Quantity):

The smallest quantity a supplier will accept for an order. MOQs vary widely; buyers from emerging markets or smaller enterprises should negotiate flexible MOQs to minimize inventory risks and upfront costs. -

RFQ (Request for Quotation):

A formal inquiry sent to suppliers to obtain pricing, lead times, and terms for specified products. A well-prepared RFQ with detailed technical requirements accelerates supplier responses and ensures accurate comparisons. -

Incoterms (International Commercial Terms):

Standardized trade terms defining responsibilities for shipping, insurance, and tariffs between buyers and sellers. Common terms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Understanding Incoterms helps buyers manage logistics, costs, and risk, especially for cross-continental shipments. -

Binning:

The process of sorting LEDs based on color and brightness consistency. High-quality suppliers provide binning data to guarantee uniform lighting output, essential for professional applications where visual consistency is a priority. -

CRI (Color Rendering Index):

Though a technical spec, CRI is often referenced in trade discussions to assess light quality. Buyers should request CRI values to ensure the LED strips meet the visual standards required for their market or project.

Mastering these technical properties and trade terms empowers international buyers to make informed decisions, optimize sourcing strategies, and foster productive partnerships with manufacturers and suppliers worldwide.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the mini strip led Sector

Market Overview & Key Trends

The global mini strip LED market is experiencing robust growth driven by increasing demand for compact, energy-efficient lighting solutions across multiple industries, including retail, hospitality, automotive, and architectural applications. Key drivers include urbanization, smart city initiatives, and the rising adoption of IoT-integrated lighting systems. For international B2B buyers—particularly in emerging regions such as Africa, South America, and the Middle East—mini strip LEDs offer versatile applications that support infrastructure modernization and energy savings.

In regions like the UAE and Brazil, government incentives for energy-efficient technologies and smart building projects are accelerating demand. European markets continue to prioritize high-performance and customizable LED solutions that meet stringent quality and safety standards. Consequently, manufacturers are increasingly offering bespoke mini strip LED products tailored to diverse environmental conditions, such as high humidity or extreme temperatures common in tropical and desert climates.

Sourcing trends highlight a shift towards customization and flexible manufacturing. Buyers benefit from partners who provide low minimum order quantities (MOQs) and rapid prototyping, enabling faster time-to-market for specialized products. Additionally, integration with smart controls and wireless connectivity is becoming a standard expectation, enhancing operational efficiency and remote management capabilities. Supply chain resilience is critical; buyers should seek manufacturers with diversified sourcing strategies and local distribution hubs to mitigate disruptions and reduce lead times.

Sustainability & Ethical Sourcing in B2B

Sustainability is increasingly central to procurement decisions in the mini strip LED sector. The environmental impact of LED production, including raw material extraction and electronic waste, demands attention from B2B buyers focused on long-term value and corporate social responsibility. Ethical sourcing practices ensure supply chains avoid conflict minerals and labor violations, which is vital for maintaining brand reputation and compliance with international regulations.

Buyers should prioritize manufacturers who comply with recognized green certifications, such as RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and ENERGY STAR. These certifications guarantee that mini strip LEDs meet environmental safety standards and reduce harmful emissions during manufacturing and operation. Additionally, sourcing components with recyclable materials and designing for ease of disassembly supports circular economy principles.

In markets like Europe, sustainability credentials are often mandatory for public and private contracts, while in Africa and South America, the focus is shifting towards affordable yet eco-friendly solutions. Partnering with suppliers who demonstrate transparent sustainability reporting and invest in energy-efficient production technologies can help buyers reduce their carbon footprint and meet evolving regulatory demands.

Illustrative Image (Source: Google Search)

Evolution of Mini Strip LED Technology

Mini strip LEDs have evolved from simple, fixed-length light strips to highly customizable, smart-enabled modules. Early iterations focused primarily on basic illumination with limited color and brightness control. Today’s mini strip LEDs incorporate advanced chip technology, enabling higher lumen output, improved color rendering, and enhanced energy efficiency in smaller form factors.

The integration of flexible PCBs and waterproof coatings has expanded applications to outdoor and industrial environments, while developments in control systems allow seamless integration with building automation platforms. This evolution reflects a broader industry trend toward intelligent lighting solutions that deliver both aesthetic appeal and operational functionality, making mini strip LEDs a strategic choice for B2B buyers seeking innovation and adaptability in their lighting projects.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of mini strip led

-

How can I effectively vet suppliers of mini strip LED products for international B2B purchases?

To vet suppliers, start by verifying their business licenses and certifications such as ISO, CE, or RoHS relevant to LED products. Request factory audits or third-party inspection reports to assess manufacturing capabilities and quality control processes. Check references and customer reviews, especially from buyers in your region (Africa, South America, Middle East, Europe). Evaluate their communication responsiveness and transparency. Prioritize suppliers offering product samples and detailed technical datasheets. This due diligence helps ensure reliability and reduces risks in international trade. -

What customization options are typically available for mini strip LEDs, and how can I leverage them for my market?

Manufacturers often offer customization in LED color temperature, strip length, waterproofing levels (IP ratings), adhesive backing, and connectors. Some provide smart lighting features integration, such as dimming or color control via apps. Tailoring these aspects to your target market’s climate, installation needs, and regulatory standards can increase product appeal and reduce returns. Engage early with suppliers to discuss design requirements and request prototypes to validate before bulk orders. -

What are typical minimum order quantities (MOQs) and lead times for mini strip LED orders from international suppliers?

MOQs vary widely, typically ranging from 500 to 5,000 meters depending on customization and supplier scale. Lead times can span 3 to 8 weeks, influenced by order complexity and manufacturing schedules. For emerging markets like Africa or South America, factoring in additional shipping and customs clearance time is critical. Negotiate flexible MOQs if you are testing new products or markets, and confirm realistic lead times upfront to align your procurement and sales cycles.

Illustrative Image (Source: Google Search)

-

Which payment terms are standard in international B2B transactions for mini strip LEDs, and how can buyers protect themselves?

Common payment terms include 30% deposit upfront with balance upon shipment or letter of credit (L/C) for larger orders. Using escrow services or trade finance instruments can mitigate risks. Always verify supplier bank details independently and avoid full prepayments without safeguards. For new suppliers, smaller initial orders with secure payment methods build trust. Clear contract terms specifying delivery, quality standards, and penalties for non-compliance also protect buyers. -

What quality assurance measures and certifications should I demand for mini strip LEDs?

Request suppliers to provide relevant certifications such as CE (Europe), UL (North America), RoHS compliance for hazardous substances, and IEC standards for electrical safety. Insist on product testing reports covering lumen output, color consistency, waterproofing, and lifespan. Third-party lab testing or in-house quality control documents enhance confidence. Implement your own incoming inspection protocols upon receipt to verify batch consistency, especially important when importing to diverse markets with varying regulations. -

How should I plan logistics and shipping for mini strip LED imports to regions like the Middle East, Africa, or South America?

Choose suppliers experienced in international shipping and familiar with your destination’s customs regulations. Opt for consolidated shipments to reduce costs and ensure product safety. Understand import duties, VAT, and compliance documentation required locally. Use reliable freight forwarders offering door-to-door services with tracking. Plan for potential delays due to port congestion or regulatory inspections by building buffer time into your supply chain. -

What steps can I take if I encounter disputes or quality issues with my mini strip LED supplier?

First, document all discrepancies with photos and detailed descriptions. Communicate promptly with the supplier to seek resolution, referencing agreed quality standards and contracts. Escalate issues through formal dispute resolution clauses, such as mediation or arbitration, often included in international sales agreements. If payment was made via escrow or letter of credit, leverage these tools to negotiate refunds or replacements. Establishing clear contracts and maintaining transparent communication reduces conflict risks. -

How can I ensure compliance with regional regulations when importing mini strip LEDs into markets like the UAE or Brazil?

Research and comply with local electrical safety standards, energy efficiency requirements, and import certifications. For example, the UAE mandates Emirates Conformity Assessment Scheme (ECAS) certification, while Brazil requires INMETRO approval. Work with suppliers who understand these requirements and can provide compliant product documentation. Partnering with local agents or consultants can streamline certification processes and prevent customs clearance issues, ensuring smoother market entry.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for mini strip led

Strategic sourcing of mini strip LED products presents a compelling opportunity for international B2B buyers seeking to enhance their product offerings with high-quality, energy-efficient lighting solutions. Key takeaways emphasize the importance of partnering with manufacturers who provide customization options, robust supply chain capabilities, and compliance with international standards. For buyers in regions such as Africa, South America, the Middle East, and Europe, understanding local market needs alongside global trends—like smart integration and environmental adaptability—can unlock significant competitive advantages.

Effective strategic sourcing involves:

- Prioritizing manufacturers with flexible minimum order quantities and rapid prototyping to reduce time-to-market.

- Ensuring thorough quality assurance and certification support to meet regional regulations and customer expectations.

- Leveraging supplier partnerships that offer tailored solutions, including branded identity and performance customization.

Looking ahead, the mini strip LED market is poised for growth driven by increasing demand for sustainable and intelligent lighting technologies. Buyers who adopt a proactive sourcing strategy, emphasizing collaboration and innovation, will be best positioned to capitalize on emerging trends. International buyers are encouraged to deepen supplier relationships and invest in market intelligence to navigate evolving supply dynamics confidently and sustainably. This forward-looking approach will not only optimize procurement outcomes but also drive long-term value in diverse global markets.