Introduction: Navigating the Global Market for led strip channel

In today’s rapidly evolving lighting industry, LED strip channels have become a cornerstone for delivering high-performance, durable, and visually appealing LED installations. For international B2B buyers—from emerging markets in Africa and South America to established industrial hubs in the Middle East and Europe—the strategic sourcing of LED strip channels is essential to ensuring project success, cost efficiency, and long-term value. These aluminum profiles do more than just house LED strips; they provide critical thermal management, enhanced light diffusion, and mechanical protection that extend the lifespan and quality of LED lighting systems.

This comprehensive guide offers a deep dive into the world of LED strip channels, empowering buyers with actionable insights across multiple dimensions. You will gain clarity on different channel types and their ideal applications, including surface-mounted, recessed, corner, and suspended profiles, tailored for diverse architectural and commercial needs. The guide also covers material selection, manufacturing standards, and quality control practices—key factors influencing durability and performance in varying climates and regulatory environments.

Moreover, sourcing strategies are examined with a focus on international trade dynamics, supplier vetting, and cost structures to help buyers from regions such as Saudi Arabia and Germany negotiate effectively and minimize risks. The guide also addresses market trends and frequently asked questions, ensuring buyers stay ahead of technological innovations and evolving industry standards.

By integrating these insights, B2B buyers can make informed decisions that optimize procurement, streamline installation, and ultimately deliver superior lighting solutions that meet both functional and aesthetic demands across global markets.

Understanding led strip channel Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Surface Mounted Channel | Mounted directly on visible surfaces; low-profile aluminum housing | Retail displays, under-cabinet lighting, office accent lighting | Pros: Easy installation, cost-effective, versatile. Cons: Visible mounting may not suit high-end aesthetics. |

| Recessed Channel | Embedded flush within walls, ceilings, or furniture for hidden lighting | High-end interiors, hospitality, luxury retail | Pros: Sleek, minimalist look; hides light source. Cons: Higher installation complexity and cost. |

| Corner Channel | Designed for 90° angles; fits corners and edges | Staircases, cabinet corners, display cases | Pros: Enables directional lighting, ideal for tight spaces. Cons: Limited to angular applications. |

| Suspended Channel | Hung via cables or suspension kits; linear pendant style | Open-plan offices, commercial foyers, conference rooms | Pros: Modern design, supports indirect lighting. Cons: Requires structural support, higher installation effort. |

| Stair Nosing Channel | Integrated into stair edges with protective diffusers | Hotels, theaters, residential staircases | Pros: Enhances safety and aesthetics; durable. Cons: Specialized installation, niche application. |

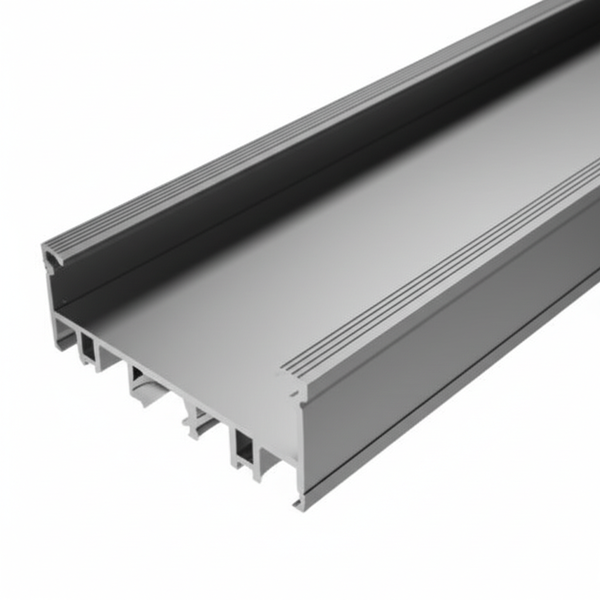

Surface Mounted Channels

These channels are the most common and straightforward option for LED strip installation. Their low-profile aluminum housings mount directly onto surfaces such as walls, ceilings, or furniture. This type is highly versatile, suitable for commercial retail spaces, office accent lighting, and under-cabinet illumination. For B2B buyers, surface mounted channels offer cost efficiency and ease of installation, making them ideal for large-scale projects requiring quick deployment. However, their visible mounting may not align with premium design requirements.

Recessed Channels

Recessed profiles are embedded flush into drywall, ceilings, or cabinetry, creating a seamless and minimalist lighting effect. This type is favored in luxury retail, hospitality, and high-end architectural projects where aesthetic refinement is critical. B2B buyers should consider that recessed channels typically involve higher installation complexity and labor costs. However, the clean, hidden light source delivers exceptional visual appeal and can enhance property value in commercial builds.

Corner Channels

Specifically designed for 90-degree angles, corner channels fit neatly into corners and edges, directing light along two intersecting planes. These are ideal for staircases, cabinet corners, and display cases where space constraints or angular lighting effects are required. For international buyers, corner channels offer a practical solution for maximizing lighting in tight spaces but are limited to niche applications. Ensuring precise measurements and compatibility with LED strips is essential during procurement.

Suspended Channels

Suspended LED channels are installed using suspension kits or wires, creating linear pendant fixtures that suit modern office environments, commercial foyers, and conference rooms. This type supports both direct and indirect lighting designs, adding architectural interest and improved illumination quality. Buyers from regions emphasizing contemporary office design, like Germany or Saudi Arabia, will appreciate the aesthetic and functional benefits. However, these channels require structural support and professional installation, impacting project timelines and costs.

Stair Nosing Channels

These specialized channels are integrated into stair edges, combining illumination with safety features. Common in hotels, theaters, and upscale residential projects, stair nosing channels improve visibility and reduce accident risks while enhancing design. From a B2B perspective, they require precise customization and durable materials to withstand foot traffic. While niche, this type presents an excellent opportunity for suppliers targeting hospitality and real estate sectors focused on safety and luxury.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of led strip channel

| Industry/Sector | Specific Application of led strip channel | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial | Display lighting and shelf illumination in stores | Enhances product visibility, creates attractive displays, and improves customer experience | Durability for high-traffic environments, customizable lengths, and aesthetic finishes |

| Hospitality & Hotels | Ambient and accent lighting in lobbies, corridors, and rooms | Provides elegant, seamless lighting solutions that enhance guest comfort and brand image | Compliance with regional safety standards, ease of installation, and moisture resistance for wet areas |

| Architecture & Interior Design | Recessed and cove lighting in residential and commercial buildings | Enables sleek, modern lighting integration with efficient heat dissipation for longevity | Variety of profiles for different mounting options, high-quality diffusers for even light diffusion |

| Industrial & Manufacturing | Task lighting and safety lighting in workspaces and staircases | Improves workplace safety and productivity with consistent, glare-free illumination | Robust mechanical protection, thermal management, and IP-rated profiles for harsh environments |

| Transportation & Infrastructure | Lighting for tunnels, stations, and signage edges | Enhances visibility and safety, reduces maintenance costs with durable LED solutions | Weatherproofing, high-impact resistant profiles, and long lifespan LED compatibility |

In the Retail & Commercial sector, LED strip channels are extensively used for display lighting and shelf illumination. These channels house LED strips to provide uniform, glare-free light that highlights products, attracting customers and increasing sales potential. For international buyers, particularly in regions like Europe and the Middle East, sourcing channels with customizable lengths and premium finishes is critical to match diverse store designs and high aesthetic standards. Durable materials are essential to withstand frequent maintenance and foot traffic.

Within Hospitality & Hotels, LED strip channels deliver ambient and accent lighting in lobbies, corridors, and guest rooms. Their ability to create seamless, soft illumination enhances the guest experience and aligns with luxury branding efforts. Buyers from markets such as Saudi Arabia and South Africa must prioritize channels that meet stringent fire and electrical safety regulations, as well as moisture-resistant options for spa and bathroom areas, ensuring compliance and long-term reliability.

In Architecture & Interior Design, LED strip channels enable recessed and cove lighting that integrates discreetly into ceilings and walls. These profiles improve heat dissipation, extending LED lifespan while providing smooth light diffusion that complements modern aesthetics. European and South American buyers often require a broad range of profile shapes and diffuser options to accommodate complex architectural features and high-end interior projects.

For Industrial & Manufacturing environments, LED strip channels serve as task lighting and safety illumination along staircases and workstations. Their robust aluminum construction protects LEDs from dust, impacts, and heat, critical for harsh factory conditions. B2B buyers from Africa and the Middle East should focus on sourcing profiles with IP ratings and superior thermal management to ensure durability and consistent performance in demanding settings.

In Transportation & Infrastructure, LED strip channels are used in tunnels, stations, and signage edges to enhance visibility and safety. These applications demand weatherproof and impact-resistant profiles that can withstand environmental stressors. Buyers in regions with extreme climates, such as parts of South America and the Middle East, must verify that products have long operational lifespans and comply with local regulatory standards to minimize maintenance and operational costs.

Related Video: How to Install Recessed LED Channel and LED Strip Lights in Drywall for Recessed Linear Lighting

Strategic Material Selection Guide for led strip channel

Aluminum

Key Properties: Aluminum is the most common material for LED strip channels due to its excellent thermal conductivity (around 205 W/mK), lightweight nature, and corrosion resistance. It typically withstands temperatures up to 200°C and is resistant to oxidation, making it suitable for diverse environmental conditions.

Pros & Cons: Aluminum channels offer superior heat dissipation, which prolongs LED lifespan and maintains brightness. They are durable, lightweight, and easy to extrude into various profiles, allowing customization. However, aluminum can be more expensive than plastic alternatives and requires surface treatment (anodizing or powder coating) to enhance corrosion resistance in harsh environments.

Impact on Application: Aluminum’s heat management makes it ideal for commercial and architectural lighting projects, especially in regions with high ambient temperatures such as the Middle East and parts of Africa. Its corrosion resistance suits outdoor installations in humid or coastal areas found in South America and Europe.

International B2B Considerations: Buyers from Germany and Saudi Arabia often require aluminum profiles to comply with DIN and ASTM standards, ensuring mechanical strength and surface finish quality. In Africa and South America, suppliers should verify corrosion resistance certifications and consider local climate conditions. Aluminum’s recyclability also aligns with European sustainability regulations.

Polycarbonate (PC)

Key Properties: Polycarbonate is a thermoplastic known for high impact resistance, optical clarity, and temperature tolerance up to 115°C. It offers good UV resistance when treated, making it suitable for outdoor diffusers and protective covers.

Pros & Cons: PC is lightweight, cost-effective, and provides excellent light diffusion, reducing hotspots from LED strips. It is less thermally conductive than aluminum, so it does not aid heat dissipation but protects LEDs mechanically. However, it can yellow over time if not UV-stabilized and is less durable under extreme heat.

Impact on Application: Polycarbonate channels are widely used in indoor applications where impact resistance and light diffusion are priorities, such as retail displays and office lighting. In regions with intense sunlight like the Middle East or parts of South America, UV-treated PC is essential to prevent degradation.

International B2B Considerations: European buyers often require PC materials to meet EN ISO standards for fire retardancy and UV resistance. African and South American buyers should ensure suppliers provide UV-stabilized PC to withstand local environmental conditions. Compliance with RoHS and REACH is critical for import into the EU market.

PVC (Polyvinyl Chloride)

Key Properties: PVC is a versatile plastic with good chemical resistance, moderate temperature tolerance (up to 60-80°C), and inherent flame retardant properties. It is heavier than PC but cheaper and easier to manufacture.

Pros & Cons: PVC channels offer excellent moisture and chemical resistance, making them suitable for wet or industrial environments. They are cost-effective and easy to produce in large volumes. However, PVC has lower thermal conductivity and can deform under prolonged heat exposure from LED strips, limiting its use in high-performance lighting.

Impact on Application: PVC is commonly used in budget-conscious projects or environments requiring chemical resistance, such as industrial facilities in South America or humid regions in Africa. It is less suited for high-temperature or high-end architectural lighting.

International B2B Considerations: Buyers in Europe and the Middle East must verify compliance with stringent fire safety and environmental regulations (e.g., REACH, RoHS). PVC’s environmental impact is scrutinized in Europe, pushing buyers to seek recycled or low-VOC variants. African and South American markets may prioritize cost and chemical resistance over environmental factors.

Stainless Steel

Key Properties: Stainless steel offers exceptional mechanical strength, corrosion resistance, and temperature tolerance exceeding 500°C. It is highly durable and resistant to impact, abrasion, and chemical exposure.

Pros & Cons: Stainless steel LED channels provide maximum protection and longevity, ideal for harsh industrial or outdoor environments. However, they are significantly heavier and more expensive than aluminum or plastics, and manufacturing complexity is higher due to machining and finishing requirements.

Impact on Application: Stainless steel channels are favored in high-end commercial projects, outdoor installations in corrosive environments (e.g., coastal areas in South America or the Middle East), and industrial settings requiring robust protection. They also support compliance with strict hygiene standards in food or pharmaceutical industries.

International B2B Considerations: European buyers often require stainless steel to meet EN 10088 and ASTM A240 standards for corrosion resistance and mechanical properties. Saudi Arabian and African buyers in industrial sectors may prioritize stainless steel for durability and compliance with local safety codes. The higher cost necessitates justification through project longevity and environmental conditions.

| Material | Typical Use Case for led strip channel | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum | Commercial, architectural, outdoor lighting | Excellent heat dissipation and corrosion resistance | Higher cost and requires surface treatment | Medium |

| Polycarbonate | Indoor decorative lighting, retail displays | High impact resistance and light diffusion | Lower heat resistance, potential UV yellowing | Low |

| PVC | Industrial, budget projects, wet environments | Chemical and moisture resistance, low cost | Poor heat dissipation, deformation risk | Low |

| Stainless Steel | Industrial, coastal outdoor, high-end commercial projects | Superior durability and corrosion resistance | Heavy, expensive, complex manufacturing | High |

In-depth Look: Manufacturing Processes and Quality Assurance for led strip channel

Manufacturing Processes for LED Strip Channels

The production of LED strip channels involves precise engineering and multiple stages to ensure durability, functionality, and aesthetic quality. For B2B buyers, understanding these stages helps in evaluating supplier capabilities and ensuring that the final products meet both performance and regulatory requirements.

1. Material Preparation

The foundation of LED strip channels is typically high-grade aluminum, chosen for its excellent thermal conductivity and lightweight properties. The aluminum material undergoes:

- Alloy Selection: Common alloys like 6063 are preferred for extrusion due to their balance of strength and corrosion resistance.

- Raw Material Inspection: Suppliers perform initial quality checks on aluminum billets to verify chemical composition and mechanical properties, ensuring consistency.

- Surface Treatment Prep: The aluminum may be pre-treated with cleaning or degreasing to prepare for extrusion and subsequent finishing steps.

2. Extrusion and Forming

The core manufacturing step is aluminum extrusion, where heated aluminum billets are forced through a shaped die to create the LED channel profile. Key techniques include:

- Precision Die Design: Custom dies produce specific channel shapes (surface-mounted, recessed, corner profiles) with tight tolerances to ensure uniformity.

- Controlled Extrusion Parameters: Temperature and pressure are carefully managed to avoid defects such as warping or internal stresses.

- Cutting to Length: After extrusion, profiles are cut to standard or custom lengths using automated saws to meet project specifications.

3. Assembly

Assembly involves integrating additional components that enhance the LED channel’s functionality:

- Diffuser Installation: Polycarbonate or PMMA diffusers are inserted or clipped into the aluminum profile to provide light diffusion and protection.

- End Caps and Mounting Accessories: Plastic or aluminum end caps seal the channels, while mounting clips and screws facilitate installation.

- Sealing and Waterproofing (if applicable): For outdoor or moisture-prone applications, gaskets or silicone seals may be added to ensure IP-rated protection.

4. Surface Finishing

Finishing enhances corrosion resistance, aesthetics, and durability:

- Anodizing: A common finish that creates a protective oxide layer, available in various colors and textures, widely used for both indoor and outdoor applications.

- Powder Coating: Provides thicker and more durable finishes with customizable colors, often preferred for architectural projects demanding specific design aesthetics.

- Polishing or Brushing: Offers a premium look with smooth or textured metallic surfaces.

- Quality Checks Post-Finishing: Visual inspections ensure uniformity of finish without scratches, bubbles, or discoloration.

Quality Assurance and Control in LED Strip Channel Production

Effective quality assurance (QA) and quality control (QC) frameworks are critical to delivering LED strip channels that meet international standards and client expectations. B2B buyers should prioritize suppliers with robust QA/QC systems that align with global and regional regulatory demands.

Illustrative Image (Source: Google Search)

Key International and Industry Standards

- ISO 9001: The foundational quality management system (QMS) standard ensuring consistent production processes, documentation, and continuous improvement.

- CE Marking: Mandatory for products sold within the European Economic Area (EEA), demonstrating compliance with health, safety, and environmental protection standards.

- RoHS Compliance: Restriction of hazardous substances is crucial, especially for European buyers, ensuring materials do not exceed limits for lead, mercury, and other harmful elements.

- IP Ratings (Ingress Protection): Relevant for LED channels intended for outdoor or wet environments; certifications like IP65 or IP67 indicate dust and water resistance.

- Additional Regional Certifications: For Middle Eastern markets (e.g., SASO in Saudi Arabia) or South American countries, buyers should verify compliance with local regulatory bodies.

Quality Control Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials including aluminum billets, plastic diffusers, and accessory components. Checks focus on material certifications, dimensional accuracy, and surface quality.

- In-Process Quality Control (IPQC): Monitoring during extrusion, assembly, and finishing stages. This includes dimensional measurements, extrusion surface quality, diffuser fitting accuracy, and assembly integrity.

- Final Quality Control (FQC): Comprehensive testing of finished products before shipment. Typical checks include:

- Visual inspection for surface defects or finish inconsistencies.

- Dimensional verification against design specifications.

- Functional testing for diffuser light uniformity and fit.

- Mechanical strength tests for mounting clips and end caps.

- Environmental testing for waterproofing and corrosion resistance (salt spray tests).

Common Testing Methods

- Thermal Conductivity Tests: Ensures aluminum profiles effectively dissipate heat to prolong LED lifespan.

- Light Diffusion and Uniformity Testing: Measuring the consistency of light distribution through diffusers using photometric equipment.

- Corrosion Resistance Tests: Salt spray and humidity chamber tests simulate long-term exposure to harsh environments.

- Mechanical Durability: Impact resistance and vibration tests verify structural integrity during installation and use.

How B2B Buyers Can Verify Supplier Quality Control

For international buyers—especially from Africa, South America, the Middle East, and Europe—verifying supplier QC practices is crucial to mitigate risks and ensure product reliability.

Supplier Audits and Factory Inspections

- On-site Audits: Engage third-party inspection agencies or conduct your own audits to assess supplier facilities, manufacturing processes, and QC systems.

- Process Documentation Review: Request detailed documentation such as process flow charts, inspection reports, and ISO 9001 certification to confirm systematic quality management.

- Sample Testing: Obtain product samples for independent lab testing to validate compliance with specifications and certifications.

Quality Reports and Certifications

- Material Certificates: Verify raw material origins and compliance with alloy standards.

- Test Reports: Request recent batch test results for corrosion resistance, mechanical durability, and light diffusion.

- Third-Party Certifications: Prefer suppliers audited by internationally recognized bodies (e.g., TÜV, SGS) for objective quality assurance.

Illustrative Image (Source: Google Search)

QC and Certification Nuances for Global B2B Buyers

Understanding regional regulatory nuances helps buyers navigate import regulations and avoid costly compliance issues.

- Europe (e.g., Germany): Strict adherence to CE marking, RoHS, and REACH regulations is mandatory. Buyers should prioritize suppliers with full documentation and compliance declarations.

- Middle East (e.g., Saudi Arabia): SASO certification and conformity assessment schemes require products to meet local safety and quality standards. Buyers should confirm suppliers’ familiarity with these requirements.

- Africa and South America: Regulatory frameworks vary widely; some countries require local certifications or testing. Buyers should verify import rules and consider suppliers offering tailored documentation for customs clearance.

- Environmental and Safety Compliance: Increasingly important across all regions, ensuring that LED strip channels are free from hazardous substances and meet energy efficiency standards.

Strategic Recommendations for B2B Buyers

- Prioritize Suppliers with Transparent QA/QC Processes: Request detailed QC plans and certifications upfront.

- Leverage Third-Party Inspection Services: Especially for initial large orders or new suppliers, to mitigate risks associated with overseas manufacturing.

- Specify Custom Testing Requirements: Tailor QC checkpoints to the specific application environment—such as enhanced waterproofing for outdoor installations in humid climates.

- Consider Long-Term Partnerships: Work with suppliers committed to continuous improvement and capable of scaling production while maintaining quality.

By thoroughly understanding the manufacturing processes and quality assurance frameworks behind LED strip channels, international B2B buyers can confidently select suppliers that deliver reliable, compliant, and high-performance lighting solutions tailored to their regional market needs.

Related Video: Inside LEDYi LED Strip Factory | Full Manufacturing Process by Leading LED Strip Manufacturer

Comprehensive Cost and Pricing Analysis for led strip channel Sourcing

Understanding the cost and pricing dynamics of LED strip channels is crucial for international B2B buyers aiming to optimize procurement strategies while ensuring product quality and project success. This section breaks down the key cost components, price influencers, and actionable buyer tips tailored for markets in Africa, South America, the Middle East, and Europe.

Key Cost Components in LED Strip Channel Manufacturing

-

Materials: The primary cost driver is high-grade aluminum for the extrusion profile, along with polycarbonate or PMMA for diffusers. Material quality directly affects thermal management, durability, and aesthetics. Premium alloys or special coatings (e.g., anodizing) increase costs but improve corrosion resistance, important for humid or outdoor environments.

-

Labor: Skilled labor is required for extrusion, cutting, finishing, assembly (including fitting diffusers, end caps, and mounting accessories), and quality inspection. Labor costs vary significantly by region and factory expertise.

-

Manufacturing Overhead: Includes utilities, maintenance of extrusion machines, tooling depreciation, and factory administrative expenses. Efficient production lines with automated cutting and assembly lower overhead per unit.

-

Tooling: Custom dies and molds for extrusion profiles represent upfront investments. Custom or complex profile designs increase tooling costs and minimum order quantities (MOQs).

-

Quality Control (QC): Rigorous QC processes ensure dimensional accuracy, surface finish, and proper fit with LED strips and accessories. Certifications (e.g., CE for Europe, IEC standards) add cost but are vital for compliance and buyer confidence.

-

Logistics and Shipping: Costs depend on shipment mode (sea freight preferred for bulk to reduce costs), packaging quality to prevent damage, and import duties or taxes, which vary by destination country.

-

Margin: Supplier margins typically range from 10-30%, influenced by order size, customization, and market competition.

Critical Price Influencers for Buyers

-

Order Volume and MOQs: Larger orders yield economies of scale, lowering unit prices. However, buyers should balance volume with inventory costs and project timelines. MOQ requirements vary by supplier and tooling needs, often higher for custom profiles.

-

Specifications and Customization: Custom lengths, unique cross-sectional shapes, special finishes (e.g., powder coating), and integrated accessories (clips, end caps) increase unit costs. Standard profiles are more cost-effective but may limit design flexibility.

-

Material Quality: Higher-grade aluminum alloys, UV-resistant diffusers, and certified materials command premium pricing but extend product lifespan and reduce maintenance costs.

-

Quality Certifications: Compliance with international standards (CE, RoHS, UL) can add to cost but is essential for market acceptance, especially in Europe and the Middle East.

-

Supplier Reliability and Location: Established suppliers with proven track records may price higher but reduce risks of delays or quality issues. Proximity to shipping ports or regional warehouses can lower logistics costs and lead times.

-

Incoterms Selection: Terms like FOB, CIF, or DDP impact the total landed cost. For example, DDP (Delivered Duty Paid) shifts all logistics and customs responsibilities to the supplier, which may increase unit price but simplifies import processes for buyers unfamiliar with local regulations.

Practical Buyer Tips for International B2B Procurement

-

Negotiate Based on Volume and Long-Term Partnership: Leverage forecasted volumes to negotiate better pricing or favorable payment terms. Suppliers often offer discounts for repeat orders or bundled purchases (e.g., channels plus LED strips).

-

Consider Total Cost of Ownership (TCO): Evaluate not only unit price but also factors like warranty coverage, expected lifespan, maintenance needs, and energy efficiency benefits. Higher upfront costs for premium channels can yield savings over time.

-

Request Samples and Certifications Early: Testing samples ensures compatibility with your LED strips and installation conditions. Verifying supplier certifications minimizes compliance risks, especially for regulated markets like the EU and GCC countries.

-

Account for Regional Import Duties and Taxes: Import tariffs and VAT can significantly affect landed cost. Engage with freight forwarders or customs brokers familiar with your region (e.g., South America or Africa) to optimize cost-effective shipping routes and documentation.

-

Clarify Incoterms and Delivery Responsibilities: Understand which party handles shipping, customs clearance, and last-mile delivery to avoid unexpected charges or delays.

-

Factor in Currency Fluctuations: For buyers in volatile currency markets, negotiate contracts in stable currencies (USD, EUR) or consider forward contracts to hedge risks.

-

Explore Local Warehousing or Consolidation: For buyers in regions like the Middle East or Europe, consolidating orders or using regional warehouses can reduce shipping times and costs.

Indicative Pricing Disclaimer

Due to varying factors such as material grades, customization levels, order sizes, and regional logistics, LED strip channel prices typically range from USD 2 to 10 per meter as a rough benchmark. Buyers should obtain tailored quotations from multiple suppliers, considering all total landed costs, to make informed procurement decisions.

By dissecting cost elements and understanding pricing drivers, international B2B buyers can strategically source LED strip channels that balance quality, cost, and project requirements—ensuring competitive advantage and long-term value across diverse markets.

Spotlight on Potential led strip channel Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led strip channel’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led strip channel

Critical Technical Properties of LED Strip Channels

When selecting LED strip channels for commercial or industrial projects, understanding the technical specifications is crucial for ensuring durability, performance, and cost-efficiency. Below are key properties that international B2B buyers should consider:

-

Material Grade and Composition

Most LED strip channels are made from aluminum alloys such as 6063-T5, prized for their excellent thermal conductivity and corrosion resistance. High-grade aluminum ensures efficient heat dissipation, which prolongs LED lifespan and maintains brightness. For buyers in humid or coastal regions (e.g., Middle East, South America), corrosion-resistant grades are essential to prevent degradation. -

Thermal Management Capability

The channel’s ability to dissipate heat directly affects the LED strip’s operational efficiency and longevity. Channels with optimized fin designs or thicker walls offer better heat transfer, reducing the risk of overheating. For large-scale installations or high-output LED strips, prioritize channels with superior thermal performance. -

Dimensional Tolerance and Fit

Precision in channel dimensions and diffuser fit is critical to ensure seamless installation and consistent light diffusion. Tolerances typically range within ±0.1 mm. For B2B buyers, tight tolerances minimize installation issues and reduce waste, especially when channels are cut to custom lengths. -

Diffuser Material and Light Transmission

Diffusers are usually made from polycarbonate (PC) or polymethyl methacrylate (PMMA). PC offers high impact resistance and UV stability, suitable for outdoor or exposed environments. PMMA provides better light transmission but is less impact-resistant. Choosing the right diffuser material balances durability and visual quality based on application needs. -

IP Rating (Ingress Protection)

The IP rating indicates the channel’s resistance to dust and water ingress. For outdoor or wet area applications (e.g., bathrooms, outdoor façades), channels with at least IP65 rating are recommended. This protects the LED strips from moisture and extends service life. -

Mounting and Installation Compatibility

Channels come in various mounting types: surface-mounted, recessed, corner, or suspended. Understanding the mounting method compatibility with existing structures or architectural requirements is vital. Buyers should verify channel dimensions, mounting hardware included, and ease of installation to reduce labor costs and installation time.

Essential Trade Terminology for LED Strip Channel Procurement

Navigating international LED strip channel purchases requires familiarity with industry-standard trade terms. Here are commonly used terms B2B buyers should understand:

-

OEM (Original Equipment Manufacturer)

OEM refers to manufacturers producing LED strip channels that can be branded or customized for other companies. For buyers seeking private label solutions or specific design modifications, working with OEMs provides flexibility in product specifications and branding. -

MOQ (Minimum Order Quantity)

MOQ defines the smallest order size a supplier is willing to accept. This is critical for budgeting and inventory planning. Buyers from emerging markets like Africa or smaller European businesses should negotiate MOQs that align with their project scale to avoid overstocking or cash flow strain. -

RFQ (Request for Quotation)

An RFQ is a formal document sent to suppliers asking for detailed pricing and terms based on specified product requirements. Preparing a clear RFQ with technical details, quantities, and delivery expectations helps buyers obtain accurate and comparable offers. -

Incoterms (International Commercial Terms)

Incoterms specify the responsibilities of buyers and sellers for shipping, insurance, and customs clearance. Common terms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Understanding Incoterms enables buyers to manage logistics costs and risks effectively. -

Lead Time

Lead time is the period between placing an order and receiving the goods. For large projects or tight deadlines, buyers must confirm supplier lead times to ensure timely delivery and avoid project delays. -

Certification and Compliance

Certifications like CE (Europe), RoHS (Restriction of Hazardous Substances), and IP ratings ensure that LED strip channels meet regional safety and quality standards. Verifying compliance is essential for legal importation and client trust, particularly in regulated markets such as the EU and Saudi Arabia.

By thoroughly assessing these technical properties and mastering key trade terminology, international B2B buyers can make informed procurement decisions, optimize project outcomes, and foster successful supplier partnerships in the competitive LED strip channel market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led strip channel Sector

Market Overview & Key Trends

The global LED strip channel market is experiencing robust growth driven by increasing adoption of LED lighting in commercial, architectural, and residential sectors. For international B2B buyers, especially those in Africa, South America, the Middle East, and Europe, this growth is shaped by several key factors:

-

Rising Demand for Energy Efficiency: Governments across Europe and the Middle East are implementing stringent energy regulations, incentivizing businesses to switch to LED lighting solutions that promise significant energy savings and longer lifespans. This trend is increasingly mirrored in emerging markets in Africa and South America, where infrastructure modernization is a priority.

-

Customization and Integration: LED strip channels are evolving from simple housings to customizable architectural elements. Buyers seek modular, flexible profiles that can be tailored in length, shape, and finish to fit unique project requirements, such as recessed or corner installations. This demand is particularly strong in high-end retail, hospitality, and corporate office projects in regions like Germany and Saudi Arabia.

-

Thermal Management and Durability: As LED technology advances, the importance of effective heat dissipation through aluminum profiles becomes critical to maintain performance and longevity. B2B buyers prioritize channels with superior thermal conductivity and weatherproof ratings, especially for outdoor or industrial applications common in African and Middle Eastern climates.

-

Supply Chain Localization and Digital Sourcing: Recent disruptions have accelerated the shift toward diversified and localized sourcing strategies. Buyers in Europe and the Middle East are increasingly leveraging digital platforms to directly connect with manufacturers offering transparent lead times, quality assurances, and competitive pricing. This trend helps mitigate risks and reduce shipping costs.

-

Technology Integration: The integration of smart lighting controls and IoT compatibility in LED strip channels is gaining traction. Buyers seek profiles that support dimmable LEDs, color-changing capabilities, and compatibility with smart building management systems to future-proof installations.

Sustainability & Ethical Sourcing in B2B

Sustainability is no longer optional but a critical factor influencing procurement decisions in the LED strip channel sector. Environmental impact concerns and corporate social responsibility commitments are driving buyers to prioritize suppliers who demonstrate strong green credentials and ethical practices.

-

Material Selection: Aluminum, the primary material for LED channels, is highly recyclable, making it a preferred choice for sustainable lighting solutions. Buyers should verify that aluminum used is sourced from recycled or responsibly mined origins to reduce carbon footprint.

-

Green Certifications: Certifications such as RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and Energy Star provide assurance that products meet environmental and safety standards. For B2B buyers in Europe and the Middle East, compliance with these certifications is often mandatory for public or large-scale projects.

-

Ethical Supply Chains: Transparency in sourcing is essential. Buyers should engage with suppliers who enforce fair labor practices, ensure safe working conditions, and avoid conflict minerals. This is particularly important when sourcing from regions with complex supply chain challenges.

-

Lifecycle and End-of-Life Considerations: Sustainable procurement involves considering the entire product lifecycle, including ease of disassembly for recycling and availability of replacement parts. LED strip channels designed for durability and maintenance reduce waste and total cost of ownership.

-

Energy Efficiency and Waste Reduction: Optimized thermal management not only extends LED lifespan but also reduces energy consumption and replacement frequency. Choosing LED channels that enhance energy efficiency aligns with global sustainability goals and reduces operational expenses.

Evolution and Historical Context

The LED strip channel sector has evolved significantly since the early 2000s when LED tape lights first gained popularity as cost-effective accent lighting. Initially, channels were simple aluminum extrusions primarily focused on mounting convenience. However, as LED technology advanced, the role of strip channels expanded to include thermal management, light diffusion, and aesthetic integration.

By the 2010s, the introduction of diffusers made from polycarbonate and PMMA transformed channels into essential components for achieving uniform, glare-free lighting. The rise of smart lighting and architectural design integration further pushed manufacturers to innovate customizable and multifunctional profiles.

Today, the sector is characterized by a mature supply chain offering a wide variety of specialized channels tailored to diverse applications—from recessed profiles for minimalist interiors to rugged, waterproof options for outdoor use. This evolution reflects the increasing sophistication of B2B buyers’ needs worldwide, emphasizing performance, sustainability, and design flexibility.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of led strip channel

-

How can I effectively vet suppliers of LED strip channels to ensure quality and reliability?

Start by verifying the supplier’s business credentials, certifications (such as ISO 9001), and track record in LED lighting components. Request detailed product specifications and compliance documents (CE, RoHS). Check references or reviews from other international buyers, especially those operating in similar markets like Africa or the Middle East. Conduct sample testing for durability, heat dissipation, and finish quality. Engage in direct communication to assess responsiveness and transparency. A well-vetted supplier reduces risks of substandard products and project delays. -

What customization options are typically available for LED strip channels in bulk orders?

Most manufacturers offer customization in channel length, profile shape (surface-mounted, recessed, corner), and diffuser type (polycarbonate or PMMA). Color finishes and anodizing options can also be tailored to match architectural requirements or branding. For large orders, it’s common to request custom packaging or branding to enhance market appeal. Clearly communicate your technical and aesthetic requirements upfront to ensure the supplier can accommodate your project’s unique needs. -

What are the usual minimum order quantities (MOQs), lead times, and payment terms for international B2B buyers?

MOQs vary widely but typically start from 500 to 1,000 meters or equivalent channel units, depending on the supplier and customization level. Lead times range from 3 to 8 weeks, factoring in production and international shipping. Payment terms often require a 30% deposit upfront with the balance paid before shipment or upon delivery. Negotiation on terms is possible for long-term partnerships or repeat orders, so clarify these details early in the procurement process. -

Which quality assurance standards and certifications should I demand for LED strip channels?

Request proof of compliance with international standards such as CE (Europe), RoHS (hazardous substances), and UL (safety, especially for North American markets). ISO 9001 certification indicates robust quality management systems. For outdoor or moisture-exposed applications, ask for IP ratings to confirm water and dust resistance. Insist on documented thermal performance tests to ensure effective heat dissipation, critical for LED longevity and energy efficiency. -

How can I optimize logistics and shipping when importing LED strip channels from overseas suppliers?

Choose suppliers experienced in international trade and familiar with your region’s import regulations and customs procedures. Consolidate orders to reduce freight costs and select reliable shipping methods (sea freight for large volumes, air freight for urgent orders). Ensure clear documentation including commercial invoices, packing lists, and certificates of origin. Consider working with freight forwarders who specialize in lighting products to streamline customs clearance and avoid delays. -

What strategies can help resolve disputes or quality issues with LED strip channel suppliers?

Establish clear contractual terms covering product specifications, inspection rights, and remedies for defects before placing orders. Conduct pre-shipment inspections or third-party quality audits to catch issues early. Maintain open communication channels to address concerns promptly. If disputes arise, use documented evidence such as inspection reports and correspondence to negotiate amicable solutions. International trade platforms often provide arbitration options; consider these as a last resort. -

Are there specific considerations for sourcing LED strip channels for markets in Africa, South America, and the Middle East?

Yes, consider local environmental conditions such as high humidity, temperature extremes, or dust which may require channels with higher IP ratings or specialized coatings. Compliance with regional electrical and safety standards is essential—some countries have unique certification requirements. Evaluate the supplier’s ability to provide after-sales support and spare parts locally or through regional distributors to minimize downtime. Understanding regional logistics challenges helps in planning inventory and delivery schedules. -

How can I ensure consistent product quality across multiple shipments of LED strip channels?

Develop a comprehensive quality control checklist with your supplier, including material quality, extrusion precision, and diffuser clarity. Request batch-specific quality certificates and production photos. Implement routine sample testing upon receipt and maintain detailed records to track any deviations over time. Establish a strong partnership with the supplier, encouraging transparency and continuous improvement. Consistency safeguards your reputation and reduces costly reworks or returns in your target markets.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led strip channel

Key Insights and Strategic Sourcing Imperatives for LED Strip Channels

For international B2B buyers across Africa, South America, the Middle East, and Europe, LED strip channels represent a critical component that enhances the durability, efficiency, and aesthetics of LED lighting installations. Strategic sourcing of high-quality aluminum profiles not only ensures superior thermal management and mechanical protection but also elevates the overall project value through improved light diffusion and installation flexibility.

Key takeaways for buyers include:

- Prioritize suppliers offering customizable LED channel solutions tailored to diverse architectural and commercial applications.

- Evaluate product durability, material quality, and compatibility with LED strips to maximize operational lifespan and energy efficiency.

- Leverage bulk purchasing and supplier partnerships to optimize cost-efficiency, reduce lead times, and secure access to the latest innovations in LED lighting technology.

As global demand for sustainable and sophisticated lighting solutions grows, buyers from emerging and established markets must adopt a forward-looking procurement strategy. This includes integrating supplier reliability, regulatory compliance, and after-sales support into sourcing decisions. By doing so, businesses in regions like Saudi Arabia, Germany, Brazil, Nigeria, and beyond can confidently deliver cutting-edge lighting projects that meet evolving market needs and sustainability goals.

Embrace strategic partnerships today to unlock the full potential of LED strip channels and stay ahead in a competitive, rapidly evolving lighting industry.