Guide to Led Shaft Lights

- Introduction: Navigating the Global Market for LED Shaft Lights

- Understanding LED Shaft Lights Types and Variations

- Key Industrial Applications of LED Shaft Lights

- Strategic Material Selection Guide for LED Shaft Lights

- In-depth Look: Manufacturing Processes and Quality Assurance for LED Shaft Lights

- Comprehensive Cost and Pricing Analysis for LED Shaft Lights Sourcing

- Spotlight on Potential LED Shaft Lights Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for LED Shaft Lights

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the LED Shaft Lights Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of LED Shaft Lights

- Strategic Sourcing Conclusion and Outlook for LED Shaft Lights

Introduction: Navigating the Global Market for LED Shaft Lights

In today’s rapidly evolving industrial and commercial lighting landscape, LED shaft lights have emerged as a pivotal technology, combining efficiency, durability, and versatility. For international B2B buyers across Africa, South America, the Middle East, and Europe—including dynamic markets like Indonesia and Brazil—understanding the complexities of sourcing high-quality LED shaft lights is essential to staying competitive and sustainable. These specialized lighting solutions are integral in sectors ranging from manufacturing and infrastructure to smart city developments, where precision and reliability are non-negotiable.

This comprehensive guide offers an authoritative roadmap to mastering the global LED shaft light market. It delves into the critical types and materials used, ensuring buyers can align product specifications with application needs. The guide also demystifies manufacturing processes and quality control standards, enabling buyers to evaluate supplier capabilities rigorously. Additionally, it presents detailed insights into supplier landscapes, cost structures, and emerging market trends, empowering procurement teams to negotiate with confidence and optimize investment.

By addressing region-specific considerations such as regulatory frameworks, energy efficiency mandates, and logistical challenges, this guide equips international buyers with actionable intelligence to make informed sourcing decisions. Whether you are navigating import regulations in the Middle East, assessing cost-efficiency in South America, or evaluating supplier reliability in Europe and Africa, this resource is designed to enhance your strategic procurement and foster long-term partnerships in the LED lighting domain. With practical FAQs and industry best practices, it is the essential toolkit for anyone seeking to harness the full potential of LED shaft lights in a globalized market.

Understanding LED Shaft Lights Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Linear LED Shaft Light | Long, narrow form factor with uniform light output | Industrial shafts, conveyor belts, tunnels | Pros: Energy-efficient, uniform illumination; Cons: Limited beam angle |

| Adjustable Beam LED Shaft Light | Features adjustable lenses for beam direction control | Mining, oil rigs, manufacturing plants | Pros: Customizable lighting direction; Cons: Higher cost and complexity |

| High-Intensity LED Shaft Light | High lumen output with robust thermal management | Heavy industry, outdoor shafts, ports | Pros: Bright output, durable; Cons: Higher energy consumption |

| Explosion-Proof LED Shaft Light | Certified for hazardous environments, sealed design | Chemical plants, refineries, offshore rigs | Pros: Safety compliance, rugged; Cons: Premium pricing, specialized installation |

| Compact LED Shaft Light | Small size, easy integration into tight spaces | Electronics assembly lines, small machinery | Pros: Space-saving, versatile; Cons: Lower brightness compared to larger types |

Linear LED Shaft Light

Linear LED shaft lights are designed with a slim, elongated profile that provides consistent illumination along shafts or narrow spaces. Their uniform light output is ideal for industrial conveyor systems, tunnels, and shafts where even lighting is critical. B2B buyers should consider energy efficiency and ease of installation when selecting these lights, especially for large-scale operations requiring extended runs of lighting.

Adjustable Beam LED Shaft Light

These lights incorporate adjustable lenses or swivels to direct the beam precisely where needed. They are suited for dynamic industrial environments such as mining sites or manufacturing plants where task-specific lighting is necessary. For buyers, the flexibility in beam direction offers enhanced operational safety and productivity, though the increased complexity and cost must be justified by application needs.

High-Intensity LED Shaft Light

High-intensity variations deliver superior brightness and incorporate advanced thermal management to maintain performance in demanding environments. Their robust construction makes them suitable for heavy industry, port facilities, and outdoor shafts exposed to harsh conditions. B2B purchasers should evaluate power consumption against lighting requirements and assess the durability standards to ensure long-term ROI.

Explosion-Proof LED Shaft Light

Designed for hazardous environments, these LED shaft lights comply with strict safety certifications such as ATEX or IECEx. Their sealed, rugged construction prevents ignition risks in volatile atmospheres like chemical plants or offshore oil rigs. Buyers must prioritize compliance with local and international safety regulations and be prepared for higher upfront costs balanced by reduced risk and downtime.

Compact LED Shaft Light

Compact models offer a smaller footprint, making them ideal for integration into tight or confined spaces such as electronics assembly lines or small machinery shafts. While they provide versatility and ease of installation, their brightness output is typically lower than larger counterparts. For B2B buyers, these lights are cost-effective solutions when space constraints are a key consideration without compromising basic illumination needs.

Key Industrial Applications of LED Shaft Lights

| Industry/Sector | Specific Application of LED Shaft Lights | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing & Automation | Machine tool illumination and inspection lighting | Enhanced precision and reduced downtime | Durability under vibration, IP rating for dust and moisture |

| Mining & Heavy Industry | Underground shaft and tunnel lighting | Improved safety and operational visibility | Explosion-proof certification, ruggedness, long lifespan |

| Oil & Gas | Drilling rig and pipeline shaft lighting | Reliable illumination in hazardous environments | Compliance with ATEX/IECEx standards, corrosion resistance |

| Transportation & Logistics | Conveyor shaft and loading bay lighting | Increased operational efficiency and worker safety | Energy efficiency, compatibility with existing systems |

| Renewable Energy | Wind turbine shaft illumination | Facilitates maintenance and inspection | Vibration resistance, weatherproofing, low power consumption |

Manufacturing & Automation

In manufacturing plants, LED shaft lights are critical for illuminating machine tools and inspection points where precision is paramount. These lights provide consistent, bright illumination that helps reduce errors and machine downtime. For international buyers in regions such as South America and Europe, sourcing LED shaft lights with high vibration resistance and IP ratings suitable for dusty or oily environments is essential to ensure longevity and reliable performance.

Mining & Heavy Industry

Mining operations rely heavily on LED shaft lights to illuminate underground shafts and tunnels where natural light is absent. These lights enhance worker safety by improving visibility in hazardous, confined spaces. Buyers from Africa and the Middle East should prioritize explosion-proof and rugged LED shaft lights that meet local safety certifications to withstand harsh mining conditions and ensure compliance with occupational safety regulations.

Oil & Gas

In the oil and gas sector, LED shaft lights are used on drilling rigs and pipeline shafts to provide reliable illumination under extreme conditions, including exposure to flammable gases and corrosive elements. International B2B buyers, particularly from oil-rich regions in the Middle East and South America, must ensure that LED shaft lights comply with ATEX or IECEx certifications and offer robust corrosion resistance to maintain safety and operational continuity.

Transportation & Logistics

LED shaft lights are employed in conveyor shafts and loading bays to optimize workflow and enhance worker safety by providing clear, focused lighting. For logistics hubs in Europe and Africa, energy-efficient LED shaft lights that can integrate seamlessly with existing infrastructure are preferred. Buyers should consider lights with easy installation features and low maintenance requirements to reduce operational costs.

Renewable Energy

Wind turbines require LED shaft lights for internal shaft illumination to facilitate routine maintenance and inspections. These lights must endure constant vibration and exposure to weather elements. Buyers from Europe and Indonesia focusing on renewable energy projects should select LED shaft lights with superior vibration resistance, weatherproof designs, and low power consumption to support sustainable and cost-effective operations.

Related Video: DIFFERENCE between 365nm and 400nm UV LED Black Lights Explained VISUALLY

Strategic Material Selection Guide for LED Shaft Lights

When selecting materials for LED shaft lights, B2B buyers must consider the operational environment, mechanical demands, and compatibility with LED technology. The choice of material impacts durability, thermal management, corrosion resistance, and overall cost-effectiveness. Below is an analysis of four common materials used for LED shaft lights, highlighting their properties, advantages, limitations, and regional considerations for buyers from Africa, South America, the Middle East, and Europe.

Stainless Steel (Typically Grades 304 and 316)

Key Properties:

Stainless steel offers excellent corrosion resistance, especially grade 316 which is resistant to chloride environments common in coastal and industrial areas. It has good mechanical strength and can withstand moderate temperature ranges typical in LED lighting applications. Its smooth surface finish aids in hygiene and ease of cleaning.

Pros & Cons:

Pros include high durability, resistance to rust and chemical attack, and good aesthetic appeal. However, stainless steel is relatively expensive and heavier than alternatives, which can increase manufacturing complexity and shipping costs. Machining stainless steel requires specialized tools and processes, potentially raising lead times.

Impact on Application:

Ideal for outdoor or harsh environments where exposure to moisture, salt, or chemicals is expected. Its corrosion resistance ensures long-term reliability, particularly in industrial or coastal installations. Stainless steel shafts maintain structural integrity and appearance over time.

Regional Considerations:

Buyers in Africa and the Middle East benefit from stainless steel’s corrosion resistance in humid or saline conditions. European and South American markets often require compliance with ASTM A240 or EN 10088 standards, ensuring material traceability and quality. In Brazil and Indonesia, preference for 316-grade stainless steel is common for coastal projects. Availability and cost may vary regionally, so sourcing from certified suppliers is essential.

Aluminum Alloys (e.g., 6061-T6)

Key Properties:

Aluminum alloys are lightweight with good corrosion resistance due to natural oxide formation. They offer excellent thermal conductivity, which helps dissipate heat generated by LED components. Aluminum is also easy to machine and form, enabling complex designs.

Pros & Cons:

The main advantages are low weight, good corrosion resistance, and cost-effectiveness. Aluminum is less durable than stainless steel in abrasive or high-impact environments and may suffer from galvanic corrosion if paired improperly with other metals. Surface treatments like anodizing are often required to enhance durability.

Impact on Application:

Aluminum shafts are suitable for indoor or mild outdoor conditions where weight reduction is important, such as in portable or modular LED lighting systems. Its thermal conductivity supports LED longevity by reducing heat buildup.

Regional Considerations:

In South America and Africa, aluminum’s affordability and availability make it attractive for large-scale projects. Compliance with ASTM B221 or EN 573 standards is typical. In humid or industrial Middle Eastern environments, buyers should ensure anodized or coated finishes to prevent corrosion. European buyers often demand certifications for recycled content and sustainability, aligning with green procurement policies.

Brass (Copper-Zinc Alloys)

Key Properties:

Brass offers good corrosion resistance, especially against water and mild chemicals, and has excellent machinability. It provides moderate strength and good thermal conductivity, beneficial for LED heat management.

Pros & Cons:

Brass is durable and aesthetically pleasing with a natural gold-like finish, making it suitable for decorative LED shaft lights. However, it is heavier and more expensive than aluminum, and can tarnish over time without protective coatings. It is less resistant to harsh chemicals and saltwater compared to stainless steel.

Impact on Application:

Brass is preferred in architectural or decorative LED lighting where appearance is important, and environmental exposure is controlled. Its thermal properties help maintain LED efficiency.

Regional Considerations:

In Europe and the Middle East, brass is often specified for premium lighting fixtures with compliance to EN 12165 or ASTM B16 standards. Buyers in Brazil and Indonesia may face higher costs and sourcing challenges. Corrosion protection measures are critical in tropical or coastal African markets.

Carbon Steel (e.g., AISI 1045)

Key Properties:

Carbon steel provides high strength and toughness but has poor corrosion resistance unless coated or painted. It can withstand high mechanical loads and impact, making it suitable for robust structural applications.

Pros & Cons:

The main advantage is cost-effectiveness and mechanical strength. The downside is susceptibility to rust and corrosion, requiring protective coatings or regular maintenance. Manufacturing is straightforward, but long-term durability depends heavily on environmental protection.

Impact on Application:

Best suited for indoor or controlled environments where corrosion risk is minimal. Carbon steel shafts are used in industrial LED lighting with protective finishes or in applications where mechanical stress dominates.

Regional Considerations:

In Africa and South America, carbon steel is a budget-friendly option but requires consideration of local climate and maintenance capabilities. Compliance with ASTM A105 or EN 10025 standards is common. In humid or coastal Middle Eastern and European markets, buyers should evaluate coating quality and lifecycle costs carefully.

| Material | Typical Use Case for LED Shaft Lights | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Stainless Steel (304/316) | Outdoor/industrial LED lighting in corrosive environments | Excellent corrosion resistance and durability | Higher cost and weight, machining complexity | High |

| Aluminum Alloys (6061-T6) | Indoor/mild outdoor LED lighting requiring lightweight parts | Lightweight with good thermal conductivity | Lower durability, needs surface treatment | Medium |

| Brass (Copper-Zinc Alloys) | Decorative or architectural LED shaft lights | Attractive finish and good machinability | Tarnishes, less corrosion resistant than stainless steel | High |

| Carbon Steel (AISI 1045) | Indoor or protected industrial LED lighting | High strength and low cost | Poor corrosion resistance without coatings | Low |

This guide enables international B2B buyers to align material selection with application demands, environmental conditions, and regional compliance requirements, optimizing performance and lifecycle value of LED shaft lights.

In-depth Look: Manufacturing Processes and Quality Assurance for LED Shaft Lights

Manufacturing Processes for LED Shaft Lights

The manufacturing of LED shaft lights involves a multi-stage process combining precision engineering and advanced materials technology to ensure durability, performance, and efficiency. International B2B buyers, particularly from emerging and established markets such as Africa, South America, the Middle East, and Europe, should understand these stages to assess supplier capabilities effectively.

1. Material Preparation

The process begins with sourcing and preparing high-quality raw materials:

- Semiconductor Chips: The core LED chips are fabricated using semiconductor wafers, typically gallium nitride (GaN) based, prepared in cleanroom environments to avoid contamination.

- Shaft Components: The shafts are commonly made from durable metals such as aluminum or stainless steel, chosen for corrosion resistance and thermal conductivity.

- Optical Elements: Lenses and diffusers crafted from polycarbonate or glass are selected for light distribution properties.

- Electrical Components: Wiring, connectors, and PCBs (Printed Circuit Boards) are prepared, often using high-temperature resistant materials to ensure reliability.

Material preparation includes cutting, cleaning, and surface treatment to optimize adhesion and electrical performance.

2. Forming and Machining

The shaft and housing components undergo precision forming processes:

- CNC Machining: Computer Numerical Control (CNC) machines shape the metal shafts to exact dimensions, ensuring consistency and tight tolerances.

- Extrusion and Casting: Some suppliers use extrusion for aluminum shafts or die-casting for complex housings, balancing cost and structural integrity.

- Surface Treatment: Anodizing or powder coating is applied to enhance corrosion resistance and aesthetic appeal, critical for harsh environments common in outdoor or industrial applications.

These steps ensure the mechanical robustness and longevity of the LED shaft lights.

3. Assembly

Assembly integrates the optical, electrical, and mechanical components into a functional unit:

- Chip Mounting: LED chips are die-bonded onto the PCB, followed by wire bonding to establish electrical connections.

- Optical Integration: Secondary optics such as lenses or reflectors are precisely aligned to optimize light output and beam angle.

- Shaft and Housing Assembly: The shaft is fitted with PCBs, heat sinks, and drivers, then sealed to protect against dust and moisture.

- Thermal Management: Heat sinks and thermal interface materials are incorporated to dissipate heat, maintaining LED efficiency and lifespan.

Automated assembly lines with robotic arms and pick-and-place machines are common in advanced manufacturing setups to increase throughput and reduce human error.

4. Finishing and Packaging

Final steps ensure product readiness and protection:

- Quality Surface Inspection: Visual and mechanical inspections check for surface defects, correct assembly, and finish quality.

- Labeling and Documentation: Products are labeled with certification marks, serial numbers, and batch codes for traceability.

- Packaging: Custom packaging is designed to protect LED shaft lights during transit, often including anti-static and shock-absorbing materials.

Packaging must comply with international shipping standards to prevent damage during long-distance logistics.

Quality Assurance and Control (QA/QC)

Robust quality assurance is essential for LED shaft lights due to their application in critical lighting environments such as industrial facilities, outdoor installations, and commercial premises. For B2B buyers in diverse regions, understanding QC practices and standards is vital for supplier evaluation and risk mitigation.

Key International and Industry Standards

- ISO 9001: The foundation for quality management systems, ensuring consistent manufacturing processes and continual improvement.

- CE Marking: Mandatory for products sold in the European Economic Area, indicating compliance with health, safety, and environmental protection standards.

- RoHS Compliance: Restricts hazardous substances, important for environmentally conscious buyers, especially in Europe and parts of Asia.

- IEC Standards: Including IEC 60598 for luminaires, specifying performance and safety requirements.

- Industry-Specific Standards: For example, API (American Petroleum Institute) certifications for LED lights used in hazardous environments such as oil and gas facilities.

Buyers should verify that suppliers maintain certifications relevant to their target markets and applications.

QC Checkpoints in Manufacturing

- Incoming Quality Control (IQC): Inspection of raw materials and components for defects, dimensional accuracy, and compliance with specifications before production.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly, including solder joint inspections, alignment of optical components, and thermal interface application.

- Final Quality Control (FQC): Comprehensive testing of finished products, covering electrical performance, light output, color temperature, and mechanical integrity.

Each stage includes documentation and traceability to ensure accountability and facilitate issue resolution.

Common Testing Methods

- Electrical Testing: Verification of voltage, current, power consumption, and driver functionality.

- Photometric Testing: Measurement of luminous intensity, beam angle, color rendering index (CRI), and correlated color temperature (CCT).

- Thermal Testing: Assessment of heat dissipation and operating temperature under load to prevent premature failure.

- Mechanical Testing: Vibration, shock, and ingress protection (IP rating) tests confirm robustness, especially for outdoor or industrial environments.

- Accelerated Life Testing: Simulates long-term usage to predict lifespan and identify early failures.

Buyers should request test reports and certifications to validate these parameters.

Verifying Supplier Quality Control for International B2B Buyers

For buyers from Africa, South America, the Middle East, and Europe, ensuring supplier QC integrity involves multiple proactive steps:

- Factory Audits: Conduct or commission on-site audits focusing on production capabilities, QC procedures, equipment calibration, and workforce skills.

- Review of QC Documentation: Inspect quality manuals, inspection records, calibration certificates, and non-conformance reports.

- Third-Party Inspections: Engage independent inspection bodies (e.g., SGS, Bureau Veritas) to perform random sampling and verification before shipment.

- Sample Testing: Request product samples for independent lab testing to confirm compliance with specifications and standards.

- Supplier Quality Agreements: Formalize expectations regarding QC processes, documentation, and corrective actions within contractual agreements.

Buyers should consider cultural and regulatory differences impacting QC practices and adapt oversight accordingly.

QC and Certification Nuances for Different Regions

- Africa: Emerging markets may have less stringent local standards; buyers should prioritize suppliers with international certifications and emphasize durability given harsh climates.

- South America: Compliance with Mercosur standards and local import regulations is critical; energy efficiency certifications like Brazil’s PROCEL can be advantageous.

- Middle East: Focus on suppliers meeting IEC and local electrical safety codes; explosion-proof certifications (e.g., ATEX) may be necessary for oil and gas applications.

- Europe: The highest regulatory demands apply, including CE marking, RoHS, and energy efficiency labeling under the EU’s Ecodesign Directive; documentation rigor is paramount.

- Indonesia and Southeast Asia: Buyers should verify compliance with SNI (Indonesian National Standard) and consider import tariffs and certification equivalences for smooth customs clearance.

Understanding these nuances helps buyers avoid costly delays and ensure product acceptance in their target markets.

Summary

For B2B buyers sourcing LED shaft lights internationally, a thorough grasp of manufacturing processes and quality assurance practices is essential. From raw material preparation through to final packaging, every stage affects product performance and reliability. Rigorous QC governed by international standards like ISO 9001 and CE marking, combined with robust inspection regimes, ensures product excellence.

Engaging in factory audits, demanding transparent documentation, and utilizing third-party inspections empower buyers across Africa, South America, the Middle East, and Europe to mitigate risks. Tailoring QC expectations to regional regulatory environments further enhances procurement success and long-term supplier partnerships.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for LED Shaft Lights Sourcing

Breakdown of Cost Components in LED Shaft Lights Sourcing

When sourcing LED shaft lights, understanding the underlying cost components enables buyers to make informed decisions and negotiate effectively.

-

Materials: The primary cost driver. High-quality semiconductors, aluminum or steel shafts, PCBs, optics, and housing materials influence both performance and price. Material costs fluctuate with global supply chains and raw material prices, notably for rare earth elements and specialized alloys.

-

Labor: Skilled labor is essential for precision assembly, soldering, and quality control. Labor costs vary significantly by manufacturing location, impacting the final product cost.

-

Manufacturing Overhead: Includes factory utilities, equipment depreciation, maintenance, and indirect labor. Efficient plants with automated processes reduce overhead but require upfront capital investment.

-

Tooling and Machinery: Initial tooling costs for molds, dies, and specialized assembly equipment can be substantial. These are amortized over production volumes but add to unit cost for smaller orders.

-

Quality Control (QC): Rigorous testing—electrical, thermal, and photometric—is vital to ensure reliability and certification compliance. QC adds to cost but reduces risks and warranty claims.

-

Logistics and Shipping: Transportation, customs duties, and insurance fees vary widely depending on origin, destination, and chosen Incoterms (e.g., FOB, CIF). For buyers in Africa, South America, the Middle East, and Europe, these costs can be significant due to port handling and inland freight.

-

Supplier Margin: Manufacturers include a margin to cover profit and contingencies. This margin is influenced by market competition, order size, and supplier capacity.

Key Pricing Influencers for International B2B Buyers

Several factors influence LED shaft light pricing beyond the basic cost components:

-

Order Volume and Minimum Order Quantity (MOQ): Larger volumes typically yield better unit pricing due to economies of scale. MOQ requirements vary by supplier and product complexity.

-

Specifications and Customization: Custom shaft lengths, lumen outputs, color temperatures, and integration with smart lighting systems increase costs. Standardized products are generally more cost-effective.

-

Material Quality and Certifications: Products with certifications such as CE, RoHS, UL, or energy efficiency ratings command premium pricing but ensure compliance and long-term savings.

-

Supplier Location and Reputation: Established suppliers with proven quality and after-sales support may charge higher prices but reduce risks. Sourcing from emerging manufacturers can be cost-efficient but requires due diligence.

-

Incoterms and Payment Terms: Negotiating favorable Incoterms (e.g., FOB vs. DDP) can shift shipping and customs costs. Payment terms (L/C, T/T) affect cash flow and bargaining power.

Strategic Buyer Tips for Cost-Efficiency and Negotiation

For international buyers—especially in regions like Africa, South America, the Middle East, and Europe—strategic sourcing can optimize cost and value:

-

Leverage Volume Consolidation: Pool orders with partners or across projects to meet MOQ thresholds, unlocking better pricing and reduced logistics costs.

-

Prioritize Total Cost of Ownership (TCO): Consider energy savings, lifespan, maintenance, and warranty when evaluating price. Cheaper upfront costs can lead to higher long-term expenses.

-

Request Detailed Cost Breakdowns: Engage suppliers for transparent quotes showing material, labor, overhead, and logistics components. This clarity aids negotiation and supplier comparison.

-

Assess Supplier Capabilities and Certifications: Verify supplier quality management systems and product certifications relevant to your market to avoid costly compliance issues.

-

Negotiate Incoterms and Payment Conditions: Tailor terms to your logistics capabilities. For example, choosing FOB can reduce supplier risk but requires robust import handling on the buyer side.

-

Plan for Currency Fluctuations and Tariffs: Factor in exchange rate risks and potential import duties, which can vary by region and product classification.

-

Localize Support and Spare Parts: Where possible, source from suppliers with local warehouses or service centers to reduce downtime and logistics costs.

Indicative Pricing Disclaimer

Pricing for LED shaft lights varies widely due to product complexity, order volume, supplier region, and market dynamics. The figures discussed serve as general guidance; buyers should obtain multiple quotes and conduct thorough due diligence tailored to their specific requirements and regional conditions.

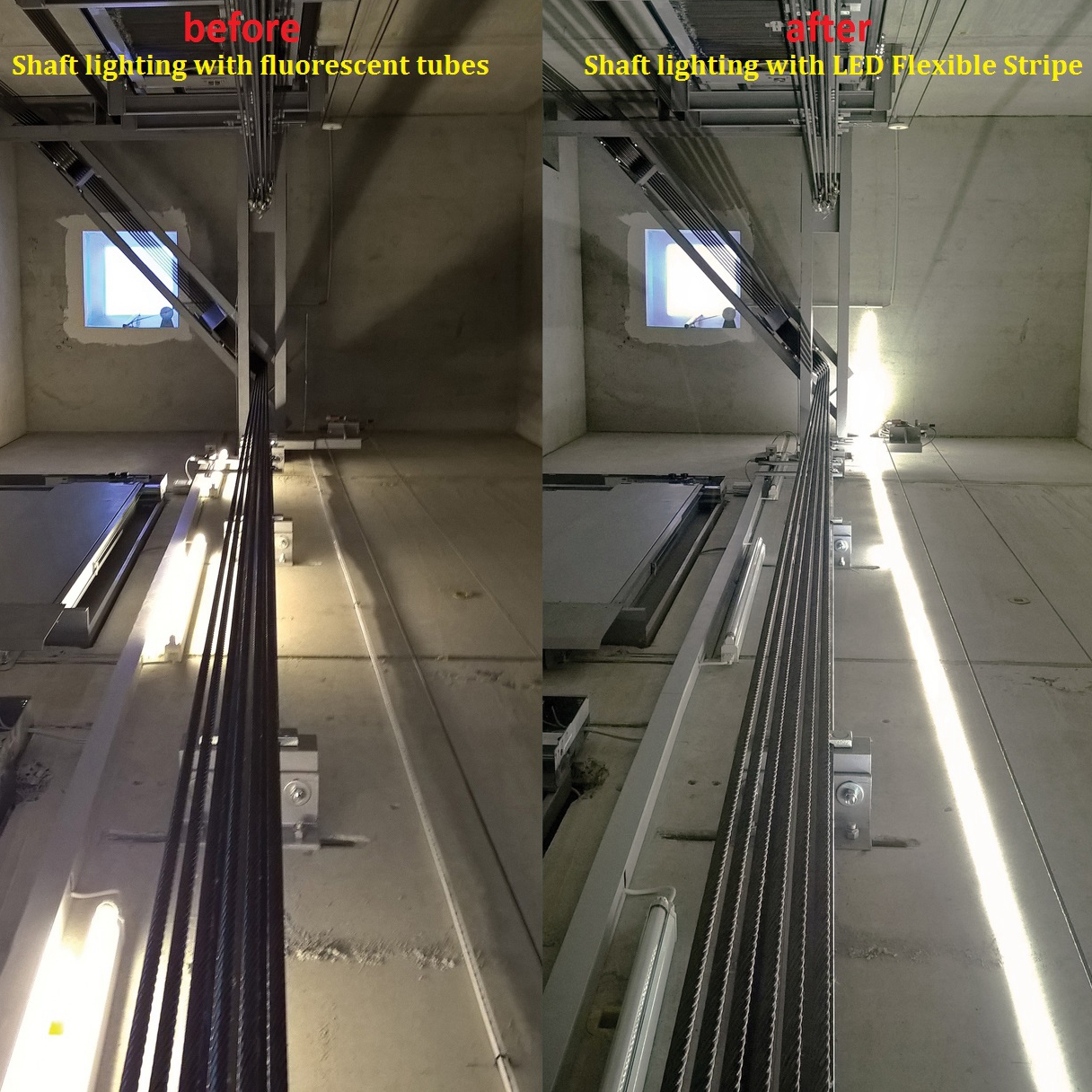

Illustrative Image (Source: Google Search)

By understanding these cost structures and pricing influencers, international B2B buyers can better navigate the LED shaft light sourcing landscape, achieving optimal balance between cost, quality, and long-term value.

Spotlight on Potential LED Shaft Lights Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘LED Shaft Lights’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for LED Shaft Lights

Critical Technical Properties of LED Shaft Lights

When sourcing LED shaft lights, understanding key technical specifications is essential for ensuring product quality, compatibility, and performance in your applications. Here are the most important properties to evaluate:

-

Material Grade of Shaft and Housing

The shaft and housing materials (commonly aluminum alloy or stainless steel) determine durability, corrosion resistance, and thermal conductivity. For buyers in humid or industrial environments (e.g., coastal Africa or the Middle East), selecting corrosion-resistant grades (such as anodized aluminum or marine-grade stainless steel) is crucial for longevity and maintenance cost reduction. -

Dimensional Tolerance and Precision

Tolerance refers to the allowable deviation from specified dimensions (e.g., diameter, length). Tight tolerance (e.g., ±0.05 mm) ensures a precise fit in mechanical assemblies and consistent optical alignment. This precision minimizes installation issues and enhances system reliability, critical for OEM customers or projects requiring interchangeability. -

Ingress Protection (IP) Rating

The IP rating defines protection against solids and liquids (e.g., IP65 or IP67). High IP ratings guarantee that the LED shaft light is dust-tight and water-resistant, suitable for outdoor or industrial environments common in South America and Europe. Confirming the IP rating helps avoid premature failures due to environmental exposure. -

Thermal Management Efficiency

Effective heat dissipation via heat sinks or thermal interface materials prolongs LED life and maintains luminous efficiency. Buyers should assess thermal resistance values or cooling design, especially for high-power LED shaft lights used in continuous operation. Poor thermal management risks early degradation and increased operational costs. -

Electrical Specifications (Voltage, Current, Power Consumption)

Understanding operating voltage and current ranges ensures compatibility with your power supply and control systems. Power consumption directly impacts energy efficiency and total cost of ownership, a significant consideration for large-scale commercial or industrial installations across diverse regions with variable energy costs. -

Light Output and Color Temperature

Measured in lumens and Kelvin (K), these parameters influence brightness and light quality. For applications requiring precise lighting conditions—such as automotive or industrial inspection—specifying consistent color temperature and adequate luminous flux is essential to meet performance expectations.

Common Industry and Trade Terminology

Navigating international LED shaft light procurement involves familiarity with key industry terms that facilitate smooth communication and transactions:

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers producing components or products that other companies brand and sell. For B2B buyers, partnering with OEMs can enable product customization, cost savings, and control over quality standards. -

MOQ (Minimum Order Quantity)

The smallest number of units a supplier is willing to sell in one order. Understanding MOQ helps buyers plan inventory, negotiate pricing, and manage cash flow effectively, especially when entering new markets or testing products. -

RFQ (Request for Quotation)

A formal document sent by buyers to suppliers to obtain detailed pricing, lead times, and terms for specific products. Crafting clear RFQs with technical requirements accelerates supplier evaluation and procurement decisions. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyers and sellers (e.g., FOB, CIF, DDP). Clarity on Incoterms prevents misunderstandings regarding costs and risks during international shipment. -

Lead Time

The period from order placement to product delivery. Knowing supplier lead times supports production scheduling and project planning, critical for markets with fluctuating demand or logistical challenges. -

BOM (Bill of Materials)

A comprehensive list of components and materials required to manufacture a product. Reviewing the BOM helps buyers verify product composition, identify potential supply chain risks, and assess customization feasibility.

Mastering these technical properties and trade terms empowers international B2B buyers to make informed procurement decisions, optimize supplier relationships, and ensure the LED shaft lights they source meet both performance and business objectives across diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the LED Shaft Lights Sector

Market Overview & Key Trends

The global LED shaft lights market is experiencing robust growth driven by escalating demand for energy-efficient, durable, and versatile lighting solutions across residential, commercial, and industrial sectors. Key growth regions include Africa, South America, the Middle East, and Europe, where rapid urbanization, infrastructure modernization, and government-led sustainability initiatives are catalyzing LED adoption. For instance, countries like Brazil and Indonesia are investing heavily in smart city projects and industrial upgrades, creating substantial opportunities for international B2B buyers sourcing LED shaft lights that combine reliability with advanced performance.

Key market drivers include:

- Energy Efficiency: LED shaft lights consume significantly less power compared to traditional lighting, offering up to 80-90% energy savings, a critical factor for markets with rising electricity costs and grid constraints.

- Longevity and Durability: Extended lifespan reduces maintenance and replacement frequency, appealing to industrial and outdoor applications prevalent in harsh environments across Africa and the Middle East.

- Smart Integration: Increasing demand for IoT-enabled lighting systems supports connected infrastructure, enabling remote control, adaptive lighting, and data analytics, especially in emerging smart cities.

- Customization & Versatility: Modular designs and varied beam angles allow tailored lighting solutions for tunnels, shafts, and industrial shafts, meeting diverse operational requirements.

From a sourcing perspective, buyers are prioritizing suppliers offering cutting-edge semiconductor technology, robust quality control, and certifications that comply with regional standards such as CE (Europe), INMETRO (Brazil), and SASO (Middle East). The trend towards local assembly and regional distribution hubs is also gaining traction, reducing lead times and import costs for B2B buyers in these markets. Additionally, supply chain agility is critical amid global semiconductor shortages and logistics disruptions, urging buyers to establish diversified supplier portfolios and foster long-term partnerships.

Sustainability & Ethical Sourcing in B2B

Sustainability is no longer optional but a fundamental criterion for B2B buyers in the LED shaft lights sector. The environmental impact of lighting solutions is scrutinized not only from an operational energy perspective but also throughout the product lifecycle—from raw material extraction to end-of-life disposal.

Key sustainability considerations include:

- Material Selection: Utilizing eco-friendly materials such as recyclable aluminum housings, lead-free solder, and halogen-free components reduces toxic waste and facilitates circular economy practices.

- Energy Consumption: LED shaft lights inherently reduce carbon footprints by offering superior luminous efficacy. Buyers increasingly demand products certified by ENERGY STAR, RoHS, or equivalent green standards, ensuring compliance with stringent energy and environmental regulations.

- Ethical Supply Chains: Transparency in sourcing critical raw materials like rare earth elements is vital. B2B buyers are prioritizing suppliers who demonstrate responsible mining practices, conflict-free sourcing, and adherence to labor rights, aligning with global ESG (Environmental, Social, Governance) frameworks.

- Waste Management & Recycling: Manufacturers offering take-back programs, modular designs for easy repair, and recyclability certifications help buyers meet their corporate sustainability goals and regulatory mandates.

For buyers in Africa, South America, and the Middle East, where regulatory environments are evolving, partnering with suppliers committed to sustainability can provide a competitive edge and reduce risks associated with compliance failures. Furthermore, green credentials support brand reputation and open access to government incentives and subsidies that promote energy-efficient infrastructure.

Evolution and Historical Context

LED shaft lights have evolved significantly since the inception of LED technology in the early 1960s. Initially limited to indicator lights and low-brightness applications, advances in semiconductor fabrication and phosphor technology in the 1990s enabled the creation of high-intensity, white LED lighting suitable for industrial and commercial uses.

The transition from incandescent and fluorescent shaft lighting to LED was driven by the need for enhanced energy efficiency, longer lifespan, and reduced maintenance costs. Early LED shaft lights focused primarily on illumination performance; however, over the past decade, integration with smart controls and IoT connectivity has revolutionized their functionality, enabling adaptive lighting solutions that optimize energy use based on environmental conditions.

For international B2B buyers, understanding this evolution underscores the importance of selecting technologically advanced LED shaft lights that not only meet current operational needs but are also future-proofed for emerging smart infrastructure trends. This historical perspective also highlights the sector’s trajectory towards sustainability and digital integration, aligning with global market dynamics and sourcing priorities.

By closely monitoring these market dynamics, sourcing trends, and sustainability imperatives, international B2B buyers can make informed decisions that maximize value, ensure regulatory compliance, and support long-term operational resilience in the LED shaft lights sector.

Related Video: What is the Strait of Hormuz – and why does it matter to global trade?

Frequently Asked Questions (FAQs) for B2B Buyers of LED Shaft Lights

-

How can I effectively vet LED shaft light suppliers in international markets like Africa, South America, or the Middle East?

To vet suppliers thoroughly, start with verifying their business licenses and certifications such as ISO 9001 and CE marking to ensure compliance with quality and safety standards. Request product samples and technical datasheets to assess quality and specifications. Check references and past client feedback, especially from buyers in your region. Utilize third-party inspection services to conduct factory audits and pre-shipment inspections. Understanding their production capacity and after-sales support is vital to mitigate risks in international transactions. -

Is customization of LED shaft lights feasible for large-scale international orders?

Yes, many manufacturers offer customization options including lumen output, color temperature, shaft length, mounting types, and driver specifications. For international buyers, clearly communicate technical requirements and compliance standards upfront. Custom orders often require longer lead times and may have higher minimum order quantities (MOQs). Establishing a detailed contract that covers design approvals, prototypes, and testing phases can help ensure the final product meets your market’s needs. -

What are typical MOQ and lead times for LED shaft light orders from overseas suppliers?

MOQs vary widely depending on the supplier’s scale and manufacturing process but typically range from 100 to 500 units per model. Lead times can range from 4 to 12 weeks, influenced by order size, customization, and supplier location. For buyers in regions like Africa or South America, factor in additional time for shipping and customs clearance. Early communication with suppliers about order scheduling and buffer stock planning is essential to avoid supply chain disruptions. -

Which payment terms are common for international B2B transactions involving LED shaft lights?

Common payment methods include Telegraphic Transfer (T/T) with 30% advance and 70% before shipment, Letters of Credit (L/C) for larger orders, and sometimes Escrow services for added security. Negotiate terms based on supplier reliability and your company’s creditworthiness. Using trade finance solutions or working with reputable trade platforms can reduce risks. Always confirm payment terms in the contract and align them with your cash flow and import regulations. -

What quality assurance certifications should I look for when sourcing LED shaft lights internationally?

Look for internationally recognized certifications such as CE (Europe), UL or DLC (North America), RoHS (restriction of hazardous substances), and ISO 9001 quality management. Additionally, certifications related to energy efficiency like ENERGY STAR or equivalent regional certifications are important. These ensure compliance with local regulations and customer expectations. Request test reports from accredited labs and confirm that suppliers have robust quality control processes including in-line testing and final product inspection. -

How should I handle logistics and shipping challenges when importing LED shaft lights?

Choose suppliers with experience exporting to your region and familiarity with international shipping regulations. Consolidate shipments to reduce freight costs and opt for reliable freight forwarders who provide end-to-end tracking and customs brokerage. Understand import duties, taxes, and documentation requirements specific to your country to prevent delays. Consider Incoterms carefully to clarify responsibilities for freight, insurance, and customs clearance between you and the supplier. -

What steps can I take to resolve disputes or quality issues with overseas LED shaft light suppliers?

Establish clear contractual terms detailing product specifications, inspection rights, warranties, and dispute resolution mechanisms (e.g., arbitration clauses). Maintain detailed communication records and photographic evidence of any issues. Engage third-party inspection agencies for unbiased verification. If disputes arise, attempt amicable negotiation first, then consider mediation or arbitration under internationally recognized frameworks like ICC. Having a local agent or representative can facilitate quicker resolution.

- Are there specific considerations for sourcing LED shaft lights for markets like Indonesia or Brazil?

Yes, each market has unique regulatory and environmental standards. For example, Brazil requires INMETRO certification for electrical products, while Indonesia has its own SNI standards. Additionally, consider local voltage and frequency standards to ensure compatibility. Market preferences may vary on features such as color temperature and design aesthetics. Working with suppliers who understand regional compliance and consumer preferences reduces risk and accelerates market acceptance. Also, factor in local import tariffs and potential government incentives promoting energy-efficient lighting.

Strategic Sourcing Conclusion and Outlook for LED Shaft Lights

The LED shaft light market presents a compelling opportunity for international B2B buyers seeking energy-efficient, durable, and cost-effective lighting solutions. Strategic sourcing in this sector involves carefully evaluating suppliers based on product quality, manufacturing capabilities, compliance with international standards, and innovation in LED technology. For buyers in Africa, South America, the Middle East, and Europe, aligning procurement decisions with local market needs—such as climate resilience, energy infrastructure, and regulatory frameworks—is crucial for maximizing ROI and operational efficiency.

Key considerations include partnering with manufacturers who emphasize sustainability, offer scalable production capacities, and provide comprehensive after-sales support. Leveraging insights into LED shaft light manufacturing processes and market trends enables buyers to negotiate better terms, reduce supply chain risks, and ensure timely delivery.

Looking ahead, the increasing global push towards smart lighting integration and green energy policies will continue to drive demand and technological advancements in LED shaft lights. Buyers are encouraged to adopt a proactive sourcing strategy that embraces innovation and sustainability, positioning their businesses at the forefront of this evolving market. By doing so, they can capitalize on emerging opportunities and contribute to a more energy-conscious future.

Illustrative Image (Source: Google Search)