Guide to Ideas For Led Lights

- Introduction: Navigating the Global Market for ideas for led lights

- Understanding ideas for led lights Types and Variations

- Key Industrial Applications of ideas for led lights

- Strategic Material Selection Guide for ideas for led lights

- In-depth Look: Manufacturing Processes and Quality Assurance for ideas for led lights

- Comprehensive Cost and Pricing Analysis for ideas for led lights Sourcing

- Spotlight on Potential ideas for led lights Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for ideas for led lights

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the ideas for led lights Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of ideas for led lights

- Strategic Sourcing Conclusion and Outlook for ideas for led lights

Introduction: Navigating the Global Market for ideas for led lights

The global LED lighting market is undergoing rapid innovation, driven by evolving technologies and heightened demand for energy-efficient, sustainable solutions. For international B2B buyers—especially those operating in dynamic regions such as Africa, South America, the Middle East, and Europe—access to cutting-edge ideas for LED lights is pivotal. These ideas not only influence product selection but also impact operational efficiency, regulatory compliance, and long-term cost savings.

In an era where 67% of B2B lighting buyers conduct extensive online research before supplier engagement, understanding the full spectrum of LED lighting concepts is a competitive advantage. This guide offers a thorough exploration of LED lighting ideas, covering essential facets including product types, innovative materials, manufacturing and quality control processes, supplier landscapes, cost considerations, and emerging market trends. It also addresses frequently asked questions, providing clarity on complex technical and commercial aspects.

By leveraging this comprehensive resource, buyers from diverse markets—whether sourcing for large infrastructure projects in Nigeria, commercial developments in Indonesia, or energy retrofit programs in Europe—can make well-informed decisions. The guide empowers procurement teams to identify solutions that align with specific environmental conditions, budget constraints, and regulatory standards, while fostering supplier partnerships that support scalability and innovation.

Key benefits of this guide include:

- Deep insights into LED lighting innovations tailored to regional market needs

- Practical evaluation criteria for supplier selection and cost optimization

- Strategic understanding of manufacturing quality assurance and certification compliance

- Enhanced capability to navigate complex buyer journeys with data-driven knowledge

Equipped with these insights, international B2B buyers are positioned to capitalize on the transformative potential of LED lighting, driving sustainable growth and operational excellence across their projects and portfolios.

Understanding ideas for led lights Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| High Bay LED Lights | High lumen output, designed for ceiling heights over 15 ft | Warehouses, factories, large retail spaces | Pros: Energy-efficient, long lifespan; Cons: Higher upfront cost |

| LED Panel Lights | Slim, flat panels offering uniform light distribution | Offices, hospitals, schools | Pros: Low glare, easy installation; Cons: Limited outdoor use |

| LED Strip Lights | Flexible strips with adhesive backing, customizable length | Retail displays, architectural lighting | Pros: Versatile, customizable; Cons: Lower brightness, requires careful installation |

| Flood LED Lights | Wide beam angle for broad area illumination | Outdoor security, sports arenas, billboards | Pros: Powerful illumination, durable; Cons: Higher energy consumption |

| Smart LED Lights | Integrated with IoT for remote control and automation | Smart buildings, hotels, commercial offices | Pros: Energy savings via automation, enhanced control; Cons: Higher complexity and cost |

High Bay LED Lights

High Bay LED lights are engineered for spaces with high ceilings, typically above 15 feet, delivering intense, uniform illumination. Their high lumen output makes them ideal for industrial environments such as warehouses and manufacturing plants. For B2B buyers, key considerations include energy efficiency ratings, fixture durability in harsh environments, and compatibility with existing electrical infrastructure. Although initial costs may be higher, the long-term savings and reduced maintenance justify the investment for large-scale facilities.

LED Panel Lights

LED Panel lights provide sleek, flat illumination panels that distribute light evenly, minimizing glare and enhancing visual comfort. They are widely used in office buildings, healthcare facilities, and educational institutions. B2B buyers should evaluate factors like color temperature options, dimming capabilities, and compliance with local lighting standards. Their low profile and easy installation reduce retrofit costs, making them a practical choice for commercial interiors focused on productivity and well-being.

LED Strip Lights

LED Strip lights offer flexible, adhesive-backed lighting solutions that can be cut to size and shaped for creative applications. They are popular in retail environments, hospitality, and architectural accent lighting. Buyers should assess IP ratings for moisture resistance, color rendering index (CRI), and power supply compatibility. While they provide excellent design versatility, their lower brightness means they are best suited for accent or decorative purposes rather than primary lighting.

Flood LED Lights

Flood LED lights are characterized by their wide beam angles and powerful illumination, suitable for outdoor and large-area lighting such as security perimeters, sports arenas, and signage. Durability against weather and impact is critical for B2B buyers, alongside energy efficiency and ease of installation. Although these lights consume more power than indoor LEDs, their robust performance and long lifespan reduce operational costs in demanding environments.

Smart LED Lights

Smart LED lights integrate IoT technology, enabling remote control, scheduling, and automation through apps or building management systems. They are increasingly adopted in smart commercial buildings, hotels, and offices aiming to optimize energy use and enhance occupant comfort. Buyers must consider system compatibility, cybersecurity features, and vendor support services. Despite higher upfront investments, smart LEDs offer significant operational efficiencies and data-driven facility management advantages.

Related Video: Building DIY LED lights

Key Industrial Applications of ideas for led lights

| Industry/Sector | Specific Application of ideas for led lights | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing & Warehousing | High-bay LED lighting for factory floors and storage areas | Improved visibility, energy efficiency, reduced maintenance | Durability, IP rating, energy consumption, long lifespan |

| Agriculture & Horticulture | LED grow lights for controlled environment agriculture | Enhanced crop yield, optimized growth cycles, energy savings | Spectrum customization, heat dissipation, waterproofing |

| Hospitality & Retail | Ambient and accent LED lighting for hotels and stores | Enhanced customer experience, brand differentiation, energy cost reduction | Color rendering index (CRI), dimming capability, design flexibility |

| Transportation & Logistics | LED lighting for warehouses, loading docks, and vehicle fleets | Safety enhancement, operational efficiency, reduced downtime | Shock resistance, energy efficiency, ease of installation |

| Healthcare & Laboratories | Task-specific LED lighting for examination and lab areas | Precision lighting, reduced eye strain, compliance with standards | Flicker-free operation, color accuracy, certification (e.g., IEC) |

Manufacturing & Warehousing:

In manufacturing plants and warehouses, high-bay LED lighting is essential for ensuring safety and productivity. These LED solutions provide bright, uniform illumination over large areas, reducing shadows and enhancing worker accuracy. For international buyers, especially in regions like Nigeria and Indonesia where industrial facilities may operate under harsh conditions, sourcing LED lights with high durability, IP ratings for dust and moisture protection, and long operational lifespans is critical. Energy efficiency also contributes significantly to lowering operational costs in energy-sensitive markets.

Agriculture & Horticulture:

LED grow lights have revolutionized controlled environment agriculture by providing tailored light spectrums that optimize photosynthesis and plant growth. For international agribusinesses in South America and Africa, where climate variability can impact yields, these LED solutions enable year-round production and improved crop quality. Buyers must prioritize spectrum customization to match specific crop needs, efficient heat management to prevent plant damage, and waterproof designs to withstand humid or wet environments common in tropical regions.

Hospitality & Retail:

LED lighting ideas in hospitality and retail sectors focus on creating inviting atmospheres that enhance customer experience and reinforce brand identity. Accent and ambient LED lighting can highlight architectural features, merchandise, or signage while reducing energy costs. European and Middle Eastern buyers often seek high CRI LEDs for true color representation and flexible dimming options to adjust ambiance. Design adaptability is also important to meet diverse aesthetic preferences and regulatory standards across markets.

Transportation & Logistics:

Efficient lighting in warehouses, loading docks, and vehicle fleets is vital for operational safety and productivity. LED lighting offers bright, instant-on illumination that improves visibility during night shifts or adverse weather conditions. For buyers in regions with expanding logistics hubs like South America and Africa, sourcing LEDs with shock resistance, easy installation, and energy-saving features supports long-term cost control and operational resilience. Integration with smart controls can further optimize lighting schedules and maintenance.

Healthcare & Laboratories:

Precision and reliability are paramount in healthcare and laboratory environments. Task-specific LED lighting solutions reduce eye strain and provide consistent, flicker-free illumination critical for diagnostic accuracy and compliance with medical standards. Buyers in international markets should look for LEDs with high color accuracy and relevant certifications such as IEC standards to ensure safety and performance. Additionally, flicker-free operation and ergonomic design support long working hours for medical staff, enhancing overall care quality.

Related Video: Wood Slat Wall Panels – Led strip lights installation process.

Strategic Material Selection Guide for ideas for led lights

When selecting materials for LED light fixtures and components, international B2B buyers must consider a balance of mechanical, thermal, and environmental properties to ensure product longevity, performance, and compliance with regional standards. This guide analyzes four common materials used in LED lighting products, focusing on their suitability for diverse markets such as Africa, South America, the Middle East, and Europe.

Aluminum Alloys

Key Properties: Aluminum alloys are prized for their excellent thermal conductivity, lightweight nature, and corrosion resistance. They typically withstand operating temperatures up to 150°C and exhibit good mechanical strength while remaining easy to machine or extrude.

Pros & Cons: Aluminum’s high thermal conductivity is crucial for LED heat sinks, enhancing longevity and efficiency. It is corrosion-resistant, especially when anodized, making it suitable for humid or coastal environments common in regions like Nigeria or Indonesia. However, aluminum can be more expensive than plastics and requires surface treatments to prevent oxidation. Manufacturing complexity is moderate, with well-established extrusion and casting processes.

Impact on Application: Aluminum is ideal for LED housings and heat sinks where heat dissipation is critical. Its corrosion resistance suits outdoor and industrial lighting in harsh climates. However, it is less suitable for highly corrosive chemical environments without additional coatings.

Regional Considerations: Buyers in Europe and the Middle East should verify compliance with ASTM B221 or EN AW standards for aluminum alloys to ensure quality and durability. In African and South American markets, suppliers offering anodized or powder-coated finishes are preferred for enhanced corrosion protection.

Polycarbonate (PC)

Key Properties: Polycarbonate is a transparent thermoplastic with high impact resistance, good UV resistance, and temperature tolerance up to approximately 120°C. It offers excellent optical clarity, making it ideal for lenses and covers.

Pros & Cons: Polycarbonate is lightweight, cost-effective, and easy to mold into complex shapes, facilitating innovative LED designs. It resists shattering and is suitable for outdoor applications with UV-stabilized grades. However, it can yellow over time under intense UV exposure and is less heat resistant than metals, which may limit use near high-heat components.

Impact on Application: PC is widely used for LED lenses, diffusers, and protective covers. Its impact resistance is valuable in environments prone to mechanical stress or vandalism, such as public spaces in urban areas across South America and Africa.

Regional Considerations: Buyers should ensure materials meet ISO 4892-2 for UV resistance and check for RoHS compliance, especially in Europe. In regions with intense sun exposure like the Middle East, UV-stabilized polycarbonate grades are essential to prevent degradation.

Stainless Steel (e.g., 304 or 316 Grades)

Key Properties: Stainless steel offers excellent corrosion resistance, mechanical strength, and temperature tolerance exceeding 400°C. Grades 304 and 316 are common, with 316 providing superior resistance to chlorides and marine environments.

Pros & Cons: Stainless steel is highly durable and ideal for harsh environments, including coastal or industrial areas. It is heavier and costlier than aluminum or plastics and more challenging to machine, increasing manufacturing costs. Its aesthetic finish is often preferred for premium or architectural LED fixtures.

Impact on Application: Stainless steel is suitable for structural components, mounting brackets, and enclosures requiring high durability and corrosion resistance. It is especially relevant in Middle Eastern and coastal African markets where salt corrosion is a concern.

Regional Considerations: Compliance with ASTM A240 or EN 10088 is critical for stainless steel quality assurance. Buyers in Europe and the Middle East often demand certification for marine-grade stainless steel (316L) to withstand aggressive environments.

Silicone Rubber

Key Properties: Silicone rubber is a flexible, heat-resistant elastomer with excellent UV and weather resistance, operating typically between -60°C to 230°C. It is electrically insulating and resistant to many chemicals.

Pros & Cons: Silicone rubber is ideal for gaskets, seals, and flexible encapsulants in LED lighting, providing protection against dust and moisture ingress. It is relatively low cost and easy to process but offers limited mechanical strength and can degrade under prolonged exposure to certain oils or solvents.

Impact on Application: Silicone is critical for outdoor LED fixtures requiring IP-rated sealing, especially in tropical or desert climates prevalent in South America and the Middle East. Its flexibility aids in vibration resistance and shock absorption.

Regional Considerations: Buyers should ensure compliance with UL 94 V-0 flammability standards and regional certifications like CE marking in Europe. In markets like Nigeria and Indonesia, material suppliers offering local testing and certification support can facilitate smoother import and regulatory approval.

| Material | Typical Use Case for ideas for led lights | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum Alloys | Heat sinks, housings, structural frames | Excellent thermal conductivity and corrosion resistance | Higher cost than plastics; requires surface treatment | Medium |

| Polycarbonate (PC) | Lenses, diffusers, protective covers | High impact resistance and optical clarity | UV degradation risk; limited heat resistance | Low |

| Stainless Steel (304/316) | Enclosures, mounting brackets, architectural fixtures | Superior corrosion resistance and durability | High cost; heavy; complex manufacturing | High |

| Silicone Rubber | Gaskets, seals, encapsulants | Flexible, UV/weather resistant, electrically insulating | Limited mechanical strength; chemical sensitivity | Low |

In-depth Look: Manufacturing Processes and Quality Assurance for ideas for led lights

Understanding the manufacturing processes and quality assurance protocols behind LED lighting solutions is critical for international B2B buyers aiming to source reliable, high-performance products. This knowledge empowers buyers—especially those operating in Africa, South America, the Middle East, and Europe—to make informed supplier selections and mitigate risks associated with product quality, compliance, and durability.

Key Manufacturing Stages for LED Lighting Solutions

The production of LED lighting products typically involves several distinct stages, each with specialized techniques designed to ensure functionality, efficiency, and longevity.

1. Material Preparation

Raw materials such as semiconductor wafers, phosphor powders, aluminum substrates, and electronic components are carefully selected and inspected. For LED chips, epitaxial wafers undergo processing to form the light-emitting layers. High-quality materials are fundamental to the performance and lifespan of the finished product.

2. Forming and Chip Fabrication

This stage includes wafer dicing (cutting wafers into individual LED chips), die bonding (attaching chips to substrates), and wire bonding (connecting electrical contacts). Precision equipment and cleanroom environments are essential to prevent contamination and defects during these microscale processes.

3. Assembly

LED chips are assembled into lighting modules or fixtures. This involves mounting LEDs on printed circuit boards (PCBs), soldering, installing lenses or diffusers, and integrating drivers and heat sinks. Automated assembly lines often utilize surface mount technology (SMT) for high throughput and consistency.

4. Finishing and Packaging

Final steps include applying protective coatings, engraving or printing product information, and packaging to safeguard products during transportation. Environmental sealing and thermal management measures are incorporated to enhance durability, especially for outdoor or industrial lighting.

Quality Assurance and Control Framework

Robust quality assurance (QA) and quality control (QC) systems underpin successful LED lighting manufacturing. These systems assure buyers that products meet international standards and perform reliably in diverse applications.

Relevant International and Industry Standards

- ISO 9001: The globally recognized quality management system standard that ensures consistent processes and continual improvement.

- CE Marking: Required for products sold within the European Economic Area (EEA), indicating compliance with safety, health, and environmental requirements.

- RoHS (Restriction of Hazardous Substances): Ensures products do not contain harmful substances above specified thresholds, critical for environmental compliance.

- IEC Standards: For LED performance and safety, including IEC 60598 (luminaires) and IEC 62717 (LED modules).

- Additional Regional Certifications: Buyers in Africa, South America, and the Middle East should verify compliance with local certifications such as SASO (Saudi Arabia), INMETRO (Brazil), SON (Nigeria), and others relevant to their markets.

QC Checkpoints Throughout Production

- Incoming Quality Control (IQC): Inspection and testing of raw materials and components upon receipt to prevent defective parts entering production.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly and fabrication stages to detect defects early, including solder joint inspections and electrical testing.

- Final Quality Control (FQC): Comprehensive testing of finished products, including functionality, photometric performance, and safety checks before shipment.

Common Testing Methods

- Electrical Testing: Verifies forward voltage, current, and power consumption to ensure LEDs operate within specified parameters.

- Photometric Testing: Measures luminous flux, color temperature, color rendering index (CRI), and beam angle to confirm lighting quality.

- Thermal Testing: Assesses heat dissipation efficiency and operating temperature to predict lifespan and prevent premature failure.

- Environmental Testing: Includes humidity, salt spray, vibration, and shock tests to simulate real-world operating conditions, particularly important for outdoor or industrial applications.

- Safety Testing: Ensures insulation resistance, leakage current, and fire resistance meet safety standards.

How B2B Buyers Can Verify Supplier Quality

For buyers in emerging and established markets alike, verifying the integrity of a supplier’s QC system is vital to avoid costly product failures and reputational damage.

- Factory Audits: Conduct on-site audits or remote virtual inspections focusing on manufacturing capabilities, quality management systems, employee training, and equipment maintenance. Third-party audit firms specializing in lighting manufacturing can provide impartial assessments.

- Review of QC Documentation: Request detailed quality reports, including IQC, IPQC, and FQC records, test certificates, and calibration logs for measurement instruments.

- Third-Party Testing and Certification: Insist on independent lab testing for critical performance and safety parameters. Recognized test labs such as UL, TUV, or Intertek add credibility.

- Sample Evaluation: Obtain product samples for in-house testing or field trials to verify performance claims under actual operating conditions.

- Supply Chain Transparency: Ensure traceability of components and materials, which reduces the risk of counterfeit or substandard parts entering the supply chain.

Quality Assurance Nuances for International Buyers

Different regions have unique regulatory environments and market expectations that international buyers must navigate:

- Africa & Middle East: Buyers should focus on certifications like SONCAP (Nigeria) or SASO (Saudi Arabia), which mandate product compliance and quality control. Additionally, the harsh environmental conditions in many areas require LED products with robust thermal management and ingress protection ratings (e.g., IP65 or higher).

- South America: Compliance with INMETRO certification is crucial. Buyers should verify supplier familiarity with local electrical standards and grid conditions to ensure product compatibility and safety.

- Europe: The CE marking and adherence to EU directives such as the Ecodesign Directive are mandatory. European buyers often demand higher environmental and energy efficiency standards, emphasizing suppliers’ adherence to RoHS and WEEE directives.

- Cross-Regional Considerations: Logistics and customs processes can affect product handling. Buyers should assess packaging quality and supplier responsiveness to international shipping requirements to minimize damage and delays.

Strategic Takeaways for B2B Buyers

- Prioritize suppliers with certified quality management systems (ISO 9001) and proven compliance with applicable international and regional standards.

- Request transparent QC documentation and third-party test results to validate product claims, especially when sourcing from new or unfamiliar manufacturers.

- Engage in factory audits or leverage trusted inspection agencies to assess production capabilities and quality culture firsthand.

- Consider regional compliance nuances and environmental conditions to ensure LED lighting products are fit for purpose in your target markets.

- Collaborate with suppliers offering digital tools such as real-time inventory updates, technical datasheets, and virtual product demonstrations to streamline procurement decisions.

By thoroughly understanding manufacturing processes and quality assurance practices, B2B buyers can confidently select LED lighting suppliers who deliver superior products aligned with their operational requirements and compliance expectations—ultimately driving sustainable business growth across diverse global markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for ideas for led lights Sourcing

When sourcing LED lighting solutions, understanding the comprehensive cost and pricing structure is vital for international B2B buyers aiming to optimize procurement decisions. The LED lighting market involves multiple cost components and pricing influencers that vary according to product specifications, supplier capabilities, and regional market dynamics. This analysis breaks down the key elements impacting costs and offers actionable insights for buyers across Africa, South America, the Middle East, and Europe.

Key Cost Components in LED Lighting Manufacturing

-

Materials

The primary cost driver is the bill of materials (BOM), which includes LED chips, drivers, heat sinks, lenses, and housing materials (often aluminum or plastic). Premium components, such as high-efficiency LEDs or specialized optics, increase costs but can improve product lifespan and performance. -

Labor

Labor costs depend on the manufacturing location and complexity of assembly. Regions with higher wages or stringent labor regulations typically reflect increased production expenses. Automated production lines can mitigate labor costs but may require higher upfront tooling investments. -

Manufacturing Overhead

Overhead covers utilities, factory maintenance, quality control processes, and administrative expenses. For LED manufacturers, overhead also includes costs associated with technology upgrades and compliance with environmental standards. -

Tooling and Equipment

Custom molds, precision tools, and testing equipment represent significant upfront investments. Tooling costs are amortized over production volumes, impacting unit costs especially for lower minimum order quantities (MOQs). -

Quality Control and Certification

Rigorous QC protocols ensure compliance with international standards (e.g., CE, RoHS, UL, DLC). Certifications add to production costs but enhance supplier credibility and market acceptance, which is crucial for buyers targeting regulated markets. -

Logistics and Freight

Shipping costs vary widely based on origin, destination, shipping mode (air, sea, land), and current global supply chain conditions. Buyers from Africa, South America, and the Middle East should factor in potential customs duties, import taxes, and inland transportation costs. -

Supplier Margin

Manufacturer and distributor margins reflect market competition, brand positioning, and after-sales support services. Transparent margin structures often correlate with higher service quality and warranty offerings.

Influencing Factors on LED Lighting Pricing

-

Order Volume and MOQ

Larger orders typically secure volume discounts, lowering unit costs. However, buyers must balance MOQs with storage capacity and cash flow considerations. -

Product Specifications and Customization

Customized solutions (e.g., specific beam angles, color temperatures, smart controls) incur additional engineering and tooling costs. Standardized products tend to be more cost-effective. -

Material Quality and Certifications

Products using certified components and meeting international safety standards command premium pricing but reduce risks of failure and liability. -

Supplier Location and Reputation

Established suppliers with robust supply chains and digital marketing presence often charge higher prices but provide reliability, technical support, and faster delivery. -

Incoterms and Payment Terms

Pricing varies significantly depending on Incoterms (e.g., FOB, CIF, DDP). Buyers should understand who bears freight, insurance, and customs clearance costs to accurately assess landed cost.

Strategic Buyer Tips for Cost-Efficient LED Light Sourcing

-

Conduct Total Cost of Ownership (TCO) Analysis

Evaluate not only the purchase price but also installation, energy consumption, maintenance, and replacement costs. High-quality LEDs may have higher upfront prices but lower lifecycle costs. -

Leverage Digital Tools for Supplier Evaluation

Use online product configurators, specification downloads, and virtual demos to reduce sourcing uncertainty and avoid costly mismatches. -

Negotiate Based on Volume and Long-Term Partnership Potential

Suppliers often offer better pricing and terms for repeat or bulk buyers. Communicate projected future volumes to secure favorable conditions. -

Consider Regional Trade Agreements and Logistics Optimization

Buyers in Africa, South America, and the Middle East should explore sourcing from suppliers within or near their regions to minimize freight costs and lead times. -

Be Mindful of Pricing Variations Due to Market Fluctuations

Raw material prices (e.g., rare earth metals for LEDs) and shipping rates can fluctuate rapidly. Request price validity periods and consider contract clauses to mitigate risks.

Indicative Pricing Disclaimer

LED lighting prices vary widely depending on product type, specifications, order quantity, and supplier. Typical unit costs for commercial LED fixtures can range from $10 to $150 or more. Buyers should request detailed quotations and factor in all ancillary costs for accurate budgeting.

By carefully analyzing these cost drivers and pricing influencers, international B2B buyers can make informed sourcing decisions that balance quality, cost-efficiency, and supplier reliability. This approach is especially crucial for buyers in emerging markets who face unique logistical and regulatory challenges but seek to leverage LED technology for sustainable energy savings and enhanced lighting solutions.

Spotlight on Potential ideas for led lights Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘ideas for led lights’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for ideas for led lights

Critical Technical Properties for LED Light Solutions

When sourcing LED lighting products, understanding the key technical specifications is essential to ensure product quality, compatibility, and performance. These properties help international B2B buyers, especially from regions like Africa, South America, the Middle East, and Europe, make informed purchasing decisions aligned with their project requirements.

-

Luminous Efficacy (lm/W)

This measures the amount of light (lumens) produced per watt of electricity consumed. Higher luminous efficacy indicates better energy efficiency, which is vital for reducing operational costs and complying with sustainability goals. B2B buyers should prioritize products with high efficacy to optimize energy savings over the product lifecycle. -

Color Temperature (Kelvin, K)

Defines the hue of the light emitted, ranging from warm (2700K) to cool daylight (6500K). Selecting the correct color temperature affects ambiance and functionality—warm tones suit hospitality and residential settings, while cooler tones are preferred in offices and industrial environments. Precise specification ensures the lighting aligns with the end-use environment. -

CRI (Color Rendering Index)

CRI measures how accurately a light source reveals colors compared to natural light. A CRI above 80 is generally acceptable for commercial use; values above 90 are preferred for retail and design-centric applications. High CRI is crucial for applications where color differentiation impacts customer experience or operational safety. -

IP Rating (Ingress Protection)

Indicates the product’s resistance to dust and water, rated by two digits (e.g., IP65). For outdoor or harsh environments, a higher IP rating ensures durability and longevity. B2B buyers must match IP ratings with installation conditions, especially in regions with extreme weather or industrial exposure. -

Material Grade and Build Quality

The quality of materials, such as aluminum heat sinks and polycarbonate lenses, affects heat dissipation and product lifespan. Good thermal management prevents LED degradation, ensuring consistent performance. Buyers should request detailed material specifications to avoid premature failures and maintenance costs. -

Tolerance and Compliance Standards

Tolerance refers to the acceptable variation in product dimensions or performance metrics. Tight tolerances guarantee compatibility with existing fixtures and installation precision. Compliance with international standards (e.g., CE, RoHS, UL) is mandatory for global trade, ensuring safety and regulatory acceptance in target markets.

Key Trade Terms Every B2B Buyer Should Know

Navigating the LED lighting supply chain involves familiarity with common trade terms that define procurement processes and commercial agreements. Understanding these terms helps buyers negotiate effectively and avoid misunderstandings.

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers producing LED lights or components that other brands may rebrand or customize. OEM partnerships allow buyers to access tailored solutions at competitive pricing but require clear agreements on specifications and intellectual property. -

MOQ (Minimum Order Quantity)

The smallest order volume a supplier is willing to accept. Knowing MOQs is critical for budget planning and inventory management, especially for buyers in emerging markets where demand may fluctuate. Negotiating MOQs can unlock better pricing or trial runs. -

RFQ (Request for Quotation)

A formal process where buyers solicit detailed price and delivery offers from suppliers based on specified product criteria. Well-prepared RFQs reduce lead times and improve supplier responsiveness, enabling buyers to compare options transparently. -

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance (e.g., FOB, CIF, DDP). Understanding Incoterms prevents costly disputes and clarifies who handles logistics risks, which is crucial for cross-border transactions. -

Lead Time

The duration between order placement and product delivery. For project-driven buyers, accurate lead time estimates are vital to align procurement with construction or installation schedules, avoiding costly delays. -

Certification

Official attestations from recognized bodies confirming product safety, performance, or environmental compliance (e.g., CE marking for Europe, SABS for South Africa). Certifications enhance supplier credibility and ease market entry, providing assurance of quality and legal compliance.

By mastering these technical properties and trade terms, international B2B buyers can confidently evaluate LED lighting suppliers, ensuring they procure solutions that meet performance expectations, regulatory requirements, and project timelines. This knowledge also fosters stronger supplier relationships and smoother negotiation outcomes.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the ideas for led lights Sector

Market Overview & Key Trends

The global LED lighting market is undergoing rapid transformation driven by energy efficiency mandates, urbanization, and technological innovation. For international B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe, the demand for innovative LED lighting ideas is shaped by both infrastructural development and sustainability priorities. Emerging economies like Nigeria and Indonesia are witnessing accelerated adoption of LED solutions in commercial, industrial, and public infrastructure projects due to their long-term cost savings and performance benefits.

Key market drivers include government incentives for energy-efficient lighting, rising electricity costs, and growing awareness of LED technology’s operational advantages. Buyers increasingly prioritize customizable LED solutions—such as tunable color temperatures, smart lighting controls, and integrated IoT capabilities—to optimize energy usage and enhance user experience. Additionally, the trend toward digital procurement is reshaping sourcing processes. Over 65% of B2B buyers now conduct detailed online research before engaging suppliers, emphasizing the need for transparent, data-rich product information and virtual demonstrations.

Sourcing trends reveal a shift toward regional manufacturing hubs closer to target markets to reduce lead times and logistics costs. In Africa and South America, local partnerships with manufacturers offering modular LED systems tailored to regional power conditions and climate are gaining traction. Buyers also seek suppliers who can provide flexible supply chain solutions, including real-time inventory visibility and just-in-time delivery, especially for large-scale projects with tight deadlines.

Technological advancements such as AI-driven lighting design tools and energy savings calculators empower buyers to make informed decisions by quantifying ROI and environmental impact upfront. Furthermore, the integration of smart lighting with building management systems is becoming a standard requirement in Europe and the Middle East, reinforcing the demand for suppliers with expertise in both hardware and software.

Sustainability & Ethical Sourcing in B2B LED Lighting

Sustainability has become a critical purchasing criterion in the LED lighting sector. International buyers are increasingly scrutinizing the environmental footprint of their lighting solutions—from raw material sourcing to end-of-life disposal. LEDs inherently offer energy savings of up to 80% compared to traditional lighting, significantly reducing carbon emissions. However, responsible buyers must also consider ethical sourcing practices to ensure supply chain transparency and minimize adverse social and environmental impacts.

Key elements of sustainable sourcing include selecting suppliers who utilize eco-friendly materials such as recyclable aluminum housings and lead-free solder, as well as those committed to reducing hazardous substances like mercury. The adoption of third-party green certifications—including ENERGY STAR, TUV Rheinland, and RoHS compliance—provides assurance of product quality and environmental stewardship. These certifications are particularly valued in European and Middle Eastern markets, where regulatory frameworks are more stringent.

Ethical supply chain management also involves verifying labor standards and fair trade practices, especially when sourcing components from emerging economies. Buyers from Africa and South America are advised to engage with manufacturers who demonstrate corporate social responsibility (CSR) initiatives and transparent auditing processes.

Incorporating sustainability into procurement strategies not only aligns with global climate goals but also enhances brand reputation and opens access to new market segments prioritizing green credentials. Leading suppliers now offer lifecycle assessments and circular economy models, including LED product recycling programs, to support long-term sustainability goals.

Evolution of LED Lighting for B2B Markets

The LED lighting sector has evolved significantly over the past two decades, transitioning from niche indicator lights to mainstream commercial and industrial illumination solutions. Initially, high costs and limited light quality restricted LED adoption. However, technological advances in semiconductor materials and manufacturing processes have drastically improved efficiency, color rendering, and affordability.

By the mid-2010s, LEDs became the preferred choice for new construction and retrofit projects worldwide due to their longevity and energy savings. This period also saw the integration of digital controls enabling dimming, color tuning, and connectivity—features now essential for smart building applications.

For B2B buyers, understanding this evolution is critical to appreciating the current landscape, where LED lighting is no longer just a product but part of comprehensive energy management and sustainability strategies. Suppliers who continuously innovate and align with market demands for customization, digitalization, and ethical sourcing will lead the sector’s next growth phase.

Frequently Asked Questions (FAQs) for B2B Buyers of ideas for led lights

-

How can I effectively vet LED light suppliers for international B2B transactions?

To ensure reliability, start by verifying the supplier’s certifications such as ISO, CE, RoHS, and energy efficiency labels relevant to your region. Request detailed product catalogs, sample units, and technical datasheets. Check references or case studies from previous international buyers, especially those operating in similar markets like Africa or South America. Evaluate their digital presence for transparency, including website functionality, responsiveness, and access to technical support. Finally, confirm their production capacity and quality assurance processes to ensure consistency for bulk orders. -

What customization options are typically available for LED lighting products?

Most reputable LED manufacturers offer extensive customization including lumen output, color temperature, beam angle, housing materials, and mounting types. Advanced options may include smart controls, dimming capabilities, and integration with IoT systems. When negotiating, clarify your project’s technical requirements and request prototype samples to validate specifications. Custom packaging and branding are also common for distributors. Ensure that any customization does not compromise certifications or warranty terms, and factor in additional lead times and costs associated with tailored solutions. -

What are the usual minimum order quantities (MOQs) and lead times for international LED light orders?

MOQs vary widely but typically range from 100 to 500 units per model, depending on customization and supplier scale. Lead times generally span 4 to 12 weeks, influenced by order size, customization complexity, and current supply chain conditions. For buyers in regions like the Middle East or Europe, it’s vital to discuss shipping schedules upfront and confirm production slots, especially during peak demand seasons. Negotiate flexible MOQs for trial orders or phased rollouts to mitigate risk while establishing supplier relationships. -

Which payment terms are common and safest for international B2B buyers of LED lights?

Common payment methods include Letters of Credit (LC), Telegraphic Transfers (T/T), and escrow services. For first-time orders, an LC provides strong protection by linking payment to shipment documents. Established buyers may negotiate partial upfront payments (e.g., 30%) with balance upon delivery or inspection. Avoid full prepayment unless dealing with highly trusted suppliers. Always clarify currency, bank charges, and potential exchange rate risks, especially when transacting from emerging markets like Nigeria or Indonesia. -

How can I verify the quality and certifications of LED lighting products?

Request official test reports from accredited labs verifying compliance with international standards such as IEC, UL, or EN. Certifications like CE, RoHS, and Energy Star indicate adherence to safety, environmental, and efficiency criteria. Insist on factory audits or third-party inspections if possible, especially for large orders. Review warranty terms and after-sales support policies carefully. Quality assurance includes not only product performance but also durability under local environmental conditions such as high humidity or voltage fluctuations common in African and Middle Eastern markets. -

What logistics considerations should I keep in mind when importing LED lights internationally?

Plan for customs clearance, import duties, and compliance with local electrical regulations in your destination country. Confirm that the supplier provides accurate HS codes and necessary export documentation like Certificates of Origin and Conformity. Choose reliable freight forwarders experienced with fragile electronics handling and temperature-sensitive cargo. Track lead times including inland transport, port handling, and potential delays. For buyers in remote regions, factor in last-mile delivery challenges and storage conditions to prevent damage or degradation. -

How should I handle disputes or quality issues with LED light suppliers?

Establish clear contractual terms covering product specifications, inspection rights, and remedies for defects before order confirmation. Use third-party inspection services to verify product quality pre-shipment. In case of disputes, document all communications and evidence such as photos and test results. Engage suppliers promptly with detailed claims and request corrective actions like replacements or refunds. If unresolved, consider mediation or arbitration clauses included in contracts, which are preferable to costly litigation in international trade scenarios. -

What strategies can help optimize ROI when sourcing LED lighting solutions internationally?

Focus on products with verified energy efficiency and long lifespans to reduce operational costs. Utilize tools like energy savings calculators provided by suppliers to model ROI specific to your application. Negotiate volume discounts and consider phased procurement aligned with project milestones to manage cash flow. Leverage supplier technical support for optimal product selection and installation guidance to maximize performance. Finally, maintain strong supplier relationships for ongoing innovation updates and favorable terms in future orders.

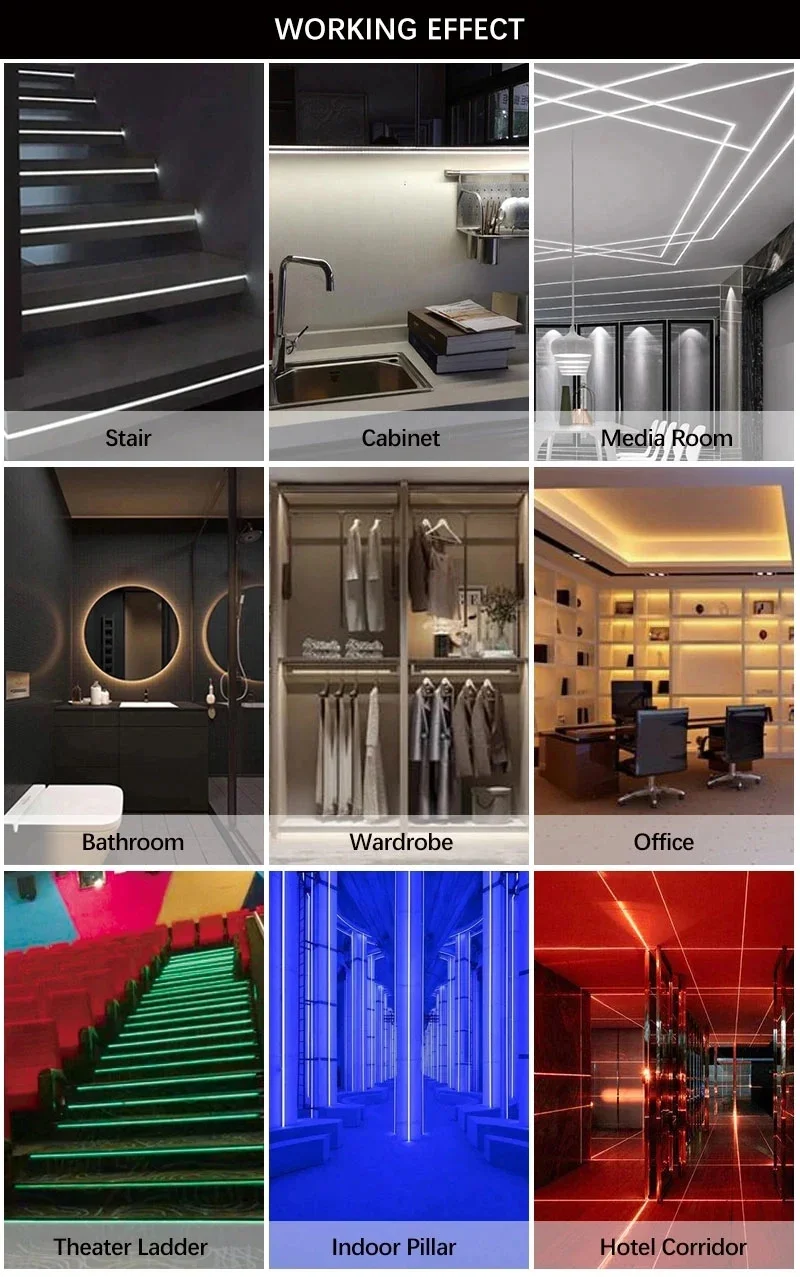

Illustrative Image (Source: Google Search)

Strategic Sourcing Conclusion and Outlook for ideas for led lights

Strategic sourcing in the LED lighting sector is a critical driver for sustainable growth and competitive advantage. For international B2B buyers—especially those in dynamic markets such as Africa, South America, the Middle East, and Europe—leveraging data-driven supplier evaluation, energy-efficient product innovations, and digital procurement tools can unlock significant cost savings and operational efficiencies. Prioritizing suppliers that offer technical transparency, certifications, and scalable solutions ensures alignment with evolving project requirements and regulatory standards.

Illustrative Image (Source: Google Search)

Key takeaways emphasize the importance of an integrated approach combining thorough market research, supplier collaboration, and adoption of cutting-edge LED technologies tailored to specific regional needs. Digital platforms now serve as essential conduits for comprehensive product information, real-time inventory insights, and interactive configuration options—empowering buyers to make informed decisions swiftly and confidently.

Looking ahead, the LED lighting industry will continue to evolve through advancements in smart lighting, IoT integration, and sustainability mandates. International buyers are encouraged to proactively engage with innovative manufacturers, invest in digital sourcing strategies, and cultivate strategic partnerships that support long-term value creation. By embracing these practices, businesses can not only meet immediate procurement goals but also drive transformative outcomes across their projects and markets.