Introduction: Navigating the Global Market for repair led strip

In today’s fast-evolving lighting industry, the ability to effectively repair LED strips is a strategic advantage for businesses operating across Africa, South America, the Middle East, and Europe. LED strip lighting is a cornerstone technology for commercial, industrial, and architectural projects, prized for its energy efficiency, versatility, and design flexibility. However, partial failures and damaged sections are common challenges that can disrupt operations, increase costs, and impact client satisfaction. For international B2B buyers, understanding the nuances of repair processes is critical to maintaining project timelines and optimizing lifecycle costs.

This comprehensive guide delves into the full spectrum of repair LED strip considerations—from identifying failure modes and selecting compatible replacement materials to evaluating manufacturing quality control and sourcing reliable suppliers globally. It covers technical insights on different LED strip types, including voltage specifications and circuit architecture, to empower buyers with the knowledge needed to troubleshoot and specify repairs confidently. Additionally, it offers a detailed overview of market dynamics, pricing structures, and regional supplier landscapes, particularly relevant for buyers in emerging and mature markets such as Indonesia and Spain.

By leveraging this guide, international buyers will gain actionable intelligence to make informed sourcing decisions, negotiate effectively, and ensure seamless integration of repaired LED strips within their projects. Whether managing large-scale installations or maintaining retail lighting solutions, businesses will be equipped to minimize downtime, reduce waste, and uphold high standards of quality and reliability in LED strip lighting applications worldwide.

Understanding repair led strip Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard 12V LED Repair Strips | Sections with 3 LEDs per segment, solderable copper pads | Retail lighting, signage, residential retrofit | Pros: Widely compatible, easy to solder; Cons: Limited length per run, voltage drop over distance |

| Standard 24V LED Repair Strips | Sections with 6 LEDs per segment, higher voltage operation | Commercial lighting, industrial installations | Pros: Longer runs possible, less voltage drop; Cons: Slightly higher cost, requires compatible power supplies |

| RGB LED Repair Strips | Multi-chip RGB modules per segment, color channel repair possible | Hospitality, entertainment, architectural lighting | Pros: Full color control, versatile; Cons: Complex repairs, requires channel-specific diagnostics |

| High-Density LED Repair Strips | Closely spaced LEDs, smaller segments, often flexible PCB | High-end displays, automotive, decorative lighting | Pros: High brightness, smooth light output; Cons: More sensitive to heat, complex soldering |

| Waterproof / Outdoor Repair Strips | Encapsulated with silicone or epoxy for moisture resistance | Outdoor signage, landscape lighting, marine use | Pros: Durable in harsh environments; Cons: Repair requires careful sealing, higher material cost |

Standard 12V LED Repair Strips

These strips consist of discrete sections, each with 3 LEDs and individual current-limiting resistors, designed for 12V power systems. Their modular segment design allows easy cutting and soldering, making them ideal for straightforward repairs in retail or residential settings. B2B buyers should consider compatibility with existing installations and ease of onsite repair. They are cost-effective but can suffer from voltage drop over longer distances, limiting their use in large-scale commercial projects.

Standard 24V LED Repair Strips

Operating at 24V, these strips feature 6 LEDs per section, enabling longer continuous runs with reduced voltage drop and better power efficiency. They are well-suited for commercial and industrial applications where longer strip lengths are common. Buyers benefit from improved energy efficiency and fewer power injection points, but must ensure power supplies match the higher voltage. Repairs are similar to 12V strips but require attention to voltage specifications.

RGB LED Repair Strips

RGB repair strips contain multi-chip modules per segment, allowing independent control of red, green, and blue LEDs for dynamic color effects. These are crucial in hospitality, entertainment, and architectural lighting projects demanding vibrant, customizable illumination. B2B purchasers should prepare for complex diagnostics and repairs, often needing channel-specific testing and soldering skills. While offering versatility, these strips require compatible controllers and more advanced installation expertise.

High-Density LED Repair Strips

Featuring tightly packed LEDs on flexible PCBs, high-density strips deliver superior brightness and uniform light output, favored in premium displays, automotive lighting, and decorative applications. Their small segments make pinpoint repairs more challenging, and heat management is critical to maintain longevity. Buyers should prioritize suppliers with quality thermal design and provide technicians skilled in delicate soldering. These strips command a higher price but offer enhanced visual performance.

Waterproof / Outdoor Repair Strips

Encapsulated with silicone or epoxy coatings, these strips resist moisture, dust, and harsh environmental conditions, making them indispensable for outdoor signage, landscape lighting, and marine applications. Repairing these strips requires careful resealing to maintain waterproof integrity, often demanding specialized adhesives or encapsulants. For B2B buyers, durability and IP rating certifications are key procurement criteria, alongside supplier support for repair materials and instructions. These strips typically carry a premium price reflecting their ruggedness.

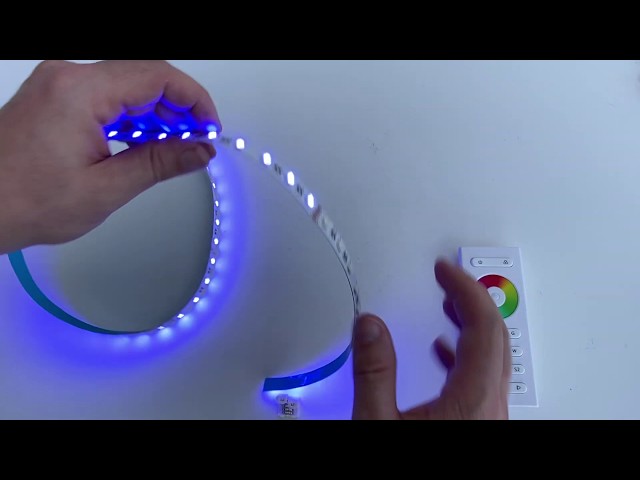

Related Video: How to repair LED tube light | Easy method

Key Industrial Applications of repair led strip

| Industry/Sector | Specific Application of repair led strip | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial | Illuminated signage and display lighting repair | Minimizes downtime and maintains brand visibility | Reliability of repair components, compatibility with existing LED strips, availability of technical support |

| Manufacturing & Warehousing | Maintenance of LED strip lighting in production lines and storage areas | Ensures consistent illumination for safety and productivity | Durability under industrial conditions, ease of on-site repair, compliance with regional safety standards |

| Hospitality & Tourism | Repair of decorative and ambient LED strip lighting in hotels and resorts | Enhances guest experience and reduces costly lighting replacements | Flexibility in color and brightness matching, fast turnaround time, local sourcing options |

| Transportation & Infrastructure | Repair of LED strip lighting in public transport stations and tunnels | Maintains safety and operational efficiency | Weather resistance, long lifespan, and adherence to local regulatory requirements |

| Architectural & Urban Development | Restoration of LED strip installations in public spaces and buildings | Supports sustainable lighting solutions and aesthetic preservation | Energy efficiency, environmental certifications, and availability of repair kits |

Retail & Commercial Sector

In retail environments across regions such as Spain and South Africa, LED strip lights are extensively used for signage and product displays. Repairing these strips promptly prevents prolonged outages that could affect customer engagement and brand perception. Buyers should prioritize suppliers offering repair kits compatible with popular LED strip models and ensure access to technical documentation. For international buyers, especially in emerging markets, securing parts with reliable shipping and local technical support is critical to minimize downtime.

Manufacturing & Warehousing

Industrial facilities in countries like Brazil and the UAE rely on continuous, high-quality lighting for operational safety and efficiency. LED strips often illuminate assembly lines and storage racks, where failures can cause hazards or slowdowns. Repairing LED strips onsite extends equipment life and reduces replacement costs. Buyers must source durable repair components that withstand harsh environments, including dust and temperature fluctuations. Compliance with regional safety standards is essential to avoid regulatory issues.

Hospitality & Tourism

Hotels and resorts in regions such as Indonesia and Morocco use LED strips for ambient lighting to create inviting atmospheres. Maintaining consistent lighting quality through repairs enhances guest satisfaction and reduces the need for full replacements, which can be costly and disruptive. Buyers should seek repair solutions that offer precise color matching and quick delivery to ensure minimal service interruption. Partnering with suppliers familiar with local market demands facilitates smoother procurement.

Transportation & Infrastructure

Public transport hubs and tunnels in European cities and Middle Eastern countries utilize LED strip lighting for safety and navigation. Malfunctioning strips can compromise visibility and passenger safety. Repairing these strips promptly ensures operational continuity and adherence to safety regulations. Buyers must focus on sourcing weather-resistant and long-lasting repair parts certified for infrastructure use. Understanding local regulatory frameworks helps avoid compliance risks.

Architectural & Urban Development

LED strips are integral to modern urban lighting projects in metropolitan areas like Johannesburg and Barcelona, enhancing both aesthetics and energy efficiency. Repairing these installations supports sustainability goals by extending product life and reducing waste. Buyers in this sector should emphasize energy-efficient repair materials with environmental certifications. Availability of comprehensive repair kits and technical support is vital for maintaining large-scale installations with minimal disruption.

Related Video: How to cut, connect & power LED Strip Lighting

Strategic Material Selection Guide for repair led strip

Flexible PCB Substrate (Polyimide and PET Films)

Flexible printed circuit boards (FPCBs) made from polyimide or polyethylene terephthalate (PET) films are the foundational materials for most LED strips. Polyimide offers excellent thermal stability, withstanding temperatures up to 260°C, which is critical during soldering and in high-heat applications. PET is less heat resistant (up to ~150°C) but provides good flexibility and cost-efficiency.

Pros: Polyimide substrates are highly durable, resistant to chemicals and UV exposure, and maintain mechanical integrity under bending stresses common in LED strip installations. PET-based substrates are lightweight, flexible, and more affordable, making them suitable for less demanding environments.

Cons: Polyimide is more expensive and may require specialized manufacturing processes, increasing lead times. PET substrates have lower thermal resistance and may degrade faster under prolonged heat or outdoor exposure.

Application Impact: For regions with high ambient temperatures such as the Middle East and parts of Africa, polyimide substrates ensure longevity and reliability. In indoor or lower-heat environments like many European or South American markets, PET substrates offer a cost-effective solution without sacrificing performance.

International B2B Considerations: Buyers should verify compliance with international standards like IPC-2223 for flexible circuits and ensure suppliers provide certifications aligned with ASTM or DIN standards. Polyimide-based strips often meet stricter UL and RoHS requirements, which are increasingly demanded in Europe and developed markets. For emerging markets, balancing cost and durability is key, making PET substrates attractive when conforming to local electrical safety standards.

Copper Traces (Electrolytic Copper Foil)

Copper foil is the conductive material forming the LED strip’s circuitry. Its thickness typically ranges from 35µm (1 oz) to 70µm (2 oz), affecting current capacity and heat dissipation.

Pros: Copper offers excellent electrical conductivity and thermal management, essential for maintaining consistent LED brightness and preventing overheating. Thicker copper layers improve durability and reduce voltage drop over long runs, which is beneficial in large-scale installations common in commercial projects.

Cons: Copper is susceptible to oxidation and corrosion if not properly protected, which can degrade electrical performance. It also adds to material costs, especially with thicker foils, and requires precise manufacturing controls to avoid microfractures during bending.

Application Impact: In humid or coastal environments such as parts of South America and Southeast Asia (Indonesia), corrosion-resistant coatings or protective laminates on copper traces are vital. In drier climates like the Middle East, oxidation risk is lower but mechanical stress remains a concern.

International B2B Considerations: Buyers should request detailed specifications on copper thickness and protective treatments. Compliance with IPC-6013 (for flexible copper clad laminates) and IEC standards ensures quality and interoperability. Suppliers offering copper with anti-corrosion coatings or ENIG (Electroless Nickel Immersion Gold) finish may command premium pricing but provide longer service life, a critical factor for high-value projects in Europe and advanced African markets.

Solder Mask and Protective Coatings

Solder mask layers protect copper traces from environmental damage and prevent solder bridging during manufacturing. Common materials include epoxy-based masks and silicone coatings for waterproofing.

Pros: Epoxy solder masks are cost-effective and provide good chemical and abrasion resistance. Silicone coatings enhance flexibility and offer superior moisture and UV resistance, making them ideal for outdoor or industrial LED strip applications.

Cons: Epoxy masks have limited flexibility and can crack under repeated bending, reducing durability in dynamic installations. Silicone coatings increase manufacturing complexity and cost, requiring specialized application processes.

Application Impact: For outdoor lighting projects in Europe and the Middle East, silicone coatings extend product life by protecting against UV radiation and moisture ingress. Indoor applications or controlled environments in South America and Africa may opt for epoxy masks to reduce costs while maintaining adequate protection.

International B2B Considerations: Certification to standards such as UL 746E (Polymeric Materials) and IEC 61000-4-2 (Electrostatic Discharge) is important for ensuring product reliability. Buyers should assess the environmental conditions of their target markets to select appropriate coatings, balancing cost and performance. Local regulations on chemical safety and RoHS compliance also influence material choices.

Connector Materials and Adhesives

Connectors and adhesives are critical for repair operations and ensuring mechanical and electrical integrity of LED strip joints. Connectors are typically made from plastic housings with metal contacts (often tin or gold-plated copper), while adhesives vary from acrylic to silicone-based.

Pros: Gold-plated connectors provide superior corrosion resistance and reliable conductivity, essential in humid or corrosive environments. Silicone adhesives offer excellent flexibility and temperature resistance, maintaining adhesion under thermal cycling.

Cons: Gold plating increases costs significantly, which may not be justified for all markets. Acrylic adhesives are less flexible and can degrade under UV exposure, limiting outdoor use.

Application Impact: In tropical and coastal regions (e.g., Indonesia, parts of South America), gold-plated connectors and silicone adhesives enhance durability and reduce maintenance. For indoor European and African applications, cost-effective connectors with standard plating and acrylic adhesives may suffice.

International B2B Considerations: Buyers should verify connector compatibility with LED strip specifications and ensure adhesives meet ASTM D1000 (pressure-sensitive adhesive standards) or equivalent. Consideration of local climate, installation practices, and maintenance capabilities is critical to selecting appropriate materials that minimize downtime and warranty claims.

Summary Table

| Material | Typical Use Case for repair led strip | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Flexible PCB Substrate (Polyimide/PET) | Base material for LED strip circuitry and flexibility | High thermal stability (Polyimide), good flexibility (PET) | Polyimide costly; PET lower heat resistance | Medium to High |

| Copper Traces | Conductive pathways for electrical current | Excellent conductivity and heat dissipation | Susceptible to corrosion without protection | Medium |

| Solder Mask & Protective Coatings | Protection of copper traces and prevention of shorts | Chemical and moisture resistance, UV protection (silicone) | Epoxy less flexible; silicone increases cost | Low to Medium |

| Connector Materials & Adhesives | Electrical and mechanical joints in repairs | Corrosion resistance (gold plating), flexible adhesion | Gold plating costly; acrylic adhesives less durable | Medium to High |

In-depth Look: Manufacturing Processes and Quality Assurance for repair led strip

Manufacturing Processes for Repair LED Strips

The production of repair LED strips involves multiple precise stages designed to ensure durability, functionality, and ease of repair. Understanding these stages helps international B2B buyers assess supplier capabilities and product quality.

-

Material Preparation

Raw materials include flexible printed circuit boards (FPCBs), LED chips, resistors, connectors, and protective coatings. High-quality copper foils and polyimide or PET substrates are selected for flexibility and electrical performance. Suppliers typically source LEDs from reputable manufacturers to ensure luminous efficiency and lifespan. Materials undergo initial inspection for defects such as substrate warping or copper trace irregularities. -

Forming and Patterning

The FPCB is patterned using photolithography or screen printing to create copper traces. This process defines the circuit paths that power and control individual LED sections. Precision is critical here to avoid short circuits or open circuits that can lead to early failure. Cutting lines and solder pads are also defined to facilitate future repair and assembly. -

Component Placement and Soldering

Automated pick-and-place machines position LED chips, resistors, and connectors onto the FPCB. This is followed by soldering, commonly using reflow soldering techniques to ensure reliable electrical and mechanical bonds. High-grade solder paste and controlled thermal profiles prevent cold joints, a common failure point in LED strips. Some manufacturers may perform selective soldering for connectors or repair points. -

Encapsulation and Protective Finishing

To protect against environmental factors such as moisture, dust, and mechanical stress, LED strips are coated with silicone, epoxy, or polyurethane layers. Waterproofing is especially important for outdoor or humid environment applications. The finishing stage may also include printing product information, serial numbers, and cutting guides for repairability. -

Packaging for Repair-Friendly Use

Repair LED strips are often designed with clear cut points and modular connectors to facilitate easy replacement of faulty sections. Packaging includes detailed instructions and tools recommendations, addressing the needs of B2B clients who may perform in-field repairs or installations.

Quality Assurance (QA) and Quality Control (QC) Practices

For B2B buyers, especially those operating across diverse international markets such as Africa, South America, the Middle East, and Europe, rigorous QA and QC practices are essential to ensure product reliability and compliance with local regulations.

International and Industry Standards

-

ISO 9001 Certification

This is the global benchmark for quality management systems. Suppliers certified to ISO 9001 demonstrate consistent process control, continual improvement, and customer satisfaction focus. B2B buyers should prioritize suppliers with ISO 9001 as it underpins all subsequent QC activities. -

CE Marking (Europe)

For buyers in Europe and regions recognizing CE, compliance with safety, electromagnetic compatibility (EMC), and environmental directives is mandatory. CE certification confirms the LED strips meet EU standards, which is vital for import and resale. -

RoHS Compliance

Restriction of Hazardous Substances directives apply widely, restricting lead, mercury, cadmium, and other harmful materials. Ensuring RoHS compliance protects buyers from regulatory risks and aligns with global sustainability trends. -

Other Regional Certifications

Depending on the market, certifications such as the Gulf Conformity Mark (G-mark) for the Middle East, INMETRO for Brazil, or SABS for South Africa may apply. Buyers should verify if suppliers provide documentation relevant to their import regions.

QC Checkpoints Throughout Production

-

Incoming Quality Control (IQC)

Raw materials and components undergo stringent inspection for dimensional accuracy, electrical properties, and physical defects. For LED strips, IQC includes verifying LED chip brightness, resistor values, substrate integrity, and solder paste quality. -

In-Process Quality Control (IPQC)

During assembly, IPQC monitors soldering quality, component placement accuracy, and circuit integrity. Automated optical inspection (AOI) systems detect misaligned LEDs, solder bridges, or missing parts. Functional tests at this stage may include powering sample sections to verify LED illumination. -

Final Quality Control (FQC)

Completed LED strips are subject to comprehensive testing: - Electrical Testing: Verifies correct voltage, current, and power consumption.

- Functional Testing: Checks full illumination, color accuracy (for RGB strips), and dimming response.

- Environmental Testing: Simulates humidity, temperature cycling, and mechanical stress to ensure durability.

- Visual Inspection: Confirms absence of cosmetic defects like discoloration or surface damage.

Common Testing Methods

-

Multimeter and Continuity Tests

Validate electrical connections and detect open or short circuits within LED sections. -

Spectrophotometry

Measures color rendering and brightness to verify adherence to specifications, crucial for RGB and color-tunable strips. -

Thermal Imaging

Identifies hotspots that could indicate faulty solder joints or component stress, preventing early failures. -

Accelerated Life Testing

Subjects products to elevated temperature and humidity over extended periods to forecast lifespan and identify latent defects.

Verifying Supplier QC for International B2B Buyers

Due diligence on supplier quality management is critical, especially when sourcing repair LED strips for markets in Africa, South America, the Middle East, and Europe.

-

Factory Audits and Inspections

Buyers should conduct or commission on-site audits assessing manufacturing capabilities, QC equipment, staff training, and process controls. For remote buyers, third-party inspection agencies provide reliable factory evaluations. -

Review of QC Documentation and Test Reports

Request detailed IQC, IPQC, and FQC reports, including batch test results and certifications. These documents provide transparency into production consistency. -

Sample Testing and Validation

Before bulk orders, buyers should procure product samples for independent laboratory testing, validating performance claims and compliance with regional standards. -

Third-Party Certification Verification

Confirm the authenticity of ISO, CE, RoHS, and other certificates through issuing bodies or international registries. Beware of counterfeit or expired documentation. -

Compliance with Regional Regulatory Requirements

Engage local consultants or certification bodies to ensure products meet specific import regulations, safety standards, and labeling requirements in target markets.

QC and Certification Nuances for Diverse International Markets

-

Africa

Regulatory frameworks vary widely; some countries require local certification or approval by national standards bodies (e.g., SON in Nigeria, SABS in South Africa). Buyers should anticipate longer lead times for compliance and factor this into procurement planning. -

South America

Countries like Brazil have stringent certification processes (INMETRO), often requiring testing within national labs. Buyers must verify supplier capability to navigate these protocols or work with local partners. -

Middle East

The Gulf Cooperation Council (GCC) countries recognize the G-mark certification. Compliance with electrical safety and EMC standards is mandatory. Regional climatic conditions (high heat and dust) necessitate robust environmental testing. -

Europe (e.g., Spain)

Strict enforcement of CE marking and RoHS directives means non-compliant products risk rejection at customs. Buyers should also consider the Waste Electrical and Electronic Equipment Directive (WEEE) for end-of-life product management. -

Additional Considerations

In all regions, traceability is increasingly important. Suppliers providing batch codes, manufacturing dates, and repair-friendly design features facilitate after-sales support and warranty management.

Actionable Insights for B2B Buyers:

- Prioritize suppliers with documented ISO 9001 and relevant regional certifications to minimize compliance risks.

- Insist on transparent QC checkpoints and access to comprehensive testing reports before purchase commitments.

- Utilize third-party audits and sample testing as part of your supplier qualification process.

- Account for regional regulatory nuances early in procurement to avoid costly delays or rejections.

- Favor repair LED strips designed with modularity and clear cut points to reduce maintenance time and cost in diverse environments.

By thoroughly understanding manufacturing processes and quality assurance protocols, international B2B buyers can make informed sourcing decisions that ensure product reliability, regulatory compliance, and customer satisfaction across global markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for repair led strip Sourcing

Understanding the cost structure and pricing dynamics for sourcing repair LED strips is crucial for international B2B buyers aiming to optimize procurement and maintain competitive project margins. This analysis breaks down key cost components, influential pricing factors, and strategic buyer considerations tailored for markets including Africa, South America, the Middle East, and Europe.

Key Cost Components in Repair LED Strip Sourcing

- Materials: The primary cost driver, encompassing LED chips, flexible PCBs, resistors, connectors, and soldering materials. High-quality components with certifications (e.g., RoHS, CE) typically command premium prices but offer better reliability and longevity.

- Labor: Skilled labor costs involve assembly, soldering, quality inspections, and testing. Labor rates vary significantly by region, influencing the overall cost—factories in Asia may offer lower labor costs compared to European suppliers.

- Manufacturing Overhead: Includes utilities, factory maintenance, equipment depreciation, and indirect labor. Efficient production lines and automation can reduce overhead, impacting price competitiveness.

- Tooling and Setup: Initial tooling for cutting, soldering fixtures, and specialized machinery can be amortized over large production runs but increase costs for smaller orders.

- Quality Control (QC): Rigorous inspection processes, including electrical testing and visual checks, add to costs but reduce defect rates, critical for B2B buyers who prioritize reliability.

- Logistics: Freight, customs duties, insurance, and warehousing fees. International shipments, especially to Africa and South America, often incur higher logistics costs due to longer transit times and complex customs procedures.

- Margin: Supplier profit margins vary based on brand positioning, market demand, and service levels. Negotiated margins can fluctuate with order size and strategic partnerships.

Influencers on Final Pricing

- Order Volume and Minimum Order Quantities (MOQ): Larger orders typically unlock volume discounts and better payment terms. MOQ requirements can be a barrier for smaller buyers but negotiating flexible batch sizes may be possible with some manufacturers.

- Technical Specifications and Customization: Customized LED strips (e.g., specific lengths, IP ratings, color temperatures, or control protocols) increase costs due to design complexity and specialized materials.

- Material Quality and Certifications: Certified components and compliance with international standards add to cost but reduce risk of failures and legal issues in regulated markets.

- Supplier Location and Reputation: Suppliers in low-cost manufacturing hubs offer competitive pricing but may require thorough vetting for quality assurance. Established European or Middle Eastern suppliers often command higher prices but provide better logistical convenience and post-sale support.

- Incoterms and Payment Terms: Delivery terms (FOB, CIF, DDP) affect who bears shipping and customs costs. Buyers should understand these terms to anticipate landed costs accurately and negotiate favorable terms.

- Market Conditions: Currency fluctuations, raw material price volatility (e.g., copper, semiconductor chips), and geopolitical factors can impact pricing unpredictably.

Strategic Buyer Tips for International Markets

- Negotiate Beyond Unit Price: Focus on total cost of ownership (TCO), including warranty, after-sales support, and potential rework costs. Sometimes a higher upfront price reduces long-term expenses.

- Leverage Local Partnerships: In regions like Africa and the Middle East, partnering with regional distributors can lower logistics costs and improve supply chain responsiveness.

- Validate Supplier Capabilities: Request samples and certifications to verify quality, especially for LED strips intended for harsh environments common in South America and Africa.

- Consider Modular Repair Approaches: Opt for suppliers offering modular strip designs that simplify on-site repairs, reducing labor costs and downtime.

- Understand Customs and Import Duties: Work with freight forwarders familiar with destination country regulations to avoid unexpected fees and delays.

- Monitor MOQ Flexibility: For emerging markets or pilot projects, seek suppliers willing to accommodate smaller MOQs to reduce inventory risks.

- Plan for Currency Risk: Use hedging strategies or negotiate contracts in stable currencies to mitigate exchange rate impacts.

Indicative Pricing Disclaimer

Pricing for repair LED strips varies widely based on specifications, order size, and supplier location. Indicative prices typically range from $0.50 to $2.50 per meter for standard quality strips, excluding shipping and customs. Buyers should request detailed quotations inclusive of all ancillary costs to make informed decisions.

Illustrative Image (Source: Google Search)

By dissecting cost elements and market factors, B2B buyers across diverse regions can negotiate smarter, optimize procurement strategies, and achieve cost-efficient, high-quality repair LED strip sourcing tailored to their operational needs.

Spotlight on Potential repair led strip Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘repair led strip’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for repair led strip

Critical Technical Properties for Repair LED Strips

1. Voltage Rating

Typically, LED strips operate at 12V or 24V DC. This rating is crucial because mismatched voltage can lead to malfunction or permanent damage. For B2B buyers, ensuring voltage compatibility with existing power supplies reduces retrofit costs and avoids returns or warranty claims.

2. LED Density and Section Configuration

LED density is measured in LEDs per meter (e.g., 30, 60, or 120 LEDs/m). Additionally, LED strips are divided into sections (3 LEDs for 12V strips, 6 LEDs for 24V strips) that function as repair units. Understanding this helps buyers estimate repair parts needed and manage inventory efficiently by stocking compatible sectional replacements.

3. Material Quality and PCB Grade

High-quality LED strips use flexible, double-layer PCB boards with copper thickness typically ranging from 1 oz to 2 oz. Superior PCB grade ensures better heat dissipation and durability, especially in industrial or outdoor environments common in Africa, South America, the Middle East, and Europe. Buyers should prioritize materials that withstand local climate conditions and reduce failure rates.

4. IP Rating (Ingress Protection)

IP ratings, such as IP20 (indoor use) or IP65/IP67 (water-resistant), indicate protection against dust and moisture. For international buyers, especially those supplying outdoor or humid region projects, selecting LED strips with appropriate IP ratings is essential to minimize repair frequency and ensure longevity.

5. Color Temperature and CRI (Color Rendering Index)

Color temperature (measured in Kelvins) defines the light’s hue, from warm white (~2700K) to daylight (~6500K). CRI indicates color accuracy under the LED light source. For B2B buyers in retail or hospitality sectors, these parameters affect product appeal and customer satisfaction, influencing repair priorities related to color consistency.

6. Solder Pad and Connector Type

LED strips are repaired via soldering or connector clips. Pad size, spacing, and copper plating quality impact ease of repair and connection reliability. Buyers should confirm these specs to ensure compatibility with repair tools and reduce labor costs in large-scale installations.

Key Industry and Trade Terms for B2B Buyers

OEM (Original Equipment Manufacturer)

Refers to the company that originally manufactures the LED strips or components. Purchasing OEM products ensures authenticity, consistent quality, and easier access to technical support and compatible replacement parts, which is vital for long-term maintenance contracts.

MOQ (Minimum Order Quantity)

The smallest quantity of LED strips or repair components a supplier will sell per order. Understanding MOQ helps buyers from emerging markets or small businesses in Africa or South America optimize inventory costs and negotiate better terms aligned with project size.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, lead times, and terms for specified LED strip products or repair kits. RFQs are essential for comparing offers internationally, especially when sourcing from multiple regions like the Middle East or Europe, enabling cost-effective procurement decisions.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyers and sellers. Familiarity with Incoterms such as FOB (Free On Board) or DDP (Delivered Duty Paid) empowers buyers to manage logistics risks and costs effectively in cross-border transactions.

Cut Points

Designated locations on LED strips where the strip can be safely cut without damaging circuits. Knowing cut points is critical for repair and customization, allowing buyers to order precise lengths and minimize waste during installation or maintenance.

Color Channels

In RGB LED strips, color channels correspond to individual red, green, and blue LEDs controlled separately to produce various colors. Understanding channel failures helps B2B buyers diagnose partial strip defects and decide whether to repair or replace specific sections, optimizing maintenance budgets.

By mastering these technical properties and trade terms, international B2B buyers can make informed purchasing and repair decisions that improve operational efficiency, reduce downtime, and enhance customer satisfaction across diverse markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the repair led strip Sector

Market Overview & Key Trends

The global repair LED strip market is experiencing steady growth driven by increasing adoption of LED lighting solutions across commercial, industrial, and residential sectors. International B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, are influenced by factors including rising energy efficiency mandates, urban infrastructure development, and the growing emphasis on cost-effective lighting maintenance. In countries like Indonesia and Spain, where infrastructural modernization and sustainability goals are prioritized, demand for durable, repairable LED strip solutions is on the rise.

Key market dynamics include a shift towards modular LED strip designs that facilitate easier repairs and replacements, reducing downtime and lifecycle costs. B2B buyers are increasingly sourcing from manufacturers who offer robust technical support, warranty services, and supply chain transparency. Additionally, the integration of smart lighting controls and IoT compatibility is becoming a differentiator in supplier selection, especially in technologically advanced markets.

Sourcing trends reveal a preference for suppliers with regional warehouses or distribution centers to minimize lead times and logistics complexities. In emerging markets, buyers value suppliers that provide comprehensive repair kits and training resources to empower local technicians. Moreover, the rise of digital platforms enables buyers to access detailed product specifications and troubleshooting guides, enhancing the decision-making process.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a critical consideration for international B2B buyers in the repair LED strip sector. Repairing LED strips rather than full replacements significantly reduces electronic waste and the environmental footprint associated with manufacturing new components. Buyers increasingly prioritize suppliers who adhere to environmental standards such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), which limit the use of toxic materials.

Ethical sourcing practices are essential to ensure supply chain integrity, particularly concerning the procurement of raw materials like rare earth elements and semiconductors. Buyers in Africa, South America, and the Middle East are placing greater scrutiny on supplier certifications that guarantee responsible mining and labor practices. Certifications such as ISO 14001 (Environmental Management) and SA8000 (Social Accountability) are becoming important benchmarks in supplier evaluation.

Material innovations also contribute to sustainability goals. For example, LED strips made with recyclable substrates and low-impact soldering materials help reduce the overall carbon footprint. B2B buyers benefit from partnering with suppliers who provide transparent life cycle assessments and invest in circular economy initiatives, such as take-back programs for end-of-life LED strips.

Evolution and Historical Context

The repair LED strip sector has evolved significantly since the early adoption of flexible LED lighting in the 2000s. Initially, LED strips were often viewed as disposable components due to difficulties in repairing failures caused by fragile circuit traces and limited modularity. Over time, advances in PCB design, soldering techniques, and connector technologies have enabled more reliable sectional repairs, extending product lifespans.

This evolution is especially relevant for B2B buyers focused on total cost of ownership and operational continuity. The transition from single-use strips to repair-friendly modular systems reflects broader industry trends toward sustainability and cost efficiency. Historical challenges in regions with limited access to replacement parts have driven demand for repair-centric solutions, encouraging manufacturers to offer tailored repair kits and training to international buyers.

Understanding this historical progression helps buyers appreciate the value proposition of current repair LED strip products, which combine durability, ease of maintenance, and environmental responsibility — all critical factors in global sourcing strategies today.

Related Video: International Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of repair led strip

-

How can I effectively vet suppliers of repair LED strips to ensure product quality and reliability?

Vet suppliers by requesting detailed product specifications, certifications (such as CE, RoHS, UL), and sample testing before placing bulk orders. Verify their manufacturing capabilities through factory audits or virtual tours, especially for complex repairs like soldering or custom PCB design. Check references or reviews from existing B2B clients in your region (Africa, South America, Middle East, Europe) to assess reliability. Confirm their compliance with international standards and inquire about their quality control processes, including how they handle defective batches and after-sales support. -

Are customization options available for repair LED strips, and how should I approach them as an international buyer?

Most reputable suppliers offer customization including length, LED density, voltage, and connector types. As an international buyer, communicate your exact technical requirements clearly, including environmental conditions (humidity, temperature), regulatory compliance, and installation specifics. Request prototypes to validate performance. Negotiate minimum order quantities (MOQs) and lead times for custom orders upfront. Consider suppliers with experience exporting to your region, as they understand local standards and can advise on suitable modifications. -

What are typical minimum order quantities (MOQs) and lead times for repair LED strips in international B2B transactions?

MOQs vary widely, typically ranging from 500 to 5,000 meters depending on customization and supplier scale. Lead times can span 3 to 8 weeks, influenced by production complexity and shipping logistics. For buyers in Africa, South America, and the Middle East, factor in additional time for customs clearance and inland transport. Engage suppliers early to confirm MOQs and negotiate staggered deliveries if needed. Prioritize suppliers with robust supply chains and experience in international shipping to minimize delays. -

Which payment terms and methods are safest for international B2B buyers of repair LED strips?

Common payment methods include Letters of Credit (L/C), Telegraphic Transfers (T/T), and escrow services. Letters of Credit provide strong protection by ensuring payment only after supplier compliance verification. T/T requires trust but is faster and often used for repeat orders. Use escrow for new suppliers to mitigate risks. Negotiate partial upfront payment with balance on delivery. Always verify supplier credentials and use secure payment platforms. For buyers in emerging markets, partnering with suppliers who understand local banking nuances can streamline transactions. -

What quality assurance certifications should I request to ensure repair LED strips meet international standards?

Request certifications such as CE (European conformity), RoHS (restriction of hazardous substances), UL (Underwriters Laboratories), and ISO 9001 (quality management systems). These attest to product safety, environmental compliance, and manufacturing consistency. For buyers in Africa and South America, ensure certifications align with local import regulations to avoid customs issues. Additionally, ask for test reports on electrical safety, waterproof ratings (e.g., IP65/IP67), and lifespan testing. A supplier committed to third-party testing demonstrates reliability and commitment to quality. -

How can I optimize logistics and shipping for large orders of repair LED strips internationally?

Plan shipments considering both air and sea freight based on urgency and cost. Sea freight is cost-effective for large volumes but slower, while air freight suits urgent orders. Use consolidated shipping to reduce costs if ordering smaller volumes. Choose suppliers experienced with your destination’s customs procedures to avoid delays. Insist on clear documentation including commercial invoices, packing lists, and certificates of origin. Collaborate with freight forwarders familiar with your region to navigate import duties, taxes, and compliance efficiently. -

What strategies should I employ to handle disputes or quality issues with international suppliers of repair LED strips?

Establish clear contracts detailing product specifications, inspection criteria, and remedies for non-compliance. Include clauses on dispute resolution methods such as mediation or arbitration in neutral jurisdictions. Conduct pre-shipment inspections or use third-party quality control agents to identify defects early. Document all communications and discrepancies meticulously. If issues arise, engage suppliers promptly to negotiate returns, replacements, or refunds. Building long-term relationships with transparent communication reduces disputes and fosters mutual trust. -

How do regional factors in Africa, South America, the Middle East, and Europe affect sourcing repair LED strips?

Regional factors such as import regulations, power standards (voltage/frequency), and climate conditions impact product suitability and logistics. For example, high humidity in tropical regions demands waterproof LED strips, while voltage differences require compatible power supplies. Customs processes and tariffs vary widely, influencing delivery times and costs. Local infrastructure may affect storage and handling. Engage suppliers familiar with these regional nuances and request tailored solutions to ensure compliance, durability, and smooth supply chain operations.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for repair led strip

Effective repair of LED strips hinges on a deep understanding of the product’s sectional design, failure modes, and the right technical interventions. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—strategic sourcing plays a pivotal role in ensuring access to high-quality replacement components, reliable tools, and expert support services. Prioritizing suppliers who provide transparent product specifications, robust quality assurance, and responsive after-sales service will minimize downtime and protect project timelines.

Key takeaways for B2B buyers include:

– Thorough diagnostics using visual and electrical testing to isolate faults quickly.

– Supplier partnerships that emphasize repairability and availability of compatible parts.

– Training and technical support to empower local teams in efficient repair execution.

– Leveraging modular LED strip designs that simplify replacement and reduce waste.

Illustrative Image (Source: Google Search)

Looking ahead, the growing demand for sustainable lighting solutions and circular economy practices will further elevate the importance of repair-led strategies. Buyers should proactively engage with manufacturers and distributors who innovate in durable, repair-friendly LED strips and foster knowledge-sharing networks. Embracing this approach not only drives cost efficiencies but also strengthens your competitive edge in diverse international markets.

Take action today: Evaluate your current LED strip supply chain for repair readiness and explore partnerships that align with your operational goals and sustainability commitments.