Guide to Led Light Colours

- Introduction: Navigating the Global Market for led light colours

- Understanding led light colours Types and Variations

- Key Industrial Applications of led light colours

- Strategic Material Selection Guide for led light colours

- In-depth Look: Manufacturing Processes and Quality Assurance for led light colours

- Comprehensive Cost and Pricing Analysis for led light colours Sourcing

- Spotlight on Potential led light colours Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for led light colours

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led light colours Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of led light colours

- Strategic Sourcing Conclusion and Outlook for led light colours

Introduction: Navigating the Global Market for led light colours

The global demand for LED lighting solutions is surging, with LED light colours playing a pivotal role in defining application effectiveness, energy efficiency, and aesthetic appeal. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—understanding the nuances of LED colour technology is essential to securing competitive advantage and meeting diverse client needs. The spectrum of LED light colours influences everything from mood setting in commercial spaces to compliance with regional lighting standards, making it a critical factor in procurement decisions.

This comprehensive guide addresses the multifaceted landscape of LED light colours, offering detailed insights into the latest types and materials used in manufacturing. It demystifies quality control protocols and certification requirements tailored to various regions, ensuring buyers can confidently evaluate supplier reliability and product performance. Beyond technical specifications, the guide explores pricing models and market trends, empowering buyers to optimize costs without compromising quality.

Whether sourcing for retail, industrial, or specialty applications, this resource equips B2B buyers with actionable knowledge on how to navigate supplier selection, negotiate contracts, and align procurement strategies with local market demands. By delving into frequently asked questions and sharing best practices, the guide transforms complex procurement challenges into clear opportunities for value creation and supply chain resilience.

Equip your business with the expertise to select the ideal LED light colours that enhance product offerings, satisfy regulatory standards, and drive sustainable growth across international markets.

Understanding led light colours Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Warm White LED | Emits light in the 2700K-3500K range, mimics incandescent glow | Hospitality, retail, residential, restaurants | Creates cozy ambiance; may have lower luminous efficacy than cool white |

| Cool White LED | Emits light in the 4000K-5000K range, bright and neutral tone | Offices, commercial spaces, industrial lighting | Enhances visibility and alertness; can feel sterile if overused |

| RGB LED | Combines red, green, and blue diodes for full color spectrum | Advertising displays, entertainment, architectural lighting | Highly customizable colors; requires controllers, higher complexity |

| Tunable White LED | Adjustable color temperature from warm to cool white | Healthcare, museums, offices, smart buildings | Flexible lighting atmosphere; higher initial cost and control systems |

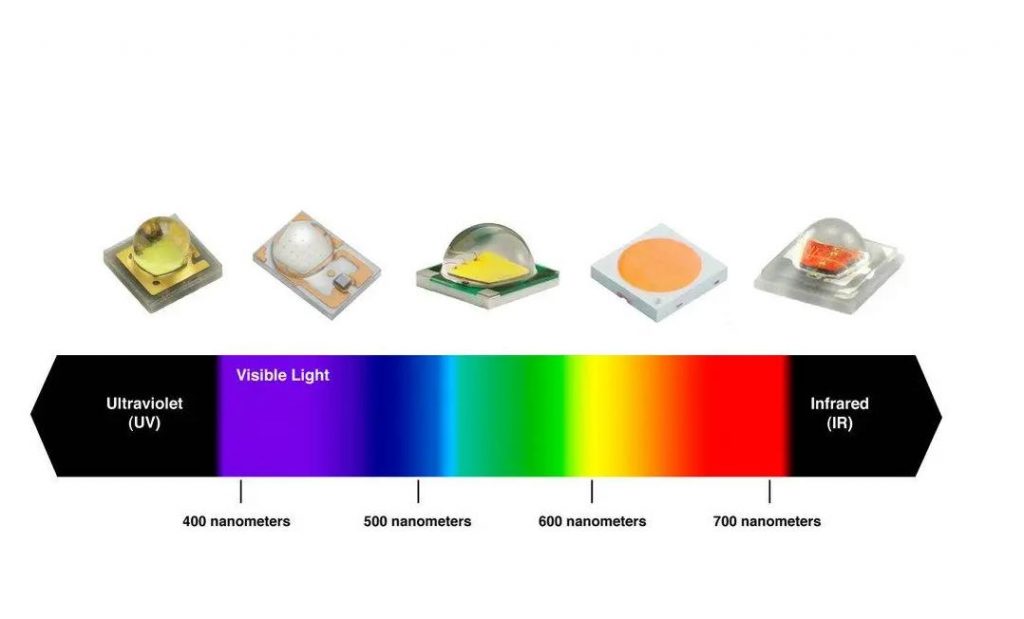

| UV and IR LEDs | Emits ultraviolet or infrared light, outside visible spectrum | Sterilization, security, sensing, industrial | Specialized applications; niche market, regulatory considerations |

Warm White LED

Warm white LEDs produce a soft, yellowish light similar to traditional incandescent bulbs, typically within a 2700K to 3500K color temperature range. This makes them ideal for environments that require a welcoming and relaxing atmosphere, such as hotels, restaurants, and retail stores. For B2B buyers, warm white LEDs offer strong appeal in hospitality and residential projects but may require balancing with higher efficacy LEDs to optimize energy costs. Verifying supplier consistency in color temperature binning is critical to maintain uniform lighting quality.

Cool White LED

Cool white LEDs emit a bright, neutral light between 4000K and 5000K, providing excellent visibility and a clean, professional appearance. They are widely used in office buildings, commercial facilities, and industrial environments where clarity and focus are paramount. Buyers should consider the potential for this light to feel harsh in some settings and may want to combine it with diffusers or warmer accents. Ensuring compliance with regional lighting standards and energy efficiency certifications is essential for international procurement.

RGB LED

RGB LEDs integrate red, green, and blue diodes to create a broad palette of colors through mixing. This versatility makes them a popular choice for dynamic advertising, stage lighting, and architectural illumination that requires customizable effects. For B2B buyers, RGB LEDs offer opportunities to differentiate products and services but involve additional costs for controllers and programming expertise. Partnering with suppliers who provide integrated solutions and after-sales support can reduce implementation risks.

Tunable White LED

Tunable white LEDs allow adjustment of color temperature across a range from warm to cool white, enabling adaptive lighting environments tailored to human circadian rhythms or specific task needs. Applications include healthcare facilities, museums, and smart office buildings where lighting quality directly impacts wellbeing and productivity. Buyers should evaluate suppliers’ control system compatibility and long-term reliability, as these systems often require integration with building management solutions.

UV and IR LEDs

Ultraviolet (UV) and infrared (IR) LEDs emit light outside the visible spectrum and serve specialized industrial, security, and healthcare functions such as sterilization, night vision, and sensing. These LEDs are typically niche products with strict regulatory compliance requirements, making supplier vetting crucial. B2B buyers should ensure certifications meet local standards and consider the technical support available for integrating these LEDs into complex systems.

Related Video: How LED works ⚡ What is a LED (Light Emitting Diode)

Key Industrial Applications of led light colours

| Industry/Sector | Specific Application of led light colours | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Agriculture & Horticulture | Growth enhancement through tailored light spectra | Accelerated plant growth, improved yield quality | Spectral accuracy, durability in humid environments, energy efficiency |

| Manufacturing & Industrial Facilities | Safety signaling and area demarcation using colour-coded LEDs | Enhanced workplace safety, reduced accident risks | Compliance with local safety standards, brightness, and visibility |

| Retail & Commercial Spaces | Mood and product highlighting via coloured accent lighting | Increased customer engagement and sales uplift | Colour consistency, dimmability, compatibility with control systems |

| Healthcare & Laboratories | Colour-coded lighting for procedural and diagnostic purposes | Improved accuracy, reduced errors, better patient outcomes | Sterilizable fixtures, colour rendering index (CRI), certification for medical use |

| Transportation & Infrastructure | Traffic and signal lights using specific LED colours | Efficient traffic management, improved safety | Weather resistance, long lifespan, regional certification compliance |

Agriculture & Horticulture

In agriculture, LED light colours are employed to optimize photosynthesis and stimulate plant growth by providing specific wavelengths such as red and blue light. This targeted spectral output accelerates growth cycles and enhances crop yields, a critical advantage for agribusinesses in regions like Africa and South America where maximizing output per square meter is vital. Buyers should prioritize LEDs with precise spectral control, robust construction to withstand humid or dusty conditions, and energy-efficient models to reduce operational costs. Customizable light recipes tailored to crop types are increasingly in demand to adapt to diverse agricultural environments.

Manufacturing & Industrial Facilities

Colour-coded LED lighting plays a pivotal role in industrial safety and workflow management. Different LED colours are used to mark hazardous zones, indicate machine status, or guide personnel through complex processes. This application is especially relevant in large-scale manufacturing plants across the Middle East and Europe, where safety regulations are stringent. Buyers must ensure that LEDs meet regional safety certifications and provide high visibility in various ambient conditions. Durability against industrial contaminants and ease of integration with existing control systems are also key purchasing criteria.

Illustrative Image (Source: Google Search)

Retail & Commercial Spaces

Retailers leverage coloured LED lighting to create dynamic atmospheres and highlight products, influencing customer behavior and increasing sales. For example, warm white and soft blue tones can enhance the appeal of fashion or food displays. In markets such as France and Brazil, where consumer experience drives competitive advantage, businesses seek LEDs with excellent colour consistency and dimming capabilities to fine-tune ambiance. B2B buyers should assess suppliers’ ability to provide customizable colour options, compatibility with smart lighting controls, and warranties that cover large-scale installations.

Healthcare & Laboratories

In healthcare settings, coloured LED lights assist in diagnostic procedures and create environments conducive to healing. Specific colours can be used to reduce eye strain for medical staff or to signal different procedural stages. Buyers in this sector must prioritize LEDs with high colour rendering index (CRI) for accurate colour perception and ensure fixtures meet hygiene and sterilization standards. For B2B buyers in Europe and the Middle East, compliance with medical device regulations and certifications is essential to guarantee safety and reliability.

Transportation & Infrastructure

Traffic management systems rely heavily on LED light colours for signals, signage, and safety indicators. Red, green, and amber LEDs must be highly reliable, visible under various weather conditions, and energy-efficient to reduce maintenance costs. For infrastructure projects in emerging markets like Africa and South America, buyers should focus on LEDs with proven durability, long lifespan, and certifications that comply with local transportation authorities. Ensuring supplier capability for volume production and timely delivery is critical for large-scale deployments.

Related Video: LED – Light Emitting Diode | Basics, Characteristics, Working & Applications | LED Vs PN Diode

Strategic Material Selection Guide for led light colours

When selecting materials for LED light colours, international B2B buyers must carefully consider the interplay between material properties, environmental conditions, regulatory compliance, and end-use application. This is especially critical for buyers from diverse regions such as Africa, South America, the Middle East, and Europe, where climatic conditions, standards, and market expectations vary significantly. Below is an analysis of four common materials used in LED light colour components, focusing on their strategic implications for procurement and application.

Polycarbonate (PC)

Key Properties:

Polycarbonate is a highly transparent thermoplastic known for its excellent impact resistance, good thermal stability (temperature resistance typically up to 115°C), and superior optical clarity. It also offers moderate UV resistance and good electrical insulation properties.

Pros & Cons:

Polycarbonate’s durability and clarity make it ideal for LED lenses and colour diffusers. It withstands mechanical stress well, which is beneficial for outdoor or industrial applications. However, it can be prone to yellowing under prolonged UV exposure unless treated with UV stabilizers, increasing manufacturing complexity and cost.

Impact on Application:

Its optical clarity and toughness make PC suitable for outdoor LED lighting in harsh environments (e.g., street lighting in Middle Eastern deserts or industrial lighting in South America). However, buyers should ensure UV stabilization for regions with high sun exposure, such as Africa and the Middle East.

Considerations for International Buyers:

Compliance with ASTM D3935 (UV resistance) and EN ISO 7823 (optical properties) is often required in Europe and increasingly in other markets. Buyers in Brazil and France should verify suppliers’ adherence to these standards. Additionally, PC’s recyclability aligns well with sustainability goals prevalent in European markets.

Acrylic (PMMA)

Key Properties:

Acrylic offers excellent light transmittance (up to 92%), good weather resistance, and moderate thermal resistance (up to ~80°C). It is more brittle than polycarbonate but provides superior UV resistance without additional treatment.

Pros & Cons:

Acrylic is cost-effective and easier to fabricate than PC, making it attractive for decorative LED colour covers and indoor lighting applications. However, its brittleness limits its use in high-impact or high-temperature environments.

Impact on Application:

Ideal for indoor LED colour applications such as retail displays or architectural lighting in Europe and South America, where UV exposure is limited. Not recommended for rugged outdoor use in harsh climates like the Middle East or Africa without protective coatings.

Considerations for International Buyers:

Buyers should confirm compliance with DIN 5036 (light transmission) and ISO 7823 standards. Acrylic’s lower thermal tolerance means it must be matched carefully with LED heat output specifications, particularly in warmer climates like Brazil or the Middle East.

Silicone

Key Properties:

Silicone is a flexible, heat-resistant polymer with excellent transparency and outstanding resistance to extreme temperatures (up to 200°C). It also exhibits excellent UV and weather resistance, making it suitable for outdoor applications.

Pros & Cons:

Silicone’s flexibility and thermal stability make it ideal for LED encapsulants and colour lenses exposed to high heat and UV radiation. Its softness can be a disadvantage where rigidity is required, and it is generally more expensive than PC or acrylic.

Impact on Application:

Silicone is preferred in high-performance LED lighting requiring durability under thermal stress, such as outdoor floodlights or industrial LEDs in Africa and the Middle East. Its weather resistance also suits coastal regions in Europe and South America.

Considerations for International Buyers:

Compliance with ASTM D2000 (rubber materials) and RoHS directives is critical. Buyers should also consider silicone’s higher cost and ensure suppliers can provide consistent material grades that meet local environmental regulations, especially in Europe and Brazil.

Aluminum

Key Properties:

Aluminum is widely used for LED heat sinks and housing due to its excellent thermal conductivity, corrosion resistance (especially when anodized), and lightweight nature. It performs well under a broad temperature range (-40°C to 150°C).

Pros & Cons:

Aluminum enhances LED longevity by efficiently dissipating heat, critical for maintaining consistent LED colour output and performance. However, manufacturing complexity and cost are higher compared to plastics, and corrosion protection treatments may be necessary in humid or coastal environments.

Impact on Application:

Ideal for outdoor and industrial LED lighting applications requiring robust heat management, such as street lights in Europe and South America or industrial lighting in Africa. Anodized aluminum is preferred in humid Middle Eastern coastal areas to prevent corrosion.

Considerations for International Buyers:

Buyers should verify compliance with EN 573 (aluminum alloys) and ASTM B209 (aluminum sheet and plate) standards. Additionally, the ability to source anodized or powder-coated finishes locally or from suppliers is important to meet durability requirements in diverse climates.

| Material | Typical Use Case for led light colours | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polycarbonate | Outdoor lenses, colour diffusers for industrial and street lighting | High impact resistance and optical clarity | Prone to UV yellowing without stabilizers | Medium |

| Acrylic | Indoor decorative LED covers, retail and architectural lighting | Superior UV resistance and light transmittance | Brittle, lower thermal resistance | Low |

| Silicone | LED encapsulants, high-heat and outdoor colour lenses | Excellent thermal and UV resistance, flexibility | Higher cost, less rigid | High |

| Aluminum | Heat sinks and housings for outdoor and industrial LEDs | Excellent thermal conductivity and corrosion resistance | Higher manufacturing complexity and cost | Medium |

This guide provides international B2B buyers with a strategic framework to select materials aligned with their regional market needs, regulatory requirements, and application-specific performance demands. Prioritizing material properties such as UV resistance, thermal stability, and mechanical durability ensures optimal LED colour performance and longevity across diverse global markets.

In-depth Look: Manufacturing Processes and Quality Assurance for led light colours

The manufacturing of LED light colours involves a series of precise, controlled steps designed to ensure product consistency, reliability, and performance. For international B2B buyers—especially from regions such as Africa, South America, the Middle East, and Europe—understanding these processes and the associated quality assurance measures is crucial for making informed procurement decisions that minimize risk and maximize value.

Key Stages in LED Light Colours Manufacturing

-

Material Preparation

– Raw Semiconductor Materials: The foundation of LED colours lies in semiconductor wafers, typically made from compounds such as gallium arsenide (GaAs), gallium phosphide (GaP), or indium gallium nitride (InGaN). These materials determine the light wavelength and colour output.

– Phosphor Coatings: For white or specific coloured LEDs, phosphor materials are prepared and precisely applied to convert the emitted light spectrum.

– Substrate and Encapsulation Materials: High-purity substrates, often sapphire or silicon carbide, are readied along with encapsulants like silicone or epoxy resins, which protect the LED chip and affect optical properties. -

Wafer Fabrication and Chip Forming

– Epitaxial Growth: Using techniques like Metal-Organic Chemical Vapor Deposition (MOCVD), thin layers of semiconductor material are deposited on wafers to form the active LED layers.

– Photolithography and Etching: These microfabrication steps pattern the wafer to define individual LED chips.

– Dicing: The wafer is cut into individual chips, each capable of emitting a specific colour depending on material composition. -

Assembly

– Die Bonding: The LED chip is mounted onto a lead frame or PCB substrate, ensuring optimal electrical and thermal contact.

– Wire Bonding: Fine wires connect the chip to external circuitry.

– Phosphor Application (if applicable): For white LEDs, a phosphor layer is applied to convert blue or UV light into the desired white spectrum.

– Encapsulation and Molding: Chips are encapsulated with clear or coloured resin, often molded into lenses that shape light distribution and colour characteristics. -

Finishing and Packaging

– Lens Coating and Colour Filters: Additional coatings or filters may be applied to fine-tune colour temperature or colour rendering index (CRI).

– Marking and Labeling: Product identification, batch numbers, and certification marks are applied.

– Final Packaging: LEDs are packaged in reels, trays, or tubes suitable for automated assembly lines or bulk shipment.

Quality Assurance and Control (QA/QC) Framework

Robust QA/QC protocols are essential to guarantee the consistency, safety, and performance of LED light colours. International buyers should look for manufacturers adhering to globally recognized standards and employing systematic quality checkpoints.

International and Industry-Specific Standards

- ISO 9001: The global benchmark for quality management systems, ISO 9001 certification confirms that a manufacturer follows standardized processes and continuous improvement practices.

- CE Marking (Europe): Demonstrates compliance with EU safety, health, and environmental requirements, mandatory for sales in the European market.

- RoHS (Restriction of Hazardous Substances): Ensures that LEDs are free from harmful substances like lead or mercury, critical for compliance in Europe and increasingly important globally.

- CB Scheme: Facilitates mutual recognition of safety test results among member countries, useful for buyers in multiple regions.

- Local Certifications: Buyers in Africa, the Middle East, and South America should verify compliance with regional standards such as INMETRO in Brazil or SASO in Saudi Arabia, which often align with international benchmarks but may have specific testing requirements.

QC Checkpoints in Manufacturing

- Incoming Quality Control (IQC): Inspection and testing of raw materials and components before production begins to prevent defects from entering the process.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing stages, including visual inspections, electrical testing of LED chips, and verification of assembly integrity.

- Final Quality Control (FQC): Comprehensive testing of finished products before shipment, covering optical performance, colour accuracy, luminous flux, electrical safety, and mechanical robustness.

Common Testing Methods

- Spectral Analysis: Measures the exact wavelength and colour consistency of LEDs to ensure conformity to specified colour bins.

- Lumen Output and Efficacy Testing: Verifies the brightness and energy efficiency of the LED.

- Thermal Testing: Assesses heat dissipation and operational stability under various temperature conditions.

- Electrical Safety and Insulation Tests: Ensures compliance with international safety standards to prevent electric shock or fire hazards.

- Environmental Stress Testing: Includes humidity, vibration, and shock tests to confirm durability for diverse climates and transport conditions.

How B2B Buyers Can Verify Supplier QC

- Factory Audits: Conduct or commission on-site inspections to review manufacturing processes, equipment calibration, and staff training. For buyers from distant regions, third-party audit firms specializing in electronics manufacturing can provide unbiased assessments.

- Review Quality Documentation: Request certificates of compliance, test reports, and batch traceability records. These documents should be detailed and verifiable.

- Sample Testing: Procure product samples for independent laboratory testing, particularly spectral and photometric performance, to confirm manufacturer claims.

- Third-Party Inspection Services: Engage independent inspection companies to perform pre-shipment inspections and random batch sampling to detect defects or inconsistencies.

- Supplier Communication and Transparency: Prioritize suppliers who maintain open dialogue, share production updates, and respond promptly to quality concerns.

QC and Certification Nuances for International Buyers

- Regional Regulatory Variances: Buyers in Europe (e.g., France) must prioritize CE and RoHS compliance, while those in Brazil should confirm INMETRO certification alongside international marks. Middle Eastern buyers often require SASO or ESMA certifications, while African markets may be in transition, increasingly adopting international standards.

- Customs and Import Controls: Some countries may require additional documentation or local testing certificates, so early coordination with suppliers is essential to avoid customs delays.

- Colour Bin Consistency: Colour perception varies across markets; buyers should specify tight binning tolerances and verify supplier adherence, especially for applications demanding precise colour matching.

- Sustainability and Environmental Compliance: Increasingly important in Europe and parts of South America, environmental standards related to material sourcing and manufacturing processes can influence procurement decisions.

By thoroughly understanding the manufacturing stages and quality assurance practices for LED light colours, international B2B buyers can significantly reduce procurement risks. Prioritizing suppliers who demonstrate rigorous quality controls, hold relevant certifications, and maintain transparent operations will ensure access to reliable, high-performance LED products tailored to diverse regional requirements. This knowledge empowers buyers from Africa, South America, the Middle East, and Europe to confidently navigate the global LED market and secure sustainable competitive advantages.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led light colours Sourcing

When sourcing LED light colours for international B2B procurement, understanding the full cost structure and pricing dynamics is critical to making informed decisions that optimize value and minimize risks. The pricing of LED light colours is influenced by a combination of direct and indirect costs, as well as market-specific factors that vary across regions like Africa, South America, the Middle East, and Europe.

Key Cost Components in LED Light Colours

-

Materials: The primary cost driver includes semiconductor materials, phosphors for colour rendering, PCB substrates, and housing components. High-quality LEDs with specialized colour temperatures or RGB capabilities often use premium-grade materials, which increase cost but enhance performance and longevity.

-

Labor and Manufacturing Overhead: Labor costs vary significantly by production location. For example, manufacturing in Asia might offer lower labor expenses compared to Europe. Overhead includes factory utilities, equipment depreciation, and indirect labor, all impacting the final cost.

-

Tooling and Customization: Custom moulds, dies, and assembly line setups for specific colour configurations or unique form factors add upfront tooling costs. These are typically amortized over production volume but can increase unit costs for smaller orders.

-

Quality Control (QC): Rigorous testing to ensure colour consistency, luminous efficacy, and compliance with certifications (CE, RoHS, CB for Europe; INMETRO for Brazil; SASO for the Middle East) involves inspection labor and equipment investments. Higher QC standards correlate with higher costs but reduce failure rates and returns.

-

Logistics and Import Duties: Shipping fees, customs clearance, insurance, and tariffs vary by destination country. Buyers in Africa and South America often face higher logistics costs and import duties compared to those in Europe, impacting landed cost significantly.

-

Supplier Margin: Suppliers factor in profit margins based on brand positioning, market demand, and service level agreements. Premium suppliers with strong warranties and after-sales support usually price higher but offer greater reliability.

Influential Pricing Factors

-

Order Volume and Minimum Order Quantity (MOQ): Larger orders typically attract volume discounts, reducing per-unit cost. However, smaller buyers in emerging markets might face higher MOQs, necessitating careful negotiation or partnership with distributors to aggregate demand.

-

Product Specifications and Customization: Custom LED colours, unique wavelengths, or integrated smart controls command premium pricing. Standard white or basic RGB LEDs tend to be more cost-effective but may not meet specific application needs.

-

Material Quality and Certifications: LEDs with verified certifications for safety and environmental compliance (e.g., CE in Europe, INMETRO in Brazil) generally cost more due to compliance costs but ease market entry and reduce regulatory risks.

-

Supplier Reliability and Location: Established suppliers with proven quality records may charge higher prices but reduce risks related to defects, delays, or non-compliance. Proximity to the buyer’s market can also affect lead times and logistics costs.

-

Incoterms and Payment Terms: The choice of Incoterms (FOB, CIF, DDP, etc.) impacts who bears shipping and customs risks and costs, influencing the total landed price. Favorable payment terms can improve cash flow and reduce financing costs.

Practical Buyer Tips for Cost-Efficient Procurement

-

Negotiate Beyond Price: Engage suppliers on payment terms, warranty periods, and after-sales service to enhance overall value rather than focusing solely on unit price.

-

Evaluate Total Cost of Ownership (TCO): Consider energy efficiency, lifespan, maintenance costs, and potential downtime alongside purchase price to select LED colours offering the best long-term ROI.

-

Leverage Local Distributors: For buyers in Africa and South America, partnering with local distributors can lower logistics costs, simplify customs clearance, and improve responsiveness.

-

Verify Certifications Early: Confirm product compliance with relevant regional standards upfront to avoid costly delays or product rejections at customs.

-

Plan for MOQ Flexibility: Where possible, negotiate smaller MOQs or phased deliveries to match cash flow and inventory capacity, especially important for startups or SMEs in emerging markets.

-

Understand Pricing Nuances by Region: Europe’s stringent quality and safety regulations may increase upfront costs but reduce total risk. In contrast, buyers in the Middle East should factor in environmental conditions affecting product specifications and warranty terms.

Disclaimer on Pricing

Prices for LED light colours vary widely based on supplier, volume, specifications, and market conditions. The above analysis provides indicative insights but should be supplemented with direct supplier quotes and market research tailored to your specific procurement context.

By comprehensively analyzing these cost and pricing elements, international B2B buyers can develop strategic sourcing approaches that balance quality, compliance, and cost-efficiency—ultimately securing LED light colours that meet their operational and market requirements.

Illustrative Image (Source: Google Search)

Spotlight on Potential led light colours Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘led light colours’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led light colours

When sourcing LED light colours for international B2B procurement, understanding the technical properties and trade terminology is crucial to ensure product quality, compatibility, and smooth transactions. Below are key specifications and terms every buyer should know to make informed decisions and optimize supplier negotiations.

Critical Technical Properties of LED Light Colours

-

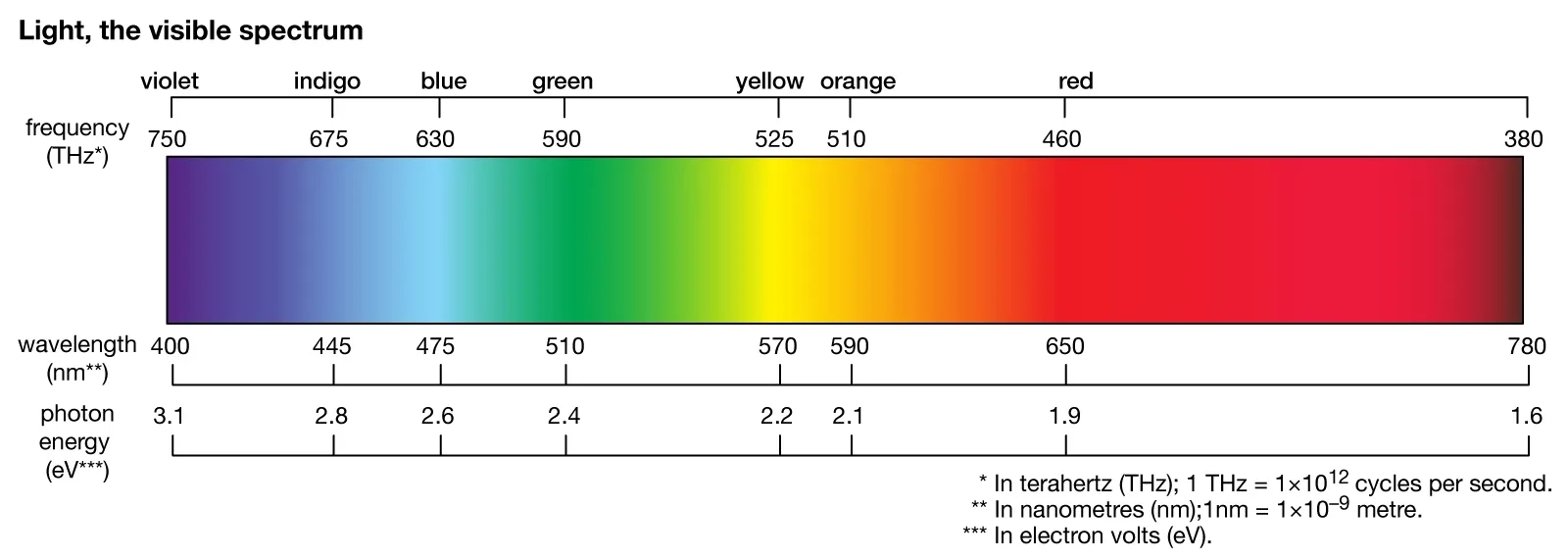

Color Temperature (Kelvin, K)

This measures the hue of the LED light, ranging from warm (around 2700K, yellowish) to cool (6500K, bluish-white). For buyers, selecting the right color temperature affects ambience and application suitability—retail spaces might prefer warmer tones, while offices often use cooler whites. Consistency in color temperature across batches is vital for brand uniformity and customer satisfaction. -

Color Rendering Index (CRI)

CRI indicates how accurately the LED light renders colors compared to natural light, on a scale of 0 to 100. Higher CRI (above 80) is essential for applications like retail, healthcare, and art galleries where true color representation matters. B2B buyers should prioritize CRI specifications aligned with end-use requirements to avoid costly returns or complaints. -

Luminous Flux (Lumens)

This denotes the total light output of the LED. Understanding lumens helps buyers compare brightness levels between different LED products, ensuring adequate illumination for the intended space. It’s important to balance luminous flux with energy efficiency to meet sustainability goals and operational cost targets. -

Bin Sorting / Binning Tolerance

Binning refers to the sorting of LEDs by color and brightness during manufacturing to ensure uniformity. Tight binning tolerances guarantee consistent color appearance in large installations, which is especially important for architectural or commercial lighting projects. Buyers should request detailed binning data to avoid mismatched lighting effects. -

Material Grade and Chip Type

The semiconductor material (typically Gallium Nitride for blue and white LEDs) and chip design influence durability, efficiency, and color stability. High-grade materials result in longer-lasting LEDs with less color shift over time. For buyers in regions with harsh climates, verifying material quality is key to ensuring product longevity and reducing warranty claims. -

Color Stability and Lifetime

Over time, LED colors can shift due to heat and material degradation. Specifications on color stability and rated lifetime (usually in hours) help buyers assess long-term performance and maintenance costs. Opting for LEDs with proven stability reduces operational disruptions and replacement expenses.

Common Trade Terminology for LED Procurement

-

OEM (Original Equipment Manufacturer)

Refers to suppliers who produce LEDs or lighting products that buyers can brand and market as their own. OEM partnerships enable customization and private labeling, which is valuable for businesses aiming to differentiate in local markets like Africa, South America, or Europe. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. Understanding MOQ is critical for inventory planning and cost management, especially for emerging markets where demand may fluctuate. Negotiating MOQs can improve cash flow and reduce storage costs. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for pricing, lead times, and terms based on specific product requirements. RFQs enable buyers to compare multiple suppliers effectively and ensure transparency in pricing and capabilities. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyers and sellers. Familiarity with Incoterms (e.g., FOB, CIF, DDP) helps buyers manage logistics risks and costs, especially when dealing with cross-continental shipments to regions like the Middle East or Europe. -

Bin Code

A code assigned to a batch of LEDs indicating specific color and brightness characteristics after binning. Buyers use bin codes to confirm consistency across orders and ensure compliance with project specifications. -

LM80 Report

A test report verifying the lumen maintenance of LED products over time, indicating how long an LED will maintain a certain brightness level. This certification is important for buyers focused on reliability and long-term value.

Actionable Tip: When evaluating suppliers, request detailed datasheets covering these technical properties and certifications. Also, clarify trade terms upfront to avoid misunderstandings during order fulfillment. Doing so ensures your procurement aligns with regional market needs and regulatory standards, ultimately supporting successful LED lighting projects worldwide.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led light colours Sector

Market Overview & Key Trends

The global market for LED light colours is experiencing rapid evolution driven by technological innovation, sustainability mandates, and shifting consumer and industrial demands. For international B2B buyers, particularly those operating across Africa, South America, the Middle East, and Europe, understanding these market dynamics is critical to making strategic sourcing decisions.

Key Drivers:

– Energy Efficiency and Regulation: Governments worldwide are enforcing stricter energy efficiency standards, pushing businesses to adopt LED lighting solutions that reduce power consumption and carbon footprints. Regions like the European Union emphasize directives such as the Ecodesign Regulation, while countries in Africa and South America are increasingly adopting energy-saving initiatives, creating growing demand for efficient LED colour lighting.

– Customization and Smart Integration: Buyers seek LEDs that offer precise colour tuning and dynamic lighting capabilities for applications ranging from commercial displays to smart city infrastructure. Advances in multi-colour LEDs and RGB technology enable tailored ambience and enhanced user experiences. This trend is particularly strong in urbanizing regions with expanding commercial sectors.

– Supply Chain Localization & Diversification: Recent global disruptions have highlighted the need for resilient supply chains. African and Middle Eastern buyers increasingly prioritize suppliers with local or regional manufacturing capabilities or those who can guarantee consistent delivery timelines. European buyers focus on suppliers compliant with stringent quality and environmental certifications.

– Emerging Technologies: Innovations such as tunable white LEDs and high-CRI (Color Rendering Index) options are gaining traction, allowing businesses to enhance product appeal and meet sector-specific needs, such as retail or healthcare lighting. For B2B buyers, sourcing products with these advanced features can unlock competitive advantages.

Market Dynamics:

– Pricing varies widely depending on LED chip quality, colour accuracy, and certification compliance. Buyers from emerging markets often balance cost against quality and warranty assurances, while European buyers prioritize compliance and longevity.

– Bulk procurement strategies increasingly favor suppliers offering flexible MOQ (Minimum Order Quantity) and customization services to suit diverse market requirements across continents.

– Digital platforms and direct supplier partnerships are becoming essential for transparency, reducing lead times, and accessing real-time product data, especially for complex colour LED products.

Sustainability & Ethical Sourcing in B2B

Sustainability is no longer optional in the LED light colours sector—it is a decisive factor shaping procurement and supplier selection. B2B buyers must evaluate the environmental impact of LED production, the ethical practices of their supply chain partners, and certifications that validate green credentials.

Environmental Impact:

– LED manufacturing involves raw materials such as rare earth elements and semiconductors, whose extraction can be environmentally intensive. Buyers should engage suppliers committed to responsible sourcing of these materials to minimize ecological damage.

– Energy-efficient LEDs contribute significantly to reducing greenhouse gas emissions over their lifecycle compared to traditional lighting. Selecting LEDs with high energy star ratings and low power consumption supports corporate sustainability goals and regulatory compliance.

Ethical Supply Chains:

– Transparency and traceability are crucial for ensuring fair labor practices and conflict-free sourcing, especially for components sourced from regions prone to ethical risks. Buyers should prioritize suppliers with audited supply chains and certifications such as ISO 14001 (Environmental Management) and SA8000 (Social Accountability).

– Collaboration with suppliers who invest in recycling programs for LED components and packaging reduces waste and supports circular economy principles.

Green Certifications & Materials:

– Certifications like RoHS (Restriction of Hazardous Substances), CE marking in Europe, and ENERGY STAR in North America signal compliance with environmental and safety standards. For Africa, Middle East, and South America buyers, aligning procurement with these certifications enhances product acceptance and marketability.

– The use of eco-friendly materials, such as lead-free solder and recyclable plastics, is becoming a standard expectation. Buyers should request detailed environmental product declarations (EPDs) to assess the sustainability profile of LED colour products.

Evolution of LED Light Colours in B2B Context

The development of LED light colours reflects a trajectory from simple indicator lights to sophisticated, tunable lighting solutions integral to modern business environments. Initially, LEDs were available in basic colours—primarily red, green, and amber—used mainly for signaling and display purposes. As semiconductor technology advanced, manufacturers introduced blue and white LEDs, enabling broader applications in general and decorative lighting.

By the 2010s, multi-colour and RGB LEDs became commercially viable, allowing dynamic colour mixing and enhanced visual effects. This evolution opened new markets in retail, hospitality, and urban lighting where ambience and branding are key. For B2B buyers, this history underscores the importance of sourcing from suppliers who stay abreast of technological advances and can provide tailored LED colour solutions that meet evolving market demands.

The ongoing innovation in LED colour technology, combined with increasing emphasis on sustainability and supply chain integrity, means B2B buyers must approach procurement with a strategic, informed mindset—balancing cost, quality, compliance, and environmental responsibility to secure long-term value.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of led light colours

-

How can I effectively vet LED light colour suppliers in different international markets?

To vet suppliers across Africa, South America, the Middle East, and Europe, start by verifying their compliance with regional certifications such as CE and RoHS for Europe, or CCC for suppliers exporting to Asia. Request detailed product datasheets specifying colour temperature, CRI (Colour Rendering Index), and binning consistency to ensure colour uniformity. Conduct factory audits or use third-party inspection services to assess manufacturing capabilities and quality control processes. Checking supplier references and reviewing past export performance will also help mitigate risks associated with quality and delivery reliability. -

Is it possible to customize LED light colours to fit specific market preferences or applications?

Yes, customization is often available but varies by supplier. Many manufacturers can adjust LED colour temperatures (e.g., warm white to cool white) and produce RGB or tunable white options tailored for retail, hospitality, or industrial applications. When sourcing internationally, clarify minimum order quantities (MOQs) and lead times for custom colours, as these can be higher than standard offerings. Request prototypes or samples to verify colour accuracy before committing to large orders, and ensure suppliers can provide consistent binning to maintain uniformity across production batches. -

What should I expect regarding minimum order quantities (MOQs), lead times, and payment terms when sourcing LED light colours internationally?

MOQs typically range from a few hundred to several thousand units, depending on the complexity of the LED colour and customization. Lead times may vary from 4 to 12 weeks, especially when custom colours or certifications are involved. Payment terms often require a 30-50% deposit upfront with the balance due before shipment or upon delivery. Negotiate terms that balance risk and cash flow, and consider suppliers offering trade assurance or escrow services to protect your investment during international transactions. -

Which quality assurance certifications are essential when purchasing LED light colours for diverse international markets?

For Europe, CE marking and RoHS compliance are mandatory to ensure safety and environmental standards. Middle Eastern buyers should look for IEC and SASO certifications, while African markets may require SABS or SONCAP approvals. Additionally, ISO 9001 certification indicates robust quality management systems. Verify that suppliers provide test reports on lumen maintenance, colour stability, and binning data to guarantee consistent LED colour output. Certifications not only reduce regulatory risks but also enhance the credibility and resale value of your products. -

How can I manage logistics and shipping challenges for international orders of LED light colours?

Partner with suppliers experienced in cross-border shipments who understand local customs and import regulations. Choose shipping methods balancing cost and delivery speed, such as sea freight for bulk orders or air freight for urgent needs. Confirm packaging standards to prevent damage and colour distortion during transit, and ensure tracking visibility. Use Incoterms like FOB or CIF to clarify responsibilities for freight and insurance. For complex or large orders, consider working with freight forwarders or 3PL providers specializing in lighting products. -

What are the best practices for handling disputes or quality issues with overseas LED light colour suppliers?

Establish clear contractual terms covering product specifications, inspection rights, warranty periods, and remedies for defects. Conduct pre-shipment inspections or use third-party quality control agencies to identify issues early. In case of disputes, maintain professional communication, document all correspondence, and escalate through supplier management or trade dispute resolution services if necessary. Leveraging international trade agreements and arbitration clauses can facilitate resolution. Building long-term relationships with trustworthy suppliers reduces the likelihood of recurring problems. -

How do regional preferences influence LED light colour selection for B2B buyers?

Cultural and climatic factors significantly affect colour temperature preferences; for example, warmer whites (2700K–3500K) are popular in Europe and the Middle East for hospitality settings, while cooler whites (4000K–6500K) may be preferred in industrial and commercial spaces in South America and Africa. Understanding end-user requirements and local lighting standards helps tailor product offerings. Buyers should request region-specific photometric data and colour samples to ensure market acceptance and compliance with local lighting norms. -

What strategies can optimize cost-effectiveness when sourcing LED light colours internationally?

Consolidate orders to meet MOQs and negotiate volume discounts while balancing inventory costs. Prioritize suppliers with streamlined manufacturing and strong supply chain networks to reduce lead times and avoid costly delays. Validate supplier claims on energy efficiency and lifespan to ensure long-term savings for your customers. Consider total landed cost—including duties, taxes, and shipping—rather than just unit price. Finally, build strategic partnerships with reliable suppliers to access better payment terms, customization options, and after-sales support, enhancing overall procurement value.

Strategic Sourcing Conclusion and Outlook for led light colours

In today’s dynamic global LED market, strategic sourcing of LED light colours is pivotal for international B2B buyers aiming to balance quality, compliance, and cost-effectiveness. Understanding the nuances of LED colour technology—from precise colour rendering to energy efficiency—enables buyers to select lighting solutions tailored to their unique commercial or industrial applications. Rigorous supplier evaluation, including verification of certifications such as CE, RoHS, and region-specific approvals, safeguards against quality inconsistencies and regulatory risks.

For buyers across Africa, South America, the Middle East, and Europe, leveraging partnerships with reputable manufacturers who offer customization and reliable logistics is essential. This approach not only optimizes operational performance but also supports sustainability goals increasingly prioritized in these markets. Furthermore, adopting a strategic sourcing mindset helps mitigate supply chain disruptions and unlocks competitive pricing advantages through volume and long-term collaboration.

Looking ahead, the evolving landscape of LED technology—with advancements in tunable colour temperatures and smart lighting integration—presents exciting opportunities for buyers ready to innovate. International B2B purchasers are encouraged to deepen market intelligence, invest in supplier relationships, and embrace emerging trends to future-proof their lighting portfolios and drive business growth in their regions.