Guide to Candela Vs Lumens

- Introduction: Navigating the Global Market for candela vs lumens

- Understanding candela vs lumens Types and Variations

- Key Industrial Applications of candela vs lumens

- Strategic Material Selection Guide for candela vs lumens

- In-depth Look: Manufacturing Processes and Quality Assurance for candela vs lumens

- Comprehensive Cost and Pricing Analysis for candela vs lumens Sourcing

- Spotlight on Potential candela vs lumens Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for candela vs lumens

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the candela vs lumens Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of candela vs lumens

- Strategic Sourcing Conclusion and Outlook for candela vs lumens

Introduction: Navigating the Global Market for candela vs lumens

In today’s competitive global lighting market, understanding the distinction between candela and lumens is essential for making strategic sourcing decisions. These two fundamental units of light measurement influence not only product performance but also application suitability, cost efficiency, and compliance with regional standards. For international B2B buyers across Africa, South America, the Middle East, and Europe—especially in dynamic markets like Italy and Vietnam—mastering this knowledge is key to securing the right lighting solutions that meet diverse operational demands.

This comprehensive guide delves into the critical differences between candela and lumens, unpacking how each metric affects brightness perception, beam focus, and energy efficiency. Beyond definitions, it explores various lighting types and materials, manufacturing processes, and quality control protocols that impact these measurements. Buyers will gain insights into evaluating suppliers, understanding cost implications, and navigating market trends to optimize procurement outcomes.

With tailored sections addressing frequently asked questions and regional market considerations, this resource empowers decision-makers to confidently assess product specifications and negotiate terms that align with their unique project requirements. Whether sourcing high-intensity directional lighting for industrial applications or broad luminous flux fixtures for commercial spaces, this guide equips B2B buyers with the expertise to balance performance with cost-effectiveness on a global scale.

By integrating technical clarity with practical sourcing strategies, international buyers can minimize risks, improve product quality, and enhance operational efficiency—ultimately driving sustainable growth in their lighting investments.

Understanding candela vs lumens Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Total Luminous Flux (Lumens) | Measures total visible light output in all directions | General lighting design, retail lighting | + Easy to compare overall brightness – Does not indicate directionality |

| Luminous Intensity (Candela) | Measures light intensity in a specific direction | Spotlights, directional lighting, stage lighting | + Critical for focused lighting needs – Complex to measure and interpret |

| Beam Angle Variations | Changes in light spread affecting candela but less so lumens | Architectural lighting, outdoor floodlights | + Allows customization of light focus – Wider beams reduce intensity (cd) |

| Steradian-Based Metrics | Uses solid angle measurement to relate lumens and candela | Precision lighting, automotive headlights | + Enables precise light distribution analysis – Requires technical understanding |

| Directional vs Omni-Directional | Differentiates between focused beam and all-around light output | Industrial inspection, general illumination | + Helps select appropriate fixture type – Misapplication can lead to inefficiency |

Total Luminous Flux (Lumens)

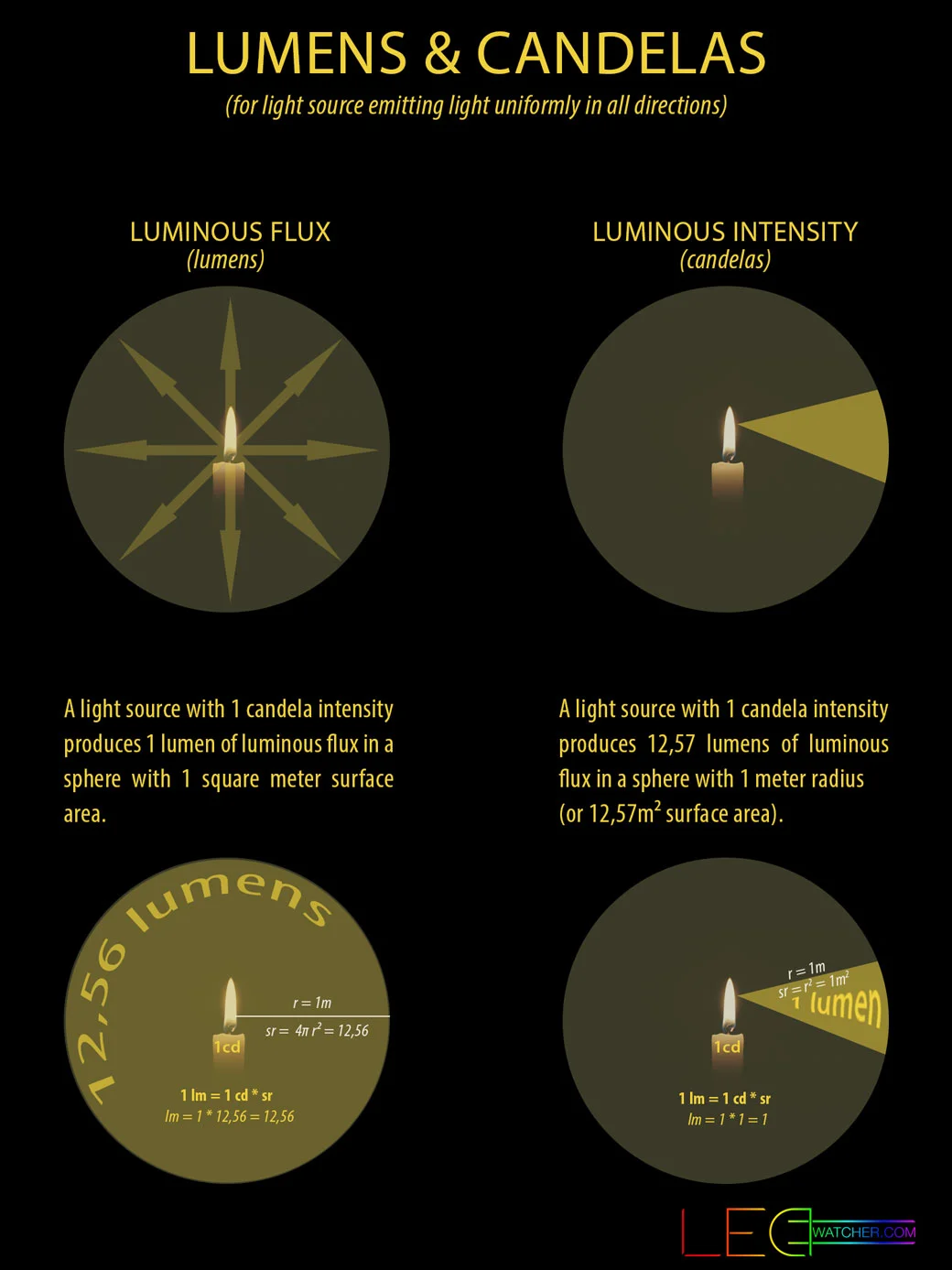

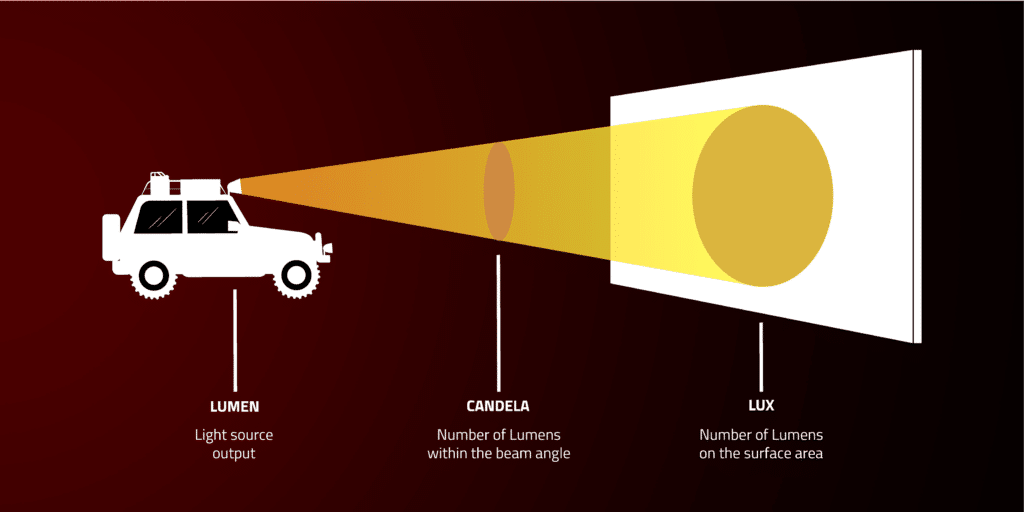

Lumens quantify the total amount of visible light emitted by a source, regardless of direction. This makes lumens a straightforward metric for buyers assessing overall brightness, especially for general illumination applications such as office lighting, retail stores, or warehouses. B2B buyers in Africa, South America, and Europe often prioritize lumens when comparing lighting products due to its simplicity. However, lumens do not provide information about how light is distributed, which can be a limitation for specialized applications requiring focused lighting.

Luminous Intensity (Candela)

Candela measures the intensity of light emitted in a particular direction, making it essential for applications where beam focus is critical, such as stage lighting, spotlights, or security lighting. For B2B buyers in sectors like event management or outdoor lighting in the Middle East and Europe, understanding candela helps optimize light placement and performance. The challenge lies in its complexity; candela requires knowledge of beam angles and solid angles, which may necessitate technical consultation during procurement.

Beam Angle Variations

Beam angle directly affects candela values by altering how light spreads from the source. Narrow beam angles concentrate light, increasing candela, while wider angles spread light more diffusely, reducing intensity. This variation is crucial for architectural lighting projects or outdoor floodlighting where control over light focus impacts energy efficiency and visual effect. Buyers must consider beam angle specifications carefully to match lighting fixtures to their spatial and functional requirements.

Steradian-Based Metrics

The relationship between lumens and candela involves the solid angle measured in steradians. This metric allows precise calculation of how much light is emitted per unit of solid angle, facilitating detailed analysis of light distribution patterns. For advanced B2B buyers in automotive or precision manufacturing industries, steradian-based measurements enable tailored lighting solutions that improve operational efficiency. However, interpreting steradian data requires technical expertise, which may influence purchasing decisions and supplier selection.

Directional vs Omni-Directional Lighting

Directional lighting focuses light in a specific area, measured primarily by candela, while omni-directional lighting emits light uniformly in all directions, measured by lumens. Understanding this distinction helps B2B buyers select fixtures that align with their application needs—directional for task lighting or omni-directional for ambient lighting. Misapplication can lead to inefficient lighting setups and increased operational costs, especially in large-scale commercial or industrial environments common in Africa and South America.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of candela vs lumens

| Industry/Sector | Specific Application of candela vs lumens | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | Headlight and signal lighting design | Ensures optimal directional intensity for safety and compliance | Compliance with regional lighting standards, beam angle precision |

| Stage & Event Production | Spotlight and beam light configuration | Maximizes focused light intensity for visual impact | Adjustable beam angles, high candela rating, energy efficiency |

| Mining & Heavy Industry | High-intensity task lighting in confined or outdoor environments | Improves worker safety and operational efficiency | Durability under harsh conditions, luminous flux vs intensity balance |

| Architectural Lighting | Façade and landscape illumination | Balances overall brightness and directional focus for aesthetics | Weather resistance, customizable beam spread, color temperature |

| Security & Surveillance | Perimeter and access point illumination | Provides focused, intense lighting for deterrence and clarity | Long-range intensity, low glare, energy consumption |

Automotive Manufacturing

In automotive production, understanding candela versus lumens is critical for designing headlights and signal lights that comply with safety regulations across diverse markets like Europe and the Middle East. Lumens quantify the total light emitted, while candela ensures the light is concentrated in specific directions to avoid glare and improve visibility. Buyers from regions such as Italy or South America should prioritize suppliers offering precise beam angle control and certification to meet local vehicle lighting standards.

Stage & Event Production

For stage lighting in entertainment hubs across Africa and Europe, candela measurements guide the selection of spotlights and beam lights that require intense, focused beams to create dramatic effects. While lumens indicate brightness, candela determines the intensity at a target area. B2B buyers should focus on fixtures with adjustable beam angles and high candela output to optimize visual impact while managing energy consumption, crucial for large-scale events.

Mining & Heavy Industry

Mining operations in South America and the Middle East demand lighting solutions that provide both broad illumination and intense focused beams for safety and productivity in challenging environments. Candela values help in selecting lights that deliver strong directional intensity to illuminate specific work zones, while lumens ensure overall brightness. Buyers must consider ruggedness, thermal management, and the balance of luminous flux and intensity for reliable performance underground or outdoors.

Architectural Lighting

In architectural and landscape lighting projects, especially in European cities and African urban developments, balancing lumens and candela is essential to highlight structures attractively without causing light pollution. Lumens assess the total light output, whereas candela focuses on the intensity in particular directions to create desired visual effects. International buyers should seek lighting products with customizable beam spreads and weather-resistant features tailored to local climate and design codes.

Security & Surveillance

Security lighting in commercial and industrial sectors across the Middle East and Europe relies heavily on candela to ensure intense, focused illumination of perimeters and access points. While lumens indicate the overall brightness, candela confirms the beam’s strength at a distance, crucial for deterrence and surveillance clarity. Buyers should prioritize sourcing lights with long-range intensity, low glare, and energy-efficient technologies to meet security requirements sustainably.

Related Video: Weapon Light Buyer’s Guide: Candela Vs. Lumens & Which One Is Right For You 🔦

Strategic Material Selection Guide for candela vs lumens

When selecting materials for lighting components and fixtures where candela and lumens measurements are critical, it is essential to consider how the material properties influence light output, durability, and compliance with international standards. Below is an analysis of four common materials used in lighting product manufacturing, focusing on their relevance to candela and lumens performance, manufacturing considerations, and regional compliance factors for B2B buyers across Africa, South America, the Middle East, and Europe.

Aluminum

Key Properties: Aluminum offers excellent thermal conductivity, lightweight characteristics, and good corrosion resistance, especially when anodized. It withstands moderate temperature ranges and is often used in heat sinks for LED lighting to maintain lumen output by preventing overheating.

Pros & Cons: Aluminum is cost-effective and easy to machine or extrude into complex shapes, making it ideal for fixtures requiring precise beam control to optimize candela intensity. However, it can oxidize if not properly treated, which may affect appearance and longevity in harsh environments.

Impact on Application: Its thermal management capabilities help sustain luminous flux (lumens) by protecting LEDs from heat damage. Aluminum’s reflectivity can be enhanced with coatings to improve light directionality, supporting higher candela values in focused lighting applications.

Regional Considerations: In Europe (e.g., Italy) and the Middle East, anodized aluminum must meet EN and ASTM standards for corrosion resistance. African and South American markets may prioritize cost and availability, with a focus on durability under tropical climates. Compliance with RoHS and REACH regulations is increasingly important for international trade.

Borosilicate Glass

Key Properties: Borosilicate glass is highly resistant to thermal shock and chemical corrosion, with excellent optical clarity. It can handle high temperatures without deforming, making it suitable for lenses and protective covers in lighting.

Pros & Cons: Its transparency ensures minimal lumen loss and maintains beam quality, directly impacting candela measurements by preserving light intensity. However, it is brittle and prone to breakage, increasing shipping and handling costs.

Impact on Application: Used in lenses and covers, borosilicate glass ensures the light beam remains focused, preserving luminous intensity (candela) and total light output (lumens). Its resistance to UV degradation is crucial for outdoor lighting solutions common in the Middle East and parts of Africa.

Regional Considerations: European buyers often require compliance with DIN and EN optical standards, while South American and African markets may emphasize durability and cost-efficiency. Importers in Vietnam and other Asian markets look for JIS certification and supplier reliability.

Polycarbonate (PC)

Key Properties: Polycarbonate is a durable, impact-resistant plastic with good optical clarity and UV resistance when treated. It performs well under a wide temperature range and is lighter than glass.

Pros & Cons: PC is less expensive and easier to mold than glass, offering flexibility in design for directional lighting to optimize candela. However, it may yellow over time under prolonged UV exposure, reducing lumen output and beam quality.

Impact on Application: Ideal for lenses and diffusers where weight and impact resistance are critical, such as in portable lighting or outdoor fixtures. Its ability to maintain beam shape supports consistent candela values, though lumen depreciation should be considered in lifecycle analysis.

Regional Considerations: Polycarbonate products must meet ASTM and ISO standards for UV resistance and impact strength, especially for export to Europe and the Middle East. African and South American buyers often seek cost-effective solutions with acceptable durability, while Vietnam’s market demands compliance with JIS and environmental regulations.

Stainless Steel (e.g., 304/316 grades)

Key Properties: Stainless steel offers excellent corrosion resistance, high mechanical strength, and good thermal stability. Grades 304 and 316 are common, with 316 providing superior resistance to chloride environments.

Pros & Cons: While heavier and more expensive than aluminum, stainless steel is preferred for structural components and enclosures in harsh environments, protecting internal optics that influence candela and lumens performance. Manufacturing complexity and cost are higher due to machining and finishing requirements.

Impact on Application: Stainless steel enclosures protect sensitive optical components from environmental degradation, ensuring consistent light intensity and output over time. It is especially valuable for outdoor and marine lighting applications prevalent in coastal regions of South America and the Middle East.

Regional Considerations: Compliance with ASTM A240 and EN 10088 standards is critical for European and Middle Eastern markets. African buyers value corrosion resistance in coastal and industrial areas, while South American clients may require certifications aligned with local standards. Vietnam’s importers often look for ISO 9001 certified suppliers.

| Material | Typical Use Case for candela vs lumens | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum | Heat sinks and fixture bodies for LED lighting | Excellent thermal conductivity and lightweight | Requires surface treatment for corrosion resistance | Medium |

| Borosilicate Glass | Lenses and protective covers for focused beam lighting | High optical clarity and thermal shock resistance | Brittle and fragile, higher shipping risk | High |

| Polycarbonate (PC) | Lenses, diffusers, and outdoor portable lighting | Impact resistant, lightweight, cost-effective | Prone to UV yellowing, lumen degradation | Low |

| Stainless Steel | Structural enclosures and housings for harsh environments | Superior corrosion resistance and strength | Heavy, costly, complex manufacturing | High |

In-depth Look: Manufacturing Processes and Quality Assurance for candela vs lumens

Understanding the manufacturing processes and quality assurance protocols behind lighting products, especially those involving metrics like candela and lumens, is crucial for international B2B buyers. This knowledge ensures that buyers source products that meet stringent performance and safety standards, tailored to their regional market requirements.

Manufacturing Processes for Lighting Products (Candela and Lumens Focus)

The production of lighting fixtures and components designed to achieve specific luminous flux (lumens) and luminous intensity (candela) involves several carefully controlled stages:

1. Material Preparation

- Raw Material Sourcing: High-quality materials such as optical-grade glass, aluminum for heat sinks, and semiconductor-grade silicon for LEDs are selected. Suppliers often require certifications to ensure material purity and consistency.

- Component Fabrication: LED chips are fabricated using semiconductor manufacturing techniques, including epitaxial growth and photolithography, to achieve precise luminous output characteristics.

- Optics Preparation: Lenses and reflectors are molded from polycarbonate or glass using injection molding or precision pressing to control beam angles, which directly affect candela values.

2. Forming and Processing

- Heat Sink and Housing Formation: Metal parts are stamped, extruded, or CNC-machined to ensure efficient thermal management critical for maintaining lumen output over product lifespan.

- Optical Component Shaping: Precision tooling ensures lenses and reflectors meet design specifications for beam shaping, directly impacting luminous intensity distribution.

3. Assembly

- LED Mounting: LED chips are mounted onto printed circuit boards (PCBs) using automated pick-and-place machines, followed by soldering, often reflow or wave soldering.

- Optical Alignment: Lenses and reflectors are carefully aligned with LEDs to achieve the desired beam angles, affecting candela measurements.

- Integration: Electrical components, drivers, and housings are assembled, ensuring proper electrical connectivity and mechanical stability.

4. Finishing

- Coating and Surface Treatment: Anti-reflective coatings on lenses and corrosion-resistant treatments on metal housings improve optical performance and durability.

- Labeling and Packaging: Products are labeled with key technical specifications, including lumen output and candela ratings, and packed to prevent damage during transit.

Quality Assurance and Control (QA/QC) Frameworks

Maintaining consistent luminous flux and intensity requires rigorous quality control throughout production. B2B buyers should be aware of the following QA/QC stages and standards:

International and Industry Standards

- ISO 9001: The fundamental quality management system standard ensuring consistent manufacturing and continuous improvement.

- IEC 62717 & IEC 62722: Specific to LED modules and luminaires, these standards govern photometric performance and safety.

- CE Marking: Mandatory for products sold within the European Economic Area, indicating compliance with health, safety, and environmental protection standards.

- RoHS & REACH: Environmental compliance standards limiting hazardous substances and ensuring safe chemical use.

- Other Regional Standards: Depending on the market, compliance with standards such as SASO (Saudi Arabia), INMETRO (Brazil), or SON (Nigeria) may be required.

QC Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials and components for compliance with specifications (e.g., LED binning for lumen output consistency).

- In-Process Quality Control (IPQC): Monitoring assembly accuracy, solder joint quality, and optical alignment to ensure design targets for candela and lumens are met.

- Final Quality Control (FQC): Comprehensive testing of finished products, including photometric testing, electrical safety, and durability tests.

Common Testing Methods for Candela and Lumens Verification

- Integrating Sphere Testing: Measures total luminous flux (lumens) emitted by the light source in all directions, crucial for verifying lumen claims.

- Goniophotometer Testing: Measures luminous intensity distribution (candela) at various angles, essential for applications requiring directional lighting.

- Thermal Testing: Ensures heat dissipation to maintain lumen maintenance over product lifetime.

- Electrical Safety Testing: Verifies compliance with voltage, current, and insulation standards.

- Environmental Testing: Includes humidity, vibration, and shock tests to simulate real-world operating conditions.

Verifying Supplier Quality Control for International B2B Buyers

For buyers in Africa, South America, the Middle East, and Europe, verifying supplier QC practices is paramount to mitigating risks associated with inconsistent lighting performance and regulatory non-compliance.

Recommended Verification Approaches

- Factory Audits: On-site evaluations of manufacturing processes, material handling, and QC systems, ideally conducted by third-party inspection agencies.

- Review of QC Documentation: Examination of inspection reports, test certificates (e.g., LM-79 for photometric data), and compliance certificates.

- Sample Testing: Independent laboratory testing of product samples for lumen output, candela distribution, and safety compliance.

- Third-Party Certifications: Preference for suppliers with recognized certifications such as UL, TUV, or Intertek which provide additional assurance.

Regional Nuances for QC and Compliance

- Africa: Import regulations may require SON or SABS certification; buyers should ensure suppliers provide appropriate documentation to avoid customs delays.

- South America: INMETRO certification is critical; B2B buyers should verify that lighting products meet local photometric and safety standards.

- Middle East: SASO and G-Mark certifications are often mandatory; understanding regional electrical standards (e.g., 220-240V, 50Hz) is essential.

- Europe (e.g., Italy): Strict adherence to CE, RoHS, and WEEE directives is expected; buyers should demand full technical files and Declarations of Conformity.

- Emerging Manufacturing Hubs (e.g., Vietnam): While cost-effective, buyers should emphasize rigorous supplier audits and insist on international standard compliance to ensure product reliability.

Strategic Recommendations for B2B Buyers

- Specify Photometric Requirements Clearly: Provide detailed lumen and candela targets, including beam angles and distribution patterns, to suppliers upfront.

- Request Detailed QC Plans: Insist on documented QC procedures aligned with international standards and supplier willingness to accommodate buyer audits.

- Leverage Technology: Use digital tools for remote factory inspections and real-time QC data sharing to maintain oversight, especially when sourcing from distant regions.

- Build Long-Term Supplier Partnerships: Collaborate closely with manufacturers to improve processes, customize products, and ensure sustained quality.

- Understand Total Cost of Ownership: Factor in quality-related costs such as warranty claims, replacements, and energy efficiency when evaluating supplier proposals.

By integrating a deep understanding of manufacturing processes and robust quality assurance mechanisms, international B2B buyers can confidently source lighting products optimized for their specific application needs, ensuring optimal luminous flux and intensity performance aligned with regional compliance and operational demands.

Related Video: China’s Top 5 Manufacturing and Mass Production Videos | by @miracleprocess

Comprehensive Cost and Pricing Analysis for candela vs lumens Sourcing

Cost Structure Analysis for Candela and Lumens-Based Lighting Products

When sourcing lighting products where candela and lumens specifications are critical, understanding the underlying cost components is essential for international B2B buyers. The overall cost structure typically includes:

- Materials: High-quality LEDs, optics (lenses and reflectors), heat sinks, and housing materials (e.g., aluminum, polycarbonate) drive the base material cost. Precision optics to control candela (light intensity) often increase material costs compared to simpler lumen-focused designs.

- Labor: Skilled labor is needed for assembly, especially for products with complex beam shaping to optimize candela. Labor costs vary significantly by region, impacting price competitiveness.

- Manufacturing Overhead: Includes factory utilities, equipment depreciation, and indirect labor. More sophisticated manufacturing processes for precise candela control can elevate overhead costs.

- Tooling: Custom molds for lenses and housings used to achieve specific beam angles (affecting candela) require upfront investment, often amortized over large production volumes.

- Quality Control (QC): Stringent QC is necessary to ensure lighting performance meets specifications for both lumens and candela, particularly for certifications like CE (Europe) or SASO (Middle East).

- Logistics: Freight costs, customs duties, and import taxes must be factored in, especially for buyers in Africa, South America, and parts of the Middle East where shipping infrastructure and tariffs vary widely.

- Margin: Suppliers factor in profit margins which depend on market demand, brand positioning, and competition.

Key Price Influencers in Candela vs Lumens Lighting Sourcing

Several factors influence the final price of lighting products specified by candela or lumens values:

- Order Volume / Minimum Order Quantity (MOQ): Larger orders reduce per-unit costs due to economies of scale, tooling amortization, and streamlined logistics. Small or trial orders often carry higher unit prices.

- Product Specifications & Customization: Tailoring beam angles, lumen output, or intensity (candela) profiles requires specialized optics and may increase tooling and R&D costs.

- Material Quality: Premium LEDs with higher efficacy and longer life span command higher prices but reduce total cost of ownership (TCO).

- Certifications & Compliance: Products certified for specific markets (e.g., CE for Europe, INMETRO for Brazil) have higher upfront costs but facilitate smoother market entry.

- Supplier Reputation & Location: Established suppliers with proven quality may price higher but offer reliability and warranty benefits. Regional suppliers may offer cost advantages but require due diligence.

- Incoterms: Delivery terms (FOB, CIF, DDP) affect who bears logistics and customs costs, impacting landed cost and cash flow planning.

Buyer Tips for Cost-Efficient International Sourcing

- Negotiate Based on Total Cost of Ownership: Look beyond unit price. Factor in energy efficiency (lumens per watt), product lifespan, warranty, and maintenance costs to identify true value.

- Leverage Volume Discounts: Consolidate orders or partner with other buyers in your region (Africa, South America, Middle East, Europe) to meet MOQs and negotiate better pricing.

- Specify Clear Technical Requirements: Precise candela and lumen specifications avoid costly redesigns or product mismatches. Use photometric data sheets and beam angle details to align expectations.

- Consider Local Compliance Early: Engage suppliers who understand regional certification requirements to avoid expensive delays or product rejections.

- Assess Supplier Logistics Capabilities: Prioritize suppliers with proven international shipping experience and transparent Incoterms to minimize unexpected freight or customs charges.

- Request Samples and Conduct Testing: Especially important for lighting intensity (candela) to verify beam focus and light distribution before large purchases.

- Plan for Currency Fluctuations: Hedging or negotiating in stable currencies can protect against exchange rate volatility common in emerging markets.

Indicative Pricing Disclaimer

Prices for lighting products specified by candela and lumens vary widely depending on design complexity, volume, and supplier location. The figures discussed are indicative and should be verified with multiple suppliers. Buyers are encouraged to conduct thorough cost-benefit analyses and supplier audits to ensure competitive pricing aligned with quality and compliance requirements.

This comprehensive cost and pricing overview equips international B2B buyers with actionable insights to optimize procurement strategies for lighting products measured by candela and lumens, ensuring cost-effective and compliant sourcing tailored to their regional needs.

Spotlight on Potential candela vs lumens Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘candela vs lumens’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for candela vs lumens

Key Technical Properties for Candela and Lumens in B2B Lighting Procurement

Understanding the critical technical properties related to candela and lumens empowers international B2B buyers to make informed lighting purchases that meet specific operational and environmental needs.

-

Luminous Flux (Lumens, lm)

Lumens measure the total visible light emitted by a source in all directions. This property indicates the overall brightness of a light fixture or bulb. For buyers in industries such as manufacturing, retail, or hospitality, specifying lumen output ensures adequate illumination levels for safety, productivity, or customer experience. -

Luminous Intensity (Candela, cd)

Candela quantifies the amount of light concentrated in a particular direction. This is crucial for applications requiring focused beams, like outdoor floodlights, stage lighting, or medical lighting equipment. Understanding candela helps buyers assess how effectively the light will cover a target area without unnecessary spill or glare. -

Beam Angle (Degrees)

The beam angle defines the spread of the light output, directly influencing how candela and lumens are perceived in practical use. Narrower beam angles yield higher candela values but concentrate light in a smaller area, while wider angles distribute lumens more broadly with reduced intensity. Selecting the correct beam angle aligns lighting performance with spatial requirements. -

Color Temperature (Kelvin, K)

While not directly related to lumens or candela, color temperature impacts the perception of brightness and ambiance. Buyers should consider color temperature to complement lumen and candela specifications for the desired environment, such as cooler light for office spaces or warmer tones for hospitality venues. -

Material and Lens Quality

The materials used in lenses or reflectors affect light transmission efficiency and durability. High-grade optical materials ensure minimal lumen loss and consistent candela output over time. For buyers in harsh climates or industrial settings, material quality also determines maintenance frequency and product lifespan. -

Tolerance and Measurement Standards

Lighting specifications often include tolerance ranges that indicate acceptable variance in lumen or candela output. Familiarity with international measurement standards (such as those from the International Commission on Illumination, CIE) is essential for verifying product claims and ensuring compliance with regional regulations.

Common Industry and Trade Terms Relevant to Candela and Lumens

For international B2B buyers, especially in Africa, South America, the Middle East, and Europe, mastering key trade terminology facilitates smoother negotiations and clearer communication with suppliers.

-

OEM (Original Equipment Manufacturer)

An OEM produces products or components that other companies rebrand or integrate into their systems. Knowing whether a lighting product is OEM or branded influences pricing, warranty, and customization options. -

MOQ (Minimum Order Quantity)

MOQ specifies the smallest quantity a supplier is willing to sell. Understanding MOQ helps buyers plan inventory, negotiate bulk discounts, and manage budget constraints, especially when importing to diverse markets. -

RFQ (Request for Quotation)

An RFQ is a formal inquiry sent to suppliers requesting detailed pricing, lead times, and terms for specific products. Crafting precise RFQs with lumen and candela requirements ensures suppliers provide accurate and comparable offers. -

Incoterms (International Commercial Terms)

Incoterms define responsibilities between buyers and sellers regarding shipping, insurance, and customs clearance. For lighting imports, terms like FOB (Free on Board) or CIF (Cost, Insurance, Freight) impact total landed cost and risk management. -

Photometric Data

This term refers to detailed measurements of light distribution, including candela and lumen outputs, beam angles, and intensity curves. Requesting photometric data from suppliers enables buyers to validate performance claims and design lighting layouts effectively. -

Luminaire Efficacy (lm/W)

Luminaire efficacy measures how efficiently a light fixture converts electrical power into visible light. Higher efficacy means energy savings and lower operating costs, a critical factor for sustainability-conscious buyers and regulatory compliance.

By grasping these technical properties and trade terms, international B2B buyers can confidently specify, evaluate, and procure lighting solutions that align with their operational goals, budget, and regulatory environments across diverse regions.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the candela vs lumens Sector

Market Overview & Key Trends

The global lighting measurement sector, centered on candela vs lumens, is witnessing dynamic growth driven by expanding industrialization, urbanization, and smart lighting technologies. For international B2B buyers across Africa, South America, the Middle East, and Europe — including markets like Italy and Vietnam — understanding the distinction between candela and lumens is crucial for sourcing optimal lighting solutions tailored to diverse applications such as commercial, industrial, and outdoor lighting.

Key market drivers include increasing demand for energy-efficient lighting, adoption of LED technology, and the integration of IoT-enabled smart lighting systems. Lumens, representing total visible light output, are favored in general illumination procurement, while candela, indicating directional light intensity, is essential for specialized lighting such as spotlights and stage lighting. This differentiation influences purchasing decisions, especially for sectors requiring precise light control like retail, manufacturing, and entertainment.

Emerging sourcing trends highlight a shift towards modular, customizable lighting products that allow buyers to specify beam angles and intensity (candela) alongside lumen output to optimize energy use and lighting quality. Digital platforms offering detailed photometric data empower buyers to compare products globally, ensuring better value and compliance with regional standards. For markets in Africa and the Middle East, resilient lighting solutions with high candela for outdoor and security applications are increasingly sought after, while Europe’s mature markets prioritize high-lumen, energy-efficient solutions aligned with sustainability mandates.

Market dynamics also emphasize vendor transparency and supply chain agility. Buyers increasingly demand suppliers provide precise candela-lumen specifications, backed by third-party certifications, to mitigate risks and ensure performance consistency. The rapid growth of e-commerce and cross-border trade has expanded access to diverse manufacturers, but requires buyers to be adept at interpreting photometric data to avoid mismatches in lighting performance.

Sustainability & Ethical Sourcing in B2B Lighting

Sustainability is a pivotal consideration shaping the lighting measurement and sourcing landscape. The environmental impact of lighting products encompasses energy consumption, raw material extraction, manufacturing processes, and end-of-life disposal. For B2B buyers, especially in environmentally conscious regions like Europe and progressive markets in South America and Africa, sourcing lighting solutions that optimize lumens per watt and minimize ecological footprints is a strategic imperative.

Ethical sourcing underpins sustainability efforts, demanding transparency across the supply chain — from responsible mining of rare earth elements used in LEDs to fair labor practices in manufacturing hubs. Buyers should prioritize suppliers who demonstrate adherence to environmental certifications such as ENERGY STAR, EU Ecodesign Directive compliance, and RoHS (Restriction of Hazardous Substances). These certifications ensure products deliver efficient luminous flux (lumens) without harmful substances, aligning with corporate social responsibility goals.

Material innovation also plays a role; the use of recycled aluminum and sustainable plastics reduces the carbon footprint of lighting fixtures. Moreover, the shift to LED technology, with its superior lumen output at lower energy consumption, exemplifies sustainable advancement in the candela vs lumens context. B2B buyers should engage with suppliers offering lifecycle assessments and circular economy initiatives, ensuring lighting solutions not only meet performance metrics but also contribute to long-term environmental stewardship.

Brief Evolution & Historical Context

The evolution of lighting measurement units from candlepower to candela marks a significant milestone relevant to B2B buyers. Historically, candlepower represented the intensity of light emitted by a single candle, a concept dating back centuries when candles were primary light sources. In 1948, this unit was standardized and renamed candela to reflect a precise, SI-based measurement of luminous intensity.

Lumens, on the other hand, emerged as a metric to quantify total visible light output regardless of direction, providing a more comprehensive understanding of a light source’s brightness. This distinction became critical with the advent of electric lighting and later LED technology, where controlling light distribution (candela) and total brightness (lumens) enables tailored lighting solutions.

For B2B buyers, this historical progression underscores the importance of selecting lighting products with clear candela and lumen specifications, ensuring that lighting designs meet both intensity and coverage requirements efficiently. Understanding this evolution aids buyers in navigating complex product data and aligning procurement with modern lighting standards and technologies.

Related Video: What is the Strait of Hormuz – and why does it matter to global trade?

Frequently Asked Questions (FAQs) for B2B Buyers of candela vs lumens

-

How can I verify the credibility of international suppliers offering lighting products measured in candela and lumens?

When sourcing lighting products internationally, especially from regions like Africa, South America, the Middle East, and Europe, start by requesting business licenses, ISO certifications, and product test reports. Verify these documents through official channels or third-party verification services. Additionally, ask for client references and check online reviews or trade platform ratings. Conduct virtual or on-site factory inspections if possible. Ensuring supplier transparency on technical specifications like luminous intensity (candela) and luminous flux (lumens) helps confirm their expertise and product quality. -

Can lighting products be customized in terms of candela and lumens output to suit specific project requirements?

Yes, many manufacturers offer customization options for luminous intensity and luminous flux to fit diverse applications, such as stage lighting, industrial illumination, or outdoor lighting. When negotiating, specify your desired beam angle, total lumens, and candela levels to tailor the light distribution and intensity. Customization may also include adjustments in lens design or LED chip configuration. Always confirm minimum order quantities (MOQ) and lead times for customized orders, as these tend to be higher than standard products. -

What are typical MOQ and lead times for bulk orders of lighting products measured in candela and lumens?

MOQ and lead times vary by supplier and product complexity but generally range from 100 to 1,000 units, with lead times between 4 to 12 weeks. Customized lighting solutions with specific candela and lumen requirements usually require longer production cycles. To optimize procurement, communicate your forecasted volumes early and negotiate flexible MOQs if possible. Understanding these parameters upfront helps in planning inventory and meeting project deadlines effectively.

Illustrative Image (Source: Google Search)

- What payment terms are standard when importing lighting products internationally, and how can buyers mitigate risks?

Common payment terms include 30% upfront deposit with the balance payable upon shipment or letter of credit (L/C) arrangements. For buyers in Africa, South America, the Middle East, and Europe, using L/Cs offers more security by ensuring payment only occurs after verifying shipment documents. Escrow services or trade assurance platforms also reduce risk. Always confirm payment terms in the contract and request product samples or certifications before committing to large payments.

Illustrative Image (Source: Google Search)

-

Which quality assurance certifications should B2B buyers look for when purchasing lighting products defined by candela and lumens?

Key certifications include CE (Europe), UL or ETL (North America), RoHS (hazardous substance compliance), and ISO 9001 (quality management systems). For buyers in Africa and the Middle East, regional certifications like SASO (Saudi Arabia) or SABS (South Africa) may also be relevant. These certifications confirm that products meet safety, performance, and environmental standards. Ensure suppliers provide test reports validating luminous intensity and luminous flux to avoid counterfeit or substandard products. -

How do logistics considerations affect the delivery of lighting products with specific candela and lumen specifications?

Lighting products, especially those with precise candela and lumen ratings, often require careful packaging to prevent damage to lenses and LED components. Shipping modes (air, sea, or road) affect transit times and costs, with sea freight being economical for large volumes but slower. Buyers should factor in customs clearance times and import duties specific to their country. Working with freight forwarders experienced in handling electronic goods can streamline delivery and reduce risks of delays or damage. -

What steps should buyers take if there is a discrepancy between promised and actual candela or lumen output?

First, document the discrepancy with photos and measurement reports from an independent lab or certified technician. Communicate the issue promptly with the supplier, referencing the original contract and specifications. Negotiate remedies such as replacement, refund, or discount. If disputes escalate, consider mediation or arbitration through trade bodies or export promotion councils. Maintaining clear quality agreements and acceptance criteria in purchase orders helps prevent such conflicts. -

How does understanding the difference between candela and lumens benefit international B2B buyers in selecting lighting products?

Understanding that lumens measure total light output while candela measures light intensity in a specific direction enables buyers to select products that best fit their application needs. For example, high candela values are crucial for focused beam lighting like spotlights, while high lumens suit ambient lighting. This knowledge helps in specifying accurate product requirements, evaluating supplier claims, and ensuring efficient lighting performance, ultimately reducing waste and optimizing energy use for projects across diverse markets.

Strategic Sourcing Conclusion and Outlook for candela vs lumens

Understanding the distinction between candela and lumens is crucial for international B2B buyers aiming to make informed lighting procurement decisions. Lumens quantify the total light output, ideal for assessing overall brightness, while candela measures light intensity in a specific direction, essential for applications requiring focused illumination. Recognizing these differences allows businesses to tailor lighting solutions to their operational needs, whether for expansive industrial facilities, precision workspaces, or architectural highlights.

From a strategic sourcing perspective, prioritizing suppliers who transparently specify both candela and lumen values enhances product evaluation accuracy and reduces the risk of mismatched expectations. This is especially pertinent in diverse markets across Africa, South America, the Middle East, and Europe, where environmental conditions and regulatory standards vary widely. Buyers should also consider beam angles and lighting design parameters that influence the effective use of light intensity and flux, ensuring optimal energy efficiency and operational effectiveness.

Looking ahead, the evolving lighting technology landscape demands continuous engagement with manufacturers to leverage innovations in LED optics and smart lighting controls. International buyers are encouraged to adopt a holistic sourcing strategy—integrating technical specifications with supplier reliability and compliance—to drive sustainable value. Embracing this approach will empower businesses across regions, including Italy and Vietnam, to illuminate their environments efficiently and competitively in the years to come.