Introduction: Navigating the Global Market for led tail light strip

The global automotive lighting market is undergoing a significant transformation, with LED tail light strips emerging as a cornerstone technology that enhances vehicle safety, energy efficiency, and aesthetic appeal. For international B2B buyers—especially those operating in fast-growing and diverse regions such as Africa, South America, the Middle East, and Europe—understanding the intricacies of LED tail light strips is essential for making strategic procurement decisions that align with evolving market demands and regulatory standards.

This guide offers a comprehensive exploration of LED tail light strips, covering a broad spectrum of critical factors: from the diverse product types including single-function, sequential, and multifunctional LED strips, to the selection of durable materials and advanced manufacturing and quality control processes that ensure long-term reliability. It also delves into supplier evaluation strategies, cost structures, and key market dynamics impacting availability and pricing across different regions.

Buyers will find actionable insights on installation requirements, warranty considerations, and common technical challenges—empowering them to mitigate risks and maximize value. Whether sourcing for fleet upgrades in South Africa, customized vehicle enhancements in Brazil, or aftermarket retail in Spain, this guide equips businesses with the knowledge to confidently identify reliable products and trusted suppliers.

By leveraging this resource, international buyers can streamline their procurement process, ensure compliance with automotive standards, and secure high-performance LED tail light strips that meet the specific needs of their markets—ultimately gaining a competitive edge in a rapidly evolving industry.

Understanding led tail light strip Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Basic Single-Function | 12V DC, ~60 LEDs/m, IP65 waterproof rating | Aftermarket upgrades, fleet lighting | + Affordable and simple installation – Limited lighting modes |

| Sequential Turn Signal | High LED density (~120 LEDs/m), IP67, dynamic lighting | Custom trucks, commercial vehicles | + Enhanced visibility and aesthetic appeal – Higher cost, complex wiring |

| Multi-Function RGB | 12V DC, 60-120 LEDs/m, IP67, integrated multi-mode control | Show vehicles, custom builds | + Versatile lighting effects – Requires advanced controllers and wiring |

| Scanning/Chase Effect | >120 LEDs/m, IP67, advanced dynamic effects | Premium aftermarket, luxury fleets | + Superior visual impact – Premium pricing, specialized installation |

| Commercial Vehicle | 12/24V DC compatibility, 60 LEDs/m, IP68 waterproofing | Fleet trucks, trailers, buses | + Durable and compliant with heavy-duty use – Limited design options |

Basic Single-Function LED Tail Light Strips

These strips offer straightforward illumination with a fixed lighting mode, typically running or brake light functions. Their moderate LED density and IP65 rating make them suitable for standard aftermarket upgrades and fleet applications where cost-efficiency and ease of installation are priorities. B2B buyers should consider these strips when targeting volume fleet retrofits or budget-conscious markets in regions like South America and Africa, where durability and simplicity outweigh advanced features.

Sequential Turn Signal LED Tail Light Strips

Featuring high LED density and dynamic sequential lighting, these strips enhance vehicle signaling with eye-catching effects that improve road safety and appeal. Their IP67 rating ensures robust outdoor performance, ideal for commercial vehicles and custom truck installations. Buyers in Europe and the Middle East often seek these for premium fleet upgrades and specialty vehicle customization, but should prepare for higher procurement costs and more complex wiring requirements.

Multi-Function RGB LED Tail Light Strips

These versatile strips integrate multiple lighting functions—running, braking, turn signals—within a single unit, controlled via embedded electronics. Offering customizable colors and effects, they cater to show vehicles and bespoke builds where aesthetic flexibility is key. B2B buyers should evaluate supplier capabilities for controller compatibility and firmware support, especially when sourcing for markets like Spain and South Africa, where customization drives demand.

Scanning/Chase Effect LED Tail Light Strips

Designed with ultra-high LED density and advanced dynamic effects, these strips deliver premium visual impact for luxury and high-end aftermarket applications. Their IP67 waterproofing and sophisticated control systems make them suitable for discerning clients seeking standout vehicle lighting. Buyers must consider higher price points and specialized installation expertise, making them ideal for niche markets focused on exclusivity and innovation.

Commercial Vehicle LED Tail Light Strips

Built for heavy-duty use, these strips support both 12V and 24V systems and offer IP68 waterproofing for maximum durability in harsh environments. Commonly used in fleets of trucks, trailers, and buses, they prioritize reliability and regulatory compliance over elaborate effects. B2B buyers targeting large-scale fleet operators in Africa, South America, and the Middle East will find these strips essential for long-term operational efficiency and reduced maintenance costs.

Related Video: Install and Review of the MICTUNING 60″ LED tailgate light strip on my 2016 Ram 2500.

Key Industrial Applications of led tail light strip

| Industry/Sector | Specific Application of led tail light strip | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Manufacturing | Integrated rear lighting for passenger cars and commercial vehicles | Enhances vehicle safety and aesthetics; meets regulatory standards | Compliance with regional automotive lighting regulations; durability and IP rating |

| Commercial Fleet Operators | Tail light retrofitting for trucks, buses, and trailers | Improves visibility and reduces maintenance costs; extends vehicle lifecycle | Compatibility with 12V/24V systems; high waterproof rating for harsh environments |

| Aftermarket Customization | Custom tail light designs for car tuning and personalization | Differentiates products in competitive markets; appeals to end consumers | Flexibility in design options; availability of multi-function strips; warranty support |

| Agricultural and Off-road Vehicles | Tail lighting for tractors, harvesters, and utility vehicles | Increases operational safety during low visibility; robust for rugged use | High impact resistance; dust and water ingress protection; long lifespan |

| Public Transportation | LED tail lights for city buses and transit vehicles | Enhances passenger safety; reduces energy consumption and maintenance | Compliance with public transport standards; supplier reliability; ease of installation |

Automotive Manufacturing

In the automotive manufacturing sector, LED tail light strips are integrated into passenger cars and commercial vehicles to provide bright, uniform rear lighting that complies with international safety standards. Manufacturers benefit from improved vehicle aesthetics and energy efficiency, which are critical for meeting increasingly stringent regulations in Europe and other regions. Buyers from Africa and South America should prioritize sourcing LED strips with certified waterproof ratings (IP67 or higher) to withstand diverse climate conditions and ensure long-term reliability.

Commercial Fleet Operators

Fleet operators in logistics and transportation rely on LED tail light strips to retrofit trucks, buses, and trailers, enhancing vehicle visibility and safety while reducing maintenance frequency. These strips must support both 12V and 24V electrical systems common in commercial vehicles. For buyers in the Middle East and Africa, where dust and extreme temperatures prevail, sourcing products with superior ingress protection and thermal tolerance is essential to minimize downtime and extend fleet service life.

Aftermarket Customization

The aftermarket vehicle customization industry leverages LED tail light strips to create unique, eye-catching designs that attract consumers seeking personalization. Multi-function LED strips that combine brake, running, and turn signals in a single unit are highly valued. Buyers in Europe and South America should focus on suppliers offering flexible design options and reliable warranty terms to support bespoke projects and maintain customer satisfaction in competitive markets.

Agricultural and Off-road Vehicles

LED tail light strips are crucial in agricultural and off-road vehicles, providing durable rear lighting solutions that operate effectively in rugged, dusty, and wet environments. These applications demand high-impact resistance and dustproof features to endure harsh field conditions. International buyers, particularly in Africa and South America, must ensure products meet these durability requirements while offering long operational lifespans to reduce replacement cycles and costs.

Public Transportation

Public transportation vehicles such as city buses and transit vans use LED tail light strips to enhance passenger and pedestrian safety while benefiting from reduced energy consumption and lower maintenance needs. Buyers in Europe and the Middle East should verify that LED strips comply with local transit authority standards and select suppliers with proven track records for quality and on-time delivery, ensuring seamless integration into large-scale public transport fleets.

Related Video: LED Tailgate Brake Light Strip Install (Wired To 7-Pin Trailer Plug)

Strategic Material Selection Guide for led tail light strip

When selecting materials for LED tail light strips, international B2B buyers must consider a balance of durability, cost-efficiency, and compliance with regional standards. The choice of materials directly influences product performance, longevity, and suitability for diverse automotive environments across Africa, South America, the Middle East, and Europe. Below is an analysis of four common materials used in LED tail light strip manufacturing, offering actionable insights for procurement professionals.

Polycarbonate (PC)

Key Properties:

Polycarbonate is a high-impact, transparent thermoplastic known for excellent temperature resistance (typically up to 120°C continuous use), UV stability, and outstanding mechanical strength. It offers good chemical resistance and can withstand harsh weather conditions, making it ideal for automotive exterior applications.

Pros & Cons:

– Pros: High durability and impact resistance reduce the risk of cracking or shattering during installation or use. Its optical clarity enhances light transmission, improving brightness and uniformity. Polycarbonate is also lightweight, aiding in fuel efficiency for vehicles.

– Cons: Higher material and processing costs compared to simpler plastics. It can be prone to scratching without protective coatings, which may affect aesthetics over time.

Impact on Application:

Polycarbonate’s robustness and clarity make it the preferred choice for LED tail light covers and lenses, especially in regions with intense sunlight or frequent mechanical stress. Its UV resistance is particularly valuable in Africa and the Middle East, where high solar exposure can degrade lesser materials.

B2B Buyer Considerations:

Buyers in Europe and South Africa should verify compliance with ASTM D3935 (Standard Specification for Polycarbonate Plastic) or DIN EN ISO 527 for mechanical properties. Suppliers offering UV-stabilized grades and scratch-resistant coatings provide added value. While costlier, polycarbonate’s long-term reliability justifies investment for premium aftermarket or OEM applications.

Silicone Rubber (for encapsulation and sealing)

Key Properties:

Silicone rubber exhibits excellent thermal stability (-60°C to 230°C), outstanding flexibility, and exceptional resistance to moisture, ozone, and UV radiation. It maintains elasticity over wide temperature ranges, making it ideal for sealing LED strips against environmental ingress.

Pros & Cons:

– Pros: Superior waterproofing capabilities (often contributing to IP67/IP68 ratings), excellent dielectric properties for electrical insulation, and resistance to chemical corrosion.

– Cons: Silicone can be more expensive than standard PVC or rubber alternatives and requires specialized molding processes. It may also attract dust and dirt due to its slightly tacky surface.

Impact on Application:

Silicone encapsulation ensures LED tail light strips remain operational in wet or dusty environments, critical for fleet vehicles operating in South American rainforests or Middle Eastern deserts. Its flexibility also accommodates vibration and thermal expansion, reducing failure rates.

B2B Buyer Considerations:

Buyers should confirm compliance with international standards such as ASTM D2000 for rubber materials and ensure suppliers provide certifications for automotive-grade silicone. In markets like Spain and South Africa, demand for long-lasting, weatherproof lighting solutions makes silicone-encapsulated strips highly desirable despite the premium cost.

Polyvinyl Chloride (PVC)

Key Properties:

PVC is a widely used thermoplastic with moderate temperature resistance (up to 60-70°C), good chemical resistance, and inherent flame retardancy. It is commonly used for insulation on wiring and protective coatings for LED strips.

Pros & Cons:

– Pros: Cost-effective, easy to process, and available in various hardness levels. PVC provides adequate protection against moisture and abrasion for many standard applications.

– Cons: Lower temperature tolerance limits use in high-heat environments. It is less flexible than silicone and can become brittle over time, especially in extreme climates. Environmental concerns over plasticizers and chlorine content are growing.

Impact on Application:

PVC is suitable for budget-conscious buyers targeting standard aftermarket upgrades or fleet retrofits in temperate climates, such as parts of Europe and South America. However, its limitations in heat resistance and flexibility make it less ideal for premium or heavy-duty applications.

B2B Buyer Considerations:

Buyers should check for compliance with RoHS and REACH regulations, especially in the European Union, to avoid restricted substances. In African and Middle Eastern markets, PVC’s affordability is attractive but must be balanced against durability requirements and warranty expectations.

Aluminum (for backing and heat dissipation)

Key Properties:

Aluminum is lightweight, corrosion-resistant, and an excellent conductor of heat. It is commonly used as a backing substrate or heat sink in LED tail light strips to manage thermal loads and improve LED lifespan.

Pros & Cons:

– Pros: Enhances thermal management, preventing LED overheating and failure. Aluminum’s corrosion resistance (especially anodized grades) ensures longevity in harsh environments. It also adds structural rigidity to flexible LED strips.

– Cons: Higher material and processing costs than plastic backings. Requires precise manufacturing to avoid electrical short circuits and may add weight compared to all-plastic designs.

Impact on Application:

Aluminum-backed LED strips are preferred in high-performance or commercial vehicle applications where heat dissipation is critical, such as fleet trucks in South Africa or long-haul vehicles in the Middle East. This material supports compliance with stringent automotive standards for electrical safety and durability.

B2B Buyer Considerations:

International buyers should verify that aluminum components meet standards like ASTM B209 (Aluminum Sheet and Plate) and consider anodized or coated finishes for improved corrosion resistance. European buyers often require compliance with ISO 9001 manufacturing quality systems to ensure consistent product performance.

Summary Table

| Material | Typical Use Case for led tail light strip | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polycarbonate (PC) | Tail light covers and lenses | High impact resistance and UV stability | Higher cost and scratch susceptibility | High |

| Silicone Rubber | Encapsulation and sealing of LED strips | Superior waterproofing and flexibility | Higher cost and dust attraction | High |

| Polyvinyl Chloride (PVC) | Wiring insulation and protective coatings | Cost-effective and flame retardant | Lower heat resistance and brittleness | Low |

| Aluminum | Backing substrate and heat dissipation | Excellent thermal management and corrosion resistance | Higher cost and manufacturing complexity | Medium |

This strategic material selection framework empowers B2B buyers to align product specifications with regional environmental challenges, regulatory standards, and cost constraints, facilitating smarter sourcing decisions for LED tail light strips across diverse global markets.

In-depth Look: Manufacturing Processes and Quality Assurance for led tail light strip

The manufacturing and quality assurance of LED tail light strips are critical factors that directly impact product performance, durability, and compliance with automotive standards. For international B2B buyers—especially those operating in Africa, South America, the Middle East, and Europe—understanding these processes is essential to make informed sourcing decisions and ensure long-term value.

Manufacturing Process Overview

The production of LED tail light strips involves several well-defined stages, each contributing to the final product’s reliability and functionality:

1. Material Preparation

- LED Chips and PCB Substrate: The process begins with sourcing high-quality LED chips and printed circuit boards (PCBs). PCBs are typically made from flexible materials (like polyimide) to allow contouring along vehicle bodies.

- Raw Material Inspection: Incoming materials undergo rigorous inspection for electrical properties, dimensional accuracy, and absence of defects to prevent downstream failures.

- Protective Coatings and Encapsulation Materials: Selection of durable silicone or epoxy resins ensures waterproofing and resistance to environmental factors.

2. Forming and Mounting

- SMD (Surface-Mount Device) Placement: Automated pick-and-place machines position LEDs and resistors onto the PCB with precision, ensuring consistent spacing and orientation.

- Reflow Soldering: The assembled PCB passes through a reflow oven where solder paste melts and solidifies, forming robust electrical connections.

- Flexible PCB Forming: For strips requiring bends or curves, the PCB is shaped accordingly, with attention to maintaining circuit integrity.

3. Assembly

- Integration of Additional Components: Multi-function strips may include microcontrollers or driver ICs mounted during this stage to enable dynamic lighting effects.

- Waterproofing and Sealing: Encapsulation using silicone or polyurethane coatings is applied, meeting specified Ingress Protection (IP) ratings—typically IP65 to IP68 for automotive applications.

- Connector Attachment and Wiring: Durable, automotive-grade connectors and wiring harnesses are assembled, often with strain relief features to withstand vibration and mechanical stress.

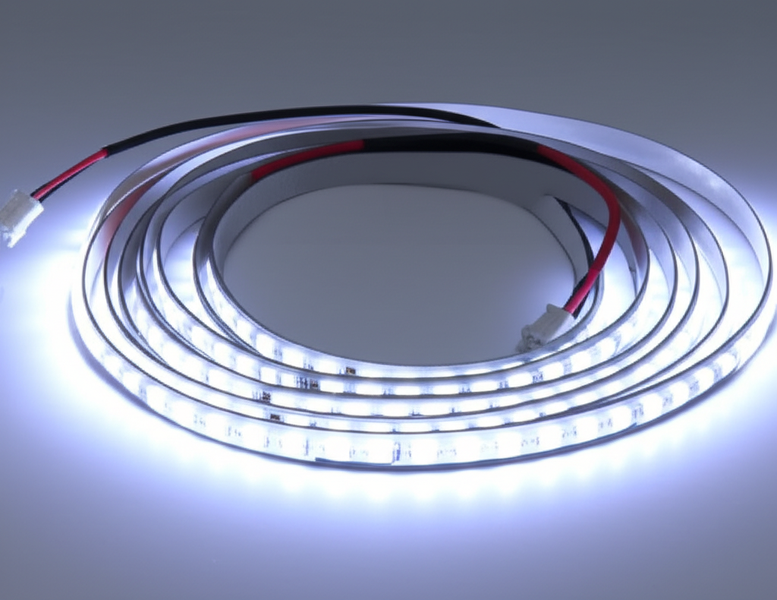

Illustrative Image (Source: Google Search)

4. Finishing and Packaging

- Functional Testing: Before packaging, strips undergo operational testing to verify brightness, color consistency, and responsiveness to control inputs.

- Labeling and Traceability: Each unit is marked with batch numbers and certification labels to facilitate traceability and after-sales support.

- Protective Packaging: Packaging materials are selected to prevent damage during shipping, considering climate variations common in target markets such as Africa and South America.

Quality Assurance and Control Measures

Robust quality control (QC) is indispensable to uphold product standards and comply with international and regional regulations. Manufacturers typically implement multiple QC checkpoints:

Key International and Industry Standards

- ISO 9001: Sets the framework for a quality management system ensuring consistent production quality and continuous improvement.

- CE Marking: Mandatory for products sold in Europe, confirming conformity with health, safety, and environmental protection standards.

- Automotive-Specific Certifications: Standards like IATF 16949 (automotive quality management), and sometimes API or SAE certifications, depending on product scope.

- Ingress Protection (IP) Ratings: Validated through standardized testing to confirm water and dust resistance crucial for exterior automotive lighting.

QC Checkpoints in Production

- Incoming Quality Control (IQC): Verifies raw materials and components before entering production, including LED chip brightness uniformity and PCB integrity.

- In-Process Quality Control (IPQC): Continuous inspection during assembly, such as solder joint quality checks, automated optical inspection (AOI) of LED placement, and real-time functional tests.

- Final Quality Control (FQC): Comprehensive end-of-line tests including electrical performance, waterproofing validation (e.g., IPX7 immersion tests), thermal resistance, vibration endurance, and visual inspection for defects.

Common Testing Methods

- Electrical Testing: Checks voltage, current draw, and LED brightness uniformity to detect circuit faults or weak LEDs.

- Environmental Stress Testing: Simulates temperature extremes, humidity, and mechanical shock to assess durability under real-world conditions.

- Optical Performance Testing: Measures color temperature, luminous intensity, and beam pattern conformity to specifications.

- Waterproofing Tests: Pressure and immersion tests to validate IP ratings, essential for outdoor automotive applications.

How B2B Buyers Can Verify Supplier Quality Control

For buyers, especially in emerging and established markets such as South Africa, Brazil, the Middle East, and Spain, verifying supplier QC is vital to mitigate risks:

- Supplier Audits: Conduct on-site or remote audits focusing on production processes, QC procedures, and compliance with international standards. Audits should evaluate factory certifications, equipment calibration, and personnel expertise.

- Review of QC Documentation: Request detailed QC reports, including IQC, IPQC, and FQC data, along with test certificates for IP ratings and electrical safety.

- Third-Party Inspections: Engage independent inspection agencies to perform random product sampling and testing before shipment, providing unbiased quality verification.

- Sample Testing: Obtain pre-production or pilot samples to conduct in-house or third-party laboratory testing for performance, durability, and regulatory compliance.

- Traceability Practices: Ensure suppliers implement batch numbering and component traceability to facilitate quality tracking and recall management if necessary.

QC and Certification Nuances for International B2B Buyers

Buyers must consider regional regulatory requirements and market expectations when evaluating LED tail light strips:

- Africa & Middle East: Many countries emphasize robust waterproofing due to challenging weather conditions; certifications like IEC standards and IP ratings are highly valued. Import regulations may require local compliance documentation or homologation.

- South America: Brazil and Argentina have specific automotive safety standards; CE marking and ISO certifications improve acceptance. Buyers should verify supplier familiarity with local customs and import requirements.

- Europe (e.g., Spain): Strict adherence to UNECE regulations (such as ECE R7 and R10 for lighting devices) is mandatory. CE marking combined with IATF 16949 certification signals high manufacturing and quality management standards.

- Cross-Regional Considerations: Voltage compatibility (12V vs. 24V systems), environmental durability, and warranty terms should align with regional vehicle standards and usage conditions.

Final Recommendations for B2B Buyers

- Prioritize suppliers with documented ISO 9001 and automotive-specific certifications, ensuring systematic quality management.

- Insist on detailed QC checkpoints and transparent reporting to minimize defects and warranty claims.

- Leverage third-party testing and audits as part of supplier qualification to build trust and mitigate supply chain risks.

- Factor in regional compliance nuances to avoid regulatory delays and ensure seamless market entry.

- Consider long-term partnerships with manufacturers who invest in R&D and continuous quality improvement, supporting evolving automotive lighting trends and regulations.

By thoroughly understanding manufacturing workflows and QC frameworks, international B2B buyers can secure LED tail light strips that deliver consistent performance, safety, and regulatory compliance—key drivers of competitive advantage in global automotive markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led tail light strip Sourcing

When sourcing LED tail light strips for automotive applications, a clear understanding of the underlying cost structure and pricing dynamics is essential for international B2B buyers. This knowledge empowers buyers—especially those in diverse markets such as Africa, South America, the Middle East, and Europe—to negotiate effectively, optimize procurement strategies, and manage total cost of ownership.

Key Cost Components in LED Tail Light Strip Manufacturing

-

Materials

The core material costs include high-quality LEDs, flexible PCBs, waterproof coatings (such as silicone or epoxy), connectors, and housing components. Premium LEDs with higher brightness and longer lifespans, as well as advanced waterproof ratings (IP67/IP68), command higher raw material costs. Material sourcing from reputable suppliers ensures product durability and compliance with automotive standards. -

Labor

Labor costs vary significantly by manufacturing location. Automated assembly reduces labor intensity but still requires skilled technicians for quality control and wiring. Regions with lower labor costs can offer competitive pricing but must be evaluated carefully for workmanship and consistency. -

Manufacturing Overhead

This encompasses factory utilities, equipment depreciation, quality assurance processes, and administrative expenses. High standards for automotive-grade products necessitate rigorous in-line and final inspections, adding to overhead. -

Tooling and Equipment

Initial tooling for custom molds, soldering jigs, and PCB assembly lines represents a capital investment often amortized across production volumes. Custom designs or advanced multi-function LED strips typically incur higher tooling costs. -

Quality Control (QC) and Certifications

Automotive LED tail light strips require compliance with international standards (e.g., ECE, SAE, CE) and often undergo stringent QC testing for electrical safety, waterproofing, and durability. Certification processes add to cost but are critical for market acceptance, especially in regulated regions like Europe. -

Logistics and Freight

Shipping costs fluctuate based on origin, destination, shipping mode (air vs. sea), and current freight market conditions. For buyers in Africa, South America, and the Middle East, longer transit times and customs complexities should be factored into landed costs. -

Supplier Margin

Suppliers include profit margins that reflect their brand positioning, service quality, and after-sales support. Established suppliers with proven track records may price higher but provide greater reliability and warranty services.

Price Influencers and Buyer Considerations

-

Order Volume and Minimum Order Quantity (MOQ)

Larger volume orders generally reduce unit prices due to economies of scale. Buyers should negotiate MOQs aligned with demand forecasts to avoid excess inventory or stockouts. -

Product Specifications and Customization

Custom LED densities, integrated functions (e.g., sequential signaling), and enhanced waterproofing increase complexity and cost. Buyers must balance feature requirements against budget constraints. -

Material Quality and Certifications

Certified components and materials that meet automotive safety and environmental standards (e.g., RoHS, REACH) command premium pricing but reduce risk and improve product longevity. -

Supplier Location and Reputation

Proximity to the buyer can reduce logistics costs and lead times. Established suppliers with strong reputations provide assurance but may have less flexible pricing. -

Incoterms and Payment Terms

Understanding and negotiating favorable Incoterms (e.g., FOB, CIF, DDP) can shift logistics responsibility and cost, impacting overall pricing. Extended payment terms may improve cash flow but could affect pricing.

Strategic Tips for International B2B Buyers

-

Negotiate Beyond Unit Price

Focus on total cost of ownership, including warranty, after-sales support, and potential rework costs. Consider bundled deals on installation accessories or technical support. -

Leverage Volume Consolidation

For buyers in emerging markets like South Africa or Brazil, consolidating purchases with regional partners can increase bargaining power and reduce per-unit costs. -

Assess Long-Term Supplier Partnerships

Prioritize suppliers offering consistent quality, certifications, and transparent pricing structures. Long-term relationships can unlock better pricing, priority production slots, and tailored services. -

Account for Hidden Costs

Factor in customs duties, import taxes, and potential delays. Engaging freight forwarders familiar with local regulations reduces unexpected expenses. -

Request Detailed Quotes with Cost Breakdowns

Transparent quotations help identify cost drivers and areas for negotiation. Avoid suppliers unwilling to disclose component or logistics cost details. -

Understand Market-Specific Pricing Trends

In Europe (e.g., Spain), compliance and certification costs are higher, whereas in parts of Africa or the Middle East, logistics and import duties can dominate costs. Tailor sourcing strategies accordingly.

Indicative Pricing Disclaimer

Prices for LED tail light strips vary widely based on specifications, order volume, supplier, and market conditions. The insights provided here serve as a general framework; buyers should obtain up-to-date quotations and conduct thorough supplier due diligence before finalizing procurement decisions.

By applying these cost and pricing insights, international B2B buyers can navigate the complexities of LED tail light strip sourcing with confidence, securing products that meet quality expectations while optimizing investment returns.

Spotlight on Potential led tail light strip Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led tail light strip’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led tail light strip

Critical Technical Properties of LED Tail Light Strips

Understanding key technical specifications is essential for international buyers to ensure product reliability, compatibility, and compliance with regional standards. Here are the most important properties to evaluate when sourcing LED tail light strips:

-

Operating Voltage (Typically 12V DC):

LED tail light strips are designed to operate on a specific voltage, usually 12 volts direct current, aligning with standard vehicle electrical systems worldwide. Ensuring voltage compatibility avoids electrical failures and optimizes performance, especially critical for fleet buyers in regions with diverse vehicle models. -

LED Density (LEDs per Meter):

This refers to the number of LEDs installed per meter of strip, commonly ranging from 60 to 120+ LEDs/m. Higher density strips deliver more uniform, brighter illumination without visible light dots, which is crucial for safety applications like brake lights and turn signals. For buyers targeting premium markets, opting for high-density strips enhances product appeal and compliance with stringent lighting regulations. -

Waterproof Rating (IP Code):

Ingress Protection (IP) ratings such as IP65, IP67, or IP68 indicate the strip’s resistance to dust and water. IP65 protects against water jets, while IP67 and IP68 can withstand temporary or continuous submersion. Buyers in climates with heavy rain or regions with off-road vehicle usage (e.g., parts of Africa or South America) should prioritize IP67 or higher to ensure durability and reduce warranty claims. -

Material Quality and Heat Dissipation:

High-grade materials like flexible PCB substrates with copper layers and silicone or epoxy coatings improve strip longevity and heat management. Proper heat dissipation prevents premature LED failure and maintains brightness consistency. This is a key decision factor for buyers requiring long-lasting products for commercial fleets or aftermarket suppliers focused on quality differentiation. -

Color Temperature and Light Output:

Tail light strips typically emit red light within a specified wavelength range to comply with automotive safety standards. Consistent color temperature ensures uniform appearance and regulatory compliance across markets. Buyers should verify manufacturer specifications and request samples to confirm light quality matches their target market requirements. -

Tolerance and Quality Control Standards:

Tolerances define acceptable deviations in electrical and physical properties, such as voltage tolerance (±5%) or LED brightness variance. Products manufactured under strict quality control standards (ISO/TS 16949 for automotive) reduce risks of defects and improve supply chain reliability. Buyers should inquire about certifications and testing protocols to safeguard product consistency.

Key Industry and Trade Terminology for B2B Buyers

Familiarity with common trade terms and industry jargon empowers buyers to navigate negotiations, contracts, and logistics efficiently:

-

OEM (Original Equipment Manufacturer):

Refers to manufacturers producing components or products that are branded and sold by another company. Buyers sourcing OEM-quality LED tail light strips can expect products meeting original vehicle manufacturer standards, ideal for fleet upgrades or aftermarket parts suppliers aiming for high authenticity. -

MOQ (Minimum Order Quantity):

The smallest quantity a supplier is willing to sell in a single order. MOQs vary widely depending on the manufacturer and product complexity. Buyers from emerging markets or smaller businesses should negotiate MOQs carefully to balance inventory costs with supplier requirements. -

RFQ (Request for Quotation):

A formal inquiry sent to suppliers asking for price, lead time, and terms for a specified product quantity and specification. Crafting detailed RFQs with technical requirements and certification requests helps buyers receive accurate and comparable offers from multiple suppliers. -

Incoterms (International Commercial Terms):

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Understanding Incoterms is vital for buyers managing cross-border shipments to Africa, South America, or Europe, as it affects total landed cost and risk allocation. -

Lead Time:

The period between order confirmation and product delivery. Reliable lead times are crucial for planning fleet rollouts or retail inventory replenishment. Buyers should confirm lead times upfront and consider seasonal or logistical delays in their procurement strategy. -

Compliance Certifications:

Certifications such as ECE R7/R23 (European vehicle lighting regulations), SAE (Society of Automotive Engineers standards), or local homologations demonstrate product adherence to safety and performance standards. Buyers targeting regulated markets must prioritize suppliers with relevant certifications to avoid import restrictions or product recalls.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions, minimize risks, and secure LED tail light strips that meet performance expectations and regulatory requirements across diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led tail light strip Sector

Market Overview & Key Trends

The global market for LED tail light strips is experiencing robust growth, driven by increasing automotive production, stringent vehicle safety regulations, and a growing preference for energy-efficient lighting solutions. For international B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe, understanding regional market dynamics is essential to capitalize on emerging opportunities. Markets like South Africa and Spain are witnessing rising demand for aftermarket customization and fleet modernization, which fuels procurement of high-quality LED tail light strips.

Illustrative Image (Source: Google Search)

Key market drivers include the shift towards advanced automotive lighting technologies such as multi-function and sequential LED strips, which offer enhanced visibility and aesthetic appeal. Buyers should note the growing adoption of high-density LED configurations (120+ LEDs/m), which deliver uniform illumination and improved durability. Additionally, integration of intelligent controllers enabling multifunctionality is becoming a standard, increasing the complexity but also the value proposition of LED tail light strips.

From a sourcing perspective, B2B buyers are increasingly prioritizing suppliers that provide comprehensive technical support, including detailed wiring diagrams and installation guidelines. This focus reduces installation errors and warranty claims, which is especially critical for fleet operators managing large-scale deployments. Geographic sourcing trends reveal a diversification away from sole reliance on traditional Asian manufacturers, with emerging suppliers in Europe offering advanced customization and faster lead times.

Digitalization is another trend reshaping procurement, with online platforms facilitating direct communication between buyers and manufacturers, enabling real-time quality control and compliance verification. Buyers in developing regions are leveraging these tools to overcome logistical challenges and ensure timely delivery. Finally, the demand for rugged, IP67+ waterproof rated LED strips tailored for harsh environments prevalent in Africa and the Middle East is increasing, reflecting the need for durable products that withstand dust, heat, and moisture.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a critical factor in the procurement of LED tail light strips as international buyers increasingly align their sourcing strategies with environmental and social responsibility goals. The automotive lighting sector’s environmental impact primarily stems from raw material extraction, energy-intensive manufacturing processes, and electronic waste generation. B2B buyers are urged to prioritize suppliers who implement eco-friendly manufacturing practices, such as energy-efficient assembly lines and waste minimization protocols.

Ethical supply chains are equally important, particularly for buyers in regions sensitive to labor standards and regulatory compliance. Transparent sourcing of components—such as LEDs, PCBs, and plastics—from certified vendors ensures adherence to fair labor practices and reduces risks related to supply chain disruptions or reputational damage. Certifications like ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety) are valuable indicators of supplier commitment to sustainability and ethical operations.

Green materials are gaining traction in LED tail light strip production. Buyers should consider products using halogen-free flame retardants, recyclable aluminum housings, and low-VOC (volatile organic compound) adhesives to reduce environmental footprint. Additionally, sourcing LED strips with RoHS (Restriction of Hazardous Substances) compliance guarantees the exclusion of toxic substances like lead and mercury, crucial for meeting European market regulations and increasingly demanded in other regions.

Adopting circular economy principles, such as modular designs that facilitate repair and recycling, is an emerging trend among forward-thinking suppliers. B2B buyers benefit from engaging with manufacturers who offer take-back programs or use recycled materials, which not only support sustainability goals but can also reduce total cost of ownership. Ultimately, embedding sustainability into sourcing decisions enhances brand value and meets the growing expectations of end customers and regulatory bodies.

Brief Evolution and Historical Context

LED tail light strips have evolved significantly since their initial introduction in the early 2000s. Originally, automotive lighting relied heavily on incandescent bulbs, which were inefficient and prone to frequent failure. The advent of LED technology marked a transformative shift, offering longer lifespans, lower power consumption, and enhanced design flexibility.

Early LED tail light strips were primarily single-function units with basic illumination, suitable for aftermarket upgrades. Over time, technological advances led to the development of sequential and multifunction LED strips, integrating turn signals, brake lights, and running lights into a single, sleek unit. This evolution has been supported by improvements in LED chip density, waterproofing standards (IP65 to IP68), and intelligent control systems that allow dynamic lighting effects.

For B2B buyers, this history underscores the importance of selecting LED tail light strips that align with current industry standards and technological innovations. Suppliers who invest in R&D and quality assurance processes tend to deliver products that meet stringent safety and performance criteria, reducing risks and enhancing customer satisfaction in competitive markets worldwide.

Related Video: Crude Oil Prices & Global Trade Market Seen Stabilising After Trump Announced Iran Israel Ceasefire

Frequently Asked Questions (FAQs) for B2B Buyers of led tail light strip

-

How can I effectively vet LED tail light strip suppliers for international B2B sourcing?

To vet suppliers, start by verifying their manufacturing credentials and certifications such as ISO 9001 and automotive quality standards (e.g., IATF 16949). Request samples to assess product quality, LED density, and waterproof ratings. Check references and client portfolios, especially projects in your region (Africa, South America, Middle East, Europe) to ensure familiarity with local regulations and market needs. Use third-party inspection services for factory audits. Confirm supplier responsiveness and after-sales support capabilities, critical for ongoing warranty and technical assistance. -

What customization options are typically available for LED tail light strips, and how do they impact lead times?

Common customizations include LED density, color temperature, waterproof rating (IP level), strip length, and multifunction integration (running, brake, turn signals). Some suppliers also offer branding, packaging, and wiring harness adaptations for specific vehicle models. Customized products generally require longer lead times, often 4-8 weeks depending on complexity and order volume. Early engagement with suppliers to finalize specifications and prototyping can streamline production schedules and avoid delays. -

What are the typical minimum order quantities (MOQs) and payment terms for international B2B orders of LED tail light strips?

MOQs vary widely but generally range from 500 to 2,000 units per SKU for standard products. Custom orders may require higher MOQs due to tooling and production setup costs. Payment terms often include a 30%-50% deposit upfront with balance before shipment or upon delivery. For established buyers, suppliers might offer Net 30 or Net 60 terms. Using secure payment methods like irrevocable letters of credit or escrow accounts can mitigate financial risks in cross-border transactions. -

Which quality assurance certifications should B2B buyers prioritize when sourcing LED tail light strips?

Prioritize suppliers with ISO 9001 certification for quality management and IATF 16949 for automotive industry compliance. Certifications like CE, RoHS, and UL confirm electrical safety and environmental compliance critical in Europe and other regulated markets. IP (Ingress Protection) ratings, such as IP65 to IP68, are essential to verify waterproof and dustproof capabilities. Request documented test reports for LED lifespan, brightness uniformity, and vibration resistance to ensure reliability in demanding automotive environments. -

What logistics considerations should international buyers keep in mind when importing LED tail light strips?

Plan for shipping modes balancing cost and lead time—sea freight is economical for bulk orders but slower; air freight suits urgent shipments but is costlier. Confirm product packaging protects against moisture and mechanical damage during transit. Understand customs clearance requirements, import duties, and compliance documentation for your country to avoid delays. Partner with freight forwarders experienced in automotive lighting shipments to navigate regulations and optimize delivery schedules across Africa, South America, Middle East, and Europe. -

How can I mitigate risks related to product disputes or quality issues post-purchase?

Establish clear contracts detailing product specifications, inspection protocols, and warranty terms before order confirmation. Insist on pre-shipment inspections or third-party quality audits. Maintain detailed records of communications and shipment documentation. In case of disputes, leverage supplier warranties and consider arbitration clauses specifying jurisdiction and dispute resolution methods. Building a strong supplier relationship based on transparency and responsiveness helps resolve issues swiftly and reduces future risks. -

Are there any region-specific compliance or technical standards I should be aware of when sourcing LED tail light strips?

Yes, compliance varies by region. In Europe, products must meet ECE regulations (e.g., ECE R7, R10) and CE marking for safety. South Africa and Middle Eastern countries may have local homologation requirements aligned with UNECE or GCC standards. Some African markets require adherence to SABS standards. Verify that suppliers can provide certification documentation valid in your target markets to ensure legal compliance and smooth market entry.

- What are the best practices for ensuring seamless communication and project management with overseas LED tail light strip suppliers?

Utilize clear, detailed technical specifications and drawings to avoid misunderstandings. Establish regular communication channels (email, video calls, project management tools) with designated contact points on both sides. Agree on milestones for sample approval, production updates, and shipment notifications. Time zone differences require scheduling flexibility. Employ bilingual staff or translators if necessary to bridge language gaps. Document all agreements and changes to maintain accountability throughout the procurement cycle.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led tail light strip

Strategic sourcing of LED tail light strips is a critical success factor for businesses aiming to enhance vehicle safety, aesthetics, and energy efficiency. International B2B buyers—particularly those operating in Africa, South America, the Middle East, and Europe—must prioritize product quality, supplier reliability, and compliance with automotive standards to ensure long-term performance and customer satisfaction. Understanding the distinctions between single-function, sequential, and multifunction LED strips enables buyers to tailor solutions to diverse market needs, from fleet modernization to aftermarket customization.

Investing in suppliers that offer robust waterproofing (IP65 and above), high LED density for uniform illumination, and comprehensive technical support will mitigate risks related to installation challenges and warranty claims. Additionally, sourcing partners with transparent manufacturing processes and adherence to international quality certifications can help buyers optimize total cost of ownership while maintaining competitive advantage.

Looking ahead, the global automotive lighting market is poised for continued innovation, driven by advances in smart lighting technologies and increasing demand for sustainable, energy-efficient components. Buyers are encouraged to adopt a forward-thinking procurement strategy that embraces emerging trends, fosters supplier partnerships, and integrates technical expertise. By doing so, businesses in regions like Spain, South Africa, Brazil, and the UAE can confidently navigate market complexities and capitalize on growth opportunities in the evolving LED tail light strip sector.