Introduction: Navigating the Global Market for aluminium channel for led strip lighting

Aluminium channels for LED strip lighting have become indispensable components in delivering high-quality, durable, and visually appealing lighting solutions across commercial and industrial applications. For international B2B buyers—especially those operating in diverse markets such as Africa, South America, the Middle East, and Europe—understanding the strategic value of these channels is crucial. They do more than just house LED strips; they enhance heat dissipation, protect delicate electronics from environmental damage, and provide a sleek, professional finish that elevates project outcomes.

This comprehensive guide is designed to empower procurement professionals, contractors, and lighting designers by delivering deep insights into the aluminium channel ecosystem. It covers the full spectrum from types and material grades, to manufacturing processes and quality control standards that ensure product longevity and compliance with regional regulations. Buyers will also gain clarity on selecting reliable suppliers, evaluating cost factors, and navigating market trends that impact availability and pricing in key regions such as Colombia, Argentina, Nigeria, Saudi Arabia, and Germany.

Moreover, the guide addresses common challenges faced in installation and maintenance, offering practical solutions tailored for diverse environmental conditions and technical requirements. By consolidating detailed product knowledge with actionable sourcing strategies, this resource enables international B2B buyers to make informed decisions that optimize project success, minimize risk, and maximize return on investment in aluminium channels for LED strip lighting.

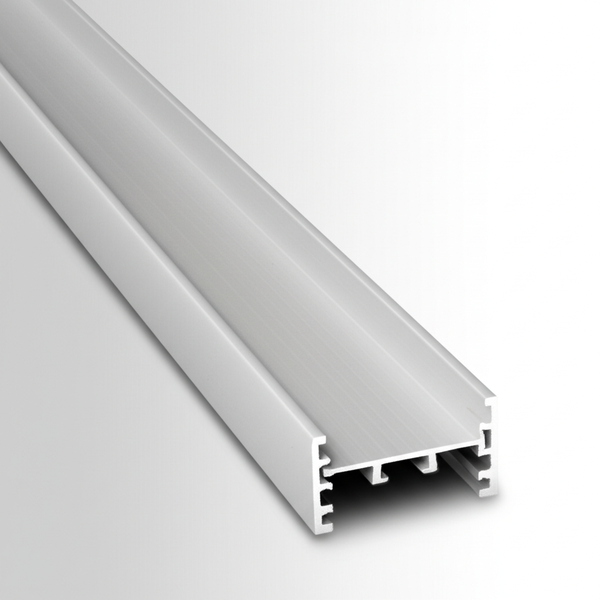

Understanding aluminium channel for led strip lighting Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Surface-Mounted Channels | U-shaped profile, mounts directly on surfaces | Retail displays, office lighting, residential | + Easy installation, versatile – May protrude from surface |

| Recessed Channels | Designed to be embedded flush within walls or furniture | High-end commercial interiors, architectural lighting | + Sleek, integrated look – Requires precise installation |

| Corner Channels | L-shaped profile for 90° angle installations | Staircases, coves, under cabinets | + Ideal for edge lighting – Limited to corner use |

| Waterproof Channels | Sealed with silicone gaskets and IP65+ rated diffusers | Outdoor, wet environments, industrial | + Weather-resistant, durable – Higher cost, heavier |

| Flexible Aluminum Channels | Bendable profiles for curved or irregular surfaces | Automotive, signage, curved architectural features | + Adaptable to shapes – Less rigid, may require support |

Surface-Mounted Channels are the most common and straightforward option, featuring a simple U-shaped profile that mounts directly onto surfaces such as walls or ceilings. Their ease of installation makes them highly suitable for retail displays and general commercial or residential lighting projects. When purchasing, B2B buyers should consider the surface finish, compatibility with LED strip widths, and mounting hardware quality. While they may protrude slightly, their versatility and cost-effectiveness make them a popular choice across diverse markets including Africa and South America.

Recessed Channels offer a clean, flush installation by being embedded into walls, ceilings, or furniture. This type is favored in premium commercial environments where aesthetics and integration matter, such as architectural lighting in offices or luxury retail stores. For B2B buyers, careful planning and precision cutting are essential to ensure seamless integration. Although installation is more complex and labor-intensive, the resulting sleek appearance can significantly enhance project value and client satisfaction.

Corner Channels are specifically designed with an L-shaped profile to fit tight 90-degree corners, perfect for accentuating edges in staircases, coves, or cabinetry. These channels provide targeted lighting solutions that enhance architectural features. Buyers should assess the compatibility with LED strip sizes and mounting surfaces. Their specialized use limits versatility but offers excellent value in niche applications requiring sharp-angle illumination.

Waterproof Channels come with sealed designs and high IP ratings (IP65 or above), making them indispensable for outdoor, damp, or industrial environments. These channels typically feature silicone gaskets and robust diffusers to protect LED strips from moisture, dust, and corrosion. B2B buyers targeting markets in humid or harsh climates, such as the Middle East or coastal regions of Europe, should prioritize these for durability and compliance with safety standards. The trade-off is a higher upfront cost and additional weight, which must be factored into installation logistics.

Flexible Aluminum Channels are engineered to bend around curves and irregular surfaces, enabling creative lighting installations on vehicles, signage, or curved architectural elements. While they provide adaptability beyond rigid profiles, they may require additional support to maintain shape and ensure proper heat dissipation. B2B buyers should verify bend radius specifications and mechanical robustness, especially for projects in dynamic environments. Their unique form factor opens new design possibilities but demands careful handling during installation.

Related Video: How to Install Recessed LED Channel and LED Strip Lights in Drywall for Recessed Linear Lighting

Key Industrial Applications of aluminium channel for led strip lighting

| Industry/Sector | Specific Application of aluminium channel for led strip lighting | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial Spaces | Ambient and accent lighting in storefronts, display cases, and shelving | Enhances product visibility, creates inviting atmospheres, and protects LED strips for longevity | Durable profiles with high-quality diffusers for glare control; UV-resistant materials for outdoor storefronts; compliance with local electrical standards |

| Hospitality & Leisure | Cove lighting, bar counters, and architectural highlights in hotels/restaurants | Provides aesthetic appeal and energy-efficient lighting, improving guest experience and reducing operational costs | Profiles with customizable finishes to match décor; moisture-resistant and IP-rated channels for humid environments; reliable supplier certifications |

| Industrial & Manufacturing | Task lighting on workbenches, machinery, and assembly lines | Improves worker safety and productivity by providing consistent, glare-free illumination | Robust, impact-resistant aluminum channels; heat dissipation features for long LED life; adherence to industrial safety and electrical codes |

| Transportation & Infrastructure | Lighting in tunnels, pedestrian walkways, and vehicle interiors | Enhances safety and visibility while offering durable, low-maintenance lighting solutions | Weatherproof and vandal-resistant channels; high IP rating; compatibility with existing infrastructure wiring standards |

| Residential & Smart Homes | Under-cabinet lighting, stairway illumination, and decorative interior lighting | Adds modern aesthetics, increases energy efficiency, and protects LED strips from dust and damage | Lightweight, easy-to-install profiles; variety of diffuser options for visual comfort; consideration for regional voltage and wiring norms |

Retail & Commercial Spaces

In retail environments, aluminium channels for LED strip lighting are extensively used to create ambient and accent lighting in storefronts, display cases, and shelving units. These channels protect LED strips from dust and physical damage while providing a sleek, professional finish that enhances product visibility and attractiveness. For international buyers in regions like South America and Africa, sourcing channels with UV-resistant coatings is vital for outdoor storefronts exposed to strong sunlight. Additionally, ensuring compliance with local electrical standards and availability of compatible diffusers to reduce glare are critical for maintaining long-term client satisfaction.

Illustrative Image (Source: Google Search)

Hospitality & Leisure

Hotels, restaurants, and leisure facilities leverage aluminium channels to install cove lighting, illuminate bar counters, and highlight architectural features. The channels contribute to a sophisticated ambiance while improving energy efficiency and reducing maintenance costs. For B2B buyers in the Middle East and Europe, selecting moisture-resistant and IP-rated profiles is essential to withstand humid environments such as kitchens and spas. Customizable finishes that blend seamlessly with interior décor also add value, making it crucial to partner with suppliers who offer a range of design options and certifications that guarantee product reliability.

Industrial & Manufacturing

In industrial and manufacturing settings, aluminium channels are used for task lighting on workbenches, machinery, and assembly lines, where consistent and glare-free illumination is paramount for worker safety and productivity. These environments demand robust, impact-resistant profiles with excellent heat dissipation to prolong LED lifespan under continuous operation. Buyers from Africa and South America should prioritize sourcing channels that meet industrial safety standards and electrical codes, ensuring durable installations capable of withstanding harsh conditions and minimizing downtime.

Transportation & Infrastructure

Aluminium channels find important applications in transportation and infrastructure projects, including tunnel lighting, pedestrian walkways, and vehicle interiors. Their weatherproof and vandal-resistant properties make them ideal for outdoor and high-traffic areas, enhancing safety and visibility with low-maintenance lighting solutions. International buyers should focus on channels with high IP ratings and compatibility with existing infrastructure wiring standards, particularly in regions like the Middle East where environmental conditions can be extreme. Reliable supply chains and adherence to local regulations are vital for successful project execution.

Residential & Smart Homes

In residential and smart home applications, aluminium channels are widely used for under-cabinet lighting, stairway illumination, and decorative interior lighting. They provide a modern, clean look while protecting LED strips from dust and accidental damage. For B2B buyers in Europe and South America, easy-to-install profiles with a variety of diffuser options are preferred to enhance visual comfort and meet diverse design preferences. Additionally, sourcing products compatible with regional voltage and wiring norms ensures smooth integration into smart home systems, supporting energy efficiency and user convenience.

Strategic Material Selection Guide for aluminium channel for led strip lighting

Aluminum 6063 Alloy

Key Properties:

Aluminum 6063 is the most commonly used alloy for LED strip lighting channels due to its excellent extrusion capabilities, good corrosion resistance, and moderate strength. It has a melting point around 615°C and offers good thermal conductivity, which aids in heat dissipation from LED strips.

Pros & Cons:

– Pros: Easy to extrude into complex profiles, cost-effective, lightweight, and provides good surface finish options (anodizing, powder coating). It resists corrosion well in indoor and mildly humid environments.

– Cons: Not suitable for extremely harsh or marine environments without additional protective coatings. Mechanical strength is moderate compared to other aluminum alloys.

Impact on Application:

Ideal for indoor commercial and residential LED lighting projects where moderate environmental exposure occurs. Its thermal conductivity helps maintain LED lifespan by dissipating heat effectively. However, for outdoor or high-moisture applications, additional surface treatment or alternative alloys may be required.

Considerations for International B2B Buyers:

Widely accepted and standardized under ASTM B221 and EN 755-2, Aluminum 6063 is readily available globally, including markets in Africa, South America, the Middle East, and Europe. Buyers from regions like Colombia and Argentina benefit from its compliance with international standards and ease of sourcing. Anodized finishes meeting ISO 7599 enhance corrosion resistance, important for humid climates common in these regions.

Aluminum 6061 Alloy

Key Properties:

Aluminum 6061 offers higher mechanical strength than 6063, with good corrosion resistance and thermal conductivity. It has a melting point near 582-652°C and is often used where structural integrity is more critical.

Pros & Cons:

– Pros: Stronger and more durable than 6063, suitable for applications requiring better mechanical performance. Good corrosion resistance and weldability.

– Cons: Slightly more expensive and less easily extruded into complex shapes compared to 6063. Surface finish options are somewhat limited.

Impact on Application:

Best suited for LED channel installations in industrial or outdoor environments where channels may be subjected to mechanical stress or impact. Its robustness supports longer spans and heavier mounting scenarios. Thermal management remains effective, supporting LED longevity.

Considerations for International B2B Buyers:

Compliance with ASTM B221 and DIN standards ensures international acceptance. Buyers in regions with demanding environmental conditions (e.g., Middle East’s high temperatures or coastal areas in South America) may prefer 6061 for its durability. However, procurement costs and manufacturing complexity should be balanced against project budgets.

Polycarbonate Diffusers (Complementary Material)

Key Properties:

While not an aluminum alloy, polycarbonate is a critical companion material used as a diffuser in aluminum channels. It offers high impact resistance, UV stability (when treated), and excellent light transmission with various finishes (opal, frosted, clear).

Pros & Cons:

– Pros: Durable, lightweight, and provides superior glare reduction and light diffusion. UV-stabilized variants resist yellowing and degradation outdoors.

– Cons: More expensive than acrylic alternatives and can scratch more easily. Thermal expansion differs from aluminum, requiring careful design to avoid warping.

Impact on Application:

Polycarbonate diffusers enhance the visual quality and durability of LED installations, especially in commercial and architectural projects. Their resistance to environmental factors is crucial in outdoor or high-UV regions such as Africa and the Middle East.

Considerations for International B2B Buyers:

Ensure diffusers meet international standards like UL 94 for flammability and ISO 4892 for UV resistance. For markets in Europe and South America, compliance with REACH and RoHS is often mandatory. Buyers should verify supplier certifications and request samples to confirm optical and mechanical properties.

Stainless Steel (Mounting Accessories and Reinforcements)

Key Properties:

Though not used for the channels themselves, stainless steel is commonly employed for mounting clips, screws, and reinforcements. It offers excellent corrosion resistance, high strength, and durability.

Pros & Cons:

– Pros: Corrosion-resistant in harsh environments, strong, and long-lasting. Suitable for outdoor and marine applications.

– Cons: Higher cost than standard steel or aluminum fasteners. Heavier and may require specialized tools for installation.

Impact on Application:

Stainless steel mounting hardware ensures secure and durable installation of aluminum channels, especially in outdoor or industrial settings prone to corrosion. It complements aluminum channels by extending overall system longevity.

Considerations for International B2B Buyers:

Buyers should specify grades like 304 or 316 stainless steel depending on environmental exposure. Compliance with ASTM A276 or EN 10088 standards is essential. In regions like coastal South America or humid African climates, stainless steel accessories prevent premature failure and reduce maintenance costs.

Summary Table

| Material | Typical Use Case for aluminium channel for led strip lighting | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum 6063 Alloy | Indoor commercial and residential LED channel profiles | Excellent extrusion, good corrosion resistance, cost-effective | Moderate strength, less suitable for harsh outdoor environments | Low |

| Aluminum 6061 Alloy | Industrial or outdoor LED channel installations requiring higher strength | Higher mechanical strength and durability | More expensive, complex extrusion | Medium |

| Polycarbonate Diffusers | Diffusers for LED channels to enhance light diffusion and protection | High impact resistance, UV stability, excellent light diffusion | Higher cost, prone to scratching, thermal expansion mismatch | Medium |

| Stainless Steel (Mounting Accessories) | Mounting clips, screws, and reinforcements for outdoor or industrial installations | Superior corrosion resistance and strength | Higher cost, heavier than alternatives | High |

In-depth Look: Manufacturing Processes and Quality Assurance for aluminium channel for led strip lighting

Manufacturing Processes for Aluminium Channels Used in LED Strip Lighting

The production of aluminium channels for LED strip lighting involves several critical stages, each ensuring that the final product meets the high demands of commercial and industrial applications. Understanding these processes helps B2B buyers evaluate suppliers and ensure product reliability and longevity in their projects.

1. Material Preparation

The process begins with selecting high-grade aluminium alloys, typically 6063-T5 or T6, known for excellent extrusion capabilities, corrosion resistance, and thermal conductivity. Raw aluminium billets are preheated to optimal extrusion temperatures (around 450-500°C) to ensure smooth forming without defects.

Suppliers often perform initial quality checks on raw materials, including chemical composition analysis and mechanical property verification, to comply with international standards. For B2B buyers, verifying material certificates (e.g., Mill Test Reports) is crucial to confirm alloy specifications and traceability.

2. Extrusion and Forming

Extrusion is the core forming technique used to create the characteristic U-shaped or custom profiles of aluminium channels. The heated billet is forced through a precision-machined steel die, shaping the aluminium into continuous profiles with consistent cross-sections.

Key factors during extrusion include die design, temperature control, and extrusion speed, which impact dimensional accuracy and surface finish. Post-extrusion, profiles undergo stretching to straighten and relieve internal stresses.

For buyers, understanding extrusion tolerances and requesting samples for dimensional verification helps ensure channel compatibility with LED strips and diffusers.

3. Machining and Assembly

Post-extrusion, aluminium channels may require secondary machining processes such as cutting to length, drilling for mounting holes, and milling for custom features. These steps are essential for precise installation and integration into lighting systems.

Assembly includes fitting diffusers (typically acrylic or polycarbonate), end caps, and mounting brackets. Diffusers are often snapped or slid into place, requiring tight manufacturing tolerances to avoid gaps or loose fittings.

B2B buyers should confirm the supplier’s capability for custom machining and assembly, especially for large-scale or bespoke projects, to reduce installation complexities.

4. Surface Finishing

Finishing processes enhance corrosion resistance, aesthetic appeal, and durability. Common finishes include anodizing, powder coating, and sometimes painting.

- Anodizing creates a hard oxide layer that protects against abrasion and UV damage, ideal for outdoor or high-moisture environments.

- Powder coating offers a broad color range and additional protection against chemical exposure.

Quality finishing ensures long-term performance and aligns with client expectations for premium installations.

Buyers should request finish samples and verify compliance with environmental standards (e.g., RoHS, REACH) and durability tests like salt spray or UV exposure.

Quality Assurance and Control Measures

Effective quality assurance (QA) and quality control (QC) frameworks are fundamental to producing aluminium channels that consistently meet technical specifications and international standards, which is critical for B2B buyers operating in diverse global markets.

Relevant International and Industry Standards

- ISO 9001: The cornerstone of quality management systems worldwide, ensuring consistent manufacturing processes and continual improvement.

- CE Marking: Mandatory for products sold in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

- RoHS Compliance: Restricts hazardous substances in electrical and electronic equipment, important for LED lighting components.

- UL Certification: Commonly required in North America but often recognized globally, certifying electrical safety.

- IP Ratings: Protection against ingress of dust and water, critical for aluminium channels used in outdoor or damp environments.

For buyers in Africa, South America, the Middle East, and Europe (e.g., Colombia, Argentina), confirming suppliers meet both local regulatory requirements and these international standards is essential for smooth importation and market acceptance.

QC Checkpoints in Manufacturing

- Incoming Quality Control (IQC): Verification of raw materials and components such as aluminium billets and diffuser materials. Tests include chemical analysis, dimensional checks, and visual inspections.

- In-Process Quality Control (IPQC): Continuous monitoring during extrusion, machining, and assembly stages. Common checks include dimensional accuracy using calipers and laser measurement tools, surface finish quality, and assembly fitment.

- Final Quality Control (FQC): Comprehensive inspection of finished products. This includes mechanical tests (hardness, tensile strength), surface finish inspection, functional tests (diffuser fit, mounting hardware compatibility), and packaging integrity checks.

B2B buyers should request detailed QC reports and test certificates at each stage to ensure traceability and accountability.

Common Testing Methods

- Dimensional Inspection: Using coordinate measuring machines (CMM), laser scanners, or manual gauges to verify channel profiles and tolerances.

- Surface Quality Testing: Visual and microscopic examination for scratches, pits, or coating defects.

- Corrosion Resistance Tests: Salt spray or humidity chamber tests simulate environmental exposure.

- Thermal Performance Evaluation: Ensures aluminium channels effectively dissipate heat, which is critical for LED longevity.

- Mechanical Strength Tests: Verify extrusion and assembly robustness to withstand installation stresses.

Verifying Supplier Quality Assurance: Practical Guidance for B2B Buyers

For international buyers, especially those from emerging markets in Africa, South America, the Middle East, and Europe, due diligence on supplier QC practices is paramount to mitigate risks related to product failures, shipment delays, and non-compliance with regulations.

Supplier Audits and Factory Assessments

- Conduct on-site audits or engage third-party inspection agencies to evaluate manufacturing facilities, QC labs, and process controls.

- Review supplier adherence to ISO 9001 and other certifications, verifying authenticity through certification bodies.

- Assess supplier capacity for traceability, documentation, and responsiveness to quality issues.

Documentation and Reporting

- Request comprehensive Quality Control Plans (QCP) detailing inspection points, acceptance criteria, and corrective actions.

- Obtain Material Test Reports (MTRs) and Certificate of Conformity (CoC) for each production batch.

- Insist on photographic evidence and inspection reports before shipment.

Third-Party Inspections

- Employ independent inspection companies for pre-shipment inspections (PSI), random sampling, and testing.

- Third-party labs can perform advanced material analysis, coating thickness measurement, and environmental testing to validate supplier claims.

Understanding QC Nuances for International Markets

- Regulatory requirements vary by region. For instance, European markets demand strict CE compliance and RoHS adherence, while Middle Eastern buyers may prioritize IP ratings for harsh environments.

- Shipping and handling conditions differ; channels destined for humid or coastal regions require enhanced corrosion protection.

- Language and communication barriers may affect documentation clarity; insist on bilingual QC documents if necessary.

Summary: Key Takeaways for B2B Buyers

- Manufacturing expertise matters: Evaluate suppliers’ extrusion capabilities, machining precision, and finishing processes to ensure product fit and finish.

- QC systems are your safeguard: Prioritize suppliers with robust IQC, IPQC, and FQC processes aligned with international standards.

- Verification is essential: Use audits, third-party inspections, and detailed documentation to verify quality.

- Adapt to regional requirements: Tailor your supplier selection and QC expectations based on the regulatory and environmental demands of your target markets.

By comprehensively understanding manufacturing and quality assurance practices, international B2B buyers can confidently source aluminium channels that enhance LED strip lighting projects with durability, aesthetics, and compliance—ultimately driving client satisfaction and business success.

Related Video: Inside LEDYi LED Strip Factory | Full Manufacturing Process by Leading LED Strip Manufacturer

Comprehensive Cost and Pricing Analysis for aluminium channel for led strip lighting Sourcing

When sourcing aluminium channels for LED strip lighting in international B2B contexts, understanding the detailed cost components and pricing influencers is crucial to making informed purchasing decisions. This section breaks down key factors affecting pricing and offers strategic guidance tailored to buyers in Africa, South America, the Middle East, and Europe.

Breakdown of Cost Components

-

Raw Materials

Aluminium quality and grade significantly impact costs. Higher-grade alloys with better corrosion resistance or surface finishes (anodized, powder-coated) command premium prices. The price of aluminium fluctuates globally, influenced by metal markets and regional tariffs, affecting unit costs. -

Manufacturing and Labor

Labor costs vary widely by country. Regions with lower wages may offer competitive pricing but buyers should verify quality standards. Manufacturing complexity—such as custom extrusion profiles, integrated diffuser grooves, or precision cutting—increases labor and machine time, impacting costs. -

Overhead and Tooling

Tooling for extrusion dies and cutting jigs represents upfront investment. For custom profiles, tooling costs are amortized over production volume, which can elevate prices for smaller orders. Overhead includes factory utilities, administrative expenses, and compliance with quality certifications (ISO, CE). -

Quality Control (QC)

Rigorous QC processes—including dimensional checks, surface finish inspections, and durability testing—add to manufacturing costs but are essential for long-term reliability. Buyers should prioritize suppliers with documented QC protocols to avoid costly rework or warranty claims. -

Logistics and Shipping

Freight costs depend on shipment size, weight, and destination port infrastructure. Buyers in Africa, South America, and the Middle East may face higher logistics costs due to longer transit distances or limited direct shipping routes. Customs duties, import taxes, and local handling fees further affect landed costs. -

Supplier Margin

Margins vary based on supplier business models and market positioning. Premium brands with strong certifications and after-sales support often price higher but deliver greater value. Negotiation on margin is possible, especially with larger volume commitments.

Key Pricing Influencers

-

Order Volume and Minimum Order Quantities (MOQ)

Larger orders benefit from economies of scale, reducing per-unit cost. MOQ policies differ by supplier; international buyers should align order sizes to MOQ to optimize pricing without excess inventory. -

Customization and Specifications

Custom colors, anodizing thickness, special diffuser types, or non-standard lengths increase costs. Buyers must balance design requirements with budget constraints, requesting detailed quotes for any deviation from standard offerings. -

Material Quality and Certification

Aluminium with certifications (e.g., RoHS, REACH compliance) and flame-retardant diffuser covers command higher prices but are often mandatory for commercial projects in regulated markets like Europe. -

Supplier Location and Reliability

Proximity to manufacturing hubs (e.g., China, Europe) influences base pricing and shipping times. Reputable suppliers with proven track records reduce risk but may charge premium prices. -

Incoterms and Payment Terms

Choosing favorable Incoterms (e.g., FOB, CIF, DDP) affects cost transparency and risk allocation. Buyers from emerging markets should consider DDP to avoid unexpected customs delays and charges. Flexible payment terms can improve cash flow.

Strategic Buyer Tips for International B2B Procurement

-

Negotiate on Total Cost of Ownership (TCO), not just unit price.

Consider quality, warranty, after-sales support, and potential downtime costs. Cheaper channels with poor durability can increase maintenance expenses over time. -

Request detailed Bills of Materials and cost breakdowns.

This transparency helps identify cost-saving opportunities such as alternative finishes or standard sizing. -

Leverage consolidated shipments and local warehousing.

Combining orders or partnering with regional distributors in Africa, South America, or the Middle East can reduce freight costs and lead times. -

Assess supplier certifications and compliance rigorously.

This is critical for European buyers subject to strict environmental and safety regulations. -

Plan for currency fluctuations and import duties.

Budget for potential exchange rate volatility, especially in markets like Colombia and Argentina, which may impact landed costs. -

Understand MOQ and volume discounts fully.

Smaller buyers may negotiate staggered deliveries or sample orders to test quality before committing to larger volumes.

Indicative Pricing Disclaimer

Due to fluctuating raw material costs, regional labor differences, and variable logistics charges, pricing for aluminium channels can vary widely. Buyers should treat any price indications as a starting point and always obtain customized quotations based on precise specifications and order details.

By thoroughly analyzing these cost and pricing factors, international B2B buyers can optimize procurement strategies for aluminium channels, ensuring competitive pricing while maintaining product quality and project reliability. This approach is especially valuable for buyers operating in emerging and diverse markets across Africa, South America, the Middle East, and Europe.

Spotlight on Potential aluminium channel for led strip lighting Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘aluminium channel for led strip lighting’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for aluminium channel for led strip lighting

Key Technical Properties of Aluminium Channels for LED Strip Lighting

When sourcing aluminium channels for LED strip lighting, understanding critical technical specifications is essential for ensuring product compatibility, durability, and performance in your projects. These properties impact installation quality, operational lifespan, and client satisfaction—factors crucial for B2B success across diverse markets such as Africa, South America, the Middle East, and Europe.

-

Material Grade (e.g., 6063-T5 Aluminium):

The alloy and temper of aluminium used affect corrosion resistance, structural integrity, and thermal conductivity. The 6063-T5 grade is widely preferred for LED channels due to its excellent extrusion capability and surface finish. Choosing the right grade ensures channels withstand environmental stresses, particularly in outdoor or humid settings common in many regions. -

Dimensional Tolerance:

Precision in channel dimensions (width, depth, wall thickness) is vital for seamless LED strip fit and diffuser compatibility. Tolerance levels typically range from ±0.1 mm to ±0.3 mm. Strict adherence to tolerances prevents installation issues like loose fittings or misalignment, which can compromise aesthetics and protection. -

Surface Finish (Anodized vs. Powder Coated):

Anodizing provides a durable, corrosion-resistant surface with a natural metallic sheen, ideal for industrial or outdoor use. Powder coating allows for customizable colors and additional protection but may add thickness affecting diffuser fitting. Selecting the appropriate finish influences longevity and design integration. -

Thermal Conductivity:

Aluminium’s ability to dissipate heat extends LED strip lifespan by preventing overheating. Channels with optimized cross-sections and surface area enhance heat transfer. This property is especially critical for long LED runs or high-power strips where heat buildup can cause early failures. -

Diffuser Compatibility and Light Transmission:

Channels are paired with diffusers made from acrylic or polycarbonate, which soften and distribute light evenly. Diffuser options include clear, frosted, or opal finishes, each offering different light transmission percentages and glare reduction. Proper pairing improves lighting quality and user comfort, a key selling point in commercial installations. -

Ingress Protection (IP) Rating:

For outdoor or damp environments, aluminium channels with IP65 or higher ratings provide protection against dust and water ingress. This ensures durability and safety in harsh climates or industrial settings, important for buyers in regions with variable weather conditions.

Common Trade Terminology for Aluminium Channel Procurement

Navigating international B2B transactions requires familiarity with industry-specific terms to communicate effectively with suppliers and avoid costly misunderstandings. Here are essential trade terms relevant to aluminium channel sourcing:

-

OEM (Original Equipment Manufacturer):

Refers to manufacturers who produce aluminium channels that can be rebranded by buyers. OEM arrangements allow businesses to customize product specifications and branding, providing flexibility for private labeling or tailored solutions. -

MOQ (Minimum Order Quantity):

The smallest quantity a supplier is willing to sell per order. MOQs vary significantly by manufacturer and product type. Understanding MOQ helps buyers plan inventory, manage cash flow, and negotiate better terms, especially critical for emerging markets with budget constraints. -

RFQ (Request for Quotation):

A formal inquiry sent to suppliers requesting price, lead time, and terms for specific aluminium channel orders. RFQs are foundational in B2B purchasing to compare offers, clarify product specs, and secure competitive pricing. -

Incoterms (International Commercial Terms):

Standardized trade terms defining responsibilities for shipping, insurance, and customs clearance between buyer and seller. Common terms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Knowing Incoterms ensures clarity on cost allocation and risk during transport. -

Lead Time:

The duration between order placement and delivery. Lead times impact project scheduling and inventory management. Buyers should confirm lead times upfront, especially when sourcing from distant suppliers or planning large-scale installations. -

Tolerance / Specification Sheet:

A document detailing exact product dimensions, materials, finishes, and performance criteria. Requesting and reviewing specification sheets minimizes risks related to quality and compatibility, enabling buyers to verify compliance with project requirements.

Understanding these technical properties and trade terms empowers international B2B buyers to make informed decisions, streamline procurement processes, and enhance the quality and reliability of aluminium channel installations for LED strip lighting projects. This knowledge is particularly valuable when negotiating with suppliers and managing complex, cross-border supply chains.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the aluminium channel for led strip lighting Sector

Market Overview & Key Trends

The aluminium channel market for LED strip lighting is rapidly evolving, driven by global demand for energy-efficient, durable, and aesthetically refined lighting solutions. International B2B buyers—particularly from regions such as Africa, South America, the Middle East, and Europe—are witnessing heightened interest in aluminium channels due to their ability to enhance LED strip performance through superior heat dissipation, protection, and visual appeal.

Key global drivers include the increasing adoption of LED lighting in commercial, industrial, and architectural projects, where longevity and quality are non-negotiable. Markets like Colombia and Argentina are expanding infrastructure and urban development, creating new opportunities for LED integration with aluminium channels. Similarly, Middle Eastern and African buyers are capitalizing on the growing emphasis on sustainable and smart lighting in both public and private sectors.

Emerging sourcing trends emphasize customization and modularity. B2B buyers seek suppliers offering a diverse range of aluminium profiles, finishes, and diffuser options tailored to project-specific requirements. This trend is coupled with a shift towards digital procurement platforms that streamline ordering, reduce lead times, and provide transparent tracking. Moreover, buyers increasingly prioritize suppliers who can provide technical support and installation expertise to ensure seamless integration.

Market dynamics reveal an emphasis on quality certification and compliance with international standards (CE, UL, RoHS). Buyers from Europe and the Middle East, in particular, demand strict adherence to these standards to meet regulatory frameworks and client expectations. Additionally, geopolitical factors and fluctuating aluminium prices impact sourcing decisions, making regional partnerships and local stocking strategies essential for cost control and supply reliability.

Sustainability & Ethical Sourcing in B2B

Sustainability has emerged as a pivotal factor influencing B2B procurement in the aluminium channel sector. Aluminium production traditionally carries a significant environmental footprint due to energy-intensive smelting processes. Consequently, international buyers are increasingly scrutinizing the carbon footprint and energy consumption associated with their aluminium channel suppliers.

Ethical sourcing goes beyond environmental concerns to include responsible mining practices, labor conditions, and supply chain transparency. Buyers from Africa, South America, and Europe are progressively demanding traceability to ensure aluminium is sourced from conflict-free zones and produced under fair labor standards. This approach mitigates reputational risks and aligns with corporate social responsibility (CSR) mandates.

The adoption of green certifications such as ISO 14001 (Environmental Management), LEED (Leadership in Energy and Environmental Design), and Aluminium Stewardship Initiative (ASI) certification is becoming a decisive differentiator. These certifications validate the sustainability claims of aluminium channel manufacturers and assure buyers of compliance with environmental best practices.

From a materials perspective, there is a growing trend toward using recycled aluminium in channel production, which drastically reduces energy use and greenhouse gas emissions compared to primary aluminium. B2B buyers should prioritize suppliers offering high recycled content and transparent lifecycle assessments. Additionally, sustainable packaging and minimizing waste during installation are emerging best practices.

Brief Evolution and Industry Context

The aluminium channel for LED strip lighting has evolved from a simple mounting accessory to a critical component that enhances both performance and aesthetics. Initially, LED strips were installed without protective housing, leading to issues such as heat buildup, damage, and uneven light distribution. The introduction of aluminium channels addressed these challenges by providing robust heat sinks, physical protection, and diffuser integration.

Over the past decade, improvements in LED technology have reduced the thermal demands, but aluminium channels remain indispensable for delivering consistent quality and professional finishes. The industry has shifted toward offering modular, customizable profiles compatible with a variety of LED strip types and diffusers, enabling architects and designers to achieve more sophisticated lighting effects.

For B2B buyers, understanding this evolution is key to selecting the right aluminium channel solutions that align with modern LED specifications, installation environments, and client expectations across diverse international markets.

Related Video: LED Strip Lighting Installs: Beginner, Intermediate and Expert Level

Frequently Asked Questions (FAQs) for B2B Buyers of aluminium channel for led strip lighting

-

How can I effectively vet suppliers of aluminium channels for LED strip lighting to ensure quality and reliability?

Conduct comprehensive due diligence by verifying supplier certifications (ISO 9001, CE, RoHS) and reviewing product datasheets for material grade and finish quality. Request samples to assess build quality and compatibility with your LED strips. Check client references and case studies, especially from similar regions or industries. Evaluate their responsiveness, after-sales support, and warranty terms. For international sourcing, confirm export experience and compliance with local regulations in Africa, South America, the Middle East, or Europe to minimize risks and delays. -

What customization options are typically available for aluminium channels, and how should I specify them?

Common customizations include channel profile shape and size, length, surface finish (anodized, powder-coated), and diffuser type (opal, frosted, clear). You can also request tailored mounting solutions, end caps, and weatherproofing for outdoor or humid environments. Provide precise technical drawings, LED strip dimensions, and environmental conditions to your supplier to ensure compatibility. Clarify color temperature and light diffusion preferences for optimal aesthetics and performance relevant to your project locale. -

What are typical minimum order quantities (MOQs) and lead times for aluminium channels, and how can I negotiate favorable terms?

MOQs vary widely but generally range from 100 to 500 units per profile type, depending on supplier scale and customization level. Lead times typically span 3 to 8 weeks, factoring in production, quality checks, and shipping. To negotiate better terms, consolidate orders across multiple projects or partner with local distributors for bulk purchasing. Early engagement and clear communication on project timelines help suppliers prioritize your order. Consider suppliers with flexible MOQs for pilot projects or phased rollouts common in emerging markets. -

Which quality assurance certifications and product standards should I require for aluminium channels intended for LED strip installations?

Insist on ISO 9001 certification for manufacturing quality management and CE marking for European market compliance. RoHS compliance is critical to ensure materials are free from hazardous substances. For electrical safety and environmental resistance, check IP ratings for outdoor or damp locations and UL certification if sourcing from or selling into North America. Confirm that diffusers meet UV stability standards and that channels use corrosion-resistant aluminum alloys suitable for your regional climate conditions. -

What payment terms and methods are recommended for international B2B transactions when importing aluminium channels?

Standard payment terms include 30% upfront deposit with balance paid upon delivery or against shipping documents. Letters of Credit (LC) offer secure payment but may involve higher bank fees. For trusted suppliers, negotiate Net 30 or Net 60 payment terms to improve cash flow. Use internationally recognized payment platforms or escrow services to mitigate fraud risks. Always verify banking details independently and consider currency fluctuation impacts, especially when dealing with suppliers in Asia or Europe. -

How should I plan logistics and shipping for aluminium channels to Africa, South America, the Middle East, or Europe?

Choose suppliers with experience in international freight forwarding and customs clearance for your target region. Opt for sea freight for cost-efficiency on bulk orders but factor in longer transit times; air freight suits urgent, smaller shipments. Verify packaging protects channels from bending and moisture damage during transit. Collaborate with reliable freight forwarders to ensure compliance with import regulations and timely delivery. Consider incoterms carefully (e.g., FOB, CIF) to clarify responsibility and cost-sharing. -

What steps can I take to handle disputes or quality issues with overseas suppliers effectively?

Establish clear contract terms including inspection rights, defect thresholds, and remedies before ordering. Use third-party inspection services at production and pre-shipment stages. Document all communications and retain samples. If issues arise, engage suppliers promptly with evidence and request corrective actions or replacements. Escalate unresolved disputes through arbitration clauses specified in contracts, preferably under neutral jurisdictions. Building long-term relationships and trust reduces conflict likelihood and expedites resolution. -

Are there regional considerations for aluminium channel specifications or installation that I should be aware of?

Yes, environmental factors such as high humidity in South America, intense UV exposure in the Middle East, or cold climates in Europe affect material and diffuser choices. For example, UV-stable polycarbonate diffusers are essential in equatorial regions to prevent yellowing. Corrosion-resistant aluminum grades suit coastal African markets. Also, ensure compliance with regional electrical and building codes, such as CE in Europe or INMETRO in Brazil. Tailoring specifications to local conditions enhances product durability and client satisfaction.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for aluminium channel for led strip lighting

Strategic sourcing of aluminium channels for LED strip lighting is a critical factor in delivering durable, high-quality, and visually appealing lighting solutions that meet the exacting demands of commercial projects. For international B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe, prioritizing suppliers who offer certified materials, consistent quality control, and comprehensive technical support ensures that installations perform reliably over time and reduce costly maintenance.

Key considerations include selecting aluminum profiles with appropriate heat dissipation properties, compatible diffusers for optimal light distribution, and weather-resistant accessories for diverse environments. Meticulous pre-installation planning and sourcing from reputable manufacturers help mitigate risks related to premature failures, aesthetic issues, and compliance with local standards.

Looking ahead, the aluminium channel market is poised for innovation driven by evolving LED technologies and increased demand for sustainable, energy-efficient lighting in emerging economies. Buyers are encouraged to foster strategic partnerships with suppliers that emphasize customization, sustainability certifications, and supply chain transparency. By doing so, international buyers can secure competitive advantages, enhance project outcomes, and confidently navigate future lighting trends in their respective markets.

Illustrative Image (Source: Google Search)