Guide to Indirect Lighting

- Introduction: Navigating the Global Market for indirect lighting

- Understanding indirect lighting Types and Variations

- Key Industrial Applications of indirect lighting

- Strategic Material Selection Guide for indirect lighting

- In-depth Look: Manufacturing Processes and Quality Assurance for indirect lighting

- Comprehensive Cost and Pricing Analysis for indirect lighting Sourcing

- Spotlight on Potential indirect lighting Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for indirect lighting

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the indirect lighting Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of indirect lighting

- Strategic Sourcing Conclusion and Outlook for indirect lighting

Introduction: Navigating the Global Market for indirect lighting

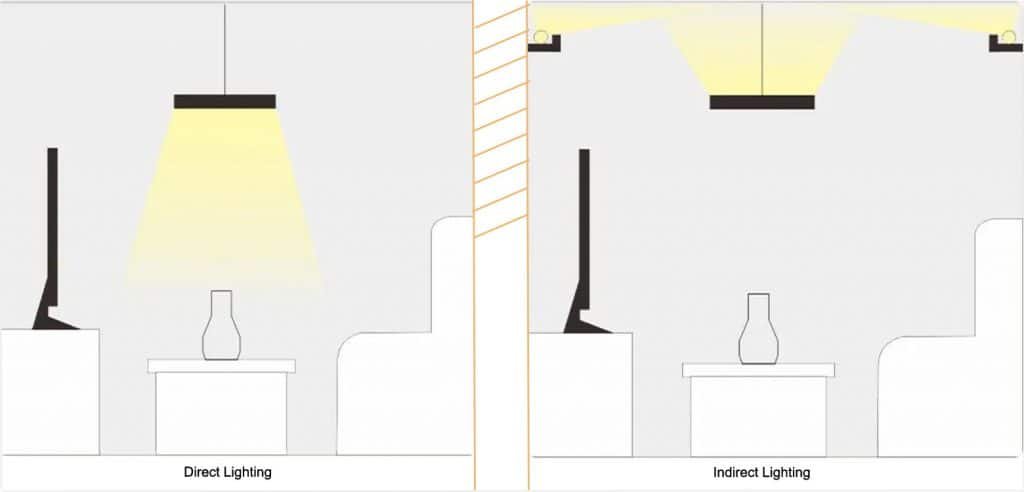

Indirect lighting has emerged as a pivotal element in modern commercial and industrial spaces, offering not only aesthetic appeal but also functional benefits that enhance work environments and reduce energy consumption. For international B2B buyers across Africa, South America, the Middle East, and Europe—including dynamic markets like Thailand and Mexico—understanding the nuances of indirect lighting is essential for making strategic procurement decisions that align with regional requirements and sustainability goals.

This guide provides a thorough exploration of indirect lighting, covering a broad spectrum of critical factors. You will gain insights into various fixture types and lighting technologies, enabling you to select solutions that optimize light distribution and minimize glare. Material choices and manufacturing quality control processes are examined to ensure durability and performance in diverse environmental conditions. Additionally, we delve into sourcing strategies, supplier evaluations, and cost considerations tailored to global trade dynamics.

By navigating this comprehensive resource, buyers will be empowered to identify reputable manufacturers and leverage market trends to negotiate competitive pricing without compromising on quality. The guide also addresses common challenges and frequently asked questions, equipping procurement professionals with actionable knowledge to streamline their indirect lighting acquisitions.

Illustrative Image (Source: Google Search)

In an increasingly interconnected marketplace, leveraging expert insights on indirect lighting not only enhances operational efficiency but also supports sustainability and occupant well-being—key drivers for businesses aiming to stay competitive on the global stage. This guide is your essential tool for informed sourcing and successful implementation of indirect lighting solutions worldwide.

Understanding indirect lighting Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Ceiling-Mounted Indirect | Fixtures suspended from ceiling, directing ≥90% light upward | Offices, commercial buildings, schools | + Reduces glare, enhances ambient light – May cause uneven lighting if used alone |

| Wall-Mounted Indirect | Fixtures mounted on walls, reflecting light off surfaces | Retail spaces, hospitality, healthcare | + Flexible placement, adds architectural interest – Limited control in shared spaces |

| Partition/Furniture-Mounted Indirect | Mounted on office partitions or furniture, localized indirect lighting | Open offices, co-working spaces | + Supports modular design, improves localized lighting – Can cause glare, limited flexibility |

| Indirect-Direct Hybrid | Combines upward indirect and downward direct lighting | Mixed-use spaces, workstations, lobbies | + Balanced lighting, reduces eye strain – Higher initial cost, more complex installation |

| Cove Lighting | Hidden light sources projecting light upward from recesses | Luxury retail, hotels, conference rooms | + Creates soft, elegant ambiance – Requires precise architectural integration |

Ceiling-Mounted Indirect Lighting

Ceiling-mounted indirect lighting fixtures distribute most light upward, reflecting it off ceilings and walls to create a diffuse, glare-free environment. This type is highly suited for office buildings and educational institutions where reducing eye strain and enhancing occupant comfort is critical. For B2B buyers, the key considerations include ceiling height, reflectivity of ceiling surfaces, and integration with existing lighting systems. While energy-efficient and enhancing productivity, relying solely on this type may lead to insufficient task lighting, necessitating complementary direct fixtures.

Wall-Mounted Indirect Lighting

Wall-mounted indirect lighting offers design flexibility by bouncing light off adjacent walls, ideal for retail environments, hospitality venues, and healthcare facilities. This type enhances spatial perception and adds architectural interest. Buyers should assess wall surface materials and color, as these impact light reflection quality. While easy to retrofit, wall-mounted units may pose challenges in controlling light for shared or partitioned areas, requiring strategic placement to avoid uneven lighting or glare.

Partition/Furniture-Mounted Indirect Lighting

Designed for open-plan offices and co-working spaces, partition or furniture-mounted indirect lighting provides localized ambient light by reflecting off nearby surfaces. This supports modular workspace layouts and can improve lighting ergonomics at individual workstations. However, B2B buyers must consider the potential for glare due to low fixture placement and limited flexibility in redesigning office layouts. Coordination with office furniture suppliers is essential to ensure compatibility and maintain lighting control.

Indirect-Direct Hybrid Lighting

Hybrid fixtures combine upward indirect light with downward direct illumination, offering a versatile solution for mixed-use spaces such as lobbies, conference rooms, and workstations. This balance enhances visual comfort by minimizing glare on screens while providing sufficient task lighting. For B2B buyers, these systems typically involve higher upfront costs and require more complex installation and maintenance planning. The investment is justified by improved occupant satisfaction and productivity.

Cove Lighting

Cove lighting uses concealed fixtures within architectural recesses to softly illuminate ceilings and upper walls, creating an elegant ambiance favored in luxury retail, hotels, and conference rooms. This approach demands precise architectural coordination and is best integrated during the design phase. Buyers should consider the compatibility of cove lighting with interior finishes and the need for specialized fixtures. While aesthetically appealing, cove lighting may not provide adequate general illumination and often needs supplementation.

Related Video: Indirect lighting: Plaster mouldings and cove lighting with LED strips and Corner Profile

Key Industrial Applications of indirect lighting

| Industry/Sector | Specific Application of indirect lighting | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Commercial Office Spaces | Ambient lighting for workstations and common areas | Reduces glare on screens, enhances worker comfort and productivity | Energy efficiency, dimmability, compatibility with existing lighting controls |

| Manufacturing & Industrial Facilities | General overhead lighting in production and assembly lines | Improves visual comfort, reduces eye strain, and enhances safety | Durability, IP rating for dust and moisture, easy maintenance |

| Hospitality & Retail | Accent and ambient lighting in lobbies and display areas | Creates inviting atmosphere, highlights architectural features | Aesthetic design, color rendering index (CRI), integration with décor |

| Healthcare Facilities | Patient rooms and corridors lighting | Provides calm, glare-free illumination conducive to healing | Compliance with healthcare lighting standards, low heat emission |

| Educational Institutions | Classrooms and lecture halls lighting | Enhances focus, reduces eye fatigue, supports varied learning activities | Flexibility in lighting control, uniform light distribution, energy savings |

Commercial Office Spaces

Indirect lighting is widely employed in commercial office environments to create a soft, glare-free ambient light that reduces eye strain for employees working with computer screens. This type of lighting is often combined with task lighting to balance visual comfort and functionality. For international buyers in regions like Africa, South America, the Middle East, and Europe, sourcing indirect lighting solutions that support energy-efficient LED technology and are compatible with smart building systems is critical. Ensuring fixtures have dimmable capabilities and low maintenance requirements enhances long-term operational efficiency.

Manufacturing & Industrial Facilities

In manufacturing and industrial settings, indirect lighting fixtures are used to provide broad, even illumination across production floors and assembly lines. This reduces harsh shadows and glare, which can cause eye fatigue and reduce worker safety. Buyers from industrial hubs in countries such as Mexico or Thailand should prioritize sourcing lighting solutions with high durability, appropriate IP ratings for dust and moisture resistance, and easy maintenance features to withstand challenging environments. Energy efficiency and compliance with local electrical standards are also key factors.

Illustrative Image (Source: Google Search)

Hospitality & Retail

Indirect lighting plays a crucial role in hospitality and retail sectors by enhancing ambiance and emphasizing architectural elements or product displays. The soft light creates an inviting atmosphere that can influence customer behavior and satisfaction. International B2B buyers should focus on fixtures with high color rendering index (CRI) to faithfully reproduce colors and designs, and lighting that integrates seamlessly with interior décor. Additionally, sourcing from manufacturers offering customizable design options can provide a competitive edge in diverse markets.

Healthcare Facilities

Healthcare environments benefit from indirect lighting due to its ability to offer calm, uniform illumination without glare, which is essential for patient comfort and staff efficiency. Indirect lighting in patient rooms and corridors helps create a soothing atmosphere conducive to healing. Buyers from international healthcare providers must ensure compliance with stringent healthcare lighting standards, prioritize low heat emission fixtures to maintain room temperature, and select products with long lifespans and easy sanitization features.

Educational Institutions

In educational settings, indirect lighting is used to provide consistent, glare-free illumination in classrooms and lecture halls, enhancing student focus and reducing eye fatigue during long study sessions. For B2B buyers in diverse educational markets, sourcing lighting systems that allow flexible control (e.g., dimming, zoning) and provide uniform light distribution is critical. Energy efficiency is also a major consideration to reduce operational costs, especially in regions with high energy prices or limited infrastructure.

Related Video: Basic 3D lighting concepts, Ray Tracing and Global Illumination

Strategic Material Selection Guide for indirect lighting

Aluminum

Key Properties: Aluminum is lightweight, highly corrosion-resistant, and has excellent thermal conductivity, making it suitable for dissipating heat generated by indirect lighting fixtures. It withstands moderate temperature variations typical in indoor environments and resists oxidation without additional coatings.

Pros & Cons: Aluminum offers ease of manufacturing, including extrusion and casting, allowing for complex fixture designs. It is durable yet lightweight, reducing installation labor and shipping costs. However, aluminum can be more expensive than some alternatives and may require anodizing or powder coating to enhance surface durability in harsh environments.

Impact on Application: Aluminum’s corrosion resistance is advantageous in humid or coastal regions, such as parts of South America and Africa, where moisture and salt exposure are concerns. Its thermal properties help maintain LED longevity by preventing overheating.

International B2B Considerations: Buyers in Europe and the Middle East often require compliance with EN and DIN standards for aluminum alloys and finishes. In regions like Thailand and Mexico, ASTM standards are common. Aluminum sourced should meet these standards to ensure compatibility with local building codes and procurement requirements. Its recyclability also aligns well with sustainability goals increasingly emphasized worldwide.

Steel (Galvanized or Stainless)

Key Properties: Steel provides high structural strength and rigidity, essential for large indirect lighting fixtures or architectural installations. Galvanized steel offers corrosion protection through zinc coating, while stainless steel provides inherent corrosion resistance and higher temperature tolerance.

Pros & Cons: Steel is cost-effective and widely available globally, making it attractive for large-scale projects. Galvanized steel is less expensive but can corrode if the coating is damaged, whereas stainless steel is more durable but significantly costlier. Steel’s weight can increase installation complexity and transportation costs.

Impact on Application: Steel is preferred in industrial or commercial environments where mechanical robustness is critical. Stainless steel is suitable for environments with higher humidity or chemical exposure, common in certain African and Middle Eastern industrial zones.

International B2B Considerations: Compliance with ASTM A653 for galvanized steel and ASTM A240 or EN 10088 for stainless steel is crucial. European buyers often look for CE marking and REACH compliance, while Middle Eastern and South American buyers prioritize corrosion resistance certifications. Steel’s availability and local fabrication capabilities in regions like Mexico and South America can reduce lead times and costs.

Polycarbonate and Acrylic Plastics

Key Properties: These plastics are lightweight, impact-resistant, and offer excellent light diffusion properties, essential for indirect lighting fixtures that require soft, glare-free illumination. They withstand moderate temperature ranges but can degrade under prolonged UV exposure unless treated.

Pros & Cons: Polycarbonate is more impact-resistant than acrylic but typically costs more. Acrylic offers superior optical clarity and is more scratch-resistant. Both materials simplify manufacturing with injection molding but may have lower fire resistance compared to metals.

Impact on Application: Ideal for indoor indirect lighting where weight reduction and design flexibility are priorities. Plastic materials are less suited for high-temperature or outdoor applications without additional UV stabilization.

International B2B Considerations: Buyers should verify compliance with fire safety standards such as UL 94 or EN 13501-1, especially in Europe and the Middle East. Material certifications for food safety or low VOC emissions may be relevant for office or hospitality sectors in Africa and South America. Supply chain reliability and local availability of high-grade plastics vary by region and should be assessed.

Painted or Powder-Coated Steel

Key Properties: Painted or powder-coated steel combines steel’s strength with enhanced corrosion resistance and aesthetic versatility. The coatings provide a protective barrier against moisture and chemicals, extending fixture lifespan.

Pros & Cons: This option is cost-effective and widely used for indirect lighting fixtures in commercial buildings. Powder coating offers a more durable finish than traditional paint but adds to manufacturing complexity and cost. Coating quality and application consistency are critical to prevent premature failure.

Impact on Application: Suitable for indoor environments with moderate exposure to humidity or pollutants. Coated steel can be customized in various colors and finishes to meet design requirements.

International B2B Considerations: Compliance with ISO 12944 for corrosion protection and ASTM D3359 for coating adhesion is important. Buyers in Europe and the Middle East often require environmental certifications for powder coatings, while African and South American markets may prioritize cost and local supplier capabilities. Proper packaging and handling during shipment are essential to avoid coating damage.

| Material | Typical Use Case for indirect lighting | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum | Lightweight fixtures with heat dissipation needs | Excellent corrosion resistance and thermal conductivity | Higher cost; may require surface treatment | Medium |

| Steel (Galvanized/Stainless) | Structural fixtures in industrial/commercial settings | High strength and durability | Heavier; corrosion risk if coating damaged | Low (galvanized) to High (stainless) |

| Polycarbonate/Acrylic Plastics | Light-diffusing components for indoor indirect lighting | Lightweight with excellent optical properties | Lower fire resistance; UV degradation risk | Medium |

| Painted/Powder-Coated Steel | Cost-effective, customizable fixtures with corrosion protection | Strong with versatile finishes | Coating can fail if not properly applied | Low to Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for indirect lighting

Manufacturing Processes for Indirect Lighting

The production of indirect lighting fixtures involves a series of precise and controlled stages designed to ensure optimal performance, durability, and aesthetic appeal. Understanding these manufacturing stages helps B2B buyers assess supplier capabilities and product quality.

1. Material Preparation

The first stage focuses on sourcing and preparing raw materials. Common materials include high-grade aluminum or steel for housing, optical-grade polycarbonate or acrylic for diffusers, and electronic components such as LEDs and drivers. Material quality directly impacts fixture longevity and light diffusion quality. Suppliers often perform incoming quality control (IQC) on materials to verify chemical composition, mechanical properties, and compliance with environmental standards (e.g., RoHS).

2. Forming and Fabrication

After material preparation, forming processes shape the fixture components:

– Sheet metal stamping and bending create the fixture body and reflectors, ensuring precise angles for optimal light reflection.

– Injection molding is used for plastic parts like diffusers and mounting brackets, allowing intricate shapes and consistent optical properties.

– Extrusion may be applied for linear lighting profiles, producing continuous lengths of aluminum housing with integrated channels for LEDs.

Advanced CNC machining and laser cutting ensure tight tolerances and consistent dimensions, critical for modular designs and installation compatibility.

3. Assembly

Assembly integrates electrical components with the mechanical structure:

– LED modules and drivers are mounted and wired, often incorporating thermal management systems such as heat sinks or cooling fins.

– Diffusers and reflectors are installed to control light distribution, focusing on achieving high indirect light output with minimal glare.

– Fixtures undergo sealing or gasketing to meet IP (Ingress Protection) ratings, ensuring protection against dust and moisture — essential for diverse climate conditions in Africa, South America, the Middle East, and Europe.

Automated assembly lines with precision robotics improve consistency and reduce human error, while manual inspection steps ensure quality at each station.

4. Finishing

The finishing process enhances both aesthetics and durability:

– Powder coating or anodizing aluminum surfaces provides corrosion resistance and a variety of color options, important for architectural integration.

– UV-resistant coatings protect plastic diffusers from yellowing and degradation in high-UV environments common in equatorial regions.

– Final cleaning and packaging are performed in controlled environments to prevent contamination.

Quality Assurance and Control (QA/QC) in Indirect Lighting Production

For international B2B buyers, especially from regions like Africa, South America, the Middle East, and Europe, thorough quality assurance practices and adherence to recognized standards are critical for ensuring product reliability and regulatory compliance.

Relevant International and Industry Standards

– ISO 9001: The global benchmark for quality management systems, ensuring consistent processes and continuous improvement.

– CE Marking: Mandatory for European markets, confirming compliance with safety, health, and environmental protection standards.

– IEC Standards (e.g., IEC 60598): Specific to luminaires, covering electrical safety and performance criteria.

– RoHS Compliance: Restricts hazardous substances in electrical products, crucial for environmental regulations worldwide.

– IP Ratings (e.g., IP20, IP65): Indicate protection against solids and liquids, vital for fixtures used in industrial or outdoor settings.

– Local Certifications: Some markets may require additional certifications (e.g., NOM in Mexico, SASO in Saudi Arabia) which suppliers must meet.

Key QC Checkpoints Throughout Production

– Incoming Quality Control (IQC): Verification of raw materials and components before production begins, checking for defects and compliance certificates.

– In-Process Quality Control (IPQC): Continuous inspections during forming, assembly, and finishing stages to detect deviations early. This includes dimensional checks, solder joint inspections, and functional testing of electronic components.

– Final Quality Control (FQC): Comprehensive testing of finished products, including performance, safety, and visual inspections before shipment.

Common Testing Methods

– Photometric Testing: Measures luminous intensity distribution, ensuring the fixture meets designed indirect lighting specifications with correct light output and uniformity.

– Electrical Safety Testing: Includes insulation resistance, earth continuity, and high-potential (hi-pot) tests to verify electrical safety.

– Thermal Testing: Assesses heat dissipation to prevent overheating and extend LED lifespan.

– Environmental Testing: Simulates conditions such as humidity, dust exposure, and UV radiation to verify durability in diverse climates.

– Mechanical Testing: Vibration and impact resistance tests ensure robustness during transport and installation.

Verifying Supplier Quality Assurance for B2B Buyers

International buyers must take proactive steps to verify supplier quality assurance, especially when sourcing from diverse global regions.

1. Supplier Audits

Conduct on-site audits or remote virtual audits focusing on:

– Quality management system certifications (ISO 9001, CE compliance documentation)

– Production process controls and traceability

– Testing facilities and equipment calibration records

– Workforce training and safety practices

Audits can be performed by buyers’ internal teams or trusted third-party inspection agencies.

2. Review of Quality Documentation and Test Reports

Request comprehensive documentation:

– Material certificates and compliance reports

– In-process inspection records and non-conformance reports

– Final product test results, including photometric and electrical safety data

– Packaging and labeling standards

3. Third-Party Inspections and Certifications

Engage independent testing laboratories or certification bodies for:

– Pre-shipment inspections verifying product conformity and packaging integrity

– Certification of compliance with regional standards (e.g., CE, NOM, SASO)

– Environmental and safety audits

This approach mitigates risks associated with supplier discrepancies or fraudulent certifications.

QC and Certification Nuances for International Markets

B2B buyers must consider regional regulatory environments and end-use conditions when evaluating QC and certifications.

- Africa and Middle East: Climate resilience is paramount. Products should have robust IP ratings and UV-resistant coatings due to high dust, heat, and sunlight exposure. Local certification requirements vary, so suppliers should demonstrate familiarity with national standards and import regulations.

- South America: Import regulations often emphasize electrical safety and environmental compliance. Buyers should verify that suppliers provide bilingual documentation (e.g., Spanish and Portuguese) and adapt products to voltage and frequency standards in countries like Brazil and Mexico.

- Europe: Compliance with stringent CE marking and RoHS directives is mandatory. Buyers benefit from suppliers with transparent quality management systems and traceability for sustainability reporting.

- Southeast Asia (e.g., Thailand): Buyers should ensure products meet both international standards and local electrical safety certifications. Environmental durability against tropical humidity and variable power quality is critical.

Actionable Insights for B2B Buyers

- Prioritize suppliers with ISO 9001 certification and documented adherence to relevant electrical and safety standards to reduce quality risks.

- Demand detailed quality documentation and conduct supplier audits focusing on process controls and testing capabilities.

- Incorporate third-party inspections in procurement contracts to independently verify product compliance and quality before shipment.

- Consider regional environmental and regulatory requirements when selecting product specifications, including IP ratings and certifications.

- Leverage digital tools for quality data sharing and remote audits to overcome geographic challenges and ensure transparency.

By understanding the manufacturing intricacies and quality assurance frameworks behind indirect lighting products, international B2B buyers can make informed sourcing decisions that align with their operational needs and compliance obligations.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for indirect lighting Sourcing

Breakdown of Cost Components in Indirect Lighting Sourcing

Understanding the key cost components is essential for international B2B buyers to effectively evaluate and negotiate indirect lighting solutions:

-

Materials: Core raw materials typically include aluminum or steel for fixture frames, diffusers made from acrylic or polycarbonate, LED modules, drivers, and wiring. The choice of materials affects durability, energy efficiency, and compliance with regional standards, impacting costs significantly.

-

Labor: Labor costs encompass the assembly, wiring, testing, and packaging of lighting fixtures. These vary greatly depending on the manufacturing location and skill level of the workforce. Buyers sourcing from regions with lower labor costs may gain price advantages but should balance this with quality assurance.

-

Manufacturing Overhead: This includes factory utilities, equipment depreciation, and indirect labor such as supervisors and maintenance staff. Overhead can fluctuate based on factory scale and automation level.

-

Tooling and Setup: Custom tooling for specific fixture designs or modifications to existing molds can add upfront costs, especially for smaller order quantities. These expenses are amortized over production runs, influencing unit pricing.

-

Quality Control (QC): Rigorous QC processes, including photometric testing, electrical safety checks, and certification compliance, add to costs but ensure product reliability and reduce warranty claims.

-

Logistics: Freight charges, customs duties, and import taxes must be factored in, particularly for buyers in Africa, South America, the Middle East, and Europe, where port charges and inland transportation can vary widely.

-

Supplier Margin: Manufacturers and distributors include margins to cover profit and risk. Margins may be higher for specialized or low-volume products.

Key Price Influencers for Indirect Lighting

Several factors directly influence the pricing structure and should be carefully considered during sourcing:

-

Order Volume and Minimum Order Quantity (MOQ): Larger volumes typically lead to lower unit costs due to economies of scale. MOQ requirements may restrict smaller buyers or increase inventory costs.

-

Specifications and Customization: Custom finishes, integrated smart controls, or unique fixture dimensions increase tooling and labor costs. Standardized products generally offer better pricing.

-

Material Quality and Certifications: Compliance with international standards such as CE, UL, or RoHS adds cost but is critical for market acceptance in Europe, the Middle East, and beyond.

-

Supplier Reputation and Reliability: Established suppliers with proven track records may charge premiums but offer better service, warranties, and after-sales support.

-

Incoterms and Delivery Terms: Terms like FOB, CIF, or DDP affect who bears transportation and customs risks and costs. Selecting appropriate Incoterms can optimize cash flow and risk exposure.

Actionable Buyer Tips for Cost-Efficient Indirect Lighting Procurement

To maximize value and control costs in international sourcing, buyers should adopt strategic approaches:

-

Negotiate Beyond Price: Engage suppliers on payment terms, lead times, and value-added services such as extended warranties or on-site training to enhance total value.

-

Focus on Total Cost of Ownership (TCO): Evaluate energy efficiency, maintenance frequency, and lifespan alongside upfront costs. High-quality LED indirect lighting may have higher initial costs but yield savings over time through reduced energy consumption and replacement needs.

-

Leverage Volume Consolidation: Where possible, aggregate demand across multiple projects or subsidiaries to unlock better pricing tiers and reduce per-unit logistics costs.

-

Assess Regional Supplier Options: For buyers in Africa, South America, the Middle East, and Europe, consider local or regional manufacturers to reduce import duties and lead times, while ensuring compliance with local standards.

-

Understand Pricing Nuances: Be aware that prices can fluctuate with raw material market trends (e.g., aluminum and copper), currency exchange rates, and geopolitical factors affecting supply chains.

-

Incorporate Digital Procurement Tools: Utilize sourcing optimization platforms that provide data-driven insights on cost benchmarking and supplier performance to inform negotiation strategies.

Disclaimer on Pricing

All cost and pricing insights provided are indicative and subject to variation based on supplier, region, order specifications, and market dynamics. Buyers should conduct due diligence and request detailed quotations tailored to their specific requirements to ensure accurate budgeting.

By thoroughly analyzing these cost and pricing factors, international B2B buyers can strategically source indirect lighting solutions that balance quality, compliance, and cost-effectiveness, ultimately enhancing operational efficiency and project success.

Spotlight on Potential indirect lighting Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘indirect lighting’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for indirect lighting

Critical Technical Properties for Indirect Lighting

When sourcing indirect lighting solutions internationally, understanding key technical properties is essential for ensuring product suitability, quality, and cost-efficiency. Here are the top specifications buyers should prioritize:

-

Light Distribution Ratio

This indicates the percentage of light directed upwards versus downwards. For indirect lighting, typically 90% or more of the lumens are projected upwards to reflect off ceilings or walls, creating soft ambient illumination. Buyers should confirm this ratio to match design intentions and achieve the desired glare-free environment. -

Color Temperature (Kelvin, K)

Color temperature defines the light’s hue, ranging from warm (2700K-3000K) to cool (5000K-6500K). Selecting the right Kelvin value affects workplace ambiance and occupant comfort. For office and commercial spaces common in Africa, Europe, and South America, a neutral white (3500K-4100K) often balances alertness and comfort. -

Material Grade and Finish

Fixtures are commonly made from aluminum, steel, or polycarbonate with powder-coated or anodized finishes. High-grade materials ensure durability, corrosion resistance (important for humid or coastal regions), and aesthetic longevity. Confirm material certifications and finish standards to reduce maintenance and replacement costs. -

Mounting and Installation Tolerance

Precision in mounting compatibility (e.g., ceiling suspension height, wall bracket dimensions) is crucial for ease of installation and retrofit projects. Buyers should verify tolerance ranges to avoid costly onsite modifications, especially when sourcing from distant suppliers. -

Energy Efficiency (Lumens per Watt, lm/W)

This metric measures the fixture’s light output relative to its power consumption. Higher lm/W values mean better efficiency and lower operating costs. Energy-efficient indirect lighting is increasingly demanded in regions with rising electricity costs and sustainability goals, such as the Middle East and Europe. -

Dimming and Control Compatibility

Integration with lighting control systems (DALI, 0-10V dimming) allows for flexible lighting scenarios and energy savings. Buyers should specify control protocol compatibility upfront to avoid costly system incompatibilities, especially in technologically advanced markets.

Key Industry and Trade Terminology for Indirect Lighting Procurement

Understanding common trade terms helps international B2B buyers navigate contracts, negotiations, and supply chain logistics effectively:

-

OEM (Original Equipment Manufacturer)

Refers to the company that manufactures the lighting fixtures or components. Some buyers prefer OEM products for assured quality and warranty, while others may opt for branded resellers or private-label suppliers. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in one order. MOQ affects inventory planning and cost per unit. For buyers in emerging markets or smaller projects, negotiating lower MOQs can reduce upfront investment and risk. -

RFQ (Request for Quotation)

A formal document sent to suppliers to obtain pricing, lead times, and terms for specified products. Clear, detailed RFQs ensure accurate bids and facilitate fair supplier comparison. -

Incoterms (International Commercial Terms)

Standardized trade terms that define responsibilities, costs, and risks between buyer and seller during shipment. Common terms include FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Selecting appropriate Incoterms clarifies logistics and customs duties, crucial for cross-border indirect lighting purchases. -

Lead Time

The period from order confirmation to delivery. Knowing accurate lead times helps buyers align procurement with project schedules and avoid costly delays. -

Warranty Terms

Specifies the coverage period and conditions under which the supplier will repair or replace defective products. Buyers should evaluate warranty length and scope to mitigate post-purchase risks.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions, optimize procurement processes, and ensure indirect lighting solutions meet performance, budget, and regulatory requirements across diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the indirect lighting Sector

Market Overview & Key Trends

The global indirect lighting market is experiencing robust growth driven by a convergence of technological innovation, evolving workplace aesthetics, and energy efficiency imperatives. For international B2B buyers, especially those in Africa, South America, the Middle East, and Europe—including emerging markets like Thailand and Mexico—understanding these dynamics is critical for strategic procurement and competitive positioning.

Key Market Drivers:

– Energy Efficiency & Cost Reduction: Indirect lighting solutions, primarily using LED technology, offer significant reductions in energy consumption compared to traditional lighting. This appeals strongly to markets facing rising energy costs and sustainability mandates.

– Workplace Well-being & Productivity: Indirect lighting reduces glare and eye strain, enhancing occupant comfort and productivity in commercial and industrial settings. This trend is particularly influential in office building projects and corporate campuses.

– Urbanization & Infrastructure Development: Rapid urban growth in Africa and South America fuels demand for modern commercial and public spaces equipped with sophisticated lighting systems that integrate indirect lighting for ambiance and functional illumination.

– Technological Advancements: Smart lighting systems with IoT integration enable dynamic control of indirect lighting fixtures, allowing for adaptive lighting schemes that optimize energy use and user experience. This is increasingly relevant for buyers focused on future-proofing their facilities.

Sourcing and Procurement Trends:

– Hybrid Lighting Solutions: Combining indirect with direct lighting fixtures is becoming a norm to balance ambiance with task lighting, accommodating diverse spatial needs in offices, retail, and hospitality sectors.

– Furniture-Integrated Fixtures: For open-plan offices, furniture or partition-mounted indirect lighting is gaining traction, though buyers should evaluate installation flexibility and glare control challenges.

– Digital Procurement Platforms: B2B buyers leverage AI-driven sourcing tools and automation platforms to streamline supplier selection, optimize costs, and manage complex supply chains in real time—critical in regions where supply chain disruptions are common.

Market Dynamics:

– Regional disparities in infrastructure maturity and energy policy affect adoption rates. For example, European buyers benefit from stringent energy regulations and incentives, while Middle Eastern buyers focus on luxury and architectural lighting applications.

– Currency volatility and import tariffs in emerging markets like Mexico and Thailand can impact procurement costs, making strategic supplier relationships and local manufacturing partnerships valuable.

Sustainability & Ethical Sourcing in B2B Indirect Lighting

Sustainability has become a cornerstone in indirect lighting procurement, driven by both regulatory frameworks and corporate social responsibility agendas. For B2B buyers across diverse geographies, embedding sustainability in sourcing decisions yields long-term value beyond compliance.

Environmental Impact Considerations:

– Energy Consumption: Indirect lighting fixtures predominantly use LED technology, which consumes up to 75% less energy than incandescent or fluorescent alternatives. Lower energy usage translates to reduced carbon footprints and operational costs.

– Material Selection: Buyers increasingly prioritize fixtures made from recyclable and low-impact materials such as aluminum and sustainably sourced plastics. Avoidance of hazardous substances like mercury is essential to meet international environmental standards.

Ethical Supply Chain Imperatives:

– Transparency & Traceability: Ensuring suppliers adhere to fair labor practices and responsible sourcing is critical, especially when sourcing from regions with less mature regulatory oversight. Certifications such as ISO 14001 (Environmental Management) and SA8000 (Social Accountability) provide assurance.

– Green Certifications: Look for products certified under recognized schemes like ENERGY STAR, EU Ecolabel, or TCO Certified, which validate energy efficiency and environmental performance. These certifications facilitate compliance with green building standards such as LEED or BREEAM.

Strategic Benefits for Buyers:

– Enhancing brand reputation by demonstrating commitment to sustainability and ethical practices.

– Accessing incentives and subsidies available in many countries for energy-efficient lighting solutions.

– Mitigating risks associated with supply chain disruptions due to environmental or social governance failures.

Evolution of Indirect Lighting in the B2B Context

Indirect lighting has evolved from a niche architectural technique to a mainstream solution integral to modern commercial and industrial spaces. Initially popularized in North America and Europe during the late 20th century for its aesthetic and ergonomic benefits, indirect lighting has progressively incorporated advanced LED technology and smart controls.

Early indirect lighting systems relied heavily on fluorescent tubes and bulky fixtures, limiting design flexibility and energy efficiency. The advent of LED technology revolutionized the sector by enabling slim, versatile fixtures with longer lifespans and significantly reduced power consumption. This shift opened new markets in developing regions where energy efficiency is both an economic and environmental priority.

Today, indirect lighting is no longer confined to ceiling-mounted fixtures but extends to integrated furniture lighting and dynamic systems that respond to occupancy and ambient light. This evolution reflects broader trends in workplace design and sustainability, positioning indirect lighting as a strategic asset for B2B buyers aiming to optimize both human experience and operational performance.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of indirect lighting

-

How can I effectively vet suppliers of indirect lighting when sourcing internationally?

To vet international suppliers, start by verifying their business licenses and certifications relevant to lighting products (e.g., ISO 9001, CE, RoHS). Request detailed product specifications, samples, and customer references, especially from buyers in similar regions or industries. Utilize third-party inspection services to audit manufacturing facilities and quality control processes. Engage in direct communication to assess responsiveness and transparency. Platforms like Alibaba or global trade shows can provide initial leads, but always follow up with due diligence tailored to your market’s regulatory and quality expectations. -

What customization options are typically available for indirect lighting products?

Many manufacturers offer customization in terms of fixture size, color temperature, lumen output, mounting types, and control systems (e.g., dimmable, smart lighting integration). For international buyers, it’s essential to specify voltage compatibility (e.g., 220V vs. 110V) and compliance with local electrical standards. Some suppliers also provide bespoke designs tailored to architectural requirements or branding needs. Early engagement with suppliers to discuss technical drawings and prototypes helps ensure your specifications align with production capabilities and local market preferences. -

What are common Minimum Order Quantities (MOQs) and lead times for indirect lighting in international B2B trade?

MOQs vary widely but typically range from 50 to 500 units, depending on the complexity and customization level. Lead times often span 4 to 12 weeks, factoring in production, quality checks, and international shipping. Buyers from Africa, South America, the Middle East, and Europe should factor in additional buffer time for customs clearance and potential logistics delays. Negotiating flexible MOQs and phased shipments can reduce upfront costs and inventory risks, especially when testing new suppliers or product lines. -

Which payment terms are standard for international purchases of indirect lighting, and how can buyers mitigate risks?

Common payment terms include 30% advance deposit with balance upon shipment or letter of credit (LC) arrangements. For new suppliers, use escrow services or trade finance solutions to protect payments. Buyers should clearly define payment milestones linked to production progress and quality inspections. Establishing long-term partnerships often leads to more favorable terms such as net 30 or net 60 days. It’s prudent to work with experienced freight forwarders and insurers to secure goods in transit, minimizing financial exposure. -

What quality assurance (QA) certifications and standards should I look for in indirect lighting products?

Look for internationally recognized certifications such as CE (European Conformity), UL (Underwriters Laboratories), RoHS (Restriction of Hazardous Substances), and energy efficiency labels like ENERGY STAR or equivalent local standards. These certify safety, environmental compliance, and performance reliability. Additionally, ISO 9001 certification for the supplier’s quality management system indicates consistent manufacturing standards. Request test reports for photometric performance, electrical safety, and durability to ensure products meet your operational requirements and local regulations. -

How should I plan logistics and shipping when importing indirect lighting from Asia or Europe to regions like Africa or South America?

Choose between sea freight for cost efficiency or air freight for faster delivery, balancing speed and budget. Coordinate with freight forwarders familiar with your destination’s import regulations, taxes, and customs procedures to avoid delays. Packaging should protect fragile components and comply with international standards. Consider consolidated shipments if sourcing multiple items. Track shipments proactively and prepare for potential local infrastructure challenges. Establish clear Incoterms (e.g., FOB, CIF) to define responsibility for shipping costs and risks. -

What strategies can help resolve disputes or quality issues with international indirect lighting suppliers?

Maintain detailed contracts specifying product specifications, delivery timelines, payment terms, and dispute resolution processes. Use third-party inspection agencies to verify quality before shipment. If issues arise, communicate promptly and document all correspondence. Leverage international arbitration clauses or mediation services to resolve conflicts efficiently. Building strong relationships and cultural understanding with suppliers can facilitate smoother negotiations. Additionally, sourcing from suppliers with established reputations and transparent operations reduces the likelihood of disputes. -

Are there any regional considerations for indirect lighting procurement in Africa, South America, the Middle East, and Europe?

Yes, regional factors such as electrical grid standards, climate conditions, and local building codes influence product selection. For example, Africa and the Middle East often require fixtures with higher IP ratings due to dust and humidity. Voltage and frequency standards differ: Europe commonly uses 230V/50Hz, while some South American countries have mixed standards. Energy efficiency incentives vary by region, impacting product demand. Understanding these nuances helps tailor procurement strategies, ensuring compliance, durability, and market acceptance. Engaging local consultants or partners can provide valuable insights.

Strategic Sourcing Conclusion and Outlook for indirect lighting

Indirect lighting presents a compelling opportunity for international B2B buyers seeking to enhance workplace environments while optimizing energy efficiency. Key takeaways emphasize the importance of selecting lighting solutions that balance indirect and direct components to minimize glare, improve occupant comfort, and increase productivity. Strategic sourcing in this category should prioritize suppliers offering innovative fixture designs adaptable to diverse architectural needs, as well as those committed to sustainable manufacturing practices.

For businesses across Africa, South America, the Middle East, and Europe—including emerging markets like Thailand and Mexico—leveraging local and regional suppliers with proven expertise can reduce lead times and logistics costs, while fostering closer collaboration on customization and compliance with local standards. Integrating procurement technologies and data-driven sourcing strategies will further enhance negotiation power and supplier performance management.

Looking ahead, the indirect lighting market is poised for growth driven by digital controls, smart integration, and sustainability demands. Buyers are encouraged to adopt a proactive sourcing approach that anticipates technological advancements and evolving regulatory landscapes. By doing so, organizations will not only secure competitive pricing and quality but also support long-term operational resilience and environmental responsibility. Now is the time to strategically invest in indirect lighting solutions that align with your business goals and global sustainability commitments.