Guide to Hardwire Led Strip

- Introduction: Navigating the Global Market for hardwire led strip

- Understanding hardwire led strip Types and Variations

- Key Industrial Applications of hardwire led strip

- Strategic Material Selection Guide for hardwire led strip

- Summary Table of Material Selection for Hardwire LED Strips

- In-depth Look: Manufacturing Processes and Quality Assurance for hardwire led strip

- Comprehensive Cost and Pricing Analysis for hardwire led strip Sourcing

- Spotlight on Potential hardwire led strip Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for hardwire led strip

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the hardwire led strip Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of hardwire led strip

- Strategic Sourcing Conclusion and Outlook for hardwire led strip

Introduction: Navigating the Global Market for hardwire led strip

The global demand for hardwire LED strips continues to surge as industries worldwide seek efficient, durable, and customizable lighting solutions. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—understanding the complexities of sourcing hardwire LED strips is essential to securing competitive advantages. These lighting systems are integral not only for enhancing commercial and industrial environments but also for meeting stringent energy efficiency and safety standards that vary across regions.

This guide delivers an authoritative roadmap to mastering the hardwire LED strip market, addressing critical aspects such as the diverse types and materials available, manufacturing processes, and quality control benchmarks. It explores how to evaluate suppliers effectively, balance cost considerations with product performance, and navigate the nuances of international logistics and compliance.

By providing in-depth insights into market trends and procurement best practices, this resource empowers buyers to make informed decisions that optimize both operational efficiency and return on investment. Whether your focus is on large-scale commercial installations or specialized applications requiring bespoke solutions, this guide equips you with the knowledge to confidently select the right products and partners.

Ultimately, this comprehensive overview is designed to streamline your sourcing strategy, mitigate risks, and enhance your supply chain resilience—ensuring your business remains ahead in an increasingly competitive global lighting market.

Understanding hardwire led strip Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Single-Color Hardwire LED Strip | Fixed color LEDs, typically white or warm white | Retail lighting, office spaces, hospitality | Pros: Cost-effective, simple installation; Cons: Limited flexibility in ambiance |

| RGB Hardwire LED Strip | Integrated Red, Green, Blue LEDs allowing color mixing | Entertainment venues, architectural lighting | Pros: Versatile color options; Cons: Higher cost, requires compatible controllers |

| Waterproof Hardwire LED Strip | Encapsulated with silicone or epoxy for moisture resistance | Outdoor signage, landscape lighting | Pros: Durable in harsh environments; Cons: Slightly higher price, limited flexibility |

| High-Density Hardwire LED Strip | Increased LED count per meter for higher brightness | Industrial lighting, task lighting | Pros: Superior illumination; Cons: Higher power consumption, increased heat output |

| Dimmable Hardwire LED Strip | Compatible with dimmer switches for adjustable brightness | Conference rooms, luxury retail, hospitality | Pros: Enhanced user control; Cons: Requires compatible dimming systems, slightly higher cost |

Single-Color Hardwire LED Strip

This type features LEDs emitting a single, fixed color, commonly warm or cool white. Its straightforward design makes it ideal for businesses requiring consistent, uniform lighting such as retail stores and offices. For B2B buyers, the key considerations include cost efficiency and ease of integration. While it lacks customization, its reliability and lower price point make it a staple for large-scale installations with standard lighting needs.

RGB Hardwire LED Strip

RGB strips combine red, green, and blue LEDs enabling dynamic color mixing and effects. This variation suits businesses in entertainment, hospitality, and architectural projects seeking customizable ambiance. Buyers should evaluate the need for compatible control systems and the increased upfront costs. The flexibility in color and mood control offers a strong value proposition for projects emphasizing brand differentiation or experiential lighting.

Waterproof Hardwire LED Strip

Designed with protective coatings, waterproof LED strips withstand moisture, dust, and outdoor elements. They are essential for outdoor signage, landscaping, and industrial environments exposed to weather. B2B purchasers must assess the IP rating to ensure suitability for specific environments. While priced higher, the durability and reduced maintenance costs justify the investment for long-term outdoor applications.

High-Density Hardwire LED Strip

These strips feature a greater number of LEDs per meter, delivering intense brightness suitable for task-oriented and industrial lighting. Buyers targeting warehouses, manufacturing plants, or detailed workspaces benefit from their superior illumination. Considerations include increased energy consumption and heat management requirements. The enhanced light output supports environments where visibility and precision are critical.

Dimmable Hardwire LED Strip

Dimmable variants allow adjustable brightness levels through compatible dimmer switches or systems. This flexibility is valuable for premium retail, conference facilities, and hospitality sectors where lighting ambiance impacts customer experience. B2B buyers should ensure system compatibility and factor in slightly higher costs. The ability to tailor lighting intensity enhances energy savings and user comfort, adding operational value.

Key Industrial Applications of hardwire led strip

| Industry/Sector | Specific Application of hardwire led strip | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing & Warehousing | Machine status indicators and safety lighting | Enhances operational safety and real-time monitoring | Durability under industrial conditions, compliance with safety standards, ease of integration with control systems |

| Retail & Commercial Spaces | Architectural accent lighting and product display illumination | Improves customer experience and highlights merchandise | Customizable brightness/color, energy efficiency, long lifespan, and aesthetic consistency |

| Transportation & Infrastructure | Tunnel and underpass lighting, vehicle interior illumination | Ensures safety and visibility, reduces maintenance costs | High IP rating for moisture/dust resistance, vibration resistance, and compliance with regional electrical standards |

| Hospitality & Entertainment | Ambient lighting in hotels, theaters, and event venues | Creates immersive environments, enhances guest satisfaction | Flexibility in installation, dimmable and color-changing options, compatibility with smart control systems |

| Healthcare Facilities | Task lighting in operating rooms and diagnostic areas | Provides precise illumination critical for medical procedures | High color rendering index (CRI), reliability, and adherence to health and safety regulations |

Manufacturing & Warehousing

Hardwire LED strips are widely used in manufacturing plants and warehouses to provide machine status indication and safety lighting. These strips help operators quickly identify operational states or hazards, reducing downtime and improving workplace safety. Buyers from Africa, South America, the Middle East, and Europe should prioritize sourcing LED strips that meet industrial-grade durability and safety certifications, ensuring longevity under harsh conditions such as dust, heat, or vibrations common in manufacturing environments.

Retail & Commercial Spaces

In retail settings, hardwire LED strips are employed to enhance architectural features and illuminate product displays, creating an inviting atmosphere that encourages customer engagement. For B2B buyers, especially in Europe and Australia, it’s important to select LED strips with customizable color temperatures and brightness levels to match brand aesthetics and comply with local energy efficiency regulations. Long lifespan and low maintenance also reduce operational costs in high-traffic commercial areas.

Transportation & Infrastructure

Hardwire LED strips are critical in tunnels, underpasses, and public transport vehicles to provide consistent, reliable lighting that enhances safety and visibility. International buyers should focus on LED strips with high ingress protection (IP) ratings for resistance to moisture and dust, as well as vibration-proof designs to withstand constant movement. Compliance with regional electrical and safety standards is essential for infrastructure projects across diverse climates and geographies.

Hospitality & Entertainment

Hotels, theaters, and event venues utilize hardwire LED strips to create dynamic ambient lighting that elevates guest experiences. The ability to dim and change colors allows for versatile lighting schemes adaptable to different moods and events. Buyers should look for products compatible with smart control systems for seamless integration and remote management, a feature increasingly demanded in technologically advanced markets such as Europe and the Middle East.

Healthcare Facilities

In healthcare, hardwire LED strips provide high-precision task lighting necessary for operating rooms and diagnostic areas where color accuracy and reliability are paramount. Buyers must ensure products have a high color rendering index (CRI) to support accurate diagnosis and treatment. Additionally, strict adherence to health and safety regulations is mandatory, particularly for buyers in regions with rigorous medical standards like the EU and Australia, ensuring patient safety and compliance.

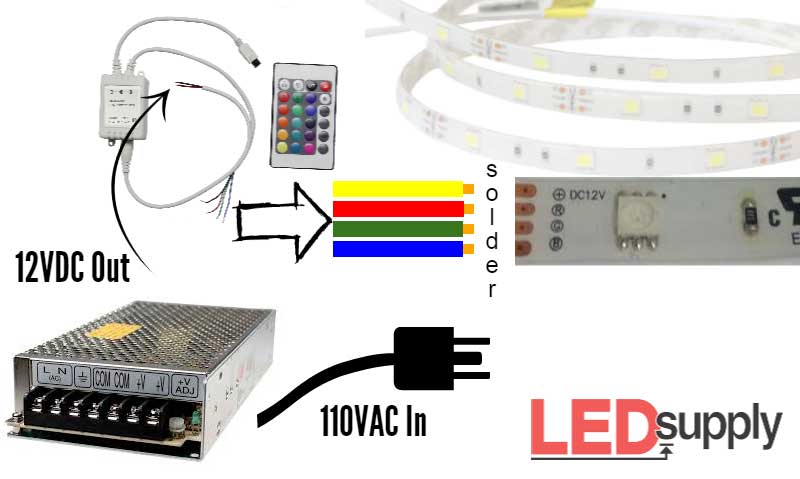

Related Video: How to cut, connect & power LED Strip Lighting

Strategic Material Selection Guide for hardwire led strip

When selecting materials for hardwire LED strips, international B2B buyers must carefully evaluate the physical properties, durability, cost implications, and compliance with regional standards. The choice of material not only affects the product’s performance and longevity but also impacts manufacturing complexity and suitability for specific applications. Below is an analysis of four common materials used in hardwire LED strip construction, focusing on their relevance to buyers in Africa, South America, the Middle East, and Europe.

1. Polyvinyl Chloride (PVC)

Key Properties:

PVC is widely used as insulation and protective sheathing for hardwire LED strips due to its excellent electrical insulation, flexibility, and moderate temperature resistance (typically up to 70–90°C). It offers good resistance to moisture and chemicals but has limited UV resistance unless specially treated.

Pros & Cons:

PVC is cost-effective and easy to manufacture, making it popular for large-scale production. However, it can become brittle over time, especially under prolonged UV exposure or extreme temperatures. It is less environmentally friendly compared to some alternatives, which may affect procurement preferences in Europe and Australia where sustainability is a growing concern.

Impact on Application:

PVC-coated hardwire LED strips are suitable for indoor and semi-outdoor environments where moderate temperature and humidity prevail. They are less ideal for harsh outdoor or industrial applications with high UV exposure or chemical contact.

Considerations for International Buyers:

Buyers in regions with intense sunlight, such as the Middle East and parts of Africa, should ensure UV-stabilized PVC grades are used. Compliance with international standards like ASTM D1784 (PVC material specifications) and RoHS (Restriction of Hazardous Substances) is critical, especially for European markets. In South America, local regulations may vary, so verifying chemical composition and flame retardance (UL94 ratings) is advisable.

2. Silicone Rubber

Key Properties:

Silicone rubber is prized for its exceptional thermal stability (operating temperatures from -60°C to +200°C), flexibility, and excellent resistance to UV, ozone, and moisture. It also has good electrical insulation properties and is highly resistant to harsh environmental conditions.

Pros & Cons:

While silicone rubber offers superior durability and flexibility, it is more expensive and complex to manufacture compared to PVC. Its softness can sometimes reduce mechanical protection, necessitating additional reinforcement in some designs.

Impact on Application:

Ideal for outdoor, industrial, and harsh environment applications where temperature extremes and UV exposure are concerns. Silicone-coated hardwire LED strips perform well in hot climates (Middle East, Australia) and humid tropical regions (parts of Africa and South America).

Considerations for International Buyers:

Buyers should verify compliance with IEC 60587 (Electrical insulation resistance to tracking and erosion) and ASTM D2000 (classification system for rubber materials). Silicone’s higher cost is often justified by longer service life and reduced maintenance, which is attractive for large-scale commercial projects in Europe and the Middle East.

3. Thermoplastic Elastomer (TPE)

Key Properties:

TPE combines the flexibility of rubber with the processability of plastics. It offers good resistance to abrasion, moisture, and chemicals, with moderate temperature tolerance generally between -40°C and +125°C. TPE materials are recyclable and can be formulated for enhanced UV resistance.

Pros & Cons:

TPE is more environmentally friendly than PVC and easier to recycle, aligning well with sustainability goals in Europe and Australia. It provides better flexibility and durability than PVC but is typically more expensive. Manufacturing complexity is moderate, with good compatibility for extrusion processes.

Impact on Application:

TPE-coated hardwire LED strips are suitable for both indoor and outdoor applications, especially where flexibility and environmental compliance are priorities. They are well-suited for installations in commercial and architectural lighting in Europe and upscale markets in South America.

Considerations for International Buyers:

Ensure suppliers provide TPE materials compliant with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in Europe and local environmental regulations. For African and Middle Eastern markets, buyers should confirm UV resistance ratings and flame retardancy certifications.

4. Polyurethane (PU)

Key Properties:

Polyurethane offers excellent abrasion resistance, elasticity, and chemical resistance. It can withstand temperatures from -40°C to +90°C and provides superior mechanical protection compared to PVC and TPE. PU coatings are also resistant to oils and solvents.

Pros & Cons:

PU is more durable and abrasion-resistant than PVC and TPE but is generally more costly and can be less flexible depending on formulation. It is more sensitive to UV degradation unless stabilized, which may limit outdoor use without additives.

Impact on Application:

PU-coated hardwire LED strips are ideal for industrial environments, automotive applications, and areas where mechanical wear and chemical exposure are concerns. They are favored in European and Australian markets for rugged installations.

Considerations for International Buyers:

Buyers should verify compliance with ASTM D412 (tensile properties of rubber materials) and ISO 527 (plastics tensile testing). In regions with strong sunlight (Middle East, Africa), UV-stabilized PU formulations are necessary. The higher cost may be justified by enhanced durability in demanding applications.

Summary Table of Material Selection for Hardwire LED Strips

| Material | Typical Use Case for hardwire led strip | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyvinyl Chloride (PVC) | Indoor and semi-outdoor lighting with moderate conditions | Cost-effective, easy to manufacture | Limited UV resistance, can become brittle | Low |

| Silicone Rubber | Harsh outdoor, industrial, and high-temperature environments | Excellent thermal stability and UV resistance | Higher cost, softer mechanical protection | High |

| Thermoplastic Elastomer (TPE) | Flexible indoor/outdoor applications with environmental focus | Good flexibility, recyclable, better than PVC | Moderate cost, requires UV and flame certification | Medium |

| Polyurethane (PU) | Industrial, automotive, and abrasion-prone environments | Superior abrasion and chemical resistance | More expensive, UV sensitivity without additives | High |

This guide equips B2B buyers with actionable insights to select materials that align with their project requirements, regional regulations, and budget constraints, ensuring optimal performance and compliance in diverse international markets.

In-depth Look: Manufacturing Processes and Quality Assurance for hardwire led strip

The manufacturing and quality assurance of hardwire LED strips involve meticulous processes and stringent standards to ensure product reliability, safety, and performance. For international B2B buyers—especially those from Africa, South America, the Middle East, and Europe—understanding these processes and quality checkpoints is essential to secure high-quality products that comply with regional and global requirements.

Manufacturing Process of Hardwire LED Strips

The production of hardwire LED strips typically follows a series of carefully controlled stages:

1. Material Preparation

This initial stage involves sourcing and preparing raw materials, including:

– LED chips and modules: High-quality semiconductor diodes are procured, often from certified suppliers.

– Flexible or rigid circuit boards: Copper-clad substrates are cut and treated for optimal conductivity and flexibility.

– Hardwiring components: Wires, connectors, and soldering materials are selected based on electrical specifications and durability requirements.

Material quality at this stage is critical, as it directly affects the strip’s lifespan and efficiency.

2. Forming and Circuit Assembly

During forming:

– Surface-mount technology (SMT) machines place LED chips and other electronic components on the circuit board with precision.

– Automated soldering ensures secure electrical connections between LEDs, resistors, and wiring.

– Hardwiring involves integrating fixed wiring harnesses or connectors that enable direct connection to power sources without additional adapters.

This stage requires precision to maintain uniform light output and reliable electrical pathways.

3. Assembly and Encapsulation

Assembly includes:

– Attaching protective layers such as silicone or epoxy coatings for waterproofing and mechanical protection.

– Adding hardwire terminals or junction boxes designed for specific voltage ratings and environmental conditions.

– Customization steps like cutting strips to length or integrating dimmable drivers.

Encapsulation safeguards the LEDs against moisture, dust, and mechanical stress, crucial for outdoor or industrial applications.

4. Finishing and Packaging

The finishing touches involve:

– Visual inspection for soldering quality, alignment, and physical defects.

– Labeling with product information, safety warnings, and compliance marks.

– Packaging designed to protect strips during transit, often including anti-static materials and moisture barriers.

Proper packaging prevents damage and ensures the product arrives in optimal condition.

Quality Assurance: Standards and Checkpoints

To meet international quality and safety expectations, hardwire LED strip manufacturers implement comprehensive quality assurance protocols that B2B buyers should scrutinize carefully.

Relevant International and Industry Standards

- ISO 9001: This global quality management standard certifies that manufacturers have systematic processes to consistently produce high-quality products and improve customer satisfaction.

- CE Marking: Mandatory for products sold in the European Economic Area, ensuring compliance with EU safety, health, and environmental protection requirements.

- RoHS (Restriction of Hazardous Substances): Ensures LED strips do not contain harmful substances above allowed limits.

- UL and ETL certifications: Common in North America but recognized worldwide, indicating compliance with electrical safety standards.

- IP Ratings: Define water and dust resistance levels (e.g., IP65, IP67), critical for outdoor or industrial use.

- Regional Certifications: Buyers from Africa, South America, the Middle East, and Australia should verify compliance with any local regulatory requirements, such as SABS in South Africa or SASO in Saudi Arabia.

Key Quality Control Checkpoints

Quality control is typically segmented into three main phases:

- Incoming Quality Control (IQC): Inspection and testing of raw materials and components upon arrival. This includes verifying LED chip performance, wire insulation integrity, and material certifications.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing. Checks include solder joint inspections, electrical continuity tests, and visual quality assessments to detect defects early.

- Final Quality Control (FQC): Comprehensive testing of finished LED strips before shipment. This stage verifies luminescence uniformity, voltage and current stability, waterproofing effectiveness, and mechanical durability.

Common Testing Methods

B2B buyers should inquire about the following standard tests to confirm product quality:

- Electrical Testing: Ensures correct voltage, current, and power consumption; includes short-circuit and insulation resistance tests.

- Optical Testing: Measures brightness (lumens), color temperature, and color rendering index (CRI) to match project requirements.

- Environmental Stress Testing: Simulates exposure to heat, humidity, and UV to confirm durability and longevity.

- Mechanical Testing: Verifies the strip’s flexibility, bend radius, and resistance to vibration or impact.

- Waterproofing Tests: For IP-rated products, immersion or spray tests validate sealing effectiveness.

How B2B Buyers Can Verify Supplier Quality Assurance

For buyers in Africa, South America, the Middle East, and Europe, ensuring supplier QC is critical to mitigate risks associated with defective or non-compliant products. Recommended practices include:

- Factory Audits: Conduct on-site or third-party audits focusing on manufacturing processes, quality control systems, and worker training.

- Review of QC Documentation: Request and analyze production reports, inspection records, and certification copies (ISO, CE, RoHS).

- Third-Party Inspections: Engage independent quality inspection firms to perform random sampling and testing before shipment.

- Sample Testing: Obtain product samples for in-house or third-party laboratory testing to verify performance claims.

- Supplier Track Record: Check references, customer testimonials, and history of compliance or recalls.

Quality Assurance Considerations for International Buyers

- Regional Compliance Nuances: Different markets have varying regulatory requirements; European buyers must prioritize CE and RoHS compliance, while Middle Eastern or African buyers should confirm local standards such as SASO or SABS.

- Supply Chain Transparency: Buyers should seek suppliers who provide clear traceability of components and manufacturing batches, aiding in swift issue resolution.

- Communication and Documentation: Language barriers and time zones can complicate QC verification; establishing clear communication channels and documentation standards is essential.

- Customization and Consistency: For projects requiring specific wiring configurations or custom packaging, QA processes must include verification of these bespoke elements to avoid costly errors.

- After-Sales Support: Reliable warranties and responsive technical support are critical, particularly for buyers operating across continents where returns and replacements can be logistically challenging.

By gaining a detailed understanding of the manufacturing steps, relevant quality standards, and effective verification methods, international B2B buyers can confidently source hardwire LED strips that meet rigorous performance and safety criteria. This knowledge empowers buyers to negotiate better terms, reduce risks, and establish long-term partnerships with reputable manufacturers aligned with their regional market requirements.

Related Video: Shooting factory production, new order are manufacturing!!!

Comprehensive Cost and Pricing Analysis for hardwire led strip Sourcing

When sourcing hardwire LED strips for international B2B procurement, understanding the detailed cost structure and pricing dynamics is essential for making informed purchasing decisions. These insights enable buyers—especially those from regions like Africa, South America, the Middle East, and Europe—to optimize expenditures while ensuring product quality and supply reliability.

Key Cost Components in Hardwire LED Strip Pricing

-

Materials

The core raw materials include LED chips, flexible PCBs, resistors, connectors, and hardwire components such as cables and terminals. The choice of LED type (e.g., SMD 2835, 5050), copper thickness, and quality of insulation directly impact costs. Higher-grade materials improve durability and efficiency but increase unit prices. -

Labor and Manufacturing Overhead

Labor costs vary significantly depending on the manufacturing location. Automated assembly lines can reduce labor expenses but require upfront investment. Overhead includes factory utilities, equipment depreciation, and administrative expenses. Efficient production processes lower overhead per unit. -

Tooling and Setup Costs

Initial tooling for custom lengths, hardwire connectors, and special packaging adds to upfront costs. For bulk orders, tooling costs amortize over large volumes, reducing per-unit impact. Customization drives tooling complexity and thus cost. -

Quality Control (QC)

Rigorous QC processes—including testing for electrical safety, waterproof ratings (IP65, IP67), and lumen output—add cost but safeguard against failures and returns. Certifications like CE, RoHS, and UL increase buyer confidence but come at an additional compliance cost. -

Logistics and Distribution

Shipping costs depend on order volume, weight, and delivery location. For international buyers, freight (air, sea, or land), customs duties, and import taxes can significantly affect landed cost. Packaging that protects hardwired connections during transit may add to logistics expenses. -

Supplier Margin

Suppliers incorporate profit margins based on market demand, competition, and service levels. Margins may be negotiable for large or repeat orders.

Pricing Influencers and Their Impact

-

Order Volume and Minimum Order Quantity (MOQ)

Larger volumes generally reduce unit prices due to economies of scale. MOQ requirements vary but can be a barrier for smaller buyers. Negotiating flexible MOQs can improve cost-efficiency. -

Product Specifications and Customization

Custom lengths, cable types, connector styles, or specialized coatings increase complexity and price. Standardized products are typically more affordable. -

Material Quality and Certification Level

Premium-grade LEDs and certified products command higher prices but reduce risks and increase lifespan. Buyers targeting premium markets or regulated regions should prioritize certified options. -

Supplier Reputation and Location

Established suppliers with proven track records often charge a premium for reliability and better service. Proximity to the buyer can reduce shipping time and cost. -

Incoterms and Payment Terms

Terms like FOB, CIF, or DDP influence who bears shipping and customs costs. DDP (Delivered Duty Paid) offers convenience but at a higher price. Negotiating favorable payment terms improves cash flow.

Practical Buyer Tips for International B2B Procurement

-

Negotiate Beyond Price

Engage suppliers in discussions about lead times, warranty terms, and after-sales support. Volume discounts, extended payment terms, or bundled shipping can enhance overall value. -

Evaluate Total Cost of Ownership (TCO)

Consider durability, energy efficiency, warranty, and replacement frequency alongside upfront price. Lower initial cost may lead to higher long-term expenses. -

Request Samples and Certifications

Before large orders, obtain product samples to verify quality and compatibility. Confirm certifications relevant to your market, especially for Europe (CE), Middle East, or Australia. -

Factor in Logistics Complexity

For buyers in Africa and South America, longer shipping routes and customs delays can increase costs. Work with suppliers familiar with local import regulations and consider consolidated shipments. -

Leverage Technology and Market Intelligence

Use digital platforms to compare supplier pricing and lead times. Stay updated on raw material price trends (e.g., copper or semiconductor shortages) that may affect future costs.

Disclaimer on Pricing

The figures and cost structures discussed are indicative and subject to variation based on supplier, order specifics, and market conditions. Buyers should conduct direct negotiations and due diligence to obtain accurate and current pricing tailored to their unique requirements.

By dissecting the cost components and pricing influencers of hardwire LED strips, international B2B buyers can strategically manage procurement expenses while securing quality products tailored to their market needs. This approach fosters competitive advantage and sustainable supplier relationships across diverse global regions.

Spotlight on Potential hardwire led strip Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘hardwire led strip’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for hardwire led strip

Critical Technical Properties of Hardwire LED Strips

Understanding the essential technical specifications of hardwire LED strips is crucial for international B2B buyers to ensure product quality, compatibility, and long-term performance. Here are the key properties to focus on:

-

Material Grade and PCB Quality

The Printed Circuit Board (PCB) material, commonly flexible polyimide or rigid fiberglass, affects durability and heat dissipation. High-grade PCBs ensure better thermal management, reducing failure rates in continuous operation. For buyers, selecting LED strips with quality PCB materials minimizes maintenance costs and extends product lifespan. -

Voltage and Power Consumption

Hardwire LED strips typically operate at 12V or 24V DC. Confirming the voltage rating is vital to ensure compatibility with existing power supplies and to avoid electrical hazards. Power consumption, measured in watts per meter, directly impacts energy efficiency and operating costs—key considerations for large-scale installations. -

LED Density (LEDs per Meter)

The number of LEDs per meter influences brightness and light uniformity. Higher density strips provide smoother, more continuous lighting but may consume more power. Buyers should balance density with project requirements and energy budgets to optimize lighting quality and cost-effectiveness. -

Ingress Protection (IP) Rating

The IP rating indicates the strip’s resistance to dust and water. For indoor use, an IP20 rating may suffice, while outdoor or damp environments require IP65 or higher. Understanding IP ratings helps buyers choose appropriate products for specific environmental conditions, reducing risks of premature failure. -

Cuttable Sections and Soldering Points

Hardwire LED strips are designed with designated cut points to customize lengths. The precision of these cut points and soldering pads affects installation ease and reliability. Buyers should verify these details to ensure flexibility in application and minimize installation errors. -

Color Temperature and CRI (Color Rendering Index)

Color temperature (measured in Kelvin) defines the hue of the light, ranging from warm white (2700K) to cool white (6500K). CRI measures how accurately the light renders colors compared to natural light, with values above 80 considered good for commercial use. Selecting the right color temperature and CRI is essential for aesthetic and functional lighting needs.

Key Trade Terminology for Hardwire LED Strip Procurement

Navigating international B2B transactions requires familiarity with common industry and trade terms. Here are critical terms every buyer should know:

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers producing LED strips that can be branded and customized by the buyer. Partnering with OEMs enables businesses to offer differentiated products with their own branding, often at competitive pricing and volume discounts. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in one order. MOQs affect inventory planning and cash flow, so buyers should negotiate MOQs aligned with their sales forecasts to avoid overstocking or supply shortages. -

RFQ (Request for Quotation)

A formal document sent to suppliers to obtain pricing, lead times, and terms for specific LED strip products. An RFQ streamlines supplier comparisons and ensures transparent communication, which is critical when dealing with multiple international vendors. -

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common Incoterms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Understanding Incoterms helps buyers manage logistics costs and risks effectively. -

Lead Time

The duration from placing an order to receiving the goods. Lead times vary by supplier capacity and shipping method. Accurate lead time knowledge is essential for project scheduling and avoiding costly delays. -

Batch Consistency

Refers to uniformity in product specifications and quality across production batches. For large projects or repeat orders, ensuring batch consistency prevents variations in light output or color, maintaining a professional and cohesive installation.

By focusing on these technical properties and trade terms, international B2B buyers from Africa, South America, the Middle East, and Europe can make informed decisions, optimize procurement processes, and ensure the successful deployment of hardwire LED strip lighting solutions.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the hardwire led strip Sector

Market Overview & Key Trends

The global hardwire LED strip market is experiencing robust growth driven by increasing demand for energy-efficient, durable, and versatile lighting solutions across commercial, industrial, and architectural sectors. For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, this market offers vast opportunities tied to urbanization, infrastructure development, and rising awareness of smart lighting technologies.

Key market drivers include:

- Energy Efficiency & Cost Savings: Hardwire LED strips consume significantly less power than traditional lighting, appealing to businesses aiming to reduce operational costs and carbon footprints.

- Technological Advancements: Integration of IoT-enabled smart controls, dimming capabilities, and customizable color temperatures are becoming standard, offering buyers enhanced flexibility for diverse applications.

- Durability & Safety: Hardwired LED strips, often designed for permanent installations, provide superior reliability in harsh environments, which is crucial for industrial and commercial projects in emerging markets.

- Growing Urban and Commercial Infrastructure: Rapid infrastructure projects in Africa and the Middle East, coupled with modernization efforts in Europe and South America, fuel demand for high-quality, scalable lighting solutions.

Emerging sourcing and supply chain trends:

- Supplier Diversification: Buyers increasingly seek multiple sourcing options to mitigate risks associated with geopolitical tensions and shipping disruptions, a vital consideration given current global supply chain volatility.

- Localized Warehousing & Distribution: To reduce lead times and shipping costs, businesses are establishing regional distribution centers, especially in Europe and the Middle East.

- Customization & Modular Solutions: Demand for tailored lengths, color profiles, and integrated control systems is rising, enabling buyers to align products precisely with project specifications.

- Digital Supply Chain Management: Adoption of real-time inventory tracking and predictive analytics improves procurement efficiency and responsiveness to market changes.

For B2B buyers from Africa, South America, and the Middle East, leveraging these trends means building resilient supply chains and securing access to innovative, compliant products that meet regional regulatory standards and project demands.

Illustrative Image (Source: Google Search)

Sustainability & Ethical Sourcing in B2B

Sustainability is no longer optional in the hardwire LED strip sector—it is a strategic imperative. Environmental regulations across Europe and increasing consumer and corporate responsibility expectations in other regions are driving B2B buyers to prioritize eco-friendly products and ethical sourcing practices.

Environmental Impact Considerations:

- LED strips inherently consume less energy and have longer lifespans compared to conventional lighting, contributing to lower carbon emissions.

- However, the production process involves raw materials such as rare earth elements and electronic components that can have significant environmental footprints if not responsibly sourced.

- Waste management and recyclability of LED strips are gaining attention; businesses are encouraged to select suppliers with take-back programs and certified recycling processes.

Ethical Supply Chain Importance:

- Transparency in sourcing ensures compliance with labor laws and human rights standards, which is particularly critical when sourcing components from regions with variable regulatory enforcement.

- Certifications such as RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and ISO 14001 (Environmental Management) provide assurance of sustainable manufacturing practices.

- Buyers should engage suppliers that demonstrate commitment to reducing harmful substances, energy-efficient manufacturing, and fair labor practices.

Green Certifications and Materials:

- Preference for LED strips using low-toxicity materials and lead-free soldering enhances product safety and environmental compliance.

- Eco-labels like Energy Star and TCO Certified products indicate adherence to rigorous sustainability criteria.

- Incorporating biodegradable or recyclable packaging further aligns procurement with circular economy principles.

For international buyers, particularly in environmentally conscious markets like Europe and Australia, embedding sustainability into procurement strategies enhances brand reputation and meets increasingly stringent regulatory requirements.

Evolution and Historical Context

The hardwire LED strip sector has evolved significantly over the past two decades, transitioning from basic, low-lumen strips used primarily for decorative purposes to sophisticated, high-performance lighting systems integral to commercial and industrial applications. Early LED strips were limited by brightness, color options, and durability. However, advancements in semiconductor technology, materials science, and manufacturing processes have driven improvements in luminous efficacy, color rendering, and lifespan.

The introduction of hardwired LED strips—designed for permanent electrical connection rather than plug-in use—marked a pivotal shift, offering enhanced safety, continuous power supply, and compatibility with building automation systems. This evolution has expanded their use into architectural lighting, retail environments, and large-scale infrastructure projects.

For B2B buyers, understanding this progression underscores the importance of selecting modern, certified products that leverage the latest innovations in energy efficiency, control integration, and sustainability to maximize long-term value and performance.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of hardwire led strip

-

How can I effectively vet suppliers of hardwire LED strips for international B2B purchases?

To ensure reliability, start by verifying the supplier’s business licenses and certifications, such as ISO quality management or CE marking for products. Check references and customer reviews, particularly from buyers in your region (Africa, South America, Middle East, Europe). Request detailed product specifications, samples, and inquire about their supply chain transparency. Strong communication and responsiveness are key indicators of professionalism. Finally, consider suppliers who offer warranties and after-sales support to mitigate risks associated with long-distance transactions. -

What customization options are typically available for hardwire LED strips in bulk orders?

Most manufacturers provide customization on length, color temperature, voltage, and packaging. You can often request specific IP ratings for water resistance, soldered connectors, or tailored cut points to suit your project needs. Branding options such as custom labels or packaging are frequently offered for large orders. Early engagement with the supplier about your technical requirements and project goals helps ensure the product matches your application perfectly, particularly for commercial or architectural installations. -

What are the typical minimum order quantities (MOQs) and lead times I should expect when ordering hardwire LED strips internationally?

MOQs vary widely but generally range from 500 to 5,000 meters depending on supplier capacity and customization complexity. Lead times typically span 3 to 8 weeks, factoring in production, quality checks, and international shipping. Planning orders well in advance is essential, especially for large-scale projects or regions with longer shipping durations such as Africa or South America. Always clarify MOQs upfront and negotiate flexible terms if possible to optimize inventory costs. -

Which payment terms and methods are safest for international B2B transactions involving hardwire LED strips?

Common payment methods include Letters of Credit (L/C), Telegraphic Transfers (T/T), and escrow services. Letters of Credit provide strong security by linking payment to delivery conditions. T/T payments are faster but riskier without trusted suppliers. For first-time transactions, consider splitting payments—partial upfront and balance upon receipt. Always confirm payment terms in writing and use contracts that specify dispute resolution mechanisms to protect both parties.

Illustrative Image (Source: Google Search)

-

What quality assurance certifications should I look for in hardwire LED strips to ensure compliance with international standards?

Look for CE certification for European markets, RoHS compliance for hazardous substance restrictions, and UL or ETL listings for North American safety standards if relevant. ISO 9001 certification indicates robust manufacturing quality management. Also, confirm adherence to IP ratings for environmental protection, especially for outdoor or industrial applications. Request third-party test reports or factory inspection audits to verify these claims before committing to bulk purchases. -

How can I optimize logistics and shipping for importing hardwire LED strips to regions like Africa, South America, or the Middle East?

Partner with freight forwarders experienced in your destination region to navigate customs, tariffs, and local regulations efficiently. Consolidate shipments to reduce per-unit shipping costs and request suppliers to use durable, export-grade packaging to prevent damage. Consider Incoterms carefully—DDP (Delivered Duty Paid) shifts customs clearance responsibility to the supplier, easing import processes. Tracking shipments and maintaining open communication with logistics providers ensures timely delivery and reduces delays. -

What are best practices for handling disputes or product issues with international hardwire LED strip suppliers?

Establish clear contractual terms covering product specifications, quality standards, and return policies before ordering. Document all communications and inspections, especially discrepancies upon receipt. Engage suppliers promptly with evidence such as photos or test reports. Use mediation or arbitration clauses in contracts to resolve disputes without lengthy legal battles. Maintaining professional relationships and negotiating in good faith often leads to amicable solutions and ongoing partnerships. -

How can I ensure consistency and scalability when sourcing hardwire LED strips for large projects across multiple countries?

Select suppliers with proven capacity to scale production and maintain consistent quality across batches. Request batch traceability and standardized testing protocols to ensure uniform performance. Where possible, negotiate long-term contracts with price locks and supply guarantees. Align delivery schedules with project timelines and consider regional distribution hubs to streamline logistics. Regularly review supplier performance and remain adaptable to shifting market conditions or regulatory changes in different countries.

Strategic Sourcing Conclusion and Outlook for hardwire led strip

Effective strategic sourcing of hardwire LED strips is essential for international B2B buyers aiming to balance quality, cost-efficiency, and timely delivery. By prioritizing partnerships with reliable suppliers and manufacturers, businesses can secure high-performance components that ensure product longevity and customer satisfaction. Leveraging technology-driven supply chain solutions and maintaining diversified supplier networks further mitigates risks associated with global logistics and market fluctuations.

Key considerations include understanding specific project requirements—such as IP ratings for outdoor use or customization options—to optimize procurement decisions. Additionally, thorough evaluation of supplier warranties, return policies, and sample testing enables buyers to minimize quality risks and enhance operational confidence. For regions like Africa, South America, the Middle East, and Europe, where supply chain challenges can vary, establishing localized distribution channels and strategic stock management can significantly improve responsiveness and reduce lead times.

Looking ahead, embracing innovation in LED technology and sustainable sourcing practices will empower businesses to stay competitive and meet evolving market demands. International buyers are encouraged to adopt a proactive sourcing strategy that integrates comprehensive supplier assessments, demand forecasting, and continuous market intelligence. This approach not only strengthens supply chain resilience but also unlocks new growth opportunities in the dynamic LED lighting sector.