Guide to Flexible Led Light Panel

- Introduction: Navigating the Global Market for flexible led light panel

- Understanding flexible led light panel Types and Variations

- Key Industrial Applications of flexible led light panel

- Strategic Material Selection Guide for flexible led light panel

- In-depth Look: Manufacturing Processes and Quality Assurance for flexible led light panel

- Comprehensive Cost and Pricing Analysis for flexible led light panel Sourcing

- Spotlight on Potential flexible led light panel Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for flexible led light panel

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the flexible led light panel Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of flexible led light panel

- Strategic Sourcing Conclusion and Outlook for flexible led light panel

Introduction: Navigating the Global Market for flexible led light panel

The global demand for flexible LED light panels is surging as industries across Africa, South America, the Middle East, and Europe embrace innovative lighting solutions that combine adaptability, efficiency, and aesthetic appeal. These panels stand out for their ability to conform to diverse shapes and surfaces, enabling bespoke lighting designs that traditional rigid panels cannot achieve. For B2B buyers, flexible LED light panels represent not just an upgrade in illumination technology but a strategic asset that enhances product displays, architectural features, and energy management.

Navigating the complex international market for flexible LED light panels requires deep insight into product variations, material quality, manufacturing standards, and supplier reliability. Buyers must evaluate critical factors such as color rendering index (CRI), tunable white versus RGB capabilities, ease of installation, and compliance with regional certifications. Market dynamics, including cost fluctuations, logistics, and after-sales support, also profoundly impact procurement success. This guide delivers a comprehensive roadmap, detailing the latest advancements in flexible LED technology, quality control protocols, supplier vetting strategies, and cost optimization techniques.

Designed specifically for discerning B2B buyers from emerging and established markets—such as Italy’s design-driven industries, Poland’s manufacturing hubs, and rapidly growing economies in Africa and South America—this guide equips you to make confident, informed sourcing decisions. By leveraging actionable insights and best practices, your business can minimize risk, maximize value, and forge resilient supply partnerships that keep you at the forefront of lighting innovation in a competitive global landscape.

Understanding flexible led light panel Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| RGB Flexible LED Light Panels | Full-color spectrum with over 4.1 billion colors; cuttable and bendable | Dynamic signage, architectural lighting, entertainment venues | Highly customizable and visually striking; requires compatible controllers and power management |

| Tunable White (CCT) LED Panels | Adjustable color temperature (2700K-6000K); high CRI (>98) | Retail displays, museums, hospitality, backlit surfaces | Excellent color accuracy and ambiance control; higher initial cost but enhances product presentation |

| Single-Color Flexible LED Panels | Uniform color output, typically in white or specific colors | General backlighting, advertising, automotive interiors | Cost-effective and simple to install; limited customization in color temperature |

| Ultra-Thin Flexible LED Sheets | Extremely thin and lightweight; easy to integrate into tight spaces | Mobile devices, wearables, signage, interior design | Space-saving and versatile; may have lower brightness compared to thicker panels |

| Waterproof Flexible LED Panels | Sealed for moisture and dust resistance (IP65+ ratings) | Outdoor signage, marine applications, industrial environments | Durable for harsh conditions; potentially higher cost and requires specialized connectors |

RGB Flexible LED Light Panels

These panels offer a broad color gamut enabling dynamic lighting effects and personalization, making them ideal for applications requiring vibrant visual impact such as event venues and retail displays. For B2B buyers, the ability to cut and bend these panels to custom shapes reduces installation complexity and material waste. However, procurement must consider compatibility with RGB controllers and power supplies to ensure seamless operation, especially in large-scale projects. Sourcing from reliable manufacturers with consistent color calibration is critical to avoid uneven lighting.

Tunable White (CCT) LED Panels

Tunable white panels provide adjustable color temperatures, allowing businesses to tailor lighting environments to specific moods or daylight conditions. Their high Color Rendering Index (CRI) makes them indispensable for sectors like museums and luxury retail where accurate color representation is paramount. Buyers should assess the range of temperature adjustment, dimmability, and integration capabilities with existing lighting controls. While the upfront investment may be higher, the flexibility and enhanced customer experience justify the cost, particularly in premium installations.

Single-Color Flexible LED Panels

Offering uniform illumination in a fixed color, these panels are a practical choice for straightforward backlighting and signage applications where color consistency is more important than variation. They are generally more affordable and easier to source, making them attractive for large-volume projects with tight budgets. Buyers should verify the luminous efficacy and ensure the panels meet local energy efficiency standards. Their simplicity translates to fewer compatibility issues, but customization options are limited compared to RGB or tunable white variants.

Ultra-Thin Flexible LED Sheets

Designed for integration into compact or irregular spaces, ultra-thin LED sheets provide lighting solutions in applications like wearable tech or slim signage panels. Their minimal thickness allows for innovative product designs but can come with trade-offs in brightness and heat dissipation. B2B buyers must evaluate the balance between form factor and performance and confirm that suppliers provide detailed thermal and photometric data. Certifications related to safety and electromagnetic compatibility are also important for international markets.

Waterproof Flexible LED Panels

Engineered for durability in outdoor and industrial environments, these panels feature IP65 or higher ratings to resist moisture, dust, and other contaminants. They serve well in outdoor advertising, marine, and harsh industrial settings where reliability is critical. When sourcing, buyers should prioritize panels with proven ingress protection, robust connectors, and warranties that cover environmental exposure. The slightly higher cost is offset by reduced maintenance and longer service life, making them a sound investment for demanding applications.

Related Video: How To Use Flexible LED Filament Wire for Lighting Projects!

Key Industrial Applications of flexible led light panel

| Industry/Sector | Specific Application of flexible led light panel | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Visual Merchandising | Backlit product displays and signage | Enhances product visibility and customer engagement; energy-efficient | Uniform brightness, color rendering index (CRI), ease of installation, durability |

| Architecture & Interior Design | Ambient and accent lighting for curved or irregular surfaces | Enables innovative design with flexible form factor; customizable color temperature | Flexibility, cut-to-size options, dimmability, compliance with regional lighting standards |

| Automotive & Transportation | Interior cabin lighting and dashboard illumination | Improves passenger comfort and safety through tailored lighting; lightweight | Heat dissipation, vibration resistance, power consumption, connector compatibility |

| Advertising & Exhibition | Illuminated trade show booths and dynamic signage | Attracts attention with vibrant, customizable lighting effects; rapid installation | RGB color capability, modularity, ease of maintenance, transport durability |

| Healthcare & Medical Facilities | Examination and diagnostic lighting panels | Provides high CRI lighting for accurate diagnostics; reduces eye strain | High CRI (≥98), flicker-free operation, compliance with medical safety standards |

Flexible LED light panels are transforming the retail and visual merchandising sector by providing uniform, energy-efficient backlighting for product displays and signage. These panels solve common issues such as hotspots and uneven illumination, which can detract from product appeal. For B2B buyers in Africa, South America, and Europe, sourcing panels with a high CRI ensures true color representation, critical for sectors like fashion and electronics retail. Additionally, ease of installation and durability under varied climatic conditions are key factors to consider.

In architecture and interior design, flexible LED panels offer unparalleled versatility, enabling designers to illuminate curved walls, ceilings, and furniture with tailored color temperatures. This flexibility supports creative lighting schemes that enhance ambiance and user experience, particularly important in hospitality and commercial real estate markets prevalent in the Middle East and Europe. Buyers should prioritize panels that allow for precise cutting and dimming, while also meeting local energy efficiency and safety regulations to ensure compliance and sustainability.

The automotive and transportation industry leverages flexible LED panels for interior cabin lighting and dashboard illumination to improve passenger comfort and safety. These panels must withstand vibration, heat, and power fluctuations common in vehicles. For international buyers, especially in emerging markets across Africa and South America, sourcing from suppliers offering robust heat dissipation and reliable connector systems is essential to maintain performance and reduce maintenance costs over vehicle lifecycles.

In advertising and exhibition, flexible LED light panels enable the creation of dynamic, eye-catching trade show booths and signage with customizable RGB lighting. This application benefits from the panels’ modularity and ease of transport, which supports rapid assembly and disassembly during events. Buyers from regions with frequent trade shows or promotional activities, such as Europe and the Middle East, should focus on sourcing panels with strong color gamut capabilities and durable construction to withstand repeated handling and varying environmental conditions.

Finally, in the healthcare and medical facilities sector, flexible LED panels are critical for examination and diagnostic lighting, where high CRI and flicker-free operation are paramount to ensure accurate visual assessment and reduce practitioner fatigue. Buyers must ensure that these panels comply with stringent medical safety standards and provide consistent light quality. For international procurement, understanding regional certification requirements and supplier quality control processes is vital to secure reliable products that meet healthcare regulations.

Related Video: How To Make A Super Bright LED Light Panel (Battery Powered)

Strategic Material Selection Guide for flexible led light panel

When selecting materials for flexible LED light panels, international B2B buyers must carefully consider the physical, chemical, and regulatory properties that influence performance, durability, and compliance across diverse markets such as Africa, South America, the Middle East, and Europe. The choice of material impacts not only the manufacturing process but also the end-use effectiveness, installation flexibility, and long-term reliability of the lighting solution.

Polyethylene Terephthalate (PET) Film

Key Properties: PET film is a thermoplastic polymer known for its excellent tensile strength, chemical resistance, and dimensional stability. It withstands temperatures typically up to 150°C and exhibits good resistance to moisture and UV exposure, making it suitable for both indoor and some outdoor applications.

Pros & Cons: PET is cost-effective and widely available, with a smooth surface ideal for LED diffusion and adhesion of conductive layers. Its flexibility supports bending and shaping without cracking. However, PET can degrade under prolonged UV exposure and high temperatures beyond its tolerance, limiting its use in harsh outdoor environments. Manufacturing complexity is moderate, with well-established processing techniques.

Impact on Application: PET is commonly used as a substrate or protective layer in flexible LED panels, especially for backlighting in retail displays, signage, and architectural lighting. Its chemical inertness ensures compatibility with various adhesives and encapsulants.

International Buyer Considerations: Buyers in Europe (Italy, Poland) will appreciate PET’s compliance with EU REACH and RoHS directives, ensuring low environmental impact and safety. In regions like the Middle East and Africa, where UV exposure can be intense, buyers should verify UV-stabilized grades or consider protective coatings. ASTM and DIN standards for film thickness and tensile strength are relevant benchmarks for quality assurance.

Polyimide (PI) Film

Key Properties: Polyimide film offers superior thermal stability, withstanding temperatures up to 400°C, excellent chemical resistance, and outstanding electrical insulation properties. It maintains flexibility even under extreme thermal cycling.

Pros & Cons: PI is highly durable and ideal for high-performance flexible LED panels requiring heat resistance, such as automotive or industrial lighting. Its cost is significantly higher than PET, and manufacturing requires specialized handling due to its chemical composition. The stiffness is slightly higher, which may limit extreme bending.

Impact on Application: PI films are preferred in applications demanding long-term reliability under heat stress or exposure to chemicals, such as in aerospace, automotive, or specialized industrial lighting panels.

International Buyer Considerations: European buyers often require compliance with stringent safety and environmental standards, where PI’s robustness is advantageous. Buyers in South America and the Middle East should consider the higher cost but benefit from PI’s longevity and resistance to environmental stressors. Certification to ISO and ASTM standards for thermal and mechanical properties is critical for validating supplier claims.

Thermoplastic Polyurethane (TPU)

Key Properties: TPU is a highly flexible, elastic polymer with excellent abrasion resistance, chemical resistance, and a broad temperature range (-40°C to 120°C). It offers good transparency and is often used as a protective encapsulant layer.

Pros & Cons: TPU’s elasticity allows for repeated bending and folding without damage, making it ideal for wearable or foldable LED panels. It provides superior impact resistance and moisture barrier properties. However, TPU is more expensive than PET and may require complex lamination processes.

Impact on Application: TPU is commonly used in flexible LED panels that require high mechanical durability and environmental protection, such as outdoor signage or wearable tech in demanding climates.

International Buyer Considerations: For buyers in Africa and South America, where humidity and mechanical stress are concerns, TPU’s protective qualities justify the higher cost. Compliance with DIN and ASTM standards for elongation and tear resistance is important. European buyers should verify compliance with EU chemical safety regulations, especially for consumer-facing products.

Silicone Elastomer

Key Properties: Silicone elastomers are flexible, heat-resistant (up to 250°C), and possess excellent UV and weather resistance. They are electrically insulating and chemically inert, with high transparency and flexibility.

Pros & Cons: Silicone provides outstanding durability in extreme environmental conditions, including outdoor and industrial settings. It is more expensive and complex to process than thermoplastics but offers superior longevity and performance. Its softness allows for excellent conformability to irregular surfaces.

Impact on Application: Silicone is ideal for flexible LED panels used in harsh outdoor environments, architectural lighting, and applications requiring waterproofing and chemical resistance.

International Buyer Considerations: Buyers in the Middle East and Europe will value silicone’s compliance with high environmental and safety standards (e.g., CE marking, RoHS). For African and South American markets, silicone’s robustness against UV and chemical exposure supports longer service life in challenging climates. ASTM and JIS standards for silicone material properties provide useful quality benchmarks.

| Material | Typical Use Case for flexible led light panel | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyethylene Terephthalate (PET) Film | Substrate and protective layer in indoor signage and displays | Cost-effective, good dimensional stability | Limited UV and high-temperature resistance | Low |

| Polyimide (PI) Film | High-temperature industrial and automotive flexible LED panels | Exceptional thermal stability and durability | Higher cost, less flexible than PET | High |

| Thermoplastic Polyurethane (TPU) | Protective encapsulant for wearable and outdoor flexible LED panels | Excellent flexibility and abrasion resistance | More expensive, complex lamination process | Medium |

| Silicone Elastomer | Outdoor, architectural, and industrial flexible LED panels | Superior environmental resistance and flexibility | Higher cost, processing complexity | High |

In-depth Look: Manufacturing Processes and Quality Assurance for flexible led light panel

Manufacturing Processes for Flexible LED Light Panels

The production of flexible LED light panels involves a series of carefully controlled stages to ensure product performance, durability, and adaptability. For international B2B buyers, understanding these manufacturing steps is essential to evaluate supplier capabilities and product quality.

1. Material Preparation

Raw materials include flexible substrates (typically polyimide or PET films), LED chips (commonly SMD or COB types), phosphor coatings, conductive layers (copper or silver-based), and adhesives. Suppliers must source high-purity materials with consistent electrical and thermal properties. Preparation includes cleaning substrates, precise cutting, and pre-treatment to enhance adhesion and conductivity.

2. Forming and Circuit Patterning

The flexible substrate undergoes photolithography or screen-printing to create the circuit pathways. This stage defines the LED layout and electrical connections. Conductive inks or copper foils are laminated onto the substrate with precision to allow for uniform current distribution and optimal heat dissipation. For panels requiring color tuning (e.g., RGB or CCT tunable), multi-layer circuit designs are integrated to support segmented control.

3. LED Assembly and Mounting

LED chips are mounted onto the patterned substrate using automated pick-and-place machines to ensure accurate positioning. Soldering (reflow or conductive adhesive) secures the LEDs electrically and mechanically. For flexible panels, the assembly process must accommodate bending stresses without damaging the connections. This stage often includes embedding resistor networks and integrating connectors or solder pads at designated cut points to facilitate customization.

4. Encapsulation and Finishing

To protect the LEDs and circuitry from moisture, dust, and mechanical damage, a flexible encapsulant or protective coating is applied. This layer must be transparent, UV-resistant, and maintain flexibility. Finishing may also include attaching 3M adhesive backings for easy installation and affixing power connectors or interconnect cables. Final shaping and cutting to customer specifications happen here, often involving laser or mechanical cutting tools.

Quality Assurance and Control (QA/QC) Practices

Quality assurance in flexible LED panel manufacturing is multifaceted, addressing material integrity, electrical performance, mechanical durability, and compliance with international standards. B2B buyers should prioritize suppliers demonstrating rigorous QC processes backed by certifications and transparent reporting.

Key International and Industry Standards

– ISO 9001: Fundamental quality management system standard ensuring consistent manufacturing processes and continuous improvement.

– CE Marking: Mandatory for Europe, indicating conformity with health, safety, and environmental protection standards.

– RoHS (Restriction of Hazardous Substances): Limits hazardous materials, essential for European and Middle Eastern markets.

– UL and FCC: Important for North American compliance, often requested by multinational buyers.

– CCC (China Compulsory Certification): Relevant if sourcing panels manufactured or assembled in China for global resale.

– API or Regional Certifications: Depending on specific industrial applications or regional regulations, additional certifications may be required.

Quality Control Checkpoints

– Incoming Quality Control (IQC): Inspection of raw materials and components, such as substrate films, LED chips, and adhesives. Ensures materials meet technical specifications and are free from defects before production.

– In-Process Quality Control (IPQC): Continuous monitoring during assembly stages. This includes verifying circuit pattern accuracy, solder joint integrity, LED placement precision, and electrical connectivity. Real-time adjustments minimize defects and maintain yield.

– Final Quality Control (FQC): Comprehensive testing of finished panels before shipment. Includes visual inspections, functionality tests, and packaging verification.

Common Testing Methods

– Electrical Testing: Verifies LED functionality, voltage, current draw, and uniform brightness across the panel.

– Thermal Imaging: Detects hotspots or uneven heat distribution that could indicate manufacturing flaws.

– Mechanical Flexibility Tests: Panels are bent repeatedly to simulate installation stresses, ensuring no cracks or connection failures.

– Optical Performance Testing: Measures color temperature, brightness uniformity, and CRI (Color Rendering Index) to confirm lighting quality.

– Environmental Stress Testing: Includes humidity, temperature cycling, and UV exposure to simulate real-world operating conditions and confirm durability.

How B2B Buyers Can Verify Supplier Quality Control

1. Factory Audits and Site Visits

Performing on-site audits allows buyers to evaluate manufacturing processes, observe quality control procedures firsthand, and assess equipment and workforce competence. For buyers in Africa, South America, the Middle East, and Europe, partnering with local inspection agencies or using third-party auditors can provide cost-effective verification.

2. Reviewing Quality Documentation

Requesting detailed QC reports, process flow charts, and certification copies (ISO, CE, RoHS) is vital. Suppliers should provide batch-level inspection records and test results for each shipment. Transparency in documentation signals a mature quality management system.

3. Third-Party Testing and Inspection

Independent labs can validate product claims and compliance with regional standards before shipment. This is especially important for buyers in regulated markets like the EU (Italy, Poland) or the Middle East, where compliance enforcement is strict. Third-party inspections also help mitigate risks associated with overseas sourcing.

4. Sample Evaluation and Pilot Runs

Before full-scale procurement, buyers should request samples or conduct pilot orders to test product performance under local conditions. This step helps verify flexibility, light quality, and mechanical robustness aligned with application requirements.

QC and Certification Nuances for International Markets

Africa and South America:

Regulatory frameworks may be less stringent or evolving, but buyers should insist on international certifications (ISO 9001, CE, RoHS) to ensure product safety and quality. Robust QC is critical to avoid costly returns or reputational damage in emerging markets. Local electrical standards should be reviewed, and compatibility with regional power supplies verified.

Middle East:

Compliance with CE and RoHS is increasingly mandatory due to Gulf Cooperation Council (GCC) regulations. Buyers should prioritize suppliers who demonstrate adherence to these standards and provide detailed test documentation. Environmental durability is also crucial due to extreme temperatures and dust exposure.

Europe (Italy, Poland):

European markets demand rigorous certification and traceability. Buyers must ensure suppliers’ ISO 9001 certification is current and that products carry CE marking with full technical documentation. High CRI and tunable color temperature features are often prerequisites for architectural and commercial lighting applications. Additionally, compliance with WEEE (Waste Electrical and Electronic Equipment) directives for recycling is becoming a purchasing consideration.

By thoroughly understanding manufacturing processes and implementing stringent quality assurance evaluations, international B2B buyers can confidently source flexible LED light panels that meet their market’s technical, regulatory, and performance demands. Establishing clear quality expectations upfront, coupled with ongoing supplier collaboration and verification, will safeguard investments and foster sustainable supply partnerships.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for flexible led light panel Sourcing

Understanding the cost and pricing dynamics of flexible LED light panels is crucial for international B2B buyers aiming to optimize procurement strategies across diverse markets such as Africa, South America, the Middle East, and Europe. This analysis breaks down the key cost components, pricing influencers, and actionable buyer tips tailored for complex global sourcing environments.

Key Cost Components in Flexible LED Light Panel Manufacturing

-

Materials

The core raw materials include LED chips (SMD or COB types), flexible substrates (often polyimide or PET), phosphors, adhesives (e.g., 3M backing), and protective encapsulants. Premium materials, such as high-CRI LEDs or specialized RGB chips, increase base costs but deliver superior lighting quality and durability. -

Labor and Manufacturing Overhead

Labor costs vary significantly by region, impacting overall pricing. Manufacturing overhead encompasses factory utilities, equipment depreciation, and indirect labor. Regions with advanced automation may reduce labor intensity, but specialized assembly (cutting, soldering, quality checks) remains labor-dependent. -

Tooling and Customization

Initial tooling for flexible panels—such as dies for cutting or custom PCB layouts—can be capital intensive. Custom shapes, segmentations, or embedded connectors add tooling complexity and cost. Buyers requesting bespoke specifications should anticipate higher upfront costs. -

Quality Control (QC) and Certification

Rigorous QC processes ensure product reliability, uniform light output, and compliance with international standards (CE, RoHS, CB for Europe; CCC for Asia; region-specific standards elsewhere). Certification costs and testing overheads are embedded in pricing but critical for long-term operational success. -

Logistics and Import Expenses

International freight, customs duties, import taxes, and insurance collectively impact landed costs. For buyers in Africa and South America, where logistics infrastructure may be less developed, these costs can be substantial. Choosing suppliers with efficient export experience and favorable Incoterms (e.g., FOB, CIF) can mitigate surprises. -

Supplier Margin

Supplier margins reflect their market positioning, volume commitments, and after-sales support. Established manufacturers with strong reputations may command premium pricing, while emerging suppliers compete aggressively on cost.

Primary Pricing Influencers

-

Order Volume and Minimum Order Quantity (MOQ)

Larger orders typically unlock volume discounts and reduce per-unit fixed costs. Buyers from Europe or the Middle East often leverage consolidated orders to minimize costs, while smaller buyers in emerging markets should negotiate flexible MOQs or pooled purchasing arrangements. -

Product Specifications and Customization

Higher LED density, advanced features like tunable white or RGB capabilities, and enhanced CRI ratings directly increase price. Custom sizes or shapes also raise costs due to tooling and production complexity. -

Material Quality and Certifications

Certified components and compliance with international standards add to costs but reduce risk and improve product acceptance in regulated markets such as the EU. Buyers targeting premium retail or architectural projects should prioritize certified products. -

Supplier Reliability and Location

Proximity to buyer markets, supplier reputation, and production lead times affect pricing. For example, sourcing from European suppliers may reduce logistics costs but increase unit price, whereas Asian manufacturers offer competitive pricing with longer shipping times. -

Incoterms and Payment Terms

The choice of Incoterms influences who bears freight, insurance, and customs risks, impacting the final cost. Favorable payment terms (e.g., letters of credit, escrow) can reduce financial risk but may affect pricing.

Actionable Buyer Tips for International Procurement

-

Negotiate on Total Cost of Ownership (TCO), Not Just Unit Price

Consider after-sales service, warranty, energy efficiency, and lifespan. For instance, higher upfront costs for high-CRI flexible LED panels can yield better long-term value through lower replacements and enhanced customer satisfaction. -

Leverage Volume Aggregation or Group Purchasing

Buyers in regions with smaller order sizes (e.g., some African or South American markets) can pool demand with industry peers or distributors to access volume discounts. -

Verify Certifications Early

Ensure suppliers provide relevant certifications upfront to avoid customs clearance delays and market entry barriers, especially in Europe and the Middle East. -

Understand Pricing Nuances by Region

Logistics, tariffs, and currency fluctuations can significantly alter landed costs. African and South American buyers should factor in extended shipping times and potential customs duties, while European buyers must comply with strict environmental and safety regulations that may increase costs. -

Request Transparent Cost Breakdowns

Engage suppliers to reveal material, labor, and overhead costs where possible. This transparency aids negotiation and identifies potential cost-saving areas such as packaging optimization or consolidated shipments. -

Use Incoterms Strategically

For first-time international transactions, terms like CIF (Cost, Insurance, Freight) reduce buyer risk by placing shipping and insurance responsibilities on the supplier. Experienced buyers may prefer FOB or EXW to control freight arrangements and reduce costs.

Indicative Pricing Disclaimer

Prices for flexible LED light panels can vary widely based on specifications, order size, supplier location, and market conditions. As a guideline, standard flexible LED sheets with basic white LEDs may start from approximately $10–$20 per square foot, while advanced RGB or tunable white panels with high CRI and customization can exceed $30 per square foot. Buyers should request formal quotations reflecting their exact requirements and incorporate all

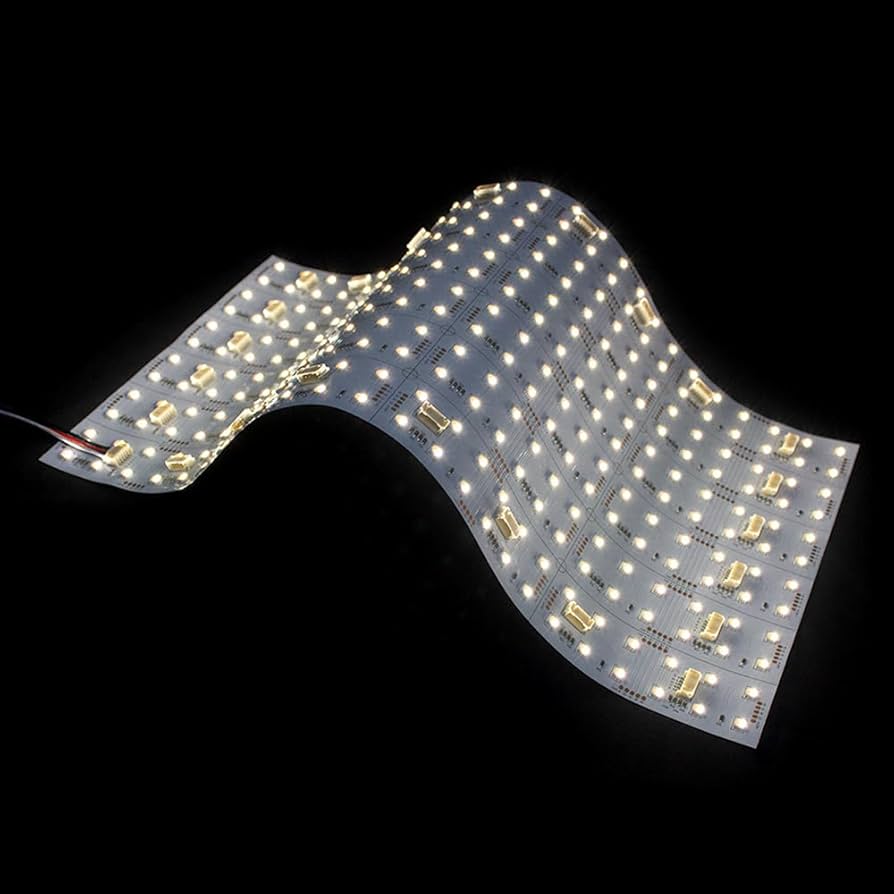

Illustrative Image (Source: Google Search)

Spotlight on Potential flexible led light panel Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘flexible led light panel’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for flexible led light panel

Critical Technical Properties of Flexible LED Light Panels

1. Material Grade and Flexibility

Flexible LED panels are typically constructed using high-grade polyimide or PET substrates, which offer durability and heat resistance while maintaining flexibility. For B2B buyers, the substrate’s quality directly influences the panel’s lifespan and ability to conform to curved or irregular surfaces without cracking or losing performance. Ensuring the correct material grade is essential for applications requiring repeated bending or installation on complex shapes.

2. Color Temperature (CCT – Correlated Color Temperature)

CCT measures the hue of the light emitted, expressed in Kelvins (K), typically ranging from warm white (~2700K) to cool white (~6000K). Buyers should select panels with adjustable or tunable CCT for enhanced versatility, especially in retail, hospitality, or architectural projects where lighting ambiance impacts customer experience and product presentation. High CCT accuracy also supports better color rendering of illuminated objects.

3. Color Rendering Index (CRI)

CRI indicates the ability of the light source to reveal colors faithfully compared to natural light, rated from 0 to 100. Flexible LED panels with CRI above 90 are preferred in sectors like retail, museums, or photography where accurate color perception is critical. High CRI panels enhance product visibility and quality perception, directly affecting consumer engagement and satisfaction.

4. Power Consumption and Efficiency (Wattage and Lumens per Watt)

Power efficiency is a key consideration for cost-conscious buyers and those aiming for sustainability. Flexible LED panels vary in wattage and luminous efficacy (lumens per watt). Panels with higher lumens per watt deliver brighter light at lower energy costs, reducing operational expenses and carbon footprint. Buyers should evaluate efficiency ratings to optimize long-term value.

5. Cuttable Segments and Connectivity Options

One of the main advantages of flexible LED panels is their modularity. Panels are designed with predefined cut points and solder pads allowing customization to fit specific dimensions. Additionally, integrated connectors or soldering options enable seamless linking of multiple panels. For B2B procurement, verifying these features ensures ease of installation, scalability, and reduced labor costs.

6. IP Rating (Ingress Protection)

The IP rating defines resistance to dust and moisture, crucial for outdoor or industrial applications. Flexible LED panels with IP65 or higher are suitable for environments exposed to water spray or dust, while lower IP-rated panels are better for indoor use only. Understanding IP ratings helps buyers select products aligned with their project’s environmental demands, avoiding premature failures.

Common Trade Terminology for Flexible LED Light Panel Procurement

OEM (Original Equipment Manufacturer)

OEM refers to manufacturers that produce goods based on a buyer’s specifications, often allowing branding customization. International B2B buyers seeking unique designs or private labeling benefit from engaging OEM suppliers who can tailor flexible LED panels to specific technical or aesthetic requirements.

MOQ (Minimum Order Quantity)

MOQ is the smallest number of units a supplier is willing to sell in one order. It impacts budgeting and inventory planning, especially for smaller businesses or pilot projects. Buyers should negotiate MOQs that align with their demand forecasts to avoid overstocking or supply shortages.

RFQ (Request for Quotation)

An RFQ is a formal document sent to suppliers asking for detailed pricing, lead times, and terms based on specified product requirements. Issuing an RFQ ensures transparent comparisons between vendors, enabling buyers to make informed decisions based on cost, quality, and service capabilities.

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Understanding Incoterms helps buyers manage logistics risks, control costs, and clarify delivery obligations.

Bin Sorting/Binning

Binning is the process of categorizing LEDs based on color consistency, brightness, and voltage. High-quality suppliers provide bin-sorted LEDs ensuring uniform light output, which is crucial for applications demanding aesthetic consistency. Buyers should request binning information to maintain product quality standards.

Dimmability

Dimmability indicates whether the LED panel’s brightness can be adjusted. This feature offers flexibility in lighting design and energy savings. Buyers should confirm compatibility with dimmer systems and drivers to meet the specific control requirements of their projects.

By mastering these technical properties and trade terms, international B2B buyers from Africa, South America, the Middle East, and Europe can confidently select flexible LED light panels that meet performance criteria, optimize costs, and align with regional regulatory and market demands.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the flexible led light panel Sector

Market Overview & Key Trends

The flexible LED light panel sector is experiencing robust growth driven by increasing demand for versatile, energy-efficient lighting solutions across commercial, retail, architectural, and industrial applications. Globally, key drivers include urbanization, smart building initiatives, and evolving aesthetic preferences that favor thin, adaptable lighting panels capable of conforming to unconventional surfaces. For B2B buyers in Africa, South America, the Middle East, and Europe (notably Italy and Poland), these trends translate into opportunities to integrate cutting-edge lighting solutions that enhance product displays, signage, and ambient environments while optimizing energy consumption.

Technological advancements such as RGB and tunable white (CCT) flexible LED panels are reshaping the market. These innovations enable precise color control, dynamic lighting effects, and superior color rendering, which are increasingly demanded by sectors like retail, hospitality, and corporate interiors. The modular design and ease of customization—through cutting, bending, and segmenting LED sheets—offer buyers significant installation flexibility and faster project turnaround.

Illustrative Image (Source: Google Search)

From a sourcing perspective, international buyers must navigate a complex landscape of suppliers varying widely in quality, certification compliance, and after-sales support. Regions like Europe emphasize stringent certifications (CE, RoHS) and high CRI ratings, ensuring safety and superior color accuracy, while buyers in emerging markets focus on cost-effective, scalable solutions without compromising basic quality. Logistics and supply chain resilience have become critical, especially in Africa and South America, where import delays and infrastructure challenges demand reliable supplier partnerships with clear communication and contingency planning.

Furthermore, the integration of smart controls and IoT compatibility is a growing trend, enabling remote dimming, color adjustment, and energy monitoring. This convergence of lighting technology with digital infrastructure presents buyers with enhanced value propositions but requires due diligence regarding interoperability and software support.

Sustainability & Ethical Sourcing in B2B

Sustainability is rapidly becoming a non-negotiable factor in the procurement of flexible LED light panels. Buyers worldwide are prioritizing products that minimize environmental impact across their lifecycle—from raw material extraction through manufacturing to end-of-life disposal or recycling. Flexible LED panels inherently offer energy savings by consuming significantly less power than traditional lighting, but sustainable sourcing goes beyond energy efficiency.

Ethical supply chains are critical for B2B buyers aiming to meet corporate social responsibility (CSR) goals and regulatory mandates, especially in Europe and the Middle East, where transparency and compliance with environmental standards are rigorously enforced. Buyers should seek suppliers who adhere to internationally recognized certifications such as RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and Energy Star ratings. These certifications ensure that materials like lead, mercury, and other toxic substances are minimized or eliminated.

Material innovation also plays a pivotal role: flexible LED panels incorporating recyclable substrates, low-impact adhesives, and eco-friendly packaging reduce overall carbon footprint. Additionally, demand for panels with extended lifespan and high durability supports sustainability by reducing waste and replacement frequency.

Engaging suppliers with transparent labor practices and responsible sourcing of components (e.g., conflict-free minerals) further strengthens ethical procurement. For buyers in Africa and South America, where local regulations may be evolving, partnering with certified suppliers from Europe or the Middle East can help leapfrog compliance challenges while reinforcing sustainable business practices.

Brief Evolution and Industry Context

The evolution of flexible LED light panels traces back to the broader development of LED technology in the early 2000s, initially focused on rigid, high-intensity lighting modules. The breakthrough came with the advent of thin, bendable substrates and surface-mounted LED (SMD) technology, enabling the creation of ultra-thin, flexible sheets that could be customized in shape and size. This innovation opened new possibilities for designers and engineers, shifting lighting from fixed installations to adaptable, integrated elements within architectural and product designs.

Over the last decade, improvements in color rendering, energy efficiency, and modularity have propelled flexible LED panels from niche applications into mainstream commercial and industrial use. The incorporation of RGB and tunable white LEDs has further expanded their versatility, allowing nuanced lighting schemes that were previously difficult or cost-prohibitive.

For international B2B buyers, understanding this technological trajectory is essential to appreciate the value of flexible LED panels as both a functional lighting solution and a strategic asset. It underscores the importance of sourcing from experienced manufacturers who can deliver quality, innovation, and compliance aligned with evolving market demands and sustainability imperatives.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of flexible led light panel

-

How can I effectively vet suppliers of flexible LED light panels for international B2B purchases?

To vet suppliers, prioritize those with verifiable certifications such as CE, RoHS, and CB for Europe and the Middle East, or relevant local standards in Africa and South America. Request detailed product datasheets and test reports. Evaluate their manufacturing capabilities, quality control processes, and after-sales support through references or third-party audits. Additionally, verify their experience with international shipping and compliance with import regulations specific to your region to avoid customs delays. Transparent communication and sample orders can further validate product quality and supplier reliability. -

What customization options are typically available for flexible LED light panels, and how should I approach them?

Flexible LED panels offer customization in size, shape, color temperature (CCT), brightness, and control systems (e.g., RGB or tunable white). B2B buyers should clearly specify project requirements upfront, including cutting patterns, adhesive backing, and connector types. Engage suppliers early to discuss feasibility, minimum order quantities (MOQs), and prototyping options. Customization can enhance product fit and functionality but may affect lead times and costs, so balancing bespoke needs with standard product offerings is key for efficient procurement. -

What are common MOQ and lead time expectations for flexible LED light panel orders in international trade?

MOQs vary widely depending on supplier capacity and customization level, often starting from a few hundred units for standard panels and higher for customized versions. Lead times typically range from 3 to 8 weeks, influenced by order size, complexity, and shipping logistics. Buyers from regions like Africa and South America should factor in longer transit times and potential customs clearance delays. Establish clear timelines during contract negotiation and consider buffer periods to accommodate unforeseen production or shipping issues. -

Which quality assurance certifications should I verify when sourcing flexible LED light panels internationally?

Ensure suppliers provide certifications relevant to your target markets, such as CE and RoHS for Europe, SASO for the Middle East, and INMETRO or ANATEL for South America. Certifications confirm compliance with safety, electromagnetic compatibility, and environmental standards. Additionally, check for ISO 9001 quality management and LM-80/LM-79 reports for LED performance. High CRI ratings (above 90) are important for accurate color rendering in applications like retail displays. Confirm that certification documents are authentic and up-to-date to avoid regulatory issues. -

What logistics considerations should I keep in mind when importing flexible LED light panels from Asia or Europe?

Flexible LED panels are lightweight but sensitive to moisture and mechanical damage. Opt for suppliers who use moisture-resistant packaging and provide clear handling instructions. Choose reliable freight forwarders experienced with electronics shipments and verify Incoterms (e.g., FOB, CIF) to understand cost and responsibility allocation. For regions with complex customs procedures like Africa or the Middle East, partner with local customs brokers to expedite clearance. Also, consider warehousing options near your market to reduce last-mile delivery delays and costs. -

How can I mitigate payment risks when dealing with new international suppliers of flexible LED panels?

Use secure payment methods such as letters of credit (LC) or escrow services to protect funds until delivery confirmation. Negotiate payment terms balancing upfront deposits (typically 30%) with final payments after inspection or receipt. Avoid full prepayment, especially with unproven suppliers. Request supplier banking details and verify legitimacy independently. Building long-term relationships can open doors to more flexible terms. Additionally, consider trade credit insurance to safeguard against non-delivery or insolvency risks. -

What are the best practices for handling disputes or quality issues after receiving flexible LED panel shipments?

Immediately inspect shipments upon arrival for physical damage and functionality. Document any defects with photos and detailed descriptions. Report issues to the supplier within the agreed warranty or claim period, referencing contract terms. Use third-party testing labs if necessary to validate defects. Maintain clear, professional communication and seek amicable resolutions such as replacements, refunds, or discounts. To prevent recurrence, include detailed quality specifications and inspection checkpoints in future contracts. -

How can buyers from diverse regions like Africa, South America, the Middle East, and Europe ensure compliance with local regulations when importing flexible LED panels?

Research and understand local import regulations, including safety certifications, labeling, and energy efficiency standards. Collaborate with suppliers who are familiar with your region’s requirements and provide compliant products. Engage local regulatory consultants or authorities to pre-approve shipments when possible. Keep abreast of changes in standards to avoid non-compliance fines or shipment rejections. Proper documentation, including certificates of origin and compliance, is essential to facilitate smooth customs clearance and market entry.

Strategic Sourcing Conclusion and Outlook for flexible led light panel

Flexible LED light panels represent a transformative opportunity for international B2B buyers seeking innovative, energy-efficient, and customizable lighting solutions. Key takeaways emphasize the importance of selecting suppliers who offer high-quality, certified products with adaptable features such as cut-to-size options, tunable color temperatures, and robust connectivity. For buyers in Africa, South America, the Middle East, and Europe—including markets like Italy and Poland—prioritizing strategic sourcing is essential to navigate regulatory requirements, ensure consistent supply chains, and leverage cost-effective, scalable solutions tailored to diverse applications.

Strategic sourcing empowers businesses to:

- Mitigate risks by verifying certifications and quality control processes

- Optimize total cost of ownership through flexible product configurations and efficient logistics

- Enhance project outcomes with advanced LED technologies like RGB and CCT tunable panels

- Foster long-term supplier partnerships that support customization and innovation

Looking ahead, the flexible LED panel market will continue evolving with advances in materials, smart controls, and sustainability standards. International buyers who proactively engage with trusted manufacturers and integrate strategic sourcing frameworks will unlock competitive advantages while meeting growing demand for adaptive lighting. Now is the time to deepen market insights, evaluate emerging suppliers, and invest in flexible LED solutions that drive both operational excellence and environmental stewardship across global markets.