Introduction: Navigating the Global Market for led light strips for car interior

The automotive interior lighting sector is undergoing a significant transformation with the widespread adoption of LED light strips, driven by their superior energy efficiency, customizable aesthetics, and enhanced driver experience. For international B2B buyers—particularly those sourcing from diverse and rapidly evolving markets such as Africa, South America, the Middle East, and Europe—understanding the strategic value and technical nuances of LED light strips for car interiors is essential. These products not only elevate vehicle appeal but also serve as critical components for aftermarket customization, fleet modernization, and smart vehicle integrations.

This comprehensive guide offers a thorough exploration of the global LED light strip market tailored specifically for automotive interiors. It encompasses detailed analyses of various product types—from basic single-color strips to advanced multifunctional RGB options—highlighting their applications and performance criteria. Buyers will gain insights into material selection and manufacturing processes that impact durability and regulatory compliance, as well as quality control measures ensuring consistent product reliability.

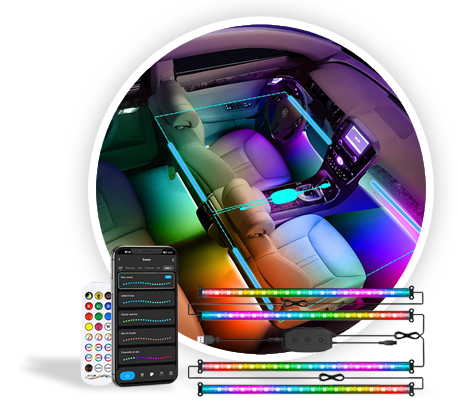

Illustrative Image (Source: Google Search)

In addition, the guide addresses how to evaluate and engage with suppliers, optimize procurement costs, and navigate region-specific market dynamics influenced by technological trends and sustainability considerations. Practical sections on installation, warranty frameworks, and frequently asked questions further empower buyers to make informed decisions while mitigating sourcing risks.

By leveraging this resource, international B2B buyers—from emerging markets like Nigeria and Argentina to established hubs in Europe and the Middle East—can confidently streamline their sourcing strategies, secure high-quality LED lighting solutions, and maintain a competitive edge in the evolving automotive industry.

Understanding led light strips for car interior Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Basic Single-Color LED | Fixed color, 12V DC, moderate LED density (~60 LEDs/m), IP65 | Fleet vehicle upgrades, basic interior lighting | + Cost-effective, simple installation – Limited customization, lower brightness |

| RGB Multi-Color LED | Color-changing, app or remote controlled, IP67 waterproof | Custom car interiors, aftermarket customization | + High versatility, dynamic effects – Higher price, requires compatible control systems |

| Music-Sync LED Strips | Integrated microphone for sound-responsive lighting effects | Entertainment vehicles, event-based fleets | + Enhances user experience, interactive – Complex installation, higher cost |

| Sequential LED Strips | Dynamic sequential lighting patterns, IP67, high LED density | Commercial vehicles, trucks, luxury cars | + Improved visibility, eye-catching – More complex wiring, premium pricing |

| Flexible Neon-Style LED | Soft, continuous light, flexible silicone casing, IP68 rated | Premium custom interiors, luxury aftermarket | + Elegant look, durable waterproofing – Higher cost, specialized installation |

Basic Single-Color LED Strips

These LED strips offer a fixed lighting color, typically white or a single hue, with moderate LED density and standard waterproofing (IP65). They are ideal for B2B buyers targeting fleet operators or businesses seeking cost-efficient interior upgrades without complex features. Their simplicity ensures easier installation and maintenance, but they lack customization and may not meet the demands of premium aftermarket segments. Buyers should consider volume pricing and supplier reliability when sourcing these basic models.

RGB Multi-Color LED Strips

RGB strips allow full-color customization controlled via apps or remote controls, boasting waterproof ratings suitable for automotive environments (IP67). This type is favored by companies specializing in vehicle customization or aftermarket retailers catering to younger or tech-savvy customers. B2B buyers must evaluate supplier capabilities for software integration, durability, and warranty terms. While offering higher margins, these strips require more sophisticated support and installation expertise.

Music-Sync LED Strips

Equipped with built-in microphones, these LED strips react to ambient sound or music, creating dynamic lighting effects inside the vehicle. They appeal to entertainment-focused vehicles or event fleets aiming to enhance user engagement. For B2B buyers, the complexity of installation and higher cost necessitate partnering with experienced manufacturers that provide reliable sound-sensing technology and robust quality assurance. Consider compatibility with vehicle electrical systems and after-sales support.

Sequential LED Strips

Sequential LED strips feature dynamic, flowing light patterns (e.g., turn signals) with high LED density and IP67 waterproofing, making them suitable for commercial trucks and luxury vehicles requiring enhanced visibility and aesthetic appeal. Buyers in logistics, transportation, or premium aftermarket sectors value these strips for safety and branding opportunities. Procurement should focus on supplier compliance with automotive lighting standards and the ability to customize sequences.

Flexible Neon-Style LED Strips

These strips mimic the appearance of neon lighting with a flexible silicone casing rated IP68, providing continuous, soft illumination ideal for premium car interiors and luxury aftermarket applications. Their durability and elegant aesthetics command higher pricing, making them suitable for discerning buyers in Europe and the Middle East’s luxury markets. B2B buyers must assess supplier expertise in specialized installation and verify product longevity under automotive conditions.

Related Video: How to Install LED Strip EL WIRE for CAR Interior – ONEUPLIGHTING

Key Industrial Applications of led light strips for car interior

| Industry/Sector | Specific Application of led light strips for car interior | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive OEMs | Ambient interior lighting in passenger vehicles | Enhances vehicle appeal and passenger comfort, differentiates models | Compliance with automotive quality standards, durability, IP rating, and color consistency |

| Aftermarket Customization | Customizable interior accent lighting for car enthusiasts | Drives aftermarket sales, supports personalization trends | Flexibility in color modes, ease of installation, compatibility with various car models |

| Fleet & Commercial Vehicles | Interior lighting for driver cabins and passenger compartments | Improves driver alertness and passenger experience, safety lighting | Robustness for heavy use, energy efficiency, long lifespan, and warranty support |

| Ride-sharing & Taxi Services | Interior illumination to create welcoming environments for passengers | Enhances customer experience, promotes brand identity | Easy integration with vehicle electronics, low power consumption, and remote control options |

| Automotive Dealerships | Demo and display vehicles with dynamic interior lighting | Attracts customers, showcases vehicle features | High visual impact, reliability, and supplier support for large volume orders |

Automotive OEMs

Original equipment manufacturers (OEMs) integrate LED light strips into the interiors of passenger vehicles to create ambient lighting that elevates the driving experience. This application addresses the demand for modern, premium aesthetics and enhances passenger comfort by providing customizable lighting moods. For international buyers, especially in Europe and South America where vehicle design innovation is a competitive advantage, sourcing LED strips that meet strict automotive standards—including IP ratings for durability and consistent color rendering—is critical to ensure both safety and brand reputation.

Illustrative Image (Source: Google Search)

Aftermarket Customization

The aftermarket sector thrives on personalization, and LED light strips offer car owners the ability to customize interior lighting with multiple colors and dynamic effects. This is particularly popular in markets like South America and the Middle East, where vehicle personalization is culturally significant. Buyers sourcing for this segment must prioritize products that offer easy installation, wireless or app-based controls, and compatibility with a wide range of vehicle types, ensuring a seamless fit and user-friendly experience for end customers.

Fleet & Commercial Vehicles

In commercial and fleet vehicles, LED interior strips serve practical functions such as improving driver alertness during night shifts and enhancing passenger comfort in buses or vans. Buyers in Africa and the Middle East should focus on sourcing durable and energy-efficient LED strips that can withstand heavy usage and harsh operating conditions. Long lifespan and warranty support are essential to reduce maintenance costs and downtime, which is critical for cost-sensitive fleet operations.

Ride-sharing & Taxi Services

Ride-sharing and taxi companies use LED light strips to create inviting and branded interior environments that improve passenger satisfaction and loyalty. For B2B buyers targeting this sector, especially in urban centers across Europe and Africa, it is important to source LED strips that integrate easily with existing vehicle electronics and offer low power consumption to avoid battery drain. Remote control and programmable lighting modes add operational flexibility for drivers and fleet managers.

Automotive Dealerships

Dealerships employ LED interior lighting in demo vehicles to attract customers and highlight vehicle features dynamically. This application requires high-impact visual appeal and reliable performance to support continuous use in showroom environments. Buyers should seek suppliers capable of providing large volume orders with consistent quality, alongside responsive technical support to assist with installation and maintenance—factors particularly important for dealerships in growing markets such as Argentina and Thailand.

Related Video: How to Cut and Connect LED Light Strips.

Strategic Material Selection Guide for led light strips for car interior

When selecting materials for LED light strips designed specifically for car interiors, B2B buyers must weigh several critical factors including durability, thermal management, manufacturing complexity, and compliance with regional standards. The choice of material directly influences product longevity, safety, and user experience, especially in diverse markets such as Africa, South America, the Middle East, and Europe. Below is an analysis of four common materials used in automotive interior LED strip manufacturing.

Polyvinyl Chloride (PVC)

Key Properties: PVC is widely used as an encapsulating and insulating material for LED strips. It offers good electrical insulation, moderate flexibility, and resistance to moisture and chemicals. PVC typically withstands temperatures up to around 60-80°C, suitable for most car interior environments.

Pros & Cons: PVC is cost-effective and easy to manufacture, making it popular for large-scale production. It provides adequate protection against dust and humidity but has limited heat resistance compared to higher-grade polymers. Over time, PVC can become brittle under UV exposure, which is a consideration for vehicles in sunny climates like parts of Africa and the Middle East.

Impact on Application: PVC’s moderate flexibility allows for easy installation in curved or irregular interior surfaces. However, in regions with extreme temperature fluctuations such as parts of South America and Europe, buyers should verify that the PVC grade used meets local automotive standards (e.g., ASTM D1784, DIN 53455).

B2B Considerations: Buyers should ensure suppliers provide PVC materials compliant with international safety and environmental regulations, such as RoHS and REACH, which are increasingly enforced in Europe and Middle Eastern markets. PVC’s affordability makes it attractive for cost-sensitive markets like Argentina and Nigeria.

Silicone Rubber

Key Properties: Silicone rubber is renowned for its excellent thermal stability, maintaining flexibility and performance across a wide temperature range (-60°C to 230°C). It offers superior resistance to UV, ozone, and moisture, making it highly durable in harsh environments.

Pros & Cons: Silicone’s high durability and flexibility come at a higher cost and more complex manufacturing processes. It is less prone to discoloration and cracking, ensuring long-term aesthetic appeal. However, silicone is softer and may require additional protective layers for abrasion resistance.

Impact on Application: Ideal for premium or high-performance LED strips used in luxury or customized vehicles, especially in markets with extreme climates such as the Middle East and parts of Europe. Silicone’s superior heat resistance supports LED longevity in tightly confined interior spaces where heat dissipation is critical.

B2B Considerations: Buyers targeting high-end automotive segments or aftermarket customization in Brazil, UAE, or Germany should prioritize silicone-based strips for compliance with stringent automotive standards (e.g., ISO 16750 for electrical components). The higher upfront cost is offset by reduced warranty claims and enhanced brand reputation.

Polyurethane (PU)

Key Properties: Polyurethane offers excellent abrasion resistance, flexibility, and moderate thermal stability (typically up to 90-120°C). It also provides good chemical resistance, particularly against oils and fuels, which can be relevant in automotive environments.

Pros & Cons: PU is more durable than PVC but less heat resistant than silicone. It provides a balance between cost and performance, with better mechanical strength and elasticity. Manufacturing complexity is moderate, and PU coatings can be customized for different hardness levels.

Impact on Application: Suitable for LED strips exposed to mechanical stress or vibration inside vehicles, such as footwell or dashboard installations. Its chemical resistance is advantageous in markets with diverse fuel qualities and environmental contaminants, such as South America and Africa.

B2B Considerations: Buyers should verify that PU materials meet regional automotive standards like JIS (Japan Industrial Standards) or DIN, which are often referenced in Middle Eastern and European automotive sectors. PU’s moderate cost and durability make it a practical choice for mid-tier vehicle models and fleet upgrades.

Polycarbonate (PC)

Key Properties: Polycarbonate is a rigid, transparent thermoplastic known for exceptional impact resistance, high temperature tolerance (up to 130°C), and excellent optical clarity. It is often used in LED strip covers or lenses.

Pros & Cons: PC offers superior protection against physical damage and UV exposure, preserving LED brightness and color fidelity. However, it is less flexible and more expensive than PVC or PU, requiring precise manufacturing techniques. Its rigidity can limit installation versatility in curved interior surfaces.

Impact on Application: Best suited for premium LED strips where durability and light diffusion are priorities, such as in European luxury car interiors or aftermarket customization in markets like Thailand and Argentina. PC covers enhance product lifespan and reduce maintenance costs.

B2B Considerations: Buyers should ensure PC materials comply with ASTM D3935 or ISO 7823 standards for automotive glazing and lighting components. The higher cost is justified by improved product robustness and customer satisfaction in competitive markets.

| Material | Typical Use Case for led light strips for car interior | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyvinyl Chloride (PVC) | General-purpose encapsulation and insulation for standard LED strips | Cost-effective, easy to manufacture, moisture resistant | Limited heat resistance, potential brittleness under UV | Low |

| Silicone Rubber | Premium flexible encapsulation for high-performance LED strips | Excellent thermal stability and UV resistance | Higher cost, softer material requiring protection | High |

| Polyurethane (PU) | Protective coating for LED strips in mechanically stressed areas | Good abrasion and chemical resistance, flexible | Moderate heat resistance, moderate cost | Medium |

| Polycarbonate (PC) | Rigid protective covers/lenses for LED strips requiring optical clarity | High impact resistance and optical clarity | Less flexible, higher manufacturing complexity | High |

In-depth Look: Manufacturing Processes and Quality Assurance for led light strips for car interior

Manufacturing Processes for LED Light Strips for Car Interior

The production of LED light strips designed for automotive interiors involves a series of carefully controlled stages to ensure product reliability, safety, and aesthetic appeal. For international B2B buyers, understanding these stages helps in assessing supplier capabilities and product quality.

1. Material Preparation

This foundational phase focuses on sourcing and preparing raw materials, including:

- Flexible Printed Circuit Boards (FPCBs): High-quality, heat-resistant, and flexible substrates are selected to ensure durability in varying automotive environments.

- LED Chips and Components: LEDs are chosen based on brightness, color temperature, power consumption, and lifespan. Suppliers often procure SMD (Surface-Mount Device) LEDs with specific automotive-grade certifications.

- Encapsulation Materials: Silicone or polyurethane resins are prepared for waterproofing and protection, critical for durability and safety.

- Adhesive Backing: High-strength, temperature-resistant tapes are prepared for secure installation in vehicle interiors.

2. Forming and PCB Assembly

- PCB Fabrication: FPCBs are cut and shaped to precise dimensions using CNC or laser cutting technology, tailored to specific car models or aftermarket kits.

- Soldering and SMT Assembly: Automated Surface-Mount Technology (SMT) machines place and solder LEDs and electronic components onto the PCB with high precision, ensuring consistent electrical performance.

- Reflow Soldering: This technique solidifies solder joints, creating reliable electrical and mechanical connections critical for automotive vibration resistance.

3. Assembly and Integration

- Wiring and Connectors: Integration of flexible wiring harnesses and automotive-grade connectors ensures compatibility with vehicle electrical systems and ease of installation.

- Encapsulation and Waterproofing: LED strips are coated with waterproof layers, typically silicone gels or polyurethane coatings, to achieve IP65 or higher ratings, essential for protection against dust and moisture inside vehicle cabins.

- Quality Labeling and Packaging: Each strip is labeled with batch numbers, model info, and safety markings. Packaging is designed to prevent damage during transit and storage.

4. Finishing and Customization

- Cutting and Segmenting: LED strips are cut into customer-specified lengths, with cut points clearly marked for end-user convenience.

- Color Calibration and Testing: For RGB or multi-color strips, color consistency and brightness levels are calibrated using specialized equipment.

- Final Assembly: Additional features such as controllers, remote receivers, or Bluetooth modules may be integrated depending on the product specification.

Quality Assurance and Control Measures

Robust quality assurance (QA) and quality control (QC) systems are vital for maintaining the performance, safety, and compliance of LED light strips in the automotive sector. International buyers, especially from regions like Africa, South America, the Middle East, and Europe, must prioritize suppliers with certified and transparent QC protocols.

Relevant International and Industry Standards

- ISO 9001: This globally recognized standard underpins quality management systems, ensuring consistent manufacturing processes and continuous improvement.

- CE Marking: Mandatory for products sold in the European Economic Area, it signifies compliance with EU safety, health, and environmental requirements.

- Automotive Industry Standards (e.g., IATF 16949): Specific to automotive suppliers, this standard emphasizes defect prevention and reduction of variation.

- RoHS Compliance: Restricts hazardous substances in electronic components, a critical factor for environmental and safety compliance.

- IP Ratings (Ingress Protection): Defines water and dust resistance levels (commonly IP65 to IP67 for interior LED strips).

- UL Certification: Particularly relevant for electrical safety in some markets, assuring that LED strips meet rigorous safety tests.

Key QC Checkpoints in Manufacturing

- Incoming Quality Control (IQC): Verification of raw materials and components such as LED chips, PCBs, adhesives, and encapsulants. This stage includes dimensional checks, material certifications, and supplier audits.

- In-Process Quality Control (IPQC): Continuous monitoring during soldering, assembly, and encapsulation. Common checks include solder joint integrity, electrical continuity, and waterproofing application consistency.

- Final Quality Control (FQC): Comprehensive testing of finished LED strips before shipment. This includes:

- Electrical Testing: Voltage and current tests, short-circuit detection, and power consumption validation.

- Optical Testing: Brightness measurement, color accuracy, and uniformity checks.

- Environmental Testing: Thermal cycling, humidity resistance, vibration, and shock tests simulating automotive conditions.

- Durability Testing: Adhesion strength of tapes, flexibility tests, and waterproofing validation.

Common Testing Methods and Verification Approaches

- Spectrophotometry: Measures LED color output to ensure consistency with specifications.

- Electrical Load Testing: Simulates real-world usage to verify electrical stability and lifespan.

- Accelerated Aging Tests: Expose products to elevated temperatures and humidity to forecast longevity.

- Mechanical Flex Tests: Assess strip flexibility and resistance to cracking or delamination under bending stress.

- Waterproof Testing: Immersion or spray tests verify IP rating claims.

How B2B Buyers Can Verify Supplier Quality Control

International buyers should adopt a multi-faceted approach to verify supplier QC capabilities:

- Factory Audits: On-site inspections or third-party audits to review manufacturing processes, QC documentation, and worker training. Remote audits via video conferencing have become increasingly common.

- Certification Review: Request copies of ISO 9001, IATF 16949, CE, RoHS, and any relevant automotive certifications to confirm compliance.

- Sample Testing: Obtain product samples for independent laboratory testing to validate supplier claims on performance and safety.

- Third-Party Inspection Reports: Engage trusted inspection agencies (e.g., SGS, Bureau Veritas) to conduct pre-shipment inspections, including random sampling and functional testing.

- Process Transparency: Suppliers that provide detailed process flowcharts, QC checklists, and real-time production monitoring data demonstrate higher reliability.

QC and Certification Nuances for Buyers in Africa, South America, the Middle East, and Europe

- Regional Regulatory Differences: While CE marking is essential for European markets, buyers in Africa, South America, and the Middle East should also consider local certification requirements, such as INMETRO in Brazil or SASO in Saudi Arabia.

- Climate Considerations: Buyers from hot and humid regions (e.g., parts of Africa and the Middle East) must emphasize waterproofing and thermal stability in QC specifications.

- Supply Chain Transparency: Regions with evolving automotive aftermarket sectors (e.g., Argentina, Thailand) benefit from suppliers who provide traceability and batch documentation to ensure authenticity and warranty support.

- After-Sales Support: Given logistical complexities in these regions, buyers should assess the supplier’s capacity for technical support, warranty services, and replacement parts availability.

- Sustainability and Compliance: European buyers increasingly demand suppliers adhere to environmental regulations (e.g., WEEE Directive), which may be less stringent elsewhere but are critical for market access.

Summary for B2B Buyers

For international B2B buyers sourcing LED light strips for car interiors, a deep understanding of the manufacturing and QC landscape is essential. Prioritizing suppliers with advanced manufacturing techniques, certified quality systems, and transparent testing protocols ensures product reliability and compliance across diverse markets. Rigorous verification through audits, certifications, and independent testing protects buyers from substandard products, ultimately safeguarding brand reputation and customer satisfaction. Tailoring QC demands to regional market conditions and regulatory environments further enhances procurement success in Africa, South America, the Middle East, and Europe.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led light strips for car interior Sourcing

When sourcing LED light strips for car interiors, understanding the detailed cost structure and the factors influencing pricing is essential for international B2B buyers. This knowledge enables strategic negotiation, cost optimization, and effective supplier evaluation, especially in diverse markets such as Africa, South America, the Middle East, and Europe.

Breakdown of Cost Components

-

Materials: The primary cost driver includes high-quality LEDs, flexible PCB substrates, waterproof coatings (e.g., silicone or epoxy), connectors, and wiring. Premium materials such as high-density LEDs or RGB chips increase costs but enhance durability and functionality.

-

Labor: Manufacturing labor costs vary significantly by region. Countries with advanced automation may offer competitive pricing due to efficiency, while manual assembly in other regions can increase costs.

-

Manufacturing Overhead: This covers utilities, factory maintenance, equipment depreciation, and indirect labor. Overhead can fluctuate based on factory scale and technological sophistication.

-

Tooling and Setup: Initial investments in molds, dies, and assembly line setup are amortized over production volumes. Custom designs or specialized features (e.g., sequential lighting) increase tooling costs.

-

Quality Control (QC): Rigorous QC processes to ensure automotive-grade reliability—such as waterproof testing, vibration resistance, and electrical safety—add to costs but reduce risk of returns and warranty claims.

-

Logistics and Shipping: International freight charges, customs duties, taxes, and insurance must be factored in. Air freight offers speed but at higher cost, while sea freight is economical for bulk orders but slower.

-

Supplier Margin: Profit margins vary by supplier size, reputation, and service level. Established manufacturers with certifications (e.g., ISO, RoHS, CE) typically command higher prices reflecting product reliability.

Key Price Influencers for Buyers

-

Order Volume and MOQ: Larger orders benefit from economies of scale, lowering per-unit costs. MOQ requirements can affect upfront investment, especially for smaller businesses or emerging markets.

-

Product Specifications and Customization: Custom lengths, RGB control features, integrated sensors, or smart app compatibility add complexity and cost. Standardized products are more cost-efficient.

-

Material Quality and Certifications: Compliance with automotive standards (e.g., IP67 waterproofing, UL certification) increases manufacturing rigor and cost but is critical for durability and safety.

-

Supplier Location and Capabilities: Proximity to shipping routes, factory automation levels, and after-sales support affect pricing and total cost of ownership.

-

Incoterms and Payment Terms: Understanding Incoterms (FOB, CIF, DDP) helps buyers anticipate logistics costs and customs responsibilities. Favorable payment terms can improve cash flow and negotiating leverage.

Practical Buyer Tips for Cost Optimization

-

Negotiate on Volume and Payment: Consolidate orders to leverage volume discounts. Negotiate payment terms (e.g., partial upfront, balance on delivery) to reduce financial risk.

-

Assess Total Cost of Ownership (TCO): Look beyond unit price—consider durability, warranty, installation ease, and after-sales support, which impact long-term value.

-

Request Detailed Cost Breakdowns: Transparent supplier pricing enables targeted negotiation and helps identify unnecessary cost layers.

-

Factor in Regional Import Duties and Compliance: For buyers in Africa, South America, the Middle East, and Europe, local import taxes and product certification requirements can add to costs; factor these into budgeting.

-

Leverage Local Partners for Logistics: Collaborate with local freight forwarders or customs brokers to optimize shipping routes, reduce delays, and avoid unexpected fees.

-

Evaluate Supplier Reliability: Sometimes paying a premium for certified, experienced suppliers reduces risk and overall expenses related to defects or delays.

Indicative Pricing Disclaimer

Prices for LED light strips for car interiors vary widely depending on specifications, order size, and supplier location. Indicative pricing ranges can shift rapidly due to raw material costs and global logistics fluctuations. Buyers should always obtain multiple quotes and validate current market conditions before finalizing procurement decisions.

By comprehensively analyzing these cost components and pricing influencers, international B2B buyers can enhance procurement strategies, secure competitive pricing, and ensure high-quality LED light strips that meet their market demands effectively.

Spotlight on Potential led light strips for car interior Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led light strips for car interior’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led light strips for car interior

Critical Technical Properties for LED Light Strips in Car Interiors

When sourcing LED light strips for car interiors, understanding key technical specifications is essential for ensuring product performance, durability, and compatibility with automotive environments. Below are the most critical properties that B2B buyers should evaluate:

-

Material Grade and Housing

Automotive-grade silicone or flexible PVC is commonly used for the strip housing to provide durability, flexibility, and resistance to heat and vibration. This is crucial because interior automotive environments experience temperature fluctuations and mechanical stress. High-grade materials prevent cracking, discoloration, or electrical failures, safeguarding long-term reliability. -

Ingress Protection (IP) Rating

IP ratings indicate the LED strip’s resistance to dust and moisture. For car interiors, a minimum of IP65 is recommended to protect against accidental spills or humidity. Higher ratings (e.g., IP67) provide added protection, especially for areas prone to moisture. This specification directly impacts product lifespan and warranty claims. -

Operating Voltage and Current

Most automotive LED strips operate at 12V DC to align with standard vehicle electrical systems. Consistency in voltage ensures compatibility and ease of integration without additional transformers. Current consumption per meter (measured in amperes) affects power supply requirements and overall energy efficiency, which is vital for fleet buyers managing operational costs. -

LED Density (LEDs per Meter)

LED density determines brightness and uniformity of illumination. Typical densities range from 30 to 120 LEDs/m. Higher density strips provide smoother, more vibrant lighting but come at a higher cost. Buyers should balance brightness needs with budget and power constraints depending on the application (e.g., ambient mood lighting vs. functional illumination). -

Color Temperature and RGB Capability

Color temperature (measured in Kelvins) affects the ambiance—cool white (~6000K) offers a modern look, while warm white (~3000K) creates a cozy feel. RGB (Red, Green, Blue) LED strips enable full color customization and dynamic effects, appealing to aftermarket customization markets. Understanding these options helps buyers meet diverse customer preferences. -

Tolerance and Quality Control Standards

Manufacturing tolerance relates to the precision of LED placement, soldering, and electrical connections. Strips meeting automotive quality standards (e.g., ISO/TS 16949) ensure consistent performance and reduce defects. For B2B buyers, emphasizing suppliers with robust quality assurance reduces returns and enhances brand reputation.

Common Industry and Trade Terminology for LED Light Strip Procurement

Navigating the LED light strip supply chain requires familiarity with specific trade terms that streamline communication and contractual clarity between buyers and suppliers:

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers producing LED light strips that can be branded or customized for a buyer’s specific requirements. For B2B buyers, partnering with OEMs allows product differentiation and potential exclusivity, which is critical in competitive markets. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell per order. MOQs vary significantly by manufacturer and product complexity. Understanding MOQ helps buyers plan inventory, control costs, and negotiate volume discounts, especially when entering new markets like Africa or South America. -

RFQ (Request for Quotation)

A formal inquiry sent by buyers to suppliers requesting detailed pricing, lead times, and technical specifications. RFQs are essential for comparing multiple suppliers and ensuring transparent procurement processes. -

Incoterms (International Commercial Terms)

A set of standardized trade terms (e.g., FOB, CIF, EXW) defining the responsibilities of buyers and sellers regarding shipping costs, risks, and customs clearance. Knowing Incoterms helps buyers from diverse regions (Europe, Middle East) manage logistics efficiently and avoid unexpected charges. -

IP Rating (Ingress Protection Rating)

As described above, this term indicates the product’s protection level against solids and liquids. It’s a universal standard critical for specifying automotive lighting products. -

Lead Time

The period between placing an order and receiving the shipment. Lead times can vary by supplier location and production capacity. For international buyers, factoring in lead times is vital for maintaining supply chain continuity and meeting market demand.

Understanding these technical properties and trade terms empowers international B2B buyers to make informed decisions when sourcing LED light strips for car interiors. This knowledge helps ensure product suitability, optimize cost-efficiency, and strengthen supplier relationships across diverse automotive markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led light strips for car interior Sector

Market Overview & Key Trends

The global market for LED light strips tailored for car interiors is witnessing robust growth fueled by increasing demand for automotive customization, energy-efficient lighting solutions, and enhanced in-vehicle experiences. For B2B buyers in regions such as Africa, South America, the Middle East, and Europe, understanding these dynamics is vital for strategic sourcing and competitive positioning.

Key Market Drivers:

– Rising Vehicle Ownership and Customization: Emerging markets like Argentina and South Africa are experiencing growing automotive sales, accompanied by consumer interest in personalized vehicle aesthetics. LED light strips offer an affordable and versatile way to enhance interiors, appealing to both OEMs and aftermarket suppliers.

– Energy Efficiency and Durability: LED technology’s low power consumption and long lifespan align well with global trends toward sustainability and cost reduction in vehicle maintenance, critical for fleet operators and commercial buyers in the Middle East and Europe.

– Technological Integration: The proliferation of smart LED strips with app control, music synchronization, and customizable RGB lighting is reshaping sourcing requirements. Buyers are increasingly prioritizing suppliers capable of delivering advanced functionalities to meet evolving consumer expectations.

Emerging Sourcing Trends:

– Localized Supply Chains: Buyers are exploring regional partnerships to mitigate logistics costs and lead times. For example, European importers are seeking suppliers with localized warehouses or manufacturing hubs in Eastern Europe or Turkey. Similarly, South American and African buyers benefit from suppliers with strong distribution networks across their continents.

– Modular and Scalable Solutions: Demand is growing for LED strips that can be easily customized or expanded, enabling businesses to cater to diverse vehicle models and consumer preferences without extensive inventory overhead.

– Compliance and Certification Focus: With varying regulatory landscapes, particularly in Europe, buyers prioritize products that meet automotive safety standards (e.g., ECE regulations) and electrical certifications to ensure seamless market entry.

By aligning procurement strategies with these market realities, international B2B buyers can secure competitive advantages, optimize inventory, and respond agilely to shifting customer demands.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a cornerstone in the procurement of automotive LED light strips, influencing purchasing decisions beyond price and quality. For B2B buyers operating across Africa, South America, the Middle East, and Europe, integrating environmental and ethical considerations into sourcing strategies is both a market expectation and a regulatory necessity.

Environmental Impact Considerations:

– Material Selection: LED light strips often incorporate plastics, electronic components, and adhesives. Choosing suppliers who utilize recyclable or bio-based materials reduces environmental footprint and aligns with circular economy principles. For instance, sourcing strips with halogen-free, low-toxicity components helps minimize hazardous waste.

– Energy Efficiency: LEDs inherently consume less power than traditional lighting, but buyers can further drive sustainability by selecting products with optimized lumen-per-watt ratios and low standby power consumption, which is especially relevant for commercial fleets aiming to reduce operational costs and emissions.

Ethical Supply Chains:

– Transparency in sourcing raw materials and manufacturing processes is critical to avoid labor abuses and ensure compliance with international labor standards. Buyers should engage with suppliers who provide clear audit trails and certifications such as ISO 14001 (environmental management) and SA8000 (social accountability).

– Increasingly, global clients and regulators demand proof of conflict-free sourcing and adherence to responsible supply chain practices, particularly for electronic components.

Green Certifications and Standards:

– Certifications like RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and Energy Star can serve as procurement benchmarks, ensuring products meet stringent environmental and safety criteria.

– Buyers in Europe and parts of the Middle East benefit from prioritizing suppliers who comply with EU directives and local environmental regulations, which can facilitate smoother customs clearance and reduce risk exposure.

Incorporating sustainability into procurement not only supports corporate responsibility goals but also enhances brand reputation and future-proofs supply chains against tightening regulations.

Brief Evolution of LED Light Strips for Car Interiors

The evolution of LED light strips for car interiors reflects broader advancements in lighting technology and automotive consumer preferences. Initially, LED strips served primarily functional roles—providing basic illumination with limited color options. Over the past decade, innovation has transformed these components into customizable, multi-functional features integral to vehicle ambiance and user experience.

Early iterations were simplistic single-color strips with modest brightness, commonly used in aftermarket modifications. However, the integration of microcontrollers and wireless connectivity has enabled the rise of smart LED strips capable of dynamic color changes, music synchronization, and remote app control. This shift has expanded their appeal from niche customization markets to mainstream automotive manufacturers and fleet operators.

For B2B buyers, understanding this trajectory is essential to anticipate future trends, such as increased demand for IoT-enabled lighting solutions and integration with vehicle infotainment systems. This awareness supports informed sourcing decisions that balance innovation, cost, and supply chain reliability.

Frequently Asked Questions (FAQs) for B2B Buyers of led light strips for car interior

-

How can international B2B buyers effectively vet suppliers of LED light strips for car interiors?

Thorough supplier vetting is critical to secure quality and reliability. Buyers should request detailed company profiles, certifications (e.g., ISO 9001, automotive-specific standards), and proof of compliance with international safety and quality regulations. Visiting supplier facilities or arranging third-party inspections can verify production capabilities and quality controls. Additionally, reviewing customer references and sample testing helps assess product performance. For buyers in Africa, South America, the Middle East, and Europe, partnering with suppliers experienced in international shipping and customs compliance reduces risks during procurement. -

What customization options are typically available for LED light strips intended for car interiors?

Suppliers often offer customization in length, LED density, color options (including RGB and programmable variants), waterproof ratings, adhesive types, and connector compatibility. Advanced customization may include integration with vehicle control systems or app-based controls for color and effects. B2B buyers should clearly communicate their technical requirements upfront and confirm the supplier’s ability to meet those specifications, especially regarding voltage compatibility and durability under automotive conditions. Custom packaging and branding are also common for large orders. -

What are typical MOQ and lead times for LED light strip orders in international B2B transactions?

Minimum Order Quantities (MOQs) vary widely, generally ranging from 500 to 5,000 units depending on customization level and supplier scale. Lead times typically span 3 to 8 weeks, factoring in production, quality checks, and shipping. Buyers from emerging markets should plan for longer lead times during peak seasons or when custom features are requested. Early communication about order forecasts can help suppliers allocate resources efficiently. Negotiating partial shipments or staggered deliveries may be possible for large-volume contracts. -

Which payment terms and methods are most common and secure for international buyers?

Common payment terms include 30%-50% upfront deposits with balance paid upon shipment or delivery. Letters of Credit (LC) and escrow services provide additional security for international transactions. Wire transfers (T/T) are widely accepted, but buyers should confirm supplier banking details and use verified payment platforms to avoid fraud. For buyers in regions with currency restrictions, discussing payment flexibility or using international trade finance services can facilitate smoother transactions. Clear contractual terms on payment schedules and penalties protect both parties. -

What quality assurance practices and certifications should B2B buyers prioritize?

Quality assurance begins with selecting suppliers who adhere to automotive industry standards such as IATF 16949 or ISO 9001. Certifications related to electrical safety (CE, RoHS) and environmental compliance (REACH) are also important. Buyers should request documented evidence of in-line testing, burn-in procedures, and final product inspections. Third-party lab testing reports or factory audits enhance trust. For critical applications, establishing quality agreements and inspection protocols within contracts ensures consistent product performance and reduces warranty claims. -

How should international buyers approach logistics and shipping for LED light strips?

Selecting reliable freight forwarders familiar with automotive components and customs procedures in target markets is essential. LED light strips are generally lightweight but sensitive to moisture and impact, so proper packaging (anti-static, waterproof) is necessary to prevent damage. Air freight suits urgent orders but increases costs, while sea freight is economical for bulk shipments with longer lead times. Buyers should clarify Incoterms (e.g., FOB, CIF) upfront and plan for potential customs delays or import duties in regions like Africa or South America. -

What strategies can buyers use to manage disputes or quality issues with overseas suppliers?

Clear, detailed contracts specifying product specifications, delivery timelines, and quality standards mitigate disputes. Including clauses on penalties, returns, and dispute resolution mechanisms (e.g., arbitration) helps enforce agreements. Maintaining open communication channels and conducting periodic performance reviews encourages proactive problem solving. In case of quality issues, requesting replacement batches or refunds based on inspection reports is standard. Engaging local agents or third-party inspectors can provide on-the-ground support in managing supplier relations. -

How do regional market dynamics in Africa, South America, the Middle East, and Europe impact sourcing LED light strips?

Regional factors such as import regulations, currency fluctuations, and infrastructure affect procurement strategies. For example, African markets may face longer customs clearance times, while European buyers often require strict CE compliance. South American buyers should consider potential tariffs and currency volatility. Middle Eastern buyers might prioritize suppliers with experience in handling logistics through key ports. Understanding these dynamics enables buyers to negotiate better terms, optimize inventory planning, and select suppliers adept at navigating regional trade complexities.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led light strips for car interior

The market for LED light strips tailored to car interiors is evolving rapidly, driven by innovation in design, enhanced energy efficiency, and increasing consumer demand for personalized vehicle aesthetics. For international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, success hinges on a strategic sourcing approach that balances product quality, supplier reliability, and cost-effectiveness. Prioritizing suppliers with proven expertise in automotive-grade LED technology and robust quality assurance protocols ensures durability and compliance with regional standards, minimizing post-purchase risks.

Key considerations include selecting LED strips that meet specific application needs—whether for fleet upgrades, aftermarket customization, or OEM partnerships—and understanding material specifications such as waterproof ratings and color versatility. Leveraging regional market insights and supplier networks can unlock competitive pricing and optimize logistics, which is crucial for emerging and mature markets alike.

Looking ahead, the demand for smart, customizable LED lighting solutions integrated with IoT and app control features is set to grow. Buyers should actively engage with innovative manufacturers and remain agile in adapting to evolving automotive lighting trends. By embracing strategic partnerships and continuous market intelligence, B2B buyers can position themselves at the forefront of this dynamic sector, delivering enhanced value and differentiation to their customers globally.