Guide to Hardwire Led Strip Lights

- Introduction: Navigating the Global Market for hardwire led strip lights

- Understanding hardwire led strip lights Types and Variations

- Key Industrial Applications of hardwire led strip lights

- Strategic Material Selection Guide for hardwire led strip lights

- In-depth Look: Manufacturing Processes and Quality Assurance for hardwire led strip lights

- Comprehensive Cost and Pricing Analysis for hardwire led strip lights Sourcing

- Spotlight on Potential hardwire led strip lights Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for hardwire led strip lights

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the hardwire led strip lights Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of hardwire led strip lights

- Strategic Sourcing Conclusion and Outlook for hardwire led strip lights

Introduction: Navigating the Global Market for hardwire led strip lights

Hardwire LED strip lights have emerged as a transformative solution in commercial and industrial lighting, blending energy efficiency with design flexibility. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—understanding the nuances of hardwired LED strip lighting is essential to making informed procurement decisions that optimize performance and cost-effectiveness.

These lighting systems offer unparalleled benefits including reduced wiring clutter, enhanced safety, and a seamless integration into existing electrical infrastructures. As demand for sustainable, customizable, and durable lighting solutions grows in sectors ranging from retail and hospitality to infrastructure and public spaces, sourcing the right products and partners becomes a strategic priority.

This comprehensive guide dives deep into every critical aspect of hardwire LED strip lights:

– Types and configurations tailored for varied applications and environments

– Materials and components that influence longevity and light quality

– Manufacturing standards and quality control benchmarks ensuring reliability

– Top global suppliers and market trends relevant to diverse regional needs

– Cost factors and budgeting insights for competitive pricing without compromising quality

– FAQs and troubleshooting tips to support long-term maintenance and operation

By equipping B2B buyers with expert knowledge and actionable insights, this guide empowers stakeholders in Africa, South America, the Middle East, and Europe—including markets like Poland and France—to confidently navigate the global supply landscape. The result: smarter sourcing strategies that drive innovation, efficiency, and lasting value in their lighting projects.

Understanding hardwire led strip lights Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Single-Color Hardwire LED Strips | Emit one fixed color, typically white or warm white, with simple wiring | Retail displays, office lighting, residential under-cabinet lighting | Pros: Cost-effective, easy installation; Cons: Limited customization, less dynamic lighting options |

| RGB Hardwire LED Strips | Multi-color LEDs with integrated controllers for color changing | Hospitality, event venues, architectural accent lighting | Pros: Highly customizable, dynamic ambiance; Cons: Higher cost, requires compatible controllers |

| High-Density LED Strips | Closely spaced LEDs for intense brightness and uniform light | Industrial workspaces, commercial kitchens, signage | Pros: Superior brightness, uniform illumination; Cons: Higher power consumption, heat management needed |

| Waterproof Hardwire LED Strips | Encased in silicone or epoxy for moisture and dust resistance | Outdoor lighting, landscaping, marine applications | Pros: Durable in harsh environments, versatile; Cons: Slightly more expensive, installation complexity |

| Tunable White LED Strips | Adjustable color temperature from warm to cool white via controllers | Healthcare facilities, offices, museums requiring circadian lighting | Pros: Enhances productivity and wellbeing, flexible lighting; Cons: More complex control systems, higher upfront cost |

Single-Color Hardwire LED Strips

These strips provide consistent illumination in a single color, often warm or cool white, making them ideal for basic lighting needs. Their straightforward wiring and installation make them attractive for buyers seeking cost-effective solutions without requiring advanced controls. B2B buyers in retail or residential sectors appreciate their reliability and ease of integration. However, limited color options may restrict creative lighting designs, which can be a disadvantage for projects demanding dynamic ambiance.

RGB Hardwire LED Strips

Featuring red, green, and blue LEDs integrated with controllers, RGB strips allow for millions of color combinations and lighting effects. This versatility suits hospitality and entertainment industries aiming to create immersive environments. International buyers should consider compatibility with control systems and the need for professional installation to optimize functionality. The higher price point is balanced by the enhanced customer experience and branding opportunities these lights offer.

High-Density LED Strips

With LEDs spaced more closely than standard strips, these variants deliver intense and uniform brightness, essential for industrial or commercial applications requiring clear visibility. Buyers from manufacturing plants, commercial kitchens, or signage companies benefit from their superior light output. Attention to power supply specifications and heat dissipation is critical in procurement to ensure longevity and safety.

Waterproof Hardwire LED Strips

Encapsulated in protective materials, waterproof LED strips are engineered for outdoor or moisture-prone environments. They are highly valued in landscaping, architectural façade lighting, and marine sectors across diverse geographies including humid or coastal regions. B2B buyers should evaluate IP ratings and installation complexity, as these factors influence durability and maintenance costs in challenging conditions.

Tunable White LED Strips

These strips offer adjustable color temperatures, shifting from warm to cool white, supporting circadian rhythm lighting strategies. Healthcare facilities, offices, and museums particularly benefit from this flexibility to enhance occupant wellbeing and adapt lighting to different times of day. Procurement decisions should weigh the sophistication of control systems and integration with building management systems, which may increase initial investment but yield long-term productivity gains.

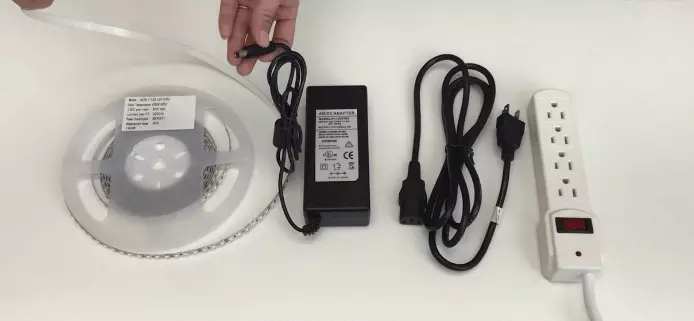

Related Video: Easy hardwire LED LightS install in the |wood shop|

Key Industrial Applications of hardwire led strip lights

| Industry/Sector | Specific Application of hardwire led strip lights | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Commercial Retail | Display and accent lighting in stores and shopping malls | Enhances product visibility, creates attractive ambience, increases customer engagement | High durability, consistent color rendering index (CRI), easy integration with existing electrical systems |

| Hospitality & Leisure | Ambient and task lighting in hotels, restaurants, and bars | Improves guest experience, customizable lighting moods, energy-efficient operation | Compliance with local safety standards, IP rating for moisture resistance, dimmability features |

| Infrastructure & Public Works | Architectural lighting for bridges, tunnels, and public buildings | Enhances safety and aesthetics, energy savings, long service life | Weatherproofing, robust mounting options, ability to operate in extreme climates |

| Manufacturing & Warehousing | Task and safety lighting in production lines and storage areas | Improves worker productivity, reduces accidents, lowers maintenance costs | High lumen output, resistance to dust and vibration, compatibility with industrial power supplies |

| Residential & Real Estate Development | Integrated lighting in luxury homes and apartment complexes | Adds value through modern design, reduces wiring clutter, energy-efficient lighting | Flexible length options, ease of installation, certifications for electrical safety |

Hardwired LED strip lights have become indispensable in commercial retail environments, where they are used extensively for display and accent lighting. Retailers in regions such as Europe and South America benefit from these lights by enhancing product visibility and creating inviting atmospheres that encourage longer customer dwell times. Buyers should prioritize LED strips with high color rendering index (CRI) to ensure true-to-life product colors, and sourcing durable, easy-to-install options compatible with local electrical standards is critical.

In the hospitality and leisure sector, including hotels and restaurants across the Middle East and Africa, hardwired LED strip lights are employed for ambient and task lighting to elevate guest experience. These lights allow for customizable moods and energy savings, essential for establishments focusing on luxury and sustainability. B2B buyers should focus on products with appropriate IP ratings for moisture resistance, dimmability, and compliance with regional safety regulations to ensure long-term reliability.

For infrastructure and public works, such as bridges and tunnels commonly found in European cities and expanding urban areas in South America, hardwired LED strip lights serve both aesthetic and functional purposes. They enhance safety by improving visibility while offering energy efficiency and durability to withstand harsh weather conditions. Key sourcing considerations include weatherproof designs, robust mounting options, and the ability to function reliably in extreme temperatures, which is especially important for projects in diverse climates like those in Africa and the Middle East.

In manufacturing and warehousing, particularly in industrial hubs across Poland and Brazil, these LED strips are used for task and safety lighting along production lines and storage zones. They contribute to higher productivity and reduce workplace accidents by providing consistent, bright illumination. Buyers should seek LED strips with high lumen output, resistance to dust and vibrations, and compatibility with industrial-grade power supplies to ensure optimal performance and minimal downtime.

Lastly, in the residential and real estate development market, hardwired LED strip lights are increasingly integrated into luxury homes and apartment complexes throughout Europe and the Middle East. They offer sleek, modern lighting solutions that reduce wiring clutter and enhance property appeal. For international buyers, flexibility in strip length, ease of installation, and adherence to electrical safety certifications are crucial factors to secure quality products that meet diverse architectural requirements.

Related Video: How to cut, connect & power LED Strip Lighting

Strategic Material Selection Guide for hardwire led strip lights

When selecting materials for hardwire LED strip lights, international B2B buyers must consider several factors including electrical safety, thermal management, corrosion resistance, and compliance with regional standards. The choice of material affects not only the durability and performance of the lighting system but also its installation complexity and long-term maintenance costs. Below is an analysis of four common materials used in components of hardwire LED strip lights such as housings, connectors, and wiring insulation.

Copper (for Wiring and Connectors)

Key Properties: Copper is widely used for electrical wiring and connectors due to its excellent electrical conductivity and thermal performance. It has a high melting point (~1085°C) and good corrosion resistance when properly coated or alloyed.

Pros & Cons: Copper offers superior electrical efficiency, reducing energy loss and heat buildup, which is critical for LED longevity. It is also relatively easy to work with during manufacturing. However, copper is more expensive than aluminum and requires protective coatings to prevent oxidation, especially in humid or coastal environments.

Impact on Application: Copper wiring ensures stable and efficient power delivery to LED strips, which is vital in installations requiring consistent brightness and color fidelity. Its corrosion resistance can be a concern in tropical or saline environments common in parts of Africa and the Middle East, necessitating additional protective measures.

International Considerations: Copper wiring must comply with IEC standards (e.g., IEC 60228 for conductors) and regional electrical codes such as the European EN standards or South American ABNT norms. Buyers in Europe (e.g., France, Poland) often require RoHS compliance and CE marking, while African and Middle Eastern markets may emphasize durability under harsh environmental conditions.

Aluminum (for Heat Sinks and Housing)

Key Properties: Aluminum is prized for its lightweight nature, excellent thermal conductivity (~205 W/mK), and corrosion resistance due to natural oxide formation. It withstands moderate mechanical stress and temperatures up to around 200°C.

Pros & Cons: Aluminum housings and heat sinks efficiently dissipate heat generated by LED strips, extending their lifespan. It is cost-effective and recyclable, making it attractive for sustainable procurement. However, aluminum is softer than steel and can be prone to denting or scratching, which may affect aesthetic appeal in premium applications.

Impact on Application: Aluminum is ideal for LED strip light fixtures in commercial or architectural settings where heat management is crucial, such as in Europe’s temperate climates or South American commercial buildings. Its corrosion resistance is beneficial in humid or coastal regions, though anodizing or powder coating is recommended for enhanced protection.

International Considerations: Compliance with ASTM B209 for aluminum sheet and EN 573 for aluminum alloys is common in Europe and South America. Buyers should verify that anodizing processes meet ISO 7599 or equivalent standards to ensure durability. In the Middle East, aluminum’s corrosion resistance is a significant advantage due to saline air.

Polyvinyl Chloride (PVC) (for Wire Insulation and Protective Covers)

Key Properties: PVC is a versatile thermoplastic polymer with good electrical insulation properties, flame retardance, and chemical resistance. It remains stable in temperatures typically ranging from -20°C to 105°C.

Pros & Cons: PVC insulation is cost-effective and widely available, making it a popular choice for wiring in LED strip lighting. It offers good mechanical protection and moisture resistance. However, PVC can become brittle over time, especially under UV exposure or extreme temperatures, limiting its use in outdoor or high-heat applications.

Impact on Application: PVC-insulated wiring is suitable for indoor installations in controlled environments such as offices and retail spaces common in European and South American markets. For outdoor or high-temperature environments (e.g., Middle East), alternatives like silicone or Teflon insulation may be preferred.

International Considerations: PVC materials must meet flame retardancy standards such as UL 94 V-0 or IEC 60332-1 for electrical safety. European buyers often require compliance with REACH and RoHS directives limiting hazardous substances. African markets may prioritize cost and availability, making PVC a practical choice if environmental conditions are moderate.

Stainless Steel (for Mounting Clips and Connectors)

Key Properties: Stainless steel offers excellent mechanical strength, corrosion resistance, and durability. Common grades like 304 and 316 stainless steel withstand temperatures up to 870°C and resist oxidation, acids, and salts.

Pros & Cons: Stainless steel mounting hardware ensures long-lasting support for LED strips, particularly in outdoor or industrial environments. It is more expensive and heavier than aluminum or plastic alternatives but offers superior resistance to wear and environmental degradation.

Impact on Application: Stainless steel is preferred for outdoor installations, public buildings, and infrastructure projects (e.g., bridges, malls) in diverse climates including humid African coasts, salty South American coastal cities, and industrial zones in Europe and the Middle East.

International Considerations: Compliance with ASTM A240 or EN 10088 standards is critical for stainless steel components. Buyers in Europe and South America often require certification for material traceability and corrosion resistance. Middle Eastern markets value stainless steel for its robustness under harsh environmental stress.

| Material | Typical Use Case for hardwire led strip lights | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Copper | Electrical wiring and connectors | Excellent electrical conductivity and thermal performance | Higher cost, requires protective coating in corrosive environments | High |

| Aluminum | Heat sinks, housings, and structural components | Lightweight, excellent heat dissipation, corrosion resistant | Softer, prone to dents and scratches | Medium |

| Polyvinyl Chloride (PVC) | Wire insulation and protective covers | Cost-effective, good insulation and flame retardance | Brittle under UV and high temperatures | Low |

| Stainless Steel | Mounting clips, connectors, and structural supports | Superior corrosion resistance and mechanical strength | Heavier and more expensive than alternatives | High |

In-depth Look: Manufacturing Processes and Quality Assurance for hardwire led strip lights

Understanding the manufacturing processes and quality assurance protocols behind hardwire LED strip lights is crucial for international B2B buyers aiming to source reliable, efficient, and compliant lighting solutions. This overview provides a detailed breakdown of typical production stages, key quality control (QC) practices, relevant international standards, and actionable insights for buyers from regions such as Africa, South America, the Middle East, and Europe.

Manufacturing Processes of Hardwire LED Strip Lights

The manufacturing of hardwire LED strip lights involves several critical stages, each designed to ensure performance, durability, and safety in the final product:

1. Material Preparation

- Substrate Selection: The base material, often flexible printed circuit boards (FPCBs) made of polyimide or polyester, is carefully chosen for heat resistance and flexibility.

- LED Chips and Components: High-quality LED chips (SMD types like 2835, 3528, or 5050) are sourced, alongside resistors, capacitors, and copper wire for hardwiring.

- Power Supply Components: Transformers, drivers, and connectors compatible with hardwiring are procured, ensuring steady voltage regulation.

2. Forming and Circuit Printing

- Copper Tracing: Precision copper circuit paths are etched or printed on the substrate to ensure efficient electrical conduction.

- Solder Mask Application: A protective solder mask layer is applied to prevent short circuits and environmental damage.

- Cutting and Shaping: The strips are cut into standard or custom lengths, with marked cutting points to maintain circuit integrity.

Illustrative Image (Source: Google Search)

3. Assembly

- LED Placement: Automated pick-and-place machines position LED chips onto the substrate with high accuracy.

- Soldering: Reflow soldering techniques secure the components, ensuring strong electrical connections and mechanical stability.

- Hardwiring Integration: Wiring harnesses, connectors, or terminal blocks are integrated to facilitate direct connection to electrical mains, suitable for hardwired installations.

4. Finishing and Protective Coating

- Encapsulation: Depending on the application (indoor/outdoor), strips may be coated with silicone or epoxy resin for water resistance and durability.

- Adhesive Backing: High-grade adhesive tapes or mounting clips are attached to ease installation.

- Labeling: Products are marked with batch numbers, voltage ratings, and certification logos for traceability and compliance.

Quality Assurance and Control in Hardwire LED Strip Light Production

Quality assurance in LED strip light manufacturing is multi-layered, addressing every stage from raw material inspection to final product testing. Buyers should be familiar with the following QC checkpoints and standards:

Key Quality Control Checkpoints

- Incoming Quality Control (IQC): Verification of raw materials and components, including LED chips, copper substrates, and wiring, to ensure they meet predefined specifications.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly and soldering processes to detect defects such as misaligned LEDs, soldering faults, or circuit breaks.

- Final Quality Control (FQC): Comprehensive testing of completed strips for electrical performance, visual defects, and physical robustness before packaging.

Common Testing Methods

- Electrical Testing: Verification of voltage, current, and power consumption to ensure strips operate within specified parameters.

- Light Output and Color Consistency: Measurement of luminous flux (lumens) and color temperature to meet design requirements.

- Durability Tests: Includes thermal cycling, vibration, and humidity exposure to simulate real-world conditions.

- Safety Tests: Insulation resistance and dielectric strength tests to prevent electrical hazards in hardwired installations.

- Ingress Protection (IP) Testing: For waterproof or outdoor-rated strips, confirming resistance to dust and water (e.g., IP65, IP67).

Relevant International and Industry Standards

Adherence to internationally recognized standards is essential for market acceptance and safety assurance:

- ISO 9001: This global quality management standard ensures that manufacturers maintain consistent processes and continuous improvement. Buyers should request ISO 9001 certification to confirm systematic quality control.

- CE Marking: Mandatory for products sold in the European Economic Area (EEA), indicating compliance with EU safety, health, and environmental requirements.

- RoHS Compliance: Restricts hazardous substances in electrical products, crucial for European and many international markets.

- UL Certification: Particularly important for buyers in regions influenced by North American standards, ensuring electrical safety.

- IP Ratings: As per IEC 60529, these ratings define the level of protection against solids and liquids—key for outdoor or humid environment applications.

- EMC Compliance: Electromagnetic compatibility standards to prevent interference with other electronic devices.

How B2B Buyers Can Verify Supplier Quality Control

For buyers from Africa, South America, the Middle East, and Europe, verifying supplier QC is vital to mitigate risks and ensure product reliability:

- Factory Audits: Conduct on-site or third-party audits to inspect manufacturing processes, QC protocols, and working conditions. Audits assess adherence to ISO 9001 and other certifications.

- Review of QC Documentation: Request detailed inspection reports, test certificates, and batch traceability documents to confirm compliance and consistency.

- Third-Party Testing: Employ independent labs to conduct performance and safety testing, especially if local regulations require additional certifications.

- Sample Evaluation: Order samples for in-house testing under expected operating conditions to validate supplier claims on brightness, color, and durability.

- Supplier Certifications: Verify the authenticity of certifications like CE, RoHS, UL, and IP ratings through official registries or certification bodies.

QC and Certification Nuances for Different Regions

- Africa & South America: These markets often face challenges with counterfeit or substandard lighting products. Buyers should prioritize suppliers with transparent QC processes and international certifications. Local electrical codes may vary, so confirming compliance with regional standards or approvals is important.

- Middle East: High-temperature and dust-prone environments demand LED strips with robust IP ratings and thermal management. Certifications related to safety and durability under harsh conditions are critical.

- Europe (e.g., Poland, France): Strict regulatory frameworks require CE marking, RoHS, and WEEE compliance. Environmental and energy efficiency standards are also emphasized. Buyers should ensure suppliers provide detailed compliance documentation and understand EU market requirements.

Strategic Recommendations for B2B Buyers

- Engage Early with Suppliers: Discuss manufacturing and QC processes upfront to assess alignment with your quality expectations.

- Specify Standards in Contracts: Clearly define required certifications, testing protocols, and inspection rights in purchase agreements.

- Leverage Local Expertise: Collaborate with regional testing agencies or consultants to navigate complex certification landscapes.

- Plan for After-Sales Support: Confirm supplier capabilities for warranty, maintenance, and replacement to safeguard your investment.

By deeply understanding manufacturing intricacies and quality assurance frameworks, international B2B buyers can confidently select hardwire LED strip light suppliers who deliver high-performance, compliant, and durable lighting solutions tailored to their regional market needs.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for hardwire led strip lights Sourcing

Understanding the cost and pricing dynamics behind hardwire LED strip lights is crucial for international B2B buyers aiming to optimize procurement strategies and ensure cost-efficiency. This analysis breaks down the key cost components, price influencers, and practical buyer tips, with a focus on markets in Africa, South America, the Middle East, and Europe.

Key Cost Components in Hardwire LED Strip Lights

-

Materials

The primary raw materials include LED chips, flexible PCB substrates, resistors, wiring, connectors, and power supplies/transformers. High-quality LEDs (e.g., SMD 2835, 5050) and durable substrates increase upfront material costs but typically enhance longevity and brightness, impacting total cost of ownership. -

Labor

Labor costs vary significantly by manufacturing location. Countries with advanced automation reduce labor expenses, while manual assembly or customization (such as specific lengths or color temperatures) can raise labor input and costs. Skilled labor is essential for precision in hardwiring, influencing quality and reliability. -

Manufacturing Overhead

Includes factory utilities, equipment depreciation, and indirect labor. Efficient production lines with lean manufacturing practices tend to lower overhead, which is reflected in competitive pricing. -

Tooling and Setup

Custom tooling for unique LED strip designs or connectors adds to upfront costs. For buyers requiring bespoke solutions (e.g., specific IP ratings or integrated dimming controls), tooling costs can be amortized over large volumes but may increase unit price for smaller orders. -

Quality Control (QC)

QC processes such as in-line testing, burn-in periods, and certifications (CE, RoHS, UL) ensure product reliability and compliance with international standards. These add to production costs but are vital for buyers targeting regulated markets in Europe and the Middle East.

-

Logistics and Shipping

Freight charges, customs duties, import taxes, and insurance vary by destination. Buyers in Africa and South America often face higher logistics costs due to longer transit times and port handling fees, which should be factored into landed cost calculations. -

Supplier Margin

Suppliers include profit margins to cover business risks and sustain operations. Margins fluctuate based on market demand, brand positioning, and supplier capacity.

Price Influencers and Their Impact

-

Order Volume and Minimum Order Quantity (MOQ)

Larger volume orders generally attract lower per-unit prices due to economies of scale. Buyers should negotiate MOQs aligned with their inventory capabilities to balance cost savings and cash flow. -

Specifications and Customization

Custom lengths, color temperatures (warm white, RGB), waterproofing (IP65, IP67), and integrated controllers raise costs. Standardized products are more cost-effective but may not meet all application needs. -

Material Quality and Certifications

Certified LEDs and compliant materials command premium pricing but reduce risks related to warranty claims and regulatory penalties. -

Supplier Location and Reliability

Suppliers in low-cost regions may offer competitive prices but require due diligence on quality and delivery reliability. Established suppliers with transparent supply chains and after-sales support are preferred by buyers targeting Europe and the Middle East. -

Incoterms and Payment Terms

Understanding Incoterms (e.g., FOB, CIF, DDP) is critical. Buyers should clarify which party bears shipping risks and costs. Favorable payment terms (e.g., letter of credit, net 30/60) improve cash flow management.

Practical Buyer Tips for International B2B Sourcing

-

Negotiate Beyond Price: Focus on total value—warranty terms, lead times, and after-sales support can outweigh small price differences. For example, suppliers offering technical support for hardwiring installation may reduce your operational costs.

-

Calculate Total Cost of Ownership (TCO): Factor in energy efficiency, lifespan, maintenance, and potential replacement costs, especially important for markets with volatile power supply like parts of Africa and South America.

-

Leverage Volume Consolidation: Pooling orders across regional branches or partners can unlock better pricing tiers and reduce logistics expenses.

-

Understand Local Compliance: Ensure products meet local electrical and safety standards to avoid costly rejections or retrofits, particularly in Europe where certifications are stringent.

-

Consider Currency and Payment Risks: Hedging currency fluctuations can protect procurement budgets, especially when dealing with suppliers outside your currency zone.

-

Request Detailed Quotes: Insist on itemized pricing including all ancillary costs such as packaging, customs clearance, and testing fees to avoid hidden charges.

Indicative Pricing Disclaimer

Prices for hardwire LED strip lights vary widely based on technical specifications, order size, and supplier terms. Typical unit prices for standard strips range from $2 to $10 per meter depending on quality and features. Custom or certified products may command higher prices. Buyers should use these figures as a baseline and conduct thorough market comparisons and supplier audits before finalizing purchases.

By comprehensively analyzing cost structures and pricing influencers, international B2B buyers can strategically source hardwire LED strip lights that align with their budget, quality expectations, and operational requirements across diverse global markets.

Spotlight on Potential hardwire led strip lights Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘hardwire led strip lights’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for hardwire led strip lights

Critical Technical Properties of Hardwire LED Strip Lights

Understanding the technical specifications of hardwire LED strip lights is essential for international B2B buyers to ensure product quality, compatibility, and longevity in various applications. Below are some of the most important properties:

-

Material Grade and Build Quality

The substrate material (commonly flexible PCB with copper traces) and encapsulation quality determine durability and heat dissipation. High-grade materials resist corrosion and maintain performance in humid or outdoor environments, which is crucial for buyers targeting markets with diverse climates, such as Africa or the Middle East. -

Voltage and Power Specifications

Most hardwired LED strips operate on low voltage DC (typically 12V or 24V). Power consumption per meter (watts/meter) affects energy efficiency and heat generation. Buyers should verify that voltage ratings align with local electrical standards and that power supplies are compatible with the intended installation environment. -

LED Density and Brightness (Lumens per Meter)

LED strip brightness depends on the number of LEDs per meter and the quality of each LED chip. Higher density strips provide uniform illumination but may require more robust power supplies. This is a key consideration for buyers planning installations in commercial spaces or public buildings where lighting uniformity and intensity are critical. -

IP Rating (Ingress Protection)

The IP rating indicates resistance to dust and water. For indoor applications, IP20 may suffice, but outdoor or high-moisture environments (e.g., bathrooms, kitchens, or exterior bridges) require IP65 or higher. Selecting the correct IP rating safeguards the installation and reduces maintenance costs. -

Color Temperature and Color Rendering Index (CRI)

Color temperature (measured in Kelvin) affects ambiance—ranging from warm white (2700K) to cool white (6500K). CRI measures how accurately the light renders colors, with values above 80 considered good for most applications. Buyers should align these specs with their target market’s aesthetic and functional needs. -

Cutting and Connection Tolerance

LED strips have designated cutting points to customize lengths. The precision of these cut points and the robustness of connection terminals influence installation flexibility and electrical reliability. This property is vital for large-scale projects requiring customized configurations without compromising safety or performance.

Key Industry and Trade Terms for B2B Buyers

Navigating trade terminology is as important as understanding product specs to streamline procurement, negotiation, and logistics.

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers producing LED strip lights that other brands can rebrand. For buyers, OEM options often provide cost advantages and customization possibilities but require careful vetting of quality and compliance with local standards. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in one order. Understanding MOQ helps buyers plan inventory, negotiate pricing, and manage cash flow, especially when sourcing for markets with varying demand sizes like small retailers in South America or large distributors in Europe. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing, lead times, and terms for specific products. Well-prepared RFQs improve communication efficiency and ensure suppliers provide accurate, comparable offers, reducing time-to-decision. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyer and seller. Common Incoterms include FOB (Free on Board) and CIF (Cost, Insurance, Freight). Clarity on Incoterms minimizes disputes and unexpected costs in international shipping. -

IP Rating

While a technical property, it is also a trade term commonly referenced in purchase specifications and compliance documentation. Buyers should explicitly state required IP ratings in purchase orders to avoid mismatches. -

Lead Time

The period between order placement and delivery. Lead time impacts project scheduling and inventory management. Buyers should confirm lead times upfront, especially for customized or OEM orders, to align supply with market demands.

By mastering these technical properties and trade terms, international B2B buyers can make informed purchasing decisions that optimize product performance, cost efficiency, and supply chain reliability for hardwire LED strip lighting projects across diverse regions.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the hardwire led strip lights Sector

Market Overview & Key Trends

The global hardwire LED strip lights market is experiencing robust growth driven by increasing demand for energy-efficient, customizable, and durable lighting solutions across commercial, industrial, and residential sectors. International B2B buyers from Africa, South America, the Middle East, and Europe are capitalizing on these trends, seeking reliable suppliers who can deliver high-quality products tailored to diverse climatic and infrastructural conditions.

Key market drivers include rising urbanization, expanding smart building projects, and government incentives promoting energy-saving lighting technologies. In regions like Europe—specifically Poland and France—regulatory frameworks encourage adoption of LED lighting for reduced carbon footprints, influencing procurement decisions toward certified and compliant hardwired LED strip lights. Similarly, Middle Eastern and African markets are witnessing increased investments in infrastructure and hospitality sectors, fueling demand for advanced LED solutions that combine aesthetics with functionality.

Emerging sourcing trends emphasize integrated solutions, such as LED strips with smart controls for IoT-enabled lighting systems. Buyers prioritize suppliers offering modular, easy-to-install strips with flexible hardwiring options that ensure seamless integration into existing electrical infrastructure. Additionally, supply chain transparency and local assembly hubs are becoming crucial to minimize lead times and logistics costs, especially for South American and African markets where import complexities can delay projects.

Technological advancements, including improved chip efficiency and heat dissipation, are making hardwired LED strips more reliable and longer-lasting, which appeals to B2B buyers focused on total cost of ownership. Customization in color temperature, brightness levels, and IP-rated protection for outdoor or humid environments also influences purchasing preferences. Overall, the sector is moving towards smart, sustainable, and cost-effective lighting solutions, aligning with global energy efficiency goals and regional market needs.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a pivotal factor in sourcing hardwire LED strip lights, with B2B buyers increasingly scrutinizing environmental impact and ethical practices across the supply chain. LED lighting inherently reduces energy consumption by up to 80% compared to traditional lighting, positioning hardwired LED strips as a green alternative. However, the sustainability profile extends beyond energy savings to encompass raw material sourcing, manufacturing processes, and end-of-life management.

International buyers are demanding products compliant with recognized green certifications such as RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and Energy Star ratings. These certifications ensure that the LED strips are free from harmful substances like lead and mercury, and meet stringent energy efficiency standards. Moreover, responsible sourcing of components—particularly rare earth elements and semiconductors—is critical to avoid supply chain risks linked to environmental degradation and labor rights violations.

Ethical supply chains are gaining prominence, especially in regions like Europe and the Middle East, where corporate social responsibility (CSR) policies influence procurement. Buyers are partnering with manufacturers that uphold fair labor practices, enforce safe working conditions, and promote circular economy principles such as recyclability and modular design. For example, selecting LED strips with recyclable aluminum channels and low-impact PCB substrates supports sustainability goals while simplifying maintenance and replacement.

Additionally, lifecycle assessments (LCAs) are becoming a standard tool for evaluating environmental footprints, guiding buyers to choose suppliers with transparent reporting on carbon emissions and waste management. By prioritizing sustainability and ethical sourcing, B2B buyers not only comply with evolving regulations but also enhance brand reputation and meet the expectations of increasingly eco-conscious end users.

Brief Evolution and Industry Context

Hardwire LED strip lights have evolved significantly since their inception in the early 2000s, transitioning from simple decorative lighting to sophisticated, integrated illumination systems. Initially used primarily for accent and mood lighting, advances in LED chip technology and power management enabled their adoption in functional and architectural lighting applications.

The shift towards hardwired configurations responded to demands for permanent, seamless installations that eliminate bulky adapters and reduce clutter, making them ideal for commercial projects and smart building integrations. Over time, improvements in flexibility, waterproofing, and color customization expanded their usability across diverse environments—from indoor office spaces in Europe to outdoor infrastructure projects in Africa and the Middle East.

This evolution has been accompanied by a growing emphasis on safety standards and energy regulations, particularly in developed markets, shaping product design and supplier selection criteria. Today, hardwired LED strip lights represent a mature sector characterized by innovation, sustainability, and tailored solutions that address the complex needs of global B2B buyers.

Related Video: Incoterms for beginners | Global Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of hardwire led strip lights

-

How can I effectively vet suppliers of hardwire LED strip lights for international B2B purchases?

To vet suppliers, start by verifying their business licenses and export certifications, especially those compliant with EU (CE), Middle Eastern (GSO), or African standards. Request product samples to assess quality and confirm adherence to specifications. Check references or client testimonials and inquire about past export experience to your target region. Evaluate their responsiveness, communication clarity, and willingness to provide technical documentation such as wiring diagrams or installation guides. Using platforms that offer verified supplier statuses or engaging third-party inspection services can further reduce risks. -

Are customization options widely available for hardwire LED strip lights, and how should I approach them?

Yes, many manufacturers offer customization including length, color temperature, IP rating, and connectors suitable for hardwiring. When sourcing internationally, clearly communicate your technical requirements and intended application (e.g., indoor, outdoor, moisture exposure). Request detailed proposals with drawings or prototypes to avoid misunderstandings. Confirm if they can accommodate regional voltage standards (e.g., 230V in Europe, 220V in the Middle East). Negotiate minimum order quantities (MOQs) for customized products, as these can be higher than standard models. -

What typical minimum order quantities (MOQs), lead times, and payment terms should I expect when ordering hardwire LED strip lights internationally?

MOQs vary by supplier but often start around 500 to 1,000 meters per order for standard LED strips; custom orders may require higher MOQs. Lead times generally range from 3 to 8 weeks, depending on customization and production capacity. Payment terms frequently include a 30-50% deposit upfront with the balance paid before shipment or upon delivery. Letter of credit (L/C) or escrow services provide additional payment security. Negotiate terms early and confirm timelines in writing to align with your project schedule. -

What quality assurance certifications and testing should I require from hardwire LED strip light suppliers?

Prioritize suppliers with internationally recognized certifications such as CE (Europe), RoHS (hazardous substances), UL or ETL (North America, sometimes accepted globally), and ISO 9001 for quality management. Request third-party test reports for electrical safety, IP rating (water/dust resistance), and photometric performance. Ensure the LEDs use reliable chip brands and that the power supplies meet efficiency standards. Clear documentation reduces compliance risks and facilitates customs clearance in different countries. -

What logistics and shipping considerations are critical for importing hardwire LED strip lights into regions like Africa, South America, the Middle East, or Europe?

LED strip lights are lightweight but sensitive to moisture and static; proper packaging with anti-static materials and moisture barriers is essential. Choose shipping methods balancing cost and speed—air freight suits urgent orders, while sea freight is economical for large volumes. Verify import duties, taxes, and certification requirements specific to your country. Work with freight forwarders experienced in electronics and verify Incoterms to clarify responsibility for customs clearance and insurance. -

How can I handle disputes or quality issues with international suppliers of hardwire LED strip lights?

Establish clear contracts specifying product specs, quality standards, inspection processes, and remedies for defects. Use third-party inspection services pre-shipment to detect issues early. In case of disputes, communicate promptly and professionally, providing photo or video evidence. Engage trade dispute resolution mechanisms such as mediation or arbitration per the contract’s governing law. Maintaining good relationships and clear documentation helps resolve issues without escalating costs or delays. -

What are the key electrical and installation factors I should verify before purchasing hardwire LED strip lights for international projects?

Confirm the strips’ voltage and current ratings align with your regional electrical standards. Ensure compatibility with local wiring colors and connectors to simplify installation. Ask if the supplier offers dimmable options or integration with smart controls if required. Verify that the strips have adequate heat dissipation features and waterproof ratings suited to the environment (e.g., IP65+ for outdoor use). Request detailed wiring diagrams and installation manuals to support your technical teams or contractors. -

How can I ensure ongoing supply chain reliability for hardwire LED strip lights across diverse international markets?

Build partnerships with multiple vetted suppliers to mitigate risks from production delays or geopolitical issues. Negotiate framework agreements with flexible MOQs and scalable production capacity. Monitor supplier performance regularly through quality audits and delivery tracking. Stay informed about raw material price fluctuations affecting LED components. Invest in inventory buffering and collaborate closely on demand forecasts to avoid stockouts, especially in fast-growing markets like Africa and the Middle East.

Strategic Sourcing Conclusion and Outlook for hardwire led strip lights

Hardwire LED strip lights present a compelling solution for businesses aiming to enhance lighting efficiency and design flexibility across diverse applications—from commercial spaces to public infrastructure. For international B2B buyers, especially in Africa, South America, the Middle East, and Europe, strategic sourcing is crucial to secure reliable, high-quality products that meet regional electrical standards and installation demands. Prioritizing suppliers with proven expertise in hardwired LED technology ensures seamless integration, energy savings, and durability.

Key considerations include verifying product certifications, understanding local wiring regulations, and evaluating supplier capabilities for customization and after-sales support. Streamlined procurement processes and partnerships with manufacturers experienced in international markets can mitigate risks associated with electrical compliance and supply chain disruptions.

Illustrative Image (Source: Google Search)

Looking ahead, the demand for sustainable, smart lighting solutions is expected to accelerate, driven by urbanization and energy efficiency mandates worldwide. Buyers who proactively engage with innovative suppliers and invest in scalable, adaptable LED strip lighting systems will position themselves at the forefront of this evolving market. Embrace strategic sourcing as a competitive advantage—partner with trusted manufacturers to deliver cutting-edge lighting solutions that illuminate future growth opportunities globally.