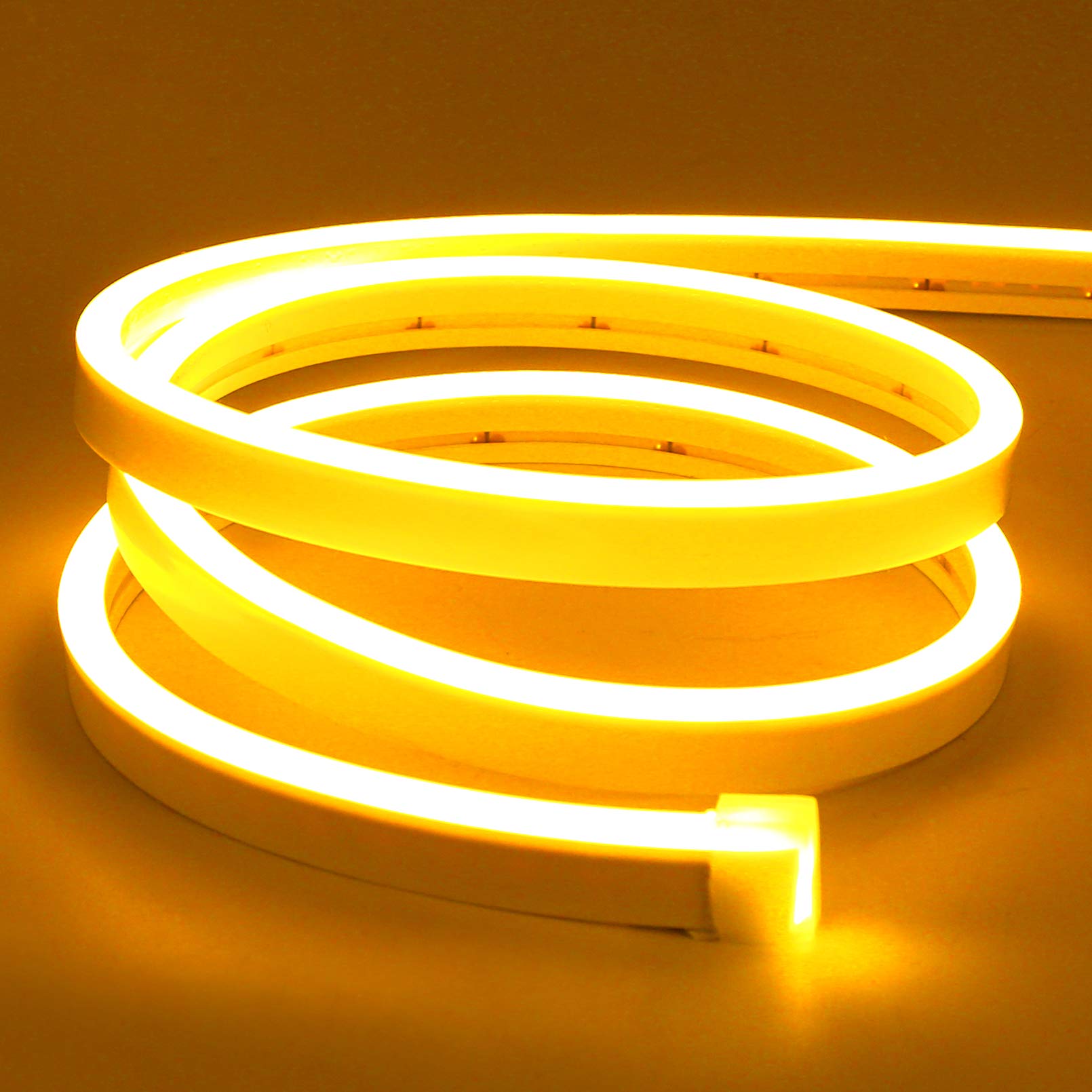

Guide to Led Strip Yellow Light

- Introduction: Navigating the Global Market for led strip yellow light

- Understanding led strip yellow light Types and Variations

- Key Industrial Applications of led strip yellow light

- Strategic Material Selection Guide for led strip yellow light

- In-depth Look: Manufacturing Processes and Quality Assurance for led strip yellow light

- Comprehensive Cost and Pricing Analysis for led strip yellow light Sourcing

- Spotlight on Potential led strip yellow light Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for led strip yellow light

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led strip yellow light Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of led strip yellow light

- Strategic Sourcing Conclusion and Outlook for led strip yellow light

Introduction: Navigating the Global Market for led strip yellow light

In today’s rapidly evolving global lighting industry, LED strip yellow light stands out as a versatile and highly sought-after component. Its applications span from enhancing retail and hospitality atmospheres to improving safety and visibility in industrial and architectural projects. For international B2B buyers—especially those operating in dynamic markets across Africa, South America, the Middle East, and Europe—understanding the nuances of sourcing these products is crucial to maintaining competitive advantage and operational excellence.

This comprehensive guide is designed to empower procurement professionals, distributors, and project managers with actionable insights for confident and strategic sourcing. You will explore the full spectrum of LED strip yellow light options, including variations in brightness, color temperature, waterproofing, and energy efficiency. We delve into critical factors such as raw materials, manufacturing processes, and stringent quality control protocols that ensure product reliability and longevity.

Beyond product specifications, the guide provides an in-depth analysis of global supplier landscapes, highlighting how to identify reputable manufacturers with proven track records and certifications. Key considerations such as cost structures, logistics challenges, and market trends relevant to regions like Saudi Arabia and Germany are thoroughly examined. The inclusion of a practical FAQ section addresses common concerns and hurdles faced by international buyers.

By leveraging this guide, B2B buyers can streamline supplier selection, optimize procurement costs, and establish sustainable supply partnerships—all while navigating complex regulatory environments and diverse market demands. This resource is your roadmap to securing high-quality LED strip yellow light solutions that drive business growth and innovation across continents.

Understanding led strip yellow light Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Yellow LED Strip | Single-color yellow LEDs, typically 3528 or 5050 SMD chips | Retail lighting, signage, decorative accents | Pros: Cost-effective, easy to install; Cons: Limited color flexibility |

| High-CRI Yellow LED Strip | Enhanced Color Rendering Index for truer yellow hues | Art galleries, museums, premium retail displays | Pros: Superior color accuracy; Cons: Higher cost, limited suppliers |

| Waterproof Yellow LED Strip | Silicone or epoxy coating for moisture protection | Outdoor signage, hospitality, automotive | Pros: Weather-resistant, durable; Cons: Slightly higher price, less flexible |

| Flexible RGB Yellow LED Strip | RGB LEDs programmed to emit yellow light dynamically | Event production, architectural lighting | Pros: Versatile color control, dynamic lighting effects; Cons: Complex control systems, higher investment |

| High-Power Yellow LED Strip | High lumen output, often with enhanced heat dissipation | Industrial lighting, large-scale commercial use | Pros: High brightness, long lifespan; Cons: Requires robust power supply, heat management |

Standard Yellow LED Strip

This is the most common type used in many B2B contexts due to its affordability and simplicity. Featuring standard SMD (Surface-Mounted Device) LEDs like 3528 or 5050 chips, these strips emit a consistent yellow light ideal for retail displays, signage, and decorative lighting. Buyers should consider volume discounts and ensure compatibility with existing dimming or control systems. While cost-effective, these strips lack advanced features like color tuning or high color fidelity.

High-CRI Yellow LED Strip

Designed to provide a more natural and vivid yellow light, high-CRI (Color Rendering Index) LED strips are crucial for environments where color accuracy impacts customer experience, such as art galleries or luxury retail. These strips typically come at a premium price and may require sourcing from specialized manufacturers. B2B buyers should evaluate supplier certifications and product testing to confirm CRI ratings and consistency.

Waterproof Yellow LED Strip

Encased in silicone or epoxy, waterproof LED strips are tailored for outdoor or moisture-prone environments, including hospitality venues, automotive lighting, and outdoor advertising. These strips offer durability and resistance against weather conditions but may have reduced flexibility and slightly increased costs. When purchasing, verify IP ratings (e.g., IP65, IP67) and inquire about warranty terms related to environmental exposure.

Flexible RGB Yellow LED Strip

Utilizing RGB LEDs programmed to emit yellow light, these strips provide dynamic lighting options and color control via controllers or smart systems. Ideal for event production and architectural projects, they enable seamless transitions and effects. However, they require more complex control infrastructure and represent a higher initial investment. B2B buyers should assess compatibility with existing lighting control protocols and long-term maintenance support.

High-Power Yellow LED Strip

These strips are engineered for high lumen output and often include enhanced heat dissipation features, making them suitable for industrial and large commercial applications where intense lighting is necessary. They demand robust power supplies and effective thermal management solutions. Buyers should prioritize suppliers who provide detailed technical specifications, thermal testing results, and scalable supply capabilities to support large projects.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of led strip yellow light

| Industry/Sector | Specific Application of led strip yellow light | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing | Safety and hazard zone marking on factory floors | Enhances worker safety by clearly delineating hazardous areas; reduces accidents and downtime | Durable, high-visibility strips with strong adhesive and IP rating for dust/oil resistance |

| Agriculture | Controlled environment lighting for plant growth | Promotes specific plant growth stages and improves crop yields through tailored light spectrum | High-efficiency, waterproof LED strips with customizable length and spectrum stability |

| Retail & Hospitality | Ambient and accent lighting in commercial spaces | Creates inviting atmospheres that boost customer engagement and increase dwell time | Flexible, dimmable strips with consistent yellow hue and energy efficiency certifications |

| Transportation | Signal and indicator lighting in tunnels and stations | Improves visibility and safety for vehicle and pedestrian traffic in low-light conditions | Strips with robust heat dissipation, vibration resistance, and compliance with local safety codes |

| Food Processing | Inspection and sorting line illumination | Enhances visual inspection accuracy by highlighting product defects and quality variations | Non-toxic materials, waterproof and easy-to-clean strips compliant with food safety standards |

Manufacturing: Safety and Hazard Zone Marking

In industrial manufacturing plants, yellow LED strip lights are widely used to mark hazardous zones, machinery boundaries, and walkways. The bright yellow illumination serves as a visual warning, reducing workplace accidents and enhancing compliance with occupational safety regulations. For B2B buyers in regions like Germany and Saudi Arabia, sourcing LED strips with high durability, strong adhesive backing, and resistance to dust, oil, and moisture is critical to withstand harsh factory environments and ensure long-lasting performance.

Agriculture: Controlled Environment Lighting

Agricultural businesses leverage yellow LED strip lights in greenhouses and indoor farms to influence plant photoperiodism and flowering cycles. Yellow light helps regulate plant growth stages, improving crop yields and quality. Buyers in Africa and South America should prioritize energy-efficient, waterproof LED strips with stable color output to ensure consistent lighting conditions. Customizable lengths and reliable waterproofing are essential to adapt to diverse farming setups and climates.

Retail & Hospitality: Ambient and Accent Lighting

In retail stores and hospitality venues, yellow LED strip lights create warm, inviting environments that enhance customer experience and increase time spent on premises. This lighting strategy supports brand differentiation and drives sales. International buyers must focus on sourcing flexible, dimmable LED strips with uniform yellow color temperature and energy-efficient certifications to meet strict energy regulations in Europe and the Middle East.

Transportation: Signal and Indicator Lighting

Yellow LED strips are critical in tunnels, subway stations, and pedestrian pathways for signaling and safety indications. Their high visibility under low-light conditions improves traffic flow and reduces accidents. For buyers in infrastructure projects across South America and Europe, it is important to procure LED strips with excellent heat dissipation, vibration resistance, and compliance with local safety and electrical standards to ensure reliability in demanding environments.

Food Processing: Inspection and Sorting Line Illumination

In food processing plants, yellow LED strip lights are used to illuminate inspection lines, highlighting product defects and color variations for quality control. The yellow hue enhances visual contrast on conveyor belts, facilitating faster, more accurate sorting. Buyers must select LED strips made from non-toxic materials, with waterproof and easy-to-clean designs that comply with food safety regulations prevalent in international markets such as the EU and Middle East.

Related Video: LED – Light Emitting Diode | Basics, Characteristics, Working & Applications | LED Vs PN Diode

Strategic Material Selection Guide for led strip yellow light

When selecting materials for LED strip yellow light products, international B2B buyers must carefully evaluate the properties and suitability of each material to ensure optimal performance, durability, and compliance with regional standards. Below is a detailed analysis of four common materials used in LED strip manufacturing, focusing on their relevance to product performance and market-specific considerations.

1. Flexible Printed Circuit Board (FPCB) Substrate – Polyimide (PI)

Key Properties:

Polyimide substrates offer excellent thermal stability, typically withstanding continuous operating temperatures up to 200°C. They exhibit good chemical resistance and mechanical flexibility, which is crucial for curved or irregular LED strip installations.

Pros & Cons:

– Pros: High temperature tolerance improves LED lifespan by reducing thermal degradation. Flexibility allows for versatile applications including automotive and architectural lighting. Resistant to many chemicals and solvents, enhancing durability in harsh environments.

– Cons: Higher cost compared to standard polyester substrates. Manufacturing complexity is greater due to handling and processing requirements.

Impact on Application:

Polyimide-based FPCBs are ideal for high-performance LED strips used in environments with elevated temperatures or where bending is required. This makes them suitable for industrial lighting in the Middle East’s hot climates or automotive applications in Europe.

International Buyer Considerations:

Buyers from regions like Saudi Arabia and Germany should prioritize polyimide substrates for compliance with stringent thermal and safety standards such as UL 94 V-0 flame retardancy and RoHS. African and South American markets may balance cost and performance, opting for polyimide when durability is critical.

2. Flexible Printed Circuit Board (FPCB) Substrate – Polyester (PET)

Key Properties:

PET substrates typically support operating temperatures up to 130°C and provide good electrical insulation. They are less flexible than polyimide but offer adequate mechanical strength for most standard LED strip applications.

Pros & Cons:

– Pros: Lower cost and easier manufacturing processes compared to polyimide. Good dimensional stability and moisture resistance.

– Cons: Limited thermal tolerance reduces suitability for high-heat environments. Less flexible, which can restrict design options.

Impact on Application:

PET substrates are commonly used in indoor LED strip lighting where thermal stress is minimal, such as residential or retail lighting in Europe and South America. They are less suited for outdoor or industrial applications in hotter climates.

International Buyer Considerations:

Buyers in Africa and South America often prefer PET for cost-sensitive projects, but should verify compliance with local standards like IEC 60598 for lighting safety. European buyers may require additional certifications for flame retardancy and UV resistance.

3. Silicone Encapsulation

Key Properties:

Silicone encapsulants provide excellent UV resistance, flexibility, and waterproofing capabilities. They can operate effectively in a wide temperature range (-40°C to 200°C) and offer superior protection against environmental factors.

Pros & Cons:

– Pros: Enhances LED strip durability in outdoor and harsh environments. Provides IP65 to IP68 waterproof ratings, critical for Middle Eastern and African outdoor applications. Flexible and resistant to yellowing over time.

– Cons: Higher material and processing costs. Silicone can complicate recycling and disposal.

Impact on Application:

Silicone encapsulation is essential for LED strips used in outdoor signage, architectural lighting, and wet locations. It is particularly valuable in regions with high UV exposure, such as the Middle East and parts of Africa.

International Buyer Considerations:

For buyers in Saudi Arabia and Africa, silicone encapsulation ensures compliance with IP waterproofing standards (IEC 60529) and improves product lifespan. European buyers may focus on eco-friendly disposal and compliance with REACH regulations.

4. Aluminum Backing (Heat Sink)

Key Properties:

Aluminum backing serves as a heat sink, improving thermal management by dissipating heat away from LEDs. It also adds mechanical strength and helps maintain strip flatness.

Pros & Cons:

– Pros: Enhances LED efficiency and longevity by reducing operating temperature. Lightweight and corrosion-resistant when anodized. Relatively low cost for the performance benefits.

– Cons: Adds rigidity, reducing flexibility. Requires precise manufacturing to ensure good thermal contact.

Impact on Application:

Aluminum-backed LED strips are preferred in commercial and industrial lighting where heat dissipation is critical, such as in factories or large retail spaces in Europe and South America. Less common in highly flexible or curved installations.

International Buyer Considerations:

European buyers often require compliance with DIN and ASTM standards for aluminum materials. Buyers in the Middle East should consider anodized aluminum to resist corrosion from dust and humidity. African markets may prioritize cost-effective aluminum grades balancing performance and price.

Summary Table

| Material | Typical Use Case for led strip yellow light | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyimide (PI) FPCB Substrate | High-temp, flexible applications (automotive, industrial) | Excellent thermal stability and flexibility | Higher cost and manufacturing complexity | High |

| Polyester (PET) FPCB Substrate | Standard indoor lighting with moderate thermal requirements | Cost-effective and good moisture resistance | Lower thermal tolerance and less flexible | Low |

| Silicone Encapsulation | Outdoor, waterproof, UV-exposed environments | Superior waterproofing and UV resistance | Higher cost and recycling challenges | High |

| Aluminum Backing | Commercial/industrial lighting requiring heat dissipation | Effective heat sink, corrosion-resistant | Reduced flexibility, requires precise manufacturing | Medium |

This guide aims to assist international B2B buyers in making informed decisions on material selection for LED strip yellow light products, balancing performance, cost, and regional compliance requirements.

In-depth Look: Manufacturing Processes and Quality Assurance for led strip yellow light

Manufacturing Process of LED Strip Yellow Light

The manufacturing of LED strip yellow light involves several precise stages designed to ensure product consistency, performance, and durability. For B2B buyers, understanding these stages is crucial to evaluate supplier capabilities and product quality effectively.

Illustrative Image (Source: Google Search)

1. Material Preparation

This initial phase focuses on sourcing and preparing high-quality raw materials. Key components include:

- LED chips: Yellow LEDs require specific phosphor coatings or semiconductor materials (like gallium arsenide phosphide) to achieve the desired wavelength and brightness.

- Flexible PCB (Printed Circuit Board): Usually made from polyimide or fiberglass with copper traces, designed to accommodate LED placement and electrical connectivity.

- Resistors and drivers: Ensure proper current regulation for consistent light output and longevity.

- Adhesives and encapsulants: For waterproofing and mechanical protection.

Quality of raw materials is critical; reputable manufacturers source from certified suppliers and maintain strict incoming quality control (IQC) to verify component specifications before production.

2. Forming and PCB Processing

The flexible PCB undergoes several treatments:

- Copper etching and plating: To form precise circuit pathways.

- Solder mask application: Protects circuits and prevents solder bridges.

- Silkscreen printing: For component placement guides and product markings.

Advanced manufacturers use automated machinery with high-resolution imaging to ensure accuracy and repeatability, reducing defects and improving yield.

3. Assembly

This stage involves mounting LEDs and other components onto the PCB. Techniques include:

- Surface Mount Technology (SMT): Automated pick-and-place machines position LEDs and resistors with micron-level precision.

- Soldering: Typically reflow soldering to secure components; ensures strong mechanical and electrical connections.

- Encapsulation: Applying silicone or epoxy coatings to protect LEDs from environmental factors, especially for outdoor or waterproof strip lights.

Assembly lines often integrate optical inspection systems to detect misaligned or damaged LEDs immediately, enabling inline corrections.

4. Finishing and Packaging

Final touches include:

- Cutting the strips to specified lengths with precision die-cut tools.

- Applying adhesive backing: High-quality adhesive tapes (3M or equivalent) ensure secure installation.

- Quality labeling and batch coding: For traceability and compliance.

Packaging is designed to protect strips during transport and storage, often using anti-static bags and moisture-proof materials.

Quality Assurance and Control (QA/QC) Framework

Quality assurance in LED strip yellow light manufacturing is multi-layered, encompassing international standards, systematic checkpoints, and rigorous testing procedures. For B2B buyers, understanding these QC practices helps in selecting reliable suppliers and minimizing supply chain risks.

Relevant International and Industry Standards

- ISO 9001: The globally recognized quality management system standard ensures consistent manufacturing processes and continuous improvement.

- CE Marking: Mandatory for European markets, indicating compliance with safety, health, and environmental protection standards.

- RoHS (Restriction of Hazardous Substances): Ensures LED strips are free from harmful substances like lead and mercury, critical for European and many international buyers.

- UL Certification: Important for North American and some Middle Eastern markets, focusing on electrical safety.

- IP Ratings (e.g., IP65, IP67): Define ingress protection levels against dust and water, especially relevant for outdoor and industrial applications.

- Specific regional standards: For example, SASO certification in Saudi Arabia or INMETRO in Brazil may be required.

Quality Control Checkpoints

-

Incoming Quality Control (IQC):

Suppliers inspect all incoming raw materials and components for compliance with specifications, including LED brightness, PCB thickness, and adhesive quality. This step prevents substandard materials from entering production. -

In-Process Quality Control (IPQC):

Continuous monitoring during assembly includes solder joint inspections, LED alignment checks, and electrical continuity tests. Automated optical inspection (AOI) and inline testing systems are common tools to detect defects early. -

Final Quality Control (FQC):

Finished LED strips undergo comprehensive testing before packaging. Key tests include:

- Light output and color consistency: Using spectrometers or colorimeters to ensure uniform yellow light wavelength and brightness.

- Electrical safety and functionality: Voltage, current, and insulation resistance tests to confirm product safety and performance.

- Environmental stress testing: Thermal cycling, humidity resistance, and waterproof testing for durability assurance.

- Adhesive and mechanical tests: To verify installation reliability.

Testing Methods and Verification for B2B Buyers

B2B buyers should request documentation and conduct verification procedures to confirm supplier quality claims:

- Sample Testing: Request product samples to test brightness, color temperature, and adhesion under local environmental conditions.

- Third-Party Inspection Reports: Engage independent labs for verification of certifications, performance testing, and compliance audits. This is especially important for buyers in Africa, South America, and the Middle East, where local regulatory requirements may differ or be evolving.

- Factory Audits: On-site or virtual audits assess manufacturing capabilities, QC processes, workforce training, and supply chain traceability. Ask suppliers for audit reports or consider third-party audit services.

- Certification Verification: Confirm validity and scope of certifications like ISO 9001, CE, RoHS, and UL through official registries or certifying bodies.

QC and Certification Nuances for International Buyers

For buyers in regions such as Saudi Arabia, Germany, Brazil, and South Africa, understanding regional certification and compliance nuances is vital:

- Saudi Arabia: Compliance with SASO standards and G-Mark certification is often mandatory. Buyers should ensure suppliers provide documentation aligned with these regulations.

- Europe (e.g., Germany): Emphasis on CE marking and RoHS compliance is strict. Environmental sustainability and energy efficiency certifications (like Energy Star or EU Energy Label) may influence purchasing decisions.

- South America: Brazil’s INMETRO certification can be a key market entry requirement. Buyers should verify local testing labs’ acceptance of supplier certificates.

- Africa: Regulatory frameworks vary widely. Buyers should focus on supplier transparency, third-party testing, and certifications recognized by local authorities or international trade agreements.

Actionable Insights for B2B Buyers

- Prioritize suppliers with transparent QC processes: Demand detailed QC documentation including IQC, IPQC, and FQC reports.

- Insist on product samples for in-house testing: Confirm LED color consistency, brightness, and adhesive strength under your typical application conditions.

- Verify certifications through official channels: Never rely solely on supplier claims; cross-check certificates with issuing bodies.

- Leverage third-party audits and inspections: Particularly if sourcing from new or unfamiliar manufacturers.

- Understand local compliance requirements: Tailor supplier selection based on the regulatory environment of your target market to avoid customs or legal issues.

By deeply understanding manufacturing processes and quality assurance protocols, international B2B buyers can mitigate risks, ensure product reliability, and build resilient supply chains for LED strip yellow light products.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led strip yellow light Sourcing

When sourcing yellow LED strip lights for international B2B procurement, understanding the comprehensive cost structure and pricing dynamics is crucial for making informed purchasing decisions. This analysis breaks down the key cost components, price influencers, and practical buyer strategies tailored for markets in Africa, South America, the Middle East, and Europe.

Key Cost Components in LED Strip Yellow Light Pricing

- Materials: The primary cost driver is the quality and type of raw materials—LED chips, flexible PCBs, resistors, adhesives, and protective coatings. Premium LEDs with better color consistency and brightness command higher prices.

- Labor: Manufacturing labor costs vary significantly by country. Asian manufacturers often offer competitive labor rates, while European or Middle Eastern production may incur higher labor expenses, impacting unit costs.

- Manufacturing Overhead: This includes utilities, factory maintenance, and indirect labor. Efficient production lines with automation can reduce overhead costs, enabling better pricing for buyers.

- Tooling and Setup: Initial tooling costs for custom designs or specific LED configurations may be amortized over order volume. Buyers requesting unique lengths, densities, or waterproofing may see higher tooling fees.

- Quality Control (QC): Rigorous QC processes, including photometric testing and durability assessments, add to production costs but ensure product reliability, which is critical for long-term supplier partnerships.

- Logistics and Shipping: Freight charges, customs duties, and local taxes vary by destination. For buyers in Africa, South America, or the Middle East, logistics complexity can significantly influence landed costs.

- Supplier Margin: Manufacturers and distributors include profit margins reflecting market demand, brand positioning, and value-added services like warranties and technical support.

Influencers of Final Pricing

- Order Volume and Minimum Order Quantities (MOQ): Larger volume orders typically reduce per-unit costs due to economies of scale. Buyers should negotiate MOQs aligned with their sales forecasts to optimize pricing.

- Product Specifications and Customization: Higher lumen output, advanced dimming features, or IP-rated waterproofing increase costs. Custom color temperatures and specialized adhesives also influence pricing.

- Material Quality and Certifications: Compliance with standards such as CE, RoHS, UL, or ISO adds assurance but can elevate prices due to certification and testing expenses.

- Supplier Reputation and Reliability: Established suppliers with proven track records may price higher but offer lower risk and more consistent quality.

- Incoterms and Payment Terms: Terms like FOB, CIF, or DDP determine how shipping and insurance costs are allocated, affecting the buyer’s total expenditure. Favorable payment terms can improve cash flow and reduce financing costs.

Practical Buyer Tips for Cost-Efficient Sourcing

- Negotiate Beyond Price: Engage suppliers on lead times, payment terms, and after-sales support. Long-term partnerships often yield better overall value than focusing solely on upfront costs.

- Assess Total Cost of Ownership (TCO): Consider warranty, durability, energy efficiency, and maintenance costs. Cheaper LED strips may incur higher replacement or operational expenses.

- Leverage Volume Discounts: Consolidate orders to meet MOQs or negotiate tiered pricing to benefit from scale economies, especially for buyers in emerging markets where import costs are high.

- Factor in Logistics Complexity: For regions like Africa or South America, plan for longer lead times and potential customs delays. Choosing suppliers with local distribution centers or reliable freight partners can reduce unexpected costs.

- Evaluate Certification Needs: Prioritize suppliers whose products meet regional regulatory standards (e.g., CE for Europe, SASO for Saudi Arabia) to avoid compliance issues and potential fines.

- Request Transparent Pricing Breakdowns: Understanding cost drivers helps in negotiation and benchmarking supplier quotes effectively.

Indicative Pricing Disclaimer

Prices for yellow LED strip lights vary widely based on specifications, order quantities, and supplier location. Indicative FOB prices generally range from $0.50 to $3.00 per meter for standard quality strips, with premium and customized options commanding higher rates. Buyers should request detailed quotations tailored to their requirements to obtain accurate pricing.

By thoroughly analyzing cost components and pricing influencers while adopting strategic negotiation and sourcing approaches, international B2B buyers can secure competitive, high-quality yellow LED strip lights that align with their operational goals and market demands.

Illustrative Image (Source: Google Search)

Spotlight on Potential led strip yellow light Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘led strip yellow light’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led strip yellow light

Critical Technical Properties for LED Strip Yellow Light

Understanding the key technical specifications of yellow LED strip lights is essential for international B2B buyers to ensure product suitability, compliance, and value in their markets.

-

Color Temperature (Kelvin, K)

This measures the hue of the yellow light emitted, typically ranging from 2000K to 3000K for warm yellow tones. Buyers should verify consistent color temperature to meet design requirements and customer expectations, particularly important in hospitality or retail environments where ambiance matters. -

Luminous Intensity (Lumens per Meter, lm/m)

Indicates the brightness level of the strip. A higher lumen output means brighter illumination. For applications requiring clear visibility or accent lighting, selecting strips with appropriate luminous intensity ensures performance and customer satisfaction. -

LED Density (LEDs per Meter)

The number of LEDs mounted per meter affects light uniformity and power consumption. Higher density strips offer smoother light distribution but may consume more power. Buyers must balance density with energy efficiency and cost. -

Material Grade and PCB Quality

The substrate (usually flexible PCB) quality impacts durability, heat dissipation, and lifespan. Premium-grade materials resist wear and environmental factors, crucial for outdoor or industrial applications common in Middle East and African markets. -

Power Consumption (Watts per Meter, W/m)

Defines the energy usage of the strip light. Lower wattage with high luminous efficiency is preferred for reducing operational costs and complying with energy regulations in Europe and other regions. -

Ingress Protection Rating (IP Rating)

Specifies water and dust resistance. For outdoor or humid environments, strips with IP65 or higher are recommended. This protects the investment and reduces returns or warranty claims in harsh climates.

Common Industry and Trade Terminology

Familiarity with these terms will help buyers navigate supplier communications, contracts, and logistics efficiently.

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers that produce LED strips which can be branded or customized by the buyer. OEM partnerships allow buyers to develop unique products tailored to local market preferences, enhancing competitiveness. -

MOQ (Minimum Order Quantity)

The smallest order size a supplier accepts. Understanding MOQ is critical for budgeting and inventory management, especially for buyers in emerging markets who may need to start with smaller volumes. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for pricing and terms based on specific product requirements. Well-prepared RFQs expedite supplier responses and ensure accurate comparisons across manufacturers. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs clearance. Common terms like FOB (Free on Board) and CIF (Cost, Insurance, and Freight) affect cost calculations and risk management, vital for cross-continental shipments to Africa, South America, or Europe. -

CRI (Color Rendering Index)

Measures how accurately the light source reveals colors compared to natural light. For yellow LED strips, a CRI above 80 is generally desirable to ensure vibrant and true color appearance, important in retail and display applications. -

Dimming Compatibility

Indicates whether the LED strip can be controlled via dimmers or smart systems. Buyers targeting smart home or architectural lighting markets should confirm compatibility with common dimming protocols to enhance product appeal.

Actionable Insight:

Before finalizing purchases, B2B buyers should request detailed datasheets highlighting these technical properties and clarify trade terms upfront. This reduces supply chain risks and aligns product features with market needs across diverse regions such as Saudi Arabia, Germany, Brazil, or Nigeria.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led strip yellow light Sector

Market Overview & Key Trends

The global market for LED strip yellow lights is experiencing robust growth, driven by increasing demand for energy-efficient lighting solutions across commercial, industrial, and residential sectors. International B2B buyers from regions such as Africa, South America, the Middle East, and Europe are actively sourcing these products to meet evolving consumer preferences and regulatory requirements. In Europe, countries like Germany emphasize high-quality standards and certifications, pushing suppliers toward innovation in performance and durability. Meanwhile, Middle Eastern markets, including Saudi Arabia, prioritize LED strip lights for large-scale architectural and urban lighting projects, fostering demand for customizable and scalable solutions.

Key market dynamics include a shift toward smart lighting integration, where LED strips are embedded with IoT-enabled controls for enhanced automation and energy management. This trend is particularly relevant for commercial buyers seeking to optimize operational costs and sustainability credentials. Additionally, sourcing strategies are evolving with a focus on supply chain resilience; buyers are diversifying suppliers and favoring manufacturers with proven track records in consistent quality and timely delivery. African and South American buyers are increasingly engaging with manufacturers offering flexible MOQ (minimum order quantities) and tailored product configurations to better align with local market needs.

Technological advancements also influence sourcing, with innovations in phosphor coatings and LED chip efficiency improving the color rendering and longevity of yellow light strips. Buyers are advised to evaluate suppliers based on certifications such as CE, RoHS, and UL, which indicate compliance with international safety and environmental standards. Furthermore, the rise of e-commerce platforms and B2B marketplaces facilitates easier access to global suppliers, enabling buyers to compare product specifications, pricing, and logistics options transparently.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a critical consideration in the procurement of LED strip yellow lights, especially for buyers committed to reducing their environmental footprint. LED technology inherently offers energy savings compared to traditional lighting; however, the full environmental impact depends on factors such as materials sourcing, manufacturing processes, and end-of-life recyclability. International buyers are increasingly scrutinizing suppliers for adherence to ethical sourcing practices, including the responsible procurement of raw materials like rare earth elements and phosphors.

Compliance with green certifications such as Energy Star, TUV Rheinland’s environmental standards, and ISO 14001 environmental management systems is a strong indicator of a supplier’s commitment to sustainable practices. These certifications ensure not only energy efficiency but also the minimization of hazardous substances, waste reduction, and efficient use of resources during production. For B2B buyers in regions with stringent environmental regulations—such as the European Union—demanding proof of such certifications is essential to maintain compliance and avoid supply chain disruptions.

Ethical considerations extend beyond environmental factors to include labor practices and corporate social responsibility. Buyers should seek manufacturers who operate transparent supply chains, provide fair labor conditions, and engage in community development initiatives. Sustainable packaging and the use of recyclable or biodegradable materials for shipping LED strips further enhance the overall green profile of the product. By prioritizing sustainability and ethical sourcing, B2B buyers not only contribute to global environmental goals but also strengthen brand reputation and meet increasing end-customer expectations.

Brief Evolution and Industry Context

LED strip lighting technology has evolved significantly since its inception in the early 2000s, transitioning from simple, low-brightness decorative applications to versatile, high-performance lighting solutions. Early yellow LED strips were often limited by inconsistent color quality and poor durability. However, advances in semiconductor materials and phosphor technology have enabled manufacturers to produce yellow LED strips with superior color uniformity, brightness, and energy efficiency.

This evolution aligns with broader industry trends emphasizing smart lighting and integration capabilities. For B2B buyers, understanding this progression underscores the importance of partnering with manufacturers who invest in research and development. Such partnerships ensure access to cutting-edge products that meet modern standards for longevity, dimmability, and environmental compliance—key factors in competitive international markets. As the sector continues to mature, buyers can expect further innovations in customizable and sustainable LED strip yellow light solutions tailored to diverse regional demands.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of led strip yellow light

-

How can I effectively vet suppliers of LED strip yellow lights for international B2B purchases?

To vet suppliers, start by verifying their company credentials and industry certifications such as ISO, CE, RoHS, and UL, which demonstrate compliance with international quality and safety standards. Review their track record through customer testimonials, case studies, and trade show participation. Request product samples to assess build quality, color consistency, and durability firsthand. Additionally, evaluate their communication responsiveness and transparency about production capacity and lead times. For buyers in Africa, South America, the Middle East, and Europe, ensure the supplier understands local market requirements and import regulations to avoid logistical or compliance issues. -

Is customization available for LED strip yellow lights, and how should I approach it?

Many manufacturers offer customization options including length, brightness, adhesive backing, waterproof ratings, and color temperature calibration. When seeking customization, clearly outline your technical specifications and application needs upfront. Request prototype samples to validate the custom features before committing to large orders. Confirm the supplier’s R&D capabilities and willingness to support adjustments during production. For international buyers, discuss how customization may affect pricing, lead times, and minimum order quantities (MOQs), ensuring that these terms align with your business goals and local market demands. -

What are typical minimum order quantities (MOQs) and lead times for international orders of LED strip yellow lights?

MOQs vary widely depending on supplier capabilities and customization level but typically range from 500 to 5,000 meters for standard LED strip lights. Lead times can span from 3 to 8 weeks, factoring in production, quality checks, and shipping logistics. Buyers from regions like Europe or the Middle East should factor in potential customs clearance delays. To optimize supply chain efficiency, negotiate MOQs and lead times early, and consider suppliers offering scalable production that can grow with your demand. Establishing a trial order before larger commitments is recommended to test supplier reliability. -

Which payment terms are common in international B2B transactions for LED strip yellow lights?

Common payment terms include 30% upfront deposit with the balance paid before shipment or upon delivery. Letters of Credit (LC) and escrow services offer safer alternatives for new partnerships, especially across continents. Wire transfers (T/T) are widely accepted but require caution to avoid fraud. For buyers in emerging markets, negotiating flexible payment schedules or partial payments aligned with delivery milestones can help manage cash flow. Always confirm payment terms in writing and consider using trade assurance platforms or third-party escrow to safeguard transactions. -

What quality assurance (QA) processes and certifications should I expect from reputable LED strip yellow light manufacturers?

Reputable manufacturers implement rigorous QA processes including in-line inspections, functional testing, and final product audits to ensure consistency in brightness, color temperature, and durability. Look for certifications like ISO 9001 for quality management, CE and RoHS for safety and environmental compliance, and UL for electrical safety. Waterproof ratings such as IP65 or IP67 are critical for outdoor or industrial applications. Request documentation of testing protocols and third-party lab reports. Buyers should also perform their own sample testing to verify QA claims before scaling orders. -

How can I manage logistics and shipping challenges when importing LED strip yellow lights internationally?

Effective logistics management starts with choosing suppliers experienced in international shipping who understand export documentation, customs regulations, and local import duties. Consolidate shipments to reduce costs and opt for reliable freight forwarders familiar with your region. For buyers in Africa, South America, or the Middle East, check for import restrictions or certification requirements that might delay clearance. Insure shipments against damage or loss, and use trackable shipping methods. Clear communication with your supplier about packing standards and lead times helps prevent delays and ensures smoother customs processing. -

What strategies can help resolve disputes or quality issues with overseas LED strip yellow light suppliers?

Establish clear contractual agreements detailing product specifications, delivery schedules, payment terms, and dispute resolution mechanisms before transactions. Maintain thorough documentation of communications and inspections. If quality issues arise, initiate dialogue promptly and request corrective actions or replacements. Leveraging third-party inspection services or arbitration can be effective for impartial resolution. Building a long-term partnership with transparent communication reduces the risk of disputes. For first-time international buyers, working with suppliers who offer warranties or after-sales support is advisable. -

Are there regional considerations for sourcing LED strip yellow lights from suppliers serving Africa, South America, the Middle East, and Europe?

Yes, regional factors impact sourcing decisions. For example, Europe and the Middle East often demand higher compliance with strict energy efficiency and safety standards, while Africa and South America may prioritize cost-effectiveness and durability under diverse environmental conditions. Shipping infrastructure and customs regulations vary, affecting delivery times and costs. Currency fluctuations and local tax regimes also influence pricing strategies. Understanding these factors helps tailor supplier selection, contract terms, and inventory planning to ensure a competitive and reliable supply chain in each target market.

Strategic Sourcing Conclusion and Outlook for led strip yellow light

Strategic sourcing of yellow LED strip lights is a critical driver for success in today’s competitive global marketplace. For international B2B buyers from Africa, South America, the Middle East, and Europe, adopting a strategic approach means prioritizing supplier reliability, product quality, and supply chain transparency. Long-term partnerships with experienced manufacturers who comply with international certifications (ISO, CE, RoHS) ensure consistent performance and reduce risks associated with fluctuating market demands and logistics challenges.

Key takeaways include the importance of thorough supplier vetting, sample testing for quality assurance, and evaluating production capabilities to meet volume and customization needs. Buyers should also emphasize clear communication and realistic lead times, which are essential to maintaining smooth operations across diverse regions such as Saudi Arabia and Germany.

Looking ahead, the LED strip yellow light market is poised for growth fueled by rising demand in commercial, architectural, and decorative lighting sectors. Buyers who leverage strategic sourcing will not only optimize cost-efficiency but also gain competitive advantage through innovation and reliability.

Actionable insight: International buyers should engage proactively with trusted manufacturers, explore customization options, and establish trial orders to build resilient supply chains that can scale with evolving market needs. This strategic mindset will position businesses to capitalize on emerging opportunities in the global LED lighting landscape.