Guide to Led Strip Low Voltage

- Introduction: Navigating the Global Market for led strip low voltage

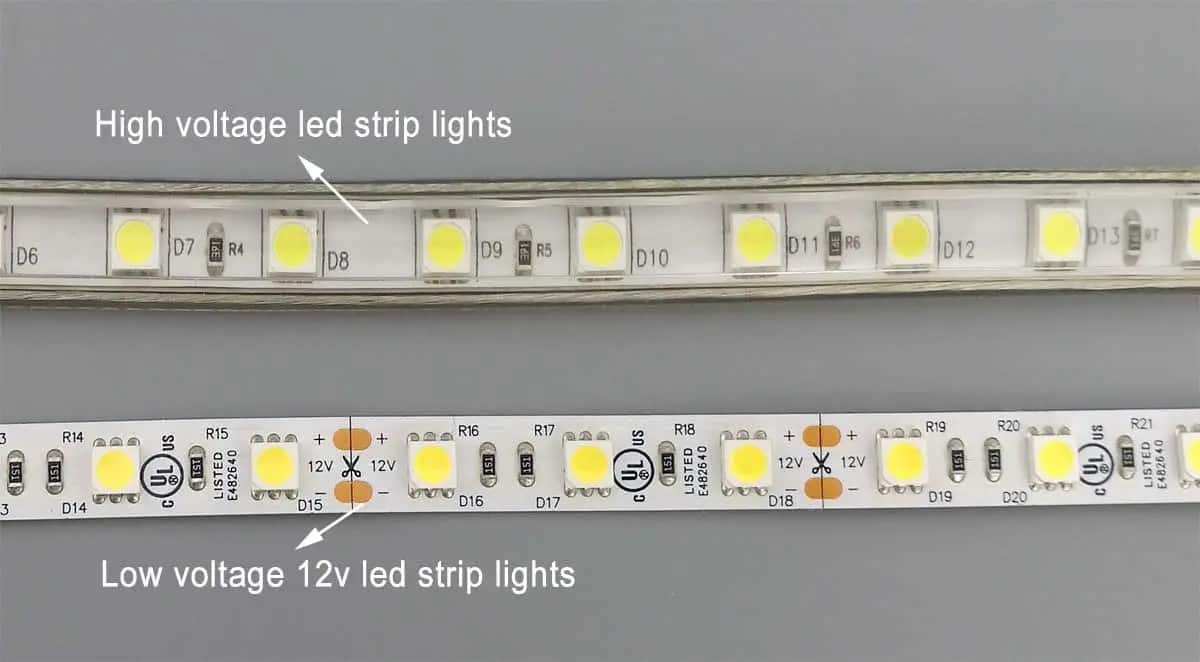

- Understanding led strip low voltage Types and Variations

- Key Industrial Applications of led strip low voltage

- Strategic Material Selection Guide for led strip low voltage

- In-depth Look: Manufacturing Processes and Quality Assurance for led strip low voltage

- Comprehensive Cost and Pricing Analysis for led strip low voltage Sourcing

- Spotlight on Potential led strip low voltage Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for led strip low voltage

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led strip low voltage Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of led strip low voltage

- Strategic Sourcing Conclusion and Outlook for led strip low voltage

Introduction: Navigating the Global Market for led strip low voltage

In today’s rapidly evolving lighting industry, low voltage LED strip lights have emerged as a cornerstone technology for commercial, industrial, and architectural applications worldwide. Their energy efficiency, flexibility, and longevity offer unparalleled advantages in creating dynamic, cost-effective lighting solutions. For international B2B buyers—especially those operating in diverse markets such as Africa, South America, the Middle East, and Europe—understanding the nuances of low voltage LED strips is essential to sourcing products that meet stringent performance, safety, and regulatory standards.

This comprehensive guide equips procurement professionals, facility managers, and lighting specialists with the critical insights needed to confidently navigate the global marketplace. It covers the full spectrum of considerations: from types of LED strips and materials used, to manufacturing processes and quality control protocols. Buyers will gain clarity on how to evaluate suppliers, compare costs, and understand market trends tailored to regional demands and installation environments.

Key focus areas include:

- Technical specifications such as voltage requirements, wiring configurations, and power management

- Sourcing strategies for reliable wholesale suppliers offering customizable options and warranty assurances

- Cost-benefit analysis addressing bulk purchasing and logistics for large-scale projects

- Market insights highlighting regional supply chain dynamics and emerging technology trends

- Practical FAQs addressing common challenges in installation, maintenance, and compliance

By harnessing this knowledge, international B2B buyers can optimize procurement decisions, reduce risk, and secure LED strip lighting solutions that deliver superior value, durability, and performance across varied global markets.

Understanding led strip low voltage Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| 12V Single Color LED Strip | Operates at 12V DC, usually monochrome, flexible and cuttable | Retail displays, accent lighting, signage | Pros: Easy installation, cost-effective; Cons: Limited run length due to voltage drop |

| 24V Single Color LED Strip | Higher voltage (24V DC) with longer run capability, single color | Industrial lighting, large commercial spaces | Pros: Supports longer runs, reduced voltage drop; Cons: Slightly higher initial cost |

| RGB LED Strip | Multi-color LEDs with integrated control for color changing | Hospitality, event venues, architectural lighting | Pros: Versatile lighting effects; Cons: Requires compatible controllers, higher complexity |

| Waterproof LED Strip | Encased in silicone or epoxy for moisture resistance | Outdoor installations, marine, and humid environments | Pros: Durable in harsh conditions; Cons: Slightly less flexible, higher price point |

| High-Density LED Strip | Increased LED count per meter for higher brightness | Task lighting, retail showcases, photography studios | Pros: Superior brightness and uniformity; Cons: Higher power consumption and cost |

12V Single Color LED Strip

The 12V single color LED strip is the most common low voltage LED strip type, favored for its simplicity and affordability. It suits smaller-scale commercial projects such as retail displays or decorative accent lighting. However, due to voltage drop limitations, runs longer than 5 meters may experience dimming, which requires additional power injection points. B2B buyers should consider the ease of installation and cost-effectiveness when targeting budget-conscious projects or spaces with shorter lighting runs.

24V Single Color LED Strip

Operating at 24 volts, these LED strips allow longer continuous runs—up to 10 meters or more—without significant voltage drop. This makes them ideal for larger commercial or industrial lighting installations where consistent brightness is critical. While the upfront cost and complexity of the power supply may be higher, the improved performance and reduced wiring complexity often justify the investment. Buyers should assess project scale and voltage infrastructure compatibility before procurement.

RGB LED Strip

RGB LED strips integrate red, green, and blue LEDs to enable dynamic color changing through external controllers. This versatility makes them popular in hospitality, event, and architectural lighting sectors where ambiance and mood lighting are key. For B2B buyers, it is essential to source strips compatible with existing control systems and ensure access to technical support for installation and maintenance. The complexity and cost are higher but offer significant value in creative lighting solutions.

Waterproof LED Strip

Designed for exposure to moisture, waterproof LED strips are sealed with silicone or epoxy coatings, making them suitable for outdoor, marine, and humid environments. These strips are critical for businesses involved in exterior architectural lighting, landscape projects, or industrial facilities where environmental resilience is mandatory. While they come at a premium price and reduced flexibility, their durability reduces maintenance costs and extends operational life, important factors for international buyers in challenging climates.

High-Density LED Strip

High-density LED strips feature a greater number of LEDs per meter, delivering superior brightness and uniform light distribution. This type is preferred in applications requiring task lighting or high-visibility displays, such as retail showcase lighting or photographic studios. The higher power demand and cost necessitate careful planning of power supply and wiring. B2B buyers should evaluate energy efficiency and heat dissipation requirements alongside brightness needs to optimize long-term operational costs.

Key Industrial Applications of led strip low voltage

| Industry/Sector | Specific Application of led strip low voltage | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial | Accent and display lighting in stores and showrooms | Enhances product visibility, improves customer experience, and drives sales | Consistent color temperature, dimmable options, flexible lengths, durability for high-traffic areas |

| Hospitality & Events | Ambient and decorative lighting in hotels, restaurants, and event venues | Creates atmosphere, reduces energy costs, and allows dynamic lighting control | Waterproof or moisture-resistant options, customizable color settings, ease of installation |

| Manufacturing & Warehousing | Task and safety lighting in assembly lines and storage areas | Improves worker safety, increases productivity, and reduces energy consumption | High brightness, robust build quality, compliance with industrial safety standards |

| Automotive & Transportation | Interior and exterior accent lighting for vehicles and public transport | Enhances aesthetic appeal, increases visibility, and supports branding | Vibration-resistant, low power consumption, compatibility with vehicle electrical systems |

| Architectural & Urban Development | Facade lighting and pathway illumination for commercial and public spaces | Improves security, highlights architectural features, and lowers maintenance costs | Weatherproof design, long lifespan, energy efficiency, and compliance with local regulations |

Retail & Commercial Lighting

In retail environments across Europe and South America, low-voltage LED strips are extensively used to highlight products and create inviting atmospheres. These strips provide consistent, vibrant illumination that attracts customers and enhances merchandise appeal. For B2B buyers, particularly in markets like Germany and Colombia, sourcing LED strips with uniform color temperature and dimmable functionality is critical to meet diverse store layouts and lighting schemes. Flexibility in installation and durability in high-traffic commercial spaces are essential to reduce maintenance costs and ensure long-term reliability.

Hospitality & Events

Hotels, restaurants, and event venues in the Middle East and Africa benefit significantly from low-voltage LED strip lighting to craft ambient and decorative lighting effects. These strips allow dynamic control over color and brightness, enabling businesses to tailor the mood for different occasions, enhancing guest experience while lowering energy consumption. International buyers should prioritize waterproof or moisture-resistant LED strips to withstand humid environments and ensure ease of installation for rapid venue transformations.

Manufacturing & Warehousing

Industrial facilities in Europe and South America utilize low-voltage LED strips for task lighting on assembly lines and safety illumination in storage areas. These applications demand high brightness and robust construction to endure harsh conditions while improving worker safety and operational efficiency. Buyers must ensure compliance with relevant industrial safety standards and select products that deliver consistent light output with minimal energy use, supporting sustainable manufacturing practices.

Automotive & Transportation

In automotive manufacturing hubs like Germany and emerging markets in Africa, low-voltage LED strips are integrated into vehicle interiors and exteriors for accent lighting and enhanced visibility. These strips improve aesthetic appeal and support brand identity while maintaining low power consumption. B2B buyers should seek vibration-resistant LED strips compatible with vehicle electrical systems, ensuring durability and safety in demanding transportation environments.

Architectural & Urban Development

LED strip lighting plays a vital role in urban development projects across Europe and the Middle East by illuminating building facades and pedestrian pathways. Low-voltage LED strips offer energy-efficient, weatherproof solutions that enhance security and highlight architectural features. For international buyers, it is crucial to source products compliant with local regulations, featuring long lifespans and low maintenance requirements to optimize total cost of ownership in public infrastructure projects.

Related Video: Power Diode (Basics, Structure, Characteristics, Working, Applications, Biasing & Types) Explained

Strategic Material Selection Guide for led strip low voltage

When selecting materials for LED strip low voltage installations, it is essential to consider factors such as electrical insulation, thermal management, durability, and environmental resistance. These parameters directly influence the performance, safety, and longevity of LED strip systems, especially in diverse international markets like Africa, South America, the Middle East, and Europe. Below is an analysis of four common materials used in LED strip low voltage components, focusing on their properties, advantages, limitations, and implications for global B2B buyers.

1. Flexible Printed Circuit Boards (FPC) – Polyimide or PET Substrates

Key Properties:

FPCs are the foundational material for LED strips, typically made from polyimide or polyethylene terephthalate (PET). Polyimide offers excellent thermal stability (up to ~260°C), chemical resistance, and mechanical flexibility, while PET is more cost-effective but with lower temperature tolerance (~120°C). Both provide good electrical insulation and are thin, enabling compact, flexible LED strip designs.

Pros & Cons:

Polyimide-based FPCs are highly durable and suitable for industrial or high-temperature environments, but they come at a higher cost and more complex manufacturing processes. PET substrates are cheaper and widely used for residential or decorative applications but may degrade faster under heat or UV exposure.

Impact on Application:

For outdoor or high-humidity environments common in parts of Africa and South America, polyimide FPCs are preferable due to their superior moisture resistance. In temperate climates like Germany, PET-based strips are often sufficient and cost-effective. The flexibility of these materials supports curved or irregular installations, crucial for architectural lighting.

International B2B Considerations:

Buyers must verify compliance with international standards such as UL 94 V-0 for flammability and IPC-6013 for flexible circuits. European buyers often require RoHS and REACH compliance, while Middle Eastern markets may prioritize certifications aligned with IEC standards. Custom thickness and adhesive backing options can be negotiated with suppliers to suit specific installation needs.

2. Silicone Rubber Coating / Encapsulation

Key Properties:

Silicone rubber is widely used as a protective coating or encapsulant for LED strips to provide water resistance (IP65 to IP68 ratings), UV stability, and flexibility. It maintains elasticity over a broad temperature range (-60°C to 200°C) and resists environmental degradation.

Pros & Cons:

Silicone coatings significantly enhance durability and enable outdoor or harsh environment applications. However, they increase manufacturing complexity and cost compared to simpler PVC coatings. Silicone is also more difficult to recycle, which may be a consideration in European markets with strict environmental regulations.

Impact on Application:

For installations in humid or outdoor settings—common in coastal regions of South America and Africa—silicone encapsulated LED strips provide reliable protection against moisture and dust ingress. In indoor commercial settings in Europe or the Middle East, silicone coatings may be optional but beneficial for longevity.

International B2B Considerations:

Buyers should assess IP rating certifications and ensure compatibility with local environmental standards. In regions with extreme temperature fluctuations, silicone’s thermal resilience is a critical selling point. Additionally, suppliers offering UV-stabilized silicone formulations can better serve Middle Eastern markets with intense sun exposure.

3. Copper Conductors (Flexible Copper Foil)

Key Properties:

Copper is the standard conductor material in LED strips due to its excellent electrical conductivity (~5.8 × 10^7 S/m) and thermal conductivity. It supports efficient current flow and heat dissipation, essential for low voltage LED performance and longevity.

Pros & Cons:

Copper offers low resistance and high reliability but is relatively expensive compared to alternatives like aluminum. It is prone to oxidation, which can degrade performance if not properly coated or plated. Manufacturing requires precision to maintain conductor integrity in flexible strips.

Impact on Application:

Copper conductors are universally preferred for quality LED strips, especially in commercial and industrial projects in Europe and the Middle East where performance standards are stringent. In cost-sensitive markets like parts of Africa and South America, buyers may negotiate for copper thickness or plating to balance cost and durability.

International B2B Considerations:

Compliance with ASTM B170 (copper foil standards) and IPC-2223 (flexible circuit design) is important. Buyers should confirm that copper layers have protective coatings (e.g., tin or silver plating) to prevent corrosion in humid or coastal environments. Lead-free soldering standards (RoHS) are critical for European buyers.

4. Polyvinyl Chloride (PVC) Insulation and Backing

Key Properties:

PVC is commonly used as an insulating and backing material for LED strips due to its low cost, ease of manufacturing, and acceptable electrical insulation properties. It offers moderate temperature resistance (up to ~105°C) and basic moisture protection.

Pros & Cons:

PVC is highly cost-effective and widely available, making it suitable for budget-conscious projects. However, it has lower thermal and UV resistance compared to silicone or polyimide, limiting its use in high-temperature or outdoor applications. PVC can release harmful compounds when burned, raising safety concerns.

Impact on Application:

PVC-backed LED strips are typically used for indoor, decorative lighting in controlled environments, such as retail stores or offices in Europe and South America. They are less suited for outdoor or industrial use in harsh climates like the Middle East or tropical Africa unless additional protective measures are applied.

International B2B Considerations:

Buyers should verify compliance with fire safety standards such as UL 94 HB or IEC 60332-1. In European markets, PVC use may be restricted or require additives to meet stringent environmental regulations. Suppliers offering halogen-free PVC variants can provide safer alternatives for sensitive applications.

| Material | Typical Use Case for led strip low voltage | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyimide or PET Flexible PCB | Base substrate for flexible LED strips (indoor/outdoor) | High thermal stability and flexibility | PET lower heat resistance; polyimide higher cost | Medium to High |

| Silicone Rubber Coating | Protective encapsulation for outdoor/humid environments | Excellent moisture and UV resistance | Higher cost and manufacturing complexity | Medium to High |

| Copper Conductors (Flexible Foil) | Electrical conduction and heat dissipation in strips | Superior conductivity and reliability | Costly; susceptible to oxidation without plating | Medium |

| PVC Insulation and Backing | Insulation/backing for indoor, low-cost LED strip projects | Cost-effective and easy to manufacture | Limited heat |

In-depth Look: Manufacturing Processes and Quality Assurance for led strip low voltage

Manufacturing and quality assurance of low voltage LED strip lights are critical factors that determine product reliability, safety, and performance in demanding B2B applications worldwide. For international buyers—especially from regions such as Africa, South America, the Middle East, and Europe—understanding the intricacies of the manufacturing process and the quality control framework can guide better procurement decisions, reduce risk, and optimize long-term value.

Typical Manufacturing Process for Low Voltage LED Strips

The production of low voltage LED strip lights generally involves four main stages: material preparation, forming, assembly, and finishing. Each stage requires specialized techniques to ensure the final product meets technical specifications and durability requirements.

1. Material Preparation

- Substrate Selection: Flexible printed circuit boards (FPCBs) are the base, commonly made from polyimide or polyester films. These substrates provide electrical insulation and mechanical flexibility.

- LED and Component Procurement: High-quality LEDs, resistors, capacitors, and connectors are sourced, often from certified suppliers. Material traceability is important for quality and warranty.

- Raw Material Inspection: Incoming quality control (IQC) inspects components for defects, conformity to datasheets, and certifications like RoHS (Restriction of Hazardous Substances).

2. Forming

- Circuit Printing: Copper traces are chemically etched or printed onto the FPCB to create conductive pathways.

- Solder Mask Application: A protective solder mask layer is applied to prevent short circuits and protect the circuitry from environmental damage.

- Surface Treatment: Processes such as gold plating or tin plating improve solderability and corrosion resistance.

3. Assembly

- Component Placement: Automated pick-and-place machines position LEDs and other components on the FPCB with precision.

- Soldering: Reflow soldering or wave soldering methods attach components permanently. This step demands strict temperature control to avoid damaging sensitive LEDs.

- Encapsulation: Depending on application, strips may be coated with silicone or epoxy to enhance water and dust resistance, critical for outdoor or industrial environments.

4. Finishing

- Cutting and Scoring: Strips are cut into standard lengths or customized sizes, with clearly marked cut points for field modification.

- Connector Installation: Power connectors, terminal blocks, or solder pads are added for easy integration.

- Packaging: Anti-static bags, moisture barrier packaging, and protective reels are used to maintain product integrity during shipping.

Quality Assurance Framework and Standards

Quality assurance (QA) in LED strip manufacturing is essential to meet international buyer expectations and regulatory compliance. B2B buyers should seek suppliers who adhere to globally recognized standards and implement rigorous quality control protocols.

Key International Standards

- ISO 9001: This is the foundational quality management system (QMS) standard, emphasizing consistent process control, continuous improvement, and customer satisfaction.

- CE Marking (Europe): Indicates compliance with EU safety, health, and environmental requirements.

- RoHS Directive: Ensures products are free from hazardous substances, important for environmental compliance and import regulations.

- UL Certification (North America): Though less critical for Europe or Africa, UL marks can indicate higher safety standards.

- IEC Standards: International Electrotechnical Commission standards cover electrical safety and performance testing.

- Other Regional Certifications: Buyers from South America or the Middle East should verify compliance with local regulations such as ANATEL (Brazil) or GSO (Gulf Cooperation Council).

Quality Control Checkpoints

Manufacturers employ multiple quality control stages throughout production to detect and correct defects early:

- Incoming Quality Control (IQC): Inspection and testing of raw materials and components before production.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing, including solder joint inspection, LED placement accuracy, and electrical continuity tests.

- Final Quality Control (FQC): Comprehensive testing of finished strips for functionality, brightness, color consistency, and physical integrity.

Common Testing Methods

- Electrical Testing: Verification of voltage, current, and resistance to ensure compliance with design specifications and safety standards.

- Photometric Testing: Measurement of luminous flux, color temperature, and color rendering index (CRI) to ensure lighting quality.

- Environmental Testing: Thermal cycling, humidity, and UV exposure tests simulate real-world operating conditions, critical for outdoor or harsh environment applications.

- Mechanical Testing: Flexibility and tensile strength tests confirm the strip’s durability during installation and use.

- Safety Testing: Insulation resistance, dielectric withstand voltage, and short circuit tests prevent electrical hazards.

How B2B Buyers Can Verify Supplier Quality Control

For international buyers, especially those operating in Africa, South America, the Middle East, and Europe, verifying supplier quality is a vital step to mitigate supply chain risks and ensure compliance.

- Factory Audits: Conduct on-site or third-party audits to assess manufacturing capabilities, QMS implementation, and worker training.

- Review Quality Documentation: Request ISO 9001 certificates, test reports, CE declarations of conformity, and batch inspection records.

- Third-Party Inspection: Employ independent inspection agencies to perform sampling, testing, and verification before shipment.

- Sample Testing: Obtain product samples for in-house or local laboratory testing to validate performance claims.

- Supplier Track Record: Evaluate supplier references, delivery punctuality, and after-sales support responsiveness.

Quality and Certification Nuances for International Markets

- Africa: Many African markets emphasize cost-efficiency but are increasingly adopting CE and RoHS compliance due to import regulations and safety concerns. Buyers should be aware of local certification requirements and customs clearance protocols.

- South America: Countries like Colombia require compliance with technical standards such as RETILAP (Reglamento Técnico de Iluminación y Alumbrado Público). Understanding regional certification and customs can prevent shipment delays.

- Middle East: The Gulf Cooperation Council (GCC) has unified standards (GSO) that include electrical safety and environmental compliance. Buyers should verify GSO marking and local conformity assessments.

- Europe: Stringent regulations require CE marking, RoHS, and REACH compliance. Buyers in Germany or other EU countries expect rigorous documentation and traceability, and may require additional certifications like TÜV or VDE for specific projects.

Strategic Recommendations for B2B Buyers

- Prioritize suppliers with transparent quality management systems and internationally recognized certifications.

- Include quality assurance clauses in contracts, specifying acceptable defect rates, testing protocols, and warranty terms.

- Invest in third-party quality inspections for large or critical orders, especially when sourcing from new or overseas suppliers.

- Stay informed about regional import regulations and certification requirements to avoid compliance issues.

- Consider long-term partnerships with manufacturers who demonstrate consistent quality, technical support, and capacity for customization.

By thoroughly understanding the manufacturing processes and quality assurance practices behind low voltage LED strip lights, international B2B buyers can make informed purchasing decisions that align with their operational, regulatory, and market needs. This knowledge is particularly valuable for buyers in emerging and regulated markets across Africa, South America, the Middle East, and Europe, where product quality and compliance directly impact project success and brand reputation.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led strip low voltage Sourcing

Understanding the cost and pricing dynamics of low-voltage LED strips is crucial for international B2B buyers aiming to optimize procurement strategies and ensure competitive project execution. The pricing structure involves multiple cost components and influential factors that vary significantly depending on order scale, product specifications, and sourcing geography.

Key Cost Components in Low-Voltage LED Strip Manufacturing

-

Materials: The primary cost driver includes the LED chips, flexible PCB substrates, resistors, and encapsulation materials. Higher-grade LEDs with better lumen output and color consistency typically command premium prices. For low-voltage strips (commonly 12V or 24V), power supply units and wiring also contribute significantly to material costs.

-

Labor: Skilled labor is required for assembly, soldering, quality inspection, and packaging. Labor costs vary widely by country, impacting the final product price. Suppliers in regions with lower labor costs may offer more competitive pricing but buyers should weigh this against quality control standards.

-

Manufacturing Overhead: This includes factory utilities, equipment depreciation, and indirect labor. Efficient production lines with automation can reduce overhead per unit, benefiting large-volume buyers.

-

Tooling and Setup: Initial tooling for custom designs or unique connectors adds to upfront costs, which are amortized over the order volume. Custom packaging or branding can also increase tooling expenses.

-

Quality Control (QC): Rigorous testing for electrical safety, brightness uniformity, and certification compliance (e.g., CE, RoHS) incurs additional costs but is essential for long-term reliability and regulatory adherence in diverse markets.

-

Logistics and Shipping: Freight costs, customs duties, and import taxes vary by destination and chosen Incoterms (e.g., FOB, CIF). Efficient logistics management can reduce lead times and costs, especially for buyers in Africa, South America, the Middle East, and Europe, where import infrastructure and tariffs differ widely.

-

Supplier Margin: Manufacturers and distributors include profit margins that reflect market demand, competition, and supplier positioning.

Influential Pricing Factors for Buyers

-

Order Volume and Minimum Order Quantity (MOQ): Pricing is highly sensitive to volume. Larger orders typically unlock tiered discounts, reducing per-unit cost. Buyers should negotiate MOQ terms to balance inventory risk and cost efficiency.

-

Specifications and Customization: Custom lengths, color temperatures, waterproof ratings (IP65/IP67), and integrated smart controls increase complexity and cost. Standard product lines are generally more cost-effective.

-

Material Quality and Certifications: Certified products with documented quality assurance command higher prices but reduce downstream risks such as warranty claims or regulatory non-compliance.

-

Supplier Reputation and Location: Established suppliers with proven quality and after-sales support may price higher but offer reliability. Sourcing from regions closer to the buyer (e.g., European suppliers for Germany) can reduce shipping time and costs.

-

Incoterms and Payment Terms: Understanding trade terms impacts landed cost. For example, FOB pricing requires buyers to handle shipping and customs, potentially reducing upfront prices but increasing logistical responsibility.

Strategic Tips for International B2B Buyers

-

Negotiate Beyond Price: Engage suppliers on terms such as extended warranties, flexible MOQs, sample provisions, and lead times to enhance value.

-

Evaluate Total Cost of Ownership (TCO): Consider installation complexity, energy consumption, maintenance, and potential replacement costs alongside purchase price. Higher upfront costs for premium LED strips can yield lower TCO.

-

Leverage Local Market Knowledge: Buyers from regions like Africa and South America should account for import duties, local regulations, and currency fluctuations when budgeting.

-

Request Samples and Conduct Pilot Runs: Prior to large orders, testing product quality and compatibility minimizes costly errors.

-

Consolidate Orders Where Possible: Combining procurement of LED strips with related components (power supplies, connectors) can improve negotiation leverage and reduce shipping costs.

-

Be Aware of Pricing Fluctuations: Raw material prices (e.g., copper for wiring, semiconductor chips) are subject to global market volatility, influencing supplier pricing unpredictably.

Indicative Pricing Disclaimer

Prices for low-voltage LED strips vary widely based on specifications, volume, supplier, and region. Typical wholesale prices can range from $1 to $5 per meter for standard 12V or 24V strips, with customized or certified products commanding higher rates. Buyers should treat all pricing as indicative and conduct detailed supplier negotiations and due diligence to obtain accurate, current quotations.

By understanding these cost components and pricing influencers, international B2B buyers can strategically source low-voltage LED strips that meet technical requirements while optimizing procurement budgets across diverse global markets.

Spotlight on Potential led strip low voltage Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘led strip low voltage’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led strip low voltage

Critical Technical Properties of Low Voltage LED Strips

When sourcing low voltage LED strips for commercial or industrial projects, understanding key technical specifications is essential to ensure product reliability, performance, and compatibility with your installation environment.

-

Voltage Rating (12V or 24V DC):

Low voltage LED strips typically operate at 12 or 24 volts direct current (DC). Selecting the correct voltage is crucial as it impacts wiring design, power supply compatibility, and voltage drop considerations. For longer runs or higher power needs, 24V systems often provide better efficiency and less voltage drop. -

Power Consumption (Watts per Meter):

This indicates the energy usage of the LED strip per unit length, affecting your power supply sizing and operational costs. Higher wattage strips deliver brighter illumination but require more robust power infrastructure. Accurately calculating total wattage helps in selecting proper wire gauges and power supplies to avoid overheating and voltage drops. -

LED Density (LEDs per Meter):

LED density defines how many diodes are mounted per meter of strip. Higher densities produce more uniform and intense lighting, suitable for premium or detailed lighting applications. For B2B buyers, specifying LED density helps match product output with project requirements, especially in architectural or retail lighting. -

Material Grade and IP Rating:

The strip’s substrate material (usually flexible PCB) and protective coatings determine durability and environmental suitability. IP ratings (e.g., IP20, IP65, IP67) indicate resistance to dust and water — critical for outdoor or humid environments common in many regions. Choosing the correct IP rating prevents premature failure and maintenance costs. -

Color Temperature and CRI (Color Rendering Index):

Color temperature (measured in Kelvins) defines the light’s warmth or coolness. CRI indicates how accurately the light renders colors compared to natural light. High CRI (above 80) is important for retail, hospitality, and display lighting where color fidelity impacts customer experience. -

Tolerance and Quality Standards:

Manufacturing tolerances on voltage, current, and luminous output affect consistency across batches. Adherence to international standards such as CE, RoHS, and UL certification ensures safety, legal compliance, and reduces risk of faulty products in your supply chain.

Common Trade Terminology for LED Strip Procurement

Navigating international LED strip procurement requires familiarity with key industry terms that influence pricing, logistics, and contract negotiations.

-

OEM (Original Equipment Manufacturer):

Refers to suppliers who produce LED strips that can be branded or customized by buyers. OEM partnerships allow B2B buyers to specify product features and branding, which is valuable for companies seeking unique product lines or private labeling. -

MOQ (Minimum Order Quantity):

The smallest number of units a supplier will accept for an order. MOQs impact inventory planning and cash flow, especially for buyers in emerging markets or those managing multiple small projects. Negotiating MOQs can be vital for reducing upfront costs. -

RFQ (Request for Quotation):

A formal inquiry sent to suppliers requesting pricing, terms, and availability. A detailed RFQ helps buyers compare offers accurately and ensures suppliers understand technical and commercial requirements clearly, streamlining the sourcing process. -

Incoterms (International Commercial Terms):

Standardized trade terms that define responsibilities and risk transfer between buyers and sellers during shipment (e.g., FOB, CIF, DDP). Understanding Incoterms helps buyers from Africa, South America, the Middle East, and Europe manage import costs, customs clearance, and delivery schedules effectively. -

Lead Time:

The duration between placing an order and receiving the goods. Lead time affects project timelines and inventory management. Longer lead times may require advanced planning, especially for bulk orders or customized LED strips. -

Power Injection:

A technical term referring to adding power supply points along long LED strip runs to prevent voltage drop and maintain brightness uniformity. Knowing this term aids buyers in specifying installation requirements and ensuring suppliers provide compatible solutions.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions, negotiate effectively, and optimize their LED strip low voltage procurement to meet diverse project needs across Africa, South America, the Middle East, and Europe.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led strip low voltage Sector

Market Overview & Key Trends

The global LED strip low voltage market is experiencing robust growth driven by energy efficiency demands, technological advancements, and expanding applications across commercial, industrial, and residential sectors. International B2B buyers, particularly from emerging and established markets such as Africa, South America, the Middle East, and Europe, are increasingly investing in LED strip lighting solutions that combine performance with cost-effectiveness. Countries like Colombia and Germany exemplify contrasting yet complementary market dynamics—Colombia benefits from infrastructure development and urbanization, fueling demand for affordable, scalable lighting solutions, while Germany leads in innovation and sustainability-driven purchases.

Key market drivers include the rising adoption of 24V LED strips for longer runs with minimal voltage drop, and the integration of smart lighting controls such as dimmable, color-changing, and app-controlled strips, which add value in commercial and architectural projects. For B2B buyers, sourcing trends highlight a shift toward parallel wiring configurations to ensure consistent brightness and simplified maintenance in complex installations, especially important in large-scale projects.

Another significant trend is the growing preference for wholesale purchasing to leverage cost efficiencies, product variety, and customization options. Wholesale suppliers increasingly offer tailored solutions, including waterproof strips for outdoor use and high-lumen options for task lighting, which cater to diverse project requirements. Additionally, the rise of direct-from-manufacturer sourcing and regional distribution centers enhances supply chain reliability and reduces lead times for international buyers.

Emerging markets in Africa and the Middle East are witnessing rapid adoption due to infrastructure upgrades and a focus on energy conservation, whereas European buyers prioritize compliance with strict energy efficiency and safety standards. This regional diversity requires buyers to balance cost, quality, and regulatory compliance when selecting suppliers.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a critical consideration for B2B buyers in the LED strip low voltage sector. The environmental impact of lighting products extends beyond energy consumption to include manufacturing processes, raw material sourcing, and end-of-life disposal. Buyers from Europe and increasingly from Africa and South America are demanding eco-friendly materials such as lead-free solder and recyclable circuit boards, alongside RoHS (Restriction of Hazardous Substances) and REACH compliance certifications.

Ethical sourcing is equally important, with buyers scrutinizing supply chains to ensure that components are procured responsibly, minimizing risks related to labor practices and conflict minerals. Transparent supply chains and certifications such as ISO 14001 (environmental management) and BSCI (Business Social Compliance Initiative) are becoming prerequisites for international contracts, especially when dealing with governments or multinational corporations.

Illustrative Image (Source: Google Search)

Energy efficiency remains a cornerstone of sustainability in LED strip lighting, with low-voltage systems (12V and 24V) inherently reducing power consumption and heat generation. B2B buyers are encouraged to prioritize suppliers offering energy-star rated products and those who utilize low-power drivers and advanced thermal management techniques, which extend product lifespan and reduce maintenance costs.

Furthermore, the integration of smart controls that enable dimming and adaptive lighting schedules enhances sustainability by reducing unnecessary energy use. For buyers in regions with unreliable power grids, low-voltage LED strips paired with renewable energy sources (e.g., solar-powered systems) offer a compelling sustainable solution.

Evolution and Historical Context

The LED strip lighting sector has evolved significantly since its inception in the early 2000s. Initially developed as a niche decorative lighting option, low-voltage LED strips have transitioned into mainstream commercial and industrial applications due to improvements in LED chip efficiency, flexible circuit design, and power supply technologies.

Early LED strips operated primarily at 12V, limiting their length due to voltage drop issues. The introduction of 24V systems and parallel wiring configurations revolutionized the sector by enabling longer, more complex installations without compromising brightness or reliability. This evolution has been critical for B2B buyers managing large-scale projects in retail, hospitality, and infrastructure.

Advancements in smart LED technology over the past decade have further expanded the functionality of LED strips, incorporating features such as remote control, color tuning, and integration with building management systems. These technological strides have increased the strategic value of LED strips as energy-efficient, customizable lighting solutions tailored for diverse international markets.

The sector’s history reflects a consistent trend toward greater efficiency, flexibility, and sustainability, aligning with global energy policies and commercial buyer expectations. Understanding this evolution aids buyers in selecting products that leverage the latest innovations while meeting regional regulatory and environmental standards.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of led strip low voltage

-

How can I effectively vet suppliers of low voltage LED strips for international B2B purchases?

To vet suppliers, start by verifying their business licenses and certifications such as ISO 9001 or CE marks, which indicate adherence to quality standards. Request detailed product datasheets and test reports to confirm technical specifications and compliance with international safety standards. Check for references or client testimonials, especially from your region (Africa, South America, Middle East, Europe). Conduct sample testing before bulk orders and ensure the supplier has robust after-sales support. Using platforms with verified supplier profiles or attending international trade fairs can also help identify credible partners. -

What customization options are typically available for low voltage LED strips, and how should I negotiate them?

Customizations commonly include cut-to-length strips, specific LED colors or color temperatures, IP ratings for waterproofing, and packaging tailored to your brand. Advanced options may include dimmable drivers or RGB control capabilities. When negotiating, clearly specify your technical and aesthetic requirements upfront and inquire about minimum order quantities (MOQs) for custom runs. Ensure custom products undergo quality assurance tests and confirm lead times for bespoke orders to avoid production delays. Always request samples of customized strips before finalizing large orders. -

What are typical MOQs, lead times, and payment terms for international B2B LED strip orders?

MOQs can vary widely but typically range from 100 to 500 meters per order for standard low voltage LED strips. Custom orders usually require higher MOQs. Lead times generally span 3 to 6 weeks depending on order complexity, customization, and shipping logistics. Payment terms often include 30%-50% upfront deposit with balance paid before shipment or upon delivery, depending on supplier trust and negotiation. For buyers in Africa, South America, and the Middle East, consider suppliers offering flexible payment methods such as letters of credit or escrow services to mitigate risk. -

Which quality assurance certifications should I prioritize when sourcing low voltage LED strips internationally?

Prioritize certifications that ensure product safety, performance, and regulatory compliance relevant to your market. Key certifications include CE (Europe), RoHS (restriction of hazardous substances), UL or ETL (North America but often recognized globally), and IEC standards for electrical safety. For Middle East and African markets, conformity with local electrical standards and certifications like SASO (Saudi Arabia) or SONCAP (Nigeria) is crucial. Request supplier quality control documentation such as production inspection reports and third-party testing certificates to verify compliance. -

How should I plan logistics and shipping to minimize delays and costs when importing LED strip lights?

Collaborate with suppliers to choose the most cost-effective and reliable shipping methods—sea freight is economical for large volumes but slower, while air freight is faster but costlier. Consolidate shipments to reduce per-unit freight costs and avoid partial deliveries. Ensure all customs documentation, including commercial invoices, packing lists, and certificates of origin, are accurately prepared to prevent clearance delays. Work with freight forwarders experienced in your target markets, and consider incoterms carefully (e.g., FOB, CIF) to clarify responsibilities and risks during transit. -

What strategies can B2B buyers use to handle disputes or defective shipments with LED strip suppliers?

Establish clear contract terms covering product specifications, delivery timelines, inspection procedures, and remedies for defects or delays. Insist on pre-shipment inspection rights or third-party quality audits. If issues arise, document defects with photos and detailed reports immediately and communicate with the supplier promptly. Negotiate amicable solutions such as partial refunds, replacements, or discounts. For unresolved disputes, leverage trade platforms’ dispute resolution services or international arbitration clauses included in contracts. Maintaining good supplier relationships and clear communication reduces conflict risks. -

Are there specific technical considerations for low voltage LED strips in different international markets?

Yes. Voltage standards (12V or 24V DC) are generally consistent worldwide, but ensure compatibility with local power supplies and transformers. Environmental factors such as high ambient temperatures in the Middle East or humidity in tropical African regions necessitate selecting LED strips with appropriate IP ratings and heat dissipation features. Color rendering index (CRI) and brightness levels may also be tailored to regional preferences or application needs. Confirm that your supplier’s products meet local electrical codes and safety regulations to avoid compliance issues. -

How can I ensure after-sales support and warranty coverage when purchasing LED strips from international suppliers?

Before purchase, clarify the warranty period and what it covers (e.g., LED lifespan, power supply defects). Opt for suppliers who provide technical support, installation guidance, and troubleshooting assistance remotely or through local partners. Request detailed warranty and return policies in writing, including procedures for defective products and timelines for replacement or repair. For large orders, consider establishing a service-level agreement (SLA) to guarantee response times. Reliable after-sales support reduces downtime and protects your investment in international B2B transactions.

Strategic Sourcing Conclusion and Outlook for led strip low voltage

Strategic sourcing of low-voltage LED strip lighting is essential for international B2B buyers aiming to optimize cost, quality, and performance across diverse markets such as Africa, South America, the Middle East, and Europe. Key considerations include selecting reputable suppliers with proven product reliability, verifying technical specifications like voltage compatibility and wire gauge standards, and leveraging bulk purchasing to achieve significant cost efficiencies. Prioritizing suppliers who offer customization, strong warranties, and up-to-date technology ensures your installations meet both current and future demands.

For buyers in regions like Colombia and Germany, understanding local electrical standards and environmental factors enhances installation safety and system longevity. Embracing parallel wiring configurations and professional-grade connection methods can reduce maintenance overhead and improve lighting consistency in commercial projects. Additionally, sourcing from suppliers with streamlined logistics and transparent shipping policies minimizes supply chain risks and accelerates project timelines.

Looking ahead, the LED strip lighting market is evolving rapidly with innovations in smart controls and energy efficiency. B2B buyers should proactively engage with suppliers who invest in R&D and can support scalable, sustainable lighting solutions. By integrating strategic sourcing practices with forward-thinking technology adoption, your business can secure a competitive advantage in the dynamic global lighting landscape. Act now to partner with trusted manufacturers and distributors who align with your quality standards and growth ambitions.

Illustrative Image (Source: Google Search)