Introduction: Navigating the Global Market for led strip cover

In today’s fast-evolving lighting industry, LED strip covers play a pivotal role in enhancing both the functionality and aesthetics of LED strip installations. For international B2B buyers—especially those operating across Africa, South America, the Middle East, and Europe—understanding the nuances of LED strip covers is essential to securing durable, high-performance lighting solutions that meet diverse market demands.

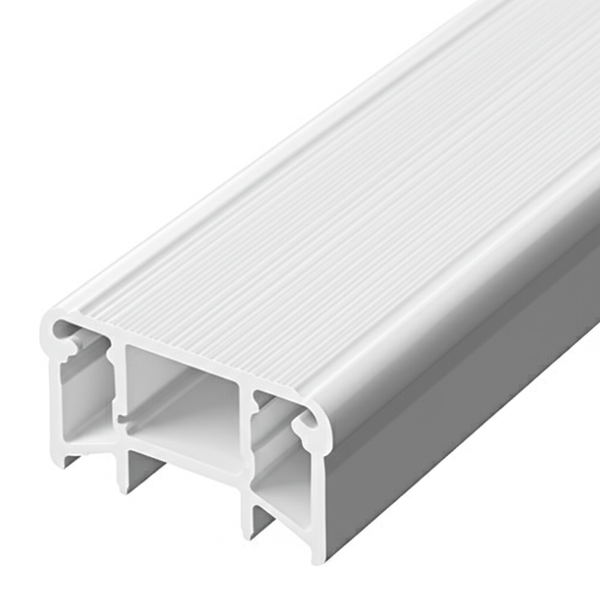

Illustrative Image (Source: Google Search)

LED strip covers do more than protect delicate LED strips from dust, moisture, and physical damage; they also improve light diffusion, reduce glare, and contribute to the overall design appeal. Choosing the right cover involves a careful balance of material quality, compatibility with LED types, and compliance with regional standards. For businesses aiming to scale, a reliable supply chain with trusted manufacturers and suppliers is equally critical.

This comprehensive guide offers a deep dive into the global LED strip cover market, equipping buyers with actionable insights into:

- Types and materials of LED strip covers suited for various applications and climates

- Manufacturing processes and quality control benchmarks to ensure consistent product reliability

- Supplier evaluation criteria, including certifications, production capacity, and customization options

- Cost factors and pricing strategies to optimize procurement budgets without compromising quality

- Market trends and regional considerations that influence sourcing decisions across continents

- An extensive FAQ section addressing common challenges and best practices

By consolidating this knowledge, the guide empowers B2B buyers to make informed sourcing decisions that enhance product longevity, streamline supply chains, and ultimately deliver superior value to their customers in competitive global markets.

Illustrative Image (Source: Google Search)

Understanding led strip cover Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Clear Acrylic Covers | Transparent, rigid, high light transmission | Retail displays, architectural lighting | Pros: Excellent brightness, durable; Cons: Less diffusing, potential glare |

| Frosted/Opal Covers | Semi-translucent, diffuses light evenly | Hospitality, office lighting, residential projects | Pros: Soft light, reduces glare; Cons: Slightly lower brightness |

| Silicone Covers | Flexible, waterproof, resistant to dust and moisture | Outdoor lighting, automotive, marine applications | Pros: Weatherproof, flexible installation; Cons: Higher cost, less rigid form |

| Aluminum Channels with Covers | Integrated heat dissipation, structural support, various cover options | Industrial, commercial, architectural lighting | Pros: Extends LED lifespan, professional finish; Cons: Requires more installation effort |

| Magnetic Covers | Easy-to-install magnetic attachment, reusable covers | Temporary setups, exhibitions, retail fixtures | Pros: Quick installation/removal; Cons: Limited structural support, less protective |

Clear Acrylic Covers

Clear acrylic covers offer high transparency and rigidity, making them ideal for projects where maximum brightness and visual clarity are essential. They are commonly used in retail displays and architectural lighting where showcasing the true color and intensity of LEDs is critical. B2B buyers should consider these covers when clarity outweighs diffusion needs but must account for potential glare and less light softening.

Frosted/Opal Covers

Frosted or opal covers provide a semi-translucent finish that diffuses LED light evenly, reducing hotspots and glare. These covers are highly favored in hospitality, office, and residential environments where a softer, more comfortable light ambiance is desirable. Buyers should evaluate the trade-off between slightly reduced brightness and improved visual comfort, especially in environments prioritizing aesthetics and user experience.

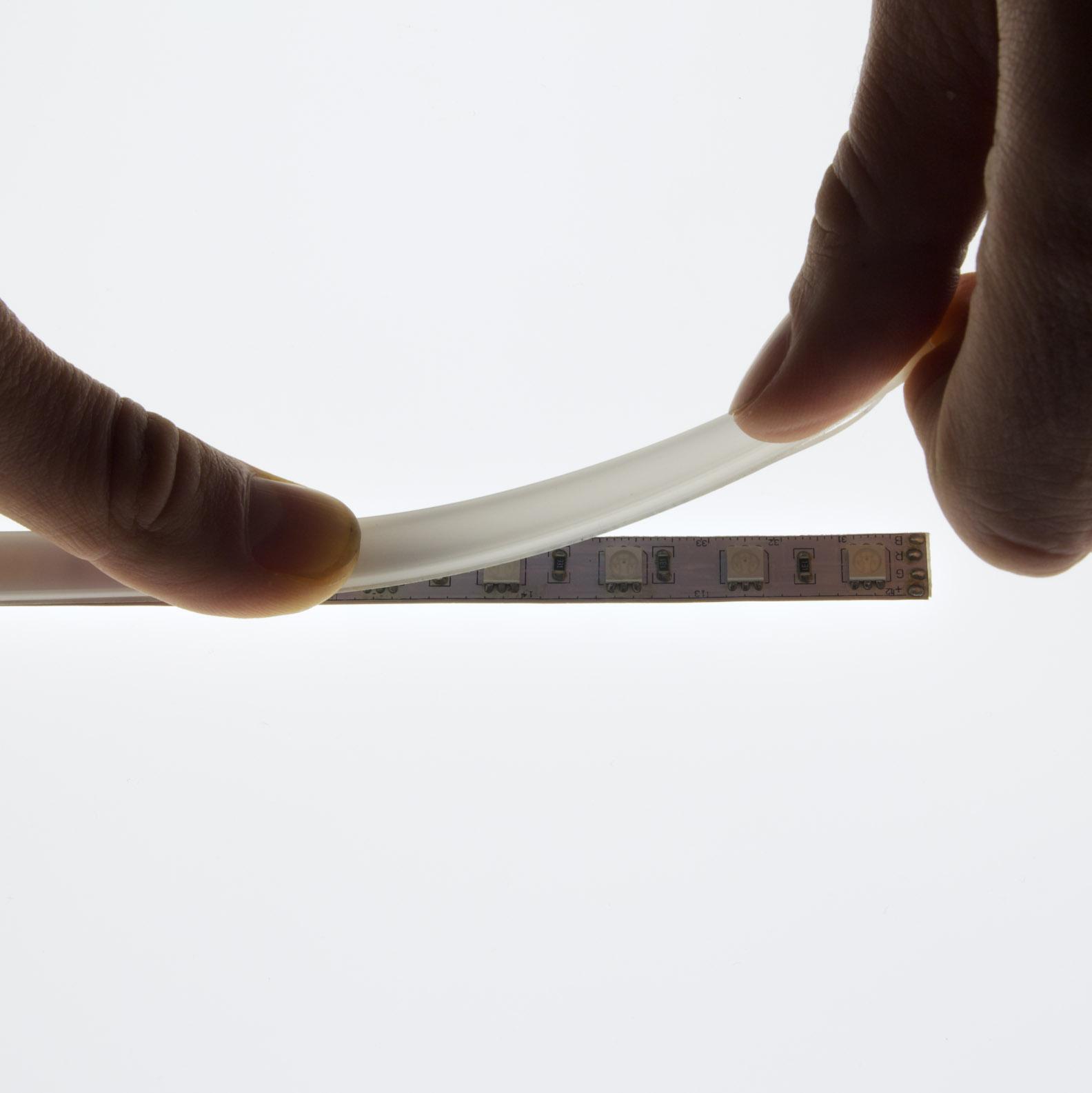

Silicone Covers

Silicone covers stand out for their flexibility and waterproof qualities, making them suitable for outdoor, automotive, and marine applications. Their resistance to dust and moisture ensures durability in harsh conditions. For B2B buyers, silicone covers represent a premium option with higher upfront costs but offer long-term reliability in challenging environments, crucial for projects requiring weatherproofing.

Aluminum Channels with Covers

Aluminum channels combined with LED strip covers provide a robust solution with built-in heat dissipation and structural support. This combination is widely used in industrial, commercial, and architectural lighting projects where durability and LED lifespan extension are priorities. Buyers should consider the additional installation complexity and costs but benefit from a professional finish and enhanced product longevity.

Magnetic Covers

Magnetic covers offer a unique advantage with easy installation and removal through magnetic attachment, ideal for temporary setups like exhibitions and retail fixtures. They provide convenience and reusability but offer limited structural protection compared to fixed covers. B2B buyers focusing on flexible, short-term lighting solutions will find magnetic covers cost-effective and practical but less suited for permanent installations.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of led strip cover

| Industry/Sector | Specific Application of led strip cover | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Architectural & Interior Design | Concealing and diffusing LED strips in decorative lighting | Enhances aesthetic appeal and prevents glare for premium projects | Durable, UV-resistant covers with customizable shapes and finishes |

| Retail & Commercial Spaces | Protective casing for LED shelf and display lighting | Increases product visibility while protecting lighting from damage | High transparency, scratch resistance, and ease of installation |

| Automotive & Transportation | Weatherproof covers for LED strip lights on vehicles | Ensures durability under harsh environmental conditions | Waterproof ratings (IP65+), impact resistance, and thermal management |

| Industrial & Manufacturing | Protective covers for LED task lighting in harsh environments | Extends lifespan of lighting, reduces maintenance costs | Chemical resistance, heat tolerance, and robust mechanical strength |

| Hospitality & Events | Diffusers for LED strips in ambient and accent lighting | Creates comfortable, uniform lighting enhancing guest experience | Flexible, lightweight materials with excellent light diffusion properties |

Architectural & Interior Design

In architectural projects and high-end interior design, LED strip covers play a critical role in concealing LED strips while diffusing light evenly to avoid harsh glare. This enhances the visual appeal of spaces such as hotels, offices, and luxury residences. For B2B buyers in Europe and the Middle East, sourcing covers with UV resistance and customizable finishes is essential to meet aesthetic standards and durability requirements, especially in sun-exposed areas.

Retail & Commercial Spaces

Retailers and commercial property developers utilize LED strip covers to protect LED lighting installed on shelves and display cases. The covers safeguard lights from dust, impact, and cleaning chemicals, while maintaining crystal-clear illumination that highlights products effectively. Buyers from Africa and South America should prioritize covers with high transparency and scratch resistance to ensure longevity in high-traffic retail environments.

Automotive & Transportation

In automotive manufacturing and aftermarket customization, LED strip covers are indispensable for protecting lighting systems from water, dust, and mechanical impact. Vehicles operating in diverse climates, such as those in the Middle East and South America, require covers with high waterproof ratings (IP65 and above) and excellent thermal dissipation properties to maintain performance and safety standards.

Industrial & Manufacturing

Factories and production facilities often deploy LED strip lights for task illumination in demanding environments. Covers designed for these applications must resist chemicals, tolerate elevated temperatures, and withstand physical abuse. International buyers, particularly in Africa and Europe, need to ensure these covers comply with industrial safety certifications and offer ruggedness to minimize downtime and maintenance expenses.

Hospitality & Events

Event planners and hospitality businesses use LED strip covers to create ambient lighting that is soft and evenly distributed, enhancing guest comfort and atmosphere. Flexible and lightweight covers with superior light diffusion are preferred to allow easy installation and adaptability. Buyers in Europe and the Middle East should also consider materials that meet fire safety regulations and provide aesthetic versatility for diverse event themes.

Related Video: LED Neon Flex & LED Strip Silicone Cover Flexible Bendable

Strategic Material Selection Guide for led strip cover

When selecting materials for LED strip covers, international B2B buyers must consider performance under diverse environmental conditions, manufacturing feasibility, and compliance with regional standards. The right material choice influences the longevity, safety, and visual quality of the LED installation, especially across markets in Africa, South America, the Middle East, and Europe where climate and regulatory frameworks vary significantly.

Polycarbonate (PC)

Key Properties: Polycarbonate is known for its excellent impact resistance and high temperature tolerance, typically up to 120°C. It offers good UV resistance when treated, making it suitable for outdoor applications. Its chemical resistance is moderate, with some vulnerability to solvents.

Pros & Cons: PC covers provide outstanding durability and clarity, ensuring consistent light diffusion without yellowing quickly. However, polycarbonate is more expensive than other plastics and can be more challenging to mold due to its higher melting point. Its rigidity is beneficial for structural protection but may require precise manufacturing controls to avoid brittleness.

Application Impact: PC is ideal for harsh environments where mechanical protection is critical, such as industrial lighting or outdoor architectural installations. Its UV resistance makes it a preferred choice in sunny regions like the Middle East and parts of Africa.

International Considerations: Buyers in Europe (e.g., UK, Spain) will appreciate PC’s compliance with stringent standards such as EN 62262 (IK rating for impact resistance) and RoHS directives. In South America and Africa, where supply chains might be less stable, PC’s durability reduces replacement frequency, lowering total cost of ownership despite higher upfront costs.

Acrylic (PMMA)

Key Properties: Acrylic offers excellent optical clarity, with high light transmittance (~92%), and good weather resistance. It has a lower temperature resistance than polycarbonate, typically up to 80°C, and is less impact resistant but more scratch-resistant.

Pros & Cons: Acrylic is cost-effective and easier to fabricate, making it popular for decorative LED strip covers in retail and residential markets. However, it is more brittle and prone to cracking under impact or thermal stress, limiting its use in heavy-duty or outdoor applications without protective coatings.

Application Impact: Acrylic covers excel in indoor applications where aesthetics and light diffusion are priorities, such as retail displays and office lighting. Its scratch resistance is beneficial in environments with frequent cleaning or handling.

International Considerations: Acrylic meets ASTM D4802 standards for weatherability, which is relevant for buyers in moderate climates like parts of Europe and South America. However, in high UV exposure regions (e.g., Middle East), untreated acrylic may degrade faster, so buyers should request UV-stabilized variants or consider alternatives.

Silicone

Key Properties: Silicone offers excellent flexibility, high thermal stability (up to 200°C), and outstanding resistance to UV, ozone, and moisture. It is chemically inert and highly resistant to corrosion and environmental degradation.

Pros & Cons: Silicone covers provide superior sealing and protection against dust and water ingress, making them ideal for waterproof LED strip applications. Their flexibility allows for easy installation on curved surfaces. On the downside, silicone is more expensive and less rigid, which may not suit applications requiring structural protection.

Application Impact: Silicone is preferred for outdoor, marine, or industrial environments where waterproofing and chemical resistance are critical. Its flexibility also suits architectural projects with complex shapes, common in European and Middle Eastern markets.

International Considerations: Compliance with IP ratings (IP65 and above) is essential for buyers in humid or rainy climates such as parts of South America and Africa. Silicone’s compliance with international standards like DIN 53505 (tear resistance) and ASTM D2240 (hardness) ensures reliability across regions.

Polyvinyl Chloride (PVC)

Key Properties: PVC is a versatile plastic with moderate temperature resistance (up to 60-70°C), good chemical resistance, and inherent flame retardancy. It is less transparent than PC or acrylic but can be made clear or frosted.

Pros & Cons: PVC is cost-effective and widely available, making it attractive for large volume orders. It is easy to extrude and shape but tends to yellow over time under UV exposure and has lower impact resistance. Environmental concerns about PVC’s chlorine content may affect procurement in eco-conscious markets.

Application Impact: PVC covers are suitable for indoor applications with limited mechanical stress and UV exposure, such as office lighting or residential use. Its flame retardant properties make it compliant with fire safety requirements in many commercial buildings.

International Considerations: European buyers must consider REACH regulations and potential restrictions on PVC additives. In Africa and South America, PVC’s affordability and availability often outweigh environmental concerns, but buyers should verify local compliance and customer preferences.

| Material | Typical Use Case for led strip cover | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polycarbonate (PC) | Outdoor architectural, industrial lighting | High impact resistance and UV stability | Higher cost and manufacturing complexity | High |

| Acrylic (PMMA) | Indoor decorative, retail, office lighting | Excellent optical clarity and scratch resistance | Lower impact and temperature resistance | Medium |

| Silicone | Waterproof outdoor, marine, flexible installations | Exceptional flexibility and environmental resistance | Higher cost and less structural rigidity | High |

| Polyvinyl Chloride (PVC) | Indoor residential and commercial lighting | Cost-effective and flame retardant | Prone to yellowing and lower UV resistance | Low |

This guide enables B2B buyers to strategically select LED strip cover materials that align with their product requirements, regional environmental conditions, and compliance standards, ensuring durable and cost-effective lighting solutions across diverse international markets.

In-depth Look: Manufacturing Processes and Quality Assurance for led strip cover

Overview of Manufacturing Processes for LED Strip Covers

The production of LED strip covers involves a series of precise, quality-driven stages designed to ensure durability, optical clarity, and compatibility with various LED strip configurations. For international B2B buyers, understanding these manufacturing phases can help in assessing supplier capabilities and product suitability for diverse markets including Africa, South America, the Middle East, and Europe.

1. Material Preparation

The manufacturing process begins with the selection and preparation of raw materials, typically high-grade polycarbonate (PC) or acrylic (PMMA) plastics. These materials are chosen for their excellent light diffusion, UV resistance, and impact strength, essential for protecting LED strips while maintaining light quality.

- Material sourcing: Reliable suppliers provide consistent-grade polymers that meet international safety and environmental standards.

- Additive blending: UV stabilizers, anti-yellowing agents, and flame retardants are often mixed into the raw plastic pellets to enhance performance.

- Drying and conditioning: Prior to molding, materials undergo drying to remove moisture that can cause defects like bubbles or reduced clarity.

2. Forming and Molding

The core shaping of LED strip covers is typically done through extrusion or injection molding.

- Extrusion: This continuous process shapes the plastic into long, uniform profiles. It allows for consistent dimensions and is well-suited for producing flexible covers with varying cross-sectional designs.

- Injection molding: Used for more complex or precision parts, injection molding offers high repeatability and surface finish quality.

- Quality control at this stage includes checking dimensional accuracy, surface smoothness, and absence of defects like warping or inclusions.

3. Assembly and Finishing

After forming, LED strip covers often undergo secondary processes before shipment.

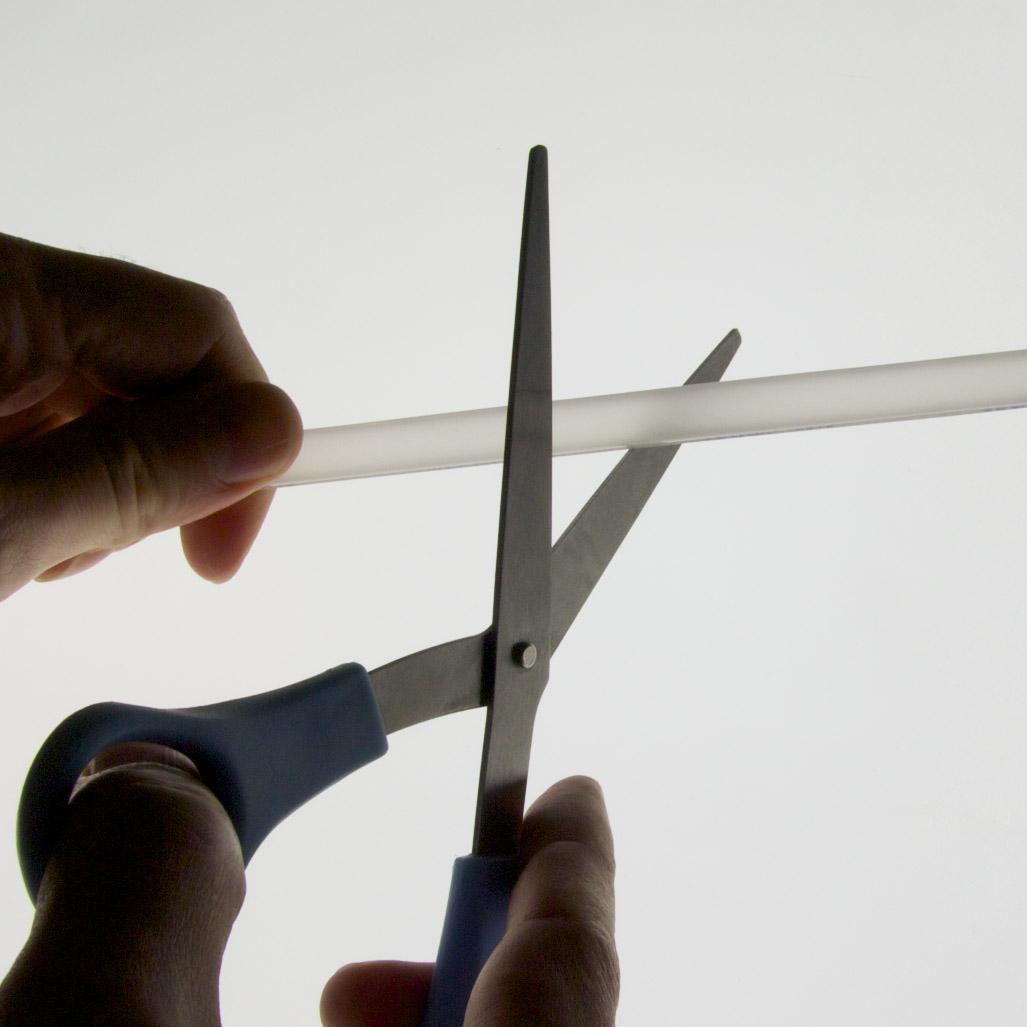

- Cutting and sizing: Covers are cut to customer-specified lengths with precision saws or laser cutters.

- Surface treatment: Anti-scratch coatings or matte finishes can be applied to improve durability and aesthetic appeal.

- Packaging preparation: Covers are cleaned, inspected, and carefully packed to avoid damage during transportation.

Quality Assurance Framework in LED Strip Cover Manufacturing

Quality assurance (QA) is critical in ensuring that LED strip covers meet both functional and regulatory requirements. Buyers from multiple regions must consider not only product quality but also compliance with international standards to avoid market entry issues.

Relevant International and Industry Standards

- ISO 9001: This globally recognized standard ensures that manufacturers have a robust quality management system in place. Buyers should verify that their suppliers are ISO 9001 certified to guarantee consistent production quality.

- CE Marking (Europe): Indicates conformity with EU health, safety, and environmental protection standards. Essential for buyers in the UK, Spain, and broader European markets.

- RoHS Compliance: Restricts hazardous substances in electrical and electronic products. Critical for European and Middle Eastern buyers to ensure environmental safety.

- UL Certification (North America): While primarily for the US market, UL testing also signals high safety and quality standards beneficial for B2B buyers globally.

- API or other regional certifications: Depending on the buyer’s location, certain industry-specific certifications may apply, especially in sectors like construction or automotive lighting.

Key Quality Control Checkpoints

Quality control (QC) is integrated throughout the manufacturing process via several inspection stages:

- Incoming Quality Control (IQC): Raw materials are tested for properties such as clarity, hardness, and chemical composition before production begins.

- In-Process Quality Control (IPQC): Continuous monitoring during extrusion or molding checks dimensions, surface finish, and mechanical properties.

- Final Quality Control (FQC): Finished products undergo thorough inspection for defects, packaging integrity, and performance testing such as UV resistance and impact testing.

Common Testing Methods

- Optical testing: Measures light transmission and diffusion to ensure consistent lighting effects.

- Mechanical testing: Includes impact resistance, flexibility, and hardness tests to guarantee durability.

- Environmental testing: Simulates exposure to UV, moisture, and temperature variations to predict long-term performance.

- Adhesion testing: For covers with coatings or surface treatments to verify bonding strength.

How B2B Buyers Can Verify Supplier Quality Control

International buyers should adopt a proactive approach to verifying supplier QC processes:

- Factory audits: Conduct on-site inspections or hire third-party auditors to review manufacturing workflows, equipment condition, and quality documentation.

- Request quality control reports: Ask for detailed IQC, IPQC, and FQC records for batches supplied, including raw material certificates and testing results.

- Third-party inspections: Engage independent quality assurance firms to perform random sampling and testing before shipment, especially for large orders.

- Sample testing: Obtain and test product samples in your local labs to confirm compliance with your market’s regulatory and performance standards.

QC and Certification Nuances for Different Regions

Buyers from Africa, South America, the Middle East, and Europe face distinct certification and quality assurance challenges:

- Africa and South America: These markets often require products to meet both international standards and local regulations, which can vary widely. Emphasis on durability and environmental resistance is critical due to diverse climates.

- Middle East: Compliance with stringent safety certifications, such as GCC conformity marks and sometimes UL or IEC standards, is common. Heat resistance and flame retardancy are often focal points.

- Europe (UK, Spain, etc.): CE marking and RoHS compliance are mandatory. Buyers should also consider environmental certifications like REACH and ensure manufacturers maintain traceability and batch control for regulatory audits.

Actionable Recommendations for Buyers

- Prioritize manufacturers with ISO 9001 certification and relevant regional marks (CE, RoHS, UL).

- Insist on comprehensive QC documentation and verify through third-party audits or inspections.

- Test product samples under real-world conditions relevant to your market’s climate and application.

- Establish long-term partnerships with suppliers who demonstrate transparency and adaptability in quality management.

- Be mindful of logistical factors affecting product integrity during transit, especially for sensitive materials like polycarbonate covers.

By thoroughly understanding the manufacturing and quality assurance landscape of LED strip covers, B2B buyers can make informed procurement decisions that reduce risk, ensure compliance, and support sustainable business growth across international markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led strip cover Sourcing

When sourcing LED strip covers, understanding the detailed cost structure and pricing dynamics is crucial for international B2B buyers aiming for cost-efficiency and reliable supply chains. The pricing landscape involves multiple components and influencing factors that vary significantly by region and supplier capabilities.

Key Cost Components in LED Strip Cover Pricing

- Materials: The primary cost driver, materials include polycarbonate, acrylic, or silicone, chosen based on durability, transparency, and flexibility requirements. Higher-grade UV-resistant or fire-retardant materials command premium pricing but enhance product longevity.

- Labor: Manufacturing labor costs fluctuate widely depending on the country of production. Regions with advanced automation may reduce labor expenses, while handcrafted or customized covers increase labor inputs.

- Manufacturing Overhead: This includes factory utilities, equipment maintenance, and indirect labor. Overhead costs tend to be amortized over large production volumes, affecting per-unit pricing.

- Tooling and Mold Fees: Initial tooling for extrusion or injection molding can be substantial, especially for custom profiles or complex shapes. These are often one-time costs but can be amortized over order volumes.

- Quality Control (QC): Rigorous QC ensures consistency, compliance with certifications (e.g., CE, RoHS), and minimizes returns. QC processes add to operational costs but reduce risk.

- Logistics and Shipping: For international buyers, freight costs, customs duties, and insurance significantly impact landed costs. These vary by origin-destination pairs and chosen Incoterms.

- Supplier Margin: Suppliers include a profit margin that reflects their market positioning, brand value, and service level.

Influencers on Price and Cost Variability

- Order Volume and Minimum Order Quantity (MOQ): Larger volumes typically attract volume discounts and reduce per-unit costs by diluting fixed expenses like tooling and overhead.

- Product Specifications and Customization: Tailored covers with specific sizes, finishes, or integrated features increase complexity and price. Buyers should balance customization needs with standard product availability.

- Material Quality and Certifications: Certified materials meeting international standards command higher prices but are critical for markets with stringent regulatory requirements, such as the EU.

- Supplier Experience and Capacity: Established manufacturers with stable supply chains can offer better pricing stability and scalability.

- Incoterms: Terms like FOB, CIF, or DDP define who bears shipping and insurance risks, influencing total procurement costs. Buyers should select terms aligned with their import capabilities and risk appetite.

Strategic Buyer Tips for Cost-Effective LED Strip Cover Procurement

- Negotiate Beyond Price: Focus on total value, including lead times, payment terms, and after-sales support. Long-term partnerships often yield better overall cost-efficiency than one-off low quotes.

- Calculate Total Cost of Ownership (TCO): Consider product lifespan, warranty, logistics, and potential tariffs to understand the real cost rather than just the invoice price.

- Leverage Volume Consolidation: Buyers from Africa, South America, the Middle East, and Europe can collaborate or consolidate orders to meet MOQs and negotiate better terms.

- Evaluate Supplier Certifications and Testing Rigor: Prioritize suppliers with robust QC and certifications to avoid costly returns or compliance issues, especially important in regulated markets like the UK and Spain.

- Understand Regional Pricing Nuances: Logistics and duties can disproportionately impact buyers in remote or tariff-heavy regions. Engage freight forwarders early to optimize shipping routes and costs.

- Request Samples and Pilot Runs: Before committing to large orders, testing samples ensures product quality matches price expectations and reduces risk.

Disclaimer on Pricing

Pricing for LED strip covers is highly variable and influenced by fluctuating raw material costs, geopolitical factors, and currency exchange rates. The figures discussed are indicative and should be validated with direct supplier quotations tailored to specific order details and market conditions.

By dissecting cost components and price influencers with a strategic approach, international B2B buyers can secure competitive pricing while ensuring quality and supply reliability in their LED strip cover sourcing endeavors.

Spotlight on Potential led strip cover Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led strip cover’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led strip cover

Key Technical Properties of LED Strip Covers

Understanding the technical properties of LED strip covers is crucial for international B2B buyers to ensure product compatibility, durability, and performance across various applications and climates.

-

Material Grade

LED strip covers are typically made from polycarbonate (PC) or acrylic (PMMA). Polycarbonate offers superior impact resistance and heat tolerance, making it ideal for industrial or outdoor applications, while acrylic provides excellent light diffusion and clarity at a lower cost. Choosing the right material grade affects longevity and UV resistance, especially important in harsh climates found in regions like Africa and the Middle East. -

Light Transmission Rate

This refers to the percentage of light that passes through the cover. High transmission rates (above 90%) ensure maximum brightness, which is critical in retail or architectural lighting. Covers with diffused finishes reduce glare and hotspots, enhancing visual comfort. Buyers should specify transmission rates based on end-use to balance brightness with aesthetic needs. -

Tolerance and Dimensions

Precision in cover dimensions and thickness (usually 1.0 to 3.0 mm) ensures a snug fit over LED strips and within channels or fixtures. Tight manufacturing tolerances prevent light leakage, dust ingress, and mechanical instability. For large-scale projects, consistent tolerances guarantee uniformity across batches, simplifying installation and reducing waste. -

IP Rating Compatibility

While LED strip covers themselves do not have an IP rating, they contribute to the overall ingress protection when combined with seals and enclosures. Covers compatible with IP65 or higher systems protect LEDs from dust and water, essential for outdoor or wet-area installations common in many international markets. -

UV and Heat Resistance

LED strip covers exposed to sunlight must resist yellowing and degradation. UV-stabilized materials maintain optical clarity over time. Additionally, covers should withstand the heat generated by LEDs without warping or melting, ensuring safety and maintaining performance. -

Surface Finish Options

Covers come in clear, frosted, or opal finishes. Frosted or opal finishes diffuse light evenly and hide the individual LED points, creating a smoother light output. The choice impacts both the aesthetic appeal and functional lighting quality, important for designers and architects.

Common Industry and Trade Terms for LED Strip Covers

Familiarity with these terms helps buyers navigate negotiations, contracts, and supply chain processes with confidence.

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers who produce products or components that are purchased by another company and retailed under that purchasing company’s brand name. B2B buyers often seek OEM partnerships for custom LED strip covers tailored to specific designs or performance requirements. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQs vary widely and can affect pricing and inventory decisions. Buyers in emerging markets should negotiate MOQs carefully to balance cost savings with storage limitations. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for pricing, lead times, and terms based on detailed specifications. An RFQ is essential for comparing multiple suppliers transparently and ensuring quotes align with technical requirements. -

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define responsibilities for shipping, insurance, and tariffs between buyers and sellers. Common terms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Understanding Incoterms helps buyers manage risks and logistics efficiently. -

Lead Time

The period between placing an order and receiving the goods. Lead times impact project schedules and inventory management, especially for international shipments where customs clearance and transport delays can occur. -

Certification Compliance

Certifications such as CE, RoHS, or UL indicate adherence to safety, environmental, and quality standards. Buyers should verify that LED strip covers meet relevant certifications to ensure market access and reduce liability risks.

By mastering these technical properties and trade terms, B2B buyers across Africa, South America, the Middle East, and Europe can make informed procurement decisions, ensuring reliable product performance and smooth supply chain operations.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led strip cover Sector

Market Overview & Key Trends

The LED strip cover market is experiencing robust growth driven by the global shift toward energy-efficient lighting solutions and the increasing demand for versatile, customizable lighting applications. For international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe (including the UK and Spain), understanding regional market dynamics is crucial. Emerging economies in Africa and South America are witnessing accelerated infrastructure development and urbanization, fueling demand for LED lighting components like strip covers. Meanwhile, Europe and the Middle East prioritize advanced lighting solutions that combine aesthetics with functionality, often integrating smart lighting technologies.

Key market drivers include rising awareness of energy conservation, government incentives for sustainable building practices, and the growing popularity of smart homes and commercial spaces. LED strip covers are evolving beyond basic protective elements to become integral design features that enhance light diffusion, durability, and heat dissipation. This evolution aligns with increasing customization demands—buyers seek covers that accommodate different IP ratings (waterproofing levels), color temperatures, and installation environments.

From a sourcing perspective, B2B buyers should note several trends:

– Shift to modular and flexible designs: Suppliers now offer covers in various materials such as polycarbonate and silicone, balancing durability with design flexibility.

– Integration with smart lighting systems: Compatibility with IoT-enabled LED strips is becoming a standard expectation in advanced markets.

– Emphasis on supply chain resilience: Buyers are prioritizing manufacturers with proven track records in managing logistics efficiently, especially given ongoing global trade fluctuations and lead time uncertainties.

– Demand for customization and R&D collaboration: Long-term partnerships with manufacturers who can tailor products to specific market needs and provide technical support are increasingly valuable.

For buyers in emerging regions, partnering with suppliers that understand local market requirements and can offer competitive pricing without compromising quality is essential. European buyers, particularly in the UK and Spain, often prioritize compliance with stringent regulatory standards and certifications, making supplier credentials a key consideration.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a non-negotiable factor in the procurement of LED strip covers. The environmental impact of lighting components is assessed not only by their energy efficiency during operation but also by the materials used and manufacturing processes. B2B buyers globally are increasingly scrutinizing the lifecycle footprint of their lighting solutions, including the LED strip covers that protect and enhance the strips.

Ethical sourcing is integral to sustainability in this sector. Buyers should seek suppliers committed to responsible raw material sourcing—favoring recyclable and low-toxicity materials like high-grade polycarbonate or silicone that reduce environmental harm. Additionally, certifications such as RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and ISO 14001 environmental management standards serve as important benchmarks for evaluating supplier sustainability credentials.

Green manufacturing processes—such as reduced water usage, minimized emissions, and energy-efficient production lines—are increasingly demanded by buyers who aim to align with global sustainability goals. For markets in Europe and the Middle East, adherence to EU Ecodesign Directive and similar regulations is critical, as these regions enforce strict environmental compliance.

Moreover, ethical labor practices and transparent supply chains are gaining prominence. Buyers should prioritize manufacturers who demonstrate fair labor conditions, social responsibility, and traceability in their sourcing. This approach mitigates reputational risks and supports sustainable development goals (SDGs), which are especially relevant for buyers in Africa and South America, where social and environmental impacts are under heightened scrutiny.

In summary, international B2B buyers should integrate sustainability criteria into their supplier evaluation frameworks—balancing cost, quality, and environmental responsibility to future-proof their supply chains.

Evolution of LED Strip Covers in B2B Context

The evolution of LED strip covers reflects broader advancements in LED lighting technology and market demands. Initially, LED strip covers served a purely functional role—protecting delicate LED diodes from dust, moisture, and mechanical damage. Early covers were often rigid, limited in design, and focused on basic durability.

As LED strip lighting gained popularity across commercial, residential, and industrial sectors, the role of strip covers expanded. Manufacturers began innovating with materials that offered better light diffusion, enhanced flexibility, and improved thermal management. This shift enabled LED strips to be used in more diverse environments, including outdoor and wet locations, significantly broadening market applications.

Today, LED strip covers are integral to creating tailored lighting solutions that meet specific aesthetic and performance requirements. The rise of smart lighting and IoT integration has also influenced cover design, with enhanced compatibility and modularity becoming key features. For B2B buyers, understanding this history underscores the importance of selecting suppliers who are not only equipped to deliver standard products but also capable of supporting evolving technical needs and customization demands.

This continuous innovation trajectory highlights the necessity of forming strategic, long-term partnerships with manufacturers who invest in R&D and demonstrate adaptability—ensuring supply chain stability and product excellence in a rapidly changing market landscape.

Related Video: International Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of led strip cover

-

How can I effectively vet LED strip cover suppliers for long-term reliability?

Start by researching suppliers’ industry experience and reputation, especially their track record in serving international markets like Africa, South America, the Middle East, and Europe. Request product samples to evaluate build quality, material durability, and compatibility with your LED strips. Check certifications such as CE, RoHS, UL, or ISO that verify compliance with safety and environmental standards. Additionally, seek references or case studies from existing B2B clients and assess their communication responsiveness and after-sales support. Long-term partnerships hinge on trust, consistent quality, and supply stability. -

What customization options are typically available for LED strip covers?

Many manufacturers offer customization in terms of cover material (e.g., polycarbonate, acrylic), opacity (clear, frosted, or diffuser), length, width, and mounting styles to suit various LED strip profiles. Custom colors, UV resistance, and waterproof sealing are also common requests. For markets with specific climate challenges—such as high humidity in the Middle East or intense sun exposure in Africa—custom UV and heat-resistant covers can enhance product longevity. Discuss your application needs early to ensure your supplier can provide tailored solutions that align with your target market requirements. -

What are typical minimum order quantities (MOQs) and lead times for international B2B buyers?

MOQs vary by manufacturer but typically range from 500 to 2,000 units per order, depending on customization complexity. Lead times usually span 3 to 8 weeks, factoring in production, quality checks, and international shipping. Buyers from regions like Europe or South America should account for potential customs delays and logistics disruptions. Negotiate with suppliers on flexible MOQs if you’re testing new products or entering new markets. Building a trial order relationship can help optimize inventory planning and reduce upfront risk. -

What payment terms should international buyers expect and negotiate?

Common payment terms include 30% upfront deposit with the balance paid before shipment or upon delivery. Letters of credit (LC) are a secure option for large orders, providing financial protection to both parties. For new suppliers, consider escrow services or third-party payment platforms to mitigate risk. Always clarify currency terms, bank fees, and whether payments cover packaging and logistics costs. Transparent communication about payment schedules and penalties for late payments strengthens supplier relationships and ensures smoother transactions. -

How do I verify the quality assurance processes and certifications of LED strip covers?

Request detailed documentation of quality control protocols, including raw material inspection, in-line testing during production, and final product inspection reports. Certifications like ISO 9001 demonstrate systematic quality management, while CE, RoHS, and UL confirm compliance with regional safety and environmental standards critical for Europe and other regulated markets. Ask for third-party lab test results validating durability, UV resistance, and flame retardancy. Insist on sample testing under your specific conditions to confirm product performance before scaling orders. -

What logistics considerations should B2B buyers keep in mind when importing LED strip covers?

Understand the supplier’s shipping methods—sea freight is cost-effective for bulk orders but slower, while air freight offers speed at a premium. Confirm packaging standards to prevent damage during transit, especially for fragile or customized covers. Factor in import duties, VAT, and customs clearance times specific to your country. Work with freight forwarders experienced in handling electronics accessories and negotiate Incoterms (e.g., FOB, CIF) that clearly define cost and risk responsibilities. Regular tracking and proactive communication with suppliers help mitigate delays. -

How can I handle disputes or quality issues with overseas suppliers effectively?

Establish clear contractual terms covering product specifications, inspection criteria, and remedies for defects. Use third-party inspection services before shipment to catch issues early. If disputes arise, approach them diplomatically—document all communications and provide evidence such as photos or test reports. Many suppliers prefer to resolve issues amicably to preserve business relationships. For unresolved conflicts, consider mediation or arbitration clauses in contracts. Maintaining open communication and transparency is key to swift problem resolution. -

Are there specific considerations for sourcing LED strip covers for diverse markets like Africa, South America, the Middle East, and Europe?

Yes, regional climate, regulatory standards, and consumer preferences vary widely. For example, waterproof and UV-resistant covers are crucial for hot, humid regions like parts of Africa and the Middle East. Europe demands strict compliance with CE and RoHS certifications and often prefers eco-friendly materials. South American buyers should consider import tariffs and logistics infrastructure. Tailoring product specifications and supply chain strategies to each market’s unique challenges enhances competitiveness and customer satisfaction. Collaborate closely with suppliers to align on these requirements.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led strip cover

In navigating the global market for LED strip covers, strategic sourcing emerges as a critical success factor for international B2B buyers. Prioritizing reliable manufacturers with proven experience, robust certifications, and consistent quality ensures supply chain stability and product excellence. Rigorous product testing and transparent communication further safeguard against costly disruptions and inferior materials.

For buyers from Africa, South America, the Middle East, and Europe, understanding the nuances of local logistics, lead times, and regulatory compliance is essential to tailor sourcing strategies effectively. Engaging suppliers capable of scaling production and offering customization supports long-term growth and differentiation in competitive markets.

Looking ahead, the LED strip cover industry is poised for innovation driven by evolving technology and sustainability demands. Buyers who cultivate long-term partnerships with agile, quality-focused manufacturers will be best positioned to capitalize on emerging trends and shifting market dynamics.

Take proactive steps now—invest in thorough supplier evaluations, pilot product trials, and establish clear communication channels. This approach will not only mitigate risks but also unlock opportunities for expanded product offerings and stronger market presence across diverse international regions.