Guide to Philips Led Light Strip Hue

- Introduction: Navigating the Global Market for philips led light strip hue

- Understanding philips led light strip hue Types and Variations

- Key Industrial Applications of philips led light strip hue

- Strategic Material Selection Guide for philips led light strip hue

- In-depth Look: Manufacturing Processes and Quality Assurance for philips led light strip hue

- Comprehensive Cost and Pricing Analysis for philips led light strip hue Sourcing

- Spotlight on Potential philips led light strip hue Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for philips led light strip hue

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the philips led light strip hue Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of philips led light strip hue

- Strategic Sourcing Conclusion and Outlook for philips led light strip hue

- Strategic Sourcing Insights and Future Directions for Philips LED Light Strip Hue

Introduction: Navigating the Global Market for philips led light strip hue

The global demand for advanced lighting solutions is rapidly evolving, and Philips LED Light Strip Hue stands at the forefront of this transformation. As a versatile, smart lighting system, it offers unparalleled customization, energy efficiency, and integration capabilities that appeal to a wide range of commercial applications—from retail and hospitality to architectural and entertainment sectors. For international B2B buyers, particularly in dynamic markets across Africa, South America, the Middle East, and Europe, understanding the nuances of Philips Hue light strips is essential to capitalizing on emerging opportunities.

This comprehensive guide delves deeply into the critical aspects of sourcing Philips LED Light Strip Hue products, providing actionable insights tailored to the needs of global buyers. You will explore the varieties of Philips Hue light strips, including indoor, outdoor, and entertainment-synced models, alongside their technical specifications such as size, IP ratings, and smart control features. The guide also covers material composition and manufacturing quality controls, ensuring you select reliable products that meet international standards.

Additionally, detailed analysis of supplier landscapes, cost structures, and market trends equips buyers to negotiate effectively and optimize procurement strategies. We also address common challenges and frequently asked questions, helping you avoid pitfalls related to installation, compatibility, and after-sales support.

By leveraging this knowledge, international B2B buyers can make informed decisions that align with their regional market demands and business goals, securing competitive advantages in smart lighting solutions that Philips Hue uniquely delivers.

Understanding philips led light strip hue Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Philips Hue Lightstrip Plus | Indoor use, 14mm width, RGBW LEDs, flexible silicone casing | Retail display lighting, office ambiance, hospitality | Pros: Versatile color range, easy installation; Cons: Limited outdoor use, moderate width requires specific mounting |

| Philips Hue Play Gradient Lightstrip | Multi-zone color control, 17mm width, ideal for immersive entertainment | Media rooms, gaming venues, experiential marketing | Pros: Advanced color gradients, syncs with media; Cons: Higher cost, wider size limits tight installations |

| Philips Hue Outdoor Lightstrip | IP67-rated waterproof, 20mm width, robust silicone casing | Outdoor signage, landscape lighting, exterior hospitality | Pros: Weatherproof, durable; Cons: Larger size, higher price point, requires weatherproof mounting |

| Philips Hue Lightstrip Extensions | Compatible extensions for base strips, same features as base models | Large-scale installations, extended retail displays | Pros: Scalable length, consistent performance; Cons: Requires base strip, can increase total cost |

| Philips Hue Lightstrip Solo | Standalone lightstrip, no base required, 14mm width | Small retail displays, accent lighting, pop-up events | Pros: Plug-and-play, portable; Cons: Limited length, fewer advanced features |

Philips Hue Lightstrip Plus

This is the most widely used indoor LED strip, featuring a 14mm width and flexible silicone casing that protects the 6-pin RGBW LED array. It suits a variety of B2B environments such as retail stores, offices, and hospitality venues looking to enhance ambiance with dynamic color options. Buyers should consider mounting compatibility due to its moderate width and ensure it aligns with indoor-only applications. Its balance of price, color range, and ease of installation makes it a reliable choice for general-purpose lighting projects.

Philips Hue Play Gradient Lightstrip

Designed for immersive lighting experiences, this strip supports multi-zone color control, allowing smooth color transitions along its 17mm width. It is ideal for media rooms, gaming centers, and experiential marketing setups where synchronized lighting with video or music content adds value. B2B buyers should weigh the higher cost and installation space requirements against the premium visual impact. Its advanced features make it suitable for clients targeting high-end entertainment or event spaces.

Philips Hue Outdoor Lightstrip

Built for durability with an IP67 waterproof rating and a robust 20mm wide casing, this strip excels in exterior applications such as landscape lighting, outdoor signage, and hospitality outdoor spaces. B2B buyers must ensure proper weatherproof mounting solutions and consider the higher price point. Its rugged build and weather resistance justify investment for projects demanding reliable outdoor smart lighting solutions.

Philips Hue Lightstrip Extensions

Extensions allow B2B buyers to scale their lighting installations beyond the base strip length, maintaining consistent lighting quality and color control. These are essential for large retail environments or extensive architectural features requiring uniform illumination. Buyers should plan the total length carefully to optimize cost and power requirements, as extensions depend on a base strip for operation.

Philips Hue Lightstrip Solo

This standalone, plug-and-play strip offers 14mm width and is perfect for smaller-scale or temporary setups like pop-up retail displays and accent lighting. It requires no base strip, simplifying deployment for short-term or mobile applications. However, its limited length and fewer advanced features mean it is less suitable for permanent or large-scale installations. Buyers benefit from its portability and ease of use for targeted accent lighting needs.

Related Video: Philips Hue LED Strip Light Plus Unboxing and Setup

Key Industrial Applications of philips led light strip hue

| Industry/Sector | Specific Application of philips led light strip hue | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Hospitality | Ambient and accent lighting in stores, hotels, and restaurants | Enhances customer experience, drives sales, and creates memorable environments | Compatibility with existing lighting control systems, IP rating for outdoor or humid environments, color range and dimming capabilities |

| Entertainment & Media | Dynamic lighting for TV sets, theaters, and event venues | Creates immersive experiences, synchronized lighting effects with media | Integration with AV systems, scalability, and ease of installation and control |

| Commercial Offices | Adaptive workspace lighting for productivity and wellness | Improves employee comfort and productivity, supports circadian rhythms | Energy efficiency, compatibility with smart building management systems, ease of maintenance |

| Architectural & Interior Design | Decorative lighting for facades, coves, and feature walls | Highlights architectural features, increases property value and brand image | Durability, color accuracy, and flexibility of installation in varied environments |

| Outdoor & Urban Planning | Street furniture and landscape lighting with smart control | Enhances safety and aesthetics, reduces energy consumption through smart controls | Weather resistance (IP67), power supply logistics, and local regulatory compliance |

Retail & Hospitality

Philips LED Light Strip Hue is widely used in retail stores, hotels, and restaurants to create customizable ambient and accent lighting that enhances the customer experience. These strips allow businesses to tailor lighting moods for different times of day or special events, encouraging longer stays and repeat visits. For international B2B buyers, especially in regions like Africa and the Middle East where climate and power stability vary, it is crucial to source strips with high IP ratings for humidity resistance and compatibility with local lighting control systems. The ability to integrate with voice or app control also supports modern hospitality trends.

Entertainment & Media

In the entertainment industry, Philips Hue light strips are employed for dynamic, synchronized lighting on TV sets, theaters, and live event venues. Their ability to display over 16 million colors and sync with media content creates immersive visual experiences that captivate audiences. Buyers from Europe and South America should prioritize models that integrate seamlessly with existing audiovisual infrastructure and offer scalability for large installations. Ease of installation and durability are also key, as venues often require quick setup and reliable performance during events.

Commercial Offices

Adaptive lighting solutions using Philips Hue strips in commercial office environments promote employee well-being and productivity by mimicking natural light cycles and reducing eye strain. This application is gaining traction globally, with B2B buyers in the UK and Vietnam focusing on energy efficiency and smart building integration. Selecting light strips that support circadian lighting programs and are compatible with building management systems ensures that lighting can be adjusted dynamically based on occupancy or daylight levels, optimizing operational costs and workplace comfort.

Architectural & Interior Design

Architectural firms and interior designers use Philips Hue light strips for decorative lighting that accentuates building facades, coves, and feature walls. This elevates the aesthetic appeal of commercial and residential properties, thereby increasing their market value and brand image. For international buyers, especially in urban areas of South America and Europe, sourcing strips with excellent color accuracy and flexible installation options is essential to meet design specifications. Durability and ease of maintenance are also important to sustain long-term visual impact.

Outdoor & Urban Planning

Philips Hue outdoor light strips are increasingly adopted in urban planning for street furniture, parks, and landscape lighting. These smart, weather-resistant strips improve public safety and beautify communal spaces while reducing energy use through intelligent controls. B2B buyers from regions with harsh climates, such as parts of Africa and the Middle East, must ensure the strips have IP67 ratings and comply with local electrical standards. Consideration of power supply logistics and ease of remote management is critical for large-scale outdoor deployments.

Related Video: Philips Hue Gradient Lightstrip: Versatile Smart LED Lighting

Strategic Material Selection Guide for philips led light strip hue

When selecting materials for Philips LED Light Strip Hue products, B2B buyers must carefully evaluate options based on performance, durability, cost, and compliance with international standards. The choice of materials directly impacts product longevity, installation flexibility, and suitability for diverse environments encountered in regions such as Africa, South America, the Middle East, and Europe.

Silicone Encapsulation

Key Properties: Silicone is widely used as the protective casing for Philips Hue light strips due to its excellent thermal stability (typically up to 200°C), UV resistance, and flexibility. It offers good electrical insulation and moisture protection, contributing to the IP20 rating for indoor strips and IP67 for outdoor variants.

Pros & Cons: Silicone’s flexibility allows for easy bending and shaping around corners, ideal for intricate installations. It is highly durable against environmental factors like heat and humidity, which is critical for outdoor applications. However, silicone is more expensive than PVC and requires specialized manufacturing processes, which can increase lead times and costs.

Impact on Application: Silicone casing ensures the light strips can withstand exposure to sunlight and moderate mechanical stress, making them suitable for both indoor and outdoor use. Its moisture resistance is particularly beneficial for humid climates common in parts of Africa and South America.

International Considerations: Buyers in Europe and the Middle East should verify compliance with RoHS and REACH regulations, which restrict hazardous substances in silicone compounds. In regions like Vietnam and South America, ensuring the silicone meets ASTM D2000 standards for rubber materials can guarantee quality and durability.

Flexible Printed Circuit Board (FPCB)

Key Properties: The LED strip’s core is a flexible printed circuit board made from polyimide or polyester substrates. Polyimide offers high thermal resistance (up to 260°C) and excellent mechanical flexibility, while polyester is more cost-effective but less heat tolerant.

Pros & Cons: Polyimide-based FPCBs provide superior heat dissipation and durability, essential for maintaining LED performance and longevity. However, they are more costly and complex to manufacture than polyester variants. Polyester FPCBs reduce costs but may limit high-temperature applications.

Impact on Application: The choice of FPCB affects the strip’s ability to maintain consistent light output under continuous operation. Polyimide boards are preferred for commercial or industrial installations in hot climates, such as the Middle East, where ambient temperatures can be extreme.

International Considerations: Compliance with IPC-6013 standards for flexible printed circuits is crucial for buyers to ensure reliability. European and UK buyers often require adherence to EN standards for electronic components, while ASTM and JIS standards may be more prevalent in South American and Asian markets.

Polyvinyl Chloride (PVC) Housing

Key Properties: PVC is commonly used as a base or backing material for LED strips due to its rigidity, chemical resistance, and ease of extrusion. It provides mechanical support but has lower thermal resistance (typically up to 60-80°C) compared to silicone.

Pros & Cons: PVC is cost-effective and widely available, making it attractive for large-scale manufacturing. However, it is less flexible and can degrade under prolonged UV exposure, limiting outdoor use unless specially treated. PVC’s environmental impact is also a concern in regions with strict sustainability regulations.

Impact on Application: PVC-backed strips are more suitable for controlled indoor environments where flexibility and high heat resistance are less critical. Their use in outdoor or high-humidity settings is limited without additional protective coatings.

International Considerations: Buyers in Europe and the UK should consider PVC grades compliant with EU directives on plasticizers and phthalates. In Africa and South America, PVC remains popular due to cost constraints, but buyers should request certifications like ISO 14001 to ensure environmental compliance.

Aluminum Mounting Channels

Key Properties: Aluminum channels are used as mounting and diffuser housings for Philips Hue light strips, offering excellent heat dissipation, corrosion resistance (especially anodized variants), and structural support.

Pros & Cons: Aluminum channels enhance LED lifespan by dissipating heat effectively and provide a professional finish to installations. They are lightweight and easy to install but add to overall product cost and require precise sizing to accommodate the wider Philips Hue strips (14-20mm).

Impact on Application: Aluminum channels are essential for commercial and architectural lighting projects where durability and aesthetics are priorities. They also facilitate compliance with fire safety standards by reducing heat buildup.

International Considerations: Buyers in the Middle East and Europe should verify compliance with EN 573 (aluminum alloy standards) and ASTM B221. In humid or coastal regions of Africa and South America, anodized or powder-coated finishes are recommended to prevent corrosion.

| Material | Typical Use Case for Philips LED Light Strip Hue | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicone Encapsulation | Protective casing for indoor and outdoor light strips | Excellent flexibility and environmental resistance | Higher manufacturing complexity and cost | High |

| Flexible Printed Circuit Board (Polyimide/Polyester) | Core substrate for LED mounting and electrical connections | High thermal resistance and flexibility (polyimide) | Polyester variant less heat resistant; cost varies | Medium to High |

| Polyvinyl Chloride (PVC) Housing | Base backing for indoor LED strips with mechanical support | Cost-effective and chemically resistant | Limited heat resistance and UV degradation risk | Low |

| Aluminum Mounting Channels | Mounting and diffuser channels for heat dissipation and aesthetics | Superior heat dissipation and structural support | Adds cost and requires precise sizing | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for philips led light strip hue

Philips LED Light Strip Hue products are manufactured through a sophisticated, multi-stage process designed to ensure durability, performance, and exceptional lighting quality. For international B2B buyers, particularly from diverse markets such as Africa, South America, the Middle East, and Europe, understanding these manufacturing and quality assurance processes is critical for making informed procurement decisions.

Manufacturing Process Overview

The production of Philips Hue LED light strips involves several key stages, each leveraging advanced materials and precise engineering:

-

Material Preparation

The process begins with sourcing high-grade components, including flexible printed circuit boards (PCBs), RGBW LEDs, silicone casings, and electrical connectors. The PCB acts as the substrate for the LEDs and electrical wiring, often fabricated from copper-clad laminates. Silicone or specialized polymer coatings are prepared to provide flexibility, protection, and weather resistance, especially for outdoor variants. -

Forming and PCB Assembly

The PCBs are precisely patterned using photolithography and etching techniques to create conductive traces. Surface mount technology (SMT) is then employed to place and solder LEDs and other electronic components onto the PCB with high accuracy. Automated pick-and-place machines ensure consistent LED positioning, which is crucial for uniform light output and color mixing. -

Encapsulation and Protective Coating

After assembly, the LED strips undergo encapsulation in flexible silicone sleeves. This step not only protects the delicate electronic components from mechanical damage and moisture ingress but also enhances the strip’s flexibility and durability. Outdoor light strips receive a thicker silicone coating rated to IP67 standards, ensuring water and dust resistance suitable for harsh environments. -

Final Assembly and Integration

Additional components such as connectors, adhesive backing, and controller interfaces are integrated. The adhesive backing uses strong, industrial-grade tapes suitable for diverse surfaces and climates, a key consideration for international buyers with varying installation environments. Quality cable harnesses and connectors are also attached to ensure compatibility with Philips Hue control systems and accessories.

- Finishing and Packaging

The finished strips are trimmed to standard lengths or bundled with extension kits as per product specifications. Packaging is designed to protect the product during transit and complies with international shipping standards, often including anti-static and moisture-resistant materials.

Quality Assurance and Control (QA/QC) Framework

Philips adheres to rigorous quality assurance protocols aligned with internationally recognized standards to maintain product excellence and reliability. For B2B buyers, familiarity with these standards and QC practices is essential to validate supplier credibility and product consistency.

Key International and Industry Standards

- ISO 9001: Philips operates under ISO 9001 certified quality management systems, ensuring systematic control over manufacturing processes, continuous improvement, and customer satisfaction.

- CE Marking: Compliance with CE standards confirms conformity with European safety, health, and environmental protection requirements, critical for buyers targeting EU markets.

- RoHS and REACH Compliance: Philips LED strips meet Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations, ensuring materials are safe and environmentally friendly.

- IP Ratings: Indoor strips typically have an IP20 rating, while outdoor models meet IP67 standards for water and dust resistance.

- EMC and LVD: Electromagnetic compatibility (EMC) and low voltage directive (LVD) certifications assure electrical safety and minimal interference.

QC Checkpoints Throughout Production

- Incoming Quality Control (IQC): Raw materials such as LEDs, PCBs, and silicone casings are inspected for conformity to specifications before entering the production line. This includes visual inspection, electrical testing, and material composition verification.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly involves automated optical inspection (AOI) of solder joints, LED placement accuracy, and real-time electrical testing of circuits to detect defects early.

- Final Quality Control (FQC): Completed LED strips undergo comprehensive testing including:

- Electrical Safety Tests: Checking insulation resistance, voltage, and current parameters.

- Functional Testing: Verifying color accuracy, brightness levels, and dynamic color changing capabilities.

- Environmental Stress Testing: Simulating temperature, humidity, and mechanical stress to ensure durability.

- Waterproof Testing: For outdoor strips, immersion and spray tests confirm IP67 compliance.

- Adhesion and Flexibility Tests: Ensuring the silicone casing and adhesive backing maintain performance under bending and mounting conditions.

Common Testing Methods and Tools

- Spectroradiometers and Colorimeters: Measure the LED light output, color rendering index (CRI), and color temperature to guarantee the wide color spectrum Philips Hue promises.

- Automated Optical Inspection (AOI): Detects assembly errors such as misaligned components or soldering defects.

- Electrical Parameter Analyzers: Validate power consumption and electrical safety.

- Environmental Chambers: Simulate extreme conditions to test product resilience.

- Waterproof Chambers: Confirm ingress protection ratings for outdoor models.

Verifying Supplier Quality for International B2B Buyers

For buyers in regions such as Africa, South America, the Middle East, and Europe—including countries with strict import regulations like Vietnam and the UK—due diligence on supplier quality is paramount.

- Factory Audits: Arrange on-site or third-party factory audits to assess production capabilities, process control, and QA systems. Audits should verify adherence to ISO 9001 and product-specific certifications.

- Quality Documentation: Request comprehensive QC reports, including material certificates, test results, and compliance declarations (e.g., CE, RoHS).

- Third-Party Inspection: Engage independent inspection agencies to perform batch inspections, random sampling, and performance tests before shipment.

- Sample Testing: Obtain product samples for in-house or third-party lab testing to confirm performance claims and regulatory compliance.

- Traceability: Ensure suppliers provide full traceability of components and production batches to facilitate quality tracking and warranty management.

QC and Certification Nuances for Diverse International Markets

- Africa and South America: Regulatory frameworks may vary; however, buyers should prioritize suppliers with recognized international certifications (ISO, CE) to ensure product safety and compatibility. Climate considerations (humidity, temperature) necessitate robust outdoor strip options.

- Middle East: Given the region’s extreme environmental conditions, waterproofing and heat resistance certifications are critical. Compliance with local standards such as SASO (Saudi Standards) may also be required.

- Europe (including UK): Strict enforcement of CE marking, RoHS, REACH, and WEEE (Waste Electrical and Electronic Equipment) directives demands stringent supplier compliance. Post-Brexit UK buyers should confirm UKCA marking or equivalent certifications.

- Vietnam and Southeast Asia: Buyers should verify compliance with local import standards and may require additional certifications such as KC or PSE, depending on distribution plans.

By understanding the comprehensive manufacturing steps and rigorous quality assurance practices behind Philips Hue LED light strips, international B2B buyers can confidently evaluate suppliers, ensure product reliability, and meet diverse market regulations. This knowledge empowers buyers to negotiate favorable terms, reduce risk, and deliver superior smart lighting solutions to their customers worldwide.

Comprehensive Cost and Pricing Analysis for philips led light strip hue Sourcing

When sourcing Philips LED Light Strip Hue products for international B2B procurement, understanding the detailed cost and pricing structure is critical to optimizing your investment and ensuring competitive pricing in your target markets. This analysis breaks down the key cost components, price influencers, and strategic buyer considerations relevant to importers and distributors across Africa, South America, the Middle East, and Europe.

Key Cost Components

-

Materials

Philips Hue light strips utilize high-quality RGBW LEDs encased in flexible silicone housing, which enhances durability and light diffusion. The cost of premium LEDs, silicone casing (especially for IP67-rated outdoor models), and electronic components (6-pin wiring for indoor strips) form a significant portion of the base material cost. -

Labor and Manufacturing Overhead

Precision assembly, including soldering, circuit integration, and quality assurance, requires skilled labor, often conducted in regions with advanced electronics manufacturing capabilities. Overhead costs include factory utilities, equipment depreciation, and workforce training. -

Tooling and Equipment

The production of Philips Hue strips involves specialized tooling to ensure consistent LED placement, flexible strip molding, and waterproof sealing for outdoor variants. Initial tooling costs can be amortized over large production runs but affect unit cost for smaller volumes. -

Quality Control (QC)

Philips enforces rigorous QC standards, including functional testing for color accuracy, brightness, waterproofing, and app compatibility. QC processes add cost but reduce returns and enhance brand reputation. -

Logistics and Distribution

International shipping costs vary widely by region. For buyers in Africa and South America, longer transit times and higher freight costs (air or sea) must be factored in. Additionally, customs duties, VAT, and import taxes vary by country and can significantly impact landed cost. -

Margin and Markup

Philips maintains premium pricing reflecting brand value and product innovation. Distributors typically add their margin, influenced by market competition and sales volume.

Price Influencers for Philips Hue Light Strips

-

Order Volume and Minimum Order Quantity (MOQ)

Larger orders benefit from economies of scale, reducing per-unit cost. MOQ requirements vary by supplier and product variant, so negotiating volume discounts is essential. -

Product Specifications and Customization

Standard indoor strips differ in price from outdoor or Play gradient models due to additional features and IP ratings. Custom lengths, packaging, or branded bundles increase cost. -

Material Quality and Certifications

Compliance with CE (Europe), FCC (US), and RoHS standards may influence cost, especially for buyers targeting regulated markets like the UK and EU. -

Supplier Factors

Direct sourcing from Philips or authorized distributors ensures authenticity but at premium pricing. Alternative authorized resellers or regional partners might offer competitive rates. -

Incoterms and Delivery Terms

Understanding Incoterms (e.g., FOB, CIF, DDP) is vital. For buyers in Africa or South America, choosing DDP can simplify customs clearance but may increase upfront cost.

Buyer Tips for International B2B Procurement

-

Negotiate Based on Total Cost of Ownership (TCO)

Don’t focus solely on unit price. Consider warranty terms, after-sales support, shipping reliability, and potential tariffs. A slightly higher unit price with better support and faster delivery can reduce overall TCO. -

Leverage Regional Distribution Hubs

For buyers in Africa and South America, sourcing from European or Middle Eastern hubs may reduce lead times and shipping costs. -

Plan for Compliance and Certification Costs

Ensure your import documentation aligns with local regulations to avoid delays and fines. Factor certification and testing costs into your pricing model. -

Consider Currency Fluctuations and Payment Terms

Negotiate favorable payment terms (e.g., letters of credit, escrow) to mitigate currency risk, especially for buyers in volatile economies. -

Request Volume-Based Pricing and Bundled Offers

Philips often provides starter kits and bundles that can lower the cost per unit. Consolidating orders for multiple product types may unlock better discounts.

Indicative Pricing Overview

While exact pricing varies based on order size, region, and product variant, typical B2B wholesale prices for Philips Hue LED light strips range approximately from $70 to $300 per unit, with outdoor and Play gradient models commanding the higher end of the spectrum. Extensions and accessory products will add incremental cost.

By thoroughly understanding these cost drivers and pricing influencers, international B2B buyers can strategically source Philips Hue light strips to maximize value, ensure compliance, and maintain competitive pricing tailored to their regional markets.

Spotlight on Potential philips led light strip hue Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘philips led light strip hue’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for philips led light strip hue

Critical Technical Properties of Philips LED Light Strip Hue

-

Material and Casing Grade

Philips Hue LED strips utilize high-grade flexible silicone casing, which provides durability and protection. Indoor strips typically have an IP20 rating, suitable for dry environments, while outdoor variants are IP67 rated, ensuring waterproof and dustproof resilience. For B2B buyers, understanding material grade is crucial for specifying applications—outdoor installations require robust weatherproofing, whereas indoor use prioritizes flexibility and aesthetics. -

Width and Form Factor

The standard indoor Philips Hue Lightstrip Plus measures approximately 14mm in width, with the outdoor strips wider at around 20mm due to added protective layers. This dimension impacts the choice of mounting channels or diffusers, which must accommodate the strip’s size. Buyers must verify compatibility with existing installation hardware to avoid costly retrofits or supply mismatches. -

Color Range and LED Technology

Philips Hue strips support up to 16 million colors via RGBW LED technology, enabling precise color tuning for diverse lighting environments. This extensive palette allows B2B clients in hospitality, retail, or entertainment sectors to create dynamic, customizable atmospheres that enhance customer experience and brand differentiation. -

Power Consumption and Voltage Requirements

These LED strips typically operate at low voltage (24V DC), offering energy efficiency and safety benefits. Power consumption varies by strip length and model but remains optimized for commercial scalability. Buyers should factor in voltage compatibility and power supply specifications to ensure seamless integration into electrical systems. -

Connectivity and Control Protocols

Philips Hue strips integrate with Zigbee wireless protocol and Wi-Fi via the Hue Bridge, supporting remote app control and voice command compatibility (Amazon Alexa, Google Assistant). For B2B customers, this technical feature enables smart automation, scalability across multiple units, and integration with existing IoT infrastructures. -

Modularity and Extension Compatibility

Hue strips come in fixed lengths with compatible extension pieces, allowing flexible customization of installation lengths. However, extension compatibility is model-specific; for example, Play Gradient Lightstrips cannot be extended with standard Hue Lightstrip Plus extensions. Clear understanding of modularity ensures buyers procure correct quantities and avoid installation delays.

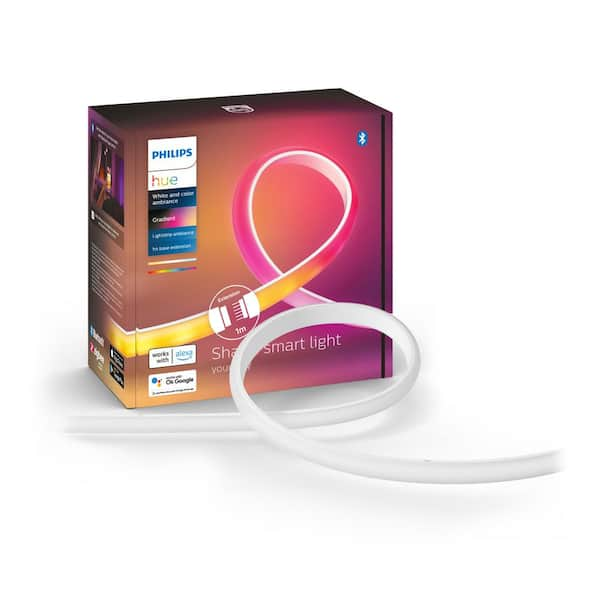

Illustrative Image (Source: Google Search)

Key Trade Terminology for Philips LED Light Strip Hue Transactions

-

OEM (Original Equipment Manufacturer)

Refers to companies that produce components or products sold under another brand’s name. For Philips Hue strips, OEM agreements may involve Philips supplying strips to other brands or custom-branded solutions. Understanding OEM options can open avenues for private labeling or exclusive distribution deals. -

MOQ (Minimum Order Quantity)

The smallest batch size a supplier will accept for an order. Philips Hue products may have MOQs depending on the distributor or region. For B2B buyers, knowing MOQ helps in inventory planning and cost control, especially when testing new markets or scaling operations. -

RFQ (Request for Quotation)

A formal process where buyers invite suppliers to submit price quotes for specified quantities and product configurations. RFQs are essential for negotiating terms, pricing, and delivery schedules for bulk Philips Hue light strip purchases, particularly in international trade. -

Incoterms (International Commercial Terms)

Standardized trade terms published by the ICC that define responsibilities for shipping, insurance, and tariffs between buyers and sellers. Common terms include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). For cross-border Philips Hue strip transactions, understanding Incoterms ensures clarity on cost allocation and logistics. -

IP Rating (Ingress Protection Rating)

A standardized rating indicating the degree of protection against solids and liquids. Philips Hue indoor strips have IP20, suitable for indoor use, while outdoor versions have IP67, suitable for exposure to rain and dust. Buyers must specify IP ratings based on installation environments to ensure product longevity. -

Lead Time

The period between placing an order and receiving the goods. Lead times for Philips Hue light strips may vary depending on stock availability, customization, and shipping logistics. Accurate lead time information is critical for project planning and meeting client deadlines.

Actionable Insight:

International B2B buyers should prioritize verifying technical compatibility—such as IP rating, strip width, and power requirements—with their intended application environments. Equally, mastering trade terms like MOQ and Incoterms will streamline procurement, reduce risks, and optimize supply chain efficiency across diverse markets in Africa, South America, the Middle East, and Europe.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the philips led light strip hue Sector

Market Overview & Key Trends

The global market for Philips LED Light Strip Hue products is expanding rapidly, driven by increasing demand for smart lighting solutions that offer flexibility, energy efficiency, and advanced control features. For international B2B buyers in regions such as Africa, South America, the Middle East, and Europe, this growth is underpinned by several key dynamics:

-

Smart Home and Commercial Integration: Philips Hue light strips are increasingly integrated into smart home ecosystems and commercial environments such as retail, hospitality, and corporate offices. Buyers in emerging markets like Vietnam and regions with growing smart infrastructure investments seek scalable lighting solutions that can be controlled via apps and voice assistants, aligning with the rise of IoT-enabled smart buildings.

-

Customization and Entertainment Synchronization: A standout feature is the ability of Hue light strips to display up to 16 million colors and sync with entertainment systems (TVs, music, gaming). This capability appeals to premium hospitality venues and retail brands aiming to enhance customer experience through immersive lighting, a trend gaining traction in Europe and Middle Eastern luxury markets.

-

Sourcing and Supply Chain Adaptability: The global supply chain for Philips Hue products is adapting to regional demands and logistical challenges. African and South American buyers benefit from Philips’ expanding distribution networks and localized partnerships, which help reduce lead times and ensure product availability. Furthermore, sourcing trends emphasize modularity, with indoor, outdoor, and gradient light strips offered in various lengths and widths to suit diverse applications.

-

Technological Advancements: Recent product iterations feature enhanced durability (e.g., IP67-rated outdoor strips) and silicone casings that improve flexibility and longevity. Such innovations address the harsh environmental conditions often encountered in outdoor projects across diverse geographies, including Middle Eastern deserts and tropical South American climates.

-

Price Sensitivity and Tiered Offerings: The market shows a bifurcation where cost-sensitive buyers in developing regions prioritize basic indoor light strips, while premium buyers in Europe and the Middle East invest in advanced gradient and entertainment-sync models. Philips’ tiered pricing and starter kits facilitate entry at multiple budget levels.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a critical consideration for B2B buyers of Philips LED Light Strip Hue products, reflecting broader corporate responsibility goals and regulatory pressures worldwide. Key insights include:

-

Energy Efficiency and Environmental Impact: Philips Hue light strips leverage LED technology that significantly reduces energy consumption compared to traditional lighting. This efficiency translates into lower operational costs and reduced carbon footprints, important for buyers aiming to meet environmental targets and certifications like LEED or BREEAM.

-

Material Selection and Durability: The use of flexible silicone casings rather than rigid PVC enhances product durability and reduces waste from replacements. Silicone’s recyclability and resistance to environmental degradation support longer product lifecycles, aligning with circular economy principles.

-

Ethical Supply Chain Practices: Philips maintains commitments to responsible sourcing, including compliance with international labor standards and conflict-free material sourcing. B2B buyers, especially in Europe and the Middle East, often require transparency and certifications such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) to ensure ethical procurement.

-

Green Certifications: Philips Hue products often meet global eco-label standards, reassuring buyers about environmental compliance. For example, the brand’s adherence to Energy Star standards and use of non-toxic materials supports sustainability claims critical for corporate procurement policies.

-

End-of-Life Management: Buyers are increasingly interested in product take-back programs and recycling initiatives. Philips’ efforts in facilitating responsible disposal and refurbishment can be a decisive factor for large-scale buyers seeking to minimize waste.

Brief Evolution & Historical Context

Philips Hue entered the smart lighting market in 2012, pioneering user-friendly, app-controlled LED lighting systems that transformed how consumers and businesses interact with ambient light. Initially focused on bulb-based solutions, Philips expanded its portfolio to include LED light strips, catering to growing demands for versatile accent and task lighting.

Over the years, Philips has progressively enhanced its light strips with improved color range, integration capabilities, and weatherproof designs for outdoor use. This evolution reflects Philips’ strategy to stay ahead in a competitive market by delivering innovative, high-quality products that address diverse B2B needs globally.

For international buyers, understanding Philips Hue’s development trajectory helps anticipate future trends such as increased AI integration, expanded smart ecosystem compatibility, and further emphasis on sustainability — all critical factors for strategic sourcing and long-term partnership decisions.

Frequently Asked Questions (FAQs) for B2B Buyers of philips led light strip hue

-

How can international B2B buyers verify the authenticity and reliability of Philips Hue LED light strip suppliers?

To ensure authenticity, buyers should request official Philips authorization or certification from potential suppliers. Verify company credentials, check references, and review past client feedback, especially from similar international markets. Conduct factory audits or request third-party inspections to assess manufacturing quality and compliance. Engaging with suppliers who participate in recognized trade shows or are listed on official Philips distribution networks enhances trust. For regions like Africa or South America, partnering with local Philips distributors or authorized resellers minimizes risks related to counterfeit products or unreliable supply chains. -

Are Philips Hue LED light strips customizable for specific B2B project requirements?

Yes, Philips Hue light strips offer various customization options, including length, color temperature, and integration with smart home systems. B2B buyers can often request tailored packaging, branding, or product bundles for retail or commercial deployment. Discuss customization capabilities directly with Philips or authorized partners, as minimum order quantities (MOQs) and lead times may vary. For international buyers, especially in Europe or the Middle East, customization can include compliance with regional electrical standards and language localization for apps and instructions. -

What are typical MOQ (Minimum Order Quantity) and lead times for Philips Hue LED light strips in international B2B transactions?

MOQ and lead times vary depending on product type and supplier agreements. Generally, Philips Hue products have moderate MOQs reflecting their premium positioning, often ranging from a few hundred to several thousand units. Lead times can span from 4 to 12 weeks, factoring in manufacturing, quality checks, and international shipping. Buyers from Africa or South America should anticipate longer transit times and potential customs delays. Early communication with suppliers about order volume, seasonal demand, and shipping logistics can optimize delivery schedules and inventory management. -

What payment terms are typically offered to international B2B buyers purchasing Philips Hue LED light strips?

Payment terms usually depend on buyer-supplier relationships and order size. Common options include advance payments, letter of credit (L/C), or net terms (e.g., 30-60 days). For new international buyers, upfront payment or partial deposits are standard to mitigate supplier risk. Established partners may negotiate extended terms or payment upon delivery. Using secure payment methods and escrow services is advisable to protect both parties. Buyers from emerging markets should clarify currency exchange conditions and any additional fees related to cross-border transactions. -

Which quality assurance certifications and standards should buyers expect for Philips Hue LED light strips?

Philips Hue products typically meet international quality and safety certifications such as CE (Europe), UL (North America), RoHS (restriction of hazardous substances), and IP ratings for water/dust resistance (especially for outdoor strips). Buyers should request documentation proving compliance with these standards, crucial for regulatory approval and market acceptance in regions like Europe or the Middle East. Additionally, Philips maintains strict internal quality control, including LED performance and durability testing, ensuring consistent product reliability for professional installations. -

What logistics and shipping considerations should international B2B buyers keep in mind when sourcing Philips Hue light strips?

Efficient logistics planning is vital due to the product’s delicate electronics and packaging requirements. Buyers should confirm that suppliers use secure, moisture-resistant packaging to prevent damage during transit. Shipping options typically include sea freight for cost efficiency or air freight for faster delivery, with customs clearance procedures varying by region. For Africa and South America, choosing suppliers familiar with regional import regulations can minimize delays. Also, consider local warehousing or distribution partnerships to streamline last-mile delivery and support after-sales service. -

How should international buyers handle warranty claims or product disputes with Philips Hue suppliers?

Warranty terms are generally provided by Philips or authorized distributors, often covering manufacturing defects for 2-3 years. Buyers should ensure clear contractual clauses detailing claim procedures, response times, and responsibilities. In case of disputes, maintaining thorough documentation—purchase orders, quality reports, and communication logs—is essential. Arbitration or mediation clauses can facilitate resolution without costly litigation. For buyers in diverse markets like the Middle East or Europe, verifying local consumer protection laws and Philips’ regional support policies can help manage warranty and dispute risks effectively. -

What strategies can B2B buyers adopt to optimize cost and supply chain efficiency when purchasing Philips Hue LED light strips internationally?

To optimize costs, buyers should leverage bulk purchasing to benefit from volume discounts and negotiate favorable payment terms. Consolidating orders across multiple projects or regions reduces freight costs and customs complexity. Establishing long-term partnerships with Philips authorized distributors ensures priority access to new products and technical support. Utilizing local warehouses or distributors in target markets (Africa, South America, Europe) can reduce lead times and enhance after-sales service. Finally, integrating demand forecasting tools helps anticipate inventory needs, minimizing overstock or stockouts while maintaining competitive pricing.

Strategic Sourcing Conclusion and Outlook for philips led light strip hue

Strategic Sourcing Insights and Future Directions for Philips LED Light Strip Hue

For international B2B buyers in Africa, South America, the Middle East, and Europe, sourcing Philips LED Light Strip Hue products offers a blend of innovation, quality, and market adaptability. Key takeaways emphasize the importance of selecting the right product variants—indoor, outdoor, or gradient—to meet diverse regional demands and installation environments. Understanding the technical specifications such as IP ratings, strip width, and compatibility with mounting solutions is crucial for seamless integration and client satisfaction.

Strategic sourcing advantages include:

- Access to cutting-edge smart lighting technology with extensive color customization and IoT compatibility.

- Reliable supply chain partnerships that ensure product authenticity and timely delivery across continents.

- Scalable options through starter kits and extensions that cater to varying project sizes and budgets.

- Compliance with international standards ensuring durability and safety, particularly for outdoor applications.

Looking ahead, B2B buyers are encouraged to deepen collaborations with Philips-certified distributors and leverage the brand’s expanding ecosystem, including app integration and smart home compatibility. Embracing these smart lighting solutions can unlock new commercial opportunities in retail, hospitality, urban development, and entertainment sectors globally.

To capitalize on evolving market trends, proactive engagement in strategic sourcing—prioritizing flexibility, innovation, and sustainability—will be pivotal. Connect with trusted Philips partners to tailor solutions that resonate with your regional market needs and future-proof your lighting portfolio.

Illustrative Image (Source: Google Search)