Introduction: Navigating the Global Market for led strip power requirements

The global demand for LED strip lighting continues to surge, driven by its energy efficiency, versatility, and aesthetic appeal across commercial, industrial, and architectural applications. For international B2B buyers—particularly in dynamic markets such as Africa, South America, the Middle East, and Europe—understanding the intricate power requirements of LED strips is paramount to securing reliable, high-performance installations that meet both operational and regulatory standards.

Power requirements form the backbone of any successful LED strip deployment. Selecting the correct voltage, current capacity, wiring configurations, and power supply specifications directly influences product longevity, energy consumption, and safety. Missteps in these areas can lead to inconsistent brightness, premature failures, and costly maintenance challenges. Therefore, a thorough grasp of these technical parameters is essential for procurement professionals, electrical contractors, and facility managers sourcing LED strips across diverse climates and infrastructure conditions.

This comprehensive guide equips buyers with actionable insights covering:

- Types of LED strips and their specific voltage and current demands

- Material considerations impacting electrical performance and durability

- Manufacturing quality control standards to ensure product reliability

- Key supplier evaluation criteria tailored for regional market nuances

- Cost analysis balancing upfront investment against lifecycle value

- Overview of emerging market trends influencing LED power solutions

- Detailed FAQs addressing common technical and procurement challenges

Armed with this knowledge, international buyers can confidently navigate supplier offerings, optimize electrical system designs, and achieve superior ROI. This resource empowers stakeholders to make informed sourcing decisions that align with their project requirements and regional operational realities, ensuring LED strip installations deliver consistent, efficient lighting solutions worldwide.

Understanding led strip power requirements Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| 12V LED Strip Power System | Operates on 12 volts DC; higher current draw for same wattage | Retail displays, short-run architectural lighting | + Easier to source components globally – Limited max run length due to voltage drop |

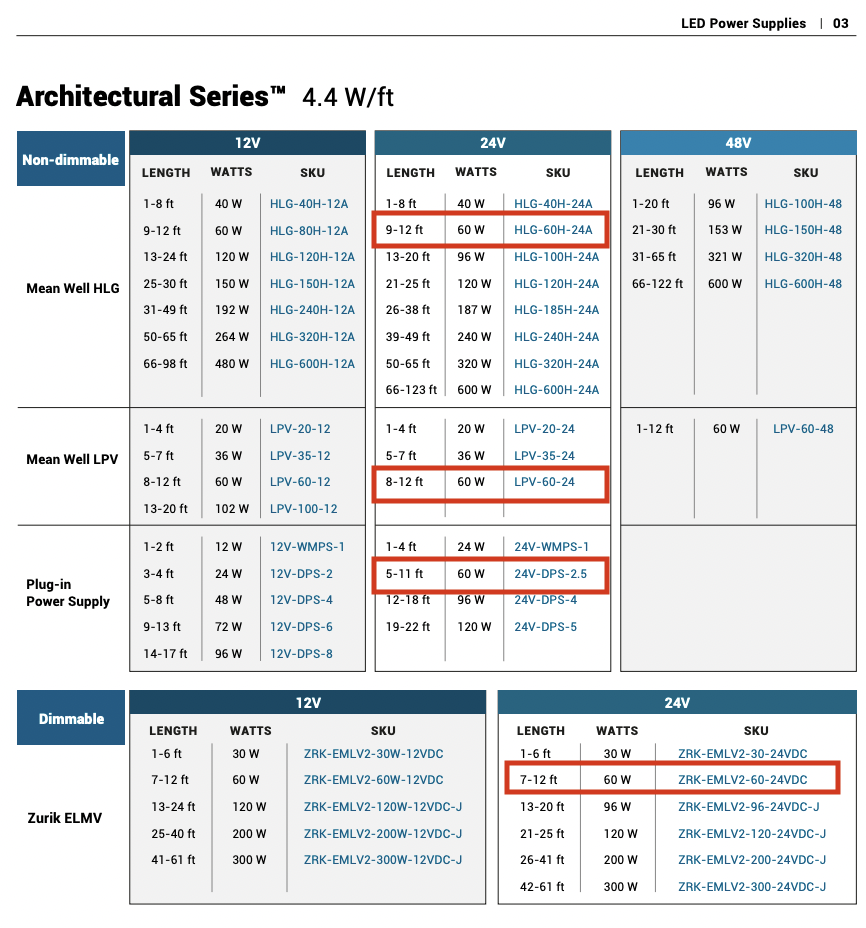

| 24V LED Strip Power System | Operates on 24 volts DC; lower current for same wattage | Large-scale commercial lighting, long runs | + Supports longer runs with less voltage drop – Slightly higher initial power supply cost |

| Constant Voltage Systems | Maintains fixed voltage across strip; common in RGB and white LED strips | Decorative lighting, signage, hospitality | + Simplifies wiring and installation – Requires careful power supply sizing |

| Constant Current Systems | Maintains fixed current; used for high-power LED strips | Industrial, horticulture, specialized lighting | + Ensures consistent brightness and color – More complex power supply and wiring |

| Dimmable & Addressable Power Systems | Integrated control for brightness and color; often includes PWM control | Smart buildings, entertainment, advertising | + Enables dynamic lighting effects – Higher upfront cost and technical complexity |

12V LED Strip Power System

12V LED strips are widely used due to their compatibility with common power supplies and ease of installation. They tend to draw higher current for a given wattage, which can limit maximum run length without power injection. For B2B buyers, especially in regions with variable power infrastructure like Africa and South America, 12V systems offer reliable, cost-effective solutions for smaller or segmented installations. However, buyers should consider the potential need for additional wiring and power distribution to avoid voltage drop issues in longer runs.

24V LED Strip Power System

24V LED strips reduce current draw compared to 12V systems, enabling longer continuous runs with less voltage drop. This makes them ideal for large commercial projects such as office buildings or retail chains across Europe and the Middle East. While initial power supply costs may be higher, the overall system efficiency and reduced wiring complexity deliver long-term cost savings and reliability. Buyers should ensure power supplies and wiring conform to local electrical standards for safe and efficient operation.

Constant Voltage Systems

Constant voltage LED strips maintain a steady voltage level, simplifying installation and wiring design. They are prevalent in RGB and white LED strips used for decorative and hospitality lighting applications. B2B buyers benefit from easier integration with existing lighting control infrastructure. However, precise calculation of total wattage and power supply capacity is critical to prevent premature failure or uneven brightness, especially in complex or multi-zone installations.

Constant Current Systems

Constant current LED strips regulate current flow to maintain consistent brightness and color temperature, which is essential in industrial or horticultural lighting where uniform output affects productivity. These systems require specialized drivers and more complex wiring, increasing upfront investment. For buyers targeting high-performance or specialized lighting markets, the improved lifespan and color fidelity justify the additional complexity. Ensuring supplier expertise and compliance with safety standards is crucial.

Dimmable & Addressable Power Systems

These advanced power systems incorporate dimming and addressable controls, often using PWM (Pulse Width Modulation) to enable dynamic lighting effects and color changes. They are increasingly popular in smart building projects, entertainment venues, and advertising displays across technologically advanced markets like the UAE and Europe. While offering superior flexibility and functionality, these systems demand higher technical skill for installation and maintenance. B2B buyers should prioritize suppliers offering comprehensive technical support and compatible control solutions.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of led strip power requirements

| Industry/Sector | Specific Application of led strip power requirements | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial | Illuminated display cases and signage with consistent brightness | Enhances product visibility and customer engagement | Stable power supply with minimal voltage drop, scalable wiring for large installations, compliance with local electrical standards |

| Hospitality & Leisure | Ambient and accent lighting in hotels, restaurants, and resorts | Creates immersive environments, reduces energy costs | Dimmable power supplies, high-quality connectors for easy maintenance, compatibility with control systems for dynamic lighting effects |

| Manufacturing & Warehousing | Task lighting and safety illumination on assembly lines and storage areas | Improves worker safety and operational efficiency | Robust wiring resistant to industrial environments, parallel wiring for long runs, reliable power injection points to maintain brightness |

| Transportation & Infrastructure | Tunnel, platform, and corridor lighting with uniform intensity | Ensures safety and operational continuity | High-capacity power supplies, redundancy in power distribution, adherence to regional safety certifications and installation codes |

| Agricultural & Horticulture | Growth lighting in greenhouses and indoor farms | Enhances plant growth with energy-efficient lighting | Precise voltage and current control, waterproof and corrosion-resistant wiring, ability to scale power according to crop needs |

Retail & Commercial Applications

In retail environments, LED strip lighting is critical for illuminated displays and signage, where consistent brightness and color accuracy directly impact product appeal and customer experience. Power requirements must accommodate long runs and multiple connection points while minimizing voltage drop to avoid uneven lighting. International buyers, especially in regions like the Middle East and Europe, should prioritize power supplies compatible with local voltage standards and capable of supporting scalable parallel wiring configurations for large commercial spaces.

Hospitality & Leisure Environments

Hotels, restaurants, and resorts utilize LED strip lighting for ambient and accent lighting to create inviting atmospheres and enhance guest comfort. Power requirements often include dimmable drivers and integration with smart control systems for dynamic lighting scenes. B2B buyers from Africa and South America should consider sourcing power supplies with high reliability and ease of maintenance, as well as connectors designed for frequent adjustments and upgrades in hospitality settings.

Manufacturing & Warehousing Facilities

LED strip lighting in manufacturing and warehousing improves visibility on assembly lines and in storage areas, contributing to safety and productivity. These applications demand power systems that support parallel wiring to extend lighting over large areas without voltage drop, as well as robust wiring solutions resistant to industrial conditions like heat and dust. Buyers from industrial hubs in Europe and the Middle East must ensure compliance with stringent safety standards and select power supplies that can handle continuous operation at high loads.

Transportation & Infrastructure Projects

Transportation sectors, including tunnels, platforms, and corridors, require LED strip lighting with uniform intensity for safety and operational continuity. Power requirements emphasize redundancy and high-capacity power supplies to maintain illumination during outages or faults. International buyers, particularly in developing regions like parts of Africa and South America, should focus on sourcing power solutions certified for regional safety regulations and capable of withstanding harsh environmental conditions.

Agricultural & Horticultural Uses

In controlled environment agriculture, LED strip lighting supports plant growth by providing targeted light spectra with energy efficiency. Power requirements include precise voltage and current control to optimize light output and spectrum tuning. Buyers from diverse climates, such as Indonesia or the UAE, must prioritize waterproof and corrosion-resistant wiring and scalable power supplies to adapt lighting intensity according to crop cycles and greenhouse sizes. This ensures maximum yield while minimizing energy consumption.

Related Video: HOW TO Power A LED Strip | Check, Calculate & Determine Power Requirements #LED #DIY #HowTo

Strategic Material Selection Guide for led strip power requirements

When selecting materials for LED strip power requirements, it is essential to consider factors such as electrical performance, thermal management, environmental durability, and regulatory compliance. The choice of materials directly affects the reliability, safety, and lifespan of LED installations, especially in diverse international markets like Africa, South America, the Middle East, and Europe. Below is an analysis of four common materials used in LED strip power components, focusing on their properties, pros and cons, and their suitability for various global B2B applications.

1. Copper Conductors

Key Properties:

Copper is the industry standard for electrical conductors due to its excellent electrical conductivity (~59.6 × 10^6 S/m), high thermal conductivity, and good corrosion resistance when properly coated. It supports high current loads with minimal voltage drop and heat generation.

Pros:

– Superior electrical and thermal conductivity ensures efficient power delivery and heat dissipation.

– Durable and flexible, facilitating easier installation in complex layouts.

– Widely accepted and compliant with international standards such as ASTM B170 (for copper wire) and IEC 60228.

Cons:

– Higher raw material cost compared to alternatives like aluminum.

– Susceptible to corrosion in highly acidic or saline environments unless adequately insulated or plated.

– Heavier than some alternatives, which may affect installation logistics in large-scale projects.

Impact on Application:

Copper is ideal for commercial and industrial LED strip installations requiring long runs and high current capacity. It performs well in indoor and controlled outdoor environments but requires protective coatings in harsh climates such as coastal regions in the Middle East or tropical areas in South America.

International Considerations:

B2B buyers in Africa, Europe, and the Middle East should verify compliance with regional electrical codes (e.g., IEC standards in Europe, SASO in the Gulf Cooperation Council countries). Copper wiring is widely available and preferred in these markets due to its reliability and ease of sourcing.

2. Aluminum Conductors

Key Properties:

Aluminum offers a lighter-weight alternative to copper with a conductivity approximately 61% that of copper. It has good corrosion resistance, especially when anodized, and excellent thermal dissipation properties.

Pros:

– Lower cost and lighter weight than copper, reducing material and shipping expenses.

– Good thermal conductivity helps manage heat in LED power systems.

– Corrosion resistance improves with anodized or coated finishes.

Cons:

– Lower electrical conductivity requires larger cross-sectional areas to carry the same current, potentially increasing cable size.

– More prone to mechanical fatigue and cracking if bent repeatedly, affecting long-term durability.

– Requires specialized connectors and installation techniques to prevent galvanic corrosion and ensure reliable joints.

Impact on Application:

Aluminum conductors are suitable for cost-sensitive projects with moderate power requirements, especially where weight is a concern, such as portable or modular LED installations. They are less ideal for very long runs or high-current systems without careful engineering.

International Considerations:

In regions like South America and parts of Africa, aluminum wiring is gaining popularity due to cost advantages but requires adherence to local standards such as NBR (Brazil) or SANS (South Africa). Buyers should ensure installers are trained in aluminum-specific handling and connection methods to avoid failures.

3. PVC Insulation and Jacketing

Key Properties:

Polyvinyl chloride (PVC) is a common insulation material for LED strip power cables, offering good electrical insulation, flame retardance, and moisture resistance. It performs well across a temperature range of approximately -20°C to 105°C.

Pros:

– Cost-effective and widely available globally.

– Provides robust protection against abrasion, moisture, and chemical exposure.

– Flame-retardant grades enhance safety in commercial installations.

Cons:

– Limited high-temperature tolerance compared to alternatives like silicone or Teflon.

– Can become brittle over time when exposed to UV radiation or extreme cold, reducing lifespan in outdoor applications.

– Environmental concerns due to PVC’s chlorine content and disposal challenges.

Impact on Application:

PVC insulation suits indoor and semi-protected outdoor LED installations, especially in temperate climates found in Europe and parts of the Middle East. For harsh outdoor or high-temperature environments, alternative insulation materials may be preferred.

International Considerations:

B2B buyers should verify that PVC insulation meets regional fire safety standards such as UL 1581 (USA), IEC 60332 (Europe), or local equivalents. In tropical or desert climates (e.g., UAE, Indonesia), UV-resistant or specialized PVC formulations are recommended to extend durability.

4. Silicone Rubber Insulation

Key Properties:

Silicone rubber insulation offers excellent flexibility, high thermal stability (operating temperatures from -60°C to +200°C), and outstanding resistance to UV, ozone, and moisture.

Pros:

– Superior heat resistance supports LED strips with higher power densities and longer lifespans.

– Exceptional flexibility facilitates complex routing and vibration resistance.

– Environmentally stable, suitable for outdoor and industrial environments.

Cons:

– Higher material and manufacturing costs compared to PVC.

– Less common in some regions, potentially complicating sourcing and increasing lead times.

– Requires specialized connectors compatible with silicone-jacketed cables.

Impact on Application:

Silicone insulation is ideal for high-performance LED installations in demanding environments such as industrial facilities, outdoor architectural lighting, or regions with extreme temperature variations like the Middle East deserts or high-altitude European locations.

International Considerations:

For buyers in Africa, South America, and the Middle East, silicone-insulated cables may offer enhanced reliability but require careful supplier vetting to ensure compliance with standards like IEC 60502 or EN 50363. Given higher costs, these materials are best suited for premium projects where longevity and safety are paramount.

Summary Table of Materials for LED Strip Power Requirements

| Material | Typical Use Case for led strip power requirements | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Copper Conductors | High-current, long-run commercial and industrial LED wiring | Excellent conductivity and durability | Higher cost and weight; requires corrosion protection | High |

| Aluminum Conductors | Cost-sensitive, moderate-power installations with weight concerns | Lower cost and weight than copper | Lower conductivity; requires special handling | Medium |

| PVC Insulation | Indoor and semi-protected outdoor LED strip power cables | Cost-effective, flame retardant, widely available | Limited temperature and UV resistance | Low |

| Silicone Rubber Insulation | High-temperature, outdoor, and industrial LED power wiring | Superior heat and environmental |

In-depth Look: Manufacturing Processes and Quality Assurance for led strip power requirements

Manufacturing Processes for LED Strip Power Components

Understanding the manufacturing process behind LED strip power components is crucial for B2B buyers seeking reliable, high-performance lighting solutions. The production typically involves multiple well-defined stages, each essential for meeting stringent power requirements and ensuring product durability.

1. Material Preparation

At this initial stage, raw materials such as copper-clad laminates for flexible printed circuit boards (FPCBs), resistors, LEDs, and power supply components are sourced and inspected. Material quality directly influences the electrical performance and longevity of LED strips. Suppliers often procure copper foils with precise thickness and purity to optimize conductivity and heat dissipation.

Key considerations during material prep include:

– Ensuring copper layers meet thickness standards for current capacity.

– Using high-quality phosphor coatings on LEDs to maintain color consistency.

– Selecting power supply components rated for stable DC output with minimal ripple.

2. Forming and Circuit Fabrication

This stage involves the fabrication of the flexible PCB, which forms the backbone of LED strips. Advanced photolithography and etching techniques shape copper traces with precision to handle specified current loads, directly impacting voltage drop and power efficiency.

Critical techniques include:

– Controlled etching to create uniform copper tracks sized for the required amperage.

– Application of solder mask layers to prevent short circuits and protect against environmental damage.

– Incorporation of segmented cutting lines and connection points for modularity.

3. Assembly and Soldering

LED chips, resistors, and other components are mounted on the FPCBs using automated pick-and-place machinery to ensure accuracy and repeatability. Soldering, typically via reflow ovens, secures components while maintaining electrical integrity.

Key process elements:

– Use of lead-free solder compliant with RoHS directives to ensure environmental safety.

– Precise temperature profiling during reflow to avoid thermal damage.

– Integration of power connectors and wiring harnesses designed to meet specific power input standards (12V, 24V DC).

4. Finishing and Protective Coating

To enhance durability, the assembled LED strips undergo protective treatments such as silicone encapsulation or polyurethane coating. These coatings safeguard against moisture, dust, and mechanical stress, which are critical in diverse international environments from humid tropical climates to arid desert regions.

Additional finishing steps:

– Application of adhesive backing with strong, temperature-resistant tapes suitable for varied installation surfaces.

– Quality marking and labeling for traceability and compliance verification.

Quality Assurance Frameworks and Standards

For international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe, understanding the quality assurance (QA) standards and certifications relevant to LED strip power requirements is vital to mitigate risks and ensure compliance.

Key International and Industry Standards

- ISO 9001: The foundational quality management system standard ensures consistent manufacturing quality and continuous improvement. Suppliers certified to ISO 9001 demonstrate robust process controls from raw material sourcing to final testing.

- CE Marking: Mandatory for products sold in the European Economic Area (EEA), CE certification verifies conformity with health, safety, and environmental protection standards, including electrical safety for LED components.

- RoHS Compliance: Restricts hazardous substances, essential for environmentally conscious buyers and those adhering to EU regulations.

- UL and ETL Certifications: Common in North America but increasingly recognized worldwide, these certifications attest to electrical safety and product reliability.

- API and Regional Standards: Some markets, particularly in the Middle East and parts of Africa, may require compliance with local or regional power and safety standards; verifying supplier adherence is critical.

Quality Control Checkpoints in Manufacturing

Effective QC integrates multiple checkpoints throughout the manufacturing cycle to detect defects early and maintain product integrity.

- Incoming Quality Control (IQC): Raw materials and components undergo stringent inspection for dimensional accuracy, electrical properties, and defect rates before entering production.

- In-Process Quality Control (IPQC): Continuous monitoring during assembly—such as solder joint inspections, component placement accuracy, and electrical continuity tests—ensures process consistency.

- Final Quality Control (FQC): Finished LED strips are subjected to comprehensive tests, including:

- Electrical load testing to verify current draw and voltage stability.

- Voltage drop measurement across the strip length.

- Thermal imaging to detect hotspots or potential failure points.

- Visual inspection for soldering defects, coating uniformity, and labeling accuracy.

- Environmental stress tests such as humidity and temperature cycling to simulate real-world operating conditions.

Common Testing Methods for LED Strip Power Requirements

B2B buyers should prioritize suppliers who employ rigorous testing protocols aligned with international best practices:

- Electrical Load and Power Consumption Testing: Confirms that LED strips draw current within specified limits and that power supplies deliver stable DC voltage under varying loads.

- Voltage Drop Analysis: Ensures wiring and copper trace design meet power delivery requirements without significant brightness loss.

- Insulation Resistance and Dielectric Strength Testing: Validates safety against electrical leakage and short circuits.

- Thermal Performance Testing: Assesses heat dissipation effectiveness, critical for maintaining LED lifespan and preventing fire hazards.

- EMC (Electromagnetic Compatibility) Testing: Ensures the product does not interfere with other electronic devices, important in commercial installations.

Verifying Supplier Quality Assurance: Best Practices for B2B Buyers

For buyers from diverse regions such as Africa, South America, the Middle East, and Europe, verifying a supplier’s quality assurance capabilities requires a proactive approach:

- Factory Audits: Conduct or commission on-site inspections to review manufacturing processes, QC systems, and workforce training. Audits should verify compliance with ISO 9001 and relevant certifications.

- Request Detailed QC Reports: Suppliers should provide test data and certification documents for each production batch, including electrical and environmental test results.

- Third-Party Inspections: Engage independent laboratories or inspection agencies to perform sampling and testing, ensuring unbiased quality verification.

- Sample Testing: Obtain product samples for in-house testing or third-party labs to validate performance claims before large-scale procurement.

- Review Traceability and Documentation: Confirm that products have proper labeling, batch numbers, and compliance documentation that meet importing country requirements.

QC and Certification Nuances for International Buyers

International buyers must navigate varying regulatory landscapes and environmental conditions that influence LED strip power requirements:

- Climate Adaptation: Suppliers should demonstrate that their LED strips and power components have been tested for conditions prevalent in target markets, such as high humidity in tropical Africa or high temperatures in Middle Eastern deserts.

- Voltage and Power Compatibility: Confirm that power supplies and wiring conform to local electrical standards, including voltage tolerances and wiring codes.

- Import Regulations: Some regions require additional certifications or testing upon import; collaborating with suppliers experienced in these markets can streamline compliance.

- After-Sales Support and Warranty: Quality assurance extends beyond manufacturing; ensure the supplier offers robust warranty terms and technical support tailored to your region’s operational challenges.

By thoroughly understanding the manufacturing processes, quality assurance protocols, and regional certification requirements, B2B buyers can make informed procurement decisions that guarantee LED strip installations meet stringent power requirements and operational reliability across diverse international markets.

Related Video: Inside LEDYi LED Strip Factory | Full Manufacturing Process by Leading LED Strip Manufacturer

Comprehensive Cost and Pricing Analysis for led strip power requirements Sourcing

Breakdown of Cost Components in LED Strip Power Requirements

When sourcing LED strip power solutions, understanding the cost structure is critical for international B2B buyers aiming to optimize procurement budgets and ensure reliable project outcomes.

- Materials: This includes copper wiring, LED drivers, connectors, insulation, and housing components. Copper prices fluctuate globally and heavily influence costs. Higher-grade materials such as oxygen-free copper or enhanced insulation for hot climates (e.g., Middle East) add to expenses but improve durability.

- Labor: Skilled labor for assembly, soldering, and quality checks contributes to the cost. Regions with higher labor costs (e.g., Europe) typically reflect this in pricing, whereas manufacturers in Asia or South America may offer competitive rates.

- Manufacturing Overhead: Factory utilities, equipment depreciation, and indirect labor impact the unit cost. Efficient production lines with automation reduce overhead per unit.

- Tooling: Custom molds, jigs, or connectors for specialized LED strips or wiring configurations require upfront investment, amortized over production volume.

- Quality Control (QC): Rigorous testing for voltage compliance, thermal safety, and longevity is essential, especially for commercial-grade installations. Higher QC standards increase cost but reduce warranty claims and failures.

- Logistics: Freight, customs, and local distribution costs vary significantly by region. Buyers in Africa, South America, or remote Middle Eastern locations should account for longer shipping routes and possible import duties.

- Margin: Suppliers add a profit margin, influenced by market competition, order size, and relationship strength with buyers.

Key Price Influencers for LED Strip Power Solutions

Several factors directly affect pricing and should be carefully evaluated during supplier negotiations:

- Order Volume and Minimum Order Quantity (MOQ): Larger volumes drastically reduce unit costs. Buyers from emerging markets can benefit from consolidating orders or partnering with distributors to meet MOQs.

- Specifications and Customization: Custom wire gauges, special connectors, or tailored power supplies increase tooling and labor costs. Standardized products usually offer better pricing and faster lead times.

- Material Quality and Certifications: Compliance with international standards (e.g., CE, RoHS, UL) adds cost but is critical for markets in Europe and the UAE, ensuring safety and regulatory approval.

- Supplier Location and Reliability: Proximity to major shipping hubs reduces logistics costs. Established suppliers with proven track records often command premium pricing but minimize risks.

- Incoterms: Understanding trade terms (FOB, CIF, DDP) affects total landed cost. Buyers should negotiate terms that optimize control over shipping and customs clearance to manage expenses efficiently.

Actionable Buyer Tips for International B2B Procurement

- Negotiate on Total Cost of Ownership (TCO), Not Just Unit Price: Consider installation, maintenance, and energy consumption costs. Investing in higher-quality power components can reduce long-term expenses, especially in hot or humid climates common in Africa and the Middle East.

- Leverage Volume Aggregation: Collaborate with regional partners or industry groups to pool demand, achieving better pricing and more favorable MOQs.

- Request Detailed Cost Breakdowns: Transparent supplier quotations help identify cost-saving opportunities, such as alternative materials or simplified wiring designs.

- Prioritize Suppliers with Local Support or Warehousing: This reduces lead times and import-related delays, crucial for dynamic markets in South America and Southeast Asia.

- Understand Pricing Nuances by Region: Logistics and duties can add 10-30% to base prices in some African and South American countries. Factor these into your budget early.

- Use Online Calculators and Technical Tools: Employ power requirement calculators to precisely size power supplies and wiring, avoiding costly over-specification or underperformance risks.

- Verify Certifications and Warranty Terms: Ensure products meet local electrical standards and come with sufficient warranty coverage to safeguard your investment.

Disclaimer on Pricing Information

Prices for LED strip power components vary widely depending on market conditions, supplier capabilities, and geopolitical factors. The guidance provided serves as a general framework to assist in cost evaluation and negotiation. Buyers should conduct direct supplier consultations and request up-to-date quotations tailored to their specific project requirements and regional considerations.

Spotlight on Potential led strip power requirements Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led strip power requirements’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led strip power requirements

Critical Technical Properties for LED Strip Power Requirements

Understanding the technical specifications of LED strips and their power needs is essential for B2B buyers to ensure reliable, safe, and efficient installations. Here are key properties to consider:

-

Voltage Rating (12V or 24V DC)

LED strips typically operate at low-voltage direct current, most commonly 12V or 24V. This rating dictates the type of power supply required and impacts wiring design. For international buyers, confirming the voltage compatibility with local power infrastructure and regulatory standards is crucial to avoid costly mismatches and ensure system longevity. -

Power Consumption (Watts per Meter)

This specifies how much power the LED strip consumes per unit length. It directly influences the total power supply capacity and wire gauge needed. Accurate power consumption data helps buyers calculate the total load, ensuring the chosen power supply can handle the demand without overheating or voltage drops. -

Current Draw (Amperes)

Derived from power consumption and voltage, current draw determines the thickness (gauge) of wires and connectors. Undersized wiring can cause excessive voltage drop, heat buildup, and safety hazards. For B2B buyers, specifying current requirements upfront ensures compliance with electrical codes and reduces maintenance costs. -

Material Grade and Thermal Management

The quality of materials—especially the copper content in wiring and the thermal conductivity of the LED strip base—affects durability and heat dissipation. High-grade materials reduce the risk of failure in harsh environments common in regions like the Middle East or Africa, where temperature extremes are frequent. -

Tolerance and Voltage Drop Limits

Tolerance indicates acceptable variation in voltage or power output, typically within ±5%. Voltage drop over long wire runs can reduce brightness and cause uneven lighting. Knowing these tolerances allows buyers to specify appropriate wiring lengths and power injection points, avoiding performance degradation in commercial projects. -

Ingress Protection (IP) Rating

The IP rating defines the LED strip’s resistance to dust and moisture (e.g., IP65, IP67). This is critical for outdoor or industrial applications prevalent in many emerging markets. Selecting LED strips with suitable IP ratings ensures compliance with local safety standards and reduces failure risks.

Key Industry and Trade Terminology for LED Strip Power Procurement

Navigating international B2B transactions involves familiarity with common trade terms and industry jargon. Below are essential terms for buyers to understand:

-

OEM (Original Equipment Manufacturer)

Refers to companies that produce LED strips or components that other brands sell under their own name. Buying OEM products can offer cost advantages and customization options. International buyers should clarify whether they are purchasing OEM or branded products to align with quality and warranty expectations. -

MOQ (Minimum Order Quantity)

The smallest amount of product a supplier is willing to sell in one order. MOQs impact inventory management and cash flow, especially for buyers in developing markets. Negotiating MOQs that fit demand and storage capacity is vital for operational efficiency. -

RFQ (Request for Quotation)

A formal process where buyers ask suppliers for pricing, lead times, and terms based on specified product requirements. A detailed RFQ ensures accurate quotes and helps compare suppliers on a level playing field, critical for cross-border procurement. -

Incoterms (International Commercial Terms)

Standardized trade terms (e.g., FOB, CIF, DDP) that define responsibilities for shipping, insurance, and customs between buyers and sellers. Understanding Incoterms prevents disputes and clarifies cost allocation, especially important for buyers importing LED strips into regions with complex customs regulations. -

Voltage Drop

A common electrical term referring to the reduction in voltage as electricity travels through wires. Excessive voltage drop can lead to dim LEDs and inefficiency. Buyers should request voltage drop specifications to ensure wiring and power supply choices meet project requirements. -

Power Injection

The technique of adding power supply connections at intervals along long LED strip runs to maintain consistent brightness. This is a critical design consideration in commercial installations and helps avoid uneven lighting and premature component failure.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions that optimize LED strip performance, ensure regulatory compliance, and streamline procurement processes across diverse markets such as Africa, South America, the Middle East, and Europe.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led strip power requirements Sector

Market Overview & Key Trends

The global market for LED strip power requirements is rapidly evolving, driven by growing demand for energy-efficient lighting solutions across commercial, industrial, and residential sectors. International B2B buyers, especially from regions like Africa, South America, the Middle East, and Europe, are increasingly prioritizing LED strip installations due to their superior longevity, low power consumption, and flexible application possibilities. Countries such as the UAE and Indonesia are witnessing significant infrastructure development, fueling demand for reliable, scalable LED lighting systems that can accommodate varying power needs.

Key market dynamics include a shift towards higher-voltage (24V) LED strips in commercial projects to support longer runs with reduced voltage drop and improved brightness consistency. Parallel wiring configurations and centralized power distribution have become industry standards for complex installations, ensuring system reliability and ease of maintenance. Additionally, the integration of smart controls and dimmable drivers is reshaping sourcing criteria, with buyers seeking adaptable power supplies compatible with IoT and building automation systems.

Sourcing trends reveal a preference for suppliers offering comprehensive technical support, including wire gauge recommendations, power supply calculators, and custom connection solutions. For B2B buyers in emerging markets, the ability to source high-quality components that comply with international safety standards (such as IEC and UL certifications) is critical. Moreover, supply chain agility is paramount due to fluctuating raw material costs and geopolitical factors affecting global logistics.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a decisive factor in the procurement of LED strip power components. The environmental impact of lighting systems extends beyond energy consumption to include manufacturing processes, material sourcing, and end-of-life disposal. B2B buyers are increasingly demanding power supplies and wiring accessories that feature eco-friendly materials, such as halogen-free cables and recyclable metal components, to minimize ecological footprints.

Ethical sourcing is equally important, with companies scrutinizing their supply chains for compliance with labor standards, conflict-free materials, and transparent environmental policies. Certifications like RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), and Energy Star provide assurance of compliance with stringent environmental and safety requirements. Buyers from Europe and the Middle East often require suppliers to adhere to such standards to align with regional regulations and corporate sustainability goals.

Furthermore, adopting LED systems with optimized power requirements reduces energy waste and lowers operational costs—an attractive proposition for markets with high energy tariffs or unstable power grids. Sustainable sourcing also enhances brand reputation and supports long-term business resilience, making it a strategic priority for international buyers aiming to future-proof their lighting investments.

Evolution of LED Strip Power Solutions

The development of LED strip power solutions has progressed from simple, low-voltage DC power supplies to sophisticated, modular systems designed for commercial scalability and smart integration. Early LED strips primarily operated at 12V with short run lengths due to significant voltage drop issues. As demand for longer, brighter, and more complex lighting configurations grew, 24V systems gained prominence, enabling runs up to 20 meters or more with reduced power loss.

Concurrently, power supply technology has evolved to include dimmable drivers, multi-channel controllers for RGB and tunable white strips, and enhanced protection features like overload and short circuit safeguards. These innovations have made LED strips suitable for diverse applications, from retail displays to architectural lighting. Today’s B2B buyers benefit from detailed technical resources and calculators that simplify power load estimations and wire gauge selection, ensuring optimal system design and energy efficiency.

This evolution reflects broader industry trends emphasizing reliability, customization, and sustainability—key considerations that international buyers must evaluate when sourcing LED strip power components in a competitive global marketplace.

Related Video: Incoterms for beginners | Global Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of led strip power requirements

-

How can I effectively vet LED strip power suppliers for international B2B purchases?

To ensure reliability, evaluate suppliers based on certifications like CE, RoHS, and UL that confirm product safety and quality compliance. Request detailed technical datasheets and test reports for their LED power supplies. Check their production capacity and history with export markets similar to your region (Africa, South America, Middle East, Europe). Verify references or case studies of past B2B projects, especially those requiring customized power solutions. Additionally, assess their communication responsiveness and after-sales support infrastructure to mitigate risks in cross-border transactions. -

What customization options are typically available for LED strip power requirements in B2B orders?

Customizations often include voltage specifications (12V, 24V), wattage capacity, connector types, cable lengths, and protection features such as over-voltage and short-circuit safeguards. Many suppliers offer tailored power supply units to meet unique installation environments or integration with smart control systems (dimming, RGB control). For international buyers, confirm the supplier’s ability to adapt product designs to local electrical standards and environmental conditions, such as high ambient temperatures common in the Middle East or humid climates in South America. -

What are common minimum order quantities (MOQs) and lead times for LED strip power supplies in international B2B transactions?

MOQs can vary widely depending on supplier scale and product complexity, typically ranging from 100 to 1000 units per SKU. Lead times often span 4 to 8 weeks, including production and quality assurance testing. For customized or certified products, expect longer lead times. To optimize procurement, negotiate MOQs aligned with your project size and inquire about sample availability for pre-order testing. Planning ahead for shipping and customs clearance is critical to avoid delays, especially when importing to regions with stringent import regulations. -

Which payment terms are standard for international B2B buyers of LED strip power supplies?

Common payment methods include Letters of Credit (L/C), Telegraphic Transfers (T/T), and increasingly, escrow or trade finance platforms for secure transactions. Suppliers typically require a 30%-50% deposit upfront, with the balance payable before shipment or upon delivery. Negotiating flexible terms may be possible with established partners or for large-volume orders. Always confirm currency exchange implications and banking fees, especially for buyers in Africa or South America, where foreign exchange controls can affect payment timing. -

What quality assurance measures should I insist on for LED strip power products?

Demand suppliers implement rigorous in-process quality control and final product testing, including electrical safety tests, load testing, and thermal performance assessments. Certifications from recognized bodies (e.g., CE for Europe, UL for North America, SABS for South Africa) are essential. Request batch-specific quality reports and consider third-party inspection services for large orders. For regions with unstable power grids, inquire about surge protection features and warranty terms covering performance under voltage fluctuations.

Illustrative Image (Source: Google Search)

-

How do logistics and shipping considerations impact international procurement of LED strip power supplies?

LED power supplies are classified as electronic components and usually ship as general cargo; however, fragile packaging and protection against moisture are vital. Opt for suppliers experienced in exporting to your region to ensure compliance with customs documentation and standards. Factor in transit times, potential customs delays, and local distribution infrastructure in Africa, South America, or the Middle East. Using freight forwarders familiar with your market can reduce risks and costs. Consider consolidated shipments if sourcing multiple components. -

What steps can mitigate disputes or quality issues after receiving LED strip power supplies internationally?

Establish clear contractual terms covering product specifications, inspection criteria, and warranty policies before purchase. Use detailed purchase orders referencing technical standards and certifications. Upon receipt, conduct thorough incoming inspections or third-party testing promptly. Maintain open communication channels with suppliers for rapid resolution of defects or discrepancies. Retain documentation of all communications and quality records to support claims. For high-value orders, consider trade credit insurance or escrow arrangements to protect financial interests. -

Are there regional electrical standards or certifications that should influence my choice of LED strip power supplies?

Yes, regional compliance is critical for legal operation and safety. Europe mandates CE marking and RoHS compliance, while the Middle East may require SASO certification (Saudi Arabia) or GSO (Gulf Cooperation Council). South American countries often reference IEC standards but may have local certifications such as INMETRO in Brazil. Africa varies widely; South Africa follows SANS standards, whereas other countries may accept international certifications. Ensure suppliers provide documentation matching your target market’s requirements to avoid customs issues and ensure product acceptance.

Illustrative Image (Source: Google Search)

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led strip power requirements

Effective management of LED strip power requirements is crucial for ensuring durable, efficient, and safe lighting solutions in commercial and industrial projects. Key takeaways for international B2B buyers include the importance of selecting appropriate voltage systems (12V vs. 24V), understanding the impact of wiring configurations on voltage drop and system reliability, and choosing the correct wire gauge tailored to current draw and installation length. Parallel wiring with centralized power distribution emerges as a best practice, especially for complex or extended runs, enhancing brightness consistency and simplifying maintenance.

Strategic sourcing plays a pivotal role in accessing high-quality components—power supplies, wiring materials, and connectors—that meet regional standards and environmental conditions. For buyers in Africa, South America, the Middle East, and Europe, partnering with experienced suppliers who offer technical support and customized solutions can significantly reduce installation risks and lifecycle costs.

Looking ahead, the growing demand for energy-efficient LED lighting across diverse markets calls for proactive sourcing strategies that emphasize scalability, compliance, and innovation. International buyers are encouraged to leverage detailed power requirement assessments and collaborate closely with manufacturers to optimize system design. Investing in these strategic sourcing insights today will position businesses to deliver superior lighting performance and unlock new market opportunities tomorrow.