Guide to Neon Flex Led Strip

- Introduction: Navigating the Global Market for neon flex led strip

- Understanding neon flex led strip Types and Variations

- Key Industrial Applications of neon flex led strip

- Strategic Material Selection Guide for neon flex led strip

- In-depth Look: Manufacturing Processes and Quality Assurance for neon flex led strip

- Comprehensive Cost and Pricing Analysis for neon flex led strip Sourcing

- Spotlight on Potential neon flex led strip Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for neon flex led strip

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the neon flex led strip Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of neon flex led strip

- Strategic Sourcing Conclusion and Outlook for neon flex led strip

Introduction: Navigating the Global Market for neon flex led strip

In today’s fast-evolving lighting industry, neon flex LED strips have emerged as a transformative solution that combines aesthetic appeal with advanced functionality. For international B2B buyers across Africa, South America, the Middle East, and Europe, these versatile lighting products offer a compelling alternative to traditional neon, delivering superior energy efficiency, flexibility, and durability. Whether for commercial signage, architectural accents, or retail environments, neon flex LED strips are redefining how businesses illuminate spaces and engage customers.

This comprehensive guide is designed to empower professional buyers with deep insights into every critical aspect of sourcing neon flex LED strips. It covers a broad spectrum—from understanding the various types, materials, and manufacturing processes to mastering quality control standards and supplier evaluation. You will also find detailed analysis of cost structures, minimum order quantities (MOQs), and customization options that influence pricing and procurement strategies.

By highlighting market trends and regional considerations relevant to key markets such as South Africa and Saudi Arabia, this guide provides actionable knowledge to optimize purchasing decisions. It also addresses frequently asked questions, helping buyers navigate common challenges and avoid costly pitfalls.

Armed with this resource, B2B buyers can confidently identify reliable manufacturers, negotiate favorable terms, and secure high-quality neon flex LED strips tailored to their specific project needs—ensuring competitive advantage and sustainable growth in a dynamic global marketplace.

Understanding neon flex led strip Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Side-Bending Neon Flex | Flexible silicone profile allowing bends on the side axis | Outdoor signage, architectural outlines | Pros: Versatile bending; Cons: Slightly higher MOQ, delicate bends |

| Top-Bending Neon Flex | Silicone casing designed to bend on top axis | Indoor décor, retail displays | Pros: Easy installation on flat surfaces; Cons: Limited bending directions |

| Free-Bending Neon Flex | Highly flexible with 360° bending capability | Custom shapes, artistic lighting installations | Pros: Maximum flexibility; Cons: Higher cost, complex installation |

| Tube-Sleeved Neon Flex | Encased in a protective tube offering IP65 water resistance | Outdoor, wet environments, event lighting | Pros: Durable, weatherproof; Cons: Bulkier, less flexible |

| Miniature Neon Flex | Slim profile LED strip with compact silicone casing | Tight spaces, intricate designs, backlighting | Pros: Space-saving; Cons: Lower brightness, limited power options |

Side-Bending Neon Flex

Side-bending neon flex LED strips are designed with a silicone profile that allows bending primarily along the strip’s side axis. This makes them ideal for applications like outdoor signage and architectural outlines where smooth curves and sharp edges are required. For B2B buyers, the main consideration is the MOQ, which tends to be moderate due to the specialized extrusion process. The flexibility allows for diverse design options but requires careful handling to avoid damage during installation.

Top-Bending Neon Flex

Top-bending neon flex types feature a silicone casing optimized for bending over the top axis, making them well-suited for indoor décor and retail display installations. These strips are easier to install on flat or gently curved surfaces, which appeals to businesses focused on quick deployment and consistent aesthetics. Buyers should note that while installation is straightforward, the bending is limited to one plane, so complex shapes may require alternative solutions.

Free-Bending Neon Flex

Offering the greatest flexibility, free-bending neon flex LED strips can be bent 360°, enabling intricate and creative lighting designs. This type is preferred for custom signage, artistic lighting, and event setups where unique shapes are essential. From a procurement standpoint, free-bending strips often come at a premium price and may have higher MOQs due to manufacturing complexity. Buyers should ensure their suppliers provide technical support for installation and customization.

Tube-Sleeved Neon Flex

Tube-sleeved neon flex strips are encased in a robust protective tube, typically rated IP65, making them highly resistant to water and dust. This variant is ideal for outdoor and wet environment applications such as event lighting and exterior architectural highlights. The trade-off for durability is reduced flexibility and a bulkier profile. For B2B buyers targeting harsh environments, investing in tube-sleeved neon flex ensures longevity but requires consideration of installation space and mounting methods.

Miniature Neon Flex

Miniature neon flex LED strips feature a slim silicone casing designed for installation in tight or intricate spaces. They are commonly used for backlighting, accent lighting, and detailed signage where space constraints exist. While they save space and allow subtle lighting effects, these strips usually have lower brightness and fewer power options. Buyers should evaluate project requirements carefully to balance compactness with illumination needs and ensure compatibility with existing power supplies.

Related Video: How to Cut and Connect Led Neon strip Flexible Strip Light | Neon Home Decor | RGB | Rope Light |

Key Industrial Applications of neon flex led strip

| Industry/Sector | Specific Application of neon flex led strip | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Hospitality | Storefront and interior accent lighting | Enhances brand visibility and customer experience; energy-efficient and durable | Weatherproofing (IP65/IP68), color customization, flexible MOQ options |

| Architecture & Construction | Architectural contour and façade lighting | Highlights building features with modern aesthetics; long-lasting outdoor use | UV resistance, robust casing materials, compliance with local regulations |

| Events & Entertainment | Stage and event decorative lighting | Creates immersive, dynamic lighting effects; easy installation and reconfiguration | Flexibility in bending, color range, power compatibility |

| Advertising & Signage | Illuminated signs, logos, and channel letters | Provides vibrant, uniform lighting with lower maintenance costs | Brightness levels, cutting and connection ease, warranty support |

| Transportation & Infrastructure | Safety and decorative lighting in tunnels, walkways | Improves safety with continuous illumination; low energy consumption | High durability, waterproof rating, compliance with safety standards |

Retail & Hospitality

In retail stores, hotels, and restaurants, neon flex LED strips are widely used to create captivating storefront displays and interior accent lighting. These strips enable businesses to attract customers through vibrant, continuous illumination that mimics traditional neon but with greater energy efficiency and durability. For international buyers in Africa, South America, the Middle East, and Europe, sourcing weatherproof and customizable LED neon flex is essential to ensure longevity in diverse climates. Flexible MOQs and color options help businesses tailor lighting to brand identity while controlling upfront investment.

Architecture & Construction

Architects and construction firms leverage neon flex LED strips to accentuate building contours, facades, and interior design elements. These lights provide a sleek, modern aesthetic that enhances the visual impact of structures while being robust enough for outdoor exposure. Buyers from regions such as South Africa and Saudi Arabia must prioritize UV-resistant materials and ensure compliance with local electrical and safety regulations. High-quality silicone or PVC casings that withstand harsh weather conditions are critical to maintain performance and reduce maintenance costs.

Events & Entertainment

Event organizers and entertainment venues use neon flex LED strips for stage design, decorative lighting, and immersive atmospheres. The strips’ flexibility allows for creative lighting configurations that can be quickly installed and reconfigured for different events, making them ideal for dynamic environments. International buyers should focus on products with wide color ranges, easy connectivity, and compatibility with various power supplies to meet diverse event requirements and regional standards.

Advertising & Signage

For outdoor and indoor signage, neon flex LED strips offer a cost-effective, eye-catching alternative to traditional neon. Businesses benefit from uniform, bright illumination that enhances brand visibility while lowering maintenance and energy costs. B2B buyers in South America, Europe, and the Middle East should consider LED strips with high brightness, ease of cutting and soldering, and reliable warranty terms to ensure signage longevity and operational continuity.

Transportation & Infrastructure

In transportation hubs, tunnels, and pedestrian walkways, neon flex LED strips serve dual purposes of safety and decoration. Continuous illumination improves visibility and guides traffic flow, while their low energy consumption supports sustainable infrastructure goals. Buyers from all targeted regions must source products with high durability, waterproof ratings (IP68), and compliance with safety standards to ensure reliability in demanding environments and harsh weather conditions.

Related Video: Make DIY LED Neon Strip with new flex silicone tube

Strategic Material Selection Guide for neon flex led strip

When selecting materials for neon flex LED strips, understanding the properties, advantages, and limitations of common casing and structural materials is essential for international B2B buyers. This ensures optimal product performance, durability, and compliance with regional standards across diverse markets such as Africa, South America, the Middle East, and Europe.

Silicone

Key Properties: Silicone is prized for its excellent flexibility, high temperature resistance (typically -60°C to 200°C), UV stability, and strong resistance to weathering and ozone. It also provides good electrical insulation and is chemically inert, making it resistant to many corrosive agents.

Pros & Cons: Silicone offers superior durability and flexibility, making it ideal for complex bending and outdoor applications. It maintains clarity and softness over time, ensuring consistent light diffusion. However, it is generally more expensive than alternatives and requires specialized extrusion processes, which can increase manufacturing complexity and lead times.

Impact on Application: Silicone casings are highly suitable for outdoor signage, architectural lighting, and environments with harsh weather or chemical exposure. Their UV resistance is particularly advantageous in sunny regions like South Africa and Saudi Arabia. Silicone’s flexibility also supports intricate designs common in retail and event lighting.

Regional Considerations: Buyers in Europe and the Middle East often prioritize compliance with stringent standards such as RoHS, CE, and UL, which silicone materials readily meet. In Africa and South America, the material’s durability against heat and humidity is a key selling point. However, the higher cost may require negotiation for bulk pricing or consideration of alternative materials for budget-sensitive projects.

PVC (Polyvinyl Chloride)

Key Properties: PVC is a widely used thermoplastic with good mechanical strength, moderate flexibility, and decent chemical resistance. It typically withstands temperatures from -20°C to 60°C and offers reasonable UV resistance when specially formulated.

Pros & Cons: PVC is cost-effective and easier to process, making it attractive for large volume orders with tighter budgets. However, it is less flexible and less durable under prolonged UV exposure compared to silicone. Over time, PVC may become brittle or yellow, especially in high-heat or outdoor conditions.

Impact on Application: PVC is suitable for indoor applications such as home décor and retail lighting where environmental stressors are minimal. It can also be used in short-term event lighting or indoor signage. For outdoor use in hot climates, PVC’s limitations on UV and heat resistance should be carefully considered.

Regional Considerations: In regions like South America and parts of Africa, where cost sensitivity is higher and indoor applications dominate, PVC is often preferred. Buyers should verify compliance with local environmental regulations and standards like ASTM or DIN to ensure safety and quality. PVC’s recyclability is also an increasingly important factor in European markets.

Polyurethane (PU)

Key Properties: Polyurethane offers excellent abrasion resistance, good elasticity, and moderate temperature tolerance (-40°C to 90°C). It also provides strong resistance to oils, solvents, and some chemicals, along with good UV stability depending on formulation.

Pros & Cons: PU balances flexibility and toughness, making it suitable for applications requiring mechanical durability. It is more resistant to physical wear than PVC but generally less heat-resistant than silicone. Manufacturing PU casings can be more complex due to curing processes.

Impact on Application: PU is ideal for industrial or commercial environments where mechanical stress or chemical exposure is a concern, such as in architectural lighting on building exteriors or in retail spaces with high foot traffic. It also performs well in moderate climates found in Europe and the Middle East.

Regional Considerations: Buyers in the Middle East and Europe may favor PU for its durability and compliance with safety standards like RoHS and CE. In African and South American markets, PU’s moderate cost and resistance to wear make it a competitive option for commercial lighting projects, though buyers should confirm supplier quality assurance.

Transparent PVC (Tube Sleeved)

Key Properties: Transparent PVC used in tube sleeving offers clarity for light diffusion and protection, with moderate flexibility and resistance to moisture. Temperature tolerance is similar to standard PVC, generally between -20°C and 60°C.

Pros & Cons: This material allows for easy insertion of LED strips and provides a clean, uniform light output. It is cost-effective and simpler to manufacture compared to integrated extrusion silicone. However, it is less durable in outdoor or high-temperature environments and may degrade faster under UV exposure.

Impact on Application: Transparent PVC tubes are commonly used for indoor signage, decorative lighting, and applications where cost control is critical. They are less suitable for harsh outdoor environments or regions with extreme temperature fluctuations.

Regional Considerations: For buyers in Africa and South America focusing on indoor or short-term projects, transparent PVC tubes offer an affordable solution. European and Middle Eastern buyers should assess UV exposure and temperature requirements carefully before selecting this material. Compliance with local fire safety and environmental standards remains important.

| Material | Typical Use Case for neon flex led strip | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Silicone | Outdoor signage, architectural lighting, event lighting | High flexibility, UV/weather resistant, durable | Higher cost, complex manufacturing | High |

| PVC | Indoor décor, retail lighting, short-term event lighting | Cost-effective, easy to process | Lower UV/heat resistance, may yellow or become brittle | Low |

| Polyurethane (PU) | Industrial/commercial lighting, exterior architectural applications | Good abrasion resistance, chemical resistant | Moderate heat tolerance, manufacturing complexity | Medium |

| Transparent PVC (Tube Sleeved) | Indoor signage, decorative lighting, budget-conscious projects | Clear light diffusion, affordable | Less durable outdoors, limited heat/UV resistance | Low |

In-depth Look: Manufacturing Processes and Quality Assurance for neon flex led strip

The manufacturing of neon flex LED strips involves a series of precise, controlled stages designed to deliver a flexible, durable, and visually consistent lighting product. For international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe, understanding these production steps and quality assurance protocols is critical to making informed procurement decisions that align with their project requirements and regulatory environments.

Manufacturing Process Overview

1. Material Preparation

The foundation of neon flex LED strips begins with high-quality raw materials: flexible printed circuit boards (PCBs), LED chips, and protective silicone or PVC coatings. Suppliers source LED chips from reputable manufacturers, often opting for premium brands to ensure brightness and longevity. The silicone or PVC materials are selected based on their flexibility, UV resistance, and weatherproof qualities, crucial for outdoor or high-exposure applications common in regions like South Africa and Saudi Arabia.

2. LED Flexible Strip Formation

The LED chips are surface-mounted on flexible PCBs through automated SMT (Surface Mount Technology) lines. This process requires precision to maintain uniform spacing and solder quality, which ensures consistent light output and prevents premature failures. The flexible PCB is then tested electrically to verify correct connectivity and functionality before moving to the next stage.

3. Encapsulation and Extrusion

Once the LED strip is ready, it undergoes encapsulation by embedding it within a silicone or PVC sheath. Two main methods are prevalent:

-

Integrated Silicone Extrusion: The LED strip is passed through an extrusion machine where liquid silicone is molded around it in a continuous process. This technique enhances waterproofing and provides a smooth, uniform diffusion layer that mimics traditional neon aesthetics.

-

Manual Insertion: For smaller volumes or specialized designs, the LED strip is manually inserted into preformed silicone tubes. While less efficient, this method offers flexibility for custom shapes and smaller order quantities.

The choice of silicone type (milky white, transparent, or colored) affects light diffusion and color vibrancy. Manufacturers carefully balance diffusion additives to optimize brightness and uniformity.

4. Assembly and Finishing

After encapsulation, the strips are cut to specified lengths and fitted with connectors or end caps. Additional steps may include soldering power leads, adding mounting clips, or applying protective coatings for enhanced durability. The strips undergo final assembly checks to ensure mechanical integrity and aesthetic quality.

Quality Assurance (QA) and Quality Control (QC) Practices

For international buyers, robust QC protocols aligned with global standards are essential to guarantee product reliability and compliance with local regulations.

Relevant Standards:

– ISO 9001: This international standard governs quality management systems and is a hallmark of consistent manufacturing excellence. Suppliers certified to ISO 9001 demonstrate systematic process controls and continuous improvement.

– CE Marking: Mandatory for products sold within the European Economic Area, CE certification ensures conformity with EU safety, health, and environmental requirements.

– RoHS Compliance: Restricts hazardous substances in electrical products, critical for buyers in Europe and increasingly adopted globally.

– UL Certification: Important for North American markets but also valued worldwide as an indicator of safety and performance.

– IP Ratings (e.g., IP65, IP68): Define ingress protection against dust and water, crucial for outdoor or harsh environment installations typical in Middle Eastern and African climates.

QC Checkpoints:

– Incoming Quality Control (IQC): Raw materials such as LED chips, PCBs, and silicone compounds undergo thorough inspection to verify specifications and detect defects before production.

– In-Process Quality Control (IPQC): During assembly and extrusion, continuous monitoring ensures soldering quality, extrusion uniformity, and correct LED placement. Automated optical inspection (AOI) and electrical testing are common here.

– Final Quality Control (FQC): Completed neon flex strips are tested for electrical safety, luminous intensity, color consistency, and physical durability. Tests include high voltage withstand, bending/flex tests, and waterproof performance verification.

Common Testing Methods:

– Electrical Testing: Verifies voltage, current, and resistance to ensure LED arrays operate within safe parameters.

– Light Uniformity and Color Rendering: Spectrometers and lux meters measure consistency and color accuracy across the strip length.

– Environmental Stress Testing: Exposure to temperature cycling, UV radiation, and humidity simulates real-world conditions to confirm long-term reliability.

– Mechanical Testing: Flexibility and tensile strength tests ensure strips can withstand installation and operational stresses without damage.

How B2B Buyers Can Verify Supplier Quality

For buyers in diverse regions, ensuring supplier reliability goes beyond certifications. Here are effective strategies to validate QC:

- Factory Audits: Arrange on-site or third-party audits to review manufacturing processes, QC procedures, and working conditions. Audits help verify ISO 9001 adherence and assess equipment calibration and operator training.

- Request QC Documentation: Insist on receiving detailed QC reports, including raw material certificates, in-process inspection logs, and final test results. These documents provide transparency and traceability.

- Third-Party Inspection: Engage independent inspection agencies to perform random sampling and testing before shipment. This is especially valuable for bulk orders and high-value projects.

- Sample Testing: Obtain samples for in-house or local lab testing to verify product performance under expected environmental and electrical conditions.

QC and Certification Nuances for International Markets

Africa and Middle East:

Buyers in countries like South Africa and Saudi Arabia should prioritize IP-rated neon flex strips due to harsh climatic factors such as intense sunlight, dust, and humidity. Certifications demonstrating UV resistance and waterproofing are critical. Local electrical safety standards may also apply, so verifying supplier compliance with regional standards is advisable.

South America:

Due to diverse climates and emerging regulatory frameworks, buyers should focus on RoHS compliance and CE marking where applicable. Customs and import regulations may require specific documentation, so working with suppliers familiar with South American market entry can streamline procurement.

Europe:

European buyers face stringent regulations requiring CE certification, RoHS compliance, and often additional environmental certifications such as REACH. ISO 9001 certification is generally expected from suppliers. Emphasis on energy efficiency and sustainable manufacturing practices is growing.

In summary, a clear understanding of the neon flex LED strip manufacturing stages—from material selection to finishing—and rigorous quality assurance aligned with international standards is indispensable for B2B buyers. By leveraging factory audits, QC documentation, and third-party inspections, buyers across Africa, South America, the Middle East, and Europe can confidently source neon flex LED strips that meet performance expectations and regulatory requirements, ensuring successful project outcomes and long-term partnerships.

Related Video: Inside LEDYi LED Strip Factory | Full Manufacturing Process by Leading LED Strip Manufacturer

Comprehensive Cost and Pricing Analysis for neon flex led strip Sourcing

Understanding the cost structure and pricing dynamics of neon flex LED strips is critical for international B2B buyers aiming to optimize procurement strategies and maximize value. This analysis breaks down the essential cost components, key price influencers, and actionable buyer insights, particularly relevant for markets in Africa, South America, the Middle East, and Europe.

Key Cost Components in Neon Flex LED Strip Sourcing

-

Raw Materials:

The core materials include high-quality LED chips, flexible PCBs, and silicone or PVC casings. Premium-grade silicone enhances durability, UV resistance, and waterproofing but comes at a higher cost. The choice between milky white, transparent, or colored silicone also affects pricing due to differing diffusion and light transmission properties. -

Labor and Manufacturing Overhead:

Labor costs vary significantly by manufacturing location, impacting overall pricing. Advanced production techniques like integrated silicone extrusion require skilled labor and specialized machinery, increasing overhead but improving product consistency and lifespan. -

Tooling and Equipment:

Initial tooling, such as extrusion dies and assembly jigs, represents a fixed cost that manufacturers amortize over production volume. Customized profiles or bends elevate tooling expenses, which are reflected in higher unit prices, especially for small or medium orders. -

Quality Control (QC):

Rigorous QC processes, including electrical testing, waterproofing checks, and certification compliance (CE, RoHS, UL), add to production costs but ensure reliability, reducing long-term risks and warranty claims. -

Logistics and Shipping:

Freight charges, customs duties, and import taxes vary widely by destination. For buyers in regions like South Africa or Saudi Arabia, understanding Incoterms and optimizing shipment methods (e.g., sea freight vs. air freight) can significantly influence landed cost. -

Supplier Margin:

Manufacturers and distributors build margins based on market demand, competition, and service levels. Transparent negotiation can help buyers secure competitive pricing while maintaining quality standards.

Factors Influencing Neon Flex LED Strip Pricing

-

Order Volume and MOQ:

Bulk purchases generally reduce per-unit cost due to economies of scale. MOQ requirements vary from 50 to 500 meters depending on product specifications and customization, so aligning order size with MOQ thresholds can unlock better pricing. -

Product Specifications and Customization:

Custom colors, unique bending types (side, top, free bending), IP ratings (IP65, IP68), and special voltage or brightness levels increase complexity and cost. Buyers should balance customization needs with budget constraints. -

Material Quality and Certifications:

Certified products with branded LED chips and compliant silicone casings command premium prices but offer enhanced performance and market acceptance, crucial for commercial projects in regulated regions. -

Supplier Reliability and Support:

Established suppliers with strong after-sales service, warranty policies, and technical support may price higher but reduce total cost of ownership by minimizing downtime and replacements. -

Incoterms and Payment Terms:

The choice of Incoterms (FOB, CIF, DDP) affects who bears shipping risk and cost. Favorable payment terms (e.g., letters of credit, escrow) can help mitigate financial exposure in international transactions.

Practical Buyer Tips for International B2B Procurement

-

Negotiate MOQ Flexibility:

Especially for new or smaller-scale buyers in Africa or South America, requesting flexible MOQs or trial orders can reduce upfront investment and allow testing product quality before committing to larger volumes. -

Calculate Total Cost of Ownership (TCO):

Consider not only unit price but also installation complexity, energy consumption, product lifespan, and warranty coverage. Higher initial costs for premium neon flex strips can lead to lower operational expenses over time. -

Leverage Supplier Certifications:

Ensure suppliers provide relevant certifications (CE, RoHS, UL) to comply with local regulations and avoid customs clearance delays in Europe and Middle Eastern markets. -

Plan for Logistics and Customs:

Factor in shipping times and duties when scheduling projects. Consolidating shipments or partnering with freight forwarders familiar with your region can reduce unexpected costs. -

Request Transparent Pricing Breakdowns:

Ask suppliers for detailed quotations that separate material, labor, customization, and shipping costs. This transparency aids in negotiating and benchmarking offers. -

Consider After-Sales and Technical Support:

Prioritize suppliers offering installation guidance, troubleshooting, and warranty service, which can be invaluable for buyers operating in remote or developing markets.

Indicative Pricing Disclaimer

Prices for neon flex LED strips vary widely based on the factors outlined above. Typical wholesale prices range from approximately $10 to $30 per meter for standard products, with custom or high-specification models commanding higher rates. These figures serve as a guideline; buyers should obtain current quotations from multiple suppliers and factor in all associated costs to make informed purchasing decisions.

By comprehensively analyzing cost drivers and market factors, B2B buyers in Africa, South America, the Middle East, and Europe can strategically source neon flex LED strips that meet quality, budget, and project requirements, ensuring competitive advantage and long-term satisfaction.

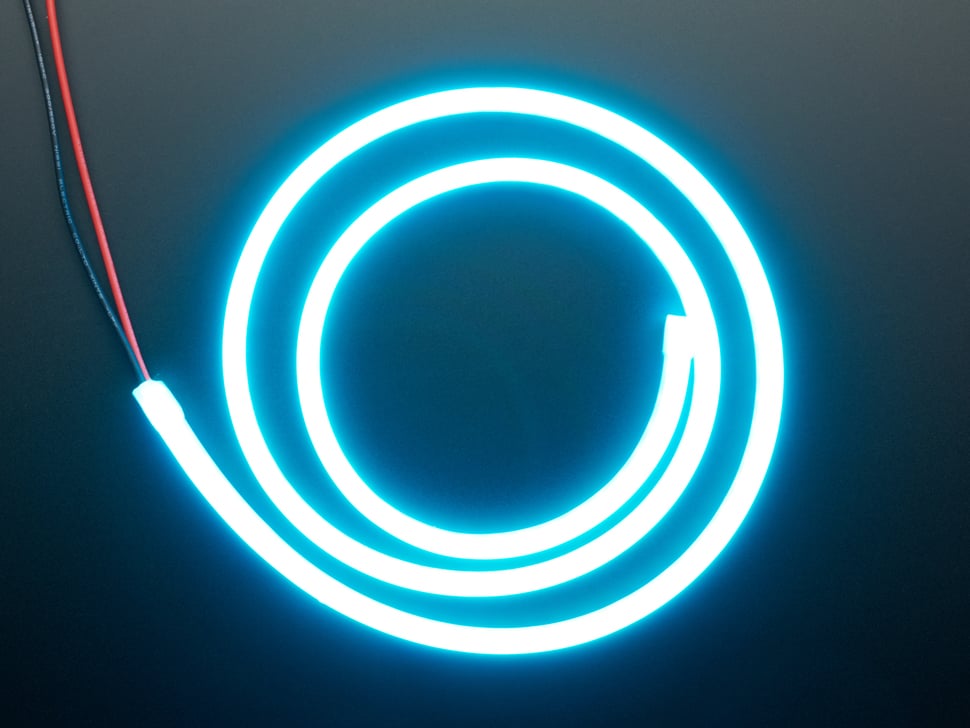

Illustrative Image (Source: Google Search)

Spotlight on Potential neon flex led strip Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘neon flex led strip’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for neon flex led strip

Critical Technical Properties of Neon Flex LED Strip

1. Material Grade (Silicone/PVC/PU)

The outer casing of neon flex LED strips is typically made from silicone, PVC, or polyurethane (PU). High-grade silicone offers superior flexibility, UV resistance, and weatherproofing, making it ideal for outdoor and harsh environment applications. For B2B buyers, selecting the right material grade ensures durability and longevity, reducing maintenance costs and enhancing project reliability.

2. IP Rating (Ingress Protection)

IP ratings such as IP65, IP67, or IP68 indicate the strip’s resistance to dust and water. IP65 is suitable for splash-proof indoor/outdoor use, while IP68 offers full waterproofing for submersion. Knowing the IP rating is crucial for buyers targeting outdoor signage or architectural lighting in humid or rainy regions like South Africa or Saudi Arabia, ensuring compliance with local environmental demands.

3. Bending Type and Radius

Neon flex strips come with different bending capabilities: side bending, top bending, or free bending. The minimum bending radius affects installation flexibility and design complexity. For example, side bending strips allow tight curves on one plane, ideal for signage, while free bending supports 360° shaping for creative architectural effects. Understanding bending types helps buyers specify the right product for their application, preventing installation issues.

4. Voltage and Power Consumption

Most neon flex LED strips operate at 12V or 24V DC. Power consumption (watts per meter) affects energy efficiency and power supply requirements. Lower wattage strips reduce operating costs, a key consideration for large-scale commercial projects in energy-conscious markets. Buyers should verify voltage compatibility with their existing electrical infrastructure and confirm power needs to avoid overspending on power supplies.

5. Light Diffusion and Brightness Uniformity

The silicone or PVC casing diffuses light to create a smooth, continuous glow without visible hotspots or gaps. High-quality diffusion ensures consistent brightness along the strip length, critical for premium signage and decorative lighting where visual appeal directly impacts brand image. Buyers should request samples or photometric data to assess light quality before bulk purchasing.

6. Tolerance and Cutting Segments

Tolerance refers to the precision in dimensions and electrical parameters. Standard cutting segments typically range from 50 to 100 mm, allowing customization of strip length on-site. Precise tolerance and clearly marked cutting points help reduce waste and simplify installation, which is particularly important in projects with complex designs or custom lengths.

Key Industry and Trade Terms for Neon Flex LED Strip Buyers

OEM (Original Equipment Manufacturer)

Refers to manufacturers who produce LED neon strips that can be rebranded or customized for a buyer’s unique specifications. OEM services allow buyers to differentiate their products through custom colors, logos, or packaging, enhancing market competitiveness especially in regions with growing LED lighting demand.

MOQ (Minimum Order Quantity)

The smallest quantity a supplier will accept per order. MOQs vary widely depending on product complexity and customization level. Understanding MOQ is critical for budgeting and inventory planning, particularly for buyers in emerging markets who may want to start with smaller volumes before scaling up.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain price quotes and product details. An effective RFQ clearly outlines specifications like length, IP rating, color temperature, and certifications. Mastering the RFQ process helps buyers secure competitive pricing and clarify supplier capabilities early in negotiations.

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities between buyer and seller for shipping, insurance, and customs. Common Incoterms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). For international buyers in Africa, South America, or the Middle East, understanding Incoterms ensures clarity on logistics costs and risk management.

CRI (Color Rendering Index)

A measure of how accurately the LED strip renders colors compared to natural light. Higher CRI values (above 80) indicate better color fidelity, which is important for retail or hospitality projects requiring vibrant, true-to-life illumination.

Certification Standards (CE, RoHS, UL)

Certifications validate compliance with safety, environmental, and quality standards. CE and RoHS are crucial for European markets, while UL certification is often required in Middle Eastern and African projects. Buyers should verify these certifications to avoid regulatory issues and ensure product reliability.

By understanding these essential technical properties and trade terms, international B2B buyers can make informed decisions, optimize procurement strategies, and ensure successful project outcomes when sourcing neon flex LED strips.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the neon flex led strip Sector

Market Overview & Key Trends

The global neon flex LED strip market is experiencing robust growth, driven by increasing demand for energy-efficient and versatile lighting solutions across commercial, architectural, and retail sectors. International B2B buyers from regions such as Africa, South America, the Middle East, and Europe are capitalizing on this trend to enhance urban development projects, retail environments, and event spaces with modern, durable lighting that offers superior flexibility compared to traditional neon.

Key market drivers include rising urbanization, expanding infrastructure projects, and a shift towards smart and customizable lighting solutions. In particular, countries like South Africa and Saudi Arabia are investing heavily in large-scale commercial and hospitality developments, fueling demand for innovative lighting that supports dynamic branding and architectural aesthetics.

From a sourcing perspective, B2B buyers are increasingly prioritizing suppliers that provide a combination of competitive pricing, product customization (e.g., color, bending types, IP ratings), and shorter lead times. Flexible MOQs are also critical, especially for emerging markets where project sizes vary considerably. Buyers are leveraging digital platforms and direct factory partnerships to negotiate better terms and ensure consistent product quality.

Technological advancements such as integrated extrusion manufacturing processes and enhanced LED chip efficiency are reducing costs and improving product lifespan, enabling broader adoption. Furthermore, the rise of intelligent lighting controls compatible with IoT systems is creating new opportunities for value-added solutions. Buyers should monitor evolving standards and certifications relevant to their regions, including CE, RoHS, and UL compliance, to ensure regulatory alignment and market acceptance.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a decisive factor in B2B procurement within the neon flex LED strip sector. Buyers worldwide, including those in Africa and the Middle East, are increasingly seeking products with reduced environmental footprints. This is driven by both regulatory pressures and growing corporate responsibility commitments.

The production of LED neon flex strips traditionally involves materials such as silicone, PVC, and LED components, which can have significant environmental impacts if not managed responsibly. Therefore, selecting suppliers who adopt eco-friendly manufacturing processes—such as using recyclable silicone materials, low-toxicity compounds, and energy-efficient production lines—is essential for reducing carbon emissions and waste.

Ethical sourcing extends beyond environmental factors to encompass labor practices and supply chain transparency. B2B buyers should prioritize manufacturers with certifications like ISO 14001 (Environmental Management), SA8000 (Social Accountability), and compliance with international labor standards. These certifications help mitigate risks associated with forced labor or poor working conditions, which are critical considerations in regions with complex supply chains.

Additionally, green certifications such as RoHS (Restriction of Hazardous Substances) and CE marking assure buyers that neon flex LED strips meet stringent safety and environmental criteria. Incorporating these standards into procurement policies not only supports sustainability goals but also enhances brand reputation and compliance with import regulations across Europe, South America, and beyond.

Brief Evolution and Industry Context

The evolution of neon flex LED strips reflects a broader shift from traditional neon lighting to modern, energy-efficient alternatives. Originally, neon signs relied on fragile glass tubes filled with inert gases, which were costly, heavy, and limited in design flexibility. The advent of LED technology introduced durable, lightweight, and flexible lighting strips encased in silicone or PVC, replicating neon’s aesthetic while overcoming its limitations.

This transition has unlocked new applications across architectural design, retail branding, and event lighting, enabling intricate shapes and dynamic color effects with significantly lower energy consumption. For B2B buyers, understanding this evolution underscores the importance of selecting suppliers with advanced manufacturing capabilities and innovation in materials and design, ensuring access to cutting-edge products that meet diverse project requirements across global markets.

Related Video: International Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of neon flex led strip

-

How can I effectively vet LED neon flex strip suppliers for international B2B purchases?

When sourcing LED neon flex strips internationally, verify supplier credentials such as business licenses, factory audits, and certifications like ISO, CE, and RoHS. Request product samples to assess quality and confirm compliance with your market’s safety standards. Check client references and reviews, especially from buyers in similar regions like Africa or the Middle East. Engage suppliers who demonstrate transparency in production processes and offer after-sales support. Utilizing third-party inspection services before shipment can further mitigate risks related to product quality and delivery. -

What customization options are typically available for neon flex LED strips, and how do they impact MOQ and pricing?

Common customizations include color temperature, silicone casing profiles, bending types (side/top/free bending), voltage specifications, and branding options such as OEM logos. Custom features often increase minimum order quantities (MOQs), typically ranging from 300 to 500 meters, due to setup and tooling costs. Pricing also rises with customization complexity and premium materials. Buyers should negotiate MOQs based on project scale and request detailed quotes outlining cost implications. Early communication about customization ensures suppliers can accommodate specifications without delaying lead times. -

What are typical MOQs and lead times for bulk LED neon flex strip orders, especially for buyers in Africa, South America, and the Middle East?

Standard MOQs generally start from 50 to 200 meters for off-the-shelf models, but custom orders may require 300 meters or more. Lead times vary between 2 to 6 weeks depending on order size, customization, and supplier location. For regions with longer shipping routes like Africa or South America, factor in additional logistics time. To optimize procurement, confirm MOQ flexibility during negotiation and plan orders well ahead of project deadlines. Establishing a long-term relationship with suppliers can also improve MOQs and expedite production schedules. -

Which quality assurance certifications should I look for when purchasing LED neon flex strips for international markets?

Focus on internationally recognized certifications such as CE (European conformity), RoHS (restriction of hazardous substances), UL (Underwriters Laboratories), and IP ratings (e.g., IP65, IP68) for waterproofing. These certifications ensure compliance with safety, environmental, and performance standards critical for export and local regulations. Suppliers offering test reports and batch quality inspections demonstrate reliability. Request certification documentation before purchase and consider third-party testing to verify product claims, particularly if lighting solutions will be installed in demanding commercial or outdoor environments. -

What are the best practices for handling international logistics and shipping of neon flex LED strips?

Choose suppliers experienced in international freight, familiar with export documentation, customs clearance, and regional import regulations. Opt for consolidated shipments when possible to reduce costs and simplify customs procedures. Use reliable freight forwarders and track shipments closely. For fragile or high-value orders, invest in quality packaging to prevent damage during transit. Buyers should clarify Incoterms (e.g., FOB, CIF) to understand responsibility for shipping costs and risk. Planning for potential customs delays, especially in regions with complex import policies, helps avoid project disruptions.

Illustrative Image (Source: Google Search)

-

How can I protect my business from disputes related to product quality or delivery delays in cross-border neon flex LED strip transactions?

Incorporate clear terms in contracts covering product specifications, quality standards, delivery schedules, and penalties for non-compliance. Use purchase orders with detailed acceptance criteria and inspection checkpoints. Employ third-party inspection services before shipment to validate product conformity. Maintain open communication channels with suppliers for early issue resolution. Consider payment methods like letters of credit or escrow services to mitigate financial risks. Establishing dispute resolution mechanisms, such as arbitration clauses in neutral jurisdictions, provides legal recourse if conflicts arise. -

What payment terms are common and advisable for international B2B purchases of LED neon flex strips?

Suppliers often request deposits (30%–50%) upfront with the balance paid before shipment or upon delivery. For new buyers or large orders, letters of credit or escrow services offer security. Payment terms can be negotiated based on buyer credibility, order size, and supplier policies. Using internationally recognized payment platforms reduces currency exchange risks. Buyers should clarify currency terms and potential bank fees upfront. Establishing trust through consistent transactions can lead to more favorable credit terms over time. -

How do differences in regional electrical standards affect the sourcing of neon flex LED strips?

Voltage and frequency standards vary globally—commonly 110-120V in the Americas, 220-240V in Europe, Africa, and parts of the Middle East. LED neon flex strips are typically low voltage (12V or 24V DC), but power supplies and connectors must match local electrical codes. Ensure suppliers provide compatible drivers and certifications for your target market to guarantee safety and performance. Customizing voltage or plug types may impact MOQ and lead time. Collaborate with suppliers to confirm compliance with regional standards to avoid costly retrofits or certification issues post-import.

Strategic Sourcing Conclusion and Outlook for neon flex led strip

In summary, successful procurement of neon flex LED strips hinges on a strategic approach that balances quality, cost-efficiency, and supplier reliability. For international B2B buyers across Africa, South America, the Middle East, and Europe, understanding critical factors such as MOQ flexibility, product certifications, and customization capabilities is essential. Prioritizing suppliers who demonstrate transparent quality control, robust after-sales support, and efficient production processes will mitigate risks and ensure consistent project outcomes.

Key takeaways for buyers include:

- Evaluate supplier credentials thoroughly, focusing on certifications like CE, RoHS, and UL to guarantee compliance with regional standards.

- Negotiate MOQs and pricing early to align with your inventory needs and budget constraints, especially when dealing with custom designs.

- Leverage customization options to differentiate your offerings and meet specific market demands, enhancing competitive advantage.

- Consider durability and material quality, particularly for harsh environmental conditions common in regions such as the Middle East and parts of Africa.

Looking ahead, the neon flex LED strip market is poised for continued growth driven by increasing demand for energy-efficient, flexible lighting solutions. Buyers who adopt a proactive sourcing strategy—embracing innovation, sustainability, and strong supplier partnerships—will position their businesses to capitalize on emerging opportunities. Now is the time for international buyers to engage with trusted manufacturers, secure favorable terms, and invest confidently in neon flex LED technology to illuminate their markets with lasting impact.