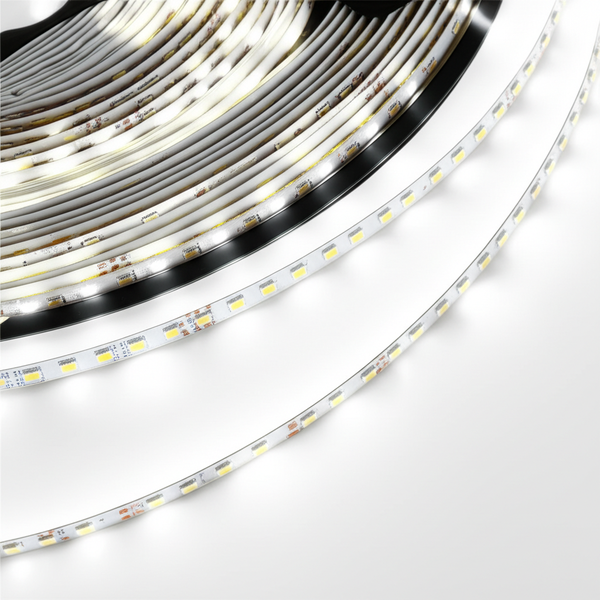

Introduction: Navigating the Global Market for led light strips close up

The global demand for LED light strips, particularly those designed for close-up applications, is surging as businesses across Africa, South America, the Middle East, and Europe seek innovative lighting solutions that combine efficiency, durability, and aesthetic appeal. For international B2B buyers, understanding the intricate details behind these products is essential—not only to secure high-quality lighting but also to optimize procurement strategies that align with diverse regional requirements and market dynamics.

LED light strips close up represent a specialized segment where precision in materials, manufacturing processes, and quality control directly influences performance and longevity. From the selection of premium LED chips and robust printed circuit boards (PCBs) to advanced phosphor coatings and thermal management techniques, every component plays a pivotal role in delivering superior illumination and energy efficiency. Navigating this complexity requires comprehensive knowledge of product types, certification standards, supplier capabilities, and cost structures.

This guide offers an authoritative deep dive into all critical aspects of LED light strips close up. It covers:

- Types and configurations tailored to different industrial and commercial needs

- Material sourcing and its impact on product reliability and lifespan

- Manufacturing and quality control processes that ensure compliance with international standards such as CE and RoHS

- Key global suppliers and how to evaluate them for consistent performance

- Pricing trends and cost factors to maximize procurement value

- Market insights relevant to emerging economies and established markets alike

- Frequently asked questions to clarify common sourcing challenges

By leveraging this guide, B2B buyers from diverse regions will be empowered to make informed decisions, mitigate risks, and establish resilient supply chains that support their lighting projects with confidence and competitive advantage.

Understanding led light strips close up Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Flexible LED Strip Lights | Thin, bendable PCB substrate; adhesive backing; RGB or single color options | Retail displays, architectural lighting, automotive accent lighting | Pros: Easy installation on curved surfaces, versatile; Cons: May have lower heat dissipation, limited to lower power applications |

| Rigid LED Strip Lights | Mounted on solid, inflexible PCB; often higher power LEDs; durable casing | Industrial lighting, commercial signage, outdoor installations | Pros: Robust and durable, better heat management; Cons: Less adaptable to irregular surfaces, heavier and bulkier |

| Waterproof LED Strip Lights | Encapsulated in silicone or epoxy; rated IP65 to IP68; suitable for wet environments | Outdoor lighting, marine applications, landscaping | Pros: Weather-resistant, durable in harsh conditions; Cons: Slightly higher cost, potential reduction in light output due to encapsulation |

| High-Density LED Strip Lights | Increased LED chip count per meter; higher brightness; often COB (Chip on Board) technology | High-end retail, film and photography lighting, industrial task lighting | Pros: Superior brightness and uniformity; Cons: Higher power consumption, costlier upfront investment |

| Addressable LED Strip Lights | Individually controllable LEDs; supports dynamic color effects and animations | Entertainment venues, advertising displays, smart building projects | Pros: Highly customizable lighting effects; Cons: More complex installation and control, requires compatible controllers |

Flexible LED Strip Lights are the most common variant, characterized by their bendable PCB and adhesive backing. They are ideal for projects requiring installation on curved or irregular surfaces, such as retail shelves or automotive interiors. For B2B buyers, assessing adhesive quality and LED chip brand is crucial to ensure durability and consistent light output, especially in diverse climates across Africa, South America, and the Middle East.

Rigid LED Strip Lights provide a sturdy alternative, mounted on inflexible PCBs that support higher power LEDs with superior heat dissipation. This type suits industrial and commercial environments where durability and longevity are paramount. Buyers targeting outdoor signage or factory lighting should prioritize suppliers with proven thermal management and compliance certifications to ensure product reliability.

Waterproof LED Strip Lights are encapsulated in silicone or epoxy, offering protection against moisture and dust. These strips are essential for outdoor, marine, or landscaping applications where environmental exposure is a concern. B2B buyers should verify IP ratings and test reports to guarantee performance in humid or wet conditions common in tropical and coastal markets.

High-Density LED Strip Lights feature a greater number of LED chips per meter, often utilizing COB technology for enhanced brightness and uniform illumination. These strips are preferred in high-end retail, photography, or industrial task lighting where precise, intense light is needed. Buyers must consider the increased power requirements and cooling solutions, especially for large-scale installations in Europe or Australia.

Addressable LED Strip Lights allow each LED to be individually controlled, enabling complex lighting effects and animations. This variation is popular in entertainment, advertising, and smart building projects demanding dynamic lighting solutions. B2B buyers should evaluate the compatibility of control systems and the technical support offered by manufacturers to manage installation complexity and ensure seamless integration.

Related Video: The Ultimate Smart Light Strip Comparison! (6 Popular Devices)

Key Industrial Applications of led light strips close up

| Industry/Sector | Specific Application of led light strips close up | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial | Display case and shelf lighting for product highlighting | Enhances product visibility, attracts customers, boosts sales | High CRI LEDs for true color rendering, flexible strips for varied shelf sizes, reliable adhesive for long-term mounting |

| Automotive Manufacturing | Interior ambient lighting and dashboard backlighting | Improves vehicle aesthetics and user experience, supports brand differentiation | Durable and heat-resistant LED strips, compliance with automotive safety standards, consistent color temperature |

| Hospitality & Tourism | Architectural accent lighting in hotels and resorts | Creates ambiance, elevates guest experience, energy-efficient | Waterproof and weather-resistant strips, dimmable options, certifications for safety and environmental compliance |

| Industrial & Warehousing | Task lighting in assembly lines and inspection stations | Increases worker productivity and accuracy, reduces errors | High brightness and uniform light output, robust build for industrial environments, ease of installation and maintenance |

| Healthcare Facilities | Medical equipment and examination area lighting | Provides precise illumination for diagnostics and procedures | Sterilizable and low-heat emission strips, flicker-free operation, adherence to medical safety standards |

Retail & Commercial Applications

In retail environments across Europe, South America, and the Middle East, LED light strips close up are extensively used for display case and shelf lighting. These strips highlight products with vivid, true-to-life colors thanks to high Color Rendering Index (CRI) LED chips. This not only enhances product appeal but also drives customer engagement and sales. International buyers must prioritize flexible and easy-to-install strips with strong adhesive backing to accommodate diverse shelving designs and ensure durability in varying climates.

Automotive Manufacturing

Automotive manufacturers in regions such as Turkey and Australia leverage LED strip lighting for interior ambient lighting and dashboard backlighting. These applications require LED strips that withstand high temperatures and vibrations while maintaining consistent color temperatures to enhance the vehicle’s luxury feel and user interface clarity. B2B buyers should source products compliant with automotive industry standards and certifications, focusing on durability and precision in lighting performance.

Hospitality & Tourism Sector

Hotels and resorts in Africa and the Middle East utilize LED strip lights for architectural accent lighting to create inviting atmospheres. These LED strips must be waterproof and weather-resistant to endure outdoor installations and humid environments. Dimmable features allow for customizable ambiance, essential for guest comfort. Buyers should ensure that the products carry relevant safety and environmental certifications to meet international hospitality standards and reduce energy costs.

Industrial & Warehousing

In industrial settings, especially in South America and Europe, LED strip lights close up are used for task lighting at assembly lines and inspection stations. These strips provide bright, uniform illumination that improves worker accuracy and productivity while minimizing eye strain. Buyers need to focus on strips with robust construction to withstand harsh industrial conditions, easy installation, and maintenance to avoid downtime. Energy efficiency and long lifespan are also critical for cost savings.

Healthcare Facilities

Medical facilities worldwide, including in Africa and Europe, require LED strip lighting for medical equipment and examination areas where precise illumination is crucial. LED strips used here must emit low heat and be flicker-free to maintain patient comfort and safety. Additionally, sterilizable materials and adherence to medical safety standards are vital. International buyers should prioritize suppliers with proven expertise in medical-grade LED solutions to ensure compliance and reliability.

Related Video: How to Cut and Connect LED Light Strips.

Strategic Material Selection Guide for led light strips close up

When selecting materials for LED light strips close up, the choice profoundly influences product longevity, performance, and suitability for diverse environments. International B2B buyers must carefully evaluate these materials to align with regional standards, climatic conditions, and application-specific requirements. Below is an analysis of four common materials used in LED strip manufacturing, emphasizing their properties, benefits, drawbacks, and strategic considerations for markets across Africa, South America, the Middle East, and Europe.

1. Flexible Polyimide (PI) PCB Substrate

Key Properties:

Polyimide substrates offer excellent thermal stability, typically withstanding temperatures up to 260°C. They exhibit high flexibility, good dielectric strength, and resistance to chemicals and moisture, making them ideal for curved or irregular installations.

Pros & Cons:

– Pros: Superior flexibility enables installation in tight or curved spaces; excellent heat resistance prevents thermal degradation; chemically stable in humid and corrosive environments.

– Cons: Higher manufacturing complexity and cost compared to standard FR4 PCBs; requires precise handling to avoid mechanical damage during assembly.

Impact on Application:

Flexible PI substrates are favored in architectural and automotive lighting where bends and curves are common. Their durability under temperature fluctuations suits harsh climates found in parts of Africa and the Middle East.

International Buyer Considerations:

Buyers in regions with high ambient temperatures or humidity (e.g., tropical Africa, coastal South America) benefit from PI’s thermal and moisture resistance. Compliance with international standards like UL 94-V0 for flammability and IEC 60384 for capacitors is essential. European buyers often require RoHS and REACH compliance, which PI substrates typically meet.

2. Rigid FR4 PCB Substrate

Key Properties:

FR4 is a glass-reinforced epoxy laminate with moderate thermal resistance (up to ~130°C) and good mechanical strength. It offers a stable platform for LED mounting but lacks flexibility.

Pros & Cons:

– Pros: Cost-effective and widely available; excellent mechanical strength; easy to manufacture and handle.

– Cons: Limited flexibility restricts use in curved applications; lower heat tolerance can lead to thermal stress in high-power LEDs.

Impact on Application:

Ideal for linear, flat installations such as commercial signage and indoor architectural lighting. Less suited for dynamic or curved installations common in automotive or wearable tech.

International Buyer Considerations:

FR4’s affordability makes it attractive for large-scale projects in emerging markets like South America and parts of Africa. Buyers should verify compliance with ASTM D256 and IEC 61189 standards. In Europe and Australia, environmental regulations may limit FR4 use in certain applications due to flame retardant chemical restrictions.

3. Silicone-Based Adhesive Backing

Key Properties:

Silicone adhesives provide excellent temperature resistance (up to 200°C), UV stability, and strong adhesion to diverse surfaces including metals, plastics, and glass. They maintain elasticity over time, preventing peeling.

Pros & Cons:

– Pros: High durability in outdoor and high-heat environments; resistant to moisture and UV degradation; flexible adhesion supports varied installation surfaces.

– Cons: Higher cost than acrylic adhesives; potential compatibility issues with some low surface energy plastics.

Impact on Application:

Silicone adhesives are preferred for outdoor LED strip installations, including signage and architectural lighting exposed to sun and rain, common in Middle Eastern and Mediterranean climates.

International Buyer Considerations:

Buyers targeting outdoor applications in harsh climates should prioritize silicone adhesive-backed strips. Compliance with ASTM D1000 for adhesive tapes and ISO 10993 for biocompatibility (where relevant) is important. European and Australian markets often require certifications for UV resistance and environmental safety.

4. Copper-Clad Aluminum (CCA) PCB

Key Properties:

CCA PCBs combine aluminum’s lightweight and thermal conductivity with a thin copper layer for electrical performance. They offer enhanced heat dissipation compared to pure copper PCBs at a lower cost.

Pros & Cons:

– Pros: Improved thermal management extends LED lifespan; lighter weight reduces shipping and installation costs; cost-effective alternative to pure copper.

– Cons: Lower electrical conductivity than pure copper; manufacturing precision is critical to avoid delamination; less common, which may affect supply chain reliability.

Impact on Application:

Well-suited for high-power LED strips requiring efficient heat dissipation, such as industrial lighting and outdoor floodlights. Their lightweight nature benefits transportation and installation in remote areas, including parts of Africa and South America.

International Buyer Considerations:

Buyers should verify supplier quality control and adherence to IPC-6012 standards for PCB fabrication. In Europe and Australia, ensuring compliance with RoHS and WEEE directives is essential. The Middle East’s preference for durable, heat-resistant materials aligns well with CCA PCBs.

Summary Table

| Material | Typical Use Case for led light strips close up | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Flexible Polyimide PCB | Curved architectural lighting, automotive, wearable tech | High thermal stability and flexibility | Higher manufacturing complexity and cost | High |

| Rigid FR4 PCB | Flat commercial signage, indoor architectural lighting | Cost-effective and mechanically strong | Limited heat tolerance and no flexibility | Low |

| Silicone Adhesive Backing | Outdoor installations, UV-exposed signage and architectural lighting | Excellent UV and temperature resistance | Higher cost, potential substrate compatibility issues | Medium |

| Copper-Clad Aluminum PCB | High-power industrial and outdoor lighting | Superior heat dissipation and lightweight | Lower electrical conductivity than pure copper | Medium |

This guide equips international B2B buyers with critical insights to select materials that best fit their LED strip lighting needs, balancing cost, durability, and compliance with regional standards. Strategic material choices can significantly enhance product reliability and customer satisfaction across diverse global markets.

In-depth Look: Manufacturing Processes and Quality Assurance for led light strips close up

The manufacturing of LED light strips involves a series of precise, interlinked stages that transform raw materials into high-quality lighting solutions. For international B2B buyers, particularly from regions such as Africa, South America, the Middle East, and Europe, understanding these processes and the associated quality assurance measures is essential to secure reliable suppliers and ensure product performance that meets local market demands.

Manufacturing Process: Key Stages and Techniques

1. Material Preparation and Sourcing

The foundation of any LED strip lies in the quality of its core components: LED chips, printed circuit boards (PCBs), adhesives, and protective coatings. High-grade LED chips, often based on Gallium Nitride (GaN) or Indium Gallium Nitride (InGaN), are sourced from reputable manufacturers to guarantee luminous efficacy and longevity. PCBs, either flexible or rigid, are fabricated using materials with excellent thermal conductivity such as copper-clad aluminum or ceramic composites to ensure heat dissipation and durability.

Material sourcing is critical; buyers should verify suppliers’ raw material certifications and conduct supplier audits to confirm compliance with international quality standards.

2. PCB Fabrication and Component Mounting

PCB fabrication involves etching copper layers onto substrate materials, followed by solder mask application and surface finishing. Flexible PCBs are especially common in LED strips, allowing for versatile installation in diverse environments.

Once PCBs are prepared, LED chips are mounted using advanced soldering techniques, such as reflow soldering, which provides precise placement and strong electrical connections. Wire bonding or conductive epoxy may be employed to attach chips to the PCB, ensuring minimal electrical resistance and robust thermal pathways.

3. Assembly and Phosphor Coating

Following chip mounting, phosphor coatings are applied to convert the blue or UV light emitted by the chips into the desired color temperature, typically white light. This step is vital for color consistency and luminous quality. Uniform phosphor application is achieved through techniques like spray coating or conformal coating, which also protect chips from environmental factors.

The assembly phase continues with attaching adhesive backings and protective silicone or epoxy encapsulations that safeguard the strip from moisture, dust, and mechanical stress. Packaging is designed to protect the product during transit, often incorporating anti-static and shock-absorbing materials.

4. Finishing and Packaging

Final steps include cutting LED strips to standardized lengths, attaching connectors or terminals for easy installation, and labeling with compliance marks and batch information. Packaging is typically designed to optimize shipment safety and facilitate efficient storage.

Quality Control Framework and Testing Protocols

Robust quality assurance is non-negotiable for B2B buyers seeking dependable LED strip suppliers. Manufacturers implement multi-tiered quality control (QC) systems aligned with international standards like ISO 9001, CE marking for European markets, and region-specific certifications such as INMETRO for Brazil or SASO for Saudi Arabia.

Quality Control Checkpoints

- Incoming Quality Control (IQC): Verifies raw materials and components upon receipt, including LED chips, PCB substrates, and adhesives, ensuring they meet specified parameters before production begins.

- In-Process Quality Control (IPQC): Conducted during manufacturing stages, monitoring soldering quality, PCB integrity, phosphor coating uniformity, and adhesive application to detect defects early.

- Final Quality Control (FQC): Comprehensive testing of finished LED strips, including visual inspections, functional tests, and packaging checks.

Common Testing Methods

- Optical Performance Testing: Measures luminous flux, color temperature, and color rendering index (CRI) to ensure consistent and accurate light output.

- Electrical Testing: Includes forward voltage, current draw, and flicker analysis to verify electrical efficiency and safety.

- Environmental Stress Testing: Simulates long-term exposure to heat, humidity, and mechanical stress to predict product lifespan and durability.

- Safety and Compliance Testing: Ensures adherence to electrical safety standards (e.g., IEC 60598), electromagnetic compatibility (EMC), and hazardous substance restrictions (RoHS).

Ensuring Supplier Quality: Verification Strategies for B2B Buyers

For buyers from diverse international markets, verifying supplier quality extends beyond documentation. Effective strategies include:

- Factory Audits: On-site inspections or virtual audits assess manufacturing capabilities, QC processes, and compliance with international standards.

- Reviewing QC Reports: Detailed batch and test reports provide transparency on quality metrics and defect rates.

- Third-Party Inspections: Independent quality inspection agencies can conduct sampling and testing to verify product conformity before shipment.

- Certification Validation: Confirm that certifications (e.g., CE, UL, RoHS) are authentic and up-to-date, as counterfeit certificates can undermine product credibility.

Regional QC and Compliance Nuances for International Buyers

- Africa and South America: Regulatory frameworks can vary widely; buyers should prioritize suppliers with ISO 9001 certification and recognized international marks like CE or UL, which facilitate product acceptance across these regions.

- Middle East (e.g., Saudi Arabia, UAE): Compliance with SASO standards and Gulf Conformity Mark (G-Mark) is often mandatory. Buyers should ensure LED strips meet local electrical safety and environmental regulations.

- Europe (including Turkey): CE marking is essential, alongside adherence to RoHS and REACH regulations restricting hazardous substances. Buyers must emphasize strict testing for electromagnetic compatibility and energy efficiency.

- Australia: Compliance with the Australian Communications and Media Authority (ACMA) and Electrical Regulatory Authorities Council (ERAC) standards is critical, especially for lighting products used in commercial settings.

Key Takeaways for B2B Buyers

- Prioritize suppliers with transparent, documented manufacturing processes emphasizing high-quality materials, advanced assembly techniques, and rigorous QC.

- Verify adherence to internationally recognized standards (ISO 9001, CE, RoHS) and region-specific certifications relevant to your market.

- Utilize a combination of audits, QC report reviews, and third-party inspections to gain confidence in supplier capabilities.

- Understand regional regulatory requirements to ensure seamless importation and market acceptance of LED strip products.

By deeply understanding the manufacturing and quality assurance processes of LED light strips, B2B buyers can make informed sourcing decisions, reduce risks, and secure products that deliver consistent performance and long-term value in their target markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led light strips close up Sourcing

Understanding the cost structure and pricing dynamics of LED light strips, especially close-up varieties, is crucial for international B2B buyers aiming to optimize procurement and profitability. The pricing landscape is shaped by several interrelated components and market factors that buyers must navigate skillfully.

Key Cost Components in LED Strip Light Production

-

Materials: The most significant portion of cost comes from high-quality LED chips, PCBs (flexible or rigid), adhesive backings, and phosphor coatings. Premium chips from reputable suppliers, superior PCB substrates (e.g., copper-clad aluminum for thermal management), and durable adhesives enhance performance but increase costs.

-

Labor: Skilled labor is needed for precise assembly, including LED chip soldering, wire bonding, and quality inspections. Labor costs vary widely depending on the manufacturing country and automation level. Facilities with advanced automation can reduce labor expenses but may have higher upfront tooling costs.

-

Manufacturing Overhead: This includes factory utilities, equipment depreciation, and facility maintenance. Overhead is influenced by production scale and efficiency. High-volume production typically dilutes overhead per unit.

-

Tooling and Equipment: Custom tooling for PCB fabrication, photolithography masks, and automated assembly lines represents a fixed cost that manufacturers amortize over production volumes.

-

Quality Control (QC): Rigorous testing—optical performance, electrical characterization, and reliability under environmental stress—is essential to ensure compliance with certifications like CE, RoHS, and UL. QC adds cost but reduces returns and enhances brand trust.

-

Logistics and Shipping: For international buyers, freight costs, customs duties, and insurance significantly impact landed cost. Packaging quality also affects product protection and cost during transit.

-

Profit Margin: Manufacturers and distributors include margins that reflect market positioning, brand value, and negotiation leverage.

Influencing Factors on Pricing

-

Order Volume and Minimum Order Quantity (MOQ): Larger orders typically secure better unit prices due to economies of scale. MOQ requirements vary, and negotiating flexible MOQs can reduce inventory risk for smaller buyers.

-

Product Specifications and Customization: Custom lengths, color temperatures, chip brands, and special features (e.g., waterproofing, dimming compatibility) raise costs. Standardized products tend to be more cost-effective.

-

Material Quality and Certifications: LED strips with premium components and full certification command higher prices but offer longer life and better performance, reducing Total Cost of Ownership (TCO).

-

Supplier Location and Reputation: Established suppliers with proven quality records may price higher but offer reliability and after-sales support. Emerging manufacturers might offer competitive pricing but require thorough vetting.

-

Incoterms and Payment Terms: Delivery terms (e.g., FOB, CIF, DDP) influence who bears shipping and customs costs. Favorable payment terms and currency stability also affect overall cost.

Practical Tips for International B2B Buyers

-

Negotiate Beyond Price: Discuss MOQ flexibility, payment schedules, warranty terms, and after-sales service. These can add significant value beyond the sticker price.

-

Assess Total Cost of Ownership: Consider product lifespan, energy efficiency, warranty, and maintenance needs. Cheaper upfront costs might lead to higher long-term expenses.

-

Verify Certifications and Compliance: For regions like Europe and Australia, compliance with local standards (CE, RoHS, UL) is non-negotiable to avoid import delays or penalties.

-

Factor in Logistics Complexity: Buyers from Africa, South America, the Middle East, and Europe should evaluate shipping routes, customs processes, and local taxes. Consolidated shipments or partnering with freight forwarders can reduce costs.

-

Leverage Local Market Insights: Regional demand and supply dynamics can affect pricing. For example, proximity to manufacturing hubs in Asia may lower costs for Turkey or Middle Eastern buyers compared to South America.

-

Request Samples and Conduct Independent Testing: Before bulk purchasing, validate quality and performance to mitigate risks associated with supplier variability.

Indicative Pricing Disclaimer

Prices for LED light strips vary widely depending on specifications, volume, and supplier terms. The figures discussed here are indicative and should be verified with suppliers. Market fluctuations in raw materials, currency exchange rates, and logistics costs can also impact final pricing.

By thoroughly understanding these cost drivers and pricing influencers, international B2B buyers can make informed sourcing decisions that balance quality, cost-efficiency, and risk management for LED light strips close-up applications.

Spotlight on Potential led light strips close up Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led light strips close up’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led light strips close up

Critical Technical Properties for LED Light Strips Close-Up

When sourcing LED light strips, understanding the technical specifications is crucial to ensure product suitability, longevity, and efficiency. Below are key properties that international B2B buyers should prioritize:

1. LED Chip Quality and Type

The core of any LED strip is its chips, typically made from Gallium Nitride (GaN) or Indium Gallium Nitride (InGaN) for blue and white light. Premium chips offer higher luminous efficacy (brightness per watt) and longer lifespan. For buyers, this means better energy efficiency and lower maintenance costs, essential for commercial or architectural projects across diverse climates.

2. PCB Material and Design

The Printed Circuit Board (PCB) provides the structural foundation. Flexible PCBs offer installation versatility (e.g., curved surfaces), while rigid PCBs enhance durability. High-quality materials such as copper-clad aluminum or ceramic substrates ensure excellent heat dissipation, preventing premature LED failure. This is particularly important for regions with extreme temperatures like the Middle East or parts of Africa.

3. Color Temperature and Color Rendering Index (CRI)

Color temperature (measured in Kelvins) defines the warmth or coolness of the light, ranging from warm white (2700K) to daylight (6500K). CRI indicates how accurately colors appear under the light source, with values above 80 preferred for commercial applications. Buyers should match these specs to their target environment to optimize ambiance and visual comfort.

4. IP Rating (Ingress Protection)

This rating classifies protection against dust and moisture. For indoor use, IP20 or IP44 may suffice; outdoor or industrial applications require IP65 or higher. Selecting the correct IP rating ensures the LED strips withstand local environmental conditions—critical for export markets with varying climates.

5. Adhesive Backing Quality

Strong adhesive backing affects installation ease and durability. Industrial-grade adhesives resist peeling, even under heat or humidity. This property reduces after-sales issues and installation downtime, a vital consideration for large-scale deployments in South America or Europe.

6. Voltage and Power Consumption

Common operating voltages are 12V or 24V DC. Lower voltage strips are safer and easier to install but might have limitations on length without voltage drop. Understanding power consumption (watts per meter) helps buyers calculate energy costs and design efficient lighting systems.

Key Industry and Trade Terminology for LED Light Strip Buyers

Navigating international LED light strip procurement requires familiarity with common trade terms that affect ordering, delivery, and quality assurance.

OEM (Original Equipment Manufacturer)

Refers to manufacturers who produce LED strips that buyers can rebrand or customize. OEM partnerships allow buyers to tailor specifications such as chip type, PCB flexibility, or packaging to their market needs, providing competitive differentiation.

MOQ (Minimum Order Quantity)

The smallest batch size a supplier will produce or sell. MOQs impact pricing, inventory management, and cash flow. Buyers from emerging markets like Africa or the Middle East should negotiate MOQs that balance affordability with supply reliability.

RFQ (Request for Quotation)

A formal inquiry sent to suppliers detailing required specifications and quantities. An effective RFQ accelerates sourcing by clearly communicating expectations and enabling precise cost comparisons across vendors.

Incoterms (International Commercial Terms)

Standardized trade terms defining the responsibilities of buyers and sellers regarding shipping, insurance, and customs. Common terms include FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Understanding Incoterms helps buyers manage logistics risk and control landed costs.

Bin or Binning

The process of sorting LED chips by brightness, color, and voltage to ensure consistency. Buyers should confirm suppliers provide binned LEDs to guarantee uniform appearance, which is crucial for projects requiring seamless lighting aesthetics.

Phosphor Coating

A layer applied on blue LED chips to convert blue light into white light of desired color temperature. Knowing whether a supplier uses remote phosphor or conformal coating impacts thermal management and long-term color stability.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions, ensuring their LED light strip purchases meet performance expectations and comply with regional standards. This knowledge reduces risks, optimizes procurement, and supports successful project execution across diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led light strips close up Sector

Market Overview & Key Trends

The global LED strip light market is experiencing robust growth, fueled by increasing demand for energy-efficient, versatile lighting solutions across commercial, industrial, and residential sectors. For B2B buyers in regions such as Africa, South America, the Middle East, and Europe—including markets like Australia and Turkey—understanding the evolving market dynamics is crucial for strategic sourcing and competitive advantage.

Key market drivers include the rising adoption of smart lighting technologies, growing urbanization, and government initiatives promoting energy-saving lighting products. LED strip lights offer customizable brightness, color options, and flexible installation, making them ideal for architectural lighting, retail displays, and automotive applications. This versatility is especially valuable in emerging markets where infrastructure modernization is underway.

Technological trends shaping procurement decisions involve the integration of IoT-enabled LED strips, enabling remote control, automation, and energy management. Buyers should prioritize suppliers investing in advanced chip technology (e.g., GaN-based LEDs) and high-quality PCB fabrication to ensure product longevity and consistent performance. Flexible PCBs and improved adhesive technologies are also gaining traction, offering easier installation and enhanced durability in diverse environments.

Sourcing dynamics reveal a shift toward regional manufacturing hubs in Asia, Europe, and the Middle East, reducing lead times and logistics costs for international buyers. However, buyers from Africa and South America must carefully evaluate suppliers’ quality control standards and certification compliance (CE, RoHS, UL) to mitigate risks associated with counterfeit or substandard products.

Emerging trends include demand for customized LED strip solutions tailored to specific applications, such as waterproof or high-temperature resistant variants. Additionally, the push for digital procurement platforms and transparent supply chains is helping B2B buyers streamline vendor selection and ensure traceability.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a decisive factor in the procurement of LED strip lights, driven by heightened environmental regulations and corporate social responsibility commitments worldwide. For B2B buyers, especially in Europe and the Middle East where green policies are stringent, sourcing from manufacturers who prioritize eco-friendly practices is essential.

Environmental impact considerations focus on reducing carbon footprints through energy-efficient LED chips, recyclable materials, and minimal waste during production. High-quality PCBs with effective thermal management not only improve product lifespan but also lower energy consumption over time, contributing to sustainability goals.

Ethical sourcing emphasizes transparent supply chains that respect labor rights and avoid conflict minerals. Buyers are encouraged to engage suppliers who hold certifications like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), ensuring materials used are safe and non-toxic.

Green certifications such as Energy Star and UL Environment mark products that meet strict energy efficiency and environmental standards. Additionally, manufacturers adopting circular economy principles—like using recyclable adhesives and packaging—offer added value to conscientious buyers.

Strategic advice for buyers includes conducting thorough supplier audits, requesting material traceability documentation, and favoring partners who invest in sustainable innovation. This approach not only aligns with global sustainability trends but also enhances brand reputation and long-term cost savings through reduced energy use and fewer replacements.

Brief Evolution and Historical Context

The LED strip light sector has evolved significantly over the past two decades, transitioning from basic indicator lights to sophisticated, high-performance illumination solutions. Early LED strips were limited by low brightness and rigid design, constraining their applications.

Advances in semiconductor materials, particularly the adoption of Gallium Nitride (GaN) and Indium Gallium Nitride (InGaN) chips, revolutionized luminous efficacy and color range. Concurrently, innovations in flexible PCB technology and adhesive formulations expanded installation possibilities, making LED strips a staple in modern lighting design.

For international B2B buyers, understanding this evolution underscores the importance of partnering with manufacturers who leverage cutting-edge chip fabrication, packaging, and thermal management techniques. These advancements ensure that today’s LED strip lights deliver superior performance, reliability, and adaptability, meeting diverse market needs across continents.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of led light strips close up

-

How can I effectively vet suppliers of LED light strips for international B2B purchases?

To vet suppliers, request detailed product specifications, including LED chip brands, PCB quality, and adhesive materials. Verify their compliance with international certifications such as CE, RoHS, and UL to ensure safety and environmental standards. Ask for samples and conduct independent third-party testing if possible. Review their manufacturing processes for quality control measures and production capacity. Additionally, check client references and assess their experience with exports to your region (Africa, South America, Middle East, Europe). A transparent communication channel and willingness to provide documentation are strong indicators of a reliable supplier. -

What customization options are typically available for LED light strips, and how do they affect pricing and lead times?

Customization can include LED chip type, color temperature, PCB flexibility, adhesive backing strength, length, and waterproofing levels. Advanced options might involve smart controls, dimming features, or specific packaging tailored for your market. Custom specs usually increase production complexity, impacting both cost and lead time. Expect MOQ (minimum order quantities) to be higher for custom orders due to tooling or material sourcing. Engage suppliers early to understand feasibility, pricing tiers, and expected delivery schedules. Clear specifications upfront reduce risk of delays and ensure the product meets your market’s unique needs. -

What are standard MOQ and lead times for bulk orders of LED light strips in international trade?

MOQ varies widely depending on supplier scale and customization level but typically ranges from 500 to 5,000 meters per order. Lead times depend on order size, customization, and current factory workload; generally, expect 3 to 8 weeks from order confirmation to shipment. For standard products, lead times can be shorter. Plan for additional time if products require certification or testing specific to your region. Always confirm these details upfront and build buffer time into your supply chain planning to accommodate potential delays due to customs or logistics. -

Which payment terms are common when sourcing LED light strips internationally, and how can buyers protect themselves?

Common payment terms include 30% deposit upfront with balance paid before shipment or via letter of credit (L/C) for larger orders. Escrow services or trade assurance platforms can provide additional security. Insist on clear contracts specifying product specs, delivery timelines, and penalties for non-compliance. Use reputable banks and consider trade finance options to optimize cash flow. Always verify supplier credentials and avoid full upfront payments without safeguards. For new suppliers, partial payments tied to inspection milestones reduce risk. -

What quality assurance measures should I expect from suppliers of LED light strips?

Suppliers should provide documentation of rigorous quality control, including in-line inspection during PCB fabrication, LED chip sorting by brightness and wavelength, and final batch testing for luminous efficacy, color consistency, and durability. Thermal management and adhesion testing are critical for long-term performance. Compliance with international certifications (CE, RoHS, UL) is essential. Request inspection reports, sample testing results, and if possible, factory audit summaries. A robust QA process reduces returns and protects your brand reputation in diverse markets. -

Which certifications are essential for LED light strips to comply with international import regulations?

Key certifications include CE (Europe), RoHS (restriction of hazardous substances), UL or ETL (North America), and sometimes CCC (China) or SAA (Australia). These confirm product safety, environmental compliance, and electromagnetic compatibility. For markets in Africa, South America, and the Middle East, check local regulations, as some countries require additional approvals. Ensure your supplier provides valid certificates and keeps them updated. Non-compliance can result in shipment rejections, fines, or delays, so prioritizing certified products is critical for smooth cross-border trade. -

What logistics considerations should B2B buyers keep in mind when importing LED light strips?

Consider product fragility and packaging quality to prevent damage during transit. LED strips require moisture-proof, shock-absorbent packaging. Choose reliable freight forwarders experienced with electronics to handle customs clearance efficiently. Understand Incoterms (e.g., FOB, CIF) to clarify responsibility for shipping costs and risks. Plan for potential delays at ports and ensure documentation (commercial invoice, packing list, certificates) is complete. Consolidating shipments can reduce costs but may increase lead time. Also, factor in import duties and VAT specific to your country to calculate total landed cost accurately.

Illustrative Image (Source: Google Search)

- How should disputes regarding product quality or delivery issues be handled in international B2B LED strip transactions?

Establish clear contractual terms covering quality standards, inspection rights, delivery timelines, and remedies for breaches before placing orders. In case of disputes, document issues thoroughly with photos and inspection reports. Engage in direct communication with the supplier to seek resolution, such as replacement, refund, or discount. If unresolved, consider mediation or arbitration clauses specified in the contract. Leveraging trade platforms or chambers of commerce in your region can also facilitate dispute resolution. Maintaining professional and timely communication reduces escalation risks and preserves long-term supplier relationships.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led light strips close up

In today’s competitive global marketplace, strategic sourcing of LED light strips close up hinges on a deep understanding of material quality, manufacturing precision, and compliance with international standards. For B2B buyers across Africa, South America, the Middle East, and Europe, prioritizing suppliers who emphasize premium LED chips, advanced PCB fabrication, robust adhesive solutions, and rigorous quality control is essential. These factors directly impact product longevity, energy efficiency, and installation versatility—key drivers of customer satisfaction and reduced total cost of ownership.

Moreover, aligning with manufacturers who demonstrate transparent testing protocols and hold relevant certifications (CE, RoHS, UL) mitigates risk and ensures regulatory compliance in diverse markets. Flexibility in sourcing—balancing cost with quality—and fostering long-term partnerships with reliable suppliers will empower buyers to meet evolving lighting demands confidently.

Illustrative Image (Source: Google Search)

Looking forward, as LED technology advances and sustainability becomes paramount, international buyers are encouraged to adopt a proactive sourcing strategy that integrates innovation, environmental responsibility, and supply chain resilience. By doing so, businesses can secure a competitive edge, delivering cutting-edge lighting solutions that resonate globally. Engage with trusted manufacturers today to illuminate your projects with confidence and drive lasting business growth.