Introduction: Navigating the Global Market for led led strips

The global market for LED strip lights is expanding rapidly, driven by increasing demand for energy-efficient, versatile lighting solutions across commercial, industrial, and decorative sectors. For international B2B buyers—particularly those operating in dynamic markets such as Africa, South America, the Middle East, and Europe—LED strip lights represent a strategic investment that balances innovation, sustainability, and cost-effectiveness. Whether outfitting retail environments in South Africa, upgrading hospitality venues in Brazil, or enhancing architectural projects in France, selecting the right LED strips can significantly impact operational efficiency and end-user satisfaction.

This comprehensive guide provides a deep dive into the critical aspects of sourcing LED strip lights at scale. It covers a broad spectrum of topics including the various LED strip types and materials, manufacturing and quality control standards, supplier evaluation criteria, pricing structures, and region-specific compliance requirements. Additionally, it addresses logistical considerations and customization options essential for tailoring solutions to local market preferences and regulatory frameworks.

By consolidating actionable insights and best practices, this guide empowers B2B buyers to navigate the complexities of global procurement confidently. It highlights how to identify reputable suppliers, optimize costs through bulk purchasing, and ensure product reliability and performance—thereby minimizing risks and maximizing value. For businesses aiming to stay competitive and future-proof their lighting investments, mastering these elements is indispensable in today’s fast-evolving LED landscape.

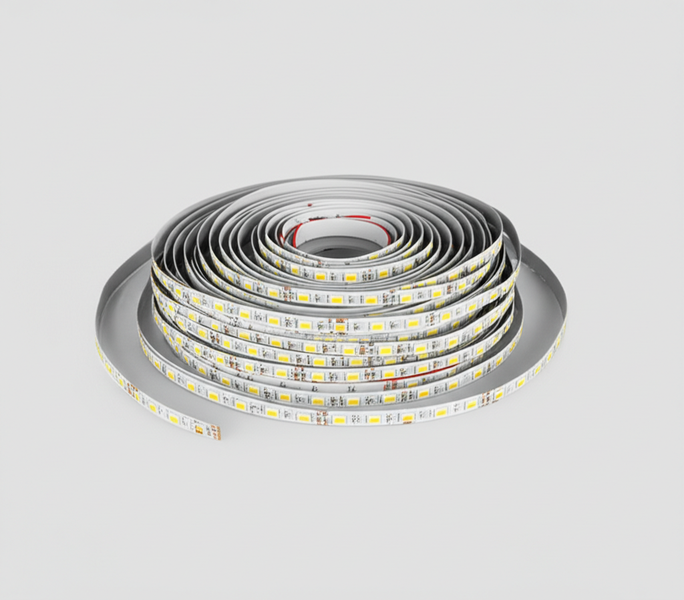

Illustrative Image (Source: Google Search)

Understanding led led strips Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Single-Color LED Strips | Emit one consistent color; simple design, often with high brightness | Retail displays, accent lighting, signage | Cost-effective, easy installation; limited flexibility |

| RGB LED Strips | Contain red, green, blue LEDs allowing color mixing and dynamic lighting | Hospitality, entertainment, architectural | Versatile and customizable; requires controllers, higher cost |

| Waterproof LED Strips | Encased in silicone or epoxy for moisture resistance | Outdoor lighting, signage, marine environments | Durable in harsh conditions; slightly higher price and installation care |

| High-Density LED Strips | Higher LED count per meter for brighter, more uniform light | Task lighting, commercial, industrial spaces | Superior brightness and uniformity; increased power consumption |

| Addressable LED Strips | Individually controllable LEDs enabling complex effects | Event production, signage, interactive displays | Highly customizable; requires advanced controllers and programming |

Single-Color LED Strips

These strips emit a fixed color, typically white or a single hue, and are valued for their simplicity and cost efficiency. They are ideal for projects where consistent lighting is needed without the complexity of color changes, such as retail shelving or office accent lighting. For B2B buyers, single-color strips offer straightforward installation and maintenance, making them a reliable choice for bulk procurement. Verify lumen output and ensure supplier quality to avoid discrepancies in brightness across batches.

RGB LED Strips

RGB strips integrate red, green, and blue LEDs, allowing users to mix colors and create dynamic lighting effects. This flexibility makes them popular in hospitality, event venues, and architectural projects where ambiance and mood lighting are critical. B2B buyers should consider the need for compatible controllers and power supplies, as well as potential training for installation teams. While more expensive than single-color strips, RGB options provide added value through customization and visual impact.

Waterproof LED Strips

Encapsulated in protective silicone or epoxy, waterproof LED strips are engineered for outdoor or wet environments such as gardens, signage exposed to weather, or marine applications. These strips ensure durability and consistent performance under challenging conditions. Buyers targeting markets with harsh climates, like parts of Africa or the Middle East, should prioritize waterproof ratings (e.g., IP65 or higher) and confirm supplier certifications to guarantee product longevity and compliance with local standards.

High-Density LED Strips

Featuring a greater number of LEDs per meter, these strips deliver higher brightness and more uniform light distribution, suited for task lighting in commercial offices, industrial facilities, or retail environments requiring clear illumination. Bulk buyers must assess power requirements and heat dissipation needs to maintain performance and lifespan. High-density strips typically command a premium but justify the cost through enhanced lighting quality and reduced fixture counts.

Addressable LED Strips

These advanced strips allow individual LED control, enabling intricate lighting patterns, animations, and interactive displays. Common in event production, digital signage, and experiential marketing, addressable strips offer unparalleled creative possibilities. For B2B buyers, sourcing from suppliers with robust technical support and compatible control systems is crucial. While these strips have higher upfront costs and complexity, they open new revenue streams through customized lighting solutions tailored to client demands.

Related Video: How to Install LED Light Strips

Key Industrial Applications of led led strips

| Industry/Sector | Specific Application of led led strips | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Commercial | Accent and display lighting in storefronts and interiors | Enhances product visibility, attracts customers, boosts sales | Waterproofing for outdoor displays, customizable colors, consistent brightness, compliance with regional safety standards (CE, RoHS) |

| Hospitality & Events | Ambient and decorative lighting in hotels, restaurants, event venues | Creates immersive atmospheres, flexible design for branding | Flexibility in length and color options, dimmability, supplier reliability for bulk orders, timely delivery |

| Industrial Facilities | Task lighting in manufacturing lines and inspection areas | Improves worker safety and precision, reduces energy costs | High durability, heat resistance, certifications for hazardous environments, long lifespan, compatibility with existing fixtures |

| Transportation | Interior lighting in buses, trains, and aircraft cabins | Enhances passenger comfort, energy-efficient, low maintenance | Vibration resistance, compliance with transport safety standards, compact design, supplier expertise in transport sector |

| Agriculture & Horticulture | Supplemental grow lighting in greenhouses and indoor farms | Boosts crop yields, energy-efficient alternative to traditional lighting | Spectrum customization, waterproof and dustproof design, energy efficiency, supplier knowledge of agricultural lighting needs |

Retail & Commercial

LED strips are widely used in retail environments to highlight merchandise and create visually appealing store layouts. For B2B buyers in regions such as South Africa and France, sourcing LED strips that offer consistent brightness and color options tailored to brand aesthetics is critical. Waterproof and durable strips are essential for outdoor signage and window displays exposed to weather. The energy efficiency of LED strips helps reduce operational costs, while flexible installation options allow for creative lighting solutions that enhance customer engagement and increase foot traffic.

Hospitality & Events

In hospitality, LED strips provide dynamic ambient and decorative lighting that can transform spaces quickly and cost-effectively. Hotels, restaurants, and event venues benefit from the ability to customize lighting scenes and colors to match branding and mood requirements. Buyers from the Middle East and Europe should prioritize suppliers who offer dimmable, customizable LED strips with reliable bulk availability to support large-scale installations and event turnover. Timely delivery and after-sales support are also crucial to maintain operational schedules.

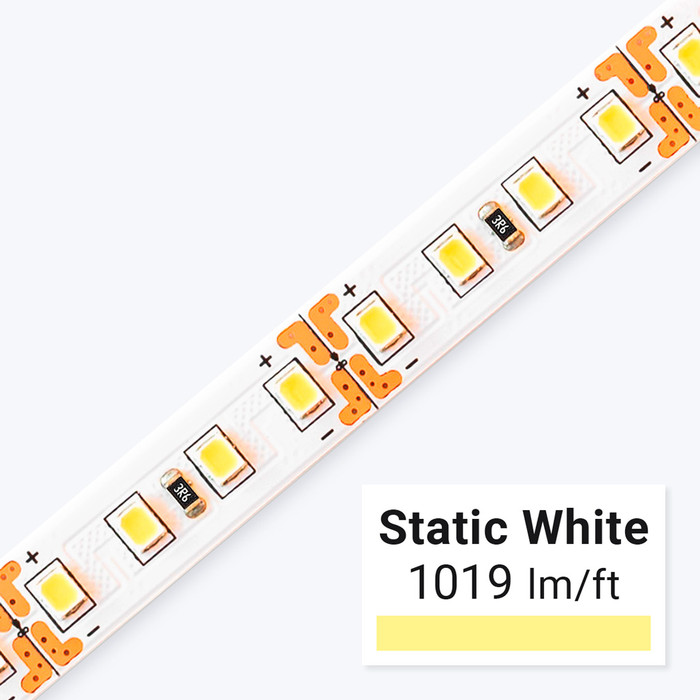

Illustrative Image (Source: Google Search)

Industrial Facilities

LED strips serve as efficient task lighting in manufacturing and inspection areas, improving visibility and worker safety while lowering energy consumption. For industrial buyers in South America and Africa, durability and heat resistance are key, as harsh environments demand robust products. Certifications for hazardous or regulated environments ensure compliance and safety. Buyers should seek LED strips with long lifespans and compatibility with existing fixtures to minimize downtime and maintenance costs, supporting continuous production efficiency.

Transportation

LED strips are increasingly used in the interiors of buses, trains, and aircraft to enhance passenger comfort with energy-efficient, low-maintenance lighting solutions. Buyers in Europe and the Middle East need LED strips that withstand vibration and meet stringent transport safety standards. Compact designs facilitate installation in confined spaces, while supplier expertise in the transportation sector ensures product reliability. This application reduces energy consumption and maintenance intervals, contributing to lower operational costs and improved passenger experience.

Agriculture & Horticulture

Supplemental grow lighting using LED strips is gaining traction in greenhouses and indoor farms across Africa and South America. These strips provide targeted light spectra to optimize plant growth, increasing yields while consuming less energy than traditional lighting. Buyers should focus on waterproof and dustproof designs to withstand humid and dusty environments. Customizable spectrum options tailored to specific crops and energy-efficient models are critical. Partnering with suppliers knowledgeable in agricultural lighting ensures the right products for local climatic and operational conditions.

Related Video: DIY Tutorial: Solder RGBW, RGB, and Single Color LED Strips

Strategic Material Selection Guide for led led strips

Polyvinyl Chloride (PVC) Coating

PVC is one of the most common materials used for the outer coating of LED strip lights due to its flexibility and cost-effectiveness. It provides good insulation and moderate resistance to moisture and chemicals, making it suitable for indoor applications and some protected outdoor environments.

- Key Properties: PVC coatings offer temperature resistance typically up to 60-70°C, moderate UV resistance, and reasonable flexibility. They provide basic protection against dust and moisture but are not fully waterproof unless specially treated.

- Pros & Cons: PVC is inexpensive and easy to manufacture, enabling competitive pricing for bulk buyers. However, it has limited durability under prolonged UV exposure and can become brittle in very cold climates. It also has lower flame retardancy compared to some alternatives.

- Impact on Application: Ideal for indoor commercial lighting, retail displays, and residential projects where environmental exposure is limited. Not recommended for harsh outdoor or industrial environments.

- International B2B Considerations: Buyers from regions with high UV exposure such as South Africa or the Middle East should verify UV stabilization additives. Compliance with European RoHS and REACH regulations is critical for buyers in the EU (e.g., France). PVC’s chemical composition must meet ASTM D1784 or DIN standards to ensure safety and performance.

Silicone Rubber Coating

Silicone rubber is increasingly popular for LED strips requiring high flexibility and superior environmental protection. It is frequently used in waterproof and outdoor-rated LED strips.

- Key Properties: Silicone offers excellent thermal stability (operating up to 200°C), outstanding UV and ozone resistance, and superior waterproofing capabilities (IP65 to IP68 ratings). It remains flexible in extreme temperatures.

- Pros & Cons: Silicone coatings significantly enhance durability and lifespan, especially in outdoor or industrial settings. The main drawback is higher material and manufacturing costs, which can increase the unit price.

- Impact on Application: Perfect for outdoor architectural lighting, signage, and industrial applications where exposure to moisture, heat, or chemicals is expected. Its flexibility also suits curved or uneven surfaces.

- International B2B Considerations: Buyers in humid or coastal regions of South America and Africa benefit from silicone’s corrosion resistance. European buyers must ensure compliance with EN 45545-2 fire safety standards for public spaces. Silicone’s chemical inertness aligns well with Middle Eastern market demands for robust, long-lasting products.

Polyurethane (PU) Coating

Polyurethane coatings are used when a balance between toughness and flexibility is required. PU offers enhanced abrasion resistance and chemical protection compared to PVC.

- Key Properties: PU coatings withstand temperatures up to 90-120°C, provide excellent resistance to oils, solvents, and abrasion, and have good waterproofing properties.

- Pros & Cons: PU is more durable than PVC and less costly than silicone, making it a middle-ground choice. It can yellow over time under UV exposure and may require UV stabilizers for outdoor use.

- Impact on Application: Suitable for commercial and industrial LED strip installations where mechanical wear or chemical exposure is a concern, such as warehouses or manufacturing plants.

- International B2B Considerations: Buyers in industrial zones across Europe and South America should prioritize PU for its chemical resilience. Compliance with DIN EN ISO 2812 (chemical resistance) and ASTM D4060 (abrasion) standards is advisable. PU coatings also meet many Middle Eastern fire safety regulations when properly formulated.

Aluminum PCB (Printed Circuit Board) Base

While not a coating, the PCB base material is critical for LED strip performance. Aluminum PCBs are widely used for their superior heat dissipation compared to traditional fiberglass.

- Key Properties: Aluminum PCBs efficiently conduct heat away from LEDs, supporting higher lumen outputs and longer lifespans. They are corrosion-resistant and mechanically robust.

- Pros & Cons: Aluminum PCBs improve reliability and performance but come at a higher cost and require more complex manufacturing processes. They are less flexible than some plastic-based PCBs but can be designed with flexible aluminum substrates.

- Impact on Application: Essential for high-power LED strips used in commercial lighting, industrial settings, and outdoor applications where thermal management is critical.

- International B2B Considerations: Buyers from regions with high ambient temperatures (e.g., Middle East, Africa) benefit from aluminum PCBs to prevent overheating. European buyers must ensure compliance with IPC-4101 standards for PCB materials. Aluminum PCBs also facilitate meeting energy efficiency goals aligned with EU Ecodesign Directive requirements.

| Material | Typical Use Case for led led strips | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| PVC Coating | Indoor residential and commercial lighting | Low cost and easy to manufacture | Limited UV and temperature resistance | Low |

| Silicone Rubber Coating | Outdoor, architectural, and industrial lighting | Excellent waterproofing and thermal stability | Higher material and production costs | High |

| Polyurethane Coating | Industrial and commercial environments with wear | Good abrasion and chemical resistance | Potential UV degradation without stabilizers | Medium |

| Aluminum PCB Base | High-power LED strips requiring heat dissipation | Superior thermal management and durability | Higher cost and less flexibility | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for led led strips

The manufacturing and quality assurance of LED strips are critical factors that directly impact performance, durability, and compliance with international standards. For B2B buyers—especially those operating in diverse markets such as Africa, South America, the Middle East, and Europe—understanding these processes ensures informed procurement decisions and mitigates risks associated with product failure or regulatory non-compliance.

Manufacturing Process of LED Strips

The production of LED strips involves several well-defined stages, each requiring precision and control to maintain high quality and functionality:

1. Material Preparation

Raw materials include flexible printed circuit boards (FPCBs), LED chips (primarily SMD types), resistors, adhesives, and protective coatings. The FPCBs are prepared by layering copper traces on a flexible substrate, often polyimide or PET film, which provides the base for the LED assembly. High-quality materials are essential for durability and consistent electrical performance.

2. Circuit Forming and Patterning

Using photolithography or etching techniques, the copper layers on the FPCB are patterned to create precise electrical circuits. This stage defines the LED strip’s electrical pathways and connection points. Accuracy here impacts the strip’s ability to evenly distribute current and avoid hotspots, which can reduce lifespan.

3. Component Mounting and Soldering

Surface-mount technology (SMT) places LEDs and electronic components onto the FPCB. Automated pick-and-place machines position SMD LEDs and resistors with high precision. Following placement, reflow soldering secures components, ensuring strong electrical and mechanical bonds. Controlled soldering temperatures prevent damage to sensitive LEDs and maintain component integrity.

4. Protective Coating and Encapsulation

To enhance durability and environmental resistance, LED strips undergo coating or encapsulation. Options include clear silicone or epoxy layers, which protect against moisture, dust, and mechanical stress. For outdoor or industrial applications, waterproofing (IP65 or higher) is achieved by applying additional layers or protective tubing.

5. Cutting and Testing

LED strips are cut into standard or custom lengths as per order specifications. Each segment typically features designated cut points. Post-cutting, strips undergo initial electrical testing to verify continuity and LED functionality before packaging.

Quality Assurance Framework for LED Strip Production

Robust quality assurance (QA) protocols are fundamental to ensure that LED strips meet performance benchmarks and regulatory requirements. Key QA stages correspond with internationally recognized standards and industry best practices:

International and Industry Standards to Consider

– ISO 9001: Emphasizes consistent quality management systems, process control, and continuous improvement. Suppliers certified under ISO 9001 demonstrate commitment to quality at all production stages.

– CE Marking (Europe): Indicates compliance with EU safety, health, and environmental requirements, essential for European buyers.

– RoHS Compliance: Restricts hazardous substances in electrical products, crucial for markets with strict environmental regulations (EU, South Africa).

– UL or ETL Listings: Important for electrical safety, particularly if products will be used in North America or regions adopting similar standards.

– Other Regional Certifications: Such as INMETRO (Brazil), SASO (Saudi Arabia), or SABS (South Africa) may apply depending on the buyer’s location.

Quality Control Checkpoints and Testing Methods

Quality control (QC) is embedded at multiple points to detect and correct defects early:

1. Incoming Quality Control (IQC)

Verification of raw materials and components before production starts. This includes checking FPCB quality, LED chip specifications, and solder paste consistency. IQC helps prevent defective inputs from entering the assembly line.

2. In-Process Quality Control (IPQC)

Continuous monitoring during manufacturing stages—such as solder joint inspections, LED placement accuracy, and circuit integrity checks. Automated Optical Inspection (AOI) systems are often used to detect misalignment, solder bridges, or missing components.

3. Final Quality Control (FQC)

Comprehensive testing of finished LED strips prior to shipment. Typical tests include:

– Electrical Testing: Checking voltage, current draw, and LED functionality.

– Lumen and Color Consistency: Measuring brightness and color temperature to ensure uniformity across batches.

– Environmental Testing: Exposure to humidity, heat, and vibration to simulate operating conditions.

– Waterproof Testing: For IP-rated strips, verifying ingress protection standards are met.

– Adhesion Tests: Ensuring the backing adhesive meets application requirements.

How B2B Buyers Can Verify Supplier Quality Control

To safeguard procurement, international buyers should take proactive steps to assess supplier QA capabilities:

- Factory Audits: On-site inspections (or virtual audits when travel is restricted) to review manufacturing processes, equipment, employee training, and QC procedures. Audits help verify adherence to ISO 9001 or other relevant standards.

- Third-Party Inspections: Engaging independent inspection agencies to perform random sampling and testing before shipment adds an unbiased layer of quality assurance.

- Request Documentation: Buyers should require detailed QC reports, test certificates, and compliance documentation (e.g., CE Declaration of Conformity, RoHS test reports).

- Sample Testing: Obtaining samples for in-house or third-party lab testing validates supplier claims regarding brightness, color rendering, and durability.

- Supplier Certifications: Confirming current certifications for ISO, CE, RoHS, or regional standards reduces risk and ensures regulatory compliance.

Navigating QC and Compliance Nuances Across Regions

For buyers in Africa, South America, the Middle East, and Europe, understanding local regulatory frameworks and market expectations is vital:

- Africa (e.g., South Africa): The South African Bureau of Standards (SABS) oversees product certification; RoHS and energy efficiency labeling are increasingly emphasized. Buyers should confirm compliance with SABS marks and regional safety standards.

- South America: Countries like Brazil require INMETRO certification for electrical products. Buyers must ensure that LED strips meet local energy efficiency and safety regulations to avoid customs delays or penalties.

- Middle East: Markets such as Saudi Arabia demand SASO certification and compliance with Gulf Conformity Mark (G-Mark). Given the harsh climate, waterproof and durable LED strips with robust QC are preferred.

- Europe (e.g., France): Strict adherence to CE marking, RoHS, and WEEE directives is mandatory. European buyers prioritize suppliers with transparent QC documentation and environmental compliance.

Key Takeaways for International B2B Buyers

- Prioritize suppliers with documented ISO 9001 certification and relevant regional approvals. These certifications signal a mature quality management system and regulatory compliance.

- Insist on clear QC checkpoints and testing protocols, including AOI, electrical, and environmental testing. A supplier’s ability to demonstrate rigorous QC reduces the risk of defective shipments.

- Use a combination of factory audits, third-party inspections, and sample testing to validate supplier quality claims before large orders.

- Understand regional certification requirements and ensure your supplier can provide compliant products to avoid customs issues and market rejection.

- Consider customization capabilities alongside QC standards, especially for projects requiring specific lengths, colors, or IP ratings. Reliable customization demands strict process controls to maintain quality.

By thoroughly evaluating manufacturing processes and quality assurance measures, B2B buyers can confidently source LED strips that meet high standards, comply with regional regulations, and deliver long-term value across diverse international markets.

Related Video: LED Light Making Process | How LED Lights Made Inside Factory | Manufacturing Process

Comprehensive Cost and Pricing Analysis for led led strips Sourcing

When evaluating costs and pricing for sourcing LED strip lights, international B2B buyers must dissect the various components contributing to the final price. Understanding these factors empowers buyers from regions such as Africa, South America, the Middle East, and Europe to negotiate effectively and optimize procurement strategies.

Key Cost Components in LED Strip Light Production

- Materials: The core raw materials include LED chips (commonly SMD), flexible PCB substrates, resistors, adhesives, and protective coatings. Material quality, especially the LED chips and phosphors, directly impacts performance and durability, influencing cost substantially.

- Labor: Manufacturing labor costs vary by country and factory expertise. Automation can reduce labor expenses but may increase initial tooling costs.

- Manufacturing Overhead: This covers factory utilities, equipment depreciation, and indirect labor. Overhead costs depend on production scale and factory efficiency.

- Tooling and Setup: Custom LED strip designs or packaging require upfront tooling investments, which are amortized over production volumes.

- Quality Control (QC): Rigorous QC processes, including photometric testing and certification compliance checks, add to costs but ensure product reliability.

- Logistics and Shipping: International freight costs, customs duties, and local transportation must be factored in, especially for buyers in regions with complex import regulations or higher shipping tariffs.

- Supplier Margin: Suppliers include a markup to cover profit and risk. Margins fluctuate based on market competition, brand reputation, and buyer-supplier relationships.

Influential Factors on Pricing

- Order Volume and Minimum Order Quantities (MOQ): Larger orders typically unlock tiered discounts, reducing per-unit costs. Buyers should align order size with demand forecasts to leverage economies of scale without overstocking.

- Specifications and Customization: Features such as waterproofing (IP ratings), color temperature, brightness (lumens), RGB capabilities, and smart controls add cost. Custom packaging or branding also increases pricing due to tooling and design work.

- Material Quality and Certifications: Higher-grade LEDs with certifications like CE, RoHS, CB (for Europe), or region-specific standards ensure compliance and durability but come at a premium.

- Supplier Factors: Established manufacturers with proven quality, warranties, and reliable lead times often price higher than newer or less reputable suppliers.

- Incoterms and Shipping Terms: Terms like FOB, CIF, or DDP affect who bears shipping, insurance, and customs responsibilities, impacting overall landed cost.

Strategic Buyer Tips for Cost-Efficient Procurement

- Thorough Market Research: Compare multiple suppliers across regions to understand price benchmarks, factoring in quality and certifications rather than selecting solely on lowest price.

- Negotiate Volume Discounts: Aggregate demand across projects or business units to negotiate better pricing and reduced MOQs.

- Request Samples and Validate Quality: Testing samples before large orders prevents costly returns or failures, ensuring alignment with project requirements.

- Factor Total Cost of Ownership (TCO): Evaluate beyond unit price to include installation, maintenance, energy savings, and warranty coverage. High-quality LEDs may cost more upfront but deliver lower operational expenses.

- Consider Logistics Optimization: Consolidate shipments and choose favorable Incoterms to minimize freight and customs costs, especially important for buyers in Africa and South America where shipping can be a significant expense.

- Leverage Local Expertise: Engage local consultants or agents familiar with regional regulations and market dynamics to avoid compliance pitfalls and hidden costs.

- Plan for Currency Fluctuations and Payment Terms: Secure favorable payment conditions and hedge currency risks to stabilize procurement costs in volatile markets.

Pricing Nuances for International Buyers by Region

- Africa and South America: Logistics and customs duties often inflate costs; sourcing from nearby hubs or negotiating DDP terms can reduce surprises. Prioritize suppliers offering flexible MOQs to accommodate variable demand.

- Middle East: High demand for certified, energy-efficient products means quality certifications are non-negotiable. Customs clearance is generally streamlined but verify compliance rigorously.

- Europe (e.g., France): Strict regulatory standards require CE, RoHS, and often additional environmental certifications. Buyers should budget for higher compliance-related costs but benefit from long-term reliability and market acceptance.

Disclaimer: The costs and pricing structures discussed are indicative and can vary significantly depending on supplier, order specifics, market conditions, and currency fluctuations. Buyers are advised to conduct due diligence and obtain formal quotations tailored to their exact requirements.

Spotlight on Potential led led strips Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘led led strips’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for led led strips

Key Technical Properties of LED Strips for B2B Buyers

Understanding the essential technical specifications of LED strips is crucial for international buyers to ensure product suitability, compliance, and cost-effectiveness. Here are the critical properties to evaluate:

-

LED Chip Type and Density

LED strips typically use Surface-Mounted Device (SMD) chips, with common types including SMD 3528, 5050, and 2835. The number denotes the chip size in millimeters and directly impacts brightness and energy consumption. Higher chip density (e.g., 60 LEDs/meter vs. 30 LEDs/meter) results in more intense and uniform lighting. For B2B buyers, selecting the right chip type and density ensures the strip meets application requirements, whether for accent lighting or high-lumen task illumination. -

Color Temperature and CRI (Color Rendering Index)

Color temperature, measured in Kelvins (K), ranges from warm white (~2700K) to daylight (~6500K). CRI indicates how accurately the light renders colors, with values above 80 considered good for most commercial uses. Buyers targeting retail or hospitality markets should prioritize strips with high CRI for appealing visual effects, while industrial applications may focus more on efficiency. -

Power Consumption and Voltage

LED strips commonly operate at 12V or 24V DC, with power consumption expressed in watts per meter (W/m). Lower voltage strips are easier to install and safer but may have shorter run lengths before voltage drop affects brightness. Understanding power specs helps buyers plan power supplies and calculate energy costs, essential for budgeting large-scale projects. -

IP Rating (Ingress Protection)

The IP rating defines the strip’s resistance to dust and water, critical for outdoor or humid environments. For example, IP20 indicates indoor use without water resistance, whereas IP65 or higher signifies waterproofing suitable for exterior or wet locations. International buyers must align IP ratings with local climate and application to avoid product failure and warranty issues. -

Material Quality and Flexibility

The base material, often a flexible PCB with copper tracks, affects durability and thermal performance. High-quality copper thickness improves heat dissipation and prolongs lifespan. Flexibility is important for installations on curved or irregular surfaces. Buyers should request detailed material specs and test samples, especially for custom or large-volume orders. -

Tolerance and Binning Consistency

Tolerance refers to the allowable variation in brightness and color output between LED strips or batches. Binning is the process manufacturers use to classify LEDs by color and brightness to ensure uniformity. Consistent binning reduces installation inconsistencies and enhances product reliability, a priority for projects demanding visual uniformity across multiple units.

Common Trade Terminology in LED Strip Procurement

Familiarity with industry jargon streamlines communication and negotiation with suppliers, reducing misunderstandings and procurement risks.

-

OEM (Original Equipment Manufacturer)

OEM refers to manufacturers that produce LED strips which can be rebranded or customized by buyers. International B2B buyers often work with OEMs to create private-label products tailored to their market or project specifications, enabling differentiation and brand control. -

MOQ (Minimum Order Quantity)

MOQ is the smallest number of units a supplier will accept for an order. Understanding MOQs helps buyers plan inventory, budget, and cash flow. Some suppliers offer flexible MOQs for new customers or custom orders, which can be advantageous when entering new markets or testing products. -

RFQ (Request for Quotation)

RFQ is a formal document sent to suppliers requesting pricing, lead times, and terms for specified products. A well-prepared RFQ with clear technical and commercial requirements accelerates supplier responses and enables accurate cost comparisons. -

Incoterms (International Commercial Terms)

Incoterms define the responsibilities and risks of buyers and sellers during shipping. Common terms include FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid). Knowing Incoterms helps buyers manage logistics, import duties, and total landed costs effectively. -

Lead Time

Lead time is the period between placing an order and receiving the goods. For LED strip projects with tight deadlines or seasonal demand, understanding and negotiating realistic lead times is critical to avoid delays and lost business. -

Certification and Compliance

Certifications such as CE (Europe), RoHS (Restriction of Hazardous Substances), and UL (Underwriters Laboratories) indicate compliance with safety and environmental standards. Buyers must ensure LED strips meet local regulatory requirements to guarantee market access and reduce liability.

By mastering these technical properties and trade terms, international B2B buyers can make informed purchasing decisions, optimize supply chain efficiency, and secure high-quality LED strip products tailored to diverse market needs.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the led led strips Sector

Market Overview & Key Trends

The global LED strip lights market is experiencing robust growth driven by increasing demand for energy-efficient and versatile lighting solutions across commercial, industrial, and residential sectors. For international B2B buyers, especially from regions like Africa, South America, the Middle East, and Europe, several key dynamics shape procurement strategies.

Energy efficiency and cost savings remain paramount as businesses seek to reduce operational expenses and comply with tightening energy regulations, particularly in Europe and the Middle East. LED strips offer significant advantages over traditional lighting, including low power consumption and long operational life, which makes them highly attractive for large-scale projects such as retail spaces, offices, and urban infrastructure.

Technological advancements are a major trend influencing sourcing decisions. The rise of smart LED strips with IoT capabilities, including app-controlled color changes and dimming features, enables businesses to offer innovative, customizable lighting experiences. RGB and addressable LED strips are gaining traction for commercial branding and event applications, especially in emerging markets like South America and Africa, where dynamic lighting can enhance customer engagement.

Customization and scalability are critical for B2B buyers managing diverse projects. Wholesale suppliers increasingly provide tailored solutions—custom lengths, specific color temperatures, and waterproofing options—to meet local climate conditions and regulatory requirements. For example, waterproof and UV-resistant LED strips are favored in the Middle East and parts of Africa for outdoor installations.

Supply chain resilience and cost optimization also dominate buyer considerations amid global economic fluctuations. Buyers in Europe and Africa are prioritizing suppliers with reliable logistics, transparent pricing, and certifications that ensure product quality and compliance. Consolidating orders with established wholesalers can reduce shipping costs and simplify procurement.

Sustainability & Ethical Sourcing in B2B

Sustainability has emerged as a decisive factor in the LED strip sector, driven by growing environmental awareness and regulatory pressure across Europe and beyond. B2B buyers are increasingly expected to demonstrate responsible sourcing practices, making sustainability a competitive differentiator.

LED strips inherently support sustainability goals due to their energy-efficient design, reducing carbon footprints for businesses and end-users. However, buyers must also evaluate the environmental impact of manufacturing processes and materials. Selecting suppliers who utilize lead-free solder, recyclable components, and low-VOC (volatile organic compound) materials helps minimize ecological harm.

Ethical supply chains are equally vital. Buyers should prioritize suppliers with transparent labor practices and adherence to international standards such as ISO 14001 (environmental management) and SA8000 (social accountability). This is particularly important for companies sourcing from regions with less stringent labor regulations.

Certifications like RoHS (Restriction of Hazardous Substances), CE marking, and REACH compliance are essential indicators of product safety and environmental stewardship, especially for European buyers. Additionally, emerging “green” certifications specific to LED manufacturing provide assurance that products meet high sustainability benchmarks.

For international buyers, integrating sustainability criteria into procurement policies not only aligns with global ESG (Environmental, Social, Governance) mandates but also appeals to increasingly eco-conscious clients and consumers. Strategic partnerships with manufacturers investing in clean energy and waste reduction can further enhance brand reputation and long-term supply security.

Evolution and Industry Context

LED strip lights have evolved significantly since their inception in the early 2000s. Originally designed for decorative purposes, technological improvements quickly expanded their application scope to include functional and industrial lighting. The transition from single-color, fixed-length strips to flexible, customizable, and smart-enabled LED strips has transformed the sector.

For B2B buyers, this evolution means access to a broader range of products that can be tailored to complex project specifications. Innovations such as addressable LEDs, integration with building automation systems, and enhanced durability have made LED strips indispensable in sectors ranging from hospitality to urban infrastructure.

Moreover, the shift toward energy efficiency and regulatory compliance has accelerated adoption globally. This history underscores the importance of staying informed about technological trends and regulatory changes to maximize investment returns and operational efficiency in lighting projects.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of led led strips

-

How can I effectively vet LED strip light suppliers for international B2B purchases?

Begin by researching suppliers with proven track records, including verified business licenses and positive customer reviews from similar markets. Request detailed product specifications, certifications (e.g., CE, RoHS for Europe, or local equivalents), and quality assurance processes. Engage in direct communication to assess responsiveness and transparency. Whenever possible, obtain samples to evaluate product quality firsthand. Additionally, check if the supplier has experience exporting to your region, ensuring familiarity with local regulations and logistics complexities. -

What customization options are typically available for wholesale LED strip orders?

Wholesale LED strip suppliers often offer customization in length, color temperature, LED density, waterproof ratings, and packaging. Businesses can request specific cut lengths or reels tailored to project requirements. Some suppliers provide options for custom branding on packaging or even unique LED chip configurations for specialized applications. When negotiating customization, clarify minimum order quantities (MOQs), lead times, and any additional costs to ensure alignment with your project timelines and budget. -

What should I know about minimum order quantities (MOQs), lead times, and payment terms when ordering LED strips internationally?

MOQs vary widely depending on supplier capabilities and customization level, ranging from a few hundred meters to several thousand. Lead times typically span 2 to 6 weeks, influenced by order complexity and shipping mode. Payment terms usually require a deposit upfront (30–50%) with the balance paid before or upon shipment. For buyers in Africa, South America, the Middle East, and Europe, negotiating flexible payment methods—such as letters of credit or escrow services—can mitigate risk. Early communication with suppliers about these terms is essential to avoid delays. -

Which quality certifications should I verify to ensure compliance and safety of LED strips for my market?

Key certifications include CE and RoHS for Europe, CCC for China exports, and IEC standards relevant to electrical safety. In regions like the Middle East and South America, local certification bodies may impose additional requirements, so consult regional regulations. Verifying certifications ensures product safety, electromagnetic compatibility, and environmental compliance, reducing customs clearance issues. Request official certification documents and consider third-party testing for critical applications to safeguard your investment and end-user satisfaction. -

What logistics considerations are critical when importing LED strip lights internationally?

Assess shipping options balancing cost, speed, and reliability—air freight offers faster delivery but at higher cost, while sea freight suits bulk orders with longer lead times. Confirm that suppliers use reliable freight forwarders familiar with your region’s customs procedures. Ensure clear documentation, including commercial invoices, packing lists, and certificates of origin, to prevent clearance delays. Factor in import duties, taxes, and potential local compliance inspections. Establish contingency plans for shipment tracking and communication to promptly address any transit issues. -

How can I manage potential disputes or quality issues after receiving LED strip shipments?

Implement a clear contract outlining product specifications, inspection standards, and warranty terms before purchase. Upon receipt, conduct thorough quality checks against agreed criteria. If defects arise, document issues with photos and detailed reports and notify the supplier immediately. Utilize established dispute resolution mechanisms such as negotiation, mediation, or involving trade associations. Maintaining open communication and leveraging supplier warranties can facilitate timely resolutions, protecting your business from financial loss and reputational damage.

-

Are there specific considerations for sourcing LED strips suited to diverse climates in Africa, South America, the Middle East, and Europe?

Absolutely. Environmental factors such as humidity, temperature extremes, and UV exposure vary widely across these regions. For outdoor or harsh environments, prioritize LED strips with appropriate IP waterproof ratings (IP65 or higher) and robust materials resistant to corrosion and heat. Verify that suppliers test products under relevant environmental conditions. Customizing strips for these factors improves durability and reduces maintenance costs, ensuring long-term performance aligned with local market demands. -

How can I ensure compatibility of LED strips with local electrical standards and existing infrastructure?

Confirm voltage and current specifications align with your region’s power supply (commonly 12V or 24V DC for LED strips). Check if the supplier provides compatible drivers or power supplies certified for your market’s electrical codes. For retrofit projects, assess compatibility with existing fixtures and control systems. Consider requesting technical support or installation guidelines from suppliers to facilitate seamless integration. Proper compatibility reduces installation challenges and enhances operational safety and efficiency.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for led led strips

Strategic sourcing of LED strip lights offers international B2B buyers a compelling opportunity to optimize costs, enhance product quality, and future-proof their lighting solutions. Key considerations include partnering with reputable suppliers who provide reliable certifications, warranties, and customization options tailored to diverse market requirements. Bulk purchasing not only drives significant price advantages but also ensures consistency and scalability, which are critical for large commercial, industrial, or retail projects.

For buyers across Africa, South America, the Middle East, and Europe, understanding regional regulatory standards—such as CE in Europe or CCC in parts of Asia—and verifying compliance is essential to avoid costly delays and ensure smooth market entry. Additionally, investing time in sample testing and supplier audits strengthens quality assurance and builds trust in supply chain reliability.

Looking ahead, the LED strip lighting market continues to evolve rapidly with innovations in smart controls, energy efficiency, and flexible designs. International buyers are encouraged to adopt a proactive sourcing strategy that embraces emerging technologies and sustainability trends. By doing so, businesses will not only meet current demand but also position themselves as leaders in their respective markets. Take decisive action now to secure strategic partnerships and leverage the full potential of wholesale LED strip solutions for lasting competitive advantage.